- Home

- »

- Medical Devices

- »

-

Digital Diabetes Management Market, Industry Report, 2030GVR Report cover

![Digital Diabetes Management Market Size, Share & Trends Report]()

Digital Diabetes Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Continuous Glucose Monitoring System, Smart Insulin Pen), By Type (Wearable, Handheld Device), By End-use (Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-689-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Diabetes Management Market Summary

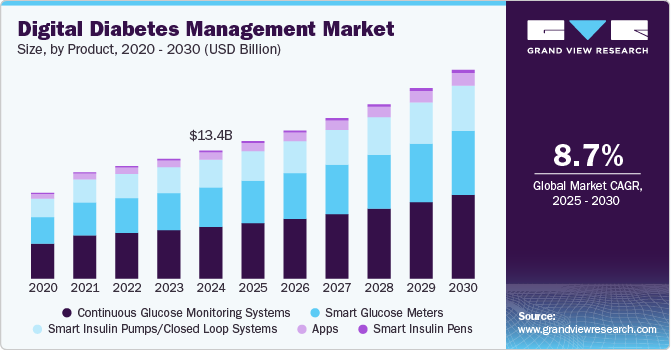

The global digital diabetes management market size was estimated at USD 13.4 billion in 2024 and is projected to reach USD 21.9 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. The robust growth of the digital diabetes management industry is majorly attributed to the growing prevalence of diabetes, coupled with technological advancements and innovations.

Key Market Trends & Insights

- North America digital diabetes management market held the largest share of 38.2% in 2024.

- Asia Pacific digital diabetes management market is expected to witness the fastest growth of CAGR 10.2% over the forecast period.

- Based on product, the continuous glucose monitoring systems segment dominated the market by capturing a share of 40.4% in 2024.

- Based on type, the wearable devices segment held the largest market share in 2024 and is also expected to grow at the fastest CAGR of 8.9% over the forecast period.

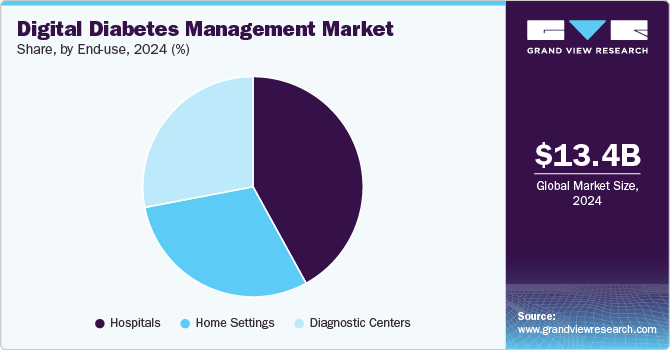

- Based on end-use, the hospital segment dominated the market by capturing a share of 41.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.4 Billion

- 2030 Projected Market Size: USD 21.9 Billion

- CAGR (2025-2030): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As per the International Diabetes Federation, around 536 million adults were living with diabetes in 2021, with the number expected to reach 783 million by 2045. As digital technology is continuously advancing, the market is expected to witness a wide range of innovations within the diabetes space, which has the potential to change the way we manage the disease. The number of smartphone apps available for diabetes management has increased sharply in recent years, and over a hundred apps are available on web-based app stores that can help patients monitor their blood glucose levels.

Digital diabetes devices, such as continuous blood glucose monitoring systems, smart insulin pens, and smart insulin pumps, are increasingly recognized for their efficiency in managing diabetes. These devices provide real-time data and precise insulin delivery, significantly enhancing diabetes management by enabling better blood sugar control, reducing the risk of complications, and improving patient adherence to treatment protocols. As the prevalence of diabetes rises globally, these devices are being adopted on a larger scale due to their ability to simplify and optimize diabetes care.

Technological advancements are expected to further accelerate growth in the digital diabetes management industry. The innovation such as the integration of AI in glucose monitoring systems, which improve predictive capabilities for managing blood sugar levels and enhancing personalized treatment plans. For instance, in July 2024, Roche announced granted the CE Mark for its Accu-Chek SmartGuide continuous glucose monitoring (CGM) system. This important milestone clears the path for the solution to be offered to individuals with type 1 and type 2 diabetes, aged 18 and older, who are on flexible insulin therapy. Additionally, advancements in interoperability enable seamless communication between glucose monitors, insulin pumps, and management apps, ensuring a more coordinated approach to diabetes care. The rise of telemedicine platforms also plays a critical role, allowing for remote monitoring and real-time adjustments to treatment plans by healthcare professionals, which increases the convenience and efficiency of diabetes management. Collectively, these innovations are transforming the way diabetes is managed, driving increased adoption of digital diabetes solutions and contributing to the continued growth of the market.

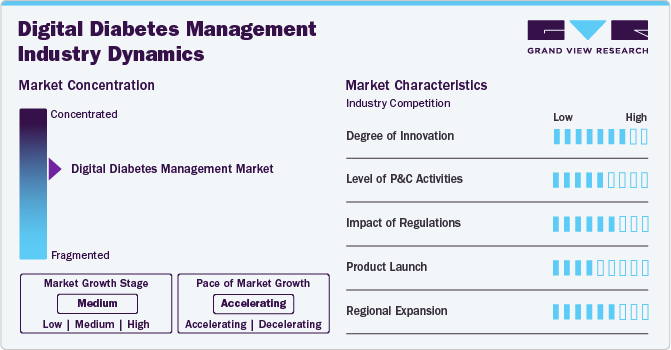

Market Concentration & Characteristics

The digital diabetes management industry is experiencing rapid growth due to the increasing burden of diabetes worldwide and the rising demand for advanced solutions to manage the condition. The expanding adoption of continuous glucose monitoring (CGM) systems, smart insulin pens, and insulin pumps reflects the growing need for more efficient and personalized diabetes care. These digital tools empower patients to track their glucose levels in real time, optimize insulin delivery, and make data-driven decisions for better disease management. Additionally, the rise in digital health apps for diet and exercise management further enhances the ability to manage diabetes effectively.

Companies in the digital diabetes management industry are capitalizing on strategic initiatives, particularly product launches, to expand their industry presence. These innovations are focused on enhancing diabetes care with the latest advancements in technology. For instance, in June 2024, Abbott announced that the U.S. Food and Drug Administration (FDA) has cleared two new over-the-counter continuous glucose monitoring (CGM) systems - Lingo and Libre Rio. Both are built on Abbott’s renowned FreeStyle Libre CGM technology, which is currently used by approximately 6 million people worldwide.

The degree of innovation in the digital diabetes management industry is high and continues to evolve rapidly. For instance, in August 2024, Insulet Corporation's Omnipod 5 Automated Insulin Delivery System (Omnipod 5), received FDA clearance for use in people with Type 2 diabetes (aged 18 years and older) in the U.S. This makes the Omnipod 5 the first and only automated insulin delivery (AID) system cleared by the FDA for both Type 1 and Type 2 diabetes management. This groundbreaking innovation underscores the increasing role of personalized, automated systems in improving glucose control and reducing the burden of diabetes management.

The level of partnership and collaboration activities in the digital diabetes management industry is high, with key players actively engaging in strategic alliances to advance innovation and improve patient outcomes. For instance, in August 2024, Abbott entered a global partnership with Medtronic to integrate Abbott's leading continuous glucose monitoring (CGM) system with Medtronic's insulin delivery devices. This collaboration aims to provide patients with a seamless diabetes management experience by combining the strengths of both companies' technologies. By integrating CGM and insulin pumps, the partnership seeks to enhance glucose control and convenience for patients, ultimately improving the quality of life for individuals with diabetes.

Regulations significantly influence the digital diabetes management industry by ensuring the safety and efficacy of devices like continuous glucose monitoring (CGM) systems and insulin pumps. FDA approvals, such as for Abbott’s FreeStyle Libre and Omnipod 5, along with OTC regulations, increase accessibility, while data privacy laws and reimbursement policies help expand adoption and integration into healthcare systems.

Manufacturers in the digital diabetes management industry are actively engaging in product launches to enhance their industry presence and offer innovative solutions for diabetes care. For instance, in August 2024, Medtronic plc announced the FDA approval for its Simplera continuous glucose monitor (CGM), marking the company’s first disposable, all-in-one CGM. Notably, the Simplera is half the size of previous Medtronic CGM models, making it more compact and user-friendly.

Industry players in the digital diabetes management industry are actively focused on regional expansion by establishing strategic partnerships, increasing production capacities, and expanding their distribution networks across key geographies.

Product Insights

The continuous glucose monitoring systems segment dominated the market by capturing a share of 40.4% in 2024. CGM systems offer real-time glucose tracking, providing critical insights for both Type 1 and Type 2 diabetes management. Additionally, technological advancements in CGMs, such as improved accuracy, smaller sizes, and longer wear times, have made these systems more convenient and user-friendly, encouraging adoption. The increasing availability of CGMs, including over-the-counter models like Abbott's FreeStyle Libre, further contributes to the growth of this segment.

The smart insulin pens segment is expected to grow at a fastest CAGR of 11.8% over the forecast period. This growth can be attributed to the rising adoption of personalized diabetes management solutions that improve insulin delivery accuracy and provide real-time data tracking. Smart insulin pens enable patients to monitor insulin doses more effectively, offering enhanced convenience and better control over blood glucose levels. Furthermore, advancements in connected devices, where smart pens are paired with mobile apps to track glucose trends, play a major role in this growth.

Type Insights

The wearable devices segment held the largest market share in 2024 and is also expected to grow at the fastest CAGR of 8.9% over the forecast period, driven by the increasing demand for convenience, continuous monitoring, and real-time data tracking. These devices, including continuous glucose monitors (CGMs) and smart insulin pumps, offer users the ability to track their glucose levels effortlessly throughout the day, leading to improved diabetes management and better glycemic control. The growing preference for non-invasive, user-friendly technologies, as well as advancements in device integration with mobile apps and smart features, further contribute to the segment’s dominance.

The handheld segment is also expected to grow owing to their affordability, portability, and ease of use. These devices, such as portable glucose meters and blood glucose test kits, provide patients with quick, on-the-go glucose monitoring, making them ideal for individuals seeking convenience without needing continuous monitoring. Additionally, the integration of advanced features like Bluetooth connectivity and data syncing with mobile apps is further boosting their adoption. These devices remain essential in regions where cost-sensitive healthcare options are crucial, and they complement wearables by offering a more targeted solution for managing diabetes on a day-to-day basis

End-use Insights

The hospital segment dominated the market by capturing a share of 41.5% in 2024. Hospitals remain the primary setting for diagnostic testing, advanced treatments, and monitoring for patients with severe or complex diabetes. The availability of advanced digital diabetes management tools, such as continuous glucose monitoring (CGM) systems and smart insulin pumps, in hospital settings allows for real-time, accurate glucose tracking, which is crucial for intensive care management and hospital-based diabetes treatment. Additionally, the rising focus on hospital digitization and integration of digital health solutions to enhance patient care and reduce complications further boosts segment growth.

The home settings segment is expected to grow at the fastest rate of 5.2% over the forecast period. This growth can be attributed to the increasing preference for convenient, at-home diabetes management solutions. The adoption of devices like continuous glucose monitors (CGMs), smart insulin pens, and mobile app-based management systems allows patients to monitor and manage their condition without frequent hospital visits. This shift is further supported by the rising availability of over the counter (OTC) digital diabetes devices, which make advanced technologies more accessible.

Regional Insights

North America digital diabetes management market held the largest share of 38.2% in 2024. This dominance is driven by the presence of leading market players in the region and the increasing prevalence of diabetes. Additionally, various strategic initiatives undertaken by these companies are propelling market growth. For instance, in September 2024, Abbott launched Lingo, its first over-the-counter continuous glucose monitoring (CGM) system in the U.S. The Lingo system, comprising a biosensor and a mobile app, is designed for consumers seeking to enhance their overall health and wellness through better glucose monitoring.

U.S. Digital Diabetes Management Market Trends

The U.S. digital diabetes management market held the largest market share in the North America region. This can be attributed to the rising prevalence of diabetes in the country and the growing demand for advanced devices to enable real-time monitoring, improve glycaemic control, and enhance patient convenience. For instance, according to the International Diabetes Federation (IDF), approximately 32.2 million people in the U.S. were living with diabetes as of 2024, a number projected to rise to 34.7 million by 2030.

Europe Digital Diabetes Management Market Trends

Europe digital diabetes management market held a significant market share in 2024, driven by the presence of key market players, such as Roche, and Abbott, which consistently invest in technological advancements and new product launches. Additionally, the rising prevalence of diabetes-spurred by aging populations and lifestyle changes-has led to a growing demand for innovative digital solutions like continuous glucose monitoring (CGM) systems, smart insulin pens, and mobile app-based management platforms.

UK digital diabetes management market is experiencing significant growth, owing to the rising incidence of diabetes, advanced healthcare infrastructure, and launch of new devices in the country. For instance, in June 2024, Insulet announced the full commercial rollout of its Omnipod 5 Automated Insulin Delivery System in the UK and the Netherlands, now featuring expanded integration with advanced glucose sensors.

The France digital diabetes management market is expected to grow over the forecast period, driven by the rising prevalence of diabetes and increasing awareness about advanced diabetes management technologies. Growing adoption of digital tools, such as continuous glucose monitors (CGMs) and smart insulin delivery systems, along with government initiatives promoting diabetes education and self-management solutions.

Germany digital diabetes management market is experiencing significant growth, driven by robust healthcare infrastructure and continuous advancements in diabetes monitoring devices. The increasing prevalence of diabetes further drives this expansion. According to the International Diabetes Federation (IDF), there were approximately 6.2 million people living with diabetes in Germany, a figure projected to rise to 6.5 million by 2030.

Asia Pacific Digital Diabetes Management Market Trends

Asia Pacific digital diabetes management market is expected to witness the fastest growth of CAGR 10.2% over the forecast period.This rapid growth is primarily attributed to the rising prevalence of diabetes in countries like India and China, which account for a significant portion of the global diabetic population. The increasing adoption of advanced technologies, such as continuous glucose monitoring (CGM) systems and smart insulin devices, along with growing awareness of digital health solutions, is driving demand. Additionally, improving healthcare infrastructure, rising disposable incomes, and supportive government initiatives to promote diabetes management are further accelerating market expansion.

China digital diabetes management market is expected to grow at a notable growth rate over the forecast period. China has one of the largest populations of diabetic patients globally, creating a strong demand for advanced diabetes management solutions such as continuous glucose monitors (CGMs), smart insulin delivery devices, and mobile health applications. Additionally, the government's focus on healthcare reforms and increased investment in digital health infrastructure is facilitating the adoption of innovative technologies.

Japan digital diabetes management market is expected to grow. Japan has a strong healthcare infrastructure and a high level of awareness regarding diabetes management, leading to an increased adoption of digital diabetes management devices like continuous glucose monitoring (CGM) systems, smart insulin pumps, and mobile health apps. Additionally, Japan’s advanced technological landscape and the growing integration of artificial intelligence (AI) into healthcare solutions play a pivotal role in the market's expansion

Latin America Digital Diabetes Management Market Trends

Latin America digital diabetes management marketis expected to growowing to the rising incidence of diabetes in the region, driven by increasing urbanization, poor dietary habits, and a growing aging population. This shift is creating a greater demand for digital diabetes management tools, such as continuous glucose monitoring (CGM) systems, smart insulin pumps, and mobile health apps that can facilitate easier and more effective self-management. Additionally, improving healthcare infrastructure in countries like Brazil, and Argentina, along with government initiatives aimed at improving chronic disease management, are contributing to market expansion.

Middle East & Africa Digital Diabetes Management Market Trends

Middle East & Africadigital diabetes management marketis experiencing notable growth. The increasing prevalence of diabetes across the region, particularly in countries such as Saudi Arabia, UAE, and South Africa, is a key factor fueling the demand for digital diabetes management solutions like continuous glucose monitoring (CGM) systems and smart insulin pumps. In addition, the region is seeing significant improvements in healthcare infrastructure, as governments invest in digital health solutions and chronic disease management programs. This is further supported by a rise in awareness about diabetes care, especially with growing access to mobile health applications that allow individuals to monitor and manage their condition more effectively.

Key Digital Diabetes Management Company Insights

Market players in the digital diabetes management industry are actively focusing on key strategies such as product innovation and launches, strategic partnerships and collaborations, regional expansion, acquisitions and mergers, and an increased focus on digital health integration. These strategies aim to enhance their product portfolios, expand market reach, and integrate advanced technologies like AI and machine learning to improve diabetes care and management solutions.

Key Digital Diabetes Management Companies:

The following are the leading companies in the digital diabetes management market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Medtronic

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- Sanofi

- Dexcom, Inc.

- LifeScan, Inc.

- Insulet Corporation

- Ascensia Diabetes Care Holdings AG

- B. Braun Melsungen AG

Recent Developments

-

In November 2024, Medtronic plc announced the FDA clearance for its InPen app, which now includes a missed meal dose detection feature. This advancement sets the stage for the upcoming launch of its Smart MDI system, which will be integrated with the Simplera continuous glucose monitor (CGM)

-

In January 2024, Abbott and Tandem Diabetes Care, Inc. announced that the t:slim X2 insulin pump with Control-IQ technology is now integrated with Abbott's FreeStyle Libre 2 Plus sensor, offering users in the U.S. the benefits of a hybrid closed-loop system that helps manage and prevent high and low blood sugar levels.

-

In April 2023, Insulet Corporation announced the FDA clearance for its latest innovation, the Omnipod GO, an insulin delivery device designed for individuals with type 2 diabetes aged 18 and older. This device is intended for those who typically require daily injections of long-acting insulin, providing a more convenient alternative to traditional injection methods.

Digital Diabetes Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.4 billion

Revenue forecast in 2030

USD 21.9 billion

Growth rate

CAGR of 8.7% from 2025 to 2030

Historical period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Medtronic; F. Hoffmann-La Roche Ltd.; Bayer AG; LifeScan, Inc.; Dexcom, Inc.; Sanofi; Insulet Corporation; Ascensia Diabetes Care Holdings AG; B. Braun Melsungen AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

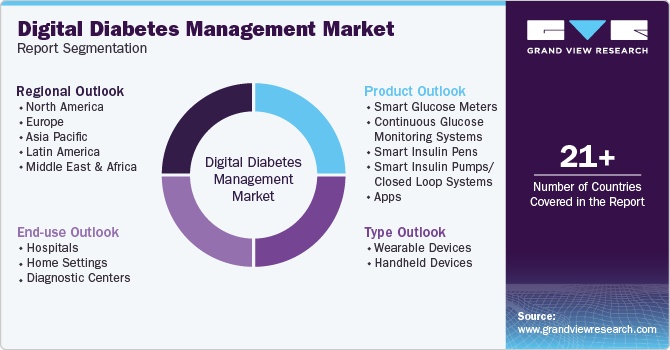

Global Digital Diabetes Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital diabetes management market report on the basis of product, type, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Glucose Meters

-

Continuous Glucose Monitoring Systems

-

Smart Insulin Pens

-

Smart Insulin Pumps/Closed Loop Systems

-

Apps

-

Digital Diabetes Management Apps

-

Weight & Diet Management Apps

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearable Devices

-

Handheld Devices

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Settings

-

Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital diabetes management market size was estimated at USD 13.4 billion in 2024 and is expected to reach USD 14.4 billion in 2025.

b. The global digital diabetes management market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2030 to reach USD 21.9 billion by 2030.

b. North America dominated the digital diabetes management market with a share of 38.2% in 2024. This is attributable to the increasing penetration of smart consumer devices and innovation in AI-based services.

b. Some key players operating in the digital diabetes management market include Abbott Laboratories; Medtronic plc; F. Hoffmann-La Roche Ltd; Bayer AG; Lifescan, Inc.; Dexcom, Inc.; Sanofi; Insulet Corporation; Ascensia Diabetes Care Holdings Ag; and B Braun Melsungen AG.

b. Key factors that are driving the digital diabetes management market growth include increasing technological advancements and rising FDA approval for innovative products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.