- Home

- »

- Next Generation Technologies

- »

-

Digital Identity Solutions Market Size, Industry Report, 2033GVR Report cover

![Digital Identity Solutions Market Size, Share & Trends Report]()

Digital Identity Solutions Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Identity Type (Biometric, Non-biometric), By Solution Type, By Organization Size, By Vertical, By Deployment, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-023-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Identity Solutions Market Summary

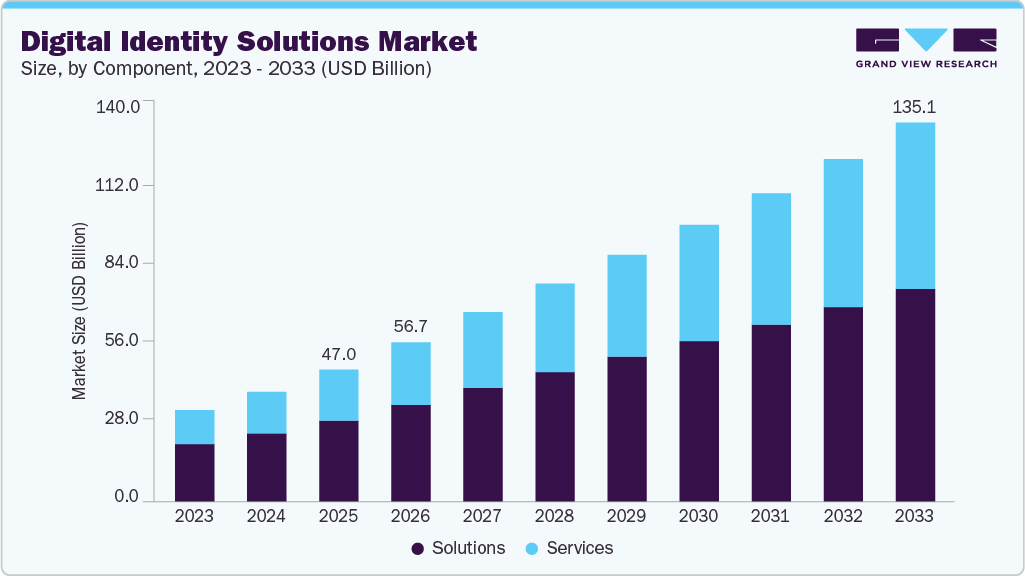

The global digital identity solutions market size was estimated at USD 47.02 billion in 2025 and is projected to reach USD 135.14 billion by 2033, growing at a CAGR of 13.2% from 2026 to 2033. The market is driven by the rising adoption of biometric authentication across banking, government, and enterprise applications, increasing regulatory emphasis on secure digital onboarding and compliance, rapid expansion of digital services and e-government platforms requiring trusted identity verification, and growing demand for decentralized and privacy-centric identity frameworks to address data security and fraud risks.

Key Market Trends & Insights

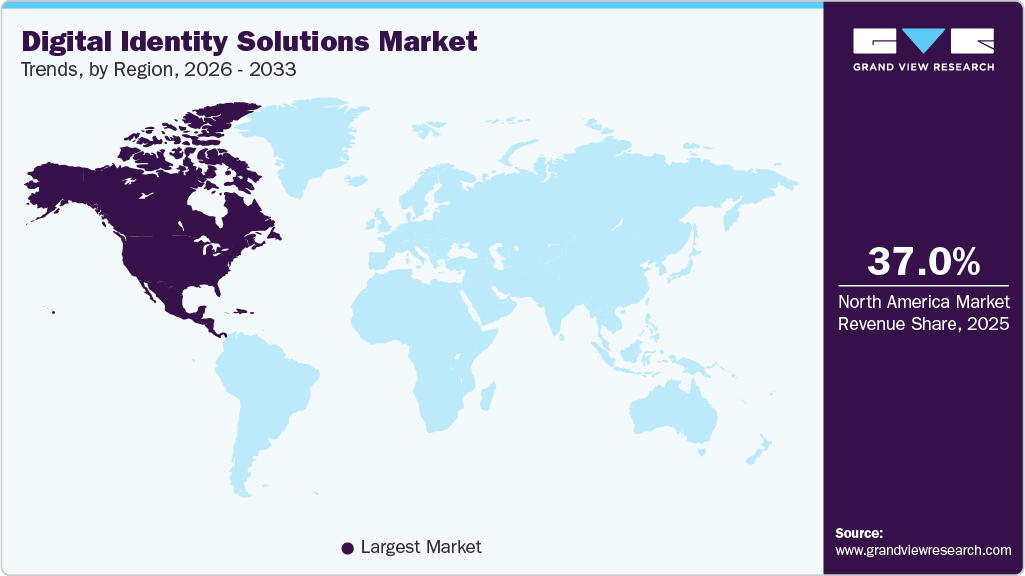

- North America is expected to hold the largest share of the global digital identity solutions market, with a revenue share of over 37% by 2025.

- The digital identity solutions market in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, solutions led the market and held the largest revenue share of over 61% in 2025.

- By identity type, biometric led the market and held the largest revenue share of over 71% in 2025.

- By vertical, BFSI is expected to grow at the fastest CAGR of over 14% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 47.02 Billion

- 2033 Projected Market Size: USD 135.14 Billion

- CAGR (2026-2033): 13.2%

- North America: Largest Market in 2025

The digital identity solutions industry is gaining strong momentum as organizations accelerate digital transformation and require secure, scalable identity verification frameworks. Rising cyber fraud, identity theft, and data breaches are compelling enterprises and governments to invest in advanced authentication technologies such as biometrics, AI-based verification, and behavioral analytics. Regulatory mandates related to data protection, KYC, and AML compliance are further driving adoption across BFSI, healthcare, and public sector applications. The rapid growth of digital banking, e-commerce, and e-government services is increasing the need for seamless, remote, and trusted identity onboarding solutions. In addition, the shift toward decentralized identity models and privacy-by-design architectures is strengthening market growth by addressing user control and data sovereignty concerns.

Biometric and AI-driven authentication technologies are becoming a primary market growth driver. Organizations are deploying facial recognition, fingerprint, iris, and behavioral biometrics to improve identity accuracy and reduce fraud. AI enhances real-time risk assessment by detecting anomalies and suspicious access patterns during authentication. These technologies significantly lower reliance on traditional passwords, which are vulnerable to breaches and phishing attacks. As digital transactions increase, biometric and AI-based identity verification continue to gain traction across banking, healthcare, and government sectors.

Digital identity solutions are expanding beyond user authentication to include devices, machines, and connected systems. IoT-enabled environments require secure identity verification to manage access and prevent unauthorized interactions. Identity-based access control enhances security across smart cities, industrial automation, and connected healthcare systems. Enterprises are leveraging identity platforms to ensure trust across complex digital ecosystems. This expansion is driving new revenue opportunities and reinforcing the strategic importance of digital identity solutions.

Component Insights

The solutions segment led the market in 2025, accounting for over 61.0% share of the global revenue, driven by the increasing demand for comprehensive digital identity platforms that integrate authentication, verification, and access management within a single framework. Enterprises and government agencies are prioritizing end-to-end solutions to address rising identity fraud, data breaches, and compliance requirements across digital channels. The scalability and flexibility of solution-based offerings enable organizations to support large user bases and complex identity ecosystems efficiently. Growing adoption of cloud-based and AI-enabled identity solutions is further strengthening segment growth by improving accuracy, speed, and operational efficiency. Collectively, these factors position the solutions segment as the dominant contributor to overall market revenue.

The services segment is predicted to foresee significant growth in the forecast years, primarily driven by the rapid adoption of digital identity solutions across enterprises requiring ongoing implementation, integration, and customization support. Organizations increasingly rely on professional and managed services to ensure seamless deployment across complex IT environments. Rising demand for identity lifecycle management, system upgrades, and continuous monitoring is further accelerating service adoption. Regulatory compliance requirements are also compelling enterprises to engage service providers for audits, risk assessments, and policy alignment. As digital identity infrastructures scale, services are becoming critical for sustaining performance, security, and long-term operational efficiency.

Identity Type Insights

The biometric segment accounted for the largest market revenue share in 2025. The growth is driven by the increasing adoption of advanced biometric authentication methods, including facial recognition, fingerprint scanning, and iris recognition, across high-security and consumer-facing applications. Organizations are prioritizing biometrics to enhance identity accuracy, reduce fraud, and eliminate vulnerabilities associated with password-based systems. Technological advancements in AI and machine learning are improving biometrics, matching accuracy and reliability, and supporting large-scale deployments. Expanding use cases across banking, government, healthcare, and border control are further strengthening segment demand. Collectively, these drivers position biometrics as a foundational component of modern digital identity solutions.

The non-biometric segment is anticipated to witness significant growth in the coming years, supported by its critical role in authorizing and validating individual identities to enable secure access to services and entitlements. These solutions rely on factors such as passwords, PINs, and knowledge-based information related to personal data or events, ensuring broad applicability across diverse digital environments. The integration of machine learning and artificial intelligence is enhancing non-biometric identity solutions by enabling proactive detection and remediation of unauthorized, suspicious, and intrusive access attempts within enterprise networks. Such capabilities improve threat visibility while strengthening access control without relying on biometric data. As a result, the non-biometric solutions segment remains a core component of digital identity frameworks and continues to experience sustained growth across multiple industries.

Solution Type Insights

The authentication segment accounted for the largest market revenue share in 2025, driven by the critical need to secure digital access across enterprise and consumer applications. The market is segmented by authentication type into single-factor and multi-factor authentication, each serving distinct security and usability requirements. Single-factor authentication relies on a single credential or attribute, such as passwords, PINs, fingerprints, facial, voice, iris, or vein recognition, and remains widely adopted due to its simplicity and ease of deployment across government, consumer electronics, banking and finance, and healthcare sectors. However, rising cyber threats and identity fraud risks are accelerating the shift toward multi-factor authentication. Multi-factor authentication delivers enhanced protection by combining multiple verification layers, significantly strengthening data confidentiality and positioning it as a key growth driver within the authentication segment.

The identity verification segment is anticipated to witness significant growth in the coming years, driven by the increasing need for secure and reliable verification in digital and remote transactions. Enterprises across banking, e-commerce, healthcare, and government sectors are strengthening verification processes to mitigate fraud and meet regulatory compliance requirements. The expansion of digital onboarding and remote customer engagement is accelerating the adoption of automated and scalable identity verification solutions. Advancements in artificial intelligence and machine learning are improving accuracy, speed, and risk detection capabilities. Together, these drivers are positioning identity verification as a critical component of modern digital identity infrastructures.

Vertical Insights

The IT and telecommunication segment accounted for the largest market revenue share in 2025, driven by its central role in managing large-scale networks of users, devices, and digital services. The rapid expansion of remote work models, cloud computing, and IoT deployments has increased the need for robust digital identity solutions to ensure secure authentication, access control, and network integrity. Telecom operators are prioritizing identity frameworks to protect infrastructure from unauthorized access, fraud, and evolving cyber threats. In parallel, IT service providers are leveraging digital identity solutions to streamline digital onboarding, automate user lifecycle management, and maintain compliance with data protection regulations. The rollout of advanced technologies such as 5G is further accelerating demand by requiring highly scalable, secure, and resilient identity architectures to support next-generation connectivity.

The BFSI segment is expected to register notable growth over the forecast period, driven by the rapid expansion of digital banking, online payments, and digitally enabled financial services. Financial institutions are increasingly deploying advanced digital identity solutions to support secure customer onboarding, strong authentication, and real-time transaction monitoring. The rising incidence of cyber fraud, identity theft, and financial crimes is accelerating the adoption of biometric and AI-powered identity technologies across banks and insurers. In parallel, the growth of fintech platforms and digital wallets is intensifying the need for seamless, scalable, and compliant identity management frameworks. Collectively, these drivers are strengthening the role of digital identity solutions as a core security and trust enabler within the BFSI sector.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2025. The growth is driven by organizations prioritizing greater control over sensitive identity data and critical authentication infrastructure. Enterprises operating in highly regulated industries prefer on-premises deployments to meet strict data sovereignty, security, and compliance requirements. These solutions enable deeper integration with legacy IT systems while supporting customized security policies and access controls. On-premises identity platforms also provide enhanced visibility and direct oversight of risk management processes. As a result, large enterprises and government organizations continue to favor on-premises digital identity solutions to maintain security assurance and regulatory alignment.

The cloud segment is anticipated to exhibit the highest CAGR over the forecast period, driven by the growing demand for scalable, flexible, and cost-efficient digital identity solutions. Organizations are increasingly adopting cloud-based identity platforms to support remote work, digital onboarding, and multi-location operations. Cloud deployment enables faster implementation, simplified updates, and seamless integration with cloud-native applications and services. The subscription-based pricing model further lowers adoption barriers, particularly for SMEs and digitally transforming enterprises. Collectively, these drivers are accelerating the shift toward cloud-based digital identity solutions across industries.

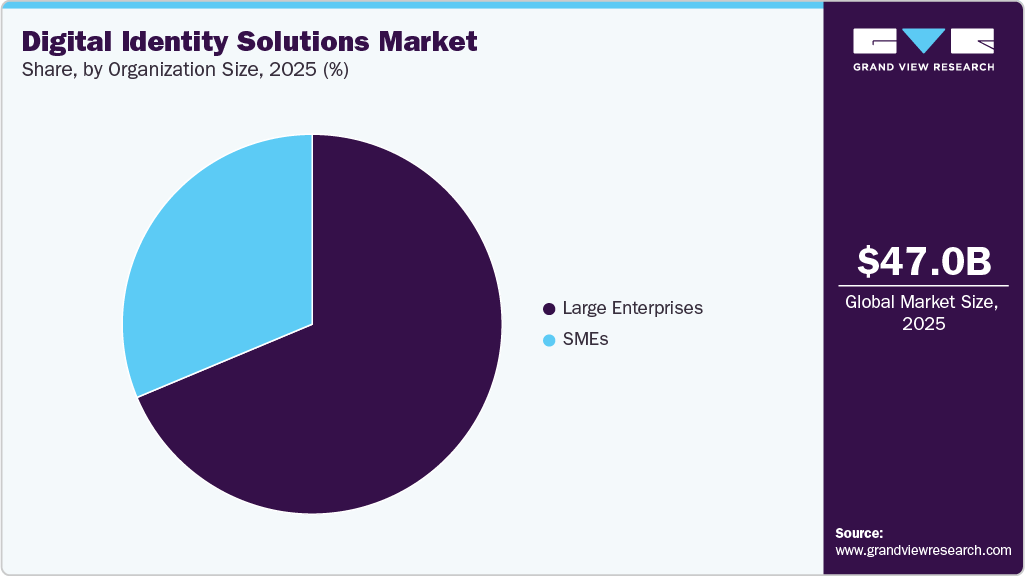

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2025, driven by early and extensive adoption of digital identity solutions across complex organizational environments. Large enterprises manage sizeable workforces and vast networks of connected devices, making them more exposed to identity-related security risks and cyber threats. Multinational operations further require real-time, secure access to enterprise systems across regions, accelerating the deployment of centralized and scalable identity platforms. Advanced digital identity solutions enable continuous monitoring, detection of access risks, and identification of anomalous behavior, supporting stronger governance and risk management. Consequently, large enterprises are increasingly investing in compliant, standards-based digital identity solutions to enhance security, productivity, and regulatory alignment.

The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period, driven by the accelerating digitalization of small and mid-sized businesses across industries. SMEs are increasingly adopting digital identity solutions to protect online transactions, prevent fraud, and secure remote access to business systems. The availability of cloud-based and subscription-driven identity platforms is lowering entry barriers by reducing upfront costs and deployment complexity. Growing regulatory awareness related to data protection and customer verification is further encouraging adoption among SMEs. Collectively, these drivers are positioning digital identity solutions as a critical enabler of secure and scalable growth for small and mid-sized enterprises.

Regional Insights

The North America digital identity solutions market dominated and accounted for over 37% share in 2025, supported by strong enterprise investment in cybersecurity and digital transformation. High digital maturity across banking, healthcare, and e-commerce continues to drive demand for secure authentication and identity verification. Regulatory enforcement related to data privacy and identity assurance is accelerating the deployment of advanced identity platforms. Enterprises are prioritizing AI-driven and biometric solutions to address rising fraud and access risks. These factors collectively sustain North America’s position as a technology-driven and high-value market.

U.S. Digital Identity Solutions Market Trends

The digital identity solutions market in the U.S. is driven by widespread cloud adoption and the shift toward identity-centric security models. Financial institutions and government agencies are strengthening digital onboarding and continuous authentication frameworks. Compliance requirements related to KYC, AML, and data protection remain a key adoption catalyst. Innovation from domestic technology providers continues to enhance AI, biometric, and decentralized identity capabilities. As a result, the U.S. remains a core growth engine for advanced digital identity solutions.

Europe Digital Identity Solutions Market Trends

The digital identity solutions market in Europe is supported by government-led digital ID programs and regulatory harmonization across member states. Strong demand from digital banking, healthcare, and public service platforms is driving the adoption of compliant identity solutions. Privacy protection and data sovereignty remain central to technology selection across enterprises. European providers are focusing on secure, user-centric, and interoperable identity frameworks. These drivers enable steady and regulation-aligned market growth across the region.

Asia Pacific Digital Identity Solutions Market Trends

The digital identity solutions market in the Asia Pacific region is experiencing rapid growth, driven by population-scale digitalization initiatives and expanding online services. China is advancing integrated digital identity across payments, super-apps, and smart infrastructure. India is scaling biometric-based identity to support financial inclusion and digital public services, while Japan is strengthening secure identity frameworks for e-government and cashless ecosystems. Rising digital transactions and government-backed programs are accelerating adoption. Collectively, these factors are positioning the Asia Pacific as the fastest-expanding market globally.

Key Digital Identity Solutions Company Insights

Some key market players include NEC Corporation, Thales Group, GB Group plc (‘GBG’), TELUS, and others.

-

NEC Corporation is the global provider of IT and network solutions, with a strong strategic market presence. The company is widely recognized for its advanced biometric authentication and identity verification technologies, particularly its high-accuracy facial recognition solutions deployed across government, finance, and healthcare sectors. NEC’s offerings enable secure user authentication, fraud prevention, and efficient digital service delivery at population and enterprise scale. Its strong alignment with global regulatory standards positions NEC as a trusted partner for organizations seeking security, compliance, and future-ready digital identity frameworks.

-

Thales Group is a prominent player in digital trust and cybersecurity, playing a critical role in the market through its comprehensive identity and access management portfolio. The company delivers secure biometric authentication, identity verification, and credentialing solutions tailored for regulated sectors such as BFSI, government, and telecommunications. Thales’s cloud-based identity platforms support secure digital onboarding while ensuring compliance with stringent data protection requirements. Its continued investment in AI and blockchain technologies strengthens its position as a key enabler of secure digital transformation worldwide.

Key Digital Identity Solutions Companies:

The following are the leading companies in the digital identity solutions market. These companies collectively hold the largest market share and dictate industry trends.

- NEC Corporation

- Thales

- GB Group plc (‘GBG’)

- TELUS

- Tessi

- Daon, Inc.

- IDEMIA

- ForgeRock, Inc.

- IMAGEWARE.

- Jumio

Recent Developments

-

In September 2025, Mastercard partnered with Smile ID to expand scalable and secure digital identity solutions across Africa. The collaboration combines Mastercard’s global identity and payment technology capabilities with Smile ID’s advanced biometric verification and fraud prevention solutions to support faster and more reliable customer onboarding. This partnership enables banks, fintechs, and digital service providers to strengthen KYC and AML compliance while reducing identity-related fraud. The initiative supports Africa’s rapidly growing digital economy by promoting financial inclusion and trusted digital transactions on a large scale.

-

In July 2025, IDnow partnered with Keyless to strengthen digital identity solutions by delivering continuous trust across the entire digital identity lifecycle. The collaboration integrates IDnow’s identity verification and onboarding capabilities with Keyless’ privacy-preserving biometric authentication to ensure secure and seamless user validation beyond initial enrollment. This approach enables organizations to reauthenticate users during high-risk interactions, such as account recovery or sensitive transactions, without adding friction to the user experience. The partnership addresses growing fraud and compliance challenges in regulated industries, positioning continuous, biometric-driven trust as a key differentiator in the market.

-

In July 2025, IN Groupe acquired IDEMIA Smart Identity, significantly strengthening its position in the global secure identity solutions market. The transaction expands IN Groupe’s capabilities across physical and digital identity technologies, enabling broader end-to-end offerings for government and enterprise customers. By combining complementary technologies, expertise, and international reach, the group enhances its ability to address growing demand for trusted identity solutions worldwide. This acquisition reinforces IN Groupe’s long-term strategy to scale innovation and leadership in secure and sovereign identity services.

Digital Identity Solutions Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 56.70 billion

Revenue forecast in 2033

USD 135.14 billion

Growth rate

CAGR of 13.2% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, identity type, solution type, organization size, vertical, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

NEC Corporation; Thales Group; GB Group plc (‘GBG’); TELUS; Tessi; Daon, Inc.; IDEMIA; ForgeRock, Inc.; IMAGEWARE.; Jumio

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Identity Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global digital identity solutions market report based on component, identity type, solution type, organization size, deployment, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Hardware

-

Software

-

-

Services

-

-

Identity Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Biometric

-

Fingerprint Recognition

-

Facial Recognition

-

Iris Recognition

-

Voice Recognition

-

Palm/Hand Recognition

-

Others

-

-

Non-biometric

-

-

Solution Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Identity Verification

-

Authentication

-

Single-factor Authentication

-

Multi-factor Authentication

-

-

Identity Lifecycle Management

-

Other

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

Banking, Financial Services, and Insurance

-

Retail & Ecommerce

-

Travel & Hospitality

-

Government & Defence

-

Healthcare

-

IT & Telecommunication

-

Energy & Utilities

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premises

-

Cloud

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global digital identity solutions market size was estimated at USD 47.02 billion in 2025 and is expected to reach USD 47.02 billion in 2025.

b. The global digital identity solutions market is expected to grow at a compound annual growth rate of 13.2% from 2026 to 2033 to reach USD 135.14 billion by 2033.

b. North America dominated the digital identity solutions market with a share of 37% share in 2025. Governments in the region have taken a cautious approach to replacing the physical ID with a digital ID, frequently opting for hybrid identification credentials to balance accessibility and convenience.

b. Some key players operating in the digital identity solutions market include NEC Corporation; Thales Group; GB Group plc (‘GBG’); TELUS; Tessi; Daon, Inc.; IDEMIA; ForgeRock, Inc.; IMAGEWARE.; Jumio

b. Key factors that are driving the digital identity solutions market growth include the development of biometrics integration in smartphones. Also, there is a growing demand for digital identity-based authentication methods such as biometric expertise and multi-factor authentication, which are more secure and reliable than passwords.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.