- Home

- »

- Biotechnology

- »

-

DNA Nanotechnology Market Size, Industry Report, 2030GVR Report cover

![DNA Nanotechnology Market Size, Share & Trends Report]()

DNA Nanotechnology Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Dynamic DNA Nanotechnology, Structural DNA Nanotechnology), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-562-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA Nanotechnology Market Size & Trends

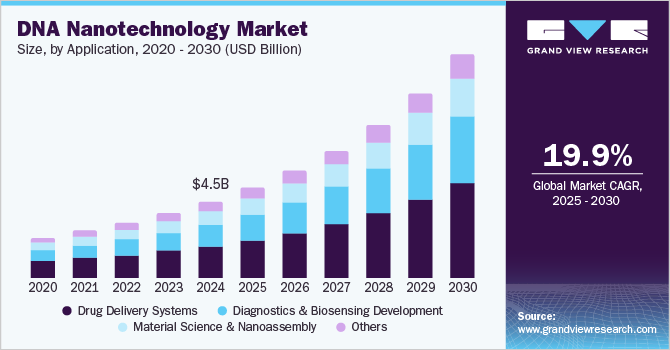

The global DNA nanotechnology market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 19.89% from 2025 to 2030. This strong growth is driven by increasing applications in targeted drug delivery, advanced diagnostics, and personalized medicine. Rising R&D investments, integration of AI in nanodevice design, and growing demand for innovative healthcare solutions are further fueling global market expansion.

The COVID-19 pandemic served as a strategic accelerator for the DNA nanotechnology industry, due to its critical role in rapid diagnostics, vaccine development, and targeted drug delivery. DNA nanostructures enabled sensitive detection of viral RNA and supported innovative therapeutic approaches. The urgent global demand for advanced biomedical technologies highlighted the versatility and potential of DNA nanotech, prompting increased funding, collaborative research, and faster adoption in healthcare.

In addition, strategic R&D investments are pivotal in driving innovation within the DNA nanotechnology industry. These investments foster the development of advanced nanodevices, expand application areas such as targeted drug delivery and diagnostics, and enhance production efficiency. Collaboration between research institutions and industry leaders accelerates technological advancements, addressing challenges related to scalability and stability. Continued R&D funding is essential for sustaining competitive advantage and unlocking long-term growth potential in the market.

The Evolution of DNA Nanotech:

In recent years, the fusion of nanotechnology and molecular biology has given rise to a transformative field: DNA nanotechnology, the manipulation of DNA at the nanoscale to construct structures with precise functionalities. This innovation has not only advanced scientific discoveries but has also unlocked new opportunities across the commercial landscape. Companies are increasingly harnessing this technology to drive product innovation, streamline manufacturing, and pioneer entirely new markets.

-

Product Development: DNA nanotechnology is significantly impacting product development. Companies like NanoString Technologies offer platforms that utilize DNA barcoding for high-throughput, multiplexed analysis of biological systems-tools that are essential for pharmaceutical R&D and diagnostics.

-

Data Storage: The ability of DNA to store vast amounts of data in an extremely compact format is being explored by startups such as Catalog Technologies, which envisions storing the entire accessible internet within a shoebox-sized DNA-based storage device.

-

Manufacturing: In manufacturing, DNA nanotech is enabling the creation of self-assembling materials. Zymergen, a biofabrication company, uses this technology to engineer microbes that produce materials with unique properties, potentially transforming sectors ranging from electronics to agriculture.

-

Therapeutics: In the healthcare space, DNA nanotechnology is facilitating the development of highly targeted drug delivery systems. Companies like Nuclera are pioneering DNA-based therapeutics designed to reach specific cells, thereby enhancing efficacy while reducing side effects.

-

Security: The unique coding properties of DNA are being leveraged for advanced anti-counterfeiting solutions. Applied DNA Sciences has developed DNA-based authentication technologies to protect products and supply chains from fraud across multiple industries.

Artificial Intelligence and Machine Learning in DNA nanotechnology for cancer detection and therapy:

Artificial Intelligence (AI) and Machine Learning (ML) are playing an increasingly vital role in enhancing DNA nanotechnology for cancer detection and therapy. By integrating AI/ML with DNA nanostructure design, researchers can model and predict the behavior of complex DNA assemblies with high accuracy. These tools help optimize DNA-based biosensors for early cancer detection by analyzing large datasets, such as gene expression profiles, tumor markers, and imaging data, to identify subtle patterns indicative of malignancy. AI-driven algorithms can also automate the customization of DNA aptamers and nanostructures to improve their binding specificity to cancer cells, significantly improving diagnostic sensitivity and speed.

In therapeutic applications, AI/ML algorithms assist in designing DNA nanocarriers tailored to deliver drugs selectively to tumor sites, minimizing off-target effects. By simulating interactions between DNA nanostructures and biological environments, AI helps refine the stability, folding, and targeting mechanisms of DNA-based delivery systems. Furthermore, ML models can monitor patient responses and adapt treatment strategies in real time, enabling personalized medicine approaches. Together, AI, ML, and DNA nanotechnology are converging to revolutionize cancer care by enabling earlier detection, smarter drug delivery, and more effective, data-driven treatment plans.

Funding Trends in the DNA Nanotechnology Industry:

Name

Description

Arizona State University

Received a total of $6 million in grants from the National Science Foundation (NSF) for two projects related to DNA nanotechnology. This includes a $3 million grant for developing DNA-enabled nanoelectronics and another $3 million grant for a project focusing on DNA-based electronics.

Ohio State University and Duke University

Awarded a $2 million grant from the NSF's Designing Materials to Revolutionize and Engineer our Future (DMREF) program for research on DNA nanodevices with applications in sensing, soft-robotics, energy, information storage, and medicine.

University at Albany

Arun Richard Chandrasekaran received a $1.95 million grant from the National Institute of General Medical Sciences for research in DNA nanotechnology for biomedical and materials science applications.

Aligned Bio

Secured SEK 19.4 million (approximately €1.6 million) in a funding round to accelerate the development and scale-up of their nanowire production technology for single-molecule DNA analysis.

Nanovery

Raised over £1.85 million (approximately $2.35 million) to advance its cancer diagnostic solutions using DNA nanotechnology. This includes contributions from various investors and a £750,000 grant from Innovate UK.

DNA Nanobots

Closed a pre-seed investment round in January 2024 to grow its DNA nanoparticle platform for targeted delivery of therapeutic agents. The exact amount was not disclosed.

USDA National Institute of Food and Agriculture (NIFA)

Awarded $3.8 million in grants for nanotechnology research, which may include projects involving DNA nanotechnology.

National Nanotechnology Initiative (NNI)

While not a specific funding, this U.S. government initiative coordinates federal nanotechnology research and development, supporting various projects, including those in DNA nanotechnology.

Imec. xpand Venture Capital Fund

Announced a $320 million fund targeting chip and nanotechnology investments, which may include DNA nanotechnology projects

Market Concentration & Characteristics

The DNA nanotechnology industry is highly innovation-driven, with rapid advancements in areas such as DNA origami, programmable nanostructures, and molecular self-assembly. Research institutions and biotech startups are pushing boundaries, developing novel applications in drug delivery, diagnostics, and synthetic biology. The high degree of customization and versatility of DNA-based nanostructures fuels constant R&D activity, making innovation a key competitive differentiator in the industry.

Mergers and acquisitions in DNA nanotechnology remain moderate but are gradually increasing as larger biotech and pharmaceutical companies seek to acquire niche technologies. Most M&A activities are concentrated around platforms that integrate DNA nanotech with complementary domains like AI-driven diagnostics or gene editing. As the market matures and commercial potential becomes clearer, strategic consolidation is expected to intensify.

Regulatory frameworks are still evolving for DNA nanotechnology, particularly due to its intersection with synthetic biology, nanomedicine, and biotechnology. While there is no unified global regulation, agencies like the FDA and EMA are beginning to develop guidelines for DNA-based therapeutic and diagnostic tools. Regulatory uncertainty can pose a barrier to commercialization, but increased regulatory clarity is anticipated as more products move into the clinical and commercial stages.

Product expansion in DNA nanotechnology is accelerating, particularly in healthcare, biosensing, and nanomaterials. Companies are diversifying their offerings to include DNA-based drug carriers, diagnostic kits, and nanosensors tailored for precision medicine. The modularity of DNA nanostructures allows for rapid adaptation to various applications, fostering continuous product innovation and market entry.

While the U.S. and parts of Europe lead in R&D and commercialization, regional expansion is gaining momentum in Asia-Pacific, particularly in China, Japan, and South Korea, driven by strong government support and growing biotech ecosystems. These regions are increasing investments in nanobiotech infrastructure and collaborative projects, making the DNA nanotechnology industry increasingly global in scope.

Technology Insights

The structural DNA nanotechnology segment dominated the market in 2024. These rigid and customizable DNA-based frameworks are essential for building nanoscale devices, drug delivery carriers, and biosensors with consistent performance and spatial accuracy. The increasing demand for nano-precision in diagnostics, therapeutics, and bioelectronics is propelling interest in structural DNA nanotechnology, supported by advancements in DNA origami techniques and automated design software that streamline fabrication and scalability for commercial use.

The dynamic DNA nanotechnology segment is projected to grow at the fastest CAGR over the forecast period due to the growing demand for smart and responsive nanodevices capable of performing complex tasks within biological environments. Unlike static structures, dynamic DNA nanostructures can change shape, reconfigure, or respond to external stimuli such as pH, temperature, or specific biomolecules, making them ideal for applications in targeted drug delivery, biosensing, and molecular computing. This adaptability is especially valuable in precision medicine and cancer therapeutics, where controlled release and real-time responsiveness are critical. As research progresses and real-world applications expand, the unique functional advantages of dynamic DNA nanotechnology continue to attract investment and commercialization interest.

Application Insights

The drug delivery systems segment dominated the market with the largest revenue share of 42.20% in 2024. DNA nanostructures offer unparalleled programmability, biocompatibility, and the ability to encapsulate and release drugs in response to specific biological signals, minimizing off-target effects and improving treatment outcomes. Their customizable design allows for precise control over size, shape, and functionalization, enabling the development of personalized therapies, especially in areas like cancer treatment and gene therapy. Growing demand for smarter, patient-specific drug delivery solutions is fueling investment and innovation in this segment of the market.

The diagnostics and biosensing development segment is projected to grow at the fastest CAGR of 20.95% over the forecast period. DNA-based nanostructures, such as aptamers and DNA origami platforms, can be precisely engineered to recognize target molecules, making them ideal for early disease detection, point-of-care diagnostics, and real-time monitoring of biological processes. Their programmability and versatility allow integration with optical, electrochemical, and fluorescence-based detection systems, enhancing diagnostic accuracy and reducing false positives. As demand grows for next-generation diagnostic tools in areas such as infectious diseases, oncology, and personalized medicine, DNA nanotechnology continues to gain traction as a transformative solution.

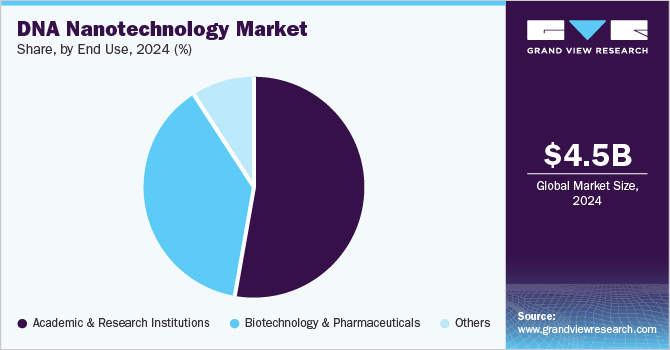

End Use Insights

The academic & research institutions segment dominated the market with the largest revenue share of 52.45% in 2024. Universities and research centers are at the forefront of developing novel DNA-based nanostructures and devices, supported by increasing government and private funding for cutting-edge biotechnology and nanoscience research. The ability to design and manipulate DNA at the nanoscale opens new avenues in synthetic biology, molecular computing, and materials science, attracting collaboration across disciplines such as chemistry, physics, biology, and engineering. This strong academic interest not only fuels innovation but also lays the groundwork for future commercial applications, making research institutions critical catalysts in advancing the DNA nanotechnology industry.

The biotechnology and pharmaceuticals segment is projected to grow at the fastest CAGR over the forecast period. DNA-based nanostructures offer customizable platforms for creating smart therapeutics, targeted delivery systems, and highly sensitive diagnostic tools, addressing key industry challenges such as off-target effects, low bioavailability, and early disease detection. Pharmaceutical companies are increasingly investing in DNA nanotech to enhance R&D efficiency, develop personalized treatments, and shorten the time-to-market for innovative therapies. This synergy between cutting-edge nanotechnology and drug development is accelerating the integration of DNA nanotech into mainstream biopharma pipelines.

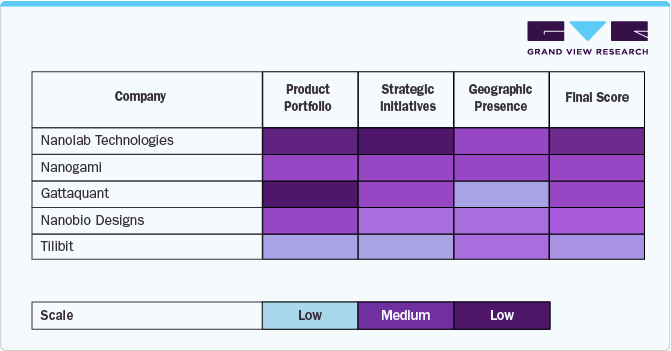

Competitive Scenario Insights

The DNA nanotechnology sector is witnessing dynamic competition, with several key players carving out distinct niches. Nanolab Technologies focuses on providing high-quality scaffold DNA and DNA origami kits, catering to laboratories worldwide. Their strategic partnership with Nanogami, a research organization specializing in DNA origami, enhances their capabilities in advancing DNA origami technology and supporting the global scientific community. Nanogami, backed by SPRIN-D funding, specializes in fabricating DNA origami probes for precise molecular placement on biochips, aiming to revolutionize molecular diagnostics by enabling single-molecule detection with high throughput. Their technology is positioned to enhance specificity and sensitivity in biochip applications, addressing the growing demand for advanced diagnostics.

These companies demonstrate a diverse range of applications and specializations within the DNA nanotechnology landscape, from foundational research and diagnostics to advanced imaging and custom nanostructure engineering. Their collaborative efforts and technological advancements contribute to the ongoing evolution of the field, addressing the increasing demand for precision and innovation in molecular diagnostics and nanotechnology applications.

Regional Insights

North America DNA nanotechnology industry dominated globally with a revenue share of 58.62% in 2024 and is projected to grow at the fastest CAGR over the forecast period, due to its strong research and development infrastructure, substantial investments in biotech and healthcare, and leading-edge advancements in nanotechnology applications. The presence of key industry players, coupled with high levels of government funding for scientific innovation, drives the region’s market leadership. In addition, North America's robust healthcare system and growing demand for precision medicine further contribute to the adoption of DNA nanotechnology in drug delivery, diagnostics, and personalized treatments. The region's early adoption of cutting-edge technologies, combined with a favorable regulatory environment, positions it as a global leader in the nanotechnology market.

U.S. DNA Nanotechnology Market Trends

The U.S. DNA nanotechnology industry leads due to substantial government funding, advanced research institutions, and a strong presence of key industry players. This is further supported by the high demand for precision medicine and innovative healthcare solutions.

Europe DNA Nanotechnology Market Trends

Europe DNA nanotechnology industry experienced second largest revenue growth in 2024 owing to strong governmental support for nanotechnology research, advanced academic institutions, and a growing focus on biotechnology innovation. The region’s emphasis on healthcare and personalized medicine, along with increased investments in R&D, is driving demand for DNA-based applications in diagnostics, drug delivery, and others. In addition, Europe’s progressive regulatory environment for nanotech solutions encourages market expansion while ensuring safety and ethical standards. Collaborative initiatives between European universities, research labs, and private enterprises further accelerate the development and commercialization of DNA nanotechnology, positioning the region as a significant player in the global market.

The UK DNA nanotechnology industry is witnessing a rising adoption of DNA nanotechnology due to strong government support for biotech innovation and a growing focus on precision medicine. Collaborative efforts between leading research institutions and industry players further accelerate its integration in healthcare applications.

Germany's DNA nanotechnology industry benefits from its robust industrial base and significant scientific research and innovation investment. The country’s leadership in biotechnology and advanced manufacturing facilitates the development and scaling of DNA-based applications in healthcare and diagnostics.

Asia Pacific DNA Nanotechnology Market Trends

Asia Pacific DNA nanotechnology industry exhibits significant growth owing to increasing investments in biotechnology, rising healthcare demands, and expanding research initiatives. The region benefits from a growing number of research institutions and a strong focus on advanced medical technologies. In addition, the increasing prevalence of chronic diseases and the need for innovative diagnostics and treatments drive the adoption of DNA nanotechnology. Countries such as China, Japan, and India are investing heavily in nanotech research, positioning Asia Pacific as a key player in the global market’s expansion.

China's DNA nanotechnology industry is expected to grow significantly due to increased government funding for biotech research and a strong emphasis on healthcare innovation. The country’s rapid advancements in nanotechnology and biotechnology drive the adoption of DNA-based applications in drug delivery and diagnostics.

Japan's DNA nanotechnology industry is growing due to strong government support for scientific research, a well-established biotech sector, and advancements in healthcare technology. The country’s focus on precision medicine and innovative drug delivery systems is accelerating the adoption of DNA nanotechnology in medical applications.

MEA DNA Nanotechnology Market Trends

The DNA nanotechnology industry in the Middle East and Africa is projected to drive the demand for DNA nanotechnology due to increasing investments in healthcare infrastructure and biotechnology research. Governments in the region are focusing on advancing medical technologies and improving healthcare systems, creating a demand for innovative diagnostic and therapeutic solutions. The rising prevalence of chronic diseases and the need for efficient drug delivery systems are fueling market growth. Collaborations between local research institutions, global biotech firms, and governments are expected to accelerate the development and adoption of DNA nanotechnology, positioning the region as a growing player worldwide.

The DNA nanotechnology industry in Kuwait is anticipated to grow steadily due to increasing government investments in healthcare and biotechnology research. The country's focus on advancing medical technology and improving diagnostics drives the demand for innovative DNA-based solutions.

Key DNA Nanotechnology Company Insights

Key players operating in the DNA nanotechnology industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling market growth.

Key DNA Nanotechnology Companies:

The following are the leading companies in the DNA nanotechnology market. These companies collectively hold the largest market share and dictate industry trends.

- Gattaquant

- Nanobio Designs

- Tilibit

- Helixworks

- SomaLogic

- EnaChip

- Ginkgo Bioworks

- Nanolab Technologies

- Nanogami

- DNA Nanobots, LLC

Recent Developments

-

In June 2024, DNA Nanobots secured an exclusive license for UC Berkeley's gene editing technology platform, focusing on non-viral gene delivery solutions utilizing DNA nanoparticles and CRISPR-Cas.

-

In January 2024, DNA Nanobots, announced the successful completion of its pre-seed funding round. The raised capital will fuel the launch of its BioPharma Partner Program, which is designed to provide end-to-end custom biopharma solutions, from design to development. The program aims to optimize preclinical and animal studies, thereby enhancing the delivery of a wide range of therapeutics.

-

In July 2022, SomaLogic Inc., a biotechnology firm, has acquired Palamedrix Inc., a California-based DNA nanotechnology company, for $52.5 million.

DNA Nanotechnology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.33 billion

Revenue forecast in 2030

USD 13.21 billion

Growth rate

CAGR of 19.89% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

Gattaquant; Nanobio Designs; Tilibit; Helixworks; SomaLogic; EnaChip; Ginkgo Bioworks; Nanolab Technologies; Nanogami; DNA Nanobots, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

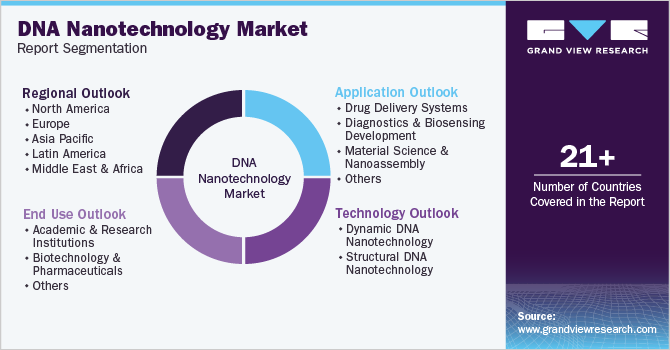

Global DNA Nanotechnology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DNA nanotechnology market report based on technology, application, end use, and region.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dynamic DNA Nanotechnology

-

Extended Lattices

-

Discrete Structures

-

Template Assembly

-

Others

-

-

Structural DNA Nanotechnology

-

Nanomechanical Devices

-

Strand Displacement Cascades

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Delivery Systems

-

Diagnostics and Biosensing Development

-

Material Science and Nanoassembly

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Academic & Research Institutions

-

Biotechnology and Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA nanotechnology market size was estimated at USD 4.51 billion in 2024 and is expected to reach USD 5.33 billion in 2025.

b. The global DNA nanotechnology market is expected to grow at a compound annual growth rate of 19.89% from 2025 to 2030 to reach USD 13.21 billion by 2030.

b. North America dominated the DNA nanotechnology market with a share of 58.62% in 2024. This is attributable to the region's increasing number of research and development initiatives, coupled with the growing adoption of innovative DNA-based technologies.

b. Some key players operating in the DNA nanotechnology market include Gattaquant, Nanobio Designs, Tilibit, Helixworks, SomaLogic, EnaChip, Ginkgo Bioworks, Nanolab Technologies, Nanogami, DNA Nanobots, LLC

b. Key factors driving market growth include the rising demand for drug delivery, biosensing, synthetic biology, and advancements in nanoscale engineering.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.