- Home

- »

- Electronic & Electrical

- »

-

Doorbell Camera Market Size, Share, Industry Report, 2033GVR Report cover

![Doorbell Camera Market Size, Share & Trends Report]()

Doorbell Camera Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Wired Doorbell Camera, Wireless Doorbell Camera), By Distribution Channel (Offline Channel, Online Channel), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-380-5

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Doorbell Camera Market Summary

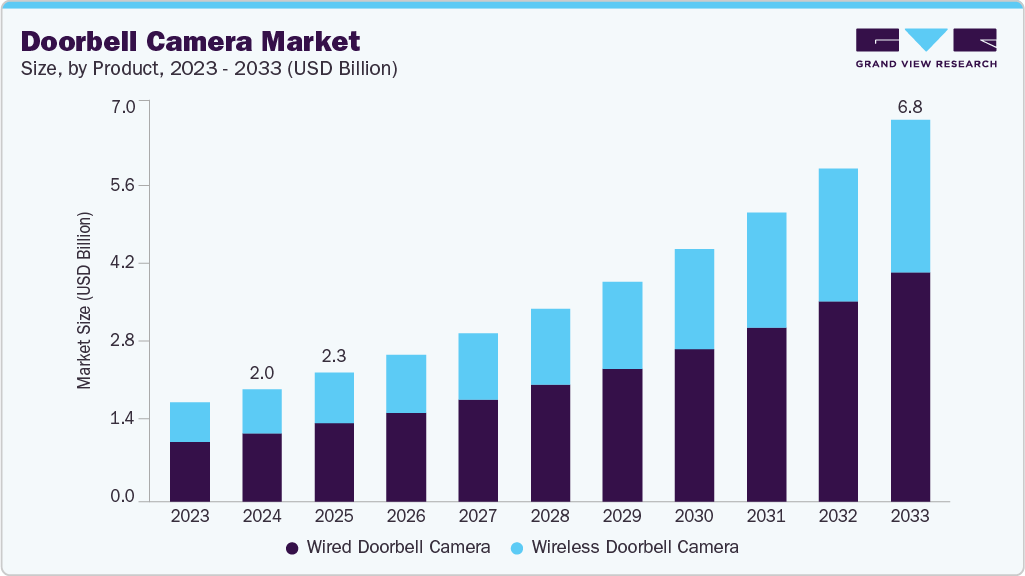

The global doorbell camera market size was estimated at USD 2.02 billion in 2024 and is projected to reach USD 6.84 billion by 2033, growing at a CAGR of 14.5% from 2025 to 2033. The market growth is driven by rising cases of burglary and crime worldwide, as well as increasing consumer spending on smart home devices.

Key Market Trends & Insights

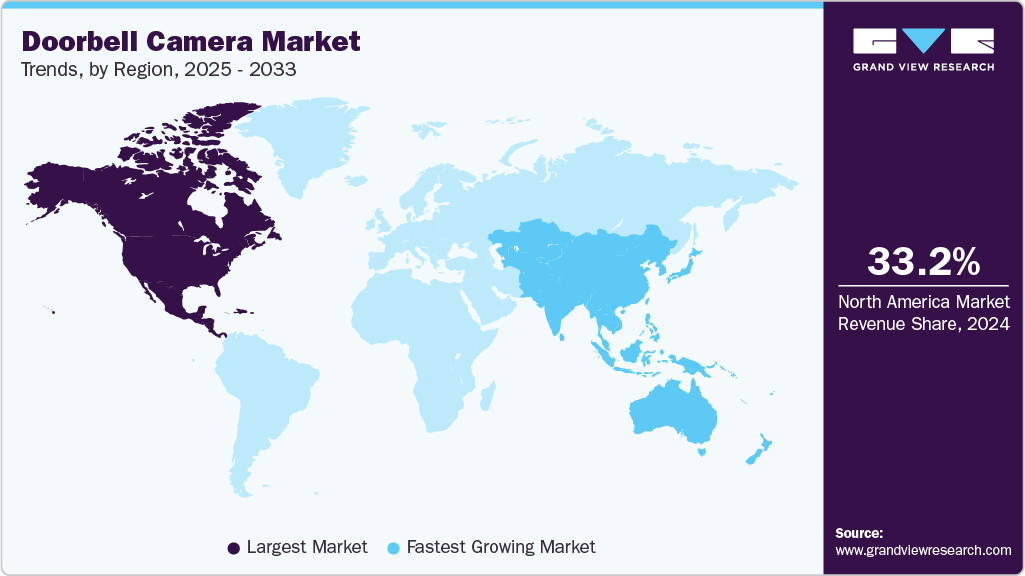

- The North America doorbell camera market held the largest global revenue share of 33.2% in 2024.

- The U.S. doorbell camera industry remains the largest market in North America, accounting for share of 79.4%in 2024.

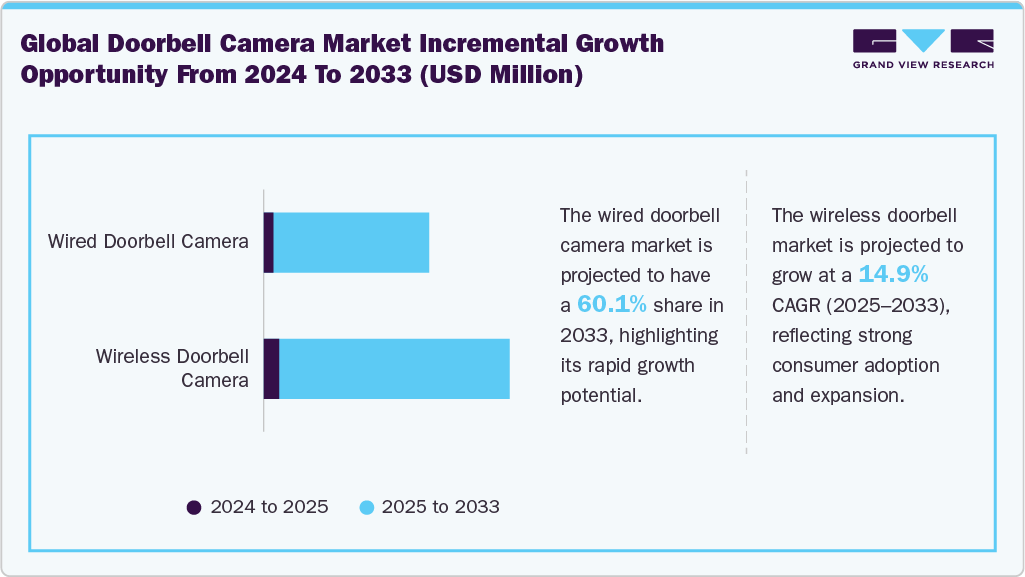

- By product, the wired doorbell camera segment held the largest share of 61.0% in 2024.

- By distribution channel, the offline channel segment held the largest share of 67.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.02 Billion

- 2033 Projected Market Size: USD 6.84 Billion

- CAGR (2025-2033): 14.5%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Rising awareness regarding home safety is expected to drive the product demand in the doorbell camera industry. Moreover, growing concerns regarding the security, safety, and well-being of individuals and families are expected to play a key role in increasing the scope of doorbell cameras. The industry's growth is further supported by the growing awareness among the masses regarding the integration of artificial intelligence (AI) into their daily routines for comfort and luxury. Tech hardware companies are manufacturing products that leverage AI features to modify and update their offerings, catering to the evolving needs of consumers. For instance, most doorbell cameras have been integrated with a two-way audio system to assist users with better communication with the visitor.

Integrating high-resolution cameras provides detailed, clear images and videos, which are essential for identifying visitors and capturing important security footage, thereby enhancing the device's overall effectiveness. Moreover, long battery life ensures that doorbell cameras remain operational without frequent recharging or battery replacement, offering continuous surveillance. These features enhance the user experience and increase the perceived importance and utility of the doorbell camera, driving its adoption in both residential and commercial settings. To cater to these demands, companies are introducing advanced doorbell features that provide consumers with clarity and reliability. For instance, in May 2024, Xiaomi launched the Smart Maoyan 2 smart doorbell camera, which has an 8000 mAh battery that lasts up to 300 days. The product features a 3-megapixel camera, providing a resolution of 2048 x 1536 and HDR support. The 180-degree wide-angle lens minimizes blind spots outside the door.

In today’s scenario, security devices are considered a necessity to keep oneself protected and alert, ensuring house safety. A rising number of crimes, including theft and burglary, has increased the prominence of home security devices, including doorbell cameras. Burglaries in the U.S. have been steadily decreasing, with reports dropping by 8.6% in 2024 compared to the previous year and a 19% decline in the first half of 2025. Residential break-ins are now 26% lower than in 2019. However, the theft of non-precious metals has surged by 71% over the last five years. In 2022, the FBI reported 847,522 burglaries, equivalent to 269.8 incidents per 100,000 people. Despite this downward trend, homes without security systems remain highly vulnerable, being 300% more likely to experience a break-in, with a burglary occurring every 26 seconds in the U.S.

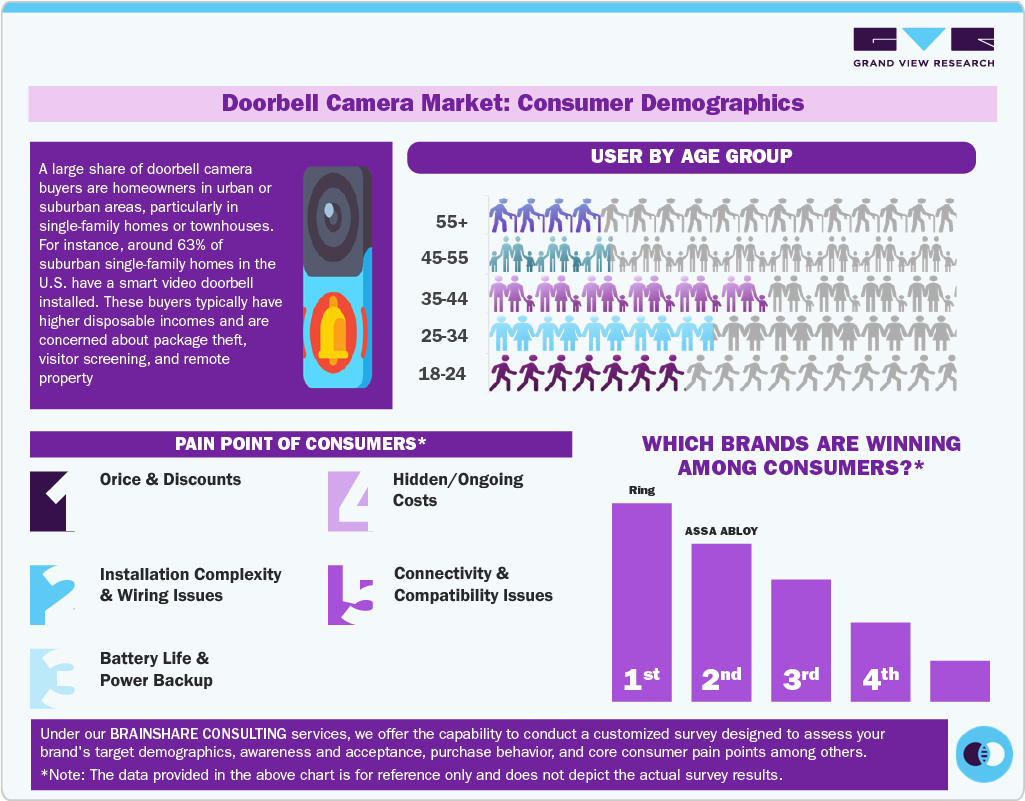

Consumer Insights for Doorbell Camera:

Product Insights

The wired doorbell camera market accounted for the largest revenue share of 61.0% in 2024. Wired doorbell cameras are connected directly to the electrical system, ensuring they receive a constant power source. It eliminates concerns about battery life or the need for frequent recharging, making them dependable for long-term surveillance. The continuous power supply ensures the camera is always operational, providing uninterrupted security coverage and reliability. For instance, in October 2023, Ecobee, a subsidiary of Generac Power Systems, launched the wired Ecobee Smart Doorbell Camera. It is designed to provide homeowners with a better field of view and integrates with Ecobee's Smart Thermostat Premium. It also incorporates several AI-powered features, including advanced radar verification and computer vision, providing homeowners with more accurate detection and meaningful notifications. Users also create customized activity zones to focus on specific areas, such as a porch or walkway.

The wireless doorbell camera market is projected to grow at the fastest CAGR of 14.9% from 2025 to 2033. Wireless doorbell cameras do not require complex wiring or professional installation, making them suitable for self-installation for enthusiasts and renters who do not have permission to change their property's wiring. The installation typically involves mounting the camera and connecting it to a Wi-Fi network, allowing users to position the camera at optimal locations without being restricted by existing wiring or electrical outlets. This ease of installation and flexibility is expected to drive the demand in the market.

Distribution Channel Insights

The sales of doorbell cameras through offline channels led the doorbell camera industry, accounting for the largest revenue share of 67.2% in 2024. Physical retail stores allow customers to experience and test doorbell cameras before making a purchase. Sales associates in electronics and home improvement stores are often knowledgeable about their products and provide detailed information, answer questions, and offer recommendations based on individual customer needs. Interactive displays and in-store demonstrations help consumers understand the features and benefits of various models, enabling them to make informed purchasing decisions.

The sales of doorbell cameras through online distribution channels are projected to grow at a significant CAGR of 15.0% from 2025 to 2033. E-commerce platforms provide a comprehensive range of doorbell camera models, brands, and price points, allowing consumers to find the product that best suits their needs and budget. Detailed product descriptions, specifications, customer reviews, and ratings provide valuable information that enables consumers to make informed purchasing decisions. Additionally, online retailers frequently run promotions, discounts, flash sales, and bundle deals that provide added value to consumers.

Regional Insights

The North America doorbell camera market captured a significant share of 33.2% in 2024. The growth is primarily driven by the rising demand for advanced home security solutions, as an increasing number of consumers are incorporating tech-integrated devices into their home security strategies. Heightened security concerns and the growing trend of smart home automation bolster the demand for video doorbells. In particular, North American consumers are increasingly opting for premium doorbell cameras that offer advanced features, such as facial recognition, motion detection, and remote access. This market growth is also supported by the widespread availability of these devices through established retail networks and robust online distribution channels. Furthermore, consumers' heightened interest in home security and smart home systems, along with technological innovations, is fostering strong growth in the region.

U.S. Doorbell Camera Market Trends

The U.S. remains the largest market in North America, accounting for 79.4% of the regional revenue share in 2024. The growth of the U.S. market is driven by strong consumer purchasing power, a growing interest in home automation, and an increasing focus on personal safety. Innovations in AI-powered features, such as real-time alerts and facial recognition, are attracting consumers seeking enhanced security. Retail partnerships and omnichannel strategies have improved the accessibility of these devices, expanding their reach to a broader consumer base. Additionally, the U.S.'s growing focus on mental health and relaxation therapies further supports the adoption of home security devices, including video doorbells.

Europe Doorbell Camera Market Trends

The doorbell camera industry in Europe held a significant share of 27.7% in 2024.The Europe market is being shaped by an increasing preference for smart home devices, as well as a growing demand for energy-efficient and eco-friendly products. Consumers are becoming more conscious of sustainability, and as a result, there is a strong demand for durable, energy-efficient video doorbells. The market is also benefiting from government initiatives aimed at promoting employee wellness, which has contributed to the growing adoption of smart home security devices in the workplace and at home. Additionally, the aging population across Europe, with higher disposable incomes, continues to drive demand for wellness-oriented devices, including video doorbells with features such as two-way communication and real-time video streaming.

The Germany doorbell camera market held the largest share of 21.8% in 2024. The demand for doorbell cameras in Germany is supported by the country’s strong healthcare infrastructure and a focus on high-quality, precision-engineered products. Consumers value durable, premium doorbell cameras that integrate well with other smart home systems. There is also a growing trend of incorporating smart security devices, like video doorbells, into physical rehabilitation and orthopedic care routines, which is further contributing to the market’s expansion in Germany. With the increasing awareness of personal security and preventive wellness programs, households in Germany are increasingly adopting video doorbell solutions to enhance their home security and overall quality of life.

Asia Pacific Doorbell Camera Market Trends

The Asia Pacific doorbell camera industry is projected to grow at the fastest CAGR of 15.5% from 2025 to 2033. The rapid urbanization and rising middle-class income levels in countries like China, Japan, South Korea, and India are driving the adoption of home security solutions, including video doorbells. In these markets, there is a growing awareness of the importance of home security, along with a strong demand for affordable, feature-rich devices that offer seamless integration with other smart home technologies. The availability of low-cost, high-quality devices from local manufacturers is making video doorbells more accessible to a wider consumer base.

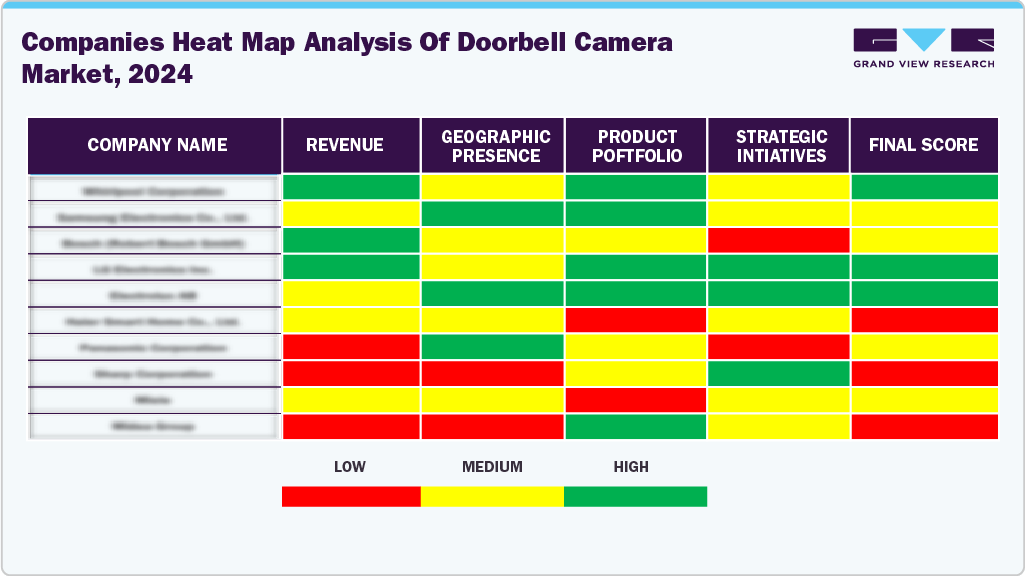

Key Doorbell Camera Company Insights

Numerous leading brands in the doorbell camera market have recognized significant opportunities within their product portfolios and are actively working to capitalize on these gaps. These companies are focusing on launching innovative designs, expanding customization options, and tailoring their marketing strategies to better align with evolving consumer preferences and cultural trends. By targeting niche segments and meeting emerging consumer demands, these brands aim to expand their market share and enhance their competitive positioning on a global scale.

Key Doorbell Camera Companies:

The following are the leading companies in the doorbell camera market. These companies collectively hold the largest market share and dictate industry trends.

- ASSA ABLOY

- AUXTRON

- Hangzhou Hikvision Digital Technology Co. Ltd.

- IFI Techsolutions

- Napco Security Technologies, Inc.

- Ring LLC

- SkyBell Technologies Inc.

- Vivint, Inc.

- VTech Communications, Inc.

- Zmodo

Recent Developments

-

In September 2025, Ring unveiled its most advanced lineup of home security cameras and doorbells, introducing new 2K and 4K models featuring Retinal Vision technology for lifelike visual clarity and enhanced low-light performance. These new devices, including Wired Doorbell Pro, Spotlight Cam Pro, Floodlight Cam Pro, and Outdoor Cam Pro (with PoE options), offer detailed imaging powered by AI for sharper and more reliable video surveillance, along with a 10x zoom feature.

-

In August 2025, Philips Hue launched its first video doorbell, the Hue Secure model, priced at $169.99, available in October. It features a 2K image sensor and a fish-eye lens for clear video quality, and operates via wired installation. The doorbell supports both 2.4GHz and 5GHz Wi-Fi and integrates with Hue lights via Zigbee, enabling automatic lighting when someone approaches. It also includes a plug-in chime that acts as a siren but requires the Hue system to function.

-

In August 2025, Aqara unveiled a new lineup of smart home products at IFA 2025 in Berlin, focusing on premium doorbell cameras and outdoor security solutions. The highlight is the Doorbell Camera G400, a wired video doorbell that integrates deeply with Apple HomeKit Secure Video, offering 2K resolution, "head-to-toe" coverage, and on-device facial recognition with Apple's encrypted cloud for privacy.

Doorbell Camera Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 2.31 billion

Revenue Forecast in 2033

USD 6.84 billion

Growth rate

CAGR of 14.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

ASSA ABLOY; AUXTRON; Hangzhou Hikvision Digital Technology Co. Ltd.; IFI Techsolutions; Napco Security Technologies, Inc.; Ring LLC; SkyBell Technologies Inc.; Vivint, Inc.; VTech; Communications, Inc.; Zmodo

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Doorbell Camera Market Report Segmentation

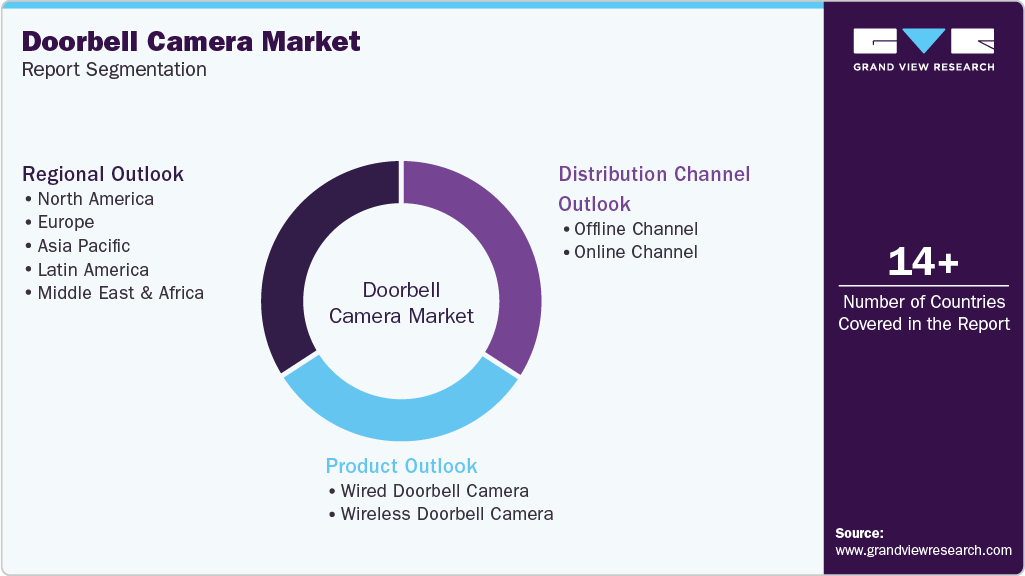

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global doorbell camera market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired Doorbell Camera

-

Wireless Doorbell Camera

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline Channel

-

Online Channel

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global doorbell camera industry was valued at USD 2.02 billion in 2024 and is expected to reach USD 2.31 billion in 2025.

b. The global doorbell camera market is projected to grow at a CAGR of 14.5% from 2025 to 2033 to reach USD 6.84 billion by 2033.

b. North America doorbell camera market captured a significant share of 33.2% in 2024. This is attributable to rising adoption of this product by residents as well as the authorities of local cops and police insisted the citizens to use video cameras, as these products not only deter the criminal, but also act as a solid evidence for proving the crime.

b. Some key players operating in the doorbell market include ASSA ABLOY; AUXTRON; Hangzhou Hikvision Digital Technology Co. Ltd.; IFI Techsolutions; Napco Security Technologies, Inc.; Ring LLC; SkyBell Technologies Inc.; Vivint, Inc.; VTech; Communications, Inc.; Zmodo

b. Key factors that are driving the market growth include rising cases of burglary and crime worldwide, as well as increasing consumer spending on smart home devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.