- Home

- »

- Next Generation Technologies

- »

-

Distributed Fiber Optic Sensor Market, Industry Report, 2033GVR Report cover

![Distributed Fiber Optic Sensor Market Size, Share & Trends Report]()

Distributed Fiber Optic Sensor Market (2026 - 2033) Size, Share & Trends Analysis Report By Function (Acoustic/ Vibration Sensing, Temperature Sensing), By Technology (Rayleigh Effect, Raman Effect), By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-462-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Distributed Fiber Optic Sensor Market Summary

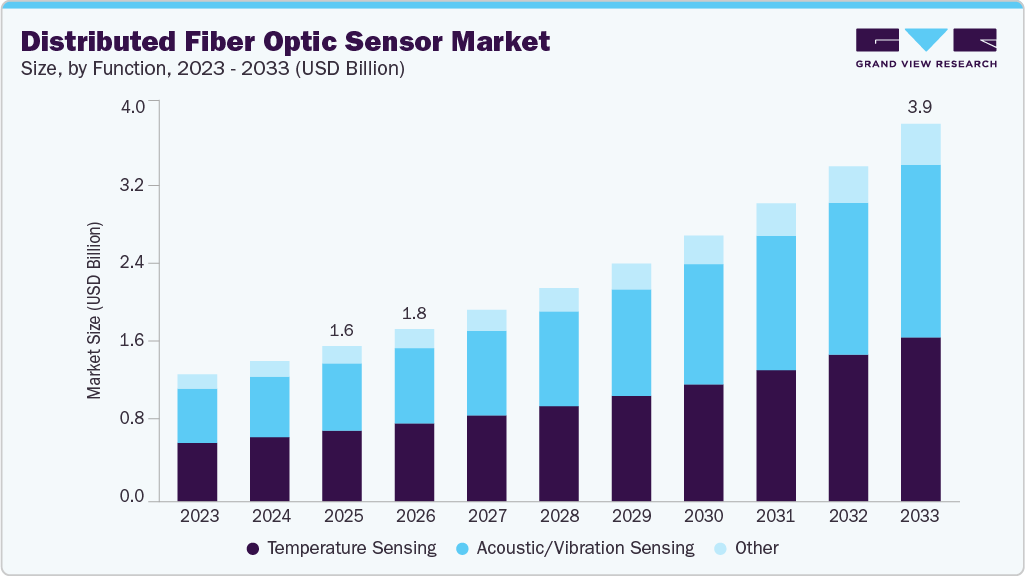

The global distributed fiber optic sensor market size was valued at USD 1.64 billion in 2025 and is projected to reach USD 3.99 billion by 2033, growing at a CAGR of 11.9% from 2026 to 2033. The growing adoption of real-time monitoring across critical infrastructure, rising integration of AI and advanced analytics in distributed fiber optic sensor (DFOS) platforms, increasing deployment in harsh and remote terrains, expanding use cases in smart cities and environmental monitoring, and accelerating demand for customized installation and maintenance services.

Key Market Trends & Insights

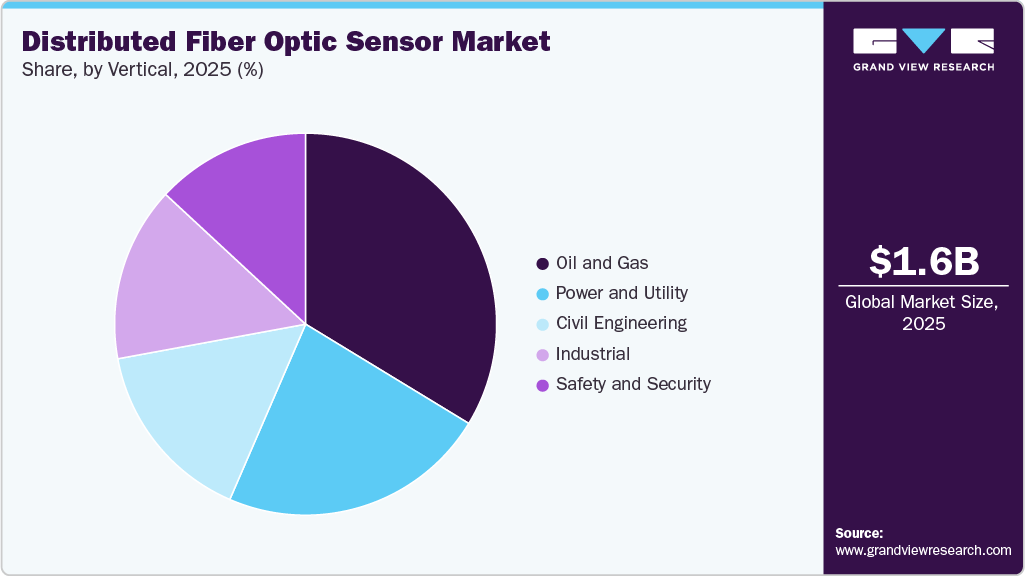

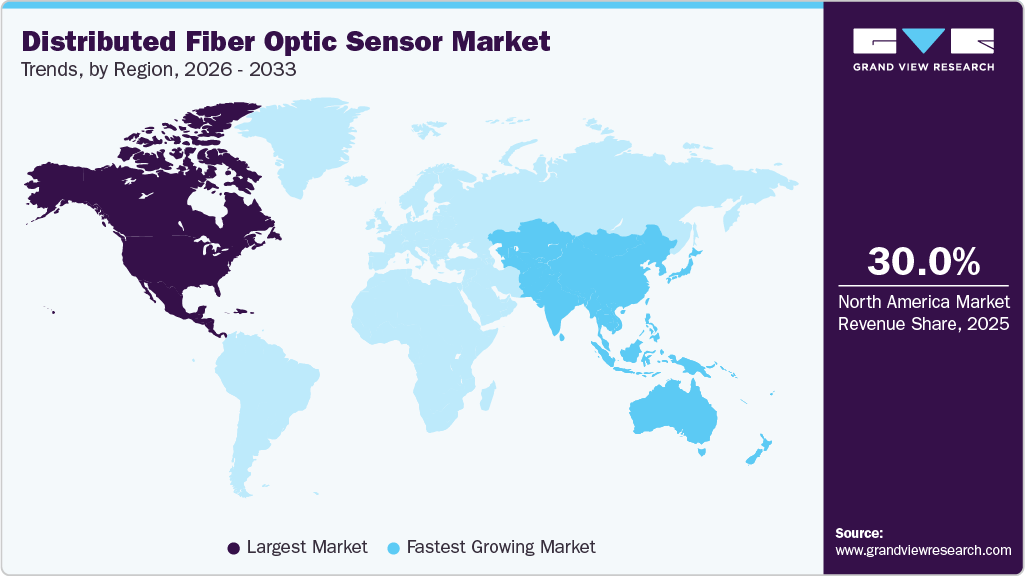

- North America dominated the global distributed fiber optic sensor market with the largest revenue share of over 30% in 2025.

- The distributed fiber optic sensor market in the U.S. led the North American region and held the largest revenue share in 2025.

- By function, temperature sensing segment led the market and held the largest revenue share of over 45% in 2025.

- By technology, the Raman effect segment held the dominant position in the market and accounted for the leading revenue share of 34% in 2025.

- By vertical, the industrial segment is expected to grow at the fastest CAGR of over 13% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 1.64 billion

- 2033 Projected Market Size: USD 3.99 billion

- CAGR (2026-2033): 11.9%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

The industry represents a rapidly evolving segment of sensing technology, driven by rising demand for advanced, real-time monitoring solutions across multiple industries. These systems leverage optical fibers to measure temperature, strain, and acoustic variations over long distances, enabling continuous data collection with high precision. Key sectors, including oil and gas, power and utilities, and civil engineering, increasingly depend on these sensors to strengthen operational safety, improve asset performance, and reduce downtime. For instance, in September 2024, SLB entered a joint venture with Patterson-UTI and ADNOC Drilling Company PJSC to establish Turnwell Industries LLC OPC, aimed at advancing smart drilling design, AI-driven production capabilities, and completions engineering to accelerate the UAE’s unconventional oil and gas development. As infrastructure networks grow more complex and geographically distributed, the demand for reliable, high-accuracy fiber optic sensing solutions continues to intensify.

Distributed fiber optic sensors based perimeter security systems are emerging as a preferred solution for airports, borders, utilities, and critical facilities that require continuous threat detection. Technology’s ability to differentiate between footsteps, vehicles, digging, cutting, and climbing activities is driving rapid adoption. Organizations are shifting from legacy point sensors to fiber-based systems to improve accuracy and reduce false alarms. Rising global security concerns and infrastructure vulnerability are further intensifying interest in acoustic-based fiber detection. This accelerating demand positions DFOS as a cornerstone technology for next-generation perimeter security networks.

Telecom operators and energy companies are rapidly adopting DFOS to monitor thousands of kilometers of submarine fiber cables for temperature shifts, vibration anomalies, and external threats. Distributed sensing enables early detection of anchor drags, seismic activity, and cable stress, reducing the risk of lengthy outages and costly repairs. Increasing global dependence on data transport and offshore energy infrastructure is accelerating investment in long-range DFOS deployments. Operators view fiber-based monitoring as a strategic capability for protecting mission-critical communication routes. This growing adoption trend is driving significant innovation in long-distance optical interrogation technologies.

Function Insights

The temperature sensing segment led the market and accounted for over 45% of the global revenue in 2025, owing to rising industry demand for continuous thermal monitoring across critical assets such as pipelines, power cables, and industrial systems. The ability of distributed fiber optic technology to deliver real-time, high-resolution temperature profiles is driving rapid adoption, as operators prioritize early detection of overheating, leaks, and equipment stress. Strong performance in harsh and electrically challenging environments positions temperature sensing as a foundational tool for safety and operational reliability. Ongoing advancements in interrogation speed and measurement accuracy are accelerating deployment across energy, utilities, and large infrastructure projects. Growing investment in predictive maintenance strategies further strengthens the segment’s momentum and solidifies its leadership in the global DFOS market.

The acoustic and vibration sensing segment is predicted to foresee significant growth in the forecast period, driven by increasing industry demand for real-time detection of disturbances, structural stress, and potential intrusions across critical assets. Distributed acoustic sensing delivers continuous, high-resolution monitoring along the entire fiber length, enabling rapid identification of events such as leaks, third-party interference, equipment faults, or ground movement. Its ability to operate reliably in harsh environments is accelerating adoption across oil and gas, rail networks, perimeter security, and geotechnical applications. Advances in signal processing and interrogation methods are enhancing accuracy and expanding the range of deployable use cases. Heightened focus on safety, operational continuity, and proactive risk mitigation continues to propel the momentum of acoustic and vibration-based DFOS solutions worldwide.

Technology Insights

The Raman effect segment accounted for the largest market revenue share in 2025, driven by the technique’s ability to deliver distributed temperature measurements through analysis of inelastic light scattering along the fiber. Its high sensitivity to thermal variations supports applications in fire detection, environmental monitoring, and industrial process control. Raman sensors perform well in electrically noisy or hazardous environments, offering non-intrusive and reliable measurement capabilities. Recent advances in interrogation technology have improved measurement speed and spatial resolution, strengthening their operational value. These enhancements are broadening application areas and improving safety across critical infrastructure.

The Rayleigh effect segment is expected to record significant growth during the forecast period, supported by its use of naturally occurring backscattering within the fiber to measure strain and temperature with very high spatial resolution. This technique is widely applied in structural health monitoring, pipeline surveillance, and geotechnical assessment due to its ability to detect localized changes with precision. Rayleigh-based sensors generate continuous data along the entire fiber, enabling detailed mapping of physical parameters for early issue detection. Advances in interrogation methods have improved signal clarity and reduced noise levels, strengthening overall accuracy. The passive nature of the method removes the need for external light sources, simplifying installation and long-term maintenance.

Application Insights

The rail infrastructure monitoring segment accounted for the largest revenue share in 2025, supported by the growing need for continuous assessment of track conditions, structural integrity, and environmental factors that influence rail operations. Distributed fiber optic sensors detect strain, vibration, and temperature changes, enabling early identification of track deformation, wear, or external disturbances that could compromise safety. For instance, in June 2025, Sensonic GmbH partnered with the Chicago Transit Authority to deploy a DAS pilot program designed to automatically detect intrusions and fallen objects along the rail right-of-way. The initiative uses fiber optic cables for continuous real-time monitoring, strengthening hazard detection and improving overall transit system reliability. These capabilities enhance maintenance planning, reduce the likelihood of accidents, and support more efficient rail network operations.

The urban monitoring segment is expected to record strong growth as cities increasingly adopt distributed fiber optic sensing to assess infrastructure health, environmental conditions, and public safety. Embedded sensors in roads, bridges, and buildings deliver continuous data on stress, vibration, and temperature, enabling proactive maintenance and early hazard identification. This non-intrusive technology can be incorporated into existing urban assets with minimal disruption, supporting long-term infrastructure resilience and lowering emergency repair costs. Real-time insights also improve resource allocation and strengthen emergency response capabilities for municipal authorities. For instance, in February 2025, the City Changer project in Croatia deployed a DAS system along a 17-kilometer fiber route between Gruda and Vitaljina, demonstrating how fiber-based sensing can detect seismic activity, traffic patterns, landslides, and other critical urban events.

Vertical Insights

The oil and gas segment accounted for the largest market revenue share in 2025, driven by the need to monitor pipelines, wells, and processing facilities for temperature, strain, and acoustic signals that indicate leaks or structural concerns. Continuous distributed sensing improves safety by enabling early detection of operational anomalies and environmental risks. Technology also supports compliance with strict industry regulations and reduces unplanned downtime through predictive maintenance. Fiber optic sensors are highly suitable for complex oilfield environments due to their immunity to electromagnetic interference and strong performance in harsh conditions. For instance, in February 2025, ABB deployed its advanced temperature measurement technology for Equinor at the Johan Sverdrup oil field in the North Sea, enabling precise, real-time temperature monitoring across pipelines and production equipment to identify issues such as overheating or blockages.

The industrial segment is projected to grow significantly over the forecast period, supported by the rising adoption of DFOS for equipment health monitoring, process control, and environmental measurement to improve safety and productivity. These sensors deliver continuous data on strain, temperature, and vibration, which strengthens predictive maintenance strategies and lowers downtime. Their resistance to harsh industrial settings and electromagnetic interference ensures dependable performance across manufacturing, chemical processing, and related sectors. Integration with industrial IoT platforms improves real-time analytics and operational decision-making. Enhanced monitoring capabilities improve asset utilization and reduce maintenance costs. The scalability and flexibility of sensor networks allow tailored configurations for diverse industrial operations, and advancements in sensing technologies and data integration continue to expand future use cases.

Regional Insights

North America distributed fiber optic sensor market accounted for over 30% of the global share in 2025, supported by strong investments across oil and gas, telecommunications, and energy infrastructure. The region’s advanced technological landscape and continuous innovation are elevating the precision and functionality of fiber optic sensing solutions. Expanding applications in civil engineering, defense, and security further reinforce market momentum. Collectively, these factors position North America as a leading hub for real-time monitoring and safety-driven DFOS deployments.

U.S. Distributed Fiber Optic Sensor Market Trends

The distributed fiber optic sensor (DFOS) market in the U.S. is propelled by growing activity in the oil and gas industry, where real-time pipeline monitoring and leak detection have become operational priorities. Advanced sensing technologies, such as OFDR and OTDR, are enhancing accuracy and broadening the range of DFOS applications. Government support, including funding initiatives from the Department of Energy and the Federal Communications Commission, continues to accelerate adoption. As a result, the U.S. maintains a strong demand for next-generation fiber optic networks and monitoring solutions.

Europe Distributed Fiber Optic Sensor Market Trends

The distributed fiber optic sensor (DFOS) market in Europe is being driven by the region’s accelerating shift toward renewable energy and the need for continuous monitoring of wind farms, solar plants, and associated transmission assets. Growing regulatory emphasis on operational safety and environmental protection is encouraging industries to adopt high-precision sensing technologies for early fault detection and structural health monitoring. Advancements in distributed acoustic sensing and temperature monitoring are enabling utilities and transportation operators to improve efficiency, reduce downtime, and optimize asset life cycles. Collectively, these factors are reinforcing DFOS as a critical enabler of Europe’s energy transition and infrastructure resilience strategy.

Asia Pacific Distributed Fiber Optic Sensor Market Trends

The distributed fiber optic sensor (DFOS) market in Asia Pacific is expected to register the fastest CAGR over the forecast period due to rapid industrial expansion and large-scale infrastructure investments across China, India, and Southeast Asia. Increasing adoption of DFOS for structural health monitoring, seismic detection, and perimeter security is strengthening its use across transportation, utilities, and civil engineering projects. The region’s growing focus on smart infrastructure, supported by government initiatives and significant telecom upgrades, including widespread 5G deployment, is further accelerating technology uptake. These developments collectively position Asia Pacific as a major engine of global DFOS market growth.

Key Distributed Fiber Optic Sensor Companies Insights

Key players operating in the distributed fiber optic sensor (DFOS) market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some key companies in the DFOS industry include Schlumberger Limited, Halliburton, Omnisens SA, OFS Fitel, LLC.

-

Schlumberger Limited is a provider of advanced technologies and services for the oil and gas industry, covering subsurface characterization, drilling, production, and processing. The company delivers a comprehensive portfolio spanning exploration initiatives to integrated pore-to-pipeline solutions designed to maximize hydrocarbon recovery and enhance reservoir performance. In addition, Schlumberger is expanding its offerings to support emerging sectors such as carbon capture and storage (CCS) and groundwater extraction, aligning its capabilities with the growing demand for sustainable resource management.

-

OFS Fitel, LLC is a prominent manufacturer of optical fiber cables, connectivity systems, and integrated fiber-optic solutions supporting telecommunication and industrial applications. Its core competencies include the design and production of high-strength fiber cables engineered for diverse indoor, outdoor, and harsh-environment use cases. OFS Fitel serves a broad range of industries-including government, aerospace, medical, industrial networking, telecommunications, and defense-through a robust product portfolio comprising optical fibers, advanced connectivity solutions, fiber laser components, fusion splicing equipment, and professional engineering services.

Key Distributed Fiber Optic Sensor Companies:

The following are the leading companies in the distributed fiber optic sensor market. These companies collectively hold the largest Market share and dictate industry trends.

- Schlumberger Limited

- Halliburton

- Yokogawa Electric Corporation

- OFS Fitel, LLC

- Omnisens SA

- Brugg Kable AG

- AP Sensing GmbH

- Baker Hughes Company

- Silixa Ltd

- Luna Innovations Inc.

Recent Developments

-

In November 2025, Knowit signed a three-year agreement with Equinor to further develop and operate Equinor’s Distributed Fiber Optic Sensing (DFOS) platform, expanding their strategic collaboration. DFOS technology provides real-time monitoring and analysis of pipelines, cables, and wells, delivering actionable insights to improve safety, resource utilization, and emissions reduction. Knowit will deliver software development, system integration, and technology advisory services to scale the DFOS platform and extend its use across Equinor’s portfolio. This partnership builds on previous projects, including Fibra, and strengthens Knowit’s position as a trusted technology partner in advanced sensor solutions for the energy sector.

-

In January 2025, OFS introduced DataSens Enhanced Optical Fiber, a distributed fiber optic sensing (DFOS) solution that delivers a greater backscatter signal than conventional fibers. It extends sensing range, improves accuracy, and is fully compatible with standard fiber types. This technology enables precise monitoring of infrastructure, vibrations, and pipelines without requiring costly signal amplification.

-

In January 2025, Baker Hughes introduced SureCONNECT FE, a downhole fiber-optic wet-mate system for real-time reservoir monitoring in HPHT conditions. The system connects lower and upper well completions, providing continuous fiber-optic and electronic data across the wellbore without intervention. It reduces rig time, maintenance costs, and operational risks while delivering insights to enhance production and well performance.

Distributed Fiber Optic Sensor Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.82 billion

Revenue forecast in 2033

USD 3.99 billion

Growth rate

CAGR of 11.9% from 2026 to 2030

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, technology, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Schlumberger Limited; Halliburton; Yokogawa Electric Corporation; OFS Fitel, LLC; Omnisens SA; Brugg Kable AG; AP Sensing GmbH; Baker Hughes Company; Silixa Ltd; Luna Innovations Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distributed Fiber Optic Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global distributed fiber optic sensor (DFOS) market report based on function, technology, application, vertical, and region.

-

Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Acoustic/ Vibration Sensing

-

Temperature Sensing

-

Other

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Rayleigh Effect

-

Brillouin Scattering

-

Raman Effect

-

Interferometric

-

Bragg Grating

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Geophysical Event Monitoring

-

Network Disturbance Monitoring

-

Rail Infrastructure Monitoring

-

Urban Monitoring

-

Subsea Infrastructure Monitoring

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil and Gas

-

Power and Utility

-

Safety and Security

-

Industrial

-

Civil Engineering

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global distributed fiber optic sensor market size was estimated at USD 1.64 billion in 2025 and is expected to reach USD 1.82 billion in 2026.

b. The global distributed fiber optic sensor market is projected to grow at a compound annual growth rate (CAGR) of 11.9% from 2026 to 2033, reaching a value of USD 3.99 billion by 2033.

b. North America dominated the global distributed fiber optic sensor market in 2025, with a revenue share exceeding 30%. The distributed fiber optic sensor (DFOS) market in North America is driven by sufficient investments in various sectors’ infrastructure, such as oil and gas, telecommunications, and energy, where real-time monitoring and safety are important.

b. Some key players operating in the distributed fiber optic sensor market include Schlumberger Limited; Halliburton; Yokogawa Electric Corporation; OFS Fitel, LLC; Omnisens SA; Brugg Kable AG; AP Sensing GmbH; Baker Hughes Company; Silixa Ltd; Luna Innovations Inc.

b. Key factors that are driving the DFOS market growth include the distributed fiber optic sensor market encompasses a dynamic segment of the sensing technology, driven by the increasing demand for advanced monitoring solutions across various sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.