- Home

- »

- Healthcare IT

- »

-

Digital Health Market Size, Share And Growth Report, 2030GVR Report cover

![Digital Health Market Size, Share & Trends Report]()

Digital Health Market Size, Share & Trends Analysis Report By Technology (Healthcare Analytics, mHealth), By Component (Hardware, Software, Services), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-886-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Digital Health Market Size & Trends

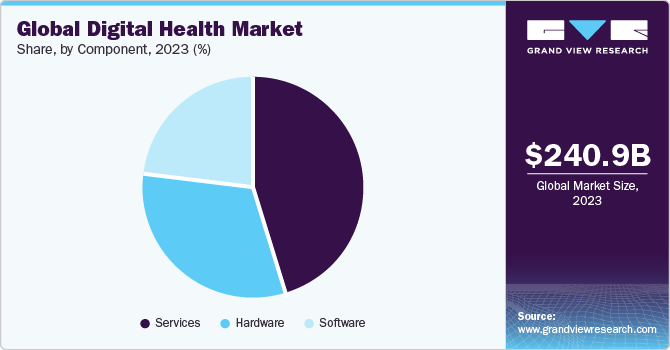

The global digital health market size was estimated at USD 240.9 billion in 2023 and is projected to grow at a compound annual growth (CAGR) of 21.9% from 2024 to 2030. The market is driven by several factors, such as a strong domestic market for telehealthcare platform developers, mHealth app providers, wearable device manufacturers, and e-prescription systems.

Moreover, the healthcare industry exhibits high growth potential for the IT industry due to supportive government initiatives across all regions. The growing trend of preventive healthcare & the rise in funding for mHealth startups are other factors boosting the market.

The rising incidence of chronic conditions such as diabetes, heart disease, and cancer is fueling the demand for remote monitoring and management solutions. Digital health tools can help patients track their health, adhere to treatment plans, and communicate with healthcare providers more effectively.

Some Statistics Related To Chronic Conditions:

-

Global Statistics: According to the WHO Non-communicable diseases cause 41 million deaths annually, constituting 74% of global fatalities. 17 million of these deaths occur before the age of 70, with 86% transpiring in low- and middle-income countries, and the majority of NCD deaths (77%) are concentrated in these regions. The leading contributors to NCD-related deaths include cancers (9.3 million), chronic respiratory diseases (4.1 million), diabetes (2.0 million, including diabetes-induced kidney disease deaths), and cardiovascular diseases (17.9 million)

-

Economic Impact: The National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP) in the U.S highlights the substantial economic impact of chronic diseases. Annually, heart disease and stroke, claiming over 877,500 lives, represent one-third of all deaths and generate a USD 216 billion economic burden on the healthcare system. Cancer, diagnosed in 1.7 million people yearly, ranks as the second leading cause of death, anticipating a cost exceeding USD 240 billion by 2030. Diabetes, affecting 37 million Americans with an additional 96 million at risk, incurred a total estimated cost of USD 327 billion in 2017, encompassing medical expenses and lost productivity

-

Individual Impact: Beyond the economic factors, chronic conditions significantly impact patients' quality of life. These conditions necessitate daily management, demanding ongoing attention, lifestyle modifications, and adherence to treatment plans. The continuous effort required to cope with chronic illnesses can lead to physical and emotional challenges, affecting not only the individuals but also their families and support networks. Moreover, if left unmanaged, chronic conditions often give rise to complications, further escalating the overall burden on patients and potentially diminishing their overall well-being

Leveraging Digital Health Solutions for Optimal Impact:

-

Remote Monitoring: Digital tools such as wearable devices and connected sensors allow patients to track vital signs, blood sugar levels, or other critical data in real-time, empowering them to manage their health proactively

-

Improved Adherence: Medication reminders, educational resources, and personalized coaching apps can help patients stay on track with treatment plans, leading to better health outcomes

-

Enhanced Communication: Telehealth platforms and secure messaging apps facilitate seamless communication between patients and healthcare providers, allowing for timely consultations, adjustments to treatment plans, and addressing concerns without physical visits

-

Empowerment & Engagement: By providing patients with accessible tools and information, digital health fosters a sense of control and engagement in their own health journey, motivating them to actively participate in their care

Specific Examples Across Chronic Conditions:

-

Diabetes: Glucose monitoring apps such as Dexcom, and continuous glucose monitors (CGMs) enable real-time blood sugar tracking, insulin dose adjustments, and dietary insights

-

Heart Disease: Wearable ECG monitors including Apple Watch can detect arrhythmias, while blood pressure cuffs like Omron connect to smartphones for remote monitoring and timely intervention

-

Cancer: Symptom tracking apps such as Carevive help patients identify and address side effects early, while telehealth platforms like CancerCare offer virtual support groups for emotional well-being

Furthermore, as per statistics published by the GSM Association report, The Mobile Economy 2023, the number of people connected to mobile services surpassed 5.4 billion in 2022, and the number of unique mobile subscribers is expected to reach 6.3 billion by 2030 (73% of the global population). The penetration of smartphones is also rising significantly. As per The Mobile Economy 2023, smartphone penetration was 76% in 2022 and is expected to reach 92% by 2030. The increasing adoption of smartphones by consumers is driving the uptake of mHealth applications in the global market. Furthermore, continuous improvement in network infrastructure and growing network coverage are boosting the demand for mHealth services. Mobile network operators view mHealth as an opportunity for investment owing to growing smartphone adoption and boosting fitness awareness.

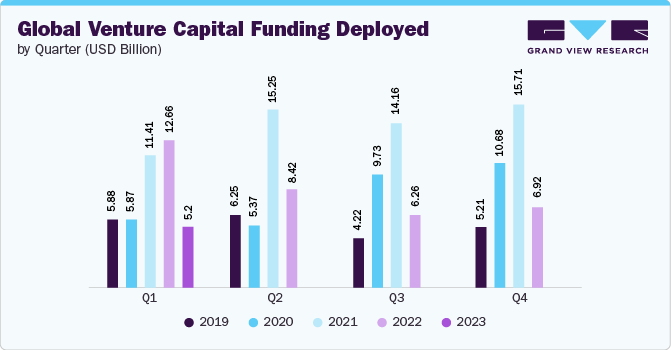

The landscape of venture funding for digital health startups is undergoing fluctuations, featuring both surges and declines. Instances such as Mantra Health securing USD 5 million in Series A extension funding in March 2023 and Aidoc securing USD 20 million in a Series B funding round in September 2020 highlight a sustained trend of increasing capital in the digital health sector. This trend not only signifies financial opportunities but also indicates a growing confidence in digital health solutions. Physicians with expertise in investments or company operations actively support digital health startups, contributing to market vitality.

However, amidst this positive trend, there was a recent downturn in digital health funding. Starting from its peak at USD 15.71 billion in Q4 2021, funding consistently declined throughout 2022, reaching USD 6.92 billion in Q4. This trend persists into Q1 2023, with global venture capital deployed in digital health further decreasing to USD 5.20 billion. Despite these declining figures, Q1 2023 should be interpreted not as a sign of diminishing interest but as a reflection of ongoing adjustments in venture valuations within the complex landscape faced by venture capital firms. The dynamic relationship between rising interest and recent funding fluctuations suggests a complex and evolving landscape for digital health startups in the upcoming years.

Nevertheless, as of 2024, the landscape of venture funding presents a dynamic overview marked by various trends and shifts. With transition funding options diminishing, digital health startups face a pivotal juncture. Some are turning to labeled fundraises at adjusted valuations, employing innovative strategies, or aligning with policy changes to attract investors. The acceleration of mergers and acquisitions (M&A) activity offers a potential exit route for financially strained companies, albeit potentially at reduced prices. Meanwhile, the public market group is undergoing modification, with struggling companies considering delisting, and late-stage players anticipating public exits after a year without one. This highlights the imperative for adaptability and strategic evolution among digital health startups in the evolving funding landscape of 2024.

Case Studies

Case Study 1: South Africa

MomConnect: Empowering Mothers in South Africa

-

The Challenge: Pregnant women and new mothers in South Africa often lack access to timely health information and quality services, impacting both their well-being and their babies' survival

-

The Solution: MomConnect, a national mobile health program, connects pregnant women and new mothers with critical information and services

Key Features:

-

Stage-Based Health Messages: Regular texts provide vital information tailored to each stage of pregnancy and early motherhood

-

Helpdesk: Users can text questions and receive prompt answers from trained health professionals

-

Health Information Library: Access various resources through an easy-to-use menu

-

Service Rating System: Users can provide feedback on their clinic experiences, fostering accountability

-

National Reach: Integrated with the health system, MomConnect serves over 65% of pregnant women and new mothers in South Africa

The Impact:

-

Over 2 million subscribers: High engagement demonstrates the program's value

-

27% of users complete service ratings: Feedback drives improvements in healthcare facilities

-

Over 500,000 helpdesk messages: Addresses individual concerns and provides personalized support

-

Constant innovation: MomConnect pilots new technologies like WhatsApp to stay ahead of the curve

-

Global expansion: The program's success paves the way for implementation in other countries like Nigeria and Uganda

Case Study 2: Indonesia

Halodoc: Bridging the Healthcare Gap in Indonesia

Challenge: Indonesia faces major hurdles in healthcare access, including:

-

Limited doctors: Only 2 doctors per 10,000 people, far below global averages

-

Uneven distribution: Rural areas lack facilities and professionals

-

Traffic congestion: Megacities make physical access difficult

-

Cost barriers: Traditional care can be expensive

Solution: Halodoc, a mobile-based platform, combines telemedicine and pharmacy delivery:

-

Teleconsultations: Connect with licensed doctors for video consultations

-

Prescription delivery: Get medication delivered within 40 minutes

-

Affordable: Consultations start at $1.75, lower than traditional clinics

-

Seamless integration: Links with insurance for cashless transactions

-

Expansive network: Covers 30 cities and partners with 1,400 hospitals

Impact:

-

Reaches 40 million users: Covers nearly 40% of the target population

-

Improves access: Provides care in remote areas and reduces travel time

-

Lowers costs: Makes healthcare more affordable

-

Partnerships: Collaborates with national health insurance for wider reach

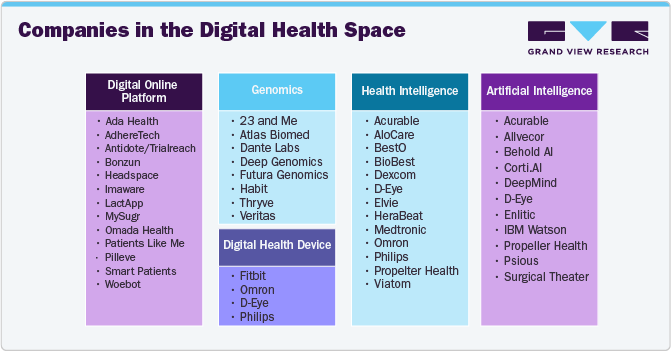

Market Concentration & Characteristics

The global market is characterized by continuous innovation, with a strong focus on user-friendly telehealth technologies. These advancements aim to simplify the adoption process for both patients and healthcare providers. The widespread use of mobiles and tablets allows convenient access to telemedicine services, health apps, and wearable health tech. This technological convergence empowers individuals to remotely monitor their health and receive medical consultations. Furthermore, various prominent players are introducing innovative products, solutions, and services to sustain a competitive advantage. For instance, in October 2023, NextGen Healthcare introduced NextGen Ambient Assist, an ambient listening solution that interprets real-time patient-provider conversations for efficient appointment summaries and care plan documentation.

Mergers and acquisitions (M&A) activities continue to shape the business landscape, with companies seeking strategic partnerships and acquisitions to enhance market presence and drive growth. Notable strategies include new product launches, expansions, and M&As. The market observes a moderate level of M&A activities among leading players. For instance, in September 2023, Enovacom, a subsidiary of Orange Business, acquired NEHS Digital, and Xperis to enhance healthcare solutions and strengthen its e-health position. Despite expectations for increased M&A activity at the end of 2022, driven by startups facing depleted cash reserves and favorable acquisition opportunities, the surge did not materialize in 2023. Notable acquisitions, such as Minded and Binx Health in Q4, occurred, but the M&A volume was 23% lower than in 2022, potentially influenced by prolonged high-interest rates and volatile capital markets.

Digital health technologies are subject to diverse regulatory frameworks across countries or regions. The structured regulatory framework positively impacts market access, growth, and compliance. For instance, In the U.S., the Food and Drug Administration (FDA) has developed guidelines for digital health technologies.

-

In Australia, Therapeutic Goods Administration (TGA) regulates digital health technologies

-

In Canada, Health Canada developed a regulatory framework for digital health technologies

-

In Germany: Medical apps and digital health products often fall under the regulations of the EU's Medical Devices Regulation (MDR) and In Vitro Diagnostics Regulation (IVDR). These EU regulations, directly applicable in Germany, are complemented by the German Act on the Implementation of EU Medical Devices Law (MPDG)

An external substitute for digital health involves opting for non-digital alternatives in healthcare, relying on traditional services and interventions. This entails utilizing conventional methods like face-to-face consultations, traditional medical treatments, or paper-based health records, instead of integrating digital technologies into healthcare processes.

Traditional Healthcare Delivery:

-

In-person consultations with doctors and other healthcare professionals: This would involve physical visits to clinics, hospitals, or other healthcare facilities

-

Paper-based medical records and communication: Information would be exchanged through physical documents and face-to-face interactions

-

Traditional diagnostic and treatment methods: These might involve non-digital tools and procedures

Community-based Healthcare:

-

Support groups and peer-to-peer networks: Individuals connect and share information and experiences without relying on digital platforms

-

Local health education and outreach programs: Communities organize workshops, events, and campaigns to promote health awareness and behavior change

-

Traditional healing practices and herbal remedies: Some communities utilize established non-digital healthcare practices

The global expansion of the digital health sector is propelled by the potential for improved accessibility, cost-effectiveness, and outcomes. Established industry leaders are venturing into emerging markets, indigenous startups are experiencing growth, and technology is being tailored to diverse contexts. Achieving harmonization through collaborative efforts, national strategies, and addressing challenges such as data privacy, digital inequality, and regulatory complexities is vital. The expansion is generally done through launching facilities, or plants in new geographies or through merging or acquiring companies based in different locations. Several market players are adopting geographical expansion strategies to strengthen their positions in the market. For instance, in March 2022, Telefonica Tech acquired Incremental, a digital transformation and data analysis company, for USD 232 million (EUR 209 million). Through this acquisition, both companies significantly increased their scale and offering of Microsoft technologies in the UK.

Component Insights

Based on component, the services segment led the market with the largest revenue share in 2023, owing to the growing demand for services, such as installation, staffing, training, maintenance, and other services. Market players are either providing these services as standalone or in packages. The growing demand for advanced software solutions and platforms, such as Electronic Medical Records (EMRs), EHR, and the increasing need for upgradation & training required to run these software solutions, are contributing to segment growth. As per 2021 HealthIT.gov report, nearly 88% of U.S. office-based doctors use EHRs, within that 78% using certified EHRs. Key players provide a wide array of pre- & post-installation services, covering project planning, staffing, implementation, training, and resource allocation & optimization.

The software segment is anticipated to register the fastest CAGR of 23.2% from 2024 to 2030, due to rapid adoption of software systems among patients, healthcare facilities, providers, and insurance payers. Growing healthcare expenses and the trend of healthcare digitalization are contributing to the growth of the software segment. Growing consumer demand for personalized medicine and the transition to value-based care is driving segment growth. In emerging economies, healthcare facilities readily adopt these advanced software solutions and platforms to streamline their organizational workflows and enhance their clinical, operational, & financial outcomes.

Technology Insights

Based on technology, the tele healthcare segment led the market with a largest revenue share of 43.2% in 2023 and is also expected to register the fastest CAGR over the forecast period. This growth rate can be attributed to advancing internet connectivity, growing smartphone penetration, advanced technology readiness, a growing shortage of healthcare providers, increasing medical expenses, easy availability of telehealth applications, and rising adoption of these technologies by patients & physicians. The constant evolution of telehealth applications and rapid technological innovations further boost segment growth. Government support, policies promoting healthcare digitization, and growing healthcare IT spending are major factors driving segment growth.

The mHealth segment held the second largest position in terms of revenue share in 2023 in the global market. Growing penetration of smartphones & internet connectivity and rising adoption of mHealth technologies by physicians & patients are factors driving segment growth. As per Uswitch Limited's calculations, the UK had approximately 71.8 million mobile connections at the beginning of 2022, surpassing the country's population by 4.2 million. This represents a 3.8% increase from 2021, which is equivalent to around 2.6 million new mobile connections. Increasing trend of preventive healthcare & rising funding for mHealth startups are other factors boosting the market.

Application Insights

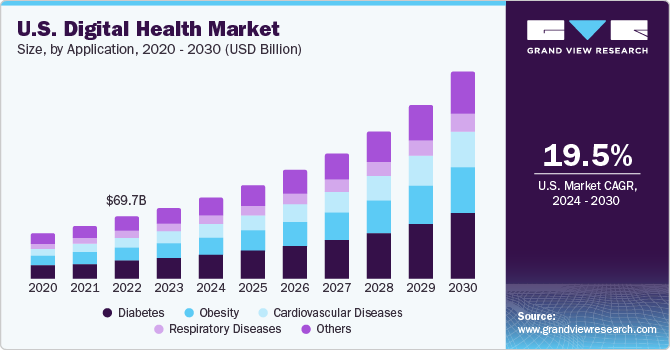

Based on applications, the diabetes segment led the market with the largest revenue share of 24.3% in 2023 and is expected to register the fastest CAGR of 23.7% from 2024 to 2030. The prevalence of diabetes and its associated complications has positioned it as the largest segment in the digital health space. Digital health technologies offer innovative solutions to address the needs of individuals with diabetes. Digital health tools, ranging from smartphone applications for glucose monitoring to wearable devices that track physical activity and offer real-time health data, enable patients to actively engage in managing their diabetes. Moreover, these technologies facilitate remote patient monitoring, enabling healthcare providers to receive timely data, make informed decisions, and offer timely interventions, ultimately contributing to more effective diabetes management.

The obesity segment is the second largest in application due to high global prevalence and the rising need for effective weight management solutions. Digital health technologies offer personalized interventions, ranging from mobile applications for dietary tracking to wearable devices monitoring physical activity, driving the segment's growth. Moreover, a shift beyond conventional applications in weight management is evident, with a growing number of companies adopting personalized approaches. This includes the use of metabolic testing, glucose monitoring, and innovative technologies such as Prism Lab’s body mapping and Spren’s smart mirror to customize treatment plans. Remote monitoring companies such as Qardio, and Rimidi utilize smart scales to track weight and aggregate data for risk factor assessment. Integration with medications enhances their role in stratifying appropriate care and monitoring adherence. All these factors collectively drive the growth of the obesity segment in the digital health landscape.

End-use Insights

Based on end-use, the patient segment held the market with the largest revenue share of 34.1% in 2023 and is expected to witness the fastest CAGR from 2024 to 2030, owing to the shift toward patient-centered care and high awareness of managing health among individuals. Digital health technologies have revolutionized the healthcare landscape by providing patients with tools for remote monitoring, self-management, and access to health information. From mobile health apps that track vital signs to telehealth platforms facilitating virtual consultations, the focus on the patient segment reflects the industry's commitment to enhancing patient engagement, promoting proactive health management, and fostering a more collaborative and informed healthcare experience.

The providers segment holds a significant share of the global market and is expected to maintain their market share over the forecast period. The growth is propelled by the widespread adoption of innovative technologies, such as telemedicine and digital therapeutics. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies outside traditional care settings. The integration of digital tools allows providers to deliver more accessible and tailored care, contributing to improved patient outcomes.

Regional Insights

North America dominated the market with the largest revenue share of 38.2% in 2023, owing to technological advancements, growing healthcare IT expenditure to advance infrastructure, favorable government initiatives, emergence of startups, readiness to adopt advanced technological solutions, options for growing smartphone penetration, advancements in internet connectivity, and lucrative funding. In addition, factors, such as advancements in coverage networks, rapid growth in the adoption of smartphones, a rise in geriatric population & prevalence of chronic diseases, and shortage of primary caregivers are responsible for industry growth.

U.S. Digital Health Market Trends

The U.S. leads in the digitalization of healthcare in North America with a revenue share of 88.2% in 2023, due to advanced healthcare management & innovative software developments and the presence of numerous key players operating across segments, such as mobile & network operations. According to a survey conducted by Insider Intelligence in December 2022, around 63.4% of U.S. adults used a health-related app in the past 12 months. In addition, health-related mobile apps are extremely popular across the U.S. due to rising health consciousness. Hence, fitness and nutrition tracking has been a leading factor in adopting digital healthcare systems, indicating a strong consumer preference for these apps.

Asia Pacific Digital Health Market Trends

Asia Pacific is estimated to witness the fastest CAGR from 2024 to 2030 in the digital health market. This surge is attributed to the increasing adoption of eHealth platforms and a rise in healthcare expenditure across the region. The growing demand for remote patient monitoring and telehealth services, supported by increasing government investments in healthcare, is expected to drive industry expansion. Notably, data from The World Bank in 2019 indicates that China allocated 5.4%, India 3.1%, and Japan 10.7% of their respective GDPs to healthcare spending. The active participation of key players in Asia Pacific has further accelerated the adoption of digital apps and platforms in the region.

The digital health market in India holds significant amount of share in the Asia Pacific region. It is one of the key countries readily embracing digital technology. The increased smartphone penetration, improved network coverage, and favorable government initiatives (such as Digital India and Disha) are boosting the adoption of digital healthcare services in the country. DISHA aims to regulate digital health data into a federal structure. It regulates a National level Healthcare Authority (NeHA) and a State level Healthcare Authority (SeHA). Under this act, national- and state-level executive committees will aid & assist NeHA and SeHA in performing their functions under DISHA.

MEA Digital Health Market Trends

The digital health market in the Middle East and Africa is expected to see significant growth in the coming years. This growth is driven by factors such as increasing adoption of digital technologies, a growing awareness of healthcare solutions, and efforts to improve healthcare infrastructure. Digital health is revolutionizing healthcare in MEA, facilitated by improving internet connectivity and government initiatives. Telemedicine, wearable devices, mHealth apps, and Artificial Intelligence (AI) are key trends transforming healthcare access, costs, & outcomes. Despite challenges including infrastructure, affordability, and data privacy, digital health’s potential to improve MEA healthcare is substantial.

Saudi Arabia digital health market is undergoing substantial growth and is anticipated to experience rapid expansion, projecting a Compound Annual Growth Rate (CAGR) of 23.2% during the forecast period spanning from 2024 to 2030. The country launched an initiative called Saudi Vision 2030. With the launch of this initiative the Kingdom of Saudi Arabia has recognized the importance of digital health in transforming its healthcare system. The vision places a significant emphasis on leveraging technology to enhance healthcare services, improve efficiency, and ensure better health outcomes for the population. Key initiatives related to digital health within Saudi Vision 2030 include:

-

E-Health Services: The development and implementation of electronic health services to streamline processes, improve patient care, and enable efficient healthcare delivery

-

Telemedicine: The promotion of telemedicine to facilitate remote consultations, monitor patients' health remotely, and increase access to healthcare services, especially in remote areas

-

Health Information Exchange (HIE): Creating a strong health information exchange system to facilitate the seamless sharing of patient information among healthcare providers, leading to better-informed decision-making

List of Countries & Digital Health Industry Outlook

Country

State of Adoption

Challenges

Future Outlook

UK

Steady growth in telehealth, focus on NHS integration

Lack of awareness, uneven internet access in rural areas

Focus on scaling existing initiatives and improving accessibility

China

Rapid adoption of wearables and AI-powered solutions

Data security concerns, limited access for rural populations

Continued government investment and development of homegrown solutions

Japan

Emphasis on telemedicine and remote patient monitoring

Traditional healthcare culture, strict data privacy regulations

Gradual integration with focus on maintaining quality and patient trust

Germany

Rising adoption of telehealth and electronic health records

Fragmented insurance landscape, data governance complexities

Streamlining data exchange and addressing interoperability issues

France

Mixed reception for telehealth, strong emphasis on patient-physician relationships

Concerns about dehumanization of healthcare, limited infrastructure in rural areas

Pilot programs and targeted initiatives to address concerns and bridge gaps

Canada

Moderate telehealth adoption, focus on chronic disease management

Public healthcare funding limitations, regional disparities in access

Continued investment in telehealth infrastructure and digital skill development

Australia

Growing adoption of mHealth apps for self-management

Rural access limitations, privacy concerns among older demographics

Focus on community-based telehealth programs and culturally appropriate solutions

Key Digital Health Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Apple, Inc., Google, Inc., and Qualcomm Technologies, Inc. are market leaders with a presence in more than 30 countries, including headquarters, manufacturing sites, distribution centers, and office locations. The Apple App Store features over 40,000 apps in the healthcare segment. In March 2023, to improve digital health, Apple Inc. announced plans to upgrade AirPods by adding ambient light sensors with health tracking features, including motion detectors, temperature monitors, blood oxygen level, and perspiration & heart rate, by 2025. In addition, H2O Therapeutics, a Turkey-based startup, received U.S. FDA clearance for its Parky app. This Apple Watch app monitors Parkinson’s disease symptoms, such as dyskinesia and tremors. Furthermore, Samsung Electronics Co. Ltd., Qualcomm Technologies, Inc., and Vodafone Group Plc. are the emerging market players.

Key Digital Health Companies:

The following are the leading companies in the digital health market. These companies collectively hold the largest market share and dictate industry trends.

- Telefónica S.A.

- Epic Systems Corporation

- QSI Management, LLC

- AT&T

- AirStrip Technologies

- Google, Inc.

- Hims & Hers Health, Inc.

- Orange

- Softserve

- Computer Programs and Systems, Inc.

- Vocera Communications

- IBM Corporation

- CISCO Systems, Inc.

- Apple Inc.

- Oracle Cerner

- Veradigm

- Mckesson Corporation

- Hims & Hers Health, Inc.

- Vodafone Group

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

Recent Developments

-

In April 2023, Microsoft collaborated with Epic Systems Corporation to integrate AI into EHR, enabling healthcare practitioners to improve their productivity and patient communication with AI-enabled solutions

-

In March 2023, BlueRock Therapeutics LP entered a collaboration with Emerald Innovations and Rune Labs with a major focus on innovations using contactless & invisible, wearable digital health technology to improve monitoring of Parkinson's disease

-

In March 2023, Google launched Open Health Stack, an open-source program for developers to build health-related apps by including strategies, such as AI partnerships focusing on cancer screening

-

In March 2023, Nabla Technologies launched Copilot, a digital assistant tool, as a Chrome extension using GPT-3 for doctors to make patients' conversations turn into action

-

In March 2022, Samsung unveiled its latest innovation, a smart healthcare TV and advanced digital health solutions for healthcare facilities, at the Healthcare Information and Management Systems Society (HIMSS) Global Conference in Florida. Furthermore, Samsung and ShareSafe partnered to develop a secure solution for casting from mobile devices to Samsung Smart Healthcare TV

-

In March 2022, Epic Systems Corporation launched Garden Plot, which provides small independent healthcare groups access to Epic software solutions and an interoperability network

-

In March 2022, Vocera Communications, a part of Stryker, introduced Minibadge. This compact, portable, voice-driven wearable device integrates with clinical and operational workflows of healthcare facilities & enables hands-free communication

Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 288.6 billion

Revenue forecast in 2030

USD 946.0 billion

Growth rate

CAGR of 21.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Australia; Singapore; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Oracle Cerner; Veradigm; Apple Inc.; Telefonica S.A.; McKesson Corp.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd.; Hims & Hers Health, Inc.; Orange; Qualcomm Technologies, Inc.; Softserve; Computer Programs and Systems, Inc.; Vocera Communications; IBM Corp.; CISCO Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global digital health market report on the basis of technology, component, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables & Connected Medical Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal & Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

mHealth Apps

-

Medical Apps

-

Women's Health

-

Fitness & Nutrition

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

Chronic Disease Management Apps

-

Diabetes Management Apps

-

Blood Pressure & ECG Monitoring Apps

-

Mental Health Management Apps

-

Cancer Management Apps

-

Obesity Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

-

Services

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-Acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

-

Digital Health Systems

-

EHR

-

E-prescribing Systems

-

-

Healthcare Analytics

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital health market size was estimated at USD 240.9 billion in 2023 and is expected to reach USD 288.6 billion in 2024.

b. The global digital health market is expected to grow at a compound annual growth rate of 21.9% from 2024 to 2030 to reach USD 946.0 billion by 2030.

b. Tele-healthcare dominated the digital health market with a share of 43.2% in 2023. This is attributable to high internet usage, increased penetration of smartphones, and the growing adoption of digital communication and information technologies for virtual home health services.

b. Some key players operating in the digital health market include Apple Inc.; AirStrip Technologies; Allscripts; Google Inc.; Orange; Qualcomm Technologies Inc.; Mqure; Samsung Electronics Co. Ltd.; Telefonica S.A.; Vodafone Group; Cerner Corporation; and McKesson Corporation.

b. Key factors that are driving the digital health market growth include increasing adoption of digital healthcare, favorable initiatives, and technological advancements for developing innovative digital solutions.

Table of Contents

Chapter 1. Digital Health Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Technology

1.2.2. Component

1.2.3. Application

1.2.4. End-use

1.3. Estimates and Forecast Timeline

1.4. Research Methodology

1.5. Information Procurement

1.5.1. Purchased Database

1.5.2. GVR’s Internal Database

1.5.3. Secondary Sources

1.5.4. Primary Research

1.6. Information Analysis

1.6.1. Data Analysis Models

1.7. Market Formulation & Data Visualization

1.8. Model Details

1.8.1. Commodity Flow Analysis

1.9. List of Secondary Sources

1.10. Objectives

Chapter 2. Digital Health Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.2.1. Technology outlook

2.2.2. Component outlook

2.2.3. Application outlook

2.2.4. End-use outlook

2.2.5. Regional outlook

2.3. Competitive Landscape Snapshot

Chapter 3. Digital Health Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing adoption of digital healthcare

3.2.1.2. Shortage of medical professionals and increasing demand for healthcare

3.2.1.3. Rise in artificial intelligence, IoT, and big data

3.2.1.4. Growing adoption of mobile health applications

3.2.2. Market Restraint Analysis

3.2.2.1. Cybersecurity and privacy concerns

3.2.2.2. Lack of healthcare infrastructure

3.3. Case Study Analysis

3.3.1. End-use case studies

3.3.1.1. Case Study 1: Nova Hospital & Enovacom

3.3.1.2. Case Study 2: Apple & NHS Teams

3.4. Business Environment Analysis

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

Chapter 4. Digital Health Market Segment Analysis, By Technology, 2018 - 2030 (USD Million)

4.1. Definition and Scope

4.2. Technology Segment Dashboard

4.3. Global Digital Health Market, by Technology, 2018 to 2030

4.4. Tele-Healthcare

4.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2. Telecare

4.4.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2.2. Activity monitoring

4.4.2.3. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2.4. Remote medication management

4.4.2.5. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.3. Telehealth

4.4.3.1. Market estimates and forecasts, 2018 to 2030, (USD Million)

4.4.3.2. Long-term care (LTC) monitoring

4.4.3.3. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.3.4. Video consultation

4.4.3.5. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5. mHealth

4.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2. Wearables & Connected Medical Devices

4.5.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.2. Vital Sign Monitoring Devices

4.5.2.2.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.2.2.Heart Rate Monitors

4.5.2.2.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.2.3.Activity Monitors

4.5.2.2.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.2.4.Electrocardiographs

4.5.2.2.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.2.5.Pulse Oximeters

4.5.2.2.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.2.6.Spirometers

4.5.2.2.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.2.7.Blood Pressure Monitors

4.5.2.2.7.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.2.8.Others

4.5.2.2.8.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.3. Sleep Monitoring Devices

4.5.2.3.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.3.2.Sleep trackers.

4.5.2.3.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.3.3.Wrist Actigraphs

4.5.2.3.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.3.4.Polysomnographs

4.5.2.3.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.3.5.Others

4.5.2.3.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.4. Electrocardiographs Fetal and Obstetric Devices

4.5.2.4.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.5. Neuromonitoring Devices

4.5.2.5.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.5.2.Electroencephalographs

4.5.2.5.3.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.5.4.Electromyographs

4.5.2.5.5.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.2.5.6.Others

4.5.2.5.7.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3. mHealth Apps

4.5.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2. Medical Apps

4.5.3.2.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.2.Women's Health

4.5.3.2.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.2.2. Fitness and Nutrition

4.5.3.2.2.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.2.3. Menstrual Health

4.5.3.2.2.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.2.4. Pregnancy Tracking & Postpartum Care

4.5.3.2.2.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.2.5. Menopause

4.5.3.2.2.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.2.6. Disease Management

4.5.3.2.2.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.2.7. Others

4.5.3.2.2.7.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.3.Chronic Disease Management Apps

4.5.3.2.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.3.2. Diabetes Management Apps

4.5.3.2.3.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.3.3. Blood Pressure and ECG Monitoring Apps

4.5.3.2.3.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.3.4. Mental Health Management Apps

4.5.3.2.3.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.3.5. Cancer Management Apps

4.5.3.2.3.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.3.6. Obesity Management Apps

4.5.3.2.3.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.3.7. Other Chronic Disease Management Apps

4.5.3.2.3.7.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.4.Personal Health Record Apps

4.5.3.2.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.5.Medication Management Apps

4.5.3.2.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.6.Diagnostic Apps

4.5.3.2.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.7.Remote Monitoring Apps

4.5.3.2.7.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.2.8.Others (Medical Reference, Professional Networking, Healthcare Education)

4.5.3.2.8.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.3.3. Fitness Apps

4.5.3.3.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.4. Services

4.5.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.4.2. Monitoring Services

4.5.4.2.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.4.2.2.Independent Aging Solutions

4.5.4.2.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.4.2.3.Chronic Disease Management & Post-Acute Care Services

4.5.4.2.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.4.3. Diagnosis Services

4.5.4.3.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.4.4. Healthcare Systems Strengthening Services

4.5.4.4.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.5.4.5. Others

4.5.4.5.1.Market estimates and forecasts, 2018 to 2030 (USD Million)

4.6. Digital Health Systems

4.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.6.2. EHR

4.6.2.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.6.3. E-prescribing Systems

4.6.3.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

4.7. Healthcare Analytics

4.7.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 5. Digital Health Market: Segment Analysis, by Component, 2018 - 2030 (USD Million)

5.1. Definition and Scope

5.2. Component Segment Dashboard

5.3. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4. Software

5.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

5.5. Hardware

5.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

5.6. Services

5.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 6. Digital Health Market: Segment Analysis, by Application, 2018 - 2030 (USD Million)

6.1. Definition and Scope

6.2. Application Segment Dashboard

6.3. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4. Obesity

6.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.5. Diabetes

6.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.6. Cardiovascular

6.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.7. Respiratory Diseases

6.7.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

6.8. Others

6.8.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 7. Digital Health Market: Segment Analysis, by End-use, 2018 - 2030 (USD Million)

7.1. Definition and Scope

7.2. End-use Segment Dashboard

7.3. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.4. Patients

7.4.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

7.5. Providers

7.5.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

7.6. Payers

7.6.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

7.7. Others

7.7.1. Market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 8. Digital Health Market: Segment Analysis, by Region, by Technology, by Component, by Application, by End Use, 2018 - 2030 (USD Million)

8.1. Definition & Scope

8.2. Regional Market Share Analysis, 2023 & 2030

8.3. Regional Market Dashboard

8.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

8.5. SWOT Analysis

8.6. North America

8.6.1. U.S.

8.6.1.1. Key country dynamics

8.6.1.2. Regulatory framework/ reimbursement structure

8.6.1.3. Competitive scenario

8.6.1.4. U.S. market estimates and forecasts, 2018 to 2030 (USD Million)

8.6.2. Canada

8.6.2.1. Key country dynamics

8.6.2.2. Regulatory framework/ reimbursement structure

8.6.2.3. Competitive scenario

8.6.2.4. Canada market estimates and forecasts, 2018 to 2030 (USD Million)

8.7. Europe

8.7.1. UK

8.7.1.1. Key country dynamics

8.7.1.2. Regulatory framework/ reimbursement structure

8.7.1.3. Competitive scenario

8.7.1.4. UK market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.2. Germany

8.7.2.1. Key country dynamics

8.7.2.2. Regulatory framework/ reimbursement structure

8.7.2.3. Competitive scenario

8.7.2.4. Germany market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.3. France

8.7.3.1. Key country dynamics

8.7.3.2. Regulatory framework/ reimbursement structure

8.7.3.3. Competitive scenario

8.7.3.4. France market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.4. Italy

8.7.4.1. Key country dynamics

8.7.4.2. Regulatory framework/ reimbursement structure

8.7.4.3. Competitive scenario

8.7.4.4. Italy market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.5. Spain

8.7.5.1. Key country dynamics

8.7.5.2. Regulatory framework/ reimbursement structure

8.7.5.3. Competitive scenario

8.7.5.4. Spain market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.6. Norway

8.7.6.1. Key country dynamics

8.7.6.2. Regulatory framework/ reimbursement structure

8.7.6.3. Competitive scenario

8.7.6.4. Norway market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.7. Sweden

8.7.7.1. Key country dynamics

8.7.7.2. Regulatory framework/ reimbursement structure

8.7.7.3. Competitive scenario

8.7.7.4. Sweden market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.8. Denmark

8.7.8.1. Key country dynamics

8.7.8.2. Regulatory framework/ reimbursement structure

8.7.8.3. Competitive scenario

8.7.8.4. Denmark market estimates and forecasts, 2018 to 2030 (USD Million)

8.8. Asia Pacific

8.8.1. Japan

8.8.1.1. Key country dynamics

8.8.1.2. Regulatory framework/ reimbursement structure

8.8.1.3. Competitive scenario

8.8.1.4. Japan market estimates and forecasts, 2018 to 2030 (USD Million)

8.8.2. China

8.8.2.1. Key country dynamics

8.8.2.2. Regulatory framework/ reimbursement structure

8.8.2.3. Competitive scenario

8.8.2.4. China market estimates and forecasts, 2018 to 2030 (USD Million)

8.8.3. India

8.8.3.1. Key country dynamics

8.8.3.2. Regulatory framework/ reimbursement structure

8.8.3.3. Competitive scenario

8.8.3.4. India market estimates and forecasts, 2018 to 2030 (USD Million)

8.8.4. Australia

8.8.4.1. Key country dynamics

8.8.4.2. Regulatory framework/ reimbursement structure

8.8.4.3. Competitive scenario

8.8.4.4. Australia market estimates and forecasts, 2018 to 2030 (USD Million)

8.8.5. South Korea

8.8.5.1. Key country dynamics

8.8.5.2. Regulatory framework/ reimbursement structure

8.8.5.3. Competitive scenario

8.8.5.4. South Korea market estimates and forecasts, 2018 to 2030 (USD Million)

8.8.6. Singapore

8.8.6.1. Key country dynamics

8.8.6.2. Regulatory framework/ reimbursement structure

8.8.6.3. Competitive scenario

8.8.6.4. Singapore market estimates and forecasts, 2018 to 2030 (USD Million)

8.9. Latin America

8.9.1. Brazil

8.9.1.1. Key country dynamics

8.9.1.2. Regulatory framework/ reimbursement structure

8.9.1.3. Competitive scenario

8.9.1.4. Brazil market estimates and forecasts, 2018 to 2030 (USD Million)

8.9.2. Mexico

8.9.2.1. Key country dynamics

8.9.2.2. Regulatory framework/ reimbursement structure

8.9.2.3. Competitive scenario

8.9.2.4. Mexico market estimates and forecasts, 2018 to 2030 (USD Million)

8.9.3. Argentina

8.9.3.1. Key country dynamics

8.9.3.2. Regulatory framework/ reimbursement structure

8.9.3.3. Competitive scenario

8.9.3.4. Argentina market estimates and forecasts, 2018 to 2030 (USD Million)

8.10. MEA

8.10.1. South Africa

8.10.1.1. Key country dynamics

8.10.1.2. Regulatory framework/ reimbursement structure

8.10.1.3. Competitive scenario

8.10.1.4. South Africa market estimates and forecasts, 2018 to 2030 (USD Million)

8.10.2. Saudi Arabia

8.10.2.1. Key country dynamics

8.10.2.2. Regulatory framework/ reimbursement structure

8.10.2.3. Competitive scenario

8.10.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030, (USD Million)

8.10.3. UAE

8.10.3.1. Key country dynamics

8.10.3.2. Regulatory framework/ reimbursement structure

8.10.3.3. Competitive scenario

8.10.3.4. UAE market estimates and forecasts, 2018 to 2030 (USD Million)

8.10.4. Kuwait

8.10.4.1. Key country dynamics

8.10.4.2. Regulatory framework/ reimbursement structure

8.10.4.3. Competitive scenario

8.10.4.4. Kuwait market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company/Competition Categorization

9.2.1. Innovators

9.3. Vendor Landscape

9.3.1. List of key distributors and channel partners

9.3.2. Key customers

9.3.3. Key company market share analysis, 2023

9.3.4. Cerner Corporation (Oracle)

9.3.4.1. Company overview

9.3.4.2. Financial performance

9.3.4.3. Product benchmarking

9.3.4.4. Strategic initiatives

9.3.5. Allscripts (Veradigm LLC)

9.3.5.1. Company overview

9.3.5.2. Financial performance

9.3.5.3. Product benchmarking

9.3.5.4. Strategic initiatives

9.3.6. Apple, Inc.

9.3.6.1. Company overview

9.3.6.2. Financial performance

9.3.6.3. Product benchmarking

9.3.6.4. Strategic initiatives

9.3.7. Telefónica S.A.

9.3.7.1. Company overview

9.3.7.2. Financial performance

9.3.7.3. Product benchmarking

9.3.7.4. Strategic initiatives

9.3.8. Mckesson Corporation

9.3.8.1. Company overview

9.3.8.2. Financial performance

9.3.8.3. Product benchmarking

9.3.8.4. Strategic initiatives

9.3.9. QSI Management, LLC

9.3.9.1. Company overview

9.3.9.2. Financial performance

9.3.9.3. Product benchmarking

9.3.9.4. Strategic initiatives

9.3.10. AT&T

9.3.10.1. Company overview

9.3.10.2. Financial performance

9.3.10.3. Product benchmarking

9.3.10.4. Strategic initiatives

9.3.11. Vodafone Group

9.3.11.1. Company overview

9.3.11.2. Financial performance

9.3.11.3. Product benchmarking

9.3.11.4. Strategic initiatives

9.3.12. AirStrip Technologies

9.3.12.1. Company overview

9.3.12.2. Financial performance

9.3.12.3. Product benchmarking

9.3.12.4. Strategic initiatives

9.3.13. Google, Inc.

9.3.13.1. Company overview

9.3.13.2. Financial performance

9.3.13.3. Product benchmarking

9.3.13.4. Strategic initiatives

9.3.14. Samsung Electronics Co., Ltd., Inc.

9.3.14.1. Company overview

9.3.14.2. Financial performance

9.3.14.3. Product benchmarking

9.3.14.4. Strategic initiatives

9.3.15. HiMS

9.3.15.1. Company overview

9.3.15.2. Financial performance

9.3.15.3. Product benchmarking

9.3.15.4. Strategic initiatives

9.3.16. Orange

9.3.16.1. Company overview

9.3.16.2. Financial performance

9.3.16.3. Product benchmarking

9.3.16.4. Strategic initiatives

9.3.17. Qualcomm Technologies, Inc.

9.3.17.1. Company overview

9.3.17.2. Financial performance

9.3.17.3. Product benchmarking

9.3.17.4. Strategic initiatives

9.3.18. Softserve

9.3.18.1. Company overview

9.3.18.2. Financial performance

9.3.18.3. Product benchmarking

9.3.18.4. Strategic initiatives

9.3.19. Computer Programs and Systems, Inc.

9.3.19.1. Company overview

9.3.19.2. Financial performance

9.3.19.3. Product benchmarking

9.3.19.4. Strategic initiatives

9.3.20. Vocera Communications

9.3.20.1. Company overview

9.3.20.2. Financial performance

9.3.20.3. Product benchmarking

9.3.20.4. Strategic initiatives

9.3.21. IBM Corporation

9.3.21.1. Company overview

9.3.21.2. Financial performance

9.3.21.3. Product benchmarking

9.3.21.4. Strategic initiatives

9.3.22. CISCO Systems, Inc.

9.3.22.1. Company overview

9.3.22.2. Financial performance

9.3.22.3. Product benchmarking

9.3.22.4. Strategic initiatives

List of Tables

Table 1. List of abbreviation

Table 2. North America digital health market, by region, 2018 - 2030 (USD Million)

Table 3. North America digital health market, by technology, 2018 - 2030 (USD Million)

Table 4. North America digital health market, by component, 2018 - 2030 (USD Million)

Table 5. North America digital health market, by application, 2018 - 2030 (USD Million)

Table 6. North America digital health market, by end-use, 2018 - 2030 (USD Million)

Table 7. U.S. digital health market, by technology, 2018 - 2030 (USD Million)

Table 8. U.S. digital health market, by component, 2018 - 2030 (USD Million)

Table 9. U.S. digital health market, by application, 2018 - 2030 (USD Million)

Table 10. U.S. digital health market, by end-use, 2018 - 2030 (USD Million)

Table 11. Canada digital health market, by technology, 2018 - 2030 (USD Million)

Table 12. Canada digital health market, by component, 2018 - 2030 (USD Million)

Table 13. Canada digital health market, by application, 2018 - 2030 (USD Million)

Table 14. Canada digital health market, by end-use, 2018 - 2030 (USD Million)

Table 15. Europe digital health market, by region, 2018 - 2030 (USD Million)

Table 16. Europe digital health market, by technology, 2018 - 2030 (USD Million)

Table 17. Europe digital health market, by component, 2018 - 2030 (USD Million)

Table 18. Europe digital health market, by application, 2018 - 2030 (USD Million)

Table 19. Europe digital health market, by end-use, 2018 - 2030 (USD Million)

Table 20. Germany digital health market, by technology, 2018 - 2030 (USD Million)

Table 21. Germany digital health market, by component, 2018 - 2030 (USD Million)

Table 22. Germany digital health market, by application, 2018 - 2030 (USD Million)

Table 23. Germany digital health market, by end-use, 2018 - 2030 (USD Million)

Table 24. UK digital health market, by technology, 2018 - 2030

Table 25. UK digital health market, by component, 2018 - 2030

Table 26. UK digital health market, by application, 2018 - 2030

Table 27. UK digital health market, by end-use, 2018 - 2030

Table 28. France digital health market, by technology, 2018 - 2030

Table 29. France digital health market, by component, 2018 - 2030

Table 30. France digital health market, by application, 2018 - 2030

Table 31. France digital health market, by end-use, 2018 - 2030

Table 32. Italy digital health market, by technology, 2018 - 2030

Table 33. Italy digital health market, by component, 2018 - 2030

Table 34. Italy digital health market, by application, 2018 - 2030

Table 35. Italy digital health market, by end-use, 2018 - 2030

Table 36. Spain digital health market, by technology, 2018 - 2030

Table 37. Spain digital health market, by component, 2018 - 2030

Table 38. Spain digital health market, by application, 2018 - 2030

Table 39. Spain digital health market, by end-use, 2018 - 2030

Table 40. Denmark digital health market, by technology, 2018 - 2030

Table 41. Denmark digital health market, by component, 2018 - 2030

Table 42. Denmark digital health market, by application, 2018 - 2030

Table 43. Denmark digital health market, by end-use, 2018 - 2030

Table 44. Sweden digital health market, by technology, 2018 - 2030

Table 45. Sweden digital health market, by component, 2018 - 2030

Table 46. Sweden digital health market, by application, (USD Million) 2018 - 2030

Table 47. Sweden digital health market, by end-use, (USD Million) 2018 - 2030

Table 48. Norway digital health market, by technology, (USD Million) 2018 - 2030

Table 49. Norway digital health market, by component, (USD Million) 2018 - 2030

Table 50. Norway digital health market, by application, 2018 - 2030

Table 51. Norway digital health market, by end-use, 2018 - 2030

Table 52. Asia Pacific digital health market, by region, 2018 - 2030

Table 53. Asia Pacific digital health market, by technology, 2018 - 2030

Table 54. Asia Pacific digital health market, by component, 2018 - 2030

Table 55. Asia Pacific digital health market, by application, 2018 - 2030

Table 56. Asia Pacific digital health market, by end-use, 2018 - 2030

Table 57. China digital health market, by technology, 2018 - 2030

Table 58. China digital health market, by component, 2018 - 2030

Table 59. China digital health market, by application, 2018 - 2030

Table 60. China digital health market, by end-use, 2018 - 2030

Table 61. Japan digital health market, by technology, 2018 - 2030

Table 62. Japan digital health market, by component, 2018 - 2030

Table 63. Japan digital health market, by application, 2018 - 2030

Table 64. Japan digital health market, by end-use, 2018 - 2030

Table 65. India digital health market, by technology, 2018 - 2030

Table 66. India digital health market, by component, 2018 - 2030

Table 67. India digital health market, by application, 2018 - 2030

Table 68. India digital health market, by end-use, 2018 - 2030

Table 69. South Korea digital health market, by technology, 2018 - 2030

Table 70. South Korea digital health market, by component, 2018 - 2030

Table 71. South Korea digital health market, by application, 2018 - 2030

Table 72. South Korea digital health market, by end-use, 2018 - 2030

Table 73. Australia digital health market, by technology, 2018 - 2030

Table 74. Australia digital health market, by component, 2018 - 2030

Table 75. Australia digital health market, by application, 2018 - 2030

Table 76. Australia digital health market, by end-use, 2018 - 2030

Table 77. Singapore digital health market, by technology, 2018 - 2030

Table 78. Singapore digital health market, by component, 2018 - 2030

Table 79. Singapore digital health market, by application, 2018 - 2030

Table 80. Singapore digital health market, by end-use, 2018 - 2030 (USD Million)

Table 81. Latin America digital health market, by region, 2018 - 2030 (USD Million)

Table 82. Latin America digital health market, by technology, 2018 - 2030 (USD Million)

Table 83. Latin America digital health market, by component, 2018 - 2030 (USD Million)

Table 84. Latin America digital health market, by application, 2018 - 2030 (USD Million)

Table 85. Latin America digital health market, by end-use, 2018 - 2030 (USD Million)

Table 86. Brazil digital health market, by technology, 2018 - 2030 (USD Million)

Table 87. Brazil digital health market, by component, 2018 - 2030 (USD Million)

Table 88. Brazil digital health market, by application, 2018 - 2030 (USD Million)

Table 89. Brazil digital health market, by end-use, 2018 - 2030 (USD Million)

Table 90. Mexico digital health market, by technology, 2018 - 2030 (USD Million)

Table 91. Mexico digital health market, by component, 2018 - 2030 (USD Million)

Table 92. Mexico digital health market, by application, 2018 - 2030 (USD Million)

Table 93. Mexico digital health market, by end-use, 2018 - 2030 (USD Million)

Table 94. Argentina digital health market, by technology, 2018 - 2030 (USD Million)

Table 95. Argentina digital health market, by component, 2018 - 2030 (USD Million)

Table 96. Argentina digital health market, by application, 2018 - 2030 (USD Million)

Table 97. Argentina digital health market, by end-use, 2018 - 2030 (USD Million)

Table 98. MEA digital health market, by region, 2018 - 2030 (USD Million)

Table 99. MEA digital health market, by technology, 2018 - 2030 (USD Million)

Table 100. MEA digital health market, by component, 2018 - 2030 (USD Million)

Table 101. MEA digital health market, by application, 2018 - 2030 (USD Million)

Table 102. MEA digital health market, by end-use, 2018 - 2030 (USD Million)

Table 103. South Africa digital health market, by technology, 2018 - 2030 (USD Million)

Table 104. South Africa digital health market, by component, 2018 - 2030 (USD Million)

Table 105. South Africa digital health market, by application, 2018 - 2030 (USD Million)

Table 106. South Africa digital health market, by end-use, 2018 - 2030 (USD Million)

Table 107. Saudi Arabia digital health market, by technology, 2018 - 2030 (USD Million)

Table 108. Saudi Arabia digital health market, by component, 2018 - 2030 (USD Million)

Table 109. Saudi Arabia digital health market, by application, 2018 - 2030 (USD Million)

Table 110. Saudi Arabia digital health market, by end-use, 2018 - 2030 (USD Million)

Table 111. UAE digital health market, by technology, 2018 - 2030 (USD Million)

Table 112. UAE digital health market, by component, 2018 - 2030 (USD Million)

Table 113. UAE digital health market, by application, 2018 - 2030 (USD Million)

Table 114. UAE digital health market, by end-use, 2018 - 2030 (USD Million)

Table 115. Kuwait digital health market, by technology, 2018 - 2030 (USD Million)

Table 116. Kuwait digital health market, by component, 2018 - 2030 (USD Million)

Table 117. Kuwait digital health market, by application, 2018 - 2030 (USD Million)

Table 118. Kuwait digital health market, by end-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Digital health market: market outlook

Fig. 9 Digital health competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook.

Fig. 12 Industry value chain analysis

Fig. 13 Digital health market driver impact

Fig. 14 Digital health market restraint impact

Fig. 15 Digital health market strategic initiatives analysis

Fig. 16 Digital health market: Technology movement analysis

Fig. 17 Digital health market: Technology outlook and key takeaways

Fig. 18 Tele-healthcare market estimates and forecasts, 2018 - 2030

Fig. 19 Tele-care market estimates and forecasts, 2018 - 2030

Fig. 20 Activity monitoring market estimates and forecasts, 2018 - 2030

Fig. 21 Remote medication management market estimates and forecasts, 2018 - 2030

Fig. 22 Telehealth market estimates and forecasts, 2018 - 2030

Fig. 23 LTC monitoring market estimates and forecasts, 2018 - 2030

Fig. 24 Video consultation market estimates and forecasts, 2018 - 2030

Fig. 25 mhealth market estimates and forecasts, 2018 - 2030

Fig. 26 Wearables & connected medical devices market estimates and forecasts, 2018 - 2030

Fig. 27 Vital sign monitoring devices market estimates and forecasts, 2018 - 2030

Fig. 28 Heart rate monitors market estimates and forecasts, 2018 - 2030

Fig. 29 Activity monitors market estimates and forecasts, 2018 - 2030

Fig. 30 Electrocardiographs market estimates and forecasts, 2018 - 2030

Fig. 31 Pulse oximeters market estimates and forecasts, 2018 - 2030

Fig. 32 Spirometers market estimates and forecasts, 2018 - 2030

Fig. 33 Blood pressure monitors market estimates and forecasts, 2018 - 2030

Fig. 34 Others market estimates and forecasts, 2018 - 2030

Fig. 35 Sleep monitoring devices market estimates and forecasts, 2018 - 2030

Fig. 36 Sleep trackers market estimates and forecasts, 2018 - 2030

Fig. 37 Wrist Actigraphs market estimates and forecasts, 2018 - 2030

Fig. 38 Polysomnographs market estimates and forecasts, 2018 - 2030

Fig. 39 Others market estimates and forecasts, 2018 - 2030

Fig. 40 Electrocardiographs fetal and obstetric devices market estimates and forecasts, 2018 - 2030

Fig. 41 Neuromonitoring devices market estimates and forecasts, 2018 - 2030

Fig. 42 Electroencephalographs market estimates and forecasts, 2018 - 2030

Fig. 43 Electromyographs market estimates and forecasts, 2018 - 2030

Fig. 44 Others market estimates and forecasts, 2018 - 2030

Fig. 45 mhealth apps market estimates and forecasts, 2018 - 2030

Fig. 46 Medical apps market estimates and forecasts, 2018 - 2030

Fig. 47 Women’s health apps market estimates and forecasts, 2018 - 2030

Fig. 48 Fitness and nutrition apps market estimates and forecasts, 2018 - 2030

Fig. 49 Menstrual health market estimates and forecasts, 2018 - 2030

Fig. 50 Pregnancy tracking & postpartum care market estimates and forecasts, 2018 - 2030

Fig. 51 Menopause market estimates and forecasts, 2018 - 2030

Fig. 52 Disease management market estimates and forecasts, 2018 - 2030

Fig. 53 Others market estimates and forecasts, 2018 - 2030

Fig. 54 Chronic disease management apps market estimates and forecasts, 2018 - 2030

Fig. 55 Diabetes management apps market estimates and forecasts, 2018 - 2030

Fig. 56 Blood pressure and ECG monitoring apps market estimates and forecasts, 2018 - 2030

Fig. 57 Mental health management apps market estimates and forecasts, 2018 - 2030

Fig. 58 Cancer management apps market estimates and forecasts, 2018 - 2030

Fig. 59 Obesity management apps market estimates and forecasts, 2018 - 2030

Fig. 60 Other Chronic disease management apps market estimates and forecasts, 2018 - 2030

Fig. 61 Personal health record apps market estimates and forecasts, 2018 - 2030

Fig. 62 Medication management apps market estimates and forecasts, 2018 - 2030

Fig. 63 Diagnostic apps market estimates and forecasts, 2018 - 2030

Fig. 64 Remote monitoring apps market estimates and forecasts, 2018 - 2030

Fig. 65 Others (Medical Reference, Professional Networking, Healthcare Education)

Fig. 66 Fitness apps management market estimates and forecasts, 2018 - 2030

Fig. 67 Services market estimates and forecasts, 2018 - 2030

Fig. 68 Monitoring services market estimates and forecasts, 2018 - 2030

Fig. 69 Independent aging solutions market estimates and forecasts, 2018 - 2030

Fig. 70 Chronic disease management & post-acute care services market estimates and forecasts, 2018 - 2030

Fig. 71 Diagnosis services market estimates and forecasts, 2018 - 2030

Fig. 72 Healthcare systems strengthening services market estimates and forecasts, 2018 - 2030

Fig. 73 Others market estimates and forecasts, 2018 - 2030

Fig. 74 Healthcare analytics market estimates and forecasts, 2018 - 2030

Fig. 75 Digital health systems market estimates and forecasts, 2018 - 2030

Fig. 76 Digital health systems market estimates and forecasts, 2018 - 2030

Fig. 77 EHR market estimates and forecasts, 2018 - 2030

Fig. 78 E-Prescribing systems market estimates and forecasts, 2018 - 2030

Fig. 79 Digital health market: Component movement analysis

Fig. 80 Digital health market: Component outlook and key takeaways

Fig. 81 Software market estimates and forecasts, 2018 - 2030

Fig. 82 Hardware market estimates and forecasts, 2018 - 2030

Fig. 83 Services market estimates and forecasts, 2018 - 2030

Fig. 84 Digital health market: Application movement analysis

Fig. 85 Digital health market: Application outlook and key takeaways

Fig. 86 Obesity market estimates and forecasts, 2018 - 2030

Fig. 87 Diabetes market estimates and forecasts, 2018 - 2030

Fig. 88 Cardiovascular market estimates and forecasts, 2018 - 2030

Fig. 89 Respiratory Diseases market estimates and forecasts, 2018 - 2030

Fig. 90 Other applications market estimates and forecasts, 2018 - 2030

Fig. 91 Digital health market: End-use movement analysis

Fig. 92 Digital health market: End-use outlook and key takeaways

Fig. 93 Patients market estimates and forecasts, 2018 - 2030

Fig. 94 Providers market estimates and forecasts, 2018 - 2030

Fig. 95 Payers market estimates and forecasts, 2018 - 2030

Fig. 96 Others market estimates and forecasts, 2018 - 2030

Fig. 97 Global Digital health market: Regional movement analysis

Fig. 98 Global Digital health market: Regional outlook and key takeaways

Fig. 99 Global Digital health market share and leading players

Fig. 100 North America market share and leading players

Fig. 101 Europe market share and leading players

Fig. 102 Asia Pacific market share and leading players

Fig. 103 Latin America market share and leading players

Fig. 104 Middle East & Africa market share and leading players

Fig. 105 North America: SWOT

Fig. 106 Europe SWOT

Fig. 107 Asia Pacific SWOT

Fig. 108 Latin America SWOT

Fig. 109 MEA SWOT

Fig. 110 North America

Fig. 111 North America market estimates and forecasts, 2018 - 2030

Fig. 112 U.S.

Fig. 113 U.S. market estimates and forecasts, 2018 - 2030

Fig. 114 Canada

Fig. 115 Canada market estimates and forecasts, 2018 - 2030

Fig. 116 Europe

Fig. 117 Europe market estimates and forecasts, 2018 - 2030

Fig. 118 UK

Fig. 119 UK market estimates and forecasts, 2018 - 2030

Fig. 120 Germany

Fig. 121 Germany market estimates and forecasts, 2018 - 2030

Fig. 122 France

Fig. 123 France market estimates and forecasts, 2018 - 2030

Fig. 124 Italy

Fig. 125 Italy market estimates and forecasts, 2018 - 2030

Fig. 126 Spain

Fig. 127 Spain market estimates and forecasts, 2018 - 2030

Fig. 128 Denmark

Fig. 129 Denmark market estimates and forecasts, 2018 - 2030

Fig. 130 Sweden

Fig. 131 Sweden market estimates and forecasts, 2018 - 2030

Fig. 132 Norway

Fig. 133 Norway market estimates and forecasts, 2018 - 2030

Fig. 134 Asia Pacific

Fig. 135 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 136 China

Fig. 137 China market estimates and forecasts, 2018 - 2030

Fig. 138 Japan

Fig. 139 Japan market estimates and forecasts, 2018 - 2030

Fig. 140 India

Fig. 141 India market estimates and forecasts, 2018 - 2030

Fig. 142 Singapore

Fig. 143 Singapore market estimates and forecasts, 2018 - 2030

Fig. 144 South Korea

Fig. 145 South Korea market estimates and forecasts, 2018 - 2030

Fig. 146 Australia

Fig. 147 Australia market estimates and forecasts, 2018 - 2030

Fig. 148 Latin America

Fig. 149 Latin America market estimates and forecasts, 2018 - 2030

Fig. 150 Brazil

Fig. 151 Brazil market estimates and forecasts, 2018 - 2030

Fig. 152 Mexico

Fig. 153 Mexico market estimates and forecasts, 2018 - 2030

Fig. 154 Argentina

Fig. 155 Argentina market estimates and forecasts, 2018 - 2030