- Home

- »

- Specialty Polymers

- »

-

Disposable Gloves Market Size & Share Analysis Report, 2030GVR Report cover

![Disposable Gloves Market Size, Share & Trends Report]()

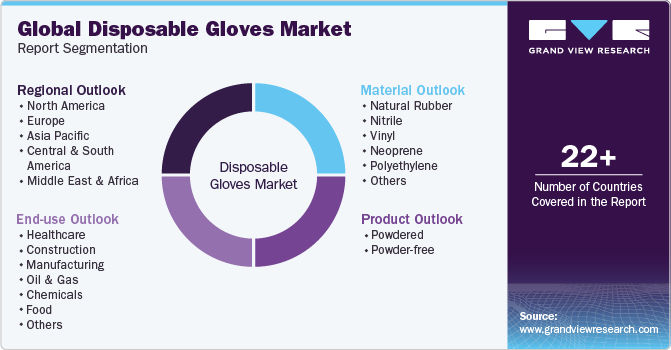

Disposable Gloves Market Size, Share & Trends Analysis Report By Material (Natural Rubber, Nitrile, Vinyl, Neoprene, Polyethylene), By Product (Powdered, Powder-free), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-574-8

- Number of Report Pages: 212

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Disposable Gloves Market Size & Trends

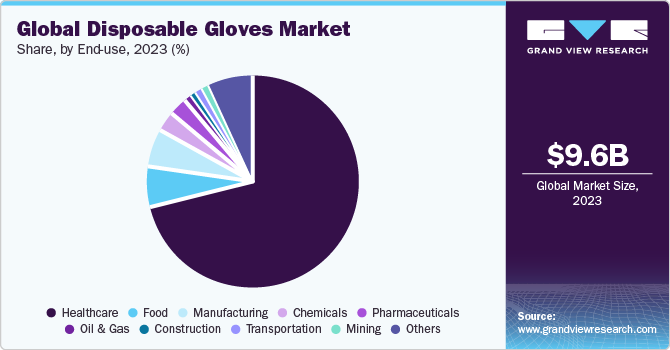

The global disposable gloves market size was estimated at USD 9.57 billion in 2023 and is projected to grow at a compounded annual growth rate (CAGR) of 8.4% from 2024 to 2030. The market is anticipated to grow over the coming years on account of several factors including favorable occupational safety regulations, increasing importance of safety and security at workplaces, and rising healthcare expenditure. The healthcare sector in major developing economies is anticipated to witness substantial growth on account of several factors, such as increasing investments in both private and public sectors along with rising population, high influx of migrants, and the growing geriatric population. Furthermore, rising healthcare expenditure is projected to drive the growth of the healthcare sector, which, in turn, is estimated to augment the demand for disposable gloves.

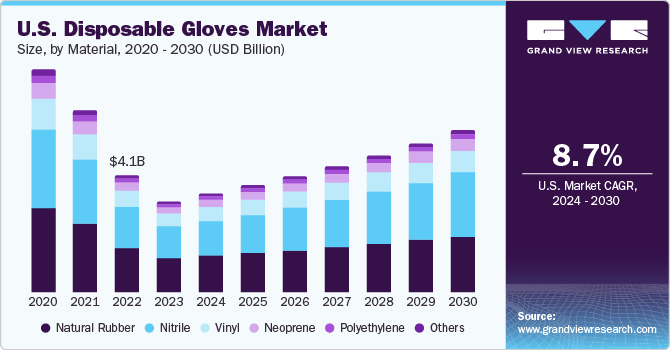

The disposable gloves industry in the U.S. is driven by factors such as advanced healthcare infrastructure, higher patient disposable income, and a significant geriatric population. Additionally, the COVID-19 pandemic has heightened the demand for disposable gloves, especially in healthcare, to curb further transmission.

In various industries like healthcare, medical, and mining, exposure to harmful chemicals poses a significant risk to workers' health, leading to issues such as skin diseases, rashes, hand cuts, amputation, and exposure to bloodborne pathogens. The implementation of safety regulations is expected to play a crucial role in driving market growth.

There is a growing awareness of the importance of raw materials in providing disposable gloves with high heat resistance, comfort, elasticity, and lightweight properties. This awareness is anticipated to fuel research and development activities among major players in the market, aiming to enhance the functionality of disposable gloves and expand their application through innovative design enhancements.

The production of disposable gloves is capital-intensive due to high raw material costs and complex manufacturing methods. Major raw material suppliers in the market have integrated into the value chain to manufacture disposable gloves, enhancing competitiveness.

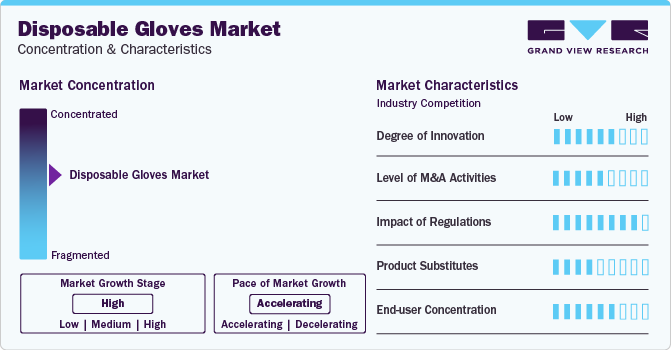

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The disposable gloves market is characterized by a high degree of competition, with a few key players dominating the industry.Major players in the market often have a global presence, supplying products to various regions and industries.Companies in this sector usually offer a diverse range of disposable gloves, catering to different industries such as healthcare, food, pharmaceuticals, and industrial sectors.

Due to the critical nature of applications, especially in healthcare, companies adhere to strict quality standards and certifications to ensure the safety and efficacy of their products. Research and development initiatives are common among leading players, focusing on technological innovations to improve the functionality, durability, and safety features of disposable gloves.

Major players in the market often integrate vertically along the supply chain. This integration includes activities ranging from raw material sourcing to manufacturing and distribution. Vertical integration helps companies control costs, ensure a steady supply of high-quality materials, and maintain a competitive edge in the market.

In response to growing environmental concerns, some market players are increasingly focusing on sustainability initiatives. This includes efforts to develop eco-friendly materials, reduce waste in production processes, and implement environmentally responsible practices. These sustainability efforts align with broader global trends and consumer preferences for environmentally friendly products, contributing to the long-term viability of companies in the market.

Material Insights

Natural rubber (latex) led the market and accounted for 36.7% of the global revenue demand in 2023. Natural rubber disposable gloves offer superior performance and protection in various applications such as medical & dental, food processing & service, janitorial & sanitation, pharmaceutical, and automotive. However, allergy caused by natural latex acts as a significant restraint in the latex medical gloves market. This has limited the penetration of natural rubber gloves in the medical and food industries. Nitrile emerged as the fastest growing material used for disposable owing to the latex-free, chemical resistance, and long shelf life offered by nitrile gloves. Owing to these properties nitrile has found itself to be one of the highest penetrated materials within the disposable surgical gloves market. Disposable examination gloves have witnessed significant growth in the medical & healthcare sector on account of higher demand product in hospital, veterinary, and dental applications further driving the disposable nitrile gloves market and cleanroom disposable gloves market.

Vinyl disposable gloves are latex-free and are made from polyvinyl chloride and plasticizers. These gloves offer high comfort and tactile sensitivity as compared to neoprene gloves. Vinyl gloves are suitable in an environment where frequent change of gloves is required, such as food preparation. Vinyl gloves are used in manufacturing, food processing, print shops, assembly, and medical industries. Polyethylene (PE) emerges as the most cost-effective material for gloves. Renowned for their affordability, PE gloves boast a loose fit and lightweight nature. Engineered for swift and effortless donning and removal, these gloves are latex- and powder-free. Primarily employed in light-duty applications demanding regular glove changes, PE gloves are ideal for tasks like food processing and serving, salad preparation, and various other food-related applications.

Product Insights

The powder-free product segment led the market and held significant share of the market in 2023. Stringent regulations on the use of powdered gloves by several governments worldwide are expected to have a positive impact on the powder-free gloves market over the forecast period. Powder-free gloves are treated with chlorination, which makes them less form-fitting to eliminate the use of powder for easy donning and removal. Rising preference for powder-free gloves across several industries, including chemical, medical, and food processing, among others, is projected to drive the market over the forecast period.

The advantages of using powdered gloves compared to powder-free gloves include their ability to fit tightly and offer protection against hazardous chemicals or physical contaminants. Cornstarch powder used in latex gloves is likely to contribute towards allergies or sensitivity, although it is not a concern in the case of vinyl or nitrile gloves. On January 19, 2017, the U.S. Food and Drug Administration (FDA) banned the manufacturing, sales, and distribution of all powdered patient examination gloves, powdered surgeon gloves, and absorbable powder used to lubricate surgeon's gloves, which, in turn, anticipated to hamper the growth of powdered gloves market over the forecast period.

End-use Insights

The medical end-use segment dominated the market in 2023. Regions with advanced healthcare systems and a large geriatric is expected to boost the disposable medical gloves market. Additionally, global events that heighten awareness of hygiene, such as pandemics, can significantly boost market demand, especially in the healthcare sector. Disposable gloves are often classified based on application as surgical gloves and examination gloves. Disposable examination gloves have witnessed substantial growth in the medical sector on account of higher demand in hospital, veterinary, and dental applications. Surgical disposable gloves have high-quality standards compared to examination gloves and are commonly used by surgeons and operating room nurses.

Disposable gloves are essential to protect employees against hand injuries that are common across numerous industries, including food processing, construction, automotive, oil & gas, and metal fabrication. These gloves protect hands from hot objects, splinters, bodily fluids, sharp edges, excessive vibrations, electricity, and extreme cold. The demand for disposable gloves in the chemical & petrochemical industries is anticipated to witness substantial growth from 2024 to 2030 owing to the rising adoption of the product for handling volatile chemicals in laboratories and chemical industries. Furthermore, rising concerns pertaining to employee safety and initiatives to reduce injury rates in manufacturing facilities are anticipated to augment the demand for protective gloves over the forecast period.

Regional Insights

North America led the market and accounted for 37.3% of the global revenue share in 2023. The region has experienced a substantial surge in demand for disposable gloves due to the onset of the COVID-19 outbreak. This trend is further propelled by heightened healthcare spending, the expansion of the elderly demographic, and an increased consciousness regarding healthcare-associated infections. The upgrading of the public healthcare system and infrastructure coupled with investments in new facilities are part of the reform plan. These developments are expected to drive the demand for medical equipment and devices. The demand for hand protection equipment such as disposable and durable gloves is anticipated to witness growth owing to the expanding medical sector in the country.

The Asia Pacific market is characterized by increased demand for disposable gloves in medical, food & beverages, and industrial applications. Furthermore, the rapid spread of the COVID-19 pandemic across numerous countries such as India, Indonesia, and the Philippines is further projected to augment the demand for disposable gloves. The disposable gloves industry in Central & South America is expected to experience significant growth during the forecast period. This anticipated expansion is attributed to factors such as the rise in public-private partnerships within the healthcare sector, enhancements in healthcare infrastructure, and the overall expansion of the healthcare industry in the region. These elements are poised to contribute positively to the market in Central & South America throughout the forecast period.

India industrial gloves market

Industrial sector is set to witness huge boom in India with all global ratings agencies backing India to take centre stage. This coupled with the favorable government policies to push Indian manufacturing sector is set to further propel demand for industrial gloves in India. The manufacturing sector in India witnessed an annual growth of 11.8% in 2021-22 period up from -9.6% in 2020-21. Vinyl is the most preferred material for gloves used in industrial applications, such trends are expected to positively impact the vinyl disposable gloves market in India and other major industrial hubs across the globe.

Middle East disposable gloves market

Oil & gas has been the mainstay for the entire Gulf region for many years now and it will continue to play its role in developing the future of the region. However, major economies across the region are now focusing on diversification and improve on other sectors beyond oil & gas. The manufacturing sector has been witnessing huge growth in the recent past with Saudi Arabia, the UAE and Egypt leading the charge. This along with increasing healthcare budget in the region is expected to create enough opportunities for players operating in the Middle East disposable gloves market.

China disposable gloves market

China has always been a global manufacturing hub since the economic liberalisation in the country. China enjoys its cost competitiveness with other manufacturing countries through cheap labor and abundant raw material availability. China is the largest disposable gloves consumer in Asia Pacific and mega projects coupled with increasing healthcare expenditure are expected to remain critical success factors in the China disposable gloves market.

Europe disposable gloves market

European countries has always enjoyed its status of being developed economies with healthcare spendings. However, Europe lost the war of manufacturing to their Asian counterparts on account of expensive labor and high taxation. Europe post Covid-19 wants to bring back the glory of being a major manufacturing hub to restore their socio-economic benefit they used to enjoy till 1980s. There has been a recent trend in the EU and the UK are committed to restore manufacturing by amending their policies and this in turn will benefit the demand for disposable gloves in Europe.

Key Companies & Market Share Insights

Some prominent players in the disposable gloves market include: Top Glove Corporation Bhd, Hartalega Holdings Berhad, Ansell Ltd, Kossan Rubber Industries Bhd

-

Top Glove is one of the largest manufacturers of rubber gloves globally. The company produces a wide range of disposable gloves, including latex, nitrile, and vinyl gloves. It serves various industries such as healthcare, food, and industrial sectors.

-

Hartalega, specializes in the production of nitrile gloves. Known for its focus on innovation and technology, Hartalega is a key player in the disposable gloves industry, supplying gloves to healthcare and laboratory settings.

Key Disposable Gloves Companies:

- Ansell Ltd

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd

- Ammex Corporation

- Kimberly-Clark Corporation

- Sempermed USA, Inc

- MCR Safety

Supermax Corporation Berhad, Kossan Rubber Industries Bhd Kimberly-Clark Corporation are some of the emerging market participants in the disposable gloves market.

-

Kossan Rubber Industries, based in Malaysia, is engaged in the manufacturing of various rubber products, including disposable gloves. The company produces gloves for medical and non-medical applications, emphasizing quality and technological advancements.

-

Kimberly-Clark, a U.S.-based multinational corporation, is known for its consumer and professional healthcare products. The company produces disposable gloves under various brands for use in healthcare and industrial settings.

Recent Developments

-

In February 2023, Ansell Ltd. announced the acquisition of Careplus (M) Sdn Bhd (Careplus). This acquisition increased Ansell’s production capacity of surgical gloves to meet the growing global demand and strengthen its supply chain and ensure greater control over the quality of its products.

-

In August 2022, Supermax Corp Bhd's subsidiary, Supermax Healthcare Canada, unveiled a strategic partnership with Minco Wholesale & Supply Inc. through a formal agreement. This collaboration entails distributing Canadian manufacturer Supermax's products throughout North America. These offerings encompass rubber gloves, masks, and non-woven cotton medical products.

Disposable Gloves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.34 billion

Revenue forecast in 2030

USD 16.77 billion

Growth Rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; Spain; UK; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Ansell Ltd; Top Glove Corporation Bhd; Hartalega Holdings Berhad; The Glove Company; Superior Gloves; MAPA Professional; Adenna LLC; MCR Safety

Atlantic Safety Products, Inc; Supermax Corporation Berhad; Kossan Rubber Industries Bhd, Ammex Corporation; Kimberly-Clark Corporation; Sempermed USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disposable gloves market based on material, product, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powdered

-

Powder-free

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Transportation

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global disposable gloves market size was estimated at USD 9.57 billion in 2023 and is expected to reach USD 10.34 billion in 2024.

b. The global disposable gloves market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 16.77 billion by 2030.

b. North America dominated the disposable gloves market with a share of 37.3% in 2023, owing to the high prevalence of COVID-19 in the region.

b. Some of the key players operating in the disposable gloves market include Ansell Ltd, Top Glove Corporation Bhd, Hartalega Holdings Berhad, The Glove Company, Superior Gloves, Adenna LLCSupermax Corporation Berhad, Kossan Rubber Industries Bhd, Ammex Corporation, and Kimberly-Clark Corporation.

b. The key factors that are driving the disposable gloves market include the increasing product demand from numerous end-use industries including medical & healthcare, pharmaceutical, automotive finishing, chemical, and oil & gas.

Table of Contents

Chapter 1. Disposable Gloves Market: Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Disposable Gloves Market:Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Disposable Gloves Market: Variables, Trends, and Scope

3.1. Market Segmentation & Scope

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.4. Regulatory Framework

3.5. Disposable gloves Market - Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Business Environmental Tools Analysis: Disposable gloves Market

3.6.1. Porter’s Five Forces Analysis

3.6.2. PESTLE Analysis

3.7. Economic Mega-Trend Analysis

Chapter 4. Disposable gloves Market: Material Estimates & Trend Analysis

4.1. Disposable gloves Market: Material Movement Analysis, 2023 & 2030

4.2. Natural Rubber

4.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3. Nitrile

4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.4. Vinyl

4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.5. Neoprene

4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.6. Polyethylene

4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.7. Others

4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5. Disposable Gloves Market: Product Estimates & Trend Analysis

5.1. Disposable Gloves Market: Product Movement Analysis, 2023 & 2030

5.2. Powdered

5.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.3. Powder-free

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 6. Disposable Gloves Market: End-Use Estimates & Trend Analysis

6.1. Disposable Gloves Market: End-Use Movement Analysis, 2023 & 2030

6.2. Healthcare

6.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.3. Construction

6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.4. Manufacturing

6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.5. Oil & Gas

6.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.6. Chemicals

6.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.7. Food

6.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.8. Transportation

6.8.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.9. Mining

6.9.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.10. Others

6.10.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 7. Disposable Gloves Market: Regional Estimates & Trend Analysis

7.1. Regional Movement Analysis & Market Share, 2023 & 2030

7.2. Disposable Gloves Market: Regional movement analysis, 2023 & 2030

7.3. North America

7.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.3.2. U.S.

7.3.2.1. Key country dynamics

7.3.2.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.3.3. Canada

7.3.3.1. Key country dynamics

7.3.3.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.3.4. Mexico

7.3.4.1. Key country dynamics

7.3.4.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4. Europe

7.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4.2. Germany

7.4.2.1. Key country dynamics

7.4.2.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4.3. UK

7.4.3.1. Key country dynamics

7.4.3.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4.4. France

7.4.4.1. Key country dynamics

7.4.4.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4.5. Russia

7.4.5.1. Key country dynamics

7.4.5.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4.6. Italy

7.4.6.1. Key country dynamics

7.4.6.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4.7. Spain

7.4.7.1. Key country dynamics

7.4.7.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5. Asia Pacific

7.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5.2. China

7.5.2.1. Key country dynamics

7.5.2.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5.3. India

7.5.3.1. Key country dynamics

7.5.3.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5.4. Japan

7.5.4.1. Key country dynamics

7.5.4.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5.5. Australia

7.5.5.1. Key country dynamics

7.5.5.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5.6. South Korea

7.5.6.1. Key country dynamics

7.5.6.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5.7. Indonesia

7.5.7.1. Key country dynamics

7.5.7.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5.8. Thailand

7.5.8.1. Key country dynamics

7.5.8.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.5.9. Malaysia

7.5.9.1. Key country dynamics

7.5.9.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.6. Central & South America

7.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.6.2. Brazil

7.6.2.1. Key country dynamics

7.6.2.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.6.3. Argentina

7.6.3.1. Key country dynamics

7.6.3.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.7. Middle East & Africa

7.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.7.2. UAE

7.7.2.1. Key country dynamics

7.7.2.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.7.3. Saudi Arabia

7.7.3.1. Key country dynamics

7.7.3.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.7.4. South Africa

7.7.4.1. Key country dynamics

7.7.4.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Company Market Share/Position Analysis, 2023

8.4. Company Heat Map Analysis

8.5. Strategy Mapping

8.5.1. Expansion

8.5.2. Mergers & Acquisition

8.5.3. Partnerships & Collaborations

8.5.4. New Product Launches

8.5.5. Research And Development

8.6. Company Profiles

8.6.1. Ansell Ltd.

8.6.1.1. Company overview

8.6.1.2. Financial performance

8.6.1.3. Product benchmarking

8.6.1.4. Strategic initiatives

8.6.2. Top Glove Corporation Bhd

8.6.2.1. Company overview

8.6.2.2. Financial performance

8.6.2.3. Product benchmarking

8.6.2.4. Strategic initiatives

8.6.3. Hartalega Holdings Berhad

8.6.3.1. Company overview

8.6.3.2. Financial performance

8.6.3.3. Product benchmarking

8.6.3.4. Strategic initiatives

8.6.4. The Glove Company

8.6.4.1. Company overview

8.6.4.2. Financial performance

8.6.4.3. Product benchmarking

8.6.4.4. Strategic initiatives

8.6.5. Superior Gloves

8.6.5.1. Company overview

8.6.5.2. Financial performance

8.6.5.3. Product benchmarking

8.6.5.4. Strategic initiatives

8.6.6. MAPA Professional

8.6.6.1. Company overview

8.6.6.2. Financial performance

8.6.6.3. Product benchmarking

8.6.6.4. Strategic initiatives

8.6.7. Adenna LLC

8.6.7.1. Company overview

8.6.7.2. Financial performance

8.6.7.3. Product benchmarking

8.6.7.4. Strategic initiatives

8.6.8. MCR Safety

8.6.8.1. Company overview

8.6.8.2. Financial performance

8.6.8.3. Product benchmarking

8.6.8.4. Strategic initiatives

8.6.9. Atlantic Safety Products, Inc.

8.6.9.1. Company overview

8.6.9.2. Financial performance

8.6.9.3. Product benchmarking

8.6.9.4. Strategic initiatives

8.6.10. Supermax Corporation Berhad

8.6.10.1. Company overview

8.6.10.2. Financial performance

8.6.10.3. Product benchmarking

8.6.10.4. Strategic initiatives

8.6.11. Kossan Rubber Industries Bhd

8.6.11.1. Company overview

8.6.11.2. Financial performance

8.6.11.3. Product benchmarking

8.6.11.4. Strategic initiatives

8.6.12. Ammex Corporation

8.6.12.1. Company overview

8.6.12.2. Financial performance

8.6.12.3. Product benchmarking

8.6.12.4. Strategic initiatives

8.6.13. Kimberly-Clark Corporation

8.6.13.1. Company overview

8.6.13.2. Financial performance

8.6.13.3. Product benchmarking

8.6.13.4. Strategic initiatives

8.6.14. Sempermed USA, Inc.

8.6.14.1. Company overview

8.6.14.2. Financial performance

8.6.14.3. Product benchmarking

8.6.14.4. Strategic initiatives

8.6.15. Cardinal Health

8.6.15.1. Company overview

8.6.15.2. Financial performance

8.6.15.3. Product benchmarking

8.6.15.4. Strategic initiatives

List of Tables

Table 1. Global disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 2. Global disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 3. Global disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 4. North America disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 5. North America disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 6. North America disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 7. U.S. disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 8. U.S. disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 9. U.S. disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 10. Canada disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 11. Canada disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 12. Canada disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 13. Mexico disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 14. Mexico disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 15. Mexico disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 16. Europe disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 17. Europe disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 18. Europe disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 19. Germany disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 20. Germany disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 21. Germany disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 22. UK disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 23. UK disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 24. UK disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 25. France disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 26. France disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 27. France disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 28. Italy disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 29. Italy disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 30. Italy disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 31. Spain disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 32. Spain disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 33. Spain disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 34. Russia disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 35. Russia disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 36. Russia disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 37. Asia Pacific disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 38. Asia Pacific disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 39. Asia Pacific disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 40. China disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 41. China disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 42. China disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 43. India disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 44. India disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 45. India disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 46. Japan disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 47. Japan disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 48. Japan disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 49. Australia disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 50. Australia disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 51. Australia disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 52. South Korea disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 53. South Korea disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 54. South Korea disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 55. Indonesia disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 56. Indonesia disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 57. Indonesia disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 58. Thailand disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 59. Thailand disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 60. Thailand disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 61. Malaysia disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 62. Malaysia disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 63. Malaysia disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 64. Central & South America disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 65. Central & South America disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 66. Central & South America disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 67. Brazil disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 68. Brazil disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 69. Brazil disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 70. Argentina disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 71. Argentina disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 72. Argentina disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 73. Middle East & Africa disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 74. Middle East & Africa disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 75. Middle East & Africa disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 76. Saudi Arabia disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 77. Saudi Arabia disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 78. Saudi Arabia disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 79. UAE disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 80. UAE disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 81. UAE disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 82. South Africa disposable gloves Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 83. South Africa disposable gloves Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 84. South Africa disposable gloves Market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 85. Recent Developments & Impact Analysis, By Key Market Participants

Table 86. Company Market Share

Table 87. Company Heat Map Analysis

Table 88. Key Companies undergoing expansion

Table 89. Key Companies involved in mergers & acquisition

List of Figures

Fig. 1 Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 Penetration and Growth Prospect Mapping

Fig. 10 Value Chain Analysis

Fig. 11 Market Dynamics

Fig. 12 Disposable Gloves Market PORTER’s Analysis

Fig. 13 Disposable Gloves Market PESTEL Analysis

Fig. 14 Disposable Gloves Market, By Material: Key Takeaways

Fig. 15 Disposable Gloves Market: Material Movement Analysis & Market Share, 2023 & 2030

Fig. 16 Natural rubber gloves market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 17 Nitrile gloves market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 18 Vinyl gloves market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 19 Neoprene gloves market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 20 Polyethylene gloves market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 21 Other gloves market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 22 Disposable Gloves Market, By Product: Key Takeaways

Fig. 23 Disposable Gloves Market: Product Movement Analysis & Market Share, 2023 & 2030

Fig. 24 Powered gloves market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 25 Powder-free gloves market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 26 Disposable Gloves Market, By End-use: Key Takeaways

Fig. 27 Disposable Gloves Market: End-use Movement Analysis & Market Share, 2023 & 2030

Fig. 28 Healthcare market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 29 Construction market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 30 Manufacturing market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 31 Oil & Gas market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 32 Chemicals market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 33 Food market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 34 Pharmaceuticals market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 35 Transportation market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 36 Mining market estimates & forecasts, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Disposable Gloves Market Material Outlook (Revenue, USD Million, 2018 - 2030)

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Disposable Gloves Market Product Outlook (Revenue, USD Million, 2018 - 2030)

- Powdered

- Powder-free

- Disposable Gloves Market End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Disposable Gloves Market Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- North America Disposable Gloves Market, By Product

- Powdered

- Powder-free

- North America Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- U.S.

- U.S. Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- U.S. Disposable Gloves Market, By Product

- Powdered

- Powder-free

- U.S. Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- U.S. Disposable Gloves Market, By Material

- Canada

- Canada Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Canada Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Canada Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Canada Disposable Gloves Market, By Material

- Mexico

- Mexico Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Mexico Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Mexico Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Mexico Disposable Gloves Market, By Material

- North America Disposable Gloves Market, By Material

- Europe

- Europe Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Europe Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Europe Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Germany

- Germany Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Germany Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Germany Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Germany Disposable Gloves Market, By Material

- UK

- UK Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- UK Disposable Gloves Market, By Product

- Powdered

- Powder-free

- UK Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- UK Disposable Gloves Market, By Material

- France

- France Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- France Disposable Gloves Market, By Product

- Powdered

- Powder-free

- France Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- France Disposable Gloves Market, By Material

- Russia

- Russia Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Russia Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Russia Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Russia Disposable Gloves Market, By Material

- Italy

- Italy Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Italy Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Italy Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Italy Disposable Gloves Market, By Material

- Spain

- Spain Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Spain Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Spain Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Spain Disposable Gloves Market, By Material

- Europe Disposable Gloves Market, By Material

- Asia Pacific

- Asia Pacific Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Asia Pacific Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Asia Pacific Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- China

- China Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- China Disposable Gloves Market, By Product

- Powdered

- Powder-free

- China Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- China Disposable Gloves Market, By Material

- India

- India Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- India Disposable Gloves Market, By Product

- Powdered

- Powder-free

- India Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- India Disposable Gloves Market, By Material

- Japan

- Japan Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Japan Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Japan Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Japan Disposable Gloves Market, By Material

- South Korea

- South Korea Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- South Korea Disposable Gloves Market, By Product

- Powdered

- Powder-free

- South Korea Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- South Korea Disposable Gloves Market, By Material

- Australia

- Australia Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Australia Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Australia Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Australia Disposable Gloves Market, By Material

- Indonesia

- Indonesia Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Indonesia Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Indonesia Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Indonesia Disposable Gloves Market, By Material

- Malaysia

- Malaysia Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Malaysia Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Malaysia Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Malaysia Disposable Gloves Market, By Material

- Thailand

- Thailand Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Thailand Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Thailand Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Thailand Disposable Gloves Market, By Material

- Asia Pacific Disposable Gloves Market, By Material

- Central & South America

- Central & South America Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Central & South America Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Central & South America Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Brazil

- Brazil Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Brazil Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Brazil Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Brazil Disposable Gloves Market, By Material

- Argentina

- Argentina Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Argentina Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Argentina Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Argentina Disposable Gloves Market, By Material

- Central & South America Disposable Gloves Market, By Material

- Middle East & Africa (MEA)

- Middle East & Africa Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Middle East & Africa Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Middle East & Africa Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Saudi Arabia

- Saudi Arabia Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Saudi Arabia Disposable Gloves Market, By Product

- Powdered

- Powder-free

- Saudi Arabia Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- Saudi Arabia Disposable Gloves Market, By Material

- UAE

- UAE Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- UAE Disposable Gloves Market, By Product

- Powdered

- Powder-free

- UAE Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- UAE Disposable Gloves Market, By Material

- South Africa

- South Africa Disposable Gloves Market, By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- South Africa Disposable Gloves Market, By Product

- Powdered

- Powder-free

- South Africa Disposable Gloves Market, By End-Use

- Healthcare

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Transportation

- Mining

- Others

- South Africa Disposable Gloves Market, By Material

- Middle East & Africa Disposable Gloves Market, By Material

- North America

Disposable Gloves Market Dynamics

Driver: Favorable Ocupational Safety Regulations

Workers’ safety related policies in industries is anticipated to drive demand for disposable gloves. Occupational safety regulations play a major role in driving the disposable gloves market. These regulations mention the type of personal protective equipment required for protection during different industrial or commercial processes. The personal protective equipment at work regulations (1992) requires companies to provide PPE to employees who may be exposed to a health or safety risk at work. In addition, the regulation requires PPE to be assessed properly to make it fit for use along with proper maintenance and storage. Instructions should be provided on how to use PPE properly and the company should ensure that the employees wear it correctly.

Driver: Rising Healthcare Expenditures

The global healthcare expenditure has witnessed significant growth in the recent past. The rising spending on health in the middle and low-income economies is attributed to the reliance of people on increased public funding instead of out-of-pocket expenditures. The expansion of public healthcare systems, increased economic power, and population growth are anticipated to increase healthcare spending globally. Aging population, rising number of people with chronic & long-term conditions, increased investments in MedTech & expensive infrastructure, increasing labor costs & staff shortages, and the growing demand for broader ecosystem services are expected to boost healthcare expenditure across the globe. The demand for healthcare services and products has led to increased use of healthcare personal protective equipment including gloves.

Restraint: Volatile Raw Material Costs

Raw material, procurement, and labor costs are major factors influencing the pricing of the gloves. Materials such as latex witnessed significant fluctuations in prices over the past few years on account of varied demand and the impact of natural factors on rubber plantations. Low-budget, small-scale manufacturers are expected to experience high raw material procurement costs and low-profit margins, which is predicted to limit overall profits in the disposable gloves market.

Most of the basic raw materials, such as nitrile and natural rubber latex, have witnessed a significant variation in demand owing to the fluctuating raw material prices. Natural rubber latex has recently gained prominence in the disposable gloves market owing to its lower price compared to the high prices of oil. Materials acquired from petrochemical derivatives include nitrile, vinyl, and neoprene, which were among the secondary options for latex glove manufacturers. However, the plummeting oil prices have created opportunities to encourage the adoption of nitrile and vinyl gloves that find significance in similar applications as those of latex gloves.

What Does This Report Include?

This section will provide insights into the contents included in this disposable gloves market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Disposable gloves market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Disposable gloves market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the disposable gloves market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for disposable gloves market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of disposable gloves market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Disposable Gloves Market Categorization:

The disposable gloves market was categorized into four segments, namely material (Natural Rubber, Nitrile, Vinyl, Neoprene, Polyethylene), product (Powdered, Powder-free), end-use (Healthcare, Construction, Manufacturing, Oil & Gas, Chemicals, Food, Pharmaceuticals, Transportation, Mining), region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa).

Segment Market Methodology:

The disposable gloves market was segmented into material, product, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The disposable gloves market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-two countries, namely, the U.S.; Canada; Mexico; Germany; France; Italy; Russia; Spain; the UK; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Brazil; Argentina; UAE; Saudi Arabia; South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Disposable gloves market companies & financials:

The disposable gloves market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Ansell Ltd.: Ansell Ltd. provides protection equipment & solutions and operates through three business segments, namely industrial, medical, and single-use solutions.

-

Top Glove Corporation Bhd: Top Glove Corporation is engaged in the manufacturing and distribution of gloves. Its product portfolio includes latex, nitrile, vinyl, household, cleanroom, cast polyethylene (CPE), and surgical gloves.

-

Hartalega Holdings Berhad: Hartalega Holdings Berhad’s product portfolio comprises nitrile and latex gloves. The company offers its products to various industries including food, healthcare, and semiconductor.

-

The Glove Company: The Glove Company is a manufacturer and distributor of gloves. It produces both disposable and durable gloves. The company also manufactures single-use gloves under the brand names TGC, Black Rocket, and iSense.

-

Superior Gloves: Superior Gloves is a manufacturer and supplier of work gloves. The company provides durable as well as disposable gloves. It produces disposable gloves under the brand name KeepKleen using latex, nitrile, vinyl, and polyethylene materials for use in automotive, paint, food handling, and janitorial industries.

-

MAPA Professional: MAPA Professional is a manufacturer and distributor of gloves. The company manufactures gloves for chemical protection, mechanical protection, thermal protection, and critical environment protection.

-

Adenna LLC: Adenna LLC is a manufacturer and supplier of disposable gloves & safety products, wipers, and washroom essentials. The company operates through three business segments including disposable glove & safety offering, wiping cloth heritage, and washroom essentials.

-

MCR Safety: MCR Safety is a manufacturer of personal protective equipment, which include protective headgears, gloves, and bodysuits.

-

Atlantic Safety Products, Inc.: Atlantic Safety Products, Inc. is a manufacturer and distributor of disposable gloves. The company produces disposable gloves under the brand names Lightning Gloves, Aloe Power Gloves, In Touch, Lighthouse, and Market Edition.

-

Supermax Corporation Berhad: Supermax Corporation Berhad is a manufacturer and distributor of gloves. The company exports its products to over 160 countries.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Disposable Gloves Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Disposable Gloves Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."