- Home

- »

- Automotive & Transportation

- »

-

Transportation Management System Market Report, 2033GVR Report cover

![Transportation Management System Market Size, Share & Trends Report]()

Transportation Management System Market (2026 - 2033) Size, Share & Trends Analysis Report By Solution (Operational Planning, Fright & Order Management), By Deployment, By Mode Of Transportation, By End User, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-973-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Transportation Management System Market Summary

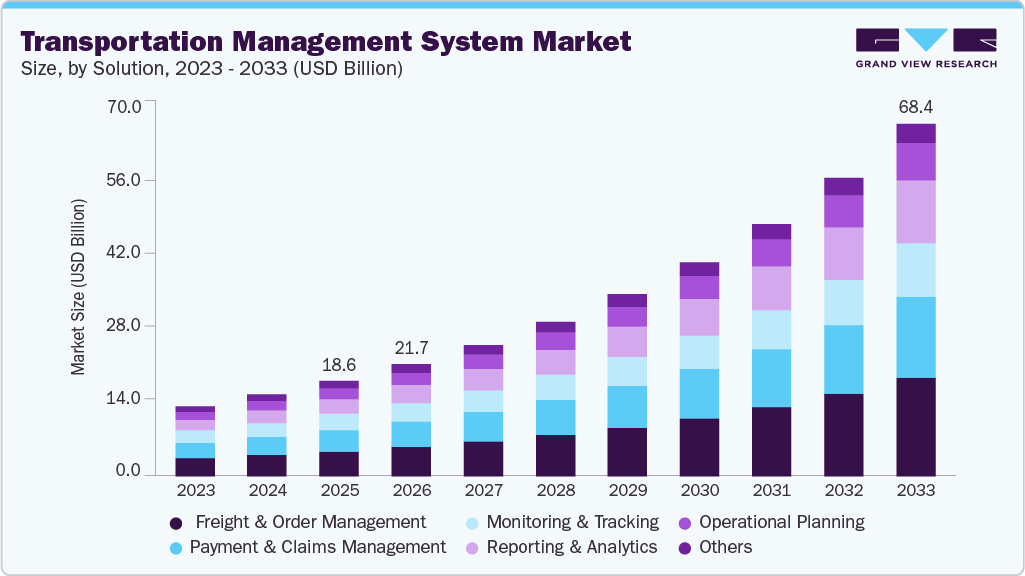

The global transportation management system market size was estimated at USD 18.56 billion in 2025 and is projected to reach USD 68.36 billion by 2033, growing at a CAGR of 17.8% from 2026 to 2033. The factors driving the global transportation management system (TMS) market include the growth of retail and e-commerce industries, consistent advancement in technology leading to the introduction of innovative solutions in the market, and the strengthening of bilateral trade relations among various countries across the world.

Key Market Trends & Insights

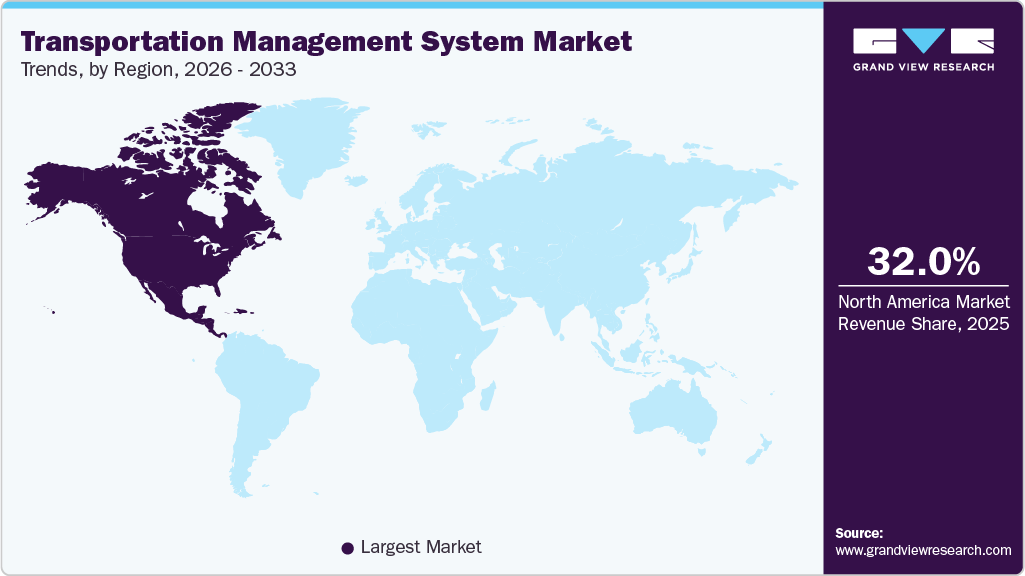

- The North America transportation management system industry was identified as a lucrative region in 2025.

- The U.S. transportation management system market held a dominant position in 2025.

- By solution, the freight & order management segment accounted for the largest share of 25.8% in 2025.

- By deployment, the on-premise segment held the largest market in 2025.

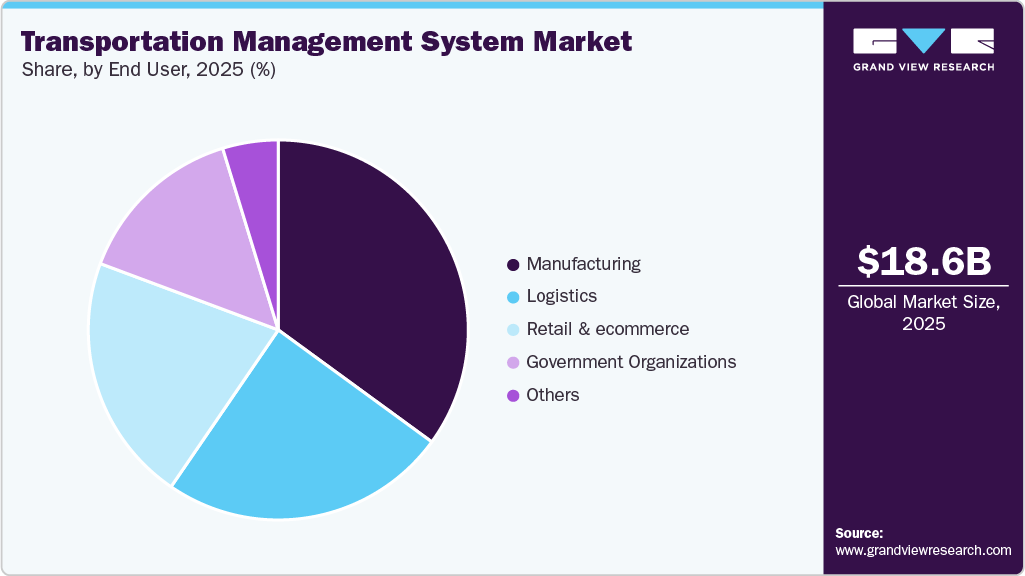

- By end-use, the manufacturing segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 18.56 Billion

- 2033 Projected Market Size: USD 68.36 Billion

- CAGR (2026-2033): 17.8%

- North America: Largest market in 2024

Further, TMS solutions help automate the manual tasks of supply chain operations, including planning and execution, route optimization, and shipment tracking. Thus, it helps reducing manual errors, saves time, and costs involved in managing transportation operations are the key factors driving the transportation management system industry growth.Transportation management systems play a primary role in supply chains, significantly affecting various aspects of the process, from operational planning, procurement, logistics, and lifecycle management. TMS offers deep visibility that helps in efficient transportation planning and monitoring, driving enhanced customer experience. Further, the dynamically expanding global trade environment and transits are making it highly crucial for businesses to have a TMS system that can allow them to successfully navigate complex transit operations and processes around trade policies and compliance. Thus, the following factors are aimed at driving the transportation management system industry growth.

In recent years, transportation and logistics industries in emerging countries have come under significant pressure from growing consumer demands, rising competition from start-ups and rival logistics operators, and changing customer expectations. Most logistics companies in countries in the APAC region utilize advanced IoT technologies to localized inventory and manage orders instead of supply chains, fleets, and assets. For instance, Here Technologies, a location platform solution provider based in the Netherlands, conducted an "APAC on the Move 2023 Survey" to offer insights on the current trends in the supply chain, logistics, and fleet management. The survey offered insights on robotics, drones, machine learning, and artificial intelligence, which are the most likely investments among logistics companies in APAC. The survey found that 45% of APAC logistics companies are utilizing shipment monitoring and asset tracking solutions with manual inputs to shipments, tracking assets, and cargo. Thus, these are the primary factors expected to drive the market growth.

AI is being implemented in several industries, including transportation, supply chain, and logistics. The growing size of data in transportation and supply chain management is driving the need for more effective data processing solutions. As such, transportation management systems are increasingly using AI to track data in real-time and optimize efficiency. For instance, several businesses in the transportation sector are using IBM Watson, which integrates AI in transportation management to identify damages to logistics assets. The solution also optimizes transportation routes and manages the network through its predictive analysis, thereby leveraging cognitive visual recognition capabilities that are anticipated to drive the transportation management system industry growth.

Inefficiencies in transportation operations between the source and destination can significantly increase the overall cost and success of the operation. Similarly, it can also lead to customer dissatisfaction and frustration, tarnishing the brand’s reputation. Hence, various industries are involved in deploying advanced TMS solutions in their business processes to minimize errors and discrepancies, saving the company from financial losses and protecting its reputation. TMS aims to provide new forms of optimization solutions that can enhance the ROI for end-users and bring operational efficiency within the business processes. Deployment of TMS solutions also helps in noticeable freight savings by streaming and optimizing transportation and supply chain operations, including efficient routing, selection of low-cost transport modes, and better procurement negotiations.

Key companies in the market are taking various strategic initiatives, including new product launches, mergers and acquisitions, and partnerships to offer advanced solutions and service offerings. For instance, in May 2023, BlackBerry Limited announced a strategic partnership with McLeod Software, a leading transportation management system provider. Based on the partnership, BlackBerry Radar, which offers innovative asset tracking and monitoring solutions for intermodal containers, chassis, trailers, equipment, and railcars, is aimed at integrating directly into McLeod Software's Loadmaster trucking dispatch management system with the intent to support McLeod's customers in gaining actionable and real-time insights on the status of their assets.

Solution Insights

The freight & order management segment accounted for the largest share of 25.8% in 2025. The growing customer-centric offerings require more intelligent solutions to engage customers and provide the right product through the right channel with significant speed and convenience based on customer requirements. Organizations are looking for advanced transportation management, logistics, and supply chain solutions that can manage the freight and order management processes, helping businesses to adapt and scale faster by ensuring seamless customer experience from onboarding to delivery and support. Freight & order management allows businesses to estimate orders, inventory availability, real-time delivery status, and fulfillment, allowing them to gain a competitive advantage and deliver enhanced customer experience are the key factors expected to drive market growth.

The reporting & analytics segment is expected to grow at the highest CAGR during the forecast period. Report & analytics TMS enables businesses to collect and integrate relevant data across various operational areas to gain business-related and specific insights, which are crucial for strategic and operational decision-making. It offers end-to-end visibility and custom reports, including fuel charges, freight and transportation expenses, and taxes, among others, allowing companies to boost service performance, drive informed decision-making, and trim additional expenses. Thus, these are the key factors aimed at driving the segment's growth in the market.

Deployment Insights

The on-premise segment held the largest market in 2025. Various manufacturing and distribution enterprises largely rely on the on-premise deployment mode for transportation management system solutions owing to the safety requirements, ease of access to the server, and greater control over customization. However, with the awareness of the benefits of the cloud's low cost of implementation as compared to the on-premise deployment, end users are expected to adopt advanced cloud-based transportation management.

The cloud-based segment is expected to register the highest CAGR during the forecast period. Cloud-based transportation management systems have gained increased popularity in recent years owing to the quick and easy setup, low initial cost, and reduced dependency on hardware requirements. It offers significant planning and optimizing advantages to vendors, shippers, and logistics providers. With the rising amount of data being generated, companies are actively looking for cloud-based TMS solutions as they offer a cost-effective alternative as compared to premise deployment, primarily reducing the licensing, data storage, and technical labor costs, thereby minimizing the overall operational costs.

Mode Of Transportation Insights

The roadways segment held the largest market in 2025. Roadways are among the most common transportation modes and are relatively cheaper compared to other modes. Moreover, it is flexible and makes loading and unloading possible at any destination. However, there are certain limitations to road transportation, such as limited carrying capacity, multipoint police checks, poor road conditions, traffic, and others. However, continuous government initiatives in emerging economies to improve the transportation infrastructure are expected to flourish the demand for logistics through roadways, hence influencing the demand for the market for the roadways segment.

The railways segment is expected to register the highest CAGR during the forecast period. The rising government initiatives for the upgradation of railways through the Public Private Partnership (PPP) are expected to drive the growth of TMS in the following segment. Railways play a significant role in cargo handling by the transportation of goods and consignment in large volumes of cargo via special wagons to carry cargo in a lesser in-transit time than roadways.

End User Insights

The manufacturing segment dominated the market in 2025. The growing number of manufacturing units in countries such as Mexico and India has led to an increase in the outsourcing of raw materials, inventories, and other materials required for manufacturing activities. Furthermore, increasing imports and exports and trade relations between countries are expected to boost the demand for shipping services, which would ultimately drive market growth. For instance, the Indian government’s ‘Make in India’ initiative has put a strong emphasis on the domestic manufacturing sector, which has triggered the local market growth.

The retail & ecommerce segment is anticipated to grow rapidly during the forecast period. Retailers use the transportation management system for a wide range of purposes, including managing, storing, and analyzing data in real-time. A retailer's success depends on extending its reach to customers through multiple stores and managing its supply chains efficiently to provide unique customer experience. Furthermore, growing demand for online retail and rising competition in the industry to provide seamless customer experience enable retailers to adopt advanced technologies such as multi-cloud management that simplify workflows, improve customer experience, and reduce IT operating costs.

Regional Insights

The North America transportation management system industry was identified as a lucrative region in 2025. The North American region is known for its fast-paced adoption of roadways as the key mode of transportation for moving freight and delivering goods. The rising spending by local municipalities on connected infrastructure is aimed at creating a favorable and smooth transit environment. It is among the key factors driving the growth of the North America TMS market. Moreover, the presence of various leading TMS vendors, including IBM Corporation, JDA Software Group Inc., Manhattan Associates, and MercuryGate International Inc., among others, providing numerous solutions to the consumers is also expected to strengthen the regional market growth.

U.S. Transportation Management System Market Trends

The U.S. transportation management system market held a dominant position in 2025. The market growth is driven by the rapid expansion of e-commerce, increasing supply chain complexity, and the widespread adoption of cloud-based TMS solutions. The need for real-time visibility, route optimization, and cost-efficient logistics is pushing U.S. businesses, particularly in retail, manufacturing, and 3PL sectors to invest in advanced TMS platforms.

Europe Transportation Management System Market Trends

Europe transportation management system market is expected to register a moderate CAGR from 2026 to 2033, fueled by the region’s strong focus on sustainability, cross-border trade, and regulatory compliance. The demand for transportation optimization tools is rising due to increasing environmental concerns and the EU’s emphasis on reducing carbon emissions in logistics. The adoption of electric vehicles and multimodal transport networks is also driving the need for more dynamic and integrated TMS solutions. Moreover, Europe's push for digital transformation across the logistics sector is accelerating cloud-based TMS deployment.

The Germany transportation management system market is expected to grow at a notable CAGR from 2026 to 2033. The country’s strong manufacturing base and export-driven economy demand highly efficient transportation systems. The push for Industry 4.0 and smart factory integration is fostering the use of advanced TMS for end-to-end supply chain visibility. Furthermore, the presence of leading logistics service providers and a mature IT infrastructure create favorable conditions for TMS adoption, especially those offering integration with ERP and WMS systems.

The UK transportation management system market held a substantial market share in 2025. The rise of e-commerce and increasing consumer demand for faster delivery times are encouraging logistics companies to invest in real-time tracking, predictive analytics, and automation-enabled TMS solutions.

Asia Pacific Transportation Management System Market Trends

The Asia Pacific transportation management system market is anticipated to grow at a fastest CAGR during the forecast period. The rising retail and e-commerce industries in China, India, Singapore, and Indonesia are aimed at driving the Asia Pacific region’s market growth during the forecast period. Further, the launch of the ASEAN Economic Community (AEC) is expected to play a major role in regional economic integration and the implementation of regulations encouraging the growth and development of trade across the region.

India’s transportation management system market is expected to grow at notable growth rate during the forecast period. India’s TMS market is rapidly expanding due to growing e-commerce penetration, government infrastructure investments, and the formalization of the logistics sector. The rise of digital freight platforms and adoption of cloud computing and mobile solutions are also contributing significantly to the TMS market growth in India.

The China transportation management system market held a substantial market share in 2025. China’s TMS market is experiencing significant growth, driven by its large-scale manufacturing sector, expanding e-commerce market, and aggressive investments in digital logistics infrastructure.

Key Transportation Management System Company Insights

Some of the key companies in the transportation management system industry include IBM Corporation, Oracle Corporation, and SAP SE among others. In the transportation management system market, organizations are prioritizing the integration of advanced technologies to enhance their offerings and maintain a competitive edge. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, business expansions, new product launches, and partnerships, among others.

-

Oracle Corporation provides Oracle Transportation Management (OTM) which offers a unified platform that enables organizations to efficiently manage all transportation activities across their supply chains. The solution helps reduce costs, enhance service levels, and supports flexible automation of business processes within global transportation and logistics operations.

-

SAP SE’s transportation management application seamlessly integrates fleet and logistics operations across your network, enabling reduced complexity, enhanced efficiency, and greater agility, contributing to a more sustainable and resilient supply chain.

Key Transportation Management System Companies:

The following are the leading companies in the transportation management system market. These companies collectively hold the largest market share and dictate industry trends.

- BluJay Solutions Ltd.

- Cargobase

- Cerasis, Inc.

- GoComet

- 3GTMS

- Infor Inc.

- IBM Corporation

- JDA Software Group, Inc.

- Manhattan Associates

- MercuryGate International, Inc.

- Oracle Corporation

- SAP SE

- The Descartes System Group Inc.

- Trimble Transportation Enterprise Solutions, Inc.

Recent Developments

-

In August 2025, project44 launched its Intelligent Transportation Management System (TMS), a next-generation, modular, cloud-native platform built on its Decision Intelligence Platform, Movement, to unify and automate global transportation operations. The solution delivers true multimodal capabilities-covering FTL, LTL, ocean, air, parcel, intermodal, and drayage with real-time rate management, AI-driven planning, intelligent carrier selection, procurement, and automated load optimization. It integrates seamlessly with order management, visibility, yard management, document management, and settlement systems, enabling end-to-end automation from purchase order creation to invoice reconciliation.

-

In February 2025, Rose Rocket unveiled TMS.ai at the Manifest 2025 conference in Las Vegas. This launch marks a significant evolution in transportation management systems (TMS), placing artificial intelligence (AI) at the core of the business’s system-of-record.

Transportation Management System Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 21.75 billion

Revenue forecast in 2033

USD 68.36 billion

Growth rate

CAGR of 17.8% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, mode of transportation, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

BluJay Solutions Ltd.; Cargobase; Cerasis, Inc.; GoComet; 3GTMS; Infor Inc.; IBM Corporation; JDA Software Group, Inc.; Manhattan Associates; MercuryGate International, Inc.; Oracle Corporation; SAP SE; The Descartes System Group Inc.; Trimble Transportation Enterprise Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transportation Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest Application trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global transportation management system market report based on solution, deployment, mode of transportation, end user, and region.

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Operational Planning

-

Fright & Order Management

-

Payment & Claims management

-

Monitoring & Tracking

-

Reporting & Analytics

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premise

-

Cloud

-

-

Mode of Transportation Outlook (Revenue, USD Million, 2021 - 2033)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail & Ecommerce

-

Manufacturing

-

Logistics

-

Government Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global transportation management system market size was estimated at USD 18.56 billion in 2025 and is expected to reach USD 21.75 billion in 2026.

b. The global transportation management system market is expected to grow at a compound annual growth rate of 17.8% from 2026 to 2033 to reach USD 68.36 billion by 2033.

b. The on-premise segment accounted for the largest transportation management systems market share in 2025. Various manufacturing and distribution enterprises largely rely on the on-premise deployment mode for transportation management system solutions owing to the safety requirements, ease of access to the server, and greater control over customization.

b. The roadways segment accounted for the largest market share of over 46.28% in 2025. Roadways are among the most common transportation modes and are relatively cheaper compared to other modes. Moreover, it is flexible and makes loading and unloading possible at any destination.

b. The manufacturing segment accounted for the largest market share of over 35.03% in 2025. The growing number of manufacturing units in countries such as Mexico and India have led to an increase in the outsourcing of raw materials, inventories, and other materials required for manufacturing activities.

b. North America dominated the global TMS market in 2025. The North American region is known for its fast-paced adoption of roadways as the key mode of transportation for moving freight and delivering goods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.