- Home

- »

- Homecare & Decor

- »

-

Disposable Cups Market Size & Share, Industry Report, 2030GVR Report cover

![Disposable Cups Market Size, Share & Trends Report]()

Disposable Cups Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Paper, Plastic, Foam), By End-use (Commercial, Institutional, Household), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-923-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Cups Market Summary

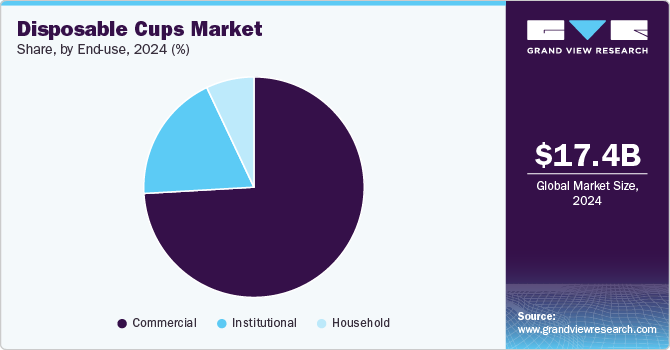

The global disposable cups market size was estimated at USD 17.40 billion in 2024 and is projected to reach USD 22.14 billion by 2030, growing at a CAGR of 3.7% from 2025 to 2030. The market growth is attributed to the growing preference for on-the-go lifestyle and convenience, which boosted the demand for disposable cups.

Key Market Trends & Insights

- The disposable cups market in North America accounted for a revenue share of around 42% in 2024.

- In 2024, the disposable cups market in the U.S. held a dominant 79.9% share of the North American market.

- By product, paper disposable cup sales accounted for over 61% of the overall disposable cups industry in 2024.

- By end use, the use of disposable cups in commercial settings accounted for a revenue share of about 74%.

Market Size & Forecast

- 2024 Market Size: USD 17.40 Billion

- 2030 Projected Market Size: 22.14 Billion

- CAGR (2025-2030): 3.7%

- North America: Largest market in 2024

Furthermore, the increasing number of quick-service cafes, restaurants, and food trucks, particularly in urban areas, contributes to this trend.

Disposable cups are a great alternative to glasses, mugs, and steins, especially if consumers are worried about breaking them or carrying them around. Increasing usage of disposable cups at social gatherings and celebrations is likely to propel their demand in the coming years. Single-serving cups have a multitude of uses in the household. They are perfect for serving beverage samples, dishing out child-friendly portions to kids, and even serving adult refreshments, such as espresso and cappuccino.

Thus, several households across the globe are keeping a supply of small disposable cups in the cabinet to prevent the spread of germs when it’s time to rinse with mouthwash or chase back pill and gel-cap medications. Small cups are also handy when mixing paints, stains, or adhesives for home improvement or craft projects.

Moreover, the growing awareness about hygiene and sanitation, especially post the COVID-19 pandemic, led consumers to favor single-use cups over reusable ones. Additionally, innovations in materials and designs, such as biodegradable and compostable cups, appeal to eco-conscious consumers and further propel market growth.

For instance, Simply Cups, a paper cup-recycling program, aims to divert paper cups from landfills through over 1500 collection points across Australia. The program develops paper cup solutions, advocates for recycling, and educates the public. With 1.8 billion hot drink cups used annually in Australia, Simply Cups collaborates with businesses and universities to create scalable solutions, such as recycling cups into concrete utility slabs and road materials. The Drop Off Only ARL system supports the initiative, promoting sustainable waste management and a circular economy.

The expansion of e-commerce and food delivery services is another major driver, as these platforms frequently use disposable cups for beverages. In addition, increasing disposable incomes and changing consumer habits in developing regions are creating new growth opportunities for the market.

Consumer Insights

In 2024, The Scottish Government's single-use beverage cup charge consultation conducted with Savanta, assessed perceptions of single-use items and regulatory impacts. More than half of the respondents in Scotland (56%) believe additional actions are necessary to address single-use items. Measures to reduce single-use cups holds 56%. In addition, 60% of respondents would buy less drinks in single-use cups if a charge was implemented along with 74% stating that charge would initiate them to use reusable cups often.

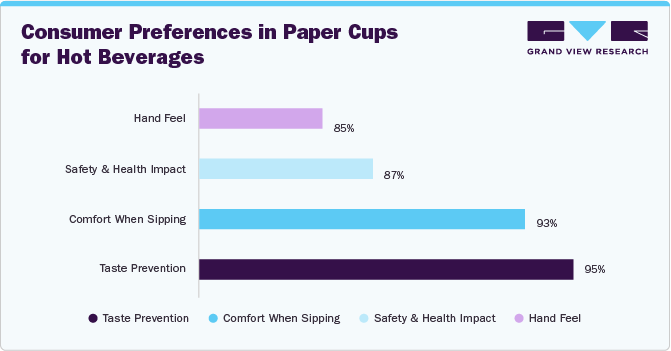

In 2023, The Shelton Group found that consumers prefer paper cups over clear plastic cups for reduced condensation and better insulation. Moreover, 11% liked seeing their drink in the cups. The consumer rated paper cup performance as “excellent” or “good” based on the research. Key factors include comfort while sipping (93% hot and 88% cold), safety and health impact (87% hot and 86% cold), taste prevention (95% hot and 84% cold), and hand feel (85 hot and 77 cold).

Product Insights

Paper disposable cup sales accounted for over 61% of the overall disposable cups industry in 2024. Paper is widely used in several industries, including packaging and disposable products, contributing to their substantial market share. Furthermore, there is a growing preference for paper over other materials due to its biodegradability, recyclability, and alignment with sustainable practices.

For instance, in July 2024, The City of Toronto accepted paper beverage cups lined with plastic for recycling at home, in apartment buildings, long-term care homes, retirement homes, and schools. A pilot program allows residents to recycle disposable coffee and fountain drink cups in blue bins, addressing previous confusion. The program, expected to expand across Ontario by 2026, includes containers similar to ice cream cups. This initiative aims to clarify recycling rules and promote sustainable regional waste management practices.

Demand for plastic disposable cups is expected to rise at a CAGR of 2.5% from 2025 to 2030. This anticipated increase reflects the ongoing demand for plastic materials, driven by their versatility, durability, and cost-effectiveness in various applications. Additionally, advancements in recycling technologies and initiatives to improve the sustainability of plastic products contribute to this growth, balancing environmental concerns with practical needs. Furthermore, government support for plastic disposable cups is anticipated to drive market growth. For instance, South Korea's Ministry of Environment withdrew the ban on paper cups at cafes and restaurants and provisionally approved plastic straws and plastic bags at convenience stores.

End-use Insights

The use of disposable cups in commercial settings accounted for a revenue share of about 74% of the overall disposable cups industry in 2024. This is attributed to the high demand for disposable cups in commercial settings such as restaurants, cafes, and catering services, where convenience and hygiene are paramount. The widespread adoption of disposable cups in these environments has significantly contributed to their substantial market share, underscoring the sector's pivotal role in driving market growth.

Demand for disposable cups in institutional applications is anticipated to grow at a CAGR of 2.9% from 2025 to 2030. The increasing demand for disposable cups in healthcare facilities, educational institutions, and corporate offices is boosting market growth. Additionally, government regulations promoting sustainable practices and reducing single-use plastics are encouraging institutions to adopt eco-friendly alternatives. These regulations often mandate the use of recyclable or biodegradable cups, further propelling the market. The focus on hygiene and sanitation, especially in healthcare and food service sectors, also contributes to the rising demand for disposable cups.

Regional Insights

The disposable cups market in North America accounted for a revenue share of around 42% in 2024 in the global disposable cups industry. The increasing awareness of hygiene and sanitation, coupled with a growing on-the-go lifestyle, has fueled the demand for disposable cups. Furthermore, the widespread use of disposable cups in commercial establishments such as restaurants, cafes, and convenience stores. Additionally, the presence of major market players and innovations in sustainable and eco-friendly cup designs have further contributed to North America's substantial market share.

In November 2024, Berry Global announced its first domestically produced recyclable polypropylene (PP) drink cups to support retailers’ own brands, to be showcased at the Private Label Manufacturers Association’s Trade Show in Chicago. Developed using Bantam technology, these cups are 10-15% lighter than polystyrene (PS) cups. Part of the B Circular Range, the cups are fully recyclable and food-contact safe. They feature enhanced sidewall rigidity, smooth contact points for grip and comfort, and are available in various sizes and designs for a superior consumer experience.

U.S. Disposable Cups Market Trends

In 2024, the disposable cups market in the U.S. held a dominant 79.9% share of the North American market. The increasing demand for convenience and on-the-go consumption is a primary driver, as disposable cups cater to busy lifestyles. Additionally, heightened awareness of hygiene and sanitation, particularly post-pandemic, is contributing to the market's expansion. Government regulations encouraging sustainable practices and the adoption of eco-friendly alternatives are also playing a crucial role. Innovations in recyclable and biodegradable materials further bolster market growth, aligning with environmental goals.

In April 2024, Starbucks introduced more sustainable cold cups in stores across the U.S. and Canada, made with less plastic and designed to reduce emissions and conserve water during production. These new cups streamline the workflow for store partners by consolidating lid combinations and simplifying storage. Developed at the Tryer Center, they reflect Starbucks' commitment to halve its carbon, water, and waste footprints by 2030. By then, Starbucks aims to ensure all customer packaging is reusable, recyclable, or compostable.

Europe Disposable Cups Market Trends

The disposable cups market in Europe accounted for a revenue share of about 32% of the overall disposable cups industry in 2024. The region’s growth is driven by the high consumption of disposable cups, especially in countries with established coffee cultures and robust food service industries.

Additionally, the increasing focus on sustainability and the adoption of eco-friendly practices have led to innovations in recyclable and biodegradable cup materials, further supporting market growth. For instance, in February 2024, Faerch Group introduced its new Tumbler range of recyclable beverage containers, containing at least 30% post-consumer recycled material. These cups can be recycled into new food packaging indefinitely, maintaining safety and functionality. The solution aims to streamline supply chains and enhance user experience for businesses and consumers.

Asia Pacific Disposable Cups Market Trends

The disposable cups market in Asia Pacific is set to grow at a CAGR of 5.8% from 2025 to 2030. The region is witnessing increasing urbanization, rising disposable incomes, and the growing popularity of on-the-go consumption, which drives market growth. The expanding food and beverage industry, particularly in emerging economies, is also driving demand for disposable cups. Innovations in sustainable materials and government initiatives promoting environmentally friendly practices also contribute to the market's growth.

Key Disposable Cups Company Insights

The disposable cups industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the market include Huhtamäki, Dart Container Corporation, Berry Global Inc., Pactiv Evergreen Inc., and others.

-

Huhtamäki is a global leader in sustainable packaging solutions, including disposable cups. It offers a wide range of products made from renewable and recyclable materials, focusing on reducing environmental impact. Huhtamäki's disposable cups are used in various sectors, including food service, retail, and healthcare. The company is committed to innovation and sustainability.

-

Dart Container Corporation is another prominent player in the disposable cup industry. It provides a comprehensive range of single use packaging solutions, including paper, foam, and plastic cups. Dart Container emphasizes hygiene and convenience, catering to quick-service restaurants, food delivery services, and large-scale events. Their products are designed to meet the growing demand for on-the-go beverage solutions while maintaining high standards of quality and safety.

Key Disposable Cups Companies:

The following are the leading companies in the disposable cups market. These companies collectively hold the largest market share and dictate industry trends.

- Huhtamäki

- Dart Container Corporation

- Berry Global Inc.

- Pactiv Evergreen Inc.

- Duni

- WestRock Company

- Genpak

- Go-Pak Group

- CONVERPACK INC.

- Bender Limited

Recent Developments

-

In April 2024, Duni Group, a sustainable catering firm based in Malmö, acquired the Australian reusable coffee cup company Huskee. Founded in 2017, Huskee manufactures cups from coffee husk waste and operates the HuskeeSwap and Huskee Loop programs for recycling. The acquisition, which aims to strengthen Duni's global packaging business in the Asia Pacific market, follows their recent acquisitions of New Zealand's Decent Packaging and an increased stake in Germany's Relevo.

-

In February 2024, Faerch Group introduced its new Tumbler range of recyclable beverage containers, containing at least 30% post-consumer recycled material. These cups can be recycled into new food packaging indefinitely, maintaining safety and functionality.

Disposable Cups Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.47 billion

Revenue forecast in 2030

USD 22.14 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; South Africa; UAE

Key companies profiled

Huhtamäki; Dart Container Corporation; Berry Global Inc.; Pactiv Evergreen Inc.; Duni; WestRock Company; Genpak; Go-Pak Group; CONVERPACK INC.; Bender Limited

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Cups Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disposable cups market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper

-

Plastic

-

Foam

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Institutional

-

Household

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global disposable cups market size was estimated at USD 17.41 billion in 2024 and is expected to reach USD 18.47 billion in 2025.

b. The global disposable cups market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2030 to reach USD 22.14 billion by 2030.

b. The disposable cups market in North America accounted for a revenue share of around 42% in 2024 in the global disposable cups market. The increasing awareness of hygiene and sanitation, coupled with a growing on-the-go lifestyle, has fueled the demand for disposable cups.

b. Some of the key players operating in the disposable cups market include Greiner Packaging GmBh, Benders Paper Cups, Dart Container, and Solo Cup Company, among others.

b. Key factors that are driving the disposable cups market growth include increasing demand for Quick Service Restaurants (QSR) from urban semi-urban market and water shortage to clean utensils is anticipated to use disposables for serving food and beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.