- Home

- »

- Automotive & Transportation

- »

-

Digital Logistics Market Size, Share, Industry Report, 2030GVR Report cover

![Digital Logistics Market Size, Share & Trends Report]()

Digital Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-premises), By Application (Transportation Management, Warehouse Management), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-422-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Logistics Market Summary

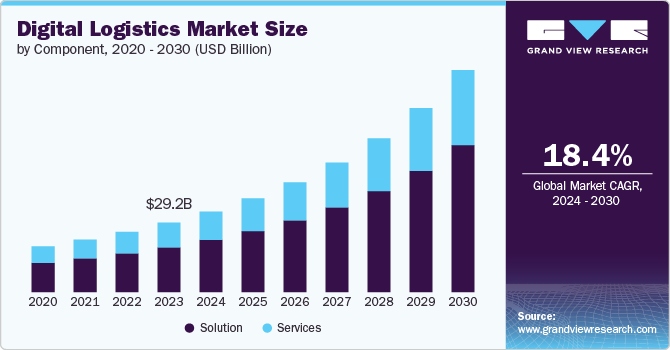

The global digital logistics market was estimated at USD 29.18 billion in 2023 and is projected to reach USD 93.28 billion by 2030, growing at a CAGR of 18.4% from 2024 to 2030. The rapid expansion of the e-commerce sector, advancements in technology, and the growing need to manage supply chain disruptions and maintain continuity are driving the growth of the global market.

Key Market Trends & Insights

- North America dominated the market in 2023, accounting for over 36.0% of the revenue.

- By application, The transportation management segment dominated the market in 2023 and accounted for more than 31.0% share of global revenue.

- By component, the solution segment dominated the market in 2023 and accounted for more than 64.0% share of global revenue.

- By deployment, the cloud segment dominated the target market in 2023 and accounted for more than 75.0% share of global revenue.

Market Size & Forecast

- 2023 Market Size: USD 29.18 Billion

- 2030 Projected Market Size: USD 93.28 Billion

- CAGR (2024-2030): 18.4%

- North America: Largest Market in 2023

Digital logistics refers to the use of digital technologies to manage, optimize, and automate logistics and supply chain operations. It involves integrating various digital tools and platforms to improve the efficiency, visibility, and flexibility of moving goods from suppliers to customers.

Digital logistics solutions offer numerous benefits, including enhanced efficiency, improved visibility, and cost reduction. Automating and optimizing logistics processes reduces manual labor, minimizes errors, and accelerates operations. In addition, real-time tracking and monitoring provide greater transparency, allowing companies to manage their supply chains more effectively. Digital logistics solutions allow companies to scale operations and adapt to changing market demands more easily.

The exponential rise in e-commerce has created a massive demand for efficient, fast, and flexible logistics solutions. Digital logistics technologies help manage the complexity of e-commerce supply chains, ensuring quick order fulfillment, real-time tracking, and efficient returns management. As businesses expand globally, managing international logistics becomes more complex. Digital logistics solutions are essential for coordinating global supply chains, managing cross-border shipments, and navigating regulatory requirements, fueling market growth.

Companies are increasingly leveraging Artificial Intelligence (AI) and Machine Learning (ML) to predict demand, optimize routes, and reduce delivery times. By analyzing vast amounts of data, these technologies can anticipate disruptions, adjust logistics plans in real-time, and enhance decision-making processes. Internet of Things (IoT) devices provide real-time data on the location, condition, and status of shipments. Sensors embedded in containers and vehicles monitor temperature, humidity, and shock levels, which are crucial for sensitive goods like pharmaceuticals and perishables.

Companies are continually innovating and launching new technology solutions for logistics operations; this is significantly driving the market's growth. For instance, in July 2024, C.H. Robinson Worldwide, Inc. introduced Digital Dispatch, an advanced load-matching platform designed to enhance efficiency for carriers. Leveraging AI and data science, the platform offers real-time, personalized load recommendations based on carriers' search history and preferences, significantly reducing the time spent searching for freight and enabling faster, more relevant matches. This innovation allows carriers to secure loads more quickly and optimize their routes, thereby increasing earnings and minimizing empty miles. Digital Dispatch currently caters to small carriers, with plans to expand to larger operators.

Component Insights

The solution segment dominated the market in 2023 and accounted for more than 64.0% share of global revenue. The segment’s growth is attributed to the growing need to improve the efficiency of logistics operations and reduce manual processes. Businesses are increasingly adopting digital logistics solutions to automate and optimize supply chain operations, reducing manual processes and improving efficiency. Automation technologies such as AI, machine learning, and robotics are integral components of these solutions, driving demand for advanced logistics software. Moreover, the shift towards cloud-based logistics solutions provides companies with scalable, flexible, and cost-effective tools to manage their operations. The ease of integration and lower upfront costs associated with cloud platforms are encouraging more companies to invest in digital logistics solutions.

The services segment is projected to grow at a considerable CAGR from 2024 to 2030. The segment’s growth can be attributed to the complexity of digital transformation. As companies undergo digital transformation, there is a growing need for expert services to guide them through the process. This includes services for integration, system upgrades, and training, all of which are essential to implement and maintain digital logistics solutions effectively. Moreover, the rapid pace of technological advancements in logistics necessitates regular updates and maintenance. Service providers offer the necessary support for keeping systems up-to-date, which is crucial for businesses to stay competitive in the dynamic logistics landscape.

Deployment Insights

The cloud segment dominated the target market in 2023 and accounted for more than 75.0% share of global revenue. The segment's growth is attributed to the scalability, flexibility, and cost efficiency of cloud-based digital logistics solutions. Cloud-based solutions offer unparalleled scalability, allowing logistics companies to expand their operations without significant capital expenditure on IT infrastructure. This flexibility enables businesses to quickly adjust to changing market conditions, such as fluctuations in demand or the introduction of new services, thereby driving the adoption of cloud deployment. Moreover, companies are launching new cloud-based logistics services and solutions. For instance, in December 2023, Fujitsu launched a cloud-based service designed to standardize and visualize logistics data for logistics companies, shippers, and vendors, aiming to enhance sustainability and address industry challenges like driver shortages, carbon footprint reduction, and regulatory compliance. This service, built on Amazon Web Services (AWS), enables secure data sharing and collaborative logistics planning while also providing analytical tools to optimize operations amid increasing supply chain complexities.

The on-premises segment is projected to grow at a considerable CAGR from 2024 to 2030. The segment’s growth is attributed to the need for prioritizing data control among organizations and customization offered by on-premises solutions. Companies that handle sensitive or proprietary information often prefer on-premises solutions due to greater control over data security. These businesses are cautious about storing data in the cloud, especially in industries where data breaches can have severe consequences. On-premises deployment allows for stricter security protocols and compliance with regulatory requirements.

Application Insights

The transportation management segment dominated the market in 2023 and accounted for more than 31.0% share of global revenue. The need for real-time visibility into supply chains is pushing companies to adopt advanced Transportation Management System (TMS) solutions. These systems provide valuable insights through data analytics, enabling businesses to make informed decisions and respond quickly to disruptions. Companies are increasingly integrating automation and AI into their TMS to optimize route planning, load management, and real-time tracking. These technologies enhance operational efficiency and reduce costs, making them attractive investments.

The warehouse management segment is projected to grow at the fastest CAGR from 2024 to 2030. The segment’s growth is attributed to the advancements in automation and robotics and the rise in omnichannel retailing. The integration of automation and robotics within warehouses is transforming operations. Automated guided vehicles (AGVs), robotic arms, and other automation technologies are being managed through an advanced Warehouse Management System (WMS), driving efficiency, reducing labor costs, and enhancing accuracy in order fulfillment. The rise of omnichannel retail strategies requires seamless integration between online and offline channels. Warehouse management applications play a critical role in managing inventory across multiple channels, ensuring that products are available where and when customers need them.

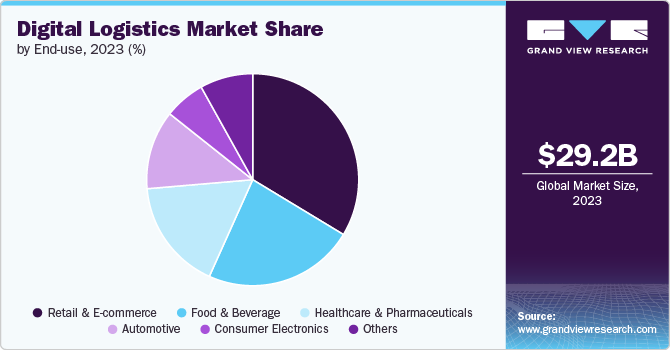

End-use Insights

The retail & e-commerce segment dominated the market in 2023 and accounted for more than 33.0% share of global revenue. The need to meet customer expectations for faster delivery drives the segment’s growth. Consumers today expect quick and reliable delivery services. This has pushed e-commerce companies to invest in sophisticated logistics systems that can optimize delivery routes, manage warehousing efficiently, and provide real-time tracking to meet these expectations. The rapid expansion of e-commerce globally has led to an increased demand for efficient and scalable logistics solutions. As online shopping continues to grow, the need for advanced digital logistics to manage inventory, order fulfillment, and last-mile delivery has intensified.

The healthcare & pharmaceuticals segment is projected to grow at a considerable CAGR from 2024 to 2030. The segment’s growth is attributed to the need to ensure compliance with stringent regulatory requirements. The healthcare and pharmaceutical industries are heavily regulated, with strict guidelines on the storage, handling, and transportation of medical products. Digital logistics solutions help companies comply with these regulations by providing real-time monitoring, tracking, and documentation, ensuring that products meet regulatory standards. Moreover, many pharmaceutical products, including vaccines and biologics, require cold chain logistics to maintain their efficacy. The increasing demand for temperature-sensitive medications has driven the adoption of advanced digital logistics systems that offer precise temperature control, monitoring, and reporting throughout the supply chain.

Regional Insights

North Americadominated the global digital logistics market and accounted for a revenue share of over 36.0% in 2023. The market’s growth in the region is attributed to the rapidly growing adoption of advanced technologies in the region. North America is a leader in adopting advanced technologies such as IoT, AI, robotics, and blockchain. These technologies are being integrated into digital logistics systems to enhance supply chain visibility, optimize operations, and improve decision-making. Government initiatives and private investments are enhancing the logistics network, making it more efficient and technologically advanced. For instance, in May 2024, the Government of Canada, through the National Trade Corridors Fund, announced an investment of over USD 35 million in 19 digital infrastructure projects to enhance the efficiency of supply chains and reduce trade barriers. By fostering innovation in transportation, these investments aim to address bottlenecks, improve the flow of goods, and create economic opportunities for Canadian businesses to thrive both domestically and globally.

U.S. Digital Logistics Market Trends

The U.S. market is expected to grow at a CAGR of 17.8% from 2024 to 2030. The market’s growth in the country is attributed to the need to ensure regulatory compliance. The complex regulatory environment in the U.S., particularly in industries such as healthcare, pharmaceuticals, and food, drives the need for advanced digital logistics systems. These systems help companies comply with regulations by providing real-time monitoring, tracking, and documentation.

Asia Pacific Digital Logistics Market Trends

The market in Asia Pacific is expected to grow at the highest CAGR of 19.7% from 2024 to 2030. The rapid e-commerce expansion, urbanization, and population growth are driving the market’s growth in the region. The Asia Pacific region is experiencing explosive growth in e-commerce, increasing the demand for advanced digital logistics solutions to manage complex supply chains, order fulfillment, and last-mile delivery. Rapid urbanization and a growing population in Asia Pacific cities are driving the need for more efficient logistics systems. Digital solutions help manage the complexities of high-density urban environments and support the movement of goods.

Europe Digital Logistics Market Trends

The market in Europe is expected to grow at a significant CAGR of 17.4% from 2024 to 2030. The market's growth can be attributed to the growing sustainability initiatives in the region. Companies are leveraging digital logistics technologies to reduce carbon footprints, optimize routes, and implement green logistics practices, aligning with European Union sustainability goals. Moreover, significant investments in transportation and logistics infrastructure across Europe are supporting the growth of digital logistics. Upgrades to ports, railways, and roads facilitate the integration of digital technologies into logistics operations.

Key Digital Logistics Company Insights

Some of the key companies operating in the market include Oracle, IBM, Microsoft, and Google, among others.

-

Oracle is a U.S.-based multinational technology company known for its comprehensive range of software, hardware, and cloud solutions. The company provides comprehensive digital logistics and supply chain management solutions through its Oracle Supply Chain Management (SCM) suite. This includes transportation management, warehouse management, inventory management, and order management, among others. Oracle operates in more than 175 countries, serving a vast and diverse customer base that includes large enterprises, governments, and small to medium-sized businesses.

Slync, Inc. and ORBCOMM are some of the emerging companies in the target market.

- ORBCOMM is a U.S.-based provider of industrial Internet of Things (IoT) and machine-to-machine (M2M) communication solutions, providing services that enable the tracking, monitoring, and management of assets across various industries. The company is known for its expertise in satellite and cellular-based connectivity, offering a comprehensive range of products and services tailored to meet the needs of industries such as transportation, logistics, maritime, oil & gas, and heavy equipment. Its solutions are used to track and monitor a wide range of assets, including trucks, trailers, containers, vessels, and heavy equipment. This provides companies with real-time visibility into their supply chain operations, enabling them to manage assets more effectively.

Key Digital Logistics Companies:

The following are the leading companies in the digital logistics market. These companies collectively hold the largest market share and dictate industry trends.

- ORBCOMM

- IBM

- Oracle

- Microsoft

- Infor

- Kuehne+Nagel

- C.H. Robinson Worldwide, Inc.

- XPO, Inc.

- Blue Yonder, Inc.

- SAP

- Slync, Inc.

Recent Developments

-

In June 2024, ORBCOMM introduced the CT 3600 device, the next generation of its reefer container monitoring solution. This device simplifies the management of intelligent reefer fleets for shipping lines and container leasing companies. Designed to reduce installation complexity and costs, the CT 3600 offers enhanced performance and quick deployment, ensuring seamless integration with all major refrigerated container brands and compliance with industry standards.

-

In January 2023, Oracle introduced new logistics capabilities within its Fusion Cloud Supply Chain & Manufacturing (SCM) platform to help organizations enhance global supply chain efficiency. These updates to Oracle Global Trade Management (GTM) and Oracle Transportation Management (OTM) enable businesses to reduce costs, automate regulatory compliance, and improve logistics flexibility, ensuring they can adapt rapidly to market changes and maintain operational excellence.

Digital Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33.79 billion

Revenue forecast in 2030

USD 93.28 billion

Growth Rate

CAGR of 18.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ORBCOMM; IBM; Oracle; Microsoft; Google; Infor; Kuehne+Nagel; C.H. Robinson Worldwide, Inc.; XPO, Inc.; Blue Yonder, Inc.; SAP; Slync, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital logistics market report based on component, deployment, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Transportation Management

-

Warehouse Management

-

Order Management

-

EDI

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Automotive

-

Healthcare & Pharmaceuticals

-

Food & Beverage

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the digital logistics market ORBCOMM, IBM, Oracle, Microsoft, Google, Infor, Kuehne+Nagel, C.H. Robinson Worldwide, Inc., XPO, Inc., Blue Yonder, Inc., SAP, and Slync, Inc.

b. Key factors driving market growth include the increasing need for real-time visibility of supply chains.

b. The global digital logistics market size was estimated at USD 29.18 billion in 2023 and is expected to reach USD 33.79 billion in 2024.

b. The global digital logistics market is expected to grow at a compound annual growth rate of 18.4% from 2024 to 2030 to reach USD 93.28 billion by 2030.

b. North America dominated the digital logistics market with a share of over 36.0% in 2023. This is attributable to the growing adoption of advanced technologies for logistics operations in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.