- Home

- »

- Biotechnology

- »

-

DNA & RNA Banking Services Market Size Report, 2030GVR Report cover

![DNA & RNA Banking Services Market Size, Share & Trends Report]()

DNA & RNA Banking Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service, By Specimen (Blood, Buccal Swabs & Hair Follicles, Others), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-325-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA & RNA Banking Services Market Summary

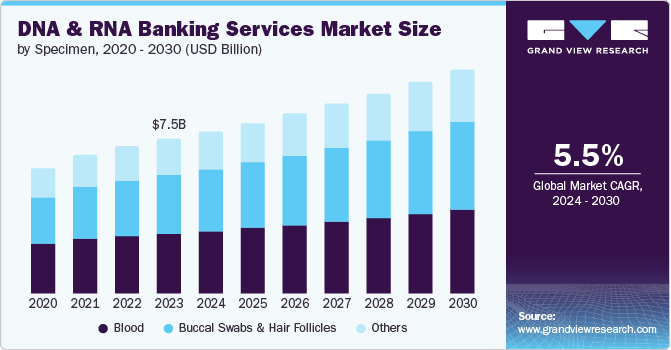

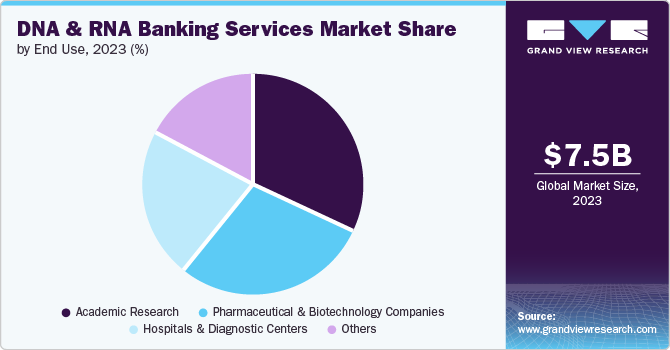

The global DNA & RNA banking services market size was valued at USD 7.53 billion in 2023 and is expected to reach USD 10.92 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. The increasing prevalence of genetic disorders and chronic diseases increases the demand for DNA and RNA banking services.

Key Market Trends & Insights

- North America DNA & RNA banking services market accounted for the largest market revenue share of 38.9% in 2023.

- The U.S. DNA & RNA banking services market dominated the North America market in 2023.

- By service, the storage service segment dominated the market and accounted for a share of 37.3% in 2023.

- By specimen, the blood segment accounted for the largest market revenue share in 2023.

- By application, drug discovery & clinical research accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.53 Billion

- 2030 Projected Market Size: USD 10.92 Billion

- CAGR (2024-2030): 5.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As genetic testing becomes more common for diagnosing and treating various medical conditions, the need to store genetic material for future use has surged. This trend is expected to drive the growth of the DNA & RNA banking services market as individuals seek to preserve their genetic information for potential healthcare needs.

Breakthroughs in genomics, including the development of CRISPR gene-editing technologies and next-generation sequencing, enhance the understanding of genetic information. These advancements foster a more significant demand for comprehensive genetic material storage as researchers and clinicians require high-quality samples for innovative studies and treatments. Personalized medicine, which tailors’ healthcare strategies based on an individual’s genetic profile, is becoming more prevalent, increasing the need for secure and accessible DNA and RNA banks.

The expansion of biobanking infrastructure and technological innovations are key factors propelling the DNA and RNA banking services market. Advances in biobanking technologies, such as improved sample preservation methods and enhanced storage solutions, are making it easier and more cost-effective for organizations to manage and maintain genetic material. Developing sophisticated data management systems also allows for better organization, analysis, and retrieval of genetic information. These technological improvements support the scalability of DNA and RNA banking services and encourage more institutions to invest in biobanking infrastructure.

Service Insights

The storage service segment dominated the market and accounted for a share of 37.3% in 2023. As personalized medicine evolves, there is a growing need to securely store vast amounts of genetic data. This trend is pushing healthcare providers, research institutions, and biotechnology companies to invest in advanced storage solutions that ensure the integrity and accessibility of genetic material for future diagnostic and therapeutic innovations.

The quality control services segment is anticipated to register the fastest CAGR of 6.4% over the forecast period. Agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national regulatory bodies have established stringent guidelines for the handling, storing, and quality of genetic materials used in research and clinical applications. These regulations demand rigorous Quality Control (QC) procedures to ensure that DNA and RNA samples are uncontaminated, correctly labeled, and stored under optimal conditions to maintain their integrity.

Specimen Insights

Blood specimen type accounted for the largest market revenue share in 2023. The rising prevalence of genetic disorders and chronic diseases with conditions such as cancer, cardiovascular diseases, and rare genetic disorders often require genetic testing for diagnosis, management, and treatment planning. Blood samples provide essential genetic material for detecting genetic mutations, understanding disease mechanisms, and developing targeted therapies.

Buccal swabs & hair follicles segment is anticipated to register the fastest CAGR over the forecast period. Advancements in DNA extraction and analysis technologies, such as improved isolation methods and more sensitive analysis technologies, have enhanced the quality and yield of genetic material obtained from buccal swabs and hair follicles. Technologies such as high-throughput sequencing and advanced PCR methods allow for more efficient and accurate genetic analysis from these specimen types.

Application Insights

Drug discovery & clinical research accounted for the largest market revenue share in 2023. The increasing adoption of precision medicine approaches integrating genomic data into clinical decision-making drives demand for high-quality genetic material stored in biobanks. Researchers can uncover valuable insights from DNA and RNA samples that inform personalized treatment strategies by leveraging advanced sequencing technologies and bioinformatics tools.

Therapeutics is anticipated to register the fastest CAGR over the forecast period. The expanding applications of DNA and RNA-based therapeutics, including gene editing, gene therapy, and mRNA-based vaccines, play a pivotal role in fostering market growth. As these innovative therapeutic modalities continue to gain traction in the healthcare industry, there is a heightened demand for high-quality genetic material for research, clinical trials, and commercialization. This has led to an increased reliance on DNA and RNA banking services to provide a reliable supply of genetic samples for the development of cutting-edge therapeutics, thus fueling the growth of this segment within the market.

End Use Insights

The academic research segment dominated the market in 2023. Government agencies, private foundations, and international organizations invest in genomic research to advance our understanding of genetics, uncover new disease mechanisms, and develop innovative treatments. For instance, initiatives such as the National Institutes of Health’s (NIH) All of Us Research Program and the European Union’s Horizon Europe program provide grants for research projects involving large-scale genomic data collection and analysis.

Hospitals & diagnostic centers segment is anticipated to register the fastest CAGR over the forecast period. Hospitals and diagnostic centers are increasingly offering specialized genetic tests for chronic conditions like cancer, cardiovascular diseases, and metabolic disorders, as well as for rare genetic disorders that require precise genetic information for diagnosis and management. As the healthcare industry emphasizes identifying genetic markers for these conditions, there is a growing need for a diverse collection of DNA and RNA specimens.

Regional Insights

North America DNA & RNA banking services market accounted for the largest market revenue share of 38.9% in 2023. North America focuses on integrating genetic testing into clinical practice to develop personalized treatment plans, improve patient outcomes, and predict disease risks. This shift towards customized medicine increases the need for comprehensive DNA and RNA banking services to support genetic testing, research, and the development of targeted therapies. Hospitals, diagnostic centers, and research institutions in North America are expanding their genetic testing capabilities, which drives the growth of the DNA & RNA banking services market.

U.S. DNA & RNA Banking Services Market Trends

The U.S. DNA & RNA banking services market dominated the North America market in 2023. The U.S. is home to several prestigious research institutions, biotech companies, and government agencies such as the National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC), which are at the forefront of genomic research. The development and commercialization of advanced technologies, including Next-Generation Sequencing (NGS), CRISPR-Cas9 gene editing, and RNA sequencing, are primarily driven by U.S.-based organizations. These technologies require substantial DNA and RNA samples for research and clinical applications. As these technologies evolve and become more accessible, the demand for high-quality DNA and RNA banking services increases, fueling market growth.

Europe DNA & RNA Banking Services Market Trends

Europe DNA & RNA banking services market was identified as a lucrative region in 2023. European countries are progressively integrating genetic information into clinical practice to provide personalized treatment plans, predict disease risks, and tailor preventive strategies. Initiatives such as the European Genomic Medicine Consortium aim to leverage genetic data for customized patient care and population health studies. The European Commission's Horizon Europe program supports this growing emphasis on personalized medicine, which funds various projects to advance genomic medicine.

The UK DNA & RNA banking services market is expected to grow rapidly in the coming years. The UK has seen an increased focus on identifying and treating rare diseases through initiatives such as the Rare Disease Framework, which aims to improve diagnosis, treatment, and care for individuals with rare conditions. Genetic testing is crucial for diagnosing these conditions and understanding their genetic underpinnings. Additionally, the increasing prevalence of chronic diseases like cancer, cardiovascular diseases, and diabetes has led to greater use of genetic tests for early detection and management of these conditions. This growing demand for genetic testing drives the need for robust DNA and RNA banking services to support research and diagnostic efforts.

Asia Pacific DNA & RNA Banking Services Market Trends

The Asia Pacific DNA & RNA banking services market is anticipated to register the fastest CAGR over the forecast period. Countries such as China, India, and Japan heavily invest in genomics to drive advancements in personalized medicine, cancer research, and rare disease studies. For instance, China’s National Genomics Data Center (NGDC) and the Chinese Academy of Sciences are leading initiatives to build large-scale genomic databases and promote innovative research in genomics. Similarly, India’s Department of Biotechnology has funded several projects focusing on genomics and bioinformatics. These investments foster the development of new technologies and methodologies, which drives the demand for DNA and RNA banking services to support various research initiatives and clinical applications.

India DNA & RNA banking services market is expected to grow rapidly in the coming years. The Indian Council of Medical Research (ICMR) and the Department of Biotechnology (DBT) fund large-scale genomics projects and biobanks to support research into genetic diseases, cancer, and personalized medicine. These investments enhance the capacity for DNA and RNA sample collection and analysis, driving the growth of the DNA & RNA banking services market in India.

Key DNA & RNA Banking Services Company Insights

Some of the key companies in the DNA & RNA banking services market include EasyDNA, DNA Genotek Inc., GoodCell, Infinity Biologix, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

EasyDNA offers individuals, researchers, and organizations various DNA and RNA banking services. Their services include storing and preserving genetic material for multiple purposes, such as future testing, research, or medical treatments. EasyDNA provides secure and reliable facilities for the long-term storage of DNA and RNA samples, ensuring the integrity and viability of the genetic material.

-

DNA Genotek Inc. offers a wide range of solutions for collecting, stabilizing, and storing genetic material, catering to various industries such as healthcare, research, and consumer genomics. DNA Genotek’s offerings include saliva-based collection kits that ensure high-quality DNA and RNA samples suitable for long-term storage and downstream analysis.

Key DNA & RNA Banking Services Companies:

The following are the leading companies in the DNA & RNA banking services market. These companies collectively hold the largest market share and dictate industry trends.

- EasyDNA

- DNA Genotek Inc.

- 23andMe, Inc.

- GoodCell

- ProteoGenex

- US Biolab Corporation, Inc.

- Infinity Biologix

- Thermo Fisher Scientific, Inc.

- deCODE genetics

- Brooks Life Sciences

- LGC Biosearch Technologies

- PreventionGenetics

Recent Developments

-

In April 2022, EasyDNA expanded its DNA and RNA banking services portfolio by launching a new and specialized service related to surrogacy DNA testing. This offering caters to individuals and families involved in surrogacy arrangements, providing accurate and reliable DNA testing services to establish biological relationships in cases of surrogacy births.

DNA & RNA Banking Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.91 billion

Revenue forecast in 2030

USD 10.92 billion

Growth Rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, specimen, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Argentina, Brazil, Saudi Arabia, Kuwait, UAE, South Africa

Key companies profiled

EasyDNA; DNA Genotek Inc.; 23andMe, Inc.; GoodCell; ProteoGenex; US Biolab Corporation, Inc.; Infinity Biologix; Thermo Fisher Scientific, Inc.; deCODE genetics; Brooks Life Sciences; LGC Biosearch Technologies; PreventionGenetics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DNA & RNA Banking Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global DNA & RNA banking services market report based on service, specimen, application, end use, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation Service

-

Processing Service

-

Storage Service

-

Quality Control Service

-

Data Storage

-

Others

-

-

Specimen Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Buccal Swabs & Hair Follicles

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Drug Discovery & Clinical Research

-

Clinical Diagnostics

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.