- Home

- »

- Network Security

- »

-

DNS, DHCP, And IPAM Market Size & Share Report, 2030GVR Report cover

![DNS, DHCP, And IPAM Market Size, Share & Trends Report]()

DNS, DHCP, And IPAM Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-151-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNS, DHCP, And IPAM Market Size & Trends

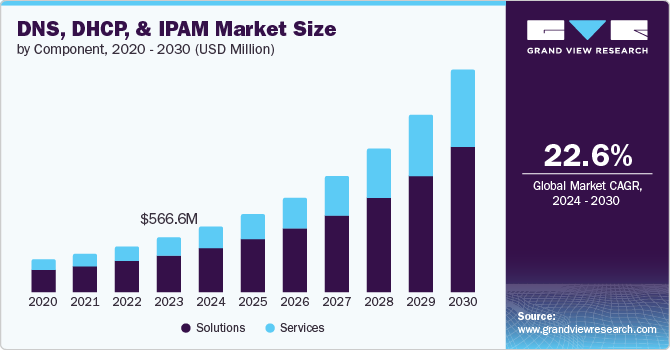

The global DNS, DHCP, And IPAM market size was valued at USD 566.6 million in 2023 and is projected to grow at a CAGR of 22.6% from 2024 to 2030. Increasing demand for network automation due to the complexity and scaling of different business operations, growing complexity of network infrastructure due to increased adoption of connected devices technology, rising penetration of advanced technologies such as the Internet of Things (IoT), cloud computing, and a dispersed workforce are the key drivers for the growth of DDI (DNS, DHCP, And IPAM) market.

Technological advancements and changing work culture has resulted in emergence of various novel practices such as Bring Your Own Device(BOYD), work from home, and remote work profiles. These work practices are assisted by the connected devices and advanced network technologies. Use of personal devices, smart phones, out of office or public network services has led to increasing need of security and scrutiny. These factors are expected to drive growth for this market in approaching years.

Modern businesses and organizations are adopting highly secure DNS (Domain Name System) as a gatekeeper, organizations can enhance data confidentiality by utilizing advanced DNS security features to identify and prevent suspicious activity. Increasing adoption, growing requirement of advanced DDI services, increasing dependability over connected devices technology, increased accessibility & availability of internet and global nature of business operations are projected to generate greater demand for this market during the forecast period.

Component Insights

Based on components, the solutions segment dominated the market and accounted for a share of 67.9% in 2023. An increase in demand for customized products and services, growing number of consulting projects delivered by companies and customized solutions preferred by businesses are the key factors fueling growth of this segment. DDI solutions are of different sorts such as hardware solutions, software solutions, cloud-based or network solutions and others.

Services segment is expected to experience the fastest CAGR from 2024 to 2030. DDI services consist of a variety of offerings such as integration, implementation, training, management and support. Increasing inclination towards automation in different industries is resulting in growing demand for DDI services. These services assist businesses in organizing tasks associated with the network administration and more.

Deployment Insights

The cloud deployment segment dominated the market and accounted for the largest revenue share in 2023. This is attributed to multiple factors such as the scalability of businesses and their global operations supported by cloud environments, growing inclination towards using cloud-based networks while deploying applications, and seamless integration provided by cloud technology. In addition, the growing adoption of advanced technologies such as the Internet of Things (IoT), connected devices and others are expected to drive growth for the cloud deployment in upcoming years.

On-premise deployment segment is projected to experience a significant growth rate during forecast period. This segment is mainly driven by the organizations operating in highly regulated industries such as security, finance, defense, healthcare, and others. Such organizations prefer to have complete control of their networks and choose on-premise deployments over cloud-based.

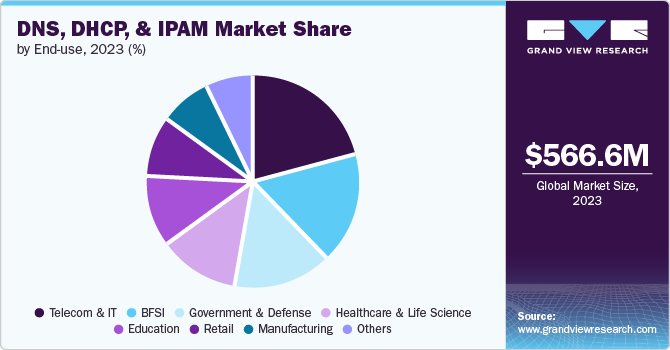

End Use Insights

The telecom and IT segment dominated the market in 2023. Technological advancements like 5G network services and cloud computing are transforming the delivery and consumption of telecommunications services. They facilitate faster speed, increased connectivity, and few more novel services. Geographical expansion strategies adopted by global telecommunication organizations are developing growth for this segment in the DDN market.

Manufacturing segment is projected to grow at the fastest CAGR over the forecast period. Enhancements in the manufacturing industry, including rising levels of mergers and acquisitions, government support, increased production capabilities, and significant investments from private equity and venture capitalists, are leading to growth in the market. Increasing need for efficient distribution and management of different business verticals is developing growing demand for DDI services in the manufacturing segment.

Enterprise Size Insights

Large enterprise segment dominated the market in 2023. Multiple businesses across numerous industries are adopting strategies such as geographical expansion, entering new regional markets, collaborations, acquisitions, and business integrations to develop competitive advantage over other market participants. This has resulted in growing use of advanced technologies, networks, security measures, and connected devices technologies, which in turn, has been developing demand for DDN market.

SMEs are expected to witness the fastest CAGR during the forecast period. SMEs in multiple industries operate at smaller or medium scale, yet their dependence on networks and connected devices is higher. The need of robust security measures and efficient network administration tasks is projected to drive growth for this segment from 2024 to 2030. According to U.S. Chamber of Commerce, small businesses in America employ nearly half of the regional workforce and contribute for 43.5% of total GDP of America. The SMEs are considered as critical part of the economy where they play role of vendors, stakeholders, partners, and collaborators for the big businesses.

Application Insights

The network automation segment held the largest revenue share in 2023. Expansion of services and network virtualization fueled by emergence of advancements in network accessibility, rising usage of interconnected devices and growing work culture encouraging combination of remote and in-office work environments has driven the demand for the flexible network. The rise in data centers as a result of an increase in network traffic has also developed the requirement for network automation.

Network security segment is projected to grow at the fastest CAGR from 2024 to 2030.The increasing number of businesses international as well as domestic and unceasing use of network connections in developing economies has generated greater demand for network security market. The growing adoption of technologies such as AI, IoT, virtual reality and mixed reality is a major factor fueling the need for the network security services. Moreover, the rising need for cloud-based network security solutions to minimize data loss and to prevent potential cyber-attacks is also fueling the growth for this segment.

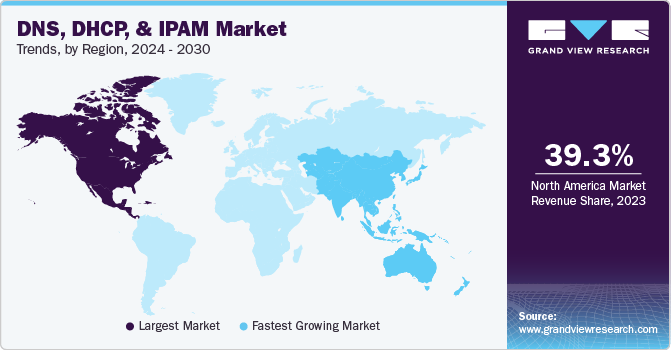

Regional Insights

North America DDI (DNS, DHCP, and IPAM) market held largest revenue share of the global industry in 2023. The presence of numerous businesses operating in various industries such as information technology, banking & finance, defense, healthcare and telecommunication is developing rising demand for the DDI services. Most of the businesses working in these industries are inclined towards the adoption of DDI solutions to have better control over their networks and related business functions.

U.S. DNS, DHCP, And IPAM Market Trends

The U.S. held 76.7% share of regional market in 2023. This is attributed to increasing adoption of connected devices technology, rising use of network based devices, growing acceptance of remote work culture and alarming need for network security measures. Constant threats of cyberattacks, inevitable dependence on technology in industries such as communications, defense, and finance, growth in presence of global business networks, and increasing number of SMEs in the country are expected to fuel growth for this market during forecast period.

Europe DNS, DHCP, And IPAM Market Trends

Europe DNS, DHCP, And IPAM market was identified as a lucrative region for this industry. Europe has an important impact on the DDI market. Its growing technological landscape and digital infrastructure is most likely to develop growth trends for this industry in approaching years. Rising adoption of modern technologies such as IoT, artificial intelligence, and connected devices, presence of large enterprises operating in industries such as pharmaceuticals, cosmetics, food & beverages, e-commerce, consumer goods, and automobile, growing dependence on network based security solutions and increasing availability of efficient DDI services in the region are projected to generate growth for this regional market.

UK DDI (DNS, DHCP, and IPAM) market is expected to experience noteworthy CAGR in approaching years. This market is primarily driven by the factors including rising applications of DDI solutions in multiple industries, growing dependability on connected networks, presence of multiple global businesses in the country and technological advancements leading to the requirement of efficient network security and network administration solution.

Asia Pacific DNS, DHCP, And IPAM Market Trends

Asia Pacific DNS, DHCP, And IPAM market is anticipated to witness fastest CAGR from 2024 to 2030. Some of the key aspects driving growth for this market are increasing adoption of technological advancements in developing economies like India, presence of large unorganized sectors searching for efficient solutions, unceasing growth in use of devices such as smartphones and laptops, and growing availability of Internet across the region.

DDI (DNS, DHCP, and IPAM) market in India held significant revenue share of the regional industry owing to increasing adoption of DDI solutions by key businesses operating in the country, the presence of large enterprises employing huge pool of personnel operating with the help of common networks, growing business operations for industries such as banking & finance, telecommunication, e-commerce, retail and others.

Key DNS, DHCP, And IPAM Company Insights

Some of the key companies operating in the DDI (DNS, DHCP, and IPAM) market include Microsoft, Infoblox, Cisco Systems, Inc., and others. As the global market has been experiencing rising competition and constantly changing customer demands, key companies in the market are adopting a variety of strategies such as innovation, collaboration, new service discoveries, new product developments, and geographical inventions.

-

Microsoft, one of the prominent companies in the technology industry, primarily offers built-in DDI capabilities such as DNS and DHP services that can suffice the requirements of small to medium-sized companies.

-

Infoblox, a prominent organization in the DDI solutions industry, provides enterprise-grade offerings. The DDI solutions offered by the company include NIOS DDI andBloxOne DDI, which integrate with on premise and cloud-based deployment respectively.

Key DNS, DHCP, And IPAM Companies:

The following are the leading companies in the DNS, DHCP, and IPAM market. These companies collectively hold the largest market share and dictate industry trends.

- BlueCat Networks

- Microsoft

- Infoblox

- Cisco Systems, Inc.

- MEN&MICE

- EfficientIP

- FusionLayer

- TCPWave Inc.

- SolarWinds Worldwide, LLC

Recent Developments

-

In February 2023, Cygna Labs, a major market participant in DDI products and services, acquired Nokia’s VitalQIP business and product portfolio. The deal included the acquisition of all the relevant intellectual properties, customer contracts and the entire team of personnel who have worked on the VitalQIP portfolio earlier.

DNS, DHCP, And IPAM Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 677.7 million

Revenue forecast in 2030

USD 2.3 billion

Growth Rate

CAGR of 22.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, and South Africa

Key companies profiled

BlueCat Networks, Microsoft, Infoblox, Cisco Systems, Inc., MEN&MICE, EfficientIP, FusionLayer, TCPWave Inc., SolarWinds Worldwide, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DNS, DHCP, And IPAM Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DDI (DNS, DHCP, and IPAM) market report based on component, deployment, enterprise size, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Network Automation

-

Virtualization and Cloud

-

Data Center Transformation

-

Network Security

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecom and IT

-

BFSI

-

Government and Defense

-

Healthcare and Life Sciences

-

Education

-

Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.