- Home

- »

- Medical Devices

- »

-

Digital Surgical Microscopes Market, Industry Report, 2030GVR Report cover

![Digital Surgical Microscopes Market Size, Share & Trends Report]()

Digital Surgical Microscopes Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Ophthalmology, Neurosurgery & Spine Surgery, ENT Surgery, Dentistry, Plastic & Reconstructive Surgeries, Gynecology), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-500-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Surgical Microscopes Market Trends

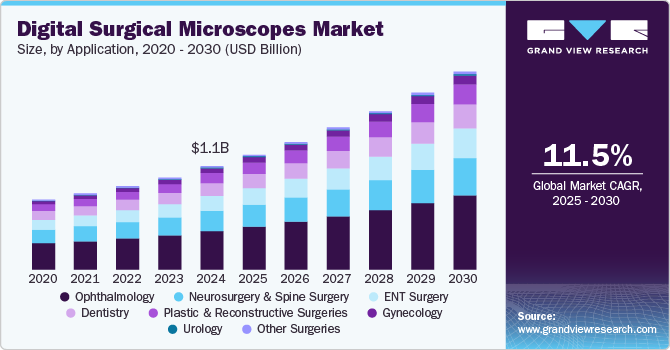

The global digital surgical microscopes market size was estimated at USD 1.12 billion in 2024 and is expected to grow at a CAGR of 11.54% from 2025 to 2030. The industry is driven by technological advancements, such as enhanced visual clarity, integration with augmented reality and 3D imaging, and improved image recording. The growing demand for minimally invasive and microsurgeries, an aging population, and rising chronic diseases further fuel market growth. The focus on patient safety, the need for surgery precision, and the expanding healthcare infrastructure in emerging markets are key factors contributing to the increased adoption of digital surgical microscopes in hospitals and clinics worldwide.

The industry is experiencing significant growth, fueled by continuous advancements in imaging and visualization technologies. For instance, in August 2022, Olympus introduced the Blue Light Imaging Mode (BL) for its ORBEYE 4K 3D exoscope system. This advanced feature enables the differentiation of tissues containing specific fluorophores from those without, utilizing a blue light LED for high-contrast, real-time dissection. Recent studies have highlighted the effectiveness of the ORBEYE exoscope compared to traditional analog microscopes in detecting tumors fluoresced with 5-aminolevulinic acid (5-ALA). The findings demonstrated that the ORBEYE exoscope is a feasible tool for tumor visualization and is associated with a high positive predictive value for accurate tumor removal.

In addition, digital surgical microscopes use advanced features such as augmented reality (AR) overlays, fluorescence imaging, and image-guided navigation systems. AR overlays allow crucial data to be displayed directly in the surgeon’s view, aiding in more informed decision-making. Fluorescence imaging enhances the visibility of structures such as blood vessels and tumor boundaries, supporting more precise resections. Image-guided navigation provides real-time feedback during procedures, further enhancing surgical precision. These technological innovations have led to increased adoption of digital surgical microscopes across various medical specialties, including neurosurgery, ophthalmology, and otorhinolaryngology.

The global shift toward minimally invasive surgeries (MIS) is another key factor fueling the demand for digital surgical microscopes. These microscopes provide high-resolution visualization of intricate anatomical structures, supporting smaller incisions and reducing patient recovery time. As MIS techniques continue to gain popularity among surgeons and patients, the adoption of advanced digital microscopes designed to meet these procedural needs is expected to expand.

The growing incidence of chronic diseases such as cancer, cardiovascular disorders, and degenerative eye conditions has resulted in a surge in surgical interventions. Digital surgical microscopes play a critical role in these procedures by offering precise visualization. For example, microsurgery for tumor removal and ophthalmic surgeries such as cataract and retinal repair benefit significantly from high-definition imaging, which enhances precision and reduces risks during the procedure.

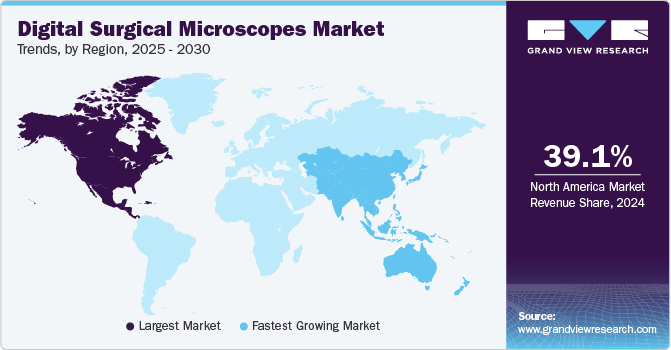

Investment in healthcare infrastructure, particularly in emerging economies, is boosting the adoption of digital surgical microscopes. Hospitals and surgical centers are equipping operating rooms with advanced surgical tools to improve patient outcomes and attract medical professionals. Additionally, government initiatives and funding to modernize healthcare facilities in regions such as Asia-Pacific and the Middle East are creating lucrative opportunities for market players.

Market Concentration & Characteristics

The industry demonstrates a high degree of innovation, driven by advancements in imaging and visualization technologies. Features including 4K and 3D imaging, augmented reality (AR) overlays, and fluorescence-guided surgery are transforming surgical precision. Integration with robotics, AI, and image-guided navigation enhances usability and outcomes, while compact, ergonomic designs improve workflow efficiency.

The industry is experiencing a medium level of M&A activity as companies seek to strengthen their technological capabilities and expand their market presence. Collaborations between surgical equipment manufacturers and tech innovators aim to accelerate R&D and improve product portfolios. Such M&A activities enable firms to meet the growing demand for precision surgery tools, enhance global distribution networks, and foster competitive market leadership.

Regulations significantly impact the industry by ensuring device safety, performance, and compliance with healthcare standards. Regulatory bodies such as the FDA and CE establish stringent guidelines for product approval, requiring thorough clinical evaluations and certifications. These processes promote high-quality, reliable products but may extend development timelines. Standards such as ISO 13485 for medical devices drive innovation while ensuring safety.

Product expansion in the digital surgical microscope market is driven by technological advancements and the increasing demand for minimally invasive procedures. Expansion into specialties such as neurosurgery, for instance, in December 2021, Leica Microsystems introduced the ARveo 8, a cutting-edge digital visualization microscope designed for neurosurgery. The system integrates AR fluorescence imaging, image-guided surgery (IGS) data, and endoscopic imaging, enabling the neurosurgical team to benefit from improved visualization and precision in complex surgical interventions.

Geographical expansion plays a pivotal role in the growth of the digital surgical microscope market. Leading manufacturers are targeting emerging regions such as Asia-Pacific, the Middle East, and Latin America, where healthcare infrastructure is rapidly evolving. The increasing adoption of advanced surgical technologies in these regions and rising healthcare investments fuel market growth.

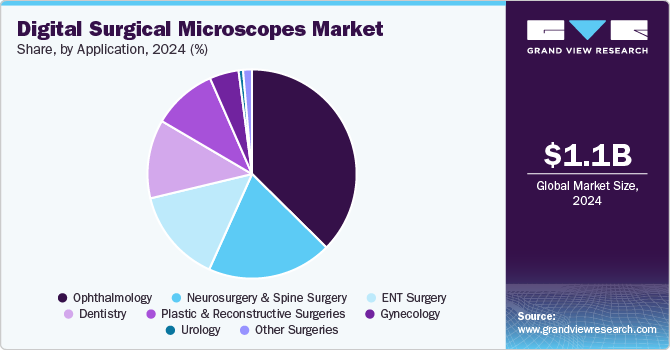

Application Insights

The ophthalmology segment led the market in 2024, accounting for the largest revenue share of 37.40%. The segment is driven by advancements in microsurgical techniques and increasing demand for precision in eye surgeries. Digital surgical microscopes offer superior imaging capabilities enabling ophthalmologists to perform intricate procedures with exceptional accuracy. The integration of features such as augmented reality (AR) overlays and fluorescence imaging further enhances surgical precision and patient outcomes, particularly in cataract, retinal, and corneal surgeries.

The ENT surgery segment is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period. The ENT surgery application segment is experiencing significant growth in the digital surgical microscope market, driven by advancements in imaging technologies and the increasing complexity of otolaryngology procedures. The growing prevalence of ENT disorders, such as chronic sinusitis, hearing loss, and throat cancers, is a key factor driving the demand for advanced surgical solutions. Additionally, the rise in minimally invasive surgical techniques and outpatient surgical centers contributes to market growth. Government initiatives supporting healthcare infrastructure and increased adoption of innovative technologies by surgeons ensure that the ENT surgery segment remains a vital driver in the digital surgical microscope market.

Regional Insights

North America digital surgical microscopes market accounted for the largest revenue share of 39.10% in 2024. North America digital surgical microscopes market is witnessing significant growth due to the presence of key market players and their strategic initiatives. Companies are focusing on innovation, partnerships, and expanding their product portfolios to meet the increasing demand for advanced surgical visualization technologies. These efforts, combined with the rising adoption of digital microscopes in various medical fields, are driving market expansion and enhancing the overall healthcare landscape.

U.S. Digital Surgical Microscopes Market Trends

The digital surgical microscopes industry in the U.S. is experiencing significant growth, driven by advancements in technology and the rising prevalence of chronic disorders. Innovations in digital imaging and enhanced visualization tools are improving surgical precision and outcomes. Additionally, the increasing demand for minimally invasive procedures is further boosting the adoption of digital surgical microscopes across various medical specialties.

Europe Digital Surgical Microscopes Market Trends

Europe digital surgical microscopes market is driven by technological advancements and the increasing demand for minimally invasive surgeries. Innovations such as digital imaging, enhanced visualization capabilities, and ergonomic designs are becoming standard features in new product launches. Companies are focusing on integrating artificial intelligence (AI) into digital surgical microscopes to enhance precision and surgical outcomes.

The UK digital surgical microscopes market is characterized by a strong focus on innovation and patient-centric solutions. The National Health Service (NHS) is increasingly adopting advanced digital surgical technologies to improve patient care, leading to a rising demand for high-quality digital surgical microscopes. Ongoing training programs for surgeons on using these advanced systems are contributing to their growing acceptance within the healthcare community.

The digital surgical microscopes market in Germany benefits from its robust healthcare infrastructure and a strong commitment to research and development. Product launches feature cutting-edge technologies such as 3D visualization systems and integrated digital imaging solutions to improve surgical precision. For instance, in March 2024, ZEISS Medical Technology launched its latest 3D visualization and digital surgical innovation. These advancements enable seamless data integration and management across cataract and refractive workflows, setting new benchmarks for personalized ophthalmic care.

Asia Pacific Digital Surgical Microscopes Market Trends

The digital surgical microscopes industry in Asia Pacific is expected to register the fastest CAGR during the forecast period. The rising prevalence of ophthalmic disorders, growing medical tourism, and an increasing number of surgeries performed in inpatient and outpatient settings are key factors driving market growth in the region. Additionally, favorable government policies aimed at improving healthcare systems and rapid economic development in several countries are expected to further propel market expansion. India is anticipated to witness significant growth during the forecast period, driven by the growing adoption of minimally invasive surgeries and the presence of both multinational and local manufacturers in the country. These factors contribute significantly to the rising demand for advanced digital surgical microscopes in the region.

Japan digital surgical microscopes industry is experiencing growth, supported by increasing government funding for healthcare advancements and technological innovation. Enhanced precision, growing adoption of specialized surgeries, and collaborations between local manufacturers and global companies further boost market expansion.

The digital surgical microscopes market in China is growing rapidly, driven by supportive regulatory frameworks and rising investments in healthcare technology. The adoption of advanced surgical tools, increasing surgical procedures, and local production capabilities further enhance market development.

Middle East & Africa Digital Surgical Microscopes Market Trends

The digital surgical microscopes industry in the Middle East and Africa region is projected to witness steady growth over the forecast period, driven by increasing demand for advanced surgical visualization tools in healthcare facilities. Factors such as the rising prevalence of chronic diseases requiring surgical interventions, growing investments in healthcare infrastructure, and an expanding medical tourism industry in countries such as the UAE and South Africa contribute significantly to this growth.

Key Digital Surgical Microscopes Company Insights

Some major players operating in the digital surgical microscopes market are ZEISS Group; Leica Microsystems; Olympus Corporation; Nikon Corporation, among others. There are various small and large manufacturers offering products, resulting in intense competition among the manufacturers. The industry players are increasing their focus on strategic partnerships such as mergers and acquisitions, new product launches & partnerships & collaborations to get maximum revenue share in this sector.

Key Digital Surgical Microscopes Companies:

The following are the leading companies in the digital surgical microscopes market. These companies collectively hold the largest market share and dictate industry trends.

- ZEISS Group

- Leica Microsystems

- Olympus Corporation

- Nikon Corporation

- Stryker Corporation

- TOPCON CORPORATION

- Vision Engineering Ltd

- haag-streit.com

- Medtronic

- MÖLLER-WEDEL OPTICAL GMBH

- Seiler Instrument Inc.

- Schneider Optical Machines

- OptoTech

- Kongsberg Gruppen

- Synaptive Medical

- Microsurgical Technology (MST)

- Alcon

- Honeywell International Inc.

Recent Developments

-

In August 2024, ZEISS Medical unveiled its latest innovations in cataract and corneal refractive workflows at the European Society of Cataract and Refractive Surgeons conference. ZEISS also introduced its advanced optical and digital ophthalmic microscopes to the CE markets, while showcasing its expanded IOL portfolio, including new clinical results for the AT ELANA trifocal IOL.

-

In January 2024, Leica Microsystems introduced an advanced version of its ARveo 8 digital visualization microscope for neurosurgery. The continually expanding ARveo 8 ecosystem enhances surgical visualization by incorporating 3D views and augmented reality (AR) fluorescence technology.

-

In March 2023, Custom Surgical announced the pre-sales of the next-generation MicroREC. Ophthalmologists use MicroREC to effortlessly capture high-quality images and videos of diagnoses and procedures.

Digital Surgical Microscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.24 billion

Revenue forecast in 2030

USD 2.15 billion

Growth Rate

CAGR of 11.54% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Parexel International (MA) Corporation; Trilogy Writing & Consulting GmbH; Freyr; Cactus Communications; GENINVO; IQVIA Inc.; ICON plc; Syneos Health; IBM; Teladoc Health, Inc.; SmarterDx; Abridge AI, Inc.; Suki AI, Inc.; Movano; Heidi; Corti; Tortus AI; Nabla Technologies.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Surgical Microscopes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital surgical microscopes market report based on application and region:

-

Application (Revenue, USD Million, 2018 - 2030)

-

Ophthalmology

-

Neurosurgery and Spine Surgery

-

ENT Surgery

-

Dentistry

-

Plastic & Reconstructive Surgeries

-

Gynecology

-

Urology

-

Other Surgeries

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital surgical microscopes market size was estimated at USD 1.12 billion in 2024 and is expected to reach USD 1.24 billion in 2025.

b. The global digital surgical microscopes market is expected to grow at a compound annual growth rate of 11.54% from 2025 to 2030 to reach USD 2.15 billion by 2030.

b. North America dominated the digital surgical microscopes market with a share of around 39.10% in 2024. This is attributable to the presence of key market players and their strategic initiatives

b. Some key players operating in the digital surgical microscopes market include Parexel International (MA) Corporation; Trilogy Writing & Consulting GmbH; Freyr; Cactus Communications; GENINVO; IQVIA Inc.; ICON plc; Syneos Health; IBM; Teladoc Health, Inc.; SmarterDx; Abridge AI, Inc.; Suki AI, Inc.; Movano; Heidi; Corti; Tortus AI; Nabla Technologies.

b. Key factors that are driving the market growth include shift towards minimally invasive surgeries (MIS), growing incidence of chronic diseases , and continuous advancements in imaging and visualization technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.