- Home

- »

- Next Generation Technologies

- »

-

Digital Experience Platform Market Size & Share Report, 2030GVR Report cover

![Digital Experience Platform Market Size, Share & Trends Report]()

Digital Experience Platform Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Platform, Services), By Deployment (On-premise, Cloud), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-886-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Experience Platform Market Summary

The global digital experience platform market size was estimated at USD 12,390.4 million in 2023 and is projected to reach USD 30,413.4 million by 2030, growing at a CAGR of 13.7% from 2024 to 2030. The continued integration of the latest technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), Virtual Reality (VR), and Machine Learning (ML), into digital experience platform (DXP) solutions, is expected to play a niche role in driving the growth of the DXP market during the forecast period.

Key Market Trends & Insights

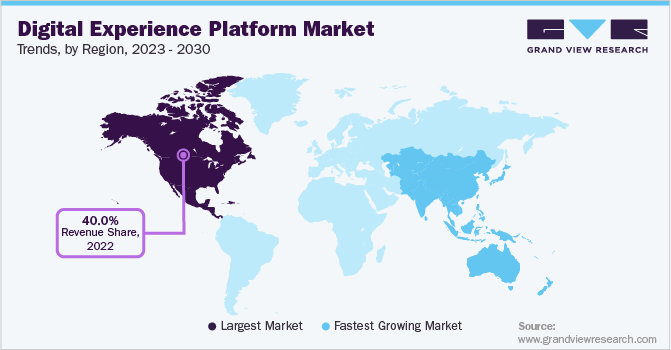

- North America digital experience platform market dominated with a revenue share of over 40% in 2022.

- Asia Pacific is anticipated to rise at the fastest CAGR of 13.3%.

- Based on component, the platform segment accounted for a market share of 69.3% in 2022.

- Based on deployment, the on-premise segment accounted for a market share of 51.1% in 2022.

- Based on application, the business-to-consumer segment accounted for a market share of 56.0% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 12,390.4 million

- 2030 Projected Market Size: USD 30,413.4 million

- CAGR (2024-2030): 13.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Digital transformation has gained significant traction in the wake of the outbreak of the COVID-19 pandemic. Several businesses are adopting DXP solutions to ensure business coherence and process optimization. Looking forward, DXP solutions would help teams in learning to collaborate, thereby opening new opportunities for the growth of the digital experience platform market over the forecast period.

The rise in the adoption of social networking, video sharing, hosted services, web applications, and podcasting, plays a vital part in promoting businesses to invest resources in digital experience platforms. With the help of DXP organizations can understand the immediate needs of the customer and deliver the right content through various digital channels.

Besides, digital experience platforms offer a few other advantages such as client activity monitoring, incorporated advanced analytical capability, and seamless integration with the existing framework. Key market players are concentrating on further improving their digital platforms by investing resources in advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and big data analytics, thereby driving the DXP market growth.

Increasing technological advancements in marketing tools and the rising popularity of digital marketing strategies to reach a larger audience are driving the DXP market growth across the globe. Companies operating in the digital experience platform industry are introducing innovations and developing DXPs in line with customer expectations to target potential audiences.

For instance, in May 2021, ON24 announced that its ON24 Digital Experience Platform would also be available in the Japanese language, starting with ON24 Webcast Elite. This demonstrates the company’s efforts to strengthen its market position in Asia-Pacific. This functionality is expected to empower ON24 Webcast Elite to provide a more user-friendly user interface to Japanese consumers for easily creating on-demand and live digital experiences with analytics and reporting.

However, the issues in determining the ROI and managing the omnichannel-generated data are anticipated to hamper the DXP market growth over the forecast period. Due to their complex software designs, end-user companies need a proper framework at their digital touchpoints to ensure the accurate distribution of content.

To tackle these issues, various industry participants are focusing on integrating ROI calculator tools into their DXPs, enabling their enterprise consumers to efficiently allocate budgets and determine the ROI based on DXP integration in their business operations. Additionally, DXP developers are focusing on expanding the capabilities of their DXPs, enabling accurate data distribution at different digital touch points. These factors would further supplement the growth of the digital experience platform industry.

Startups operating in the DXP industry are focusing on raising funds to strengthen their R&D capabilities to develop powerful DXPs. For instance, in July 2022, Kontent.ai raised USD 40 million from Expedition Growth Capital (EGC) for developing AI solutions for its Content Management Systems (CMS). The company would also utilize this money to increase its employee size and client base.

In March 2021, CMS provider Magnolia collaborated with Attraqt Group PLC for developing customized AI-powered DXPs and integrating them into the Magnolia content platform. This would allow Magnolia clients to improve their scheduled campaigns, personas, and channels. These factors would further fuel the market growth.

Component Insights

The platform segment accounted for a market share of 69.3% in 2022. The aggressive efforts being pursued by various enterprises to provide integrated, personalized, and optimized user engagement and experience across multiple marketing channels are expected to drive the growth of the segment.

DXP solutions can potentially help in delivering well-thought-out, personalized digital experiences to customers while also allowing businesses to improve their efficiency. The strong emphasis on delivering high-quality digital experiences is prompting numerous vendors to use outcome-based business models for revenue generation. These factors are responsible for the growth of the service segment.

The services segment is anticipated to grow at a CAGR of 15.3% during the forecast period. DXP services help organizations realize higher Returns on Investment (ROI), reduce expenses, and improve operational performance. Having realized that a workforce with a specific skill set would be required for accelerating digital transformation, organizations are expected to opt for professional services to accomplish their operations.

For instance, Credencys Solutions Inc., a digital platform development company, provides technology strategy consulting services that are designed to support cloud integration and migration of existing and new software solutions. The company helps its clients in reducing application downtime and subsequent data losses. Such capabilities offered by service providers are expected to contribute to the growth of the segment over the forecast period.

Deployment Insights

The on-premise segment accounted for a market share of 51.1% in 2022. Numerous organizations choose on-premise deployment due to its ability to customize as per user requirements during the implementation. On-premise deployment offers high-end security to classified information which means organizations can have better control over sensitive data and it supports easy compliance with multiple government regulations. Additionally, with on-premise deployment organizations can install a personalized network of digital transformation that suits the organization's necessities precisely and effectively.

The cloud segment is anticipated to grow at a CAGR of 15.3% during the forecast period, owing to the ease of deployment, relatively lower investments in physical infrastructure, and hassle-free integration associated with cloud deployment. Cloud computing facilitates more efficient and effective ways to adapt to the changing market environments while running business operations.

It streamlines the consumerization of technology. Further, advances in the latest technologies, such as IoT, big data, analytics, and mobility, have sparked innovation and transformation in the business environment and augmented revenues. These benefits would further supplement the growth of the segment during the forecast period.

Application Insights

The Business-to-Consumer (B2C) segment accounted for a market share of 56.0% in 2022. The segment growth can be attributed to the rising levels of disposable income, the growing popularity of online shopping, the proliferation of smartphones, and the increasing internet penetration rate. Advances in the latest technologies, such as AI and IoT, are providing customers with a real-time shopping experience.

For instance, AR and VR are allowing customers to try out apparel virtually in virtual fitting rooms in the wake of the outbreak of the COVID-19 pandemic. Further, by opting for the appropriate technology, companies can embrace change and capitalize on these opportunities to ensure long-term customer loyalty and growth.

The Business-to-Business (B2B) segment is anticipated to grow at a CAGR of 13.5% during the forecast period. The increased adoption of B2B digital experience platforms by organizations and various institutes is due to multiple factors such as omnichannel content management, analytical capabilities to increase customer retention rate, seamless integration, and consistent customer journey.

Moreover, B2B digital experience platform gives organizations a unified platform for implementing customer interaction and engagement strategies. They assist organizations in meeting customer expectations and offer them personalized product and service suggestions. B2B DXP platforms help organizations to effectively redesign business content on various touchpoints such as tablets, cell phones, and workstations.

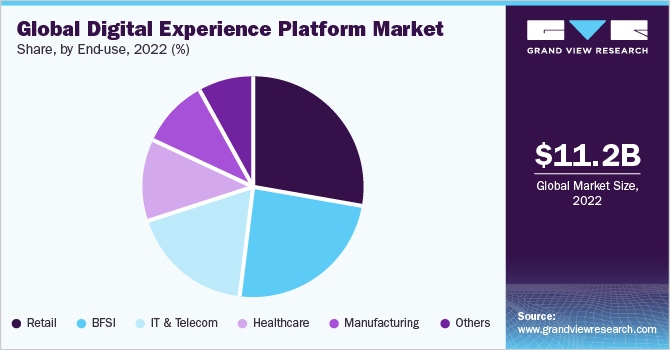

End-use Insights

The retail segment accounted for a market share of 28.1% in 2022. The segment growth can be attributed to the increasing internet penetration rate and the growing preference for mobile apps for making purchases and related decisions. Furthermore, retailers are also using digital e-commerce and web applications to attract new customers while retaining existing customers.

In the retail industry, digital transformation entails the continuous integration of merchandising, inventory, customer service, pricing, and supply chain processes to drive overall business process optimization. These factors would drive the demand for DXP solutions in the retail sector during the forecast period.

The BFSI segment is anticipated to grow at a CAGR of 15.1% during the forecast period. in line with the growing preference for digital banking. The continued rollout of contactless and paperless services by financial institutions has improved overall efficiency and productivity and led to a better customer experience.

Several major banks in India have launched virtual assistants, such as SBI Intelligent Assistant by the State Bank of India (SBI), iPal by ICICI Bank Limited, and EVA by HDFC Bank Limited, which are based on AI and ML, and help in reducing the resolution time. Such benefits and capabilities associated with AI and other latest technologies are expected to drive the adoption of digital experience platforms by the incumbents of the banking industry.

Regional Insights

The North America digital experience platform market dominated with a revenue share of over 40% in 2022. Various end-use firms in North America are adopting various business strategies to collect and analyze consumer feedback through several digital channels to improve their sales, creating robust market opportunities.

The growing preference for cloud solutions, especially among the SMEs in the region, to boost business efficiency, cost-efficiency, and flexibility, is also driving the adoption of DXP solutions. For instance, in March 2022, IBM Corporation expanded its partnership with Adobe, Inc. to develop the AI-driven weather data & Adobe experience platform. Both companies will analyze the weather channel data to measure the weather impact on online spending and other factors in the e-commerce sector.

Asia Pacific is anticipated to rise at the fastest CAGR of 13.3%. Factors such as the growth of the IT industry, rise in per capita incomes, and the high-volume sales of smartphones & tablets are a few of the crucial factors contemplated to drive the deployment of digital experience platforms by organizations in the Asia Pacific region.

Many startups and SMEs are embracing digital experience platforms to assist in the smooth functioning of business processes. Besides, the presence of several Information Technology Enabled Services (ITeS) and software companies in countries such as India, Japan, China, Singapore, and South Korea are anticipated to accelerate the deployment of digital experience platforms.

Key Companies & Market Share Insights

The key players are observed to invest resources in research & development activities to support growth and enhance their internal business operations. The report will include company analysis based on their financial performances, product benchmarking, key business strategies, and recent strategic alliances. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development, and enhancement of existing products to acquire new customers and capture more market shares.

For instance, in June 2022, Salesforce.com, Inc. announced the launch of new Customer 360 innovations that link commerce, marketing, and service data on a single platform, enabling businesses to connect, automate, and customize every connection and establish scalable, dependable partnerships. Some prominent players in the global digital experience platform market include:

-

Acquia Inc.

-

ADOBE INC.

-

International Business Machines Corporation

-

Liferay, Inc.

-

Microsoft Corporation

-

Open Text Corporation

-

Oracle Corporation

-

Salesforce.com, Inc.

-

SAP SE

-

Sitecore

Digital Experience Platform Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15,459.2 million

Revenue forecast in 2030

USD 30,413.4 million

Growth Rate

CAGR of 13.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2021

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Acquia Inc.; ADOBE INC.; International Business Machines Corporation; Liferay, Inc.; Microsoft Corporation; Open Text Corporation; Oracle Corporation; Salesforce.com, Inc.; SAP SE; Sitecore

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Experience Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital experience platform market report based on component, deployment, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Platform

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Business-to-Consumer

-

Business-to-Business

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others (Non-profit Organizations, Government, Construction, Educational Institutions, and Energy & Utility, among others)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital experience platform market size was estimated at USD 11.17 billion in 2022 and is expected to reach USD 12.39 billion in 2023.

b. The global digital experience platform market is expected to witness a compound annual growth rate of 11.9% from 2023 to 2030 to reach USD 30.41 billion by 2030.

b. North America held the largest share of 43.7% in 2022. The high importance of customer engagement and retention, a strong presence of online and conventional retailing channels, and major preference for developing customer-centric marketing campaigns are some other major factors driving the growth of the North American DXP market.

b. Key industry players operating in the digital experience platform market include Salesforce.com, Inc.; Acquia Inc.; ADOBE INC.; International Business Machines Corp.; Liferay, Inc.; Microsoft Corporation; Open Text Corporation; Oracle Corporation; SAP SE; and Sitecore.

b. The continued integration of the latest technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), Virtual Reality (VR), and Machine Learning (ML), into digital experience platform (DXP) solutions, is expected to play a niche role in driving the growth of the digital experience platform market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.