- Home

- »

- Digital Media

- »

-

Digital Video Advertising Market Size & Share Report, 2030GVR Report cover

![Digital Video Advertising Market Size, Share & Trends Report]()

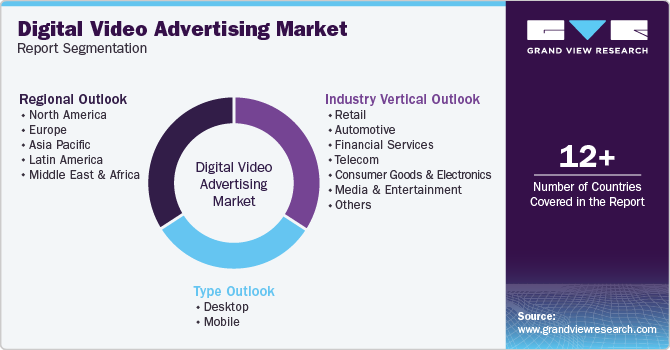

Digital Video Advertising Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Industry Vertical (Retail, Automotive, Financial Services, Telecom, Consumer Goods and Electronics, Media & Entertainment, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-744-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Video Advertising Market Summary

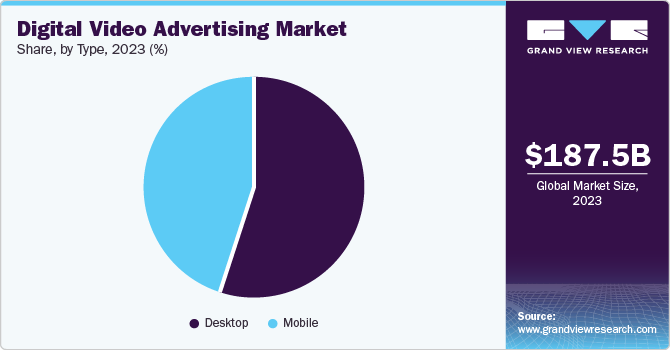

The global digital video advertising market size was estimated at USD 187.52 billion in 2023 and is projected to reach USD 659.16 billion by 2030, growing at a CAGR of 20.0% from 2024 to 2030. Technological advancements and changing consumer behavior have prompted advertisers to adopt innovative ways of digital video advertising.

Key Market Trends & Insights

- North America's digital video advertising market dominated with a revenue share of 36.8% in 2023.

- The U.S. digital video advertising market dominated the North America market in 2023.

- By type, the desktop segment accounted for the largest revenue share in 2023.

- By industrial vertical, the retail segment dominated the market and accounted for a revenue share of 20.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 187.52 Billion

- 2030 Projected Market Size: USD 659.16 Billion

- CAGR (2024-2030): 20.0%

- North America: Largest market in 2023

There is a growing trend amongst individuals to adopt visual media via platforms other than traditional cable and satellite TVs. Non-conventional platforms, such as desktops, mobile phones, Over the Top (OTT) media platforms, and social media applications, enable advertisers to enhance their service delivery methodologies to offer new revenue channels for marketers and broadcasters. Furthermore, these digital video contents are programmed to run on various platforms and in several formats to ensure maximum reach, thus enabling a better engagement rate.

The development of innovative filming techniques, including vertical filming and 360° digital videos, has significantly impacted the digital video advertising sector. These techniques offer a fresh perspective on the subject matter, appealing to a broader audience base. They enable advertisers to develop more engaging and successful campaigns, encouraging the adoption of digital video advertising strategies. Furthermore, advancements in video technology have enhanced the quality and effectiveness of video content, allowing for the capture of high-quality, detailed videos of shorter duration. This development has facilitated more efficient communication of brand messages to target audiences.

The emerging adoption of connected TVs amongst individuals encourages brands and marketers to adopt digital video advertising methodologies. The provision to access an individual’s social media accounts, analyze viewing trends, and effectively optimize search engines enables brands and marketers to offer relevant advertisements to people. Connected TV supports the transmission of highly personalized, targeted, and HD-quality ads, which boost brand exposure and promote brand loyalty. Furthermore, the ongoing trend amongst people to avoid skipping ads on TV enables marketers to portray brand messages more effectively, thus offering an impetus to market growth.

The growing usage of OTT platforms by several individuals worldwide has allowed advertisers to penetrate the market more efficiently. The availability of high-speed internet at affordable prices and the increasing demand for users to access subscription-free distribution of content provides marketers with higher chances to enhance their reach and facilitate efficient revenue generation. The ability to practice different types of advertising, such as pre, mid, and post-roll advertising, and the provision of not skipping ads by closing ad windows, offers higher chances to brands and agencies to put forward their message to audiences. Moreover, in-banner digital video and companion ads also allow marketers to take forward their marketing campaigns while ensuring viewers’ viewing experience is not hampered, which promises continued growth opportunities.

Industry Vertical Insights

The retail segment dominated the market and accounted for a revenue share of 20.8% in 2023. Digital video advertising via mobiles and desktops allows brands and marketers to identify and analyze search results using cookies, giving retailers an in-depth understanding of peoples’ needs and demands. Understanding peoples’ needs and desires offers offline retailers a chance to enhance customers’ in-store experience by providing products according to their requirements. Furthermore, digital video advertising can also be used in stores to facilitate interactive customer experiences, thus improving the effectiveness of advertisement campaigns and ensuring efficient consumer acquisition.

The financial services segment is expected to register a significant CAGR of 24.4% during the forecast period.This is mainly due to the rising demand for acquiring and keeping customers in a highly competitive market. Financial institutions leverage digital video ads to create brand recognition, educate customers about intricate financial services, and build confidence. Additionally, the shift towards customized financial guidance and services has required focused marketing campaigns, using digital video as a successful way to reach particular audiences and adjust messaging accordingly. Furthermore, the rising importance of compliance and regulations in the financial sector has prompted digital video advertising to communicate transparently and informatively with customers.

Type Insights

The desktop segment accounted for the largest revenue share in 2023. Changing consumer lifestyles and preferences are leading to the shift from TV viewership to other digital media platforms. The general trend amongst users to access multimedia content via desktops and laptops due to better viewing experience is promoting advertisers to adopt desktops as a preferred channel to indulge in advertising practices. Advertising on desktops enables advertisers to deliver ads on larger screens, which creates a better impact on audiences and drives them to undertake specific actions such as purchasing or signing up for particular services.

The mobile segment is expected to register the fastest CAGR during the forecast period. The growth can be attributed to the high penetration rate of affordable smartphones and an increasing trend amongst people to access content according to their convenience. Several mobile games offer game credits or coins to the players in exchange for viewing digital video ads between games, thus offering advertisers a new channel to enhance their reach. Furthermore, location access for mobile phones provided by service providers enables advertisers to understand the demographic trends of a region, thus allowing them to engage in advertisement practices specific to the viewing patterns of people in a particular area.

Regional Insights

North America's digital video advertising market dominated with a revenue share of 36.8% in 2023. The region has a well-established digital infrastructure, widespread internet access, and a complex advertising system. Its early adoption of online platforms and robust digital innovation culture have established it as a leader in digital advertising. Moreover, major tech giants and content creators in the region have supported creating and viewing high-quality video content, making it an appealing market for advertisers.

U.S. Digital Video Advertising Market Trends

The U.S. digital video advertising market dominated the North America market in 2023 due to the U.S. large and affluent consumer base, along with substantial disposable incomes, which has driven strong investments in advertising. Furthermore, well-known tech companies and online media platforms in the U.S. have created a favorable environment for producing and consuming video content. The widespread use of high-speed internet and digital technology has made it easier to stream videos and deliver advertisements seamlessly. Moreover, the advertising system in the U.S. is well-developed and has advanced targeting features that help optimize campaigns effectively.

Europe Digital Video Advertising Market Trends

Europe's digital video advertising market was identified as a lucrative region in 2023. The region's mature digital infrastructure, widespread internet access, and smartphone usage have fostered a favorable environment for consuming video content. Moreover, the rising popularity of streaming services and the increasing practice of eliminating cable subscriptions have sparked a higher need for online video advertising as companies aim to connect with viewers transitioning from regular T.V.

The U.K. digital video advertising market is expected to grow rapidly in the coming years due to the nation's early adoption of digital technologies and a well-established online advertising environment, which has paved the way for video advertising to flourish. Digital technology has increased with smartphone use and fast internet, leading to a rise in video viewing. The U.K.'s status as a global hub for media and entertainment has brought in large investments in video content production, resulting in a rise in video advertising prospects.

Asia Pacific Digital Video Advertising Market Trends

Asia Pacific's digital video advertising market is expected to grow at the fastest CAGR over the forecast period. The growing middle class in the region, along with higher smartphone penetration and affordable internet access, has caused a rise in digital media consumption. The increase in e-commerce platforms and the rising popularity of e-commerce have established a favorable environment for digital video advertising. Furthermore, the increasing urbanization and evolving lifestyles in numerous Asian nations create a demand for entertainment and digital content, making video advertising an attractive option for brands. Additionally, the growing popularity of OTT platforms and the evolution of innovative video content styles create more chances for advertisers to reach their desired audiences effectively.

China's digital video advertising market held a substantial market share in 2023 owing to the growing number of consumers and rising disposable incomes. This has driven the need for various goods and services, making digital video advertising essential for connecting with specific audiences. Additionally, the widespread use of smartphones and fast internet connections has made watching videos easier, and the success of local technology companies and short-form video platforms has paved the way for digital advertising to thrive. The Chinese government's encouragement of the internet industry and the advancement of digital marketing tools have driven the growth of the digital video advertising market in the country.

Key Digital Video Advertising Company Insights

Some of the key companies in the digital video advertising market are AKI TECHNOLOGIES, ExoClick, Innovid, MediaMath, PubMatic, Inc., Seedtag Advertising, S.L., and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Aki Technologies is a company that focuses on personalized advertising solutions. Its system leverages machine learning to analyze how users behave and what they prefer and then shows customized ads based on location, weather, and purchase history. This approach allows brands and retailers to connect with consumers during key moments, increasing engagement and conversion rates.

-

ExoClick is a prominent ad tech company that provides digital advertising solutions for publishers and advertisers. Its operations are focused on video advertising. The company offers different video ad formats, such as out-stream video and video slider, catering to a variety of advertiser preferences. ExoClick has become a significant player in the rapidly expanding digital video advertising market by providing creative ad solutions and utilizing advanced technologies.

Key Digital Video Advertising Companies:

The following are the leading companies in the digital video advertising market. These companies collectively hold the largest market share and dictate industry trends.

- AKI TECHNOLOGIES

- ExoClick

- Innovid

- MediaMath

- PubMatic, Inc.

- Seedtag Advertising, S.L.

- Spot X Publications Ltd.

- The Trade Desk

- Nexxen International Ltd (Tremor International Ltd.)

- TubeMogul Inc.

- Viant Technology LLC

Recent Developments

-

In April 2024, Innovid, a company that provides advertising technology for connected TV (CTV), linear TV, and digital platforms, launched a new initiative called Harmony to enhance the CTV advertising ecosystem. Harmony Direct is the first product released as part of this initiative, simplifying the buying and selling of guaranteed, non-auction-based CTV advertising inventory.

-

In June 2023, The Trade Desk introduced Kokai, a new platform designed for digital advertising that leverages advanced distributed artificial intelligence (AI), improved measurement techniques, partner integrations, and enhanced user experience. This platform aims to transform digital advertising by enabling marketers of all levels to effectively utilize the full capabilities and complexities of programmatic advertising through these advancements and additional features.

Digital Video Advertising Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 221.25 billion

Revenue forecast in 2030

USD 659.16 billion

Growth rate

CAGR of 20.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, industry vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

AKI TECHNOLOGIES; ExoClick; Innovid; MediaMath; PubMatic, Inc.; Seedtag Advertising, S.L.; Spot X Publications Ltd.; The Trade Desk; Nexxen International Ltd (Tremor International Ltd.); TubeMogul Inc.; Viant Technology LLC

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Video Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the digital video advertising market report based on type, industry vertical, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Desktop

-

Mobile

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Automotive

-

Financial Services

-

Telecom

-

Consumer Goods and Electronics

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.