- Home

- »

- Next Generation Technologies

- »

-

Distributed Antenna Systems Market Size Report, 2030GVR Report cover

![Distributed Antenna Systems Market Size, Share & Trends Report]()

Distributed Antenna Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Coverage (Indoor DAS, Outdoor DAS), By Ownership (Carrier Ownership, Neutral-Host Ownership), By Signal Source, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-768-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Distributed Antenna Systems Market Summary

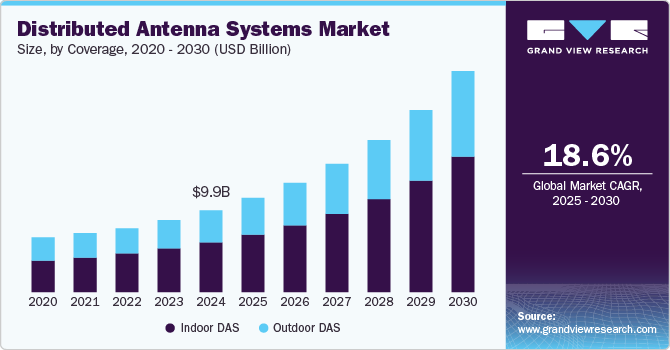

The global distributed antenna systems market size was estimated at USD 9.87 billion in 2024 and is projected to reach USD 26.70 billion by 2030, growing at a CAGR of 18.6% from 2025 to 2030. The market is primarily driven by the proliferation of smartphones and mobile devices and the expansion of 5G networks, which are driving the need to enhance mobile data connectivity and coverage, especially in densely populated urban areas and large venues.

Key Market Trends & Insights

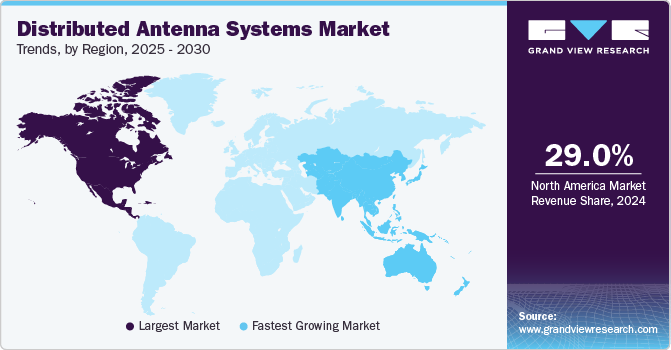

- North America distributed antenna systems market accounted for the highest revenue share of over 29% in 2024.

- The distributed antenna systems market in the U.S. held a dominant position in 2024.

- Based on coverage, the indoor segment accounted for the largest market share of over 60% in 2024.

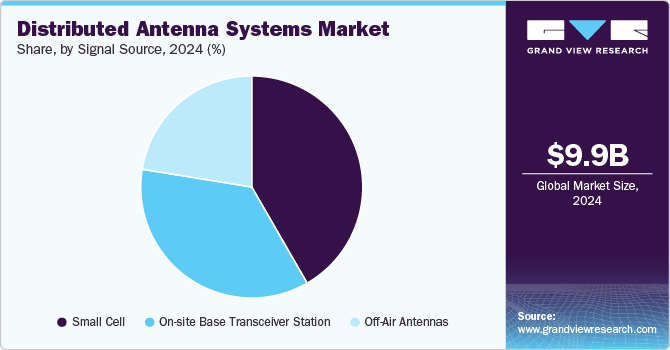

- In terms of signal source, the small cell segment dominated the market in 2024.

- On the basis of application, the indoor segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.87 billion

- 2030 Projected Market Size: USD 26.70 billion

- CAGR (2025-2030): 18.6%

- North America: Largest market in 2024

Furthermore, the regulations mandating the provisioning of reliable emergency communication, the emphasis on improved public safety communication systems, and the aggressive investments in rolling out IoT networks and smart city projects are expected to further fuel the growth in the coming years.

The evolution of cellular network technologies is a key driver for the DAS market, reflecting the ever-increasing demand for faster data speeds, greater coverage, and enhanced connectivity experiences. This evolution is a critical force shaping the DAS market. The advent of 4G and LTE (Long Term Evolution) marked a significant shift toward more data-centric communications, facilitating faster internet speeds and higher-quality video streaming. This shift heightened expectations for seamless connectivity, particularly in densely populated areas and inside large structures where traditional macro networks struggle to provide consistent coverage. DAS networks, with their ability to distribute signals efficiently within buildings, have become increasingly important to ensure that these expectations are met, and driving their adoption in commercial buildings, sporting venues, and transportation hubs.

In addition, the ongoing rollout of 5G technology is another crucial factor propelling the DAS market. DAS systems are essential for meeting the coverage and capacity requirements of 5G networks, especially in high-density environments where traditional microcell networks may struggle. The integration of DAS with 5G technology aims to deliver ultra-fast internet speeds and low latency, thereby enhancing user experience and supporting emerging applications in smart cities and IoT, thereby boosting the market expansion.

Furthermore, government initiatives aimed at improving public safety communication systems are also fostering DAS adoption. Regulatory bodies across various regions are pushing for enhanced mobile coverage in public spaces, including transportation networks and commercial buildings. This regulatory support is encouraging investment in DAS infrastructure as well as it also highlights its importance in ensuring seamless connectivity during emergencies. This trend is expected to further boost the market growth in coming years.

Moreover, technological advancements in DAS solutions, such as the adoption of massive MIMO (Multiple Input Multiple Output) technology, are enhancing spectral efficiency while minimizing interference. Companies are focusing on strategic partnerships and product innovations to expand their geographic presence and cater to the rising global demand for DAS solutions. The increasing trend toward remote work and digital transformation across industries further accelerates the need for efficient indoor network solutions.

Coverage Insights

The indoor segment accounted for the largest market share of over 60% in 2024. The growth is attributable to the increasing demand for enhanced in-building wireless connectivity catalyzed by the burgeoning number of smartphone users and data-intensive applications. As buildings become smarter and more connected, the requirement for seamless indoor coverage has become paramount. Indoor DAS solutions address these needs by providing reliable wireless coverage within these buildings.

The outdoor segment is expected to witness the fastest CAGR from 2025 to 2030. This segment plays a crucial role in improving signal strength and coverage in expansive areas such as parks, plazas, and outdoor venues, where traditional coverage methods may fall short. Cities are becoming smarter and more connected; hence, the need for robust outdoor wireless infrastructure escalates. The outdoor DAS segment addresses this demand by enabling reliable communication and data transmission in extensive outdoor environments, supporting the trend toward ubiquitous connectivity, which is further expected to propel the segment’s growth significantly in the coming years.

Signal Source Insights

The small cell segment dominated the market in 2024, owing to its effectiveness in enhancing network capacity and coverage, particularly in densely populated urban areas. Small cells are essential for offloading traffic from macro cells, thereby improving data speeds and user experience in high-demand locations such as stadiums, shopping malls, and city centers. Their compact size and ease of deployment make them ideal for addressing the growing demand for mobile data, which has been propelled by the proliferation of smartphones and IoT devices, thereby driving segmental growth.

The off-air antenna segment is expected to register the fastest CAGR from 2025 to 2030. This growth can be attributed to the increasing need for cost-effective solutions that enhance indoor coverage without extensive infrastructure investments. Off-air antennas capture signals from existing macro networks and redistribute them indoors, making them an attractive option for building owners looking to improve connectivity while minimizing installation costs.

Application Insights

The indoor segment dominated the market in 2024. This growth can be attributed to the du increasing demand for enhanced wireless connectivity within buildings. Businesses and public venues are increasingly prioritizing reliable indoor coverage to support data-intensive applications and improve user experience. Indoor DAS solutions effectively address this need by providing consistent signal strength in complex structures like offices, hospitals, and shopping malls, making them essential for modern communication infrastructure. This trend is expected to further drive the segmental growth in coming years.

The outdoor DAS segment is projected to grow at the significant CAGR from 2025 to 2030, driven by the rising demand for robust outdoor wireless infrastructure as cities become smarter and more interconnected. Outdoor DAS systems are crucial for maintaining reliable communication in extensive environments, such as urban areas and large public spaces, where traditional cellular towers may be insufficient. The ongoing rollout of 5G networks further amplifies this need, as outdoor DAS can enhance coverage and capacity to support high-speed connectivity required for advanced applications, thereby driving the segmental growth.

Ownership Insights

The neutral host ownership segment accounted for the largest market share in 2024, owing to its ability to provide seamless connectivity across multiple service providers. This model allows for shared infrastructure, significantly reducing capital expenditures for individual carriers while enhancing coverage and capacity in high-demand areas such as urban centers and large venues. The neutral host segment's value proposition is becoming increasingly attractive as more enterprises and public venues adopt DAS solutions to improve mobile coverage. This trend is expected to significantly contribute to the segmental growth.

The carrier ownership segment is expected to register a significant CAGR from 2025 to 2030. This growth can be attributed to the increasing demand for dedicated infrastructure that allows carriers to maintain control over their network performance and customer experience. As mobile data consumption continues to rise, carriers are likely to invest heavily in proprietary DAS solutions to ensure reliable service and meet consumer expectations. Additionally, advancements in technology and increasing competition among service providers will drive carriers to enhance their offerings, further contributing to this segment's robust growth during the forecast period.

Regional Insights

North America distributed antenna systems market accounted for the highest revenue share of over 29% in 2024. The growth can be attributed to the escalating demand for reliable, seamless wireless connectivity across the region. With the proliferation of smartphones, the burgeoning IoT ecosystem, and the rising mobile data consumption, particularly in urban areas, there is a pressing need for enhanced signal coverage and capacity to enable high-speed internet access.

U.S. Distributed Antenna Systems Market Trends

The distributed antenna systems market in the U.S. held a dominant position in 2024. The growing demand for remote collaboration tools in U.S., especially post-pandemic is driving the market growth. U.S. companies are increasingly utilizing VR and AR to facilitate virtual meetings and training sessions, thereby improving productivity and reducing travel costs, which is expected to drive the market growth in coming years.

Europe Distributed Antenna Systems Market Trends

The distributed antenna systems market in Europe is growing due to the escalating demand for reliable, seamless wireless connectivity across the continent. With the proliferation of smartphones, the burgeoning IoT ecosystem, and the rising mobile data consumption, particularly in urban areas, there is a pressing need for enhanced signal coverage and capacity to enable high-speed internet access. These factors are driving the market growth in Europe.

UK distributed antenna systems market is expected to grow rapidly in the coming years. The ongoing rollout of 5G networks and the increasing demand for seamless wireless coverage in both public and private spaces is driving the market growth in U.K. In addition, the growing initiatives to enhance mobile connectivity in challenging environments, such as stadiums, transportation hubs, and large commercial buildings, are also expected to drive the adoption of DAS across the U.K.

The distributed antenna systems market in Germany held a substantial market share in 2024. Germany’s commitment to enhancing wireless infrastructure and the rapid deployment of 5G networks is boosting the market growth. DAS rollouts are becoming more crucial to cater to the increasing demand for uninterrupted high-speed mobile data services across commercial spaces, healthcare establishments, and educational campuses, thereby driving the market growth in coming years.

Asia-Pacific Distributed Antenna Systems Market Trends

The distributed antenna systems market in Asia Pacific is expected to grow at the highest CAGR of over 20% from 2025 to 2030. In Asia-Pacific, the market is witnessing rapid growth, propelled by the rapid advances in telecommunications and the rollout of 5G networks underway in different parts of Asia Pacific. Unabated urbanization is driving the demand for seamless connectivity across commercial venues, transportation hubs, and healthcare establishments, making DAS increasingly crucial, and thereby driving the market growth.

Japan distributed antenna systems market is expected to grow rapidly in the coming years, the rapid technological evolution and the push for 5G network expansion are anticipated to drive the market growth in Japan. The dense urban landscapes in Japan necessitate high-quality mobile coverage in commercial and public spaces, including mass transit systems, thereby driving the demand for DAS.

The distributed antenna systems market in China held a substantial market share in 2024. The growth of the market can be attributed to the continued advances in technology and the aggressive deployment of 5G networks underway in China. With the vast and growing urban population demanding seamless connectivity, the need for DAS in commercial buildings, public venues, and transportation hubs is soaring, thereby driving the regional growth.

Key Distributed Antenna Systems Company Insights

Some of the key players operating in the market include American Tower Corporation, and AT&T Inc.

-

American Tower Corporation is a communication infrastructure market with a significant presence in the DAS sector. ATC's involvement in the DAS market underscores its commitment to enhancing mobile communication capabilities in densely populated or complex environments, such as stadiums, airports, and urban areas. American Tower Corporation operates and develops a broad portfolio of communication infrastructure, including cell towers, small cells, and fiber networks.

-

AT&T Inc. is globally recognized in the telecommunications sector, providing a wide range of services, including wireless communications, high-speed internet, and digital TV, among others. The company’s involvement in the DAS market is part of its broader strategy to meet the increasing demand for high-quality, reliable mobile services. The company invests significantly in DAS and other advanced technologies to ensure that its customers experience uninterrupted connectivity.

Whoop Wireless and Solid Gear, Inc. are some of the emerging participants in the distributed antenna systems market.

-

Whoop Wireless specializes in creating innovative in-building wireless solutions. The company focuses on delivering cost-effective and scalable DAS solutions that cater to the unique needs of various venues, including educational institutions, healthcare facilities, commercial buildings, and hospitality venues. Whoop Wireless also emphasizes simplicity, rapid deployment, and user-centric design, enabling robust wireless coverage and capacity enhancements inside structures where signal strength traditionally weakens.

-

Solid Gear Inc., a prominent player in the telecommunications industry, specializes in the design and manufacture of Distributed Antenna Systems (DAS) and related infrastructure to improve mobile coverage and capacity, especially in densely populated or structurally complex environments. Renowned for their innovative approach, the company offers solutions that address the need for reliable indoor and outdoor cellular services in venues ranging from large-scale sports stadiums and transportation hubs to corporate campuses and healthcare facilities.

Key Distributed Antenna Systems Companies:

The following are the leading companies in the distributed antenna systems market. These companies collectively hold the largest market share and dictate industry trends.

- American Tower Corporation

- AT&T Inc.

- Bird Technologies Inc.

- Boingo Wireless Inc.

- BTI Wireless

- CAES (Cobham Limited)

- Comba Telecom Systems Holdings Ltd.

- CommScope Holdings Company Inc.

- KATHREIN Digital Systems GmbH

- Corning Incorporated

- Crown Castle Inc.

- Advanced RF Technologies, Inc.

- GALTRONICS (Baylin Technologies Inc.)

- Rosenberger Hochfrequenztechnik GmbH & Co. KG.

- JMA Wireless

- PBE Axell

- Solid Gear Inc.

- TE Connectivity Corporation (TE Connectivity Ltd.)

- Telefonaktiebolaget LM Ericsson

- Westell Technologies, Inc

- Whoop Wireless

- Zinwave (Wilson Electronics)

Recent Developments

-

In May 2024, Solid Gear Inc. announced that Wireless Services, a systems integrator, has chosen the SOLiD ALLIANCE 5G Distributed Antenna System (DAS) to improve the 5G connection at the New Orleans Ernest N Morial Convention Center. The new DAS infrastructure includes 5G C-Band capability to enable adequate bandwidth and coverage for convention center guests, which are expected to exceed 800,000 by 2024.

-

In April 2024, Bird Technologies Inc. introduced the BNA 100 and BNA 1000 series Vector Network Analyzers (VNA). These introductions illustrate Bird's commitment to microwave frequency and low RF power domains, leveraging its extensive RF technological expertise to suit the changing expectations of the Application.

-

In March 2024, AT&T Inc. introduced AT&T Internet Air for Business, a wireless service for small, medium, and large businesses with the most dependable 5G network in America. It allows consumers to establish a primary internet connection in faraway regions without the need for fiber connections.

Distributed Antenna Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.36 billion

Revenue forecast in 2030

USD 26.70 billion

Growth Rate

CAGR of 18.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage, ownership, signal source, application, regional

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, Australia, Japan, India, South Korea, Brazil, South Africa, Saudi Arabia, U.A.E.

Key companies profiled

American Tower Corporation, AT&T Inc., Bird Technologies Inc., Boingo Wireless Inc., BTI Wireless, CAES (Cobham Limited), Comba Telecom Systems Holdings Ltd., CommScope Holdings Company Inc., KATHREIN Digital Systems GmbH, Corning Incorporated, Crown Castle Inc., Advanced RF Technologies, Inc., GALTRONICS (Baylin Technologies Inc.), Rosenberger Hochfrequenztechnik GmbH & Co. KG, JMA Wireless, PBE Axell, Solid Gear Inc., TE Connectivity Corporation (TE Connectivity Ltd.), Telefonaktiebolaget LM Ericsson, Westell Technologies, Inc., Whoop Wireless, and Zinwave (Wilson Electronics)

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distributed Antenna Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global distributed antenna systems market report based on coverage, ownership, signal source, application, and region:

-

Coverage Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor DAS

-

Active DAS

-

Amplifiers (Remote Units)

-

Master Units

-

Cables

-

Others

-

-

Passive DAS

-

Antennas

-

Signal Boosters

-

Splitters and Combiners

-

Cables

-

Others

-

-

Hybrid DAS

-

-

Outdoor DAS

-

-

Ownership Outlook (Revenue, USD Million, 2017 - 2030)

-

Carrier Ownership

-

Neutral-Host Ownership

-

Enterprise Ownership

-

-

Signal Source Outlook (Revenue, USD Million, 2017 - 2030)

-

On-site Base Transceiver Station

-

Off-Air Antennas

-

Small Cell

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor DAS

-

Public Venue & Safety

-

Hospitality

-

Airport & Transportation

-

Healthcare

-

Education Sector & Corporate Offices

-

Industrial

-

Others

-

-

Outdoor DAS

-

Public Venue & Safety

-

Hospitality

-

Airport & Transportation

-

Healthcare

-

Education Sector & Corporate Offices

-

Industrial

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global distributed antenna systems market size was estimated at USD 9,877.6 million in 2024 and is expected to reach USD 11,369.1 million in 2025.

b. The global distributed antenna systems market is expected to grow at a compound annual growth rate of 18.6% from 2025 to 2030 to reach USD 26,705.1 million by 2030.

b. North America dominated the distributed antenna systems market with a share of over 29% in 2024. The North American market for Distributed Antenna Systems (DAS) is witnessing substantial growth, driven by increasing demand for seamless mobile connectivity and the need for enhanced network capacity in crowded environments.

b. Some key players operating in the distributed antenna systems market include AT&T Inc., American Tower Corporation, Telefonaktiebolaget LM Ericsson, TE Connectivity Corporation, and Comba Telecom Systems Holdings Ltd, among others.

b. The growing demand for enhanced wireless connectivity has become a defining force in shaping the Distributed Antenna System (DAS) market. This surge in demand is largely driven by the digitalization of everyday activities, the proliferation of IoT devices, and the increasing consumption of high-bandwidth content.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.