- Home

- »

- Medical Devices

- »

-

Disposable Surgical Devices Market, Industry Report, 2030GVR Report cover

![Disposable Surgical Devices Market Size, Share & Trends Report]()

Disposable Surgical Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Surgical Sutures & Staplers, Electrosurgical Devices), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-332-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Surgical Devices Market Summary

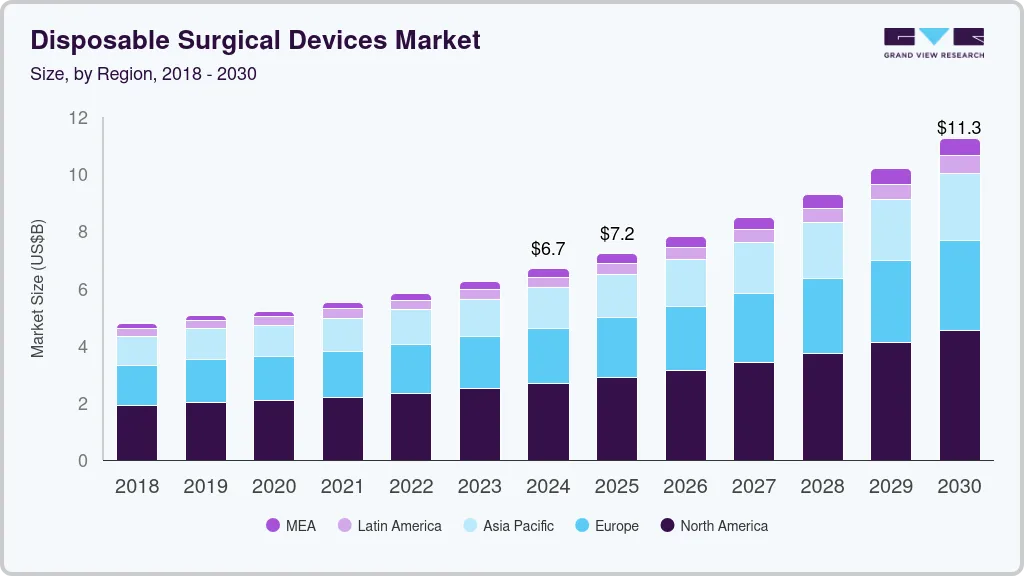

The global disposable surgical devices market size was estimated at USD 6.7 billion in 2024 and is projected to reach USD 11.26 billion by 2030, growing at a CAGR of 9.3% from 2025 to 2030. This can be attributed to the rising prevalence of chronic diseases, the increasing number of surgical procedures, the growing geriatric population, and technological advancements.

Key Market Trends & Insights

- North America disposable surgical devices industry dominated the overall global market and accounted for a 39.9% revenue share in 2024.

- The U.S. disposable surgical devices industry is driven by an increased surgical procedure volume, high prevalence of chronic diseases, and increased emphasis on infection prevention.

- By product, the surgical sutures and staplers segment held the largest market share of 44.2% in 2024.

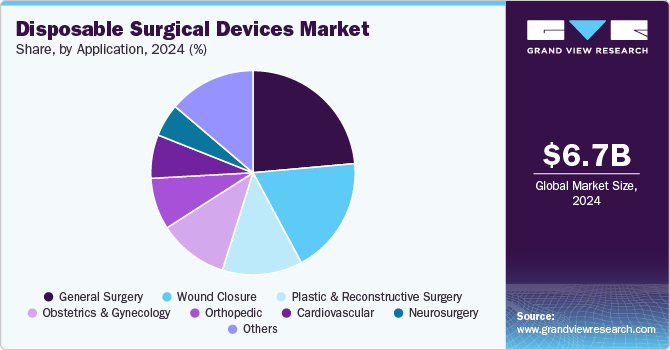

- By application, the general surgery segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.7 Billion

- 2030 Projected Market Size: USD 11.26 Billion

- CAGR (2025-2030): 9.3%

- North America: Largest market in 2024

According to the World Population Prospects 2024, the global population is projected to continue increasing for the next 50 to 60 years, reaching approximately 10.3 billion in the mid-2080s, rising from an estimated 8.2 billion in 2024.

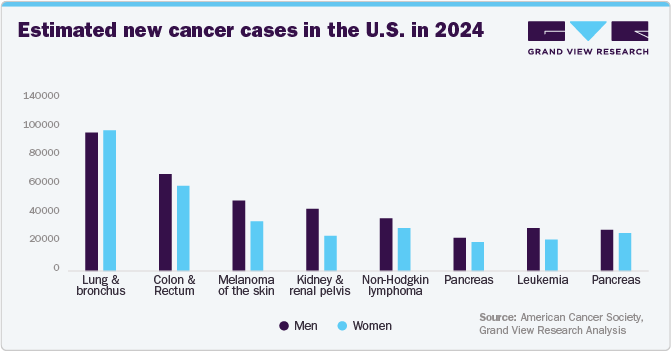

The growing burden of chronic diseases worldwide, such as cardiovascular diseases, diabetes, cancer, and chronic respiratory disorders, is becoming increasingly prevalent due to aging populations, sedentary lifestyles, and unhealthy dietary habits. These chronic conditions often require surgical interventions, thereby creating significant demand for surgical tools. According to the American Cancer Society, in 2024, around 2,001,140 new cancer cases are estimated to be diagnosed in the U.S., and an estimated 611,720 people are expected to die from the disease. This surge in chronic illnesses necessitates more frequent surgical procedures, thereby increasing the demand for disposable surgical devices that ensure safety and hygiene during operations.

The table below indicates the estimated new cancer cases in the U.S. in 2024:

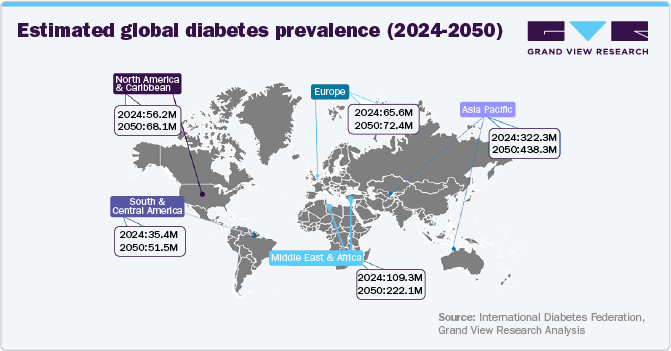

Similarly, chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders are becoming increasingly common. Disposable devices, ranging from scalpels and forceps to staplers and trocars, are increasingly being adopted to minimize the risk of infections and cross-contamination. For instance, diabetic patients undergoing debridement procedures or vascular surgeries benefit from sterile, single-use instruments that reduce postoperative complications.

The table below indicates the estimated global diabetes prevalence (2024-2050):

The rising number of surgical procedures performed globally further contributes to market growth. This growth is fueled by expanding access to healthcare, an aging population, and greater awareness of treatment options. Elective and minimally invasive surgeries are becoming more common, driven by patient preferences for quicker recovery times and fewer complications. In addition, outpatient surgery centers and ambulatory surgical units are increasingly relying on disposable devices to reduce turnaround times and maintain hygiene standards. The growing prevalence of cosmetic surgeries, bariatric procedures, and orthopedic interventions is also contributing to the market's growth. According to the American Society of Plastic Surgeons, 1,575,244 cosmetic surgical procedures were performed in 2023, increasing from 1,498,361 surgeries in 2022, indicating an increase of around 5%. Surgeons and healthcare administrators are shifting toward disposable instruments to enhance safety and comply with regulatory standards in these procedures, further fueling the market growth.

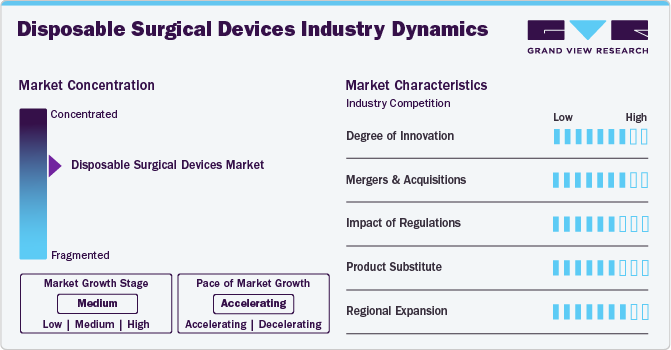

Market Concentration & Characteristics

The disposable surgical devices industry is characterized by the increasing prevalence of chronic diseases, rising surgical procedures, and heightened awareness of infection control. Factors such as advancements in medical technology, the convenience of single-use devices, and a growing preference for minimally invasive surgeries further contribute to market growth.

The degree of innovation in the market is significantly high, driven by advancements in materials and technology. Innovations such as digitally enabled surgical staplers, handheld surgical devices, and minimally invasive electrosurgical devices are further improving precision and efficiency in surgical procedures. For instance, in November 2023, Pristine Surgical launched Summit, a 4K single-use surgical arthroscope, across the U.S. The device integrates with cloud-based software for high-definition imaging, offers automated inventory management, transparent subscription pricing, and recycling options, and aims to address the challenges of reusable arthroscopes, improving efficiency, sterility, and workflow. This continuous evolution enhances the functionality of disposable devices and addresses crucial healthcare challenges, ensuring better patient outcomes.

Mergers and acquisitions (M&A) in the disposable surgical devices industry are significantly driven by companies aiming to enhance their product portfolios and expand their market presence through strategic acquisitions. Major players are actively pursuing mergers to access new product portfolios and improve operational efficiencies, thereby positioning themselves competitively in a rapidly evolving landscape. For instance, in February 2025, Demetra Holding acquired a 51% stake in Swiss-based GetSet Surgical to expand its spine sector portfolio. The partnership integrates Demetra’s infection management solutions with GetSet’s sterile, single-use spine kits, aiming to reduce infection risks and enhance hospital efficiency.

Regulations play a critical role in shaping the global disposable surgical devices industry by ensuring product safety, quality, and efficacy. Stringent regulatory frameworks enforced by regulatory agencies such as the U.S. FDA, the European Medicines Agency (EMA), and other national bodies have increased the compliance burden on manufacturers, driving up costs related to testing, certification, and documentation. However, these regulations also enhance market credibility and patient safety, ensuring trust among end users. In emerging economies, evolving regulatory landscapes are aligning with international standards, encouraging global manufacturers to expand operations while also creating opportunities for local players to compete.

The disposable surgical devices industry faces a significant threat of substitutes, driven by advancements in reprocessing technologies and the increasing adoption of reusable surgical instruments. As healthcare providers aim to minimize costs and environmental impact, the adoption of reprocessed devices grows, offering a sustainable alternative to single-use products. However, the role of disposable surgical devices is reduced due to their sterility, single-use safety, and convenience, particularly in emergency procedures, outpatient surgeries, and resource-limited settings.

The disposable surgical devices industry is witnessing significant regional expansion, driven by increasing healthcare expenditures and a rising demand for minimally invasive surgeries. Key players are actively engaging in strategic partnerships, mergers, and acquisitions to enhance their market presence. In addition, innovations in product design and technology are enabling these firms to offer advanced solutions that meet local regulatory requirements while addressing specific regional needs.

Product Insights

The surgical sutures and staplers segment held the largest market share of 44.2% in 2024 and is expected to witness a CAGR of 9.2% over the forecast period. This can be attributed to their essential role in wound closure and tissue repair across a wide range of surgical procedures. Sutures, being versatile and available in various materials, provide precise wound closure, reducing the risk of infection and promoting faster healing. Similarly, staplers offer speed and efficiency, especially in high-volume surgeries such as gastrointestinal, thoracic, and urological procedures. The convenience, reliability, and effectiveness of sutures and staplers in improving patient outcomes make them preferred choices, further increasing their adoption in surgical procedures.

The electrosurgical devices segment is projected to witness the fastest CAGR over the forecast period. As healthcare providers prioritize patient safety and infection control, disposable electrosurgical instruments offer a significant advantage of minimizing the risk of cross-contamination and reducing reprocessing costs. Moreover, the growing preference for single-use devices in ambulatory surgical centers and cost-effective surgical procedures is further contributing to segment growth.

Application Insights

The general surgery segment held the largest market share in 2024, owing to its high procedural volume and broad procedural scope. General surgeries include a wide range of interventions such as appendectomies, hernia repairs, gallbladder removals, and others that are regularly performed in both inpatient and outpatient settings. In addition, the global rise in lifestyle-related disorders and aging populations has led to an increase in elective and emergency general surgeries, further driving segment growth.

The plastic and reconstructive surgery segment is expected to witness the fastest CAGR over the forecast period due to the rising global demand for aesthetic procedures, driven by increasing awareness, social media influence, and affordability. According to the International Society of Aesthetic Plastic Surgery, the global surgical and non-surgical procedures performed reached around 34.9 million in 2023, witnessing an increase of 3.4% from the previous year. In addition, the expanding patient base of trauma and burn cases requires reconstructive interventions, further fueling demand. Moreover, advancements in minimally invasive reconstructive techniques are significantly compatible with disposable device innovation.

Regional Insights

North America disposable surgical devices industry dominated the overall global market and accounted for a 39.9% revenue share in 2024, driven by developed healthcare infrastructure, availability of advanced disposable surgical devices, and an increased focus on infection prevention. and the demand for cost-effective solutions in healthcare facilities. U.S. hospitals are prioritizing single-use instruments to reduce the risk of cross-contamination and hospital-acquired infections, which has gained importance due to CDC and FDA guidelines. In addition, the region’s aging population is significantly vulnerable to various health conditions requiring surgical intervention, further contributing to market growth in the region. According to Statistics Canada, the elderly population in the country, aged 65 years and above, accounted for around 18.9% of the country’s total population in July 2023 and is further expected to reach around 21.4% to 23.4% by 2030.

U.S. Disposable Surgical Devices Market Trends

The U.S. disposable surgical devices industry is driven by an increased surgical procedure volume, high prevalence of chronic diseases, and increased emphasis on infection prevention. According to the HF Stats 2024: Heart Failure Epidemiology and Outcomes Statistics report, around 6.7 million Americans aged 20 and older are currently living with heart failure. This number is expected to climb to 8.7 million by 2030, reach 10.3 million by 2040, and surge to 11.4 million by 2050. U.S. healthcare facilities, particularly outpatient surgical centers, are adopting disposable instruments to reduce the risk of cross-contamination and avoid costly sterilization processes. In addition, the shift toward minimally invasive and ambulatory surgeries is increasing demand for disposable tools such as trocars, staplers, and laparoscopic instruments.

Europe Disposable Surgical Devices Market Trends

The European disposable surgical devices industry is witnessing significant growth, driven by the increasing prevalence of chronic diseases and the aging population, which is resulting in the increasing demand for surgical procedures, thereby boosting the need for disposable devices. In addition, increased awareness about infection control and patient safety is increasing the adoption of disposable surgical devices in healthcare facilities. Regulatory bodies in Europe have also implemented stringent guidelines that favor the adoption of disposable devices to minimize cross-contamination risks.

The disposable surgical devices industry in the UK is witnessing substantial growth, driven by advancements in disposable surgical devices and the rising prevalence of chronic conditions such as diabetes. Recent data from Diabetes UK indicates a significant rise in diabetes cases in the UK, with estimates suggesting over 5.6 million people now live with the condition, marking an all-time high. Diagnosed cases include approximately 4.6 million individuals, with an additional 1.3 million believed to have undiagnosed type 2 diabetes. Recent registration figures for 2023-24 show an increase of 185,034 cases compared to 2022-23.

The disposable surgical devices industry in France is witnessing significant growth due to the rising adoption of single-use surgical devices in healthcare facilities. Moreover, the increasing volume of surgical procedures, coupled with a significantly high prevalence of chronic conditions in the country, further fuels the market growth. According to the IDF Diabetes Atlas, around 4.1 million people in the country are living with diabetes, with an age-standardized prevalence of 6.5% in 2024.

The disposable surgical devices industry in Germany is witnessing significant growth, driven by the increasing prevalence of chronic diseases and the aging population, which are creating higher demand for surgical procedures. In addition, advancements in technology have resulted in the development of innovative products that enhance surgical outcomes and reduce infection risks, further fueling market growth in the country.

Asia Pacific Disposable Surgical Devices Market Trends

The disposable surgical devices industry in Asia Pacific is driven by developing healthcare infrastructure, increasing healthcare access, rising prevalence of chronic diseases, and a growing aging population, which increases the need for disposable devices that ensure safety and reduce infection risks. In addition, the increasing medical tourism in several developing countries in the region further fuels the market growth in the Asia Pacific.

The disposable surgical devices industry in Japan is driven by the increasing prevalence of chronic diseases and an aging population. In September 2024, Japan's elderly population (65+ years) reached a record 36.25 million, 29.3% of the total, according to the Ministry of Internal Affairs and Communications. Similarly, the increasing focus on minimizing infection risks has further accelerated the adoption of single-use products in the country’s healthcare sector, as they eliminate the need for sterilization and reduce cross-contamination.

The disposable surgical devices industry in China is driven by the increasing prevalence of chronic diseases and a growing aging population. In addition, the Chinese government has been actively promoting healthcare reforms aimed at improving medical infrastructure and accessibility, which further fuels the market growth. Furthermore, the rise of minimally invasive surgeries has increased the utilization of disposable instruments due to their convenience and reduced risk of infection.

The India disposable surgical devices industry growth is being driven by healthcare infrastructure expansion, infection control priorities, growing chronic disease prevalence and increasing surgical procedure volumes. The Indian healthcare sector is expanding rapidly, with a focus on improving patient outcomes and reducing hospital-acquired infections, which enhances the demand for disposable products.

Latin America Disposable Surgical Devices Market Trends

The disposable surgical devices industry in Latin America is driven by increasing healthcare expenditures and a rising demand for advanced medical technologies. The region's expanding population and improving access to healthcare services are major factors contributing to market growth. Countries such as Brazil and Argentina are witnessing significant investments in healthcare infrastructure and a growing emphasis on infection control measures, thereby contributing to the market growth in the region. Moreover, the high surgical volumes in these countries further drive market growth. For instance, according to the International Society of Aesthetic Plastic Surgery, around 3.3 million aesthetic surgeries were performed in Brazil in 2023, which is the second highest globally.

Middle East And Africa (MEA) Disposable Surgical Devices Market Trends

The disposable surgical devices industry in MEA is poised for significant growth, driven by healthcare modernization and the rising burden of chronic diseases such as diabetes and cardiovascular conditions. Countries in the region, such as South Africa, Saudi Arabia, UAE, and Kuwait, are witnessing significant growth in healthcare infrastructure with increased investments. Moreover, the increasing access to healthcare services in these countries’ population is further expected to fuel the market growth over the forecast period.

Key Disposable Surgical Devices Company Insights

The disposable surgical devices industry is highly competitive, featuring key players such as B. Braun SE; Smith+Nephew; Stryker; Olympus Corporation, among others. These leading companies are actively pursuing a range of organic and inorganic strategies, including product launches, partnerships, acquisitions, mergers, and regional expansion, to address their customers' unmet needs.

Key Disposable Surgical Devices Companies:

The following are the leading companies in the disposable surgical devices market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Smith+Nephew

- Stryker

- Olympus Corporation

- Aspen Surgical

- Alcon Laboratories, Inc.

- Zimmer Biomet.

- Medtronic

- BD

- Ethicon

- CooperSurgical Inc.

- Surgical Innovations

Recent Developments

-

In March 2025, Olympus launched a new single-use hemostasis clip designed for endoscopic procedures. This innovative device aims to enhance patient safety and improve clinical outcomes by effectively controlling bleeding during gastrointestinal surgeries. The clip is easy to use, promoting efficiency in medical settings while minimizing the risk of infection.

-

In March 2025, Voom Medical Devices, Inc. annouced launch of an advanced single-use sterile kit featuring the MIBS CoPilot Shift Targeting Guide. This innovative tool aims to enhance the Bunionplasty 360 Repair procedure, improving surgical precision and patient outcomes.

-

In August 2024, CooperCompanies acquired OBP Surgical to enhance its CooperSurgical division, focusing on expanding its portfolio in surgical instruments and single-use surgical products. This strategic move aims to strengthen CooperSurgical's market presence and improve healthcare solutions for women.

Disposable Surgical Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.23 billion

Revenue forecast in 2030

USD 11.26 billion

Growth Rate

CAGR of 9.3% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

B. Braun SE; Smith+Nephew; Stryker; Olympus Corporation; Aspen Surgical; Alcon Laboratories, Inc.; Zimmer Biomet.; Medtronic; BD; Ethicon; CooperSurgical Inc.; Surgical Innovations

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Surgical Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disposable surgical devices market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical sutures & staplers

-

Handheld surgical devices

-

Electrosurgical devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery

-

Plastic & reconstructive surgery

-

Wound closure

-

Obstetrics & gynecology

-

Cardiovascular

-

Orthopedic

-

General surgery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical disposable devices market size was estimated at USD 6.7 billion in 2024 and is expected to reach USD 7.23 billion in 2025.

b. The global disposable surgical devices market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2030 to reach USD 11.26 billion by 2030.

b. North America dominated the disposable surgical devices market with a share of 39.98% in 2024. This is attributable to an increase in the number of surgical procedures due to accidents, burns, and trauma cases in the region.

b. Some key players operating in the disposable surgical devices market include B. Braun Melsungen AG, Smith & Nephew plc, Aspen Surgical, Zimmer Biomet, Medtronic, Becton, Dickinson and Company, Ethicon, CooperSurgical Inc., Surgical Innovations, and Alcon Laboratories, Inc.

b. Key factors that are driving the disposable surgical devices market growth include the increasing prevalence of chronic diseases, rising number of road accidents, and rise in the number of surgical procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.