- Home

- »

- Biotechnology

- »

-

DNA Methylation Market Size & Share, Industry Report, 2033GVR Report cover

![DNA Methylation Market Size, Share & Trends Report]()

DNA Methylation Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service (Reagents & Kits, Instruments), By Technique, By Application (Oncology, Stem Cell Research), By End-use (Academic & Research Institutes, Hospitals & Clinical Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-996-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA Methylation Market Summary

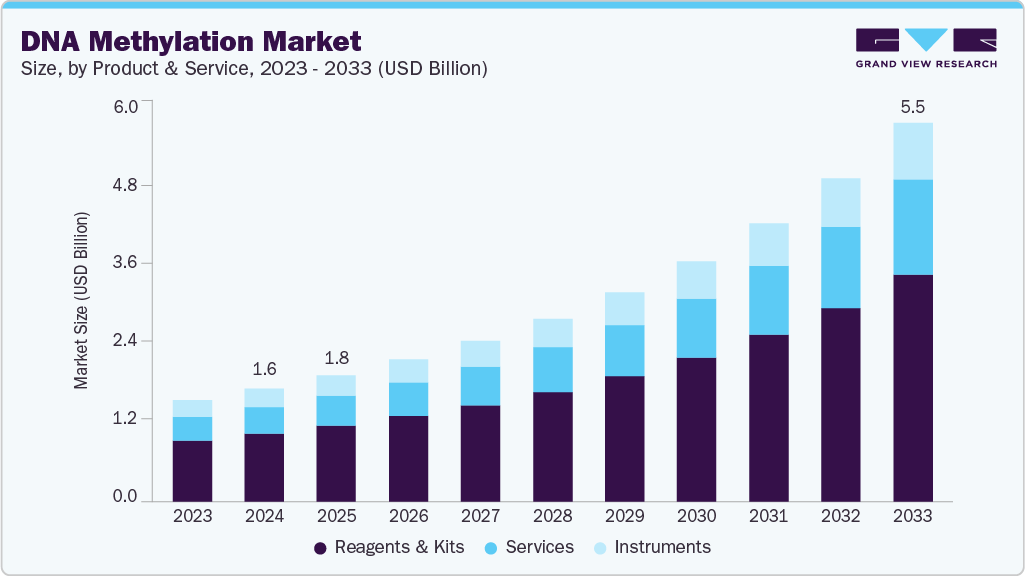

The global DNA methylation market size was estimated at USD 1.64 billion in 2024 and is projected to reach USD 5.52 billion by 2033, growing at a CAGR of 14.73% from 2025 to 2033. The rising prevalence of cancer and other chronic diseases primarily drives market growth.

Key Market Trends & Insights

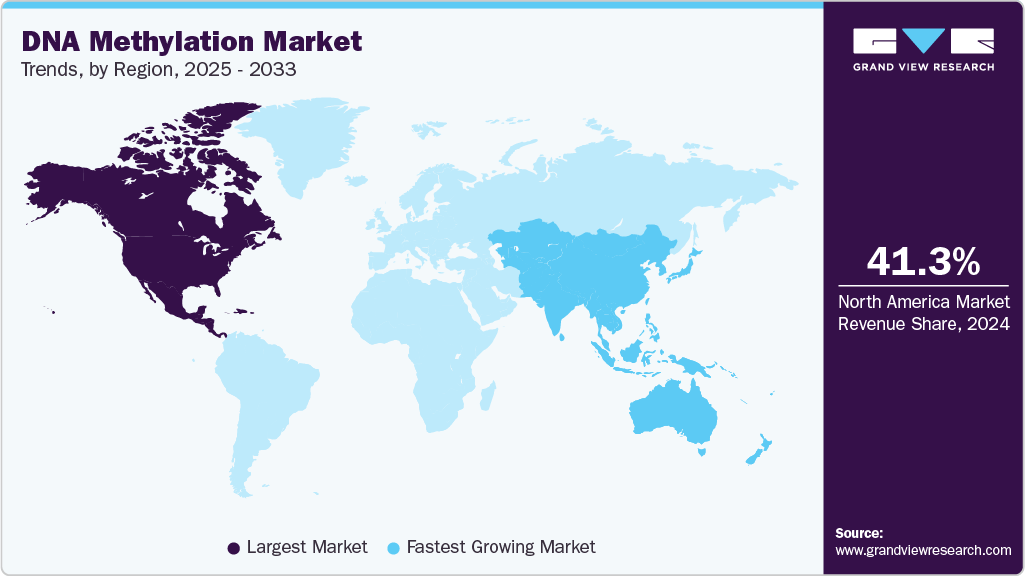

- The North America DNA methylation market held the largest share of 41.29% of the global market in 2024.

- The DNA methylation industry in the U.S. is expected to grow significantly over the forecast period.

- By product & service, the reagents & kits segment held the highest market share of 60.19% in 2024.

- Based on technique, the sequencing-based techniques segment held the highest market share of 44.14% in 2024.

- By application, the oncology segment held the highest market share of 66.35% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.64 Billion

- 2033 Projected Market Size: USD 5.52 Billion

- CAGR (2025-2033): 14.73%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to the National Cancer Institute, in 2025, approximately 2.04 million new cancer cases are expected to be diagnosed in the U.S., with an estimated 618,120 deaths projected to result from the disease.

Advancements in Epigenetic Research

The rising demand in the DNA methylation market is closely tied to the growing recognition of epigenetics in understanding human health and disease. Scientists have long known that our DNA holds the instructions for life, but it is becoming clear that how those instructions are read and sometimes silenced can be just as important. DNA methylation is an important epigenetic mechanism that has become a window into these processes. Methylation patterns are being investigated more and more by researchers and medical professionals to identify cancers early, monitor the course of diseases, or forecast how well patients will respond to treatment.

Epigenetic biomarkers in cancers

Cancer Type

Biomarker Name

Liver cancer

CDKN2A

RUNX3

Liver cancer, Lung cancer, Prostate cancer,

Colorectal cancer, Melanoma, Ovarian

RASSF1A

Lung cancer, endometrial cancer

CDO1

Colorectal cancer

SEPT9

CIMP

VIM

NDRG4

BMP3

SDC2

RARB2

BCAT1, IKZF1

Glioblastoma

MGMT

Gastric cancer

CDH1

CDKN2A

Pancreatic cancer

CD1D

Breast cancer

BRCA1/2

PTX2

Breast cancer, lung cancer

RARB2

Lung cancer

SHOX2

PTPRG

PCDH10A2

Colorectal cancer, Liver cancer, Lung cancer

LINE-1

Prostate cancer, Breast cancer

GSTP1

Oral cancer

TIMP3

This interest has grown due to technological advancements that make DNA methylation analysis faster, more accurate, and more practical outside the lab. With increasing support from government bodies and private institutions for epigenetic studies, these elements are coming together to shape a market that is not only at the forefront of science but also meets a pressing need in healthcare.

Advancements in Sequencing and Analytical Technologies

The DNA methylation market has grown significantly due to the rapid development of sequencing and analytical technologies. Methods like methylation-specific PCR (MSP), bisulfite sequencing, and next-generation sequencing (NGS) have revolutionized how scientists and medical professionals investigate epigenetic changes. Due to these advancements, DNA methylation studies are now more affordable, simpler, and time-efficient, which enables a greater variety of labs and research organizations to conduct these analyses.

These technological developments improve the depth and dependability of methylation data and create new opportunities for diagnostic and clinical uses. Early detection, prognosis, and individualized treatment plans are made easier by the discovery of novel biomarkers for cancer, neurological conditions, and other complex diseases through high-resolution epigenomic profiling, which further accelerates the adoption of the DNA methylation process.

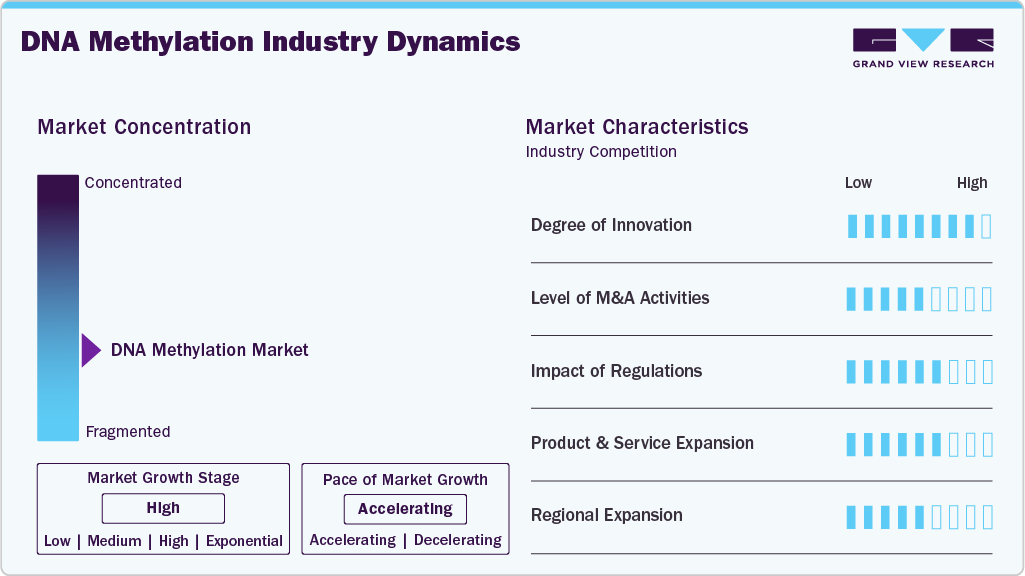

Market Concentration & Characteristics

The DNA methylation industry is characterized by a high degree of innovation, driven primarily by the development of advanced sequencing and analytical technologies. The accuracy, sensitivity, and throughput of methylation profiling have been greatly improved by innovations like digital PCR, bisulfite sequencing, single-cell methylome analysis, and next-generation sequencing (NGS). For instance, in May 2024, QIAGEN announced the launch of its QIAseq Multimodal DNA/RNA Library Kit. The new kit enables seamless preparation of DNA and RNA libraries for next-generation sequencing (NGS), such as whole genome sequencing (WGS) and whole transcriptome sequencing (WTS), as well as downstream target enrichment based on hybrid-capture from a single sample. The market is positioned at the forefront of technological advancement in epigenetics thanks to ongoing advancements in automation, cost-efficiency, and assay miniaturization, which further broaden the applications of DNA methylation analysis in drug development, diagnostics, and personalized medicine.

A moderate to high degree of mergers and acquisitions (M&A) activity has been observed in the DNA methylation industry, indicating the strategic significance of extending technological capabilities and market reach. To expand their product lines and spur innovation, businesses aggressively purchase or collaborate with niche firms specializing in bioinformatics solutions, sequencing technologies, and epigenetic assay platforms. Access to proprietary technologies, quicker entry into emerging markets, and improved service offerings in clinical diagnostics and research applications are all made possible by these consolidations.

The DNA methylation industry is greatly influenced by regulations, especially in clinical and diagnostic applications. Regulatory agencies such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) enforce strict guidelines for the validation, approval, and clinical application of methylation-based assays and diagnostic kits. Although adherence to these standards guarantees precision, dependability, and patient safety, it may also lengthen development periods and raise expenses for market participants. Regulatory oversight can be difficult, but it also helps the market grow by promoting standardized, high-quality products, building clinician trust, and promoting the broader use of DNA methylation technologies in diagnostics and treatment.

Product & service expansion is a key growth strategy in the DNA methylation industry, with companies continuously introducing new assays, kits, and platforms to address diverse research and clinical needs. For instance, in June 2024, QIAGEN launched 35 new wet-lab tested digital PCR Microbial DNA detection assays for use in its QIAcuity dPCR platform. The launch is expected to help the company expand in the microbial research field. These tests focus on pathogens causing tropical diseases, urinary tract infections (UTIs), and sexually transmitted infections (STIs). Businesses are broadening their product lines to include multiplexed assays, which allow for the simultaneous analysis of several epigenetic markers, automation-compatible platforms, and affordable options for smaller labs.

Regional expansion is a significant growth strategy in the DNA methylation industry, as companies aim to tap into emerging markets and strengthen their global footprint. To increase accessibility and local product support, major market players set up distribution networks, partnerships, and subsidiaries throughout North America, Europe, the Asia Pacific, and other high-growth regions.

Technique Insights

The sequencing-based techniques segment dominated the DNA methylation market 2024, capturing a 44.14% share. The rapidly evolving technology and decreasing cost for next-generation sequencing (NGS) have also facilitated the uptake of sequencing-based methods for basic research applications, epigenetics, cancer diagnostics, and personalized medicine in research and clinical settings.

The PCR-based techniques segment in the DNA methylation market is expected to grow significantly during the forecast period due to its high sensitivity, specificity, and cost-effectiveness for detecting methylation changes in targeted genomic regions. As a result, PCR-based approaches have developed increased utilization in clinical diagnostics, cancer, and personalized medicine settings for biomarker discovery.

Product & Service Insights

The reagents & kits segment accounted for the largest market revenue share of 60.19% in 2024, owing to the increasing demand for standardized, ready-to-use products designed to simplify the complexity of conducting DNA methylation studies. The increased adoption and interest in PCR-based, sequencing-based, and microarray-based studies in epigenetics, cancer diagnostics, and personalized medicine have driven interest in specialized reagents and kits that have appeared as market revenue drivers in this segment.

The services segment is expected to grow fastest during the forecast period. The growing utilization of NGS technologies has transformed the examination of DNA methylation, allowing for efficient and cost-friendly assessment of epigenetic patterns, which derives the growth in the market.

Application Insights

The oncology segment accounted for largest market revenue share of 66.35% in 2024 and is also is expected to register the fastest CAGR during the forecast period. Unusual DNA methylation patterns are considered valuable biomarkers for cancer, allowing for early detection and individualized treatment approaches. The increasing global incidence of cancer, coupled with a growing use of epigenetic profiling in research and clinical fields, has increased the need for excision-free DNA methylation solutions in oncology, which is the leading application segment in the global DNA methylation market.

The neurological disorders market segment is expected to record a significant CAGR in the forecast period, primarily due to increased awareness of epigenetic modifications, including DNA methylation, in the onset and progression of disorders such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis, which serves to drive the segment growth.

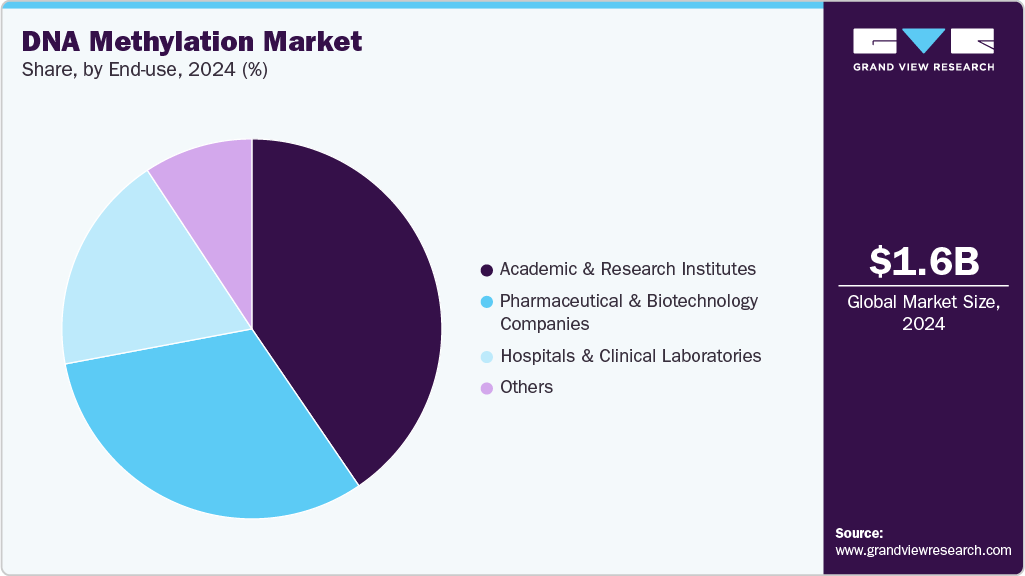

End-use Insights

The academic and research institutes segment will take the largest market revenue share of 40.47% in 2024 due to the greater use of DNA methylation analysis in basic and translational research. The investment in epigenetics research is driving the number of publications focusing on the area, and the increasing focus on personalized medicine and cancer research contributes to the growing adoption of this technology in academic and research institutes.

The hospitals & clinical laboratories segment is expected to register the fastest CAGR during the forecast period due to the growing incorporation of DNA methylation analysis into clinical diagnostics and personalized medicine. Rising awareness of epigenetic biomarkers for early disease detection, prognosis, and treatment monitoring has led to increased adoption and growth.

Regional Insights

North America dominated the DNA methylation industry in 2024, accounting for a significant share of 41.29% The region's well-established network of production plants and R&D facilities, which encourages creativity and speeds up the commercialization of new goods, is responsible for the region's leadership. Moreover, the market presence in North America has been reinforced by the growing number of product launches, approvals, and clinical and academic adoptions of sophisticated methylation analysis technologies.

U.S.DNA Methylation Market Trends

The U.S. DNA methylation market is highly competitive due to the growing use of DNA methylation detection technology as epigenetic biomarkers, increasing partnerships among academic institutions, and the emergence of more startups in the biotechnology and pharmaceutical sectors.

Europe DNA Methylation Market Trends

The Europe DNA methylation market is witnessing steady growth, owing to the growing utilization of individualized medicine methods and expanded support for genetic research projects. Moreover, the growth in revenue of the Europe DNA methylation market is driven by the rising adoption of the technique in oncology and epigenetic research laboratories. Increased interest in DNA methylation in next-generation sequencing and genome-wide analyses has resulted in a higher utilization of this method. Some factors are anticipated to fuel revenue growth in the region.

The DNA methylation industry in the UK is projected to experience rapid growth over the forecast period. Active research projects at academic institutions and research facilities examining DNA methylation's role in a range of biological processes and illnesses are the main drivers of this expansion. The government of the UK has contributed a substantial amount of funds to epigenetics research, with a particular emphasis on DNA methylation, which has further fueled the expansion of the DNA methylation market.

The DNA methylation market in Germany is witnessing steady growth, driven by increased research on epigenetic mechanisms and how they contribute to disease development. Moreover, Germany's well-established life sciences infrastructure and industry-academia collaboration projects foster innovation in assay development and diagnostic applications.

Asia Pacific DNA Methylation Market Trends

Asia Pacific is expected to grow fastest, with a CAGR of 15.72% during the forecast period, supported by various government initiatives. In addition, the increasing attention from international companies on the developing markets of the Asia Pacific continues to be a positive factor for growth. For instance, in August 2025, MedGenome launched its CNS Tumor Methylation Classifier Test in India, enabling precise classification of over 90 brain and CNS tumors, supporting diagnostics and targeted treatment decisions.

The China DNA methylation industry is growing rapidly, fueled by the increased use of NGS technologies, which have allowed for efficient and affordable DNA methylation analysis, fueling the expansion of the market. Microarray techniques provide a flexible and accurate method for researching DNA methylation, especially for focused investigations. The Chinese government's funding of healthcare facilities and services establishes a conducive atmosphere for expanding the DNA methylation market. For instance, in August 2022, oncgnostics GmbH launched its DNA methylation-based cervical cancer screening test GynTect in China, marking the first approved HPV-positive triage test and enabling early, accurate diagnosis.

The DNA methylation market in Japan is expanding due to the growing emphasis on personalized healthcare, which is also driving market demand. Partnerships amongst research institutes, medical facilities, and biotech firms are speeding up the development of novel DNA methylation assays and diagnostic tools.

MEA DNA Methylation Market Trends

The Middle East and Africa (MEA) DNA methylation industry is emerging due to rising biomedical research expenditures, increased understanding of the role of epigenetics in disease management, and the development of healthcare infrastructure. The development of DNA methylation analysis advance tools and diagnostic solutions is further fueled by supportive government initiatives, growing partnerships between regional research centers and international biotech companies, and the adoption of cutting-edge genomic technologies.

The Kuwait DNA methylation market is developing, driven by increasing awareness of epigenetic factors in disease, and government initiatives supporting advanced healthcare and genomics. The market's slow growth is also aided by the adoption of cutting-edge DNA methylation analysis technologies and growing partnerships with foreign research institutes.

Key DNA Methylation Company Insights

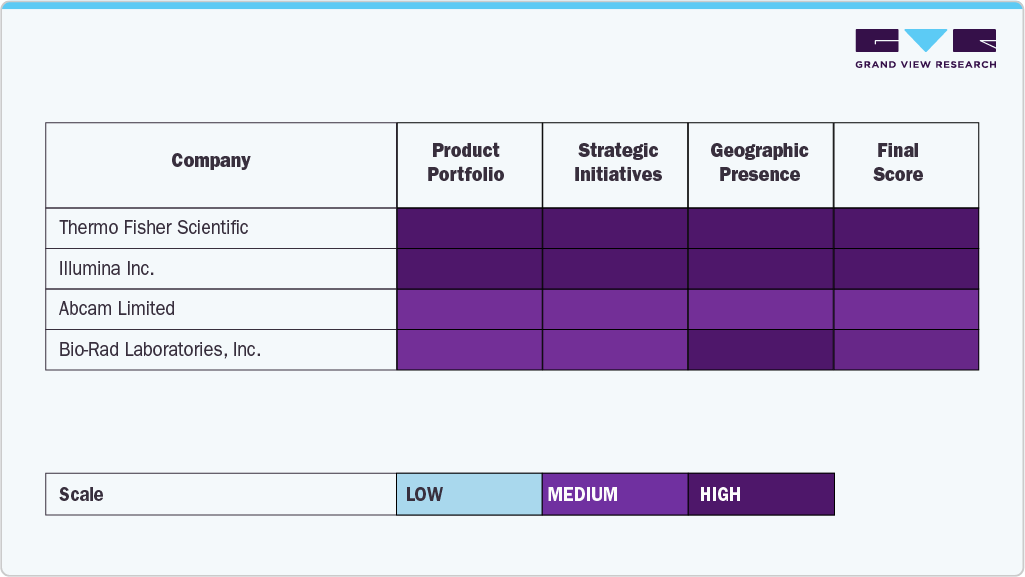

The DNA methylation industry is characterized by well-established players that maintain dominance through diversified product portfolios, technological advancements, and strategic collaborations in epigenetics and molecular diagnostics. Major players in the DNA methylation market, such as Thermo Fisher Scientific Inc., Illumina Inc., QIAGEN, Agilent Technologies Inc., and F. Hoffmann-La Roche Ltd, have the largest market share globally due to their range of DNA methylation analysis platforms, NGS capabilities, and their global distribution networks.

Some of the companies making inroads in a competitive market are Bio-Rad Laboratories, Inc., Abcam Limited, and Diagenode Diagnostics S.A. by providing quality products, including reagents, methylation-specific PCR kits, and assay solutions for research or clinical use. In addition to manufacturing quality assay products, some companies utilize automation, provide bioinformatics support, and partner with other organizations to help broaden their portfolio in translational and clinical research.

The market continues to evolve through a blend of established leadership and emerging innovators. Increased merger and acquisition activity, cross-industry partnerships, and rapid technological progress in methylation sequencing, automation, and data analytics are intensifying competition.

Key DNA Methylation Companies:

The following are the leading companies in the DNA methylation market. These companies collectively hold the largest market share and dictate industry trends.

- New England Biolabs

- Abcam Limited

- F. Hoffmann-La Roche Ltd

- Diagenode Diagnostics S.A.

- Thermo-Fisher Scientific Inc.

- Agilent Technologies Inc.

- Bio-Rad Laboratories, Inc.

- QIAGEN

- Active Motif, Inc.

- Illumina Inc.

Recent Developments

-

In April 2025, in the U.S., EpiCypher launched CUTANA meCUT&RUN and Multiomic CUT&RUN, cost-efficient DNA methylation sequencing assays, enabling high-resolution, scalable epigenomic profiling for drug discovery and academic research.

-

In April 2025, Agilent showcased its multiomic cancer research solutions in the United States, highlighting NGS-based DNA and methylation panels, automated hematologic assays, and strategic collaborations with Tagomics and Abcam.

-

In April 2024, NEB announced the launch of the Monarch Mag Viral DNA/RNA Extraction Kit. This kit boosts the retrieval of small quantities of viral DNA to allow for very precise detection. The kit efficiently and consistently extracts viral RNA and DNA using a magnetic bead process, allowing for easy automation at a larger scale.

DNA Methylation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.84 billion

Revenue forecast in 2033

USD 5.52 billion

Growth rate

CAGR of 14.73% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, product & service, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

New England Biolabs; Abcam Limited; F. Hoffmann-La Roche Ltd; Diagenode Diagnostics S.A.; Thermo-Fisher Scientific Inc.; Agilent Technologies Inc.; Bio-Rad Laboratories, Inc.; QIAGEN ; Active Motif, Inc.; Illumina Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global DNA Methylation Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global DNA methylation market on the basis of product & services, technique, application, end-use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Kits & Reagents

-

Instruments

-

Services

-

-

Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

PCR-Based Techniques

-

Sequencing-Based Techniques

-

Microarray-Based Techniques

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncolgy

-

Neurological Disorders

-

Stem Cell Research

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.