Doors Market Size & Trends

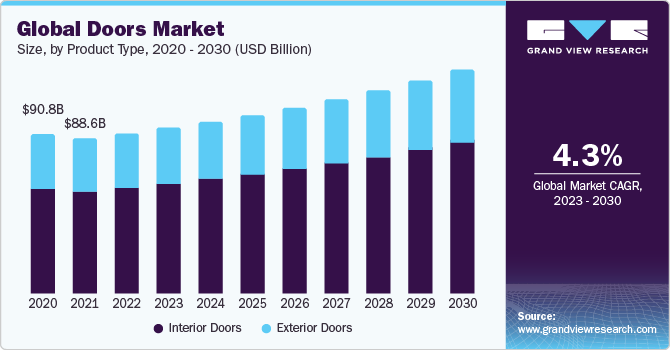

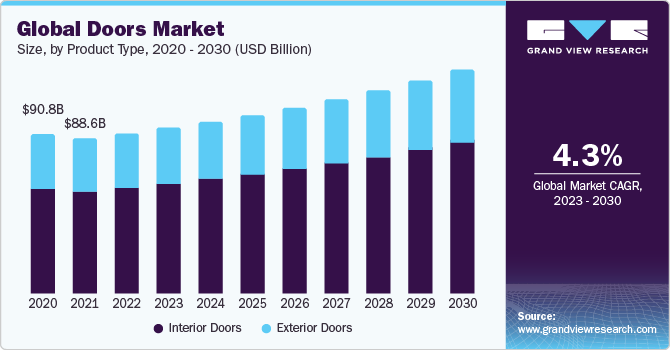

The global doors market was valued at USD 91.28 billion in 2022 and is expected to grow at a CAGR of 4.3% over the forecast period. Increasing construction spending across the globe is anticipated to elevate the penetration of residential and commercial structures. In recent years, the commercial construction industry has witnessed significant growth owing to increasing infrastructural developments. Rising urbanization and rising middle class income is anticipated to fuel the demand for construction industry, which in turn leads to the growth of the market over the forecast period.

The COVID-19 pandemic has had a significant impact on the door market, causing disruptions and changes in supply and demand patterns. Lockdowns, travel restrictions, and social distancing measures disrupted the global supply chain for door components and materials. Manufacturers faced challenges in obtaining raw materials, hardware, and other components.

The door market is influenced by a combination of economic, environmental, technological, and societal factors. These factors collectively drive the demand, supply, and trends in the wood industry. The construction industry is a major driver of the market. A strong demand for housing and commercial building projects leads to increased consumption of doors. Changing architectural styles and design preferences influence the choice of door types and styles.

Wood is a renewable resource, and the increasing focus on sustainability and eco-friendliness has driven the demand for wood doors as an alternative to non-renewable materials. The interior design and furniture industries rely heavily on wood for various applications. Consumer preferences for wooden furniture and fixtures contribute to the demand.

Product Type Insights

Based on the product type, the market is segmented into exterior and interior doors. The interior door segment held the largest market share in 2022, primarily owing to the growing residential sector across the globe. They are known for their natural beauty, warmth, and versatility, and are designed for use within the building and serve to provide privacy and separate rooms. They come in various styles and can be solid or hollow core. Exterior wood doors specially designed to withstand outdoor elements, offering both security and aesthetic appeal. They are often used as front, patio and garage doors.

Material Insights

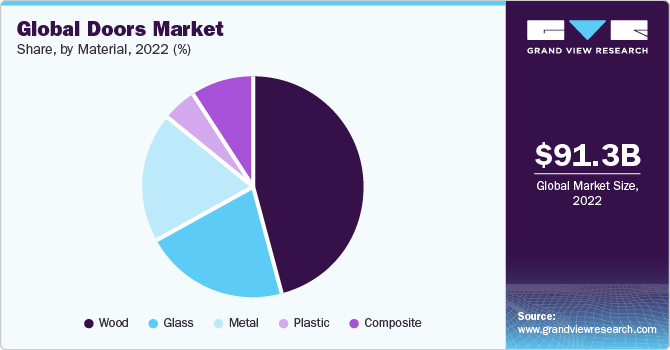

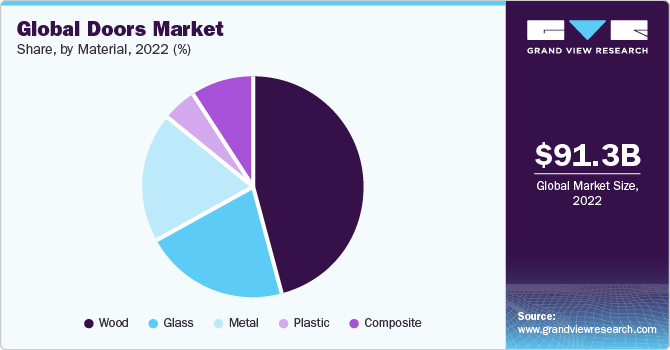

On the basis of material, the market is segmented into wood, glass, metal, composite, and plastic. The wood door segment held the largest market share in 2022, due to their properties such as aesthetics, durability, energy efficiency, and sound resistance.They are resistant to temperature changes and a great option if insulation is a key issue.

They are a classic choice for their beauty and versatility. They can complement a wide range of architectural styles, from traditional to modern. When properly maintained, they can provide many years of service while enhancing the aesthetic appeal of a home or building. Various types of woods are used in door manufacturing, and the choice of woods can significantly affect the appearance, cost, and durability of the door. Common wood species used for manufacture include oak, mahogany, cherry, pine, maple, and fir. Moreover, they can be easily customized in terms of size, shape, style, and finish. This allows for a high degree of personalization, making it possible to create doors that perfectly match the architectural design and style of a building.

Application Insights

New construction and aftermarket doors are two distinct categories used in building and renovation projects. They serve different purposes and are typically applied at different stages of a building's life cycle. New construction doors are installed during the initial construction or building phase of a structure. They are integrated into the building's framework and design from the outset. In addition, these are chosen to complement the architectural style of the new structure and are often part of the initial design plan.

The aftermarket doors, also known as replacement doors, are installed after the initial construction of a building. They are used to replace existing doors that are damaged, outdated, or in need of an upgrade.

Regional Insights

Asia Pacific dominated the market due to rising construction activities in countries such as the China, and India. According to the U.S. Department of the Treasury June 2023 report, the U.S. experienced a rise in industrial construction spending. Since 2021, the country’s real spending on construction of manufacturing facilities has doubled. However, the spending on national non-residential construction decreased by 0.2% in May 2023, according to Associated Builders and Contractors analysis report published in July 2023.

The demand for doors in Europe has been experiencing steady growth in recent years. This growth can be attributed to surging construction activities, in the region. According to the European Parliament report, approximately 90% of the buildings in the region were built before 1990 and over 40% before 1960. This fueled the requirement for several buildings requiring renovation and reconstruction in Europe. Thus, the flourishing construction industry in the region contributes to the demand for doors in Europe.

Key Companies & Market Share Insights

Key players operating in the market are ASSA ABLOY, dormakaba Group Allegion US, Masonite, Simpson Door Company, ANDERSEN CORPORATION, JELD-WEN, Inc., PGT Custom Windows and Doors. The market players are involved in the new product launches, partnerships, M&A activities, and other strategic alliance to increase their footprint in the market. The following are some instances of such initiatives.

On March 10, 2022, Kitchen Magic, a leading kitchen remodeling firm launched stylish new offerings, including six new cabinet colors and two new contemporary door styles.

On January 4th, 2022, Masonite International Corporation, a leading global manufacturer, designer, marketer, and distributor of exterior and interior doors, launched the first residential exterior doors to incorporate lights, power, a smart lock, and a video doorbell into the door system.