- Home

- »

- Automotive & Transportation

- »

-

Digital Freight Matching Market Size, Industry Report, 2030GVR Report cover

![Digital Freight Matching Market Size, Share & Trends Report]()

Digital Freight Matching Market (2025 - 2030) Size, Share & Trends Analysis Report by Service (Freight Matching Services, Value Added Services), By Platform (Web-based, Mobile-based), By Transportation Mode, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-113-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Freight Matching Market Summary

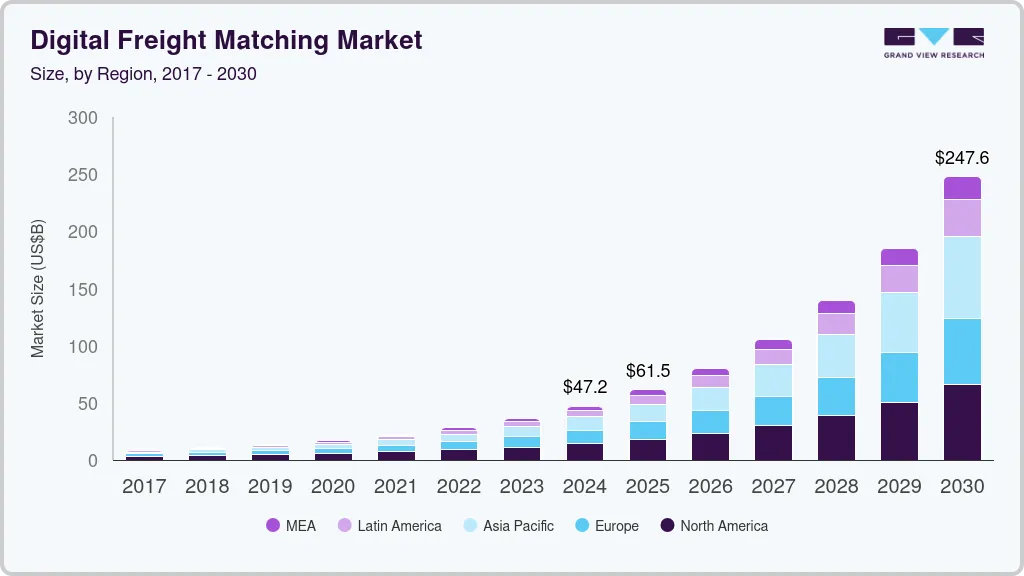

The global digital freight matching market size was estimated at USD 47,206.4 million in 2024 and is projected to reach USD 247,579.7 million by 2030, growing at a CAGR of 32.1% from 2025 to 2030. The growing need for automation and digitization across supply chains drives the growth of the digital freight matching industry.

Key Market Trends & Insights

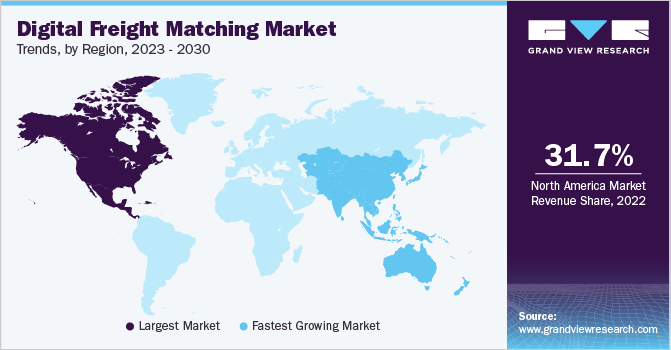

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, the U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, freight matching services accounted for a revenue of USD 29,492.7 million in 2023.

- Value Added Services is the most lucrative service segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 47,206.4 Million

- 2030 Projected Market Size: USD 247,579.7 Million

- CAGR (2025-2030): 32.1%

- North America: Largest market in 2023

Digital freight matching platforms provide solutions to shippers and carriers by connecting them in real time. It is a relatively new technology offered through an application or a platform that enables shippers to share their load requirements and assist carriers in finding and booking loads efficiently. Digital freight matching is better than traditional methods as it handles challenging manual processes such as posting and booking loads, making confirmation calls, and managing paperwork.

Digital freight matching is gaining popularity in the logistics industry as it has integration capabilities with Enterprise Resource Planning (ERP) and Transportation Management Systems (TMS). The platforms offer improved operational efficiency and quick and efficient capacity fulfillment. The platforms are developed using advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and predictive analytics in developing algorithms to match loads with carriers automatically. In March 2023, Freight Technologies, Inc. announced the launch of Fr8App, a digital freight matching platform. The platform uses ML algorithms to match shippers with carriers. With this launch, the company aimed to make the shipping process more cost-efficient and faster.

Digital freight matching platforms have been adopted rapidly in North America, a region with high penetration of internet and smartphones. Moreover, the region has the presence of many prominent players. The market is fragmented, with many established and new companies entering the market. The market players are adopting strategies such as product development and acquisition to gain a competitive edge.

The rapid growth of e-commerce is a major driver for the digital freight matching industry, creating increased demand for efficient, flexible, and on-demand freight solutions. E-commerce generates a high volume of small, frequent shipments requiring timely delivery. DFM platforms can quickly connect shippers with available carriers, streamlining the transportation process to handle the surge in e-commerce freight efficiently. Seasonal peaks in e-commerce, such as holiday shopping seasons, create surges in freight demand. Digital freight matching platforms enable shippers to scale up quickly, meeting peak demand without relying on traditional brokerage processes, which may be slower and more costly.

User-friendly mobile applications are a significant growth driver in the digital freight matching industry because they streamline operations, improve accessibility, and enhance usability for carriers, drivers, and shippers. Many small or independent carriers lack advanced logistics infrastructure. User-friendly mobile apps make it easy for these carriers to navigate the digital freight matching platform, boosting participation and creating a more competitive, diverse carrier pool.

The demand for sustainability in logistics is a powerful industry growth driver, as digital freight matching platforms provide solutions that help reduce environmental impact and promote greener operations. These platforms optimize freight loads by reducing the number of empty or partially filled trucks on the road. By matching available loads with trucks that would otherwise return empty, these platforms minimize fuel consumption and greenhouse gas emissions, meeting both operational and sustainability goals.

Service Insights

The freight matching services segment dominated the overall market, gaining a revenue share of over 80.9% in 2024. It is expected to grow at a significant CAGR from 2025 to 2030. Market players provide freight matching services like freight listing and brokerage, and online transaction services. These services are the platform's core services, and the market players have contracts with shippers and carriers for using brokerage services. The growing innovation in technologies such as AI and ML and their adoption in digital freight matching platforms is driving the growth of this segment. Algorithms powered by these technologies can help in various freight brokerage applications such as capacity management and dynamic pricing.

The value added services segment is anticipated to grow at the fastest CAGR from 2025 to 2030. Value-added services include services such as support and insurance services. Moreover, these services can offer shippers access to TMS and carriers access to software for managing traffic ticket records. These services address the needs of carriers and shippers, improving their engagement on the platform. The need for essential services on a single platform is driving the growth of this segment.

Platform Insights

The mobile-based segment dominated the overall digital freight matching industry, gaining a revenue share of more than 62.0% in 2024. It is expected to grow at the fastest CAGR from 2025 to 2030. Most market players provide mobile applications on Google Play and Apple Inc.'s App Store. China-based Full Truck Alliance (JiangSu ManYun Software Technology Co., Ltd.) provides freight matching and value-added services through mobile apps such as Yunmanman and Huochebang. Mobile-based platforms are faster than web-based apps and can work offline. Moreover, they are safer as they must be approved on the app store. The growing penetration of smartphones and ease of use drive the segment's growth.

The web-based segment is expected to grow at a considerable CAGR from 2025 to 2030. Web-based digital freight matching platforms are platforms accessed through web browsers. Web-based applications are easier to build compared to mobile apps. Moreover, they can be launched quickly, as they do not require app store approval. The ease of maintenance of web-based platforms is driving the segment’s growth.

Transportation Mode Insights

The Full truckload (FTL) segment has dominated the market, gaining a revenue share of more than 42.0% in 2024. Full truckload (FTL) involves booking the entire truck, and the goods are delivered from the starting to the end point without intermediate loading. It is a good option for shipping temperature-sensitive goods not meant to be transported with other goods. Moreover, it is a good option for transporting goods quickly without stopovers. The flexibility and quickness of Full truckload (FTL) transportation is driving the segment’s growth.

The intermodal segment is anticipated to witness a notable CAGR from 2025 to 2030. Intermodal shipping includes goods shipment through a combination of truckload and rail. Intermodal transportation is a good option when shipping needs to be done over longer distances. It is a lower-cost alternative to truckload and a more environmentally sustainable option. Asia Pacific countries are taking initiatives to make intermodal transportation more effective by expanding their rail network. Intermodal transportation's cost-effectiveness and environmental sustainability drive the segment's growth.

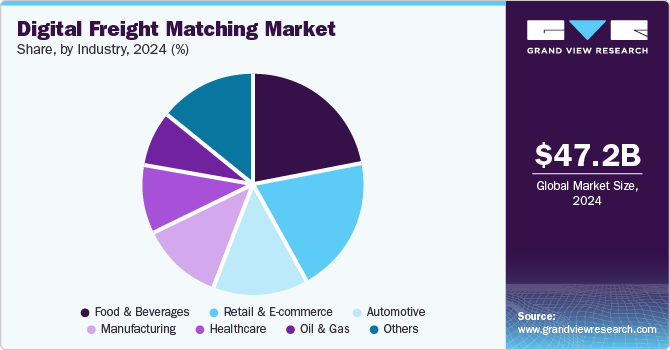

Industry Insights

The food & beverages segment has dominated the overall market, gaining a revenue share of more than 21.0% in 2024 and witnessing a significant CAGR from 2025 to 2030. The food & beverage industry consists of time-sensitive goods. The quality of the products can deteriorate over time and require specific conditions across the supply chain. Hence, they require quick and efficient transportation solutions to maintain their quality. A digital freight matching platform can improve the overall speed of freight brokerage operations as the platform connects the shippers with carriers as per load requirements. The need to maintain food quality and ensure regulatory compliance is driving the segment’s growth.

The retail & e-commerce segment is anticipated to witness the fastest CAGR from 2025 to 2030. Growing access to the internet and smartphones is driving the growth of the e-commerce sector. Moreover, e-commerce provides customers convenience as they can shop for goods from their homes. The COVID-19 pandemic accelerated e-commerce sales as people stayed at home. According to the U.S. Department of Commerce’s Annual Retail Trade Survey (ARTS) in 2020, e-commerce sales in the U.S. rose by 43% in 2020 compared to 2019. The need to meet customers’ quick delivery expectations drive the segment’s growth.

Regional Insights

North America dominated the digital freight matching industry in 2024, with a revenue share of 30.3%. North America has a developed technological infrastructure with high internet and smartphone penetration. Hence, the shippers and carriers in the region can access digital freight matching platforms. The presence of prominent market players such as U.S.-based Uber Freight (Uber Technologies, Inc.) and Convoy, Inc., and high Research and Development (R&D) activity of technologies such as AI and ML in the region is a favorable environment for the growth of the market in the region.

U.S. Digital Freight Matching Market Trends

The U.S. digital freight matching industry is expanding rapidly due to the high demand for efficiency, cost reduction, and flexibility driven by e-commerce growth, and a push for sustainability. Investments in logistics technology, along with advancements in AI, IoT, and data analytics, enable digital freight matching platforms to offer smarter, real-time load matching and regulatory compliance support. Smaller carriers are increasingly adopting these accessible digital tools to remain competitive, aligning with a trend toward greater digitalization and sustainable logistics solutions.

Asia Pacific Digital Freight Matching Market Trends

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2030. Asia Pacific makes up a significant share of the global population, and the e-commerce industry is growing rapidly. Hence, digital freight matching platforms are likely to be adopted at a significant rate to meet consumer demand in the region. According to GSM Association’s 2023 report, about 47% of Asia Pacific’s population doesn’t have mobile internet access. However, smartphone adoption and 5G connections are expected to grow significantly by 2030. Improving technological infrastructure and growing e-commerce sales are driving the market’s growth in the region.

Key Digital Freight Matching Company Insights

Some of the key players operating in the market include Uber Freight (Uber Technologies, Inc.); C.H. Robinson Worldwide, Inc.; and XPO, Inc.

-

Uber Freight (Uber Technologies, Inc.) is one of the leading digital freight matching platforms that connects trucking companies with shippers, enabling more efficient and transparent freight logistics. Launched in 2016 as part of Uber Technologies, Inc.’s broader strategy to disrupt the logistics industry, Uber Freight provides a technology-driven solution to streamline the freight booking process, offering real-time pricing, instant load booking, and end-to-end visibility.

Freight Technologies, Inc. and Freight Tiger are some of the emerging participants in the target market.

-

Freight Technologies, Inc. is a U.S.-based technology-driven logistics company specializing in providing digital freight matching solutions. The company focuses on optimizing the freight management process by connecting shippers with carriers through its platform, which uses advanced algorithms and machine learning to improve route planning, pricing, and logistics efficiency. It has a presence in North America across the U.S. and Mexico.

Key Digital Freight Matching Companies:

The following are the leading companies in the digital freight matching market. These companies collectively hold the largest market share and dictate industry trends.

- XPO, Inc.

- Freight Tiger

- Redwood Logistics

- Convoy (Flexport Freight Tech LLC)

- Freight Technologies, Inc.

- Cargomatic Inc.

- C.H. Robinson Worldwide, Inc.

- Roper Technologies, Inc.

- Uber Freight (Uber Technologies, Inc.)

- Full Truck Alliance (JiangSu ManYun Software Technology Co., Ltd.)

Recent Developments

-

In August 2024, Uber Freight (Uber Technologies, Inc.) announced the launch of Uber Freight Shipping. It is an enhanced platform built on the successful Shipper Platform and offers an easy-to-use, free service for quoting, booking, and tracking shipments. By integrating advanced technology, Uber Freight ensures faster, more reliable freight booking with real-time tracking, 24/7 live support, and expanded ERP integration aimed at improving visibility and efficiency for businesses of all sizes.

-

In August 2024, Freight Technologies, Inc. announced its integration with Tecnomotum, a leading data transmission company in Mexico, to enhance the Fr8App, its AI-powered freight-matching platform. This collaboration improves fleet connectivity, optimizes logistics operations, and provides real-time data, further solidifying Fr8App’s position as a leader in cross-border shipping within the United States-Mexico-Canada Agreement (USMCA) region.

-

In November 2021, Uber Freight (Uber Technologies, Inc.) announced the acquisition of Transplace, a tech-enabled solutions and services platform for transportation and logistics networks, for USD 2.25 billion. With this acquisition, Uber Freight (Uber Technologies, Inc.) aimed to meet the needs of carriers and shippers by using Transplace’s platform.

Digital Freight Matching Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 61.46 billion

Revenue forecast in 2030

USD 247.58 billion

Growth rate

CAGR of 32.1% from 2025 to 2030

Historic year

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, platform, transportation mode, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Uber Freight (Uber Technologies, Inc.); Redwood Logistics; C.H. Robinson Worldwide, Inc.; XPO, Inc.; Convoy (Flexport Freight Tech LLC); Full Truck Alliance (JiangSu ManYun Software Technology Co., Ltd.); Freight Technologies, Inc.; Freight Tiger; Cargomatic Inc.; Roper Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Freight Matching Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global digital freight matching market report based on service, platform, transportation mode, industry, and region:

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Freight Matching Services

-

Value Added Services

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Web-based

-

Mobile-based

-

Android

-

iOS

-

-

-

Transportation Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Full Truckload (FTL)

-

Less-than-Truckload (LTL)

-

Intermodal

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Retail & E-commerce

-

Manufacturing

-

Oil & Gas

-

Automotive

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital freight matching market size was estimated at USD 47.21 billion in 2024 and is expected to reach USD 61.46 billion in 2025.

b. The global digital freight matching market is expected to grow at a compound annual growth rate of 32.1% from 2025 to 2030 to reach USD 247.58 billion by 2030.

b. North America dominated the digital freight matching market with a share of 30.3% in 2024. This is attributable to high internet and smartphone penetration and the presence of many digital freight matching companies.

b. Some key players operating in the digital freight matching market include Uber Freight (Uber Technologies, Inc.), Redwood, C.H. Robinson Worldwide, Inc., XPO, Inc., Convoy, Inc, Full Truck Alliance (JiangSu ManYun Software Technology Co., Ltd.), Freight Technologies, Inc., Freight Tiger, Cargomatic Inc., and Roper Technologies, Inc.

b. Key factors driving the market growth include the increasing need for digitization and automation across supply chains and growing e-commerce sales.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.