- Home

- »

- Pharmaceuticals

- »

-

Dopamine Agonist Market Size, Share, Industry Report 2030GVR Report cover

![Dopamine Agonist Market Size, Share & Trends Report]()

Dopamine Agonist Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug (Non-ergot Dopamine Agonists, Ergot Alkaloids), By Route Of Administration (Oral, Injectable), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-531-1

- Number of Report Pages: 153

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dopamine Agonist Market Size & Trends

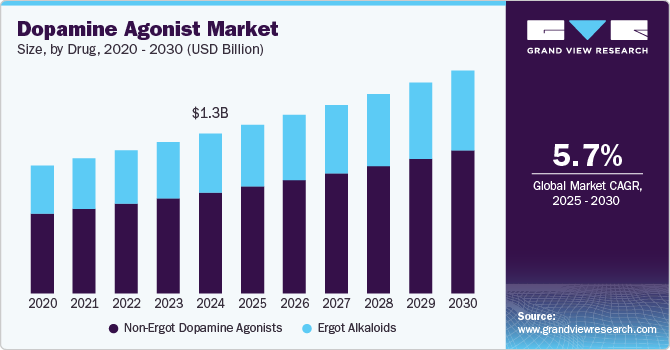

The global dopamine agonist market size was estimated at USD 1.31 billion in 2024 and is projected to grow at a CAGR of 5.70% from 2025 to 2030. The market is driven by several key factors, primarily the rising prevalence of Parkinson’s disease, restless leg syndrome, and other neurological disorders that require dopamine-modulating treatments. As the global population ages, the incidence of these conditions is expected to increase, further fueling demand. In addition, advancements in drug formulations, such as extended-release and transdermal options, enhance patient compliance and expand market potential.

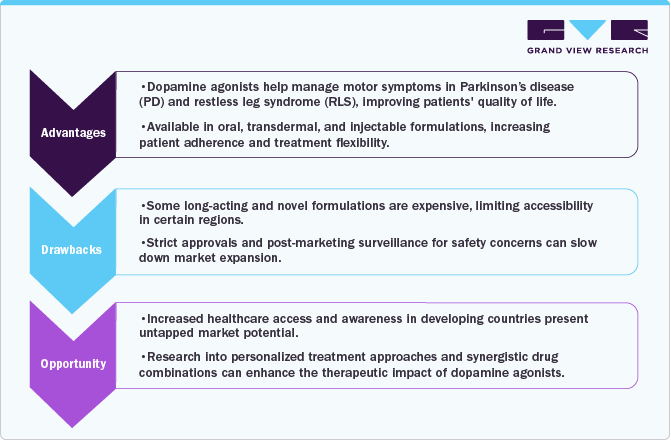

Currently, four dopamine agonists are FDA-approved and available for treating Parkinson’s disease (PD) in the U.S. The FDA-approved dopamine agonists for Parkinson’s disease (PD)-Mirapex (pramipexole), Requip (ropinirole), Neupro (rotigotine), and Apokyn (apomorphine)-offer diverse formulations, including oral, transdermal, and injectable options, enhancing treatment flexibility. The availability of long-acting formulations and continuous transdermal delivery has improved patient adherence and symptom control. However, the market is evolving with next-generation pipeline candidates like tavapadon (D1/D5 agonist) and IRL1117 (D1/D2 agonist), which promise better receptor selectivity, fewer side effects and improved dosing regimens. These innovative pipeline therapies could disrupt the market, challenging existing brands by addressing limitations such as dyskinesia, impulse control disorders, and fluctuating efficacy, potentially shifting market dynamics towards more precise and patient-friendly treatments.

In September 2024, AbbVie Inc. announced positive topline results from its pivotal Phase 3 TEMPO-1 trial for the clinical pipeline drug tavapadon, an investigational D1/D5 dopamine receptor partial agonist being studied as a once-daily treatment for Parkinson's disease. The clinical trial, which assessed two fixed doses (5 mg and 15 mg, once daily) in adults with early Parkinson’s disease, met its primary endpoint. Patients treated with tavapadon experienced a statistically significant improvement from baseline compared to placebo in the Movement Disorder Society-Unified Parkinson’s Disease Rating Scale (MDS-UPDRS) Part III scores, demonstrating its efficacy, safety, and tolerability in clinical trials. AbbVie’s market presence and investment in Parkinson’s research clinical pipeline could accelerate tavapadon’s commercial adoption, driving competition and innovation in the dopamine agonist space.

Moreover, IRL1117, currently in the preclinical phase, is being developed as a next-generation oral treatment for the core symptoms of Parkinson’s disease (PD), with the potential to replace levodopa while maintaining equal or superior efficacy without its long-term side effects. Expected to enter clinical development by late 2024 or early 2025, IRL1117’s D1/D2 receptor agonist profile could offer more stable symptom control and reduce complications like dyskinesia associated with levodopa. If successful, it could significantly disrupt the dopamine agonists industry, shifting treatment paradigms from traditional levodopa-based regimens toward more sustainable and well-tolerated therapies, thereby intensifying competition with existing dopamine agonists and shaping the future landscape of Parkinson’s treatment.

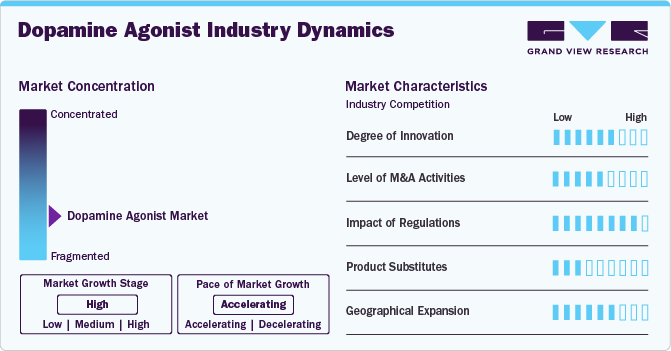

Market Concentration & Characteristics

The dopamine agonist industry is evolving with advancements in drug formulations, targeted delivery systems, and combination therapies. Innovations in both ergot alkaloids and non-ergot dopamine agonists focus on enhancing efficacy, minimizing side effects, and improving patient adherence. Long-acting injectables, extended-release oral formulations, and novel mechanisms of action are key areas of research. Emerging therapies aim to address conditions such as Parkinson's disease, restless legs syndrome (RLS), and hyperprolactinemia with improved bioavailability and reduced dosing frequency.

The market is experiencing significant merger and acquisition (M&A) activities driven by leading pharmaceutical companies seeking to strengthen their portfolios in neurological and endocrine disorders. Companies such as Teva Pharmaceutical Industries Ltd, GSK plc., Supernus Pharmaceuticals, Inc., and H. Lundbeck A/S are actively acquiring biotech firms to access novel drug formulations, improve production capacities, and expand their global presence. The increasing demand for effective oral and injectable dopamine agonists is fueling industry consolidation.

Regulatory authorities, including the FDA and EMA, impose stringent guidelines on dopamine agonists to ensure their safety, efficacy, and quality. The approval process involves extensive clinical trials and regulatory reviews, often prolonging market entry and increasing development costs. In addition, reimbursement policies and pricing strategies significantly impact adoption, particularly for high-cost injectable formulations. Companies must navigate complex regulatory landscapes to ensure broad accessibility and market penetration.

Dopamine agonists face competition from alternative therapies such as levodopa-based treatments, monoamine oxidase-B inhibitors, and catechol-O-methyltransferase (COMT) inhibitors for Parkinson's disease. In conditions like hyperprolactinemia and RLS, non-pharmacological interventions, lifestyle modifications, and surgical procedures serve as potential substitutes. Despite competition, dopamine agonists remain a preferred choice due to their targeted mechanism of action, long-term efficacy, and expanding clinical applications.

Companies are focusing on expanding their footprint in high-growth regions such as Asia-Pacific, Latin America, and the Middle East, where the prevalence of Parkinson's disease and other dopamine-related disorders is increasing. Market leaders such as Amneal Pharmaceuticals LLC, UCB Pharma, Novartis AG, VeroScience LLC, Pfizer Inc., and Boehringer Ingelheim Pharmaceuticals, Inc. are leveraging strategic partnerships, local regulatory approvals, and innovative pricing models to drive market penetration. Challenges such as affordability, supply chain logistics, and regulatory compliance continue to shape regional growth strategies.

Drug Insights

Based on drug, the market has been categorized into ergot alkaloids and non-ergot dopamine agonists. The non-ergot dopamine agonists segment held the largest revenue share of 63.11% in 2024. This dominance is attributed to their improved safety profile, lower risk of fibrosis-related side effects, and high efficacy in treating Parkinson’s disease, restless legs syndrome (RLS), and other neurological disorders. Non-ergot dopamine agonists, such as Pramipexole, Ropinirole, Rotigotine, and Apomorphine, have gained widespread adoption due to their superior tolerability and minimal cardiovascular complications compared to ergot-derived counterparts.

The ergot alkaloids segment is the second largest segment in the market. This segment includes Bromocriptine, Cabergoline, and Pergolide, which have historically been used for treating Parkinson’s disease, hyperprolactinemia, and acromegaly. An emerging trend in this segment is the rise of generic ergot alkaloid-based dopamine agonists, driven by the expiration of key patents and increased manufacturing capabilities of generic pharmaceutical companies. This shift is making these drugs more affordable and accessible, particularly in developing markets. In addition, continued research into modified formulations and combination therapies is helping reduce side effects and improve patient adherence.

Application Insights

Based on application, the market has been categorized into Parkinson's disease, Restless Legs Syndrome (RLS), hyperprolactinemia, and others. The Parkinson's disease segment held the largest revenue share of 64.15% in 2024. The rising prevalence of Parkinson’s disease (PD), with nearly 1 million cases in the U.S. expected to reach 1.2 million by 2030 and 90,000 new diagnoses annually, is significantly driving the adoption of dopamine agonists. As the second-most common neurodegenerative disorder, PD affects over 10 million people worldwide, with men being 1.5 times more susceptible than women. The economic burden, estimated at USD 52 billion annually in the U.S., including treatment, lost income, and social security costs, underscores the demand for cost-effective therapies. With medication costs averaging USD 2,500 per year, the need for affordable and long-acting dopamine agonists, including generic formulations, is increasing, further fueling market expansion.

The Restless Legs Syndrome (RLS) segment is expected to be the fastest growing in the market due to increasing awareness, rising diagnosis rates, and expanding patient populations, particularly among the aging demographic. The growing preference for non-ergot dopamine agonists like pramipexole, ropinirole, and rotigotine, which offer high efficacy with fewer side effects, is driving adoption. In addition, as treatment guidelines recognize dopamine agonists as a first-line therapy for moderate to severe RLS, prescription rates are surging. This, coupled with advancements in long-acting formulations and transdermal delivery systems, positions RLS as the most rapidly expanding segment in the market.

Route of Administration Insights

Based on route of administration, the market has been categorized into oral injectables and others. The oral segment held the largest revenue share of 46.58% in 2024. driven by its high patient compliance, ease of administration, and widespread availability. Oral formulations, including pramipexole, ropinirole, and bromocriptine, are the first-line treatment for conditions like Parkinson’s disease and Restless Legs Syndrome (RLS), contributing to their strong market share.

The injectable segment is expected to exhibit significant growth in the market over the forecast period. This growth is fueled by the rising adoption of Apomorphine injections and infusions for advanced Parkinson’s cases where oral therapies become less effective. The demand for rapid symptom relief, continuous drug delivery systems, and innovations in subcutaneous and extended-release injectables is accelerating growth in this segment, particularly for patients with motor fluctuations and severe disease progression.

Distribution Channel Insights

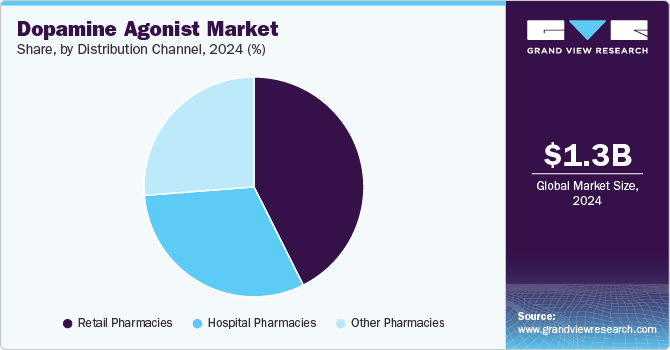

Based on distribution channel, the market has been categorized into hospital pharmacies, retail pharmacies, and other pharmacies. The retail pharmacies segment held the largest revenue share of 42.61% in 2024. This dominance can be attributed to their widespread accessibility, convenience, and high prescription refill rates for chronic conditions like Parkinson’s disease and Restless Legs Syndrome (RLS). Patients prefer retail pharmacies for ease of access to oral dopamine agonists, competitive pricing, and insurance coverage.

The other pharmacies segment is expected to exhibit significant growth in the market over the forecast period. This growth is driven by increasing digital adoption, doorstep medication delivery, and rising demand for specialty drugs like injectable dopamine agonists. The expansion of e-pharmacies, coupled with discount programs, telemedicine integration, and improved cold chain logistics for injectables, is further fueling this segment’s rapid growth outside of hospital pharmacies.

Regional Insights

The North America dopamine agonist market maintained a leading position in 2024 with a global revenue share of 38.03%. Market growth is driven by the increasing prevalence of Parkinson's disease, restless legs syndrome (RLS), and hyperprolactinemia. Advancements in drug formulations, including oral and injectable therapies, are improving patient compliance and accessibility. Expanding biopharmaceutical research, regulatory approvals, and the adoption of both ergot alkaloids and non-ergot dopamine agonists are further propelling market expansion. Hospital and retail pharmacies remain key distribution channels, with growing demand for targeted therapies.

U.S. Dopamine Agonist Market Trends

The dopamine agonist industry in the U.S. is leading in terms of revenue share due to high R&D investments, early regulatory approvals, and strong biopharmaceutical infrastructure. The increasing use of non-ergot dopamine agonists in Parkinson's disease and RLS, along with innovations in sustained-release and oral formulations, is driving market growth. In addition, the rise in hyperprolactinemia cases is boosting demand for targeted dopamine agonist therapies. The shift toward novel drug delivery technologies is improving accessibility and adherence.

Europe Dopamine Agonist Market Trends

Europe dopamine agonist industry is experiencing steady growth, with Germany, France, and the UK at the forefront. Government support for biotech innovations, increased investment in personalized medicine, and a strong clinical research landscape are key drivers. The market benefits from expanding applications of ergot and non-ergot dopamine agonists in neurodegenerative diseases and movement disorders. Hospital pharmacies dominate distribution, while retail pharmacies are increasing accessibility for chronic disease treatments.

The dopamine agonist industry in the UK is driven by the rising demand for dopamine agonists due to the growing prevalence of Parkinson's disease and RLS. Increased funding for biopharmaceutical R&D, expansion in clinical trials, and collaborations between academia and industry are fostering market growth. The demand for both oral and injectable formulations is rising, with hospital pharmacies leading in distribution and retail pharmacies gaining traction.

The dopamine agonist industry in Germany remains a key market in Europe, supported by advanced drug synthesis technologies, a strong manufacturing base, and expanding biopharmaceutical pipelines. The demand for dopamine agonists in Parkinson's disease, RLS, and hyperprolactinemia is increasing. Government initiatives supporting biotech funding and local pharmaceutical manufacturing are enhancing market expansion.

France’s dopamine agonist industry is expanding due to increased clinical adoption of both ergot and non-ergot dopamine agonists for neurological disorders. Regulatory advancements, public healthcare initiatives, and higher investments in biologics research are key market drivers. Hospital pharmacies play a dominant role in oncology and chronic disease drug distribution, while retail pharmacies are expanding access.

Asia Pacific Dopamine Agonist Market Trends

The Asia Pacific dopamine agonist industry is witnessing the fastest CAGR of 6.11% over the forecast period due to a rising chronic disease burden, increased healthcare access, and expanding biotech industry investments. Countries such as China, India, and Japan are leading this expansion, supported by increasing clinical trials, local drug manufacturing, and regulatory approvals. Advancements in oral and injectable drug delivery technologies are further driving market penetration.

Japan dopamine agonists industry is experiencing increasing adoption of dopamine agonists, particularly for Parkinson’s disease and metabolic disorders. Government funding for neurodegenerative disease research, pharmaceutical collaborations, and a focus on aging-related diseases are key growth factors. Hospital pharmacies continue to dominate distribution, while retail pharmacies are expanding accessibility for chronic disease management.

China’s dopamine agonist industry is growing rapidly due to expanding biopharmaceutical manufacturing, increasing R&D investments, and strong government support for targeted drug development. The demand for ergot and non-ergot dopamine agonists for neurological and endocrine disorders is rising. Local production capabilities and international partnerships are strengthening the market.

Latin America Dopamine Agonists Market Trends

Latin America dopamine agonists industry is experiencing growth driven by rising healthcare expenditures, increased awareness of dopamine-based treatments, and expanding access to specialty pharmaceuticals. Brazil is a key market, with government-led health initiatives, growing clinical research, and an increasing focus on pharmaceutical manufacturing.

Brazil dopamine agonist industry is growing due to increasing demand for dopamine agonists in Parkinson’s disease and RLS treatment. Hospital pharmacies remain the dominant distribution channel, with retail pharmacies expanding accessibility for chronic disease management. Regulatory improvements and rising investments in local biotech firms are accelerating market growth.

Middle East & Africa Dopamine Agonist Market Trends

The Middle East & Africa dopamine agonist industry is expanding due to growing healthcare infrastructure, increased biotech investments, and a rising chronic disease burden. Countries such as Saudi Arabia and South Africa are witnessing increased demand for dopamine-based therapies, supported by government initiatives to enhance healthcare access.

Saudi Arabia’s dopamine agonist industry is growing rapidly, supported by government-driven healthcare modernization, increased R&D investment, and rising demand for targeted therapies. Hospital pharmacies remain the primary distribution channel, with retail pharmacies expanding their presence. Regulatory advancements under Vision 2030 are further boosting market growth.

Key Dopamine Agonist Company Insights

Leading players in the dopamine agonist industry include Teva Pharmaceutical Industries Ltd., GSK plc., Supernus Pharmaceuticals, Inc., H. Lundbeck A/S, Amneal Pharmaceuticals LLC, UCB Pharma, Novartis AG, VeroScience LLC, Pfizer Inc., and Boehringer Ingelheim Pharmaceuticals, Inc. The market is driven by the increasing demand for targeted therapies, advancements in drug synthesis technologies, and the growing adoption of dopamine agonists in Parkinson’s disease, RLS, and hyperprolactinemia.

Product innovation and regulatory approvals remain key strategies for leading companies to maintain a competitive edge. Emerging players are focusing on niche areas such as sustained-release formulations and novel drug delivery systems, including oral and injectable dopamine agonists. Strategic partnerships with biotech firms, research institutions, and contract manufacturing organizations (CMOs), along with active participation in clinical trials, are enabling companies to accelerate development, expand market reach, and strengthen their position in the evolving dopamine agonist landscape.

Key Dopamine Agonist Companies:

The following are the leading companies in the dopamine agonist market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical Industries Ltd

- GSK plc.

- Supernus Pharmaceuticals, Inc.

- H. Lundbeck A/S

- Amneal Pharmaceuticals LLC

- UCB Pharma

- Novartis AG

- VeroScience LLC.

- Pfizer Inc.

- Boehringer Ingelheim Pharmaceuticals, Inc.

Recent Developments

-

In August 2024, AbbVie Inc. completed its USD 8.7 billion acquisition of Cerevel Therapeutics, a clinical-stage biopharmaceutical company specializing in neuroscience diseases. This acquisition strengthens AbbVie's position in the neuroscience market, potentially accelerating innovation in dopamine agonist therapies and enhancing competition in treatments for neurological disorders.

-

In December 2024, AbbVie Inc. announced positive topline results from its pivotal Phase III TEMPO-2 trial evaluating tavapadon, a first-in-class D1/D5 partial dopamine agonist, as a flexible-dose monotherapy for early Parkinson’s disease. Tavapadon is being investigated as a once-daily treatment, potentially offering a novel approach to PD management.

-

In September 2023, a tornado severely damaged Pfizer’s Rocky Mount facility, which produces sterile injectable drugs, including dopamine, potassium acetate, and vitamin K1 for neonatal care. The plant supplies approximately 25% of Pfizer’s sterile injectables for U.S. hospitals, accounting for around 8% of total U.S. consumption.

Dopamine Agonist Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.39 billion

Revenue forecast in 2030

USD 1.83 billion

Growth rate

CAGR of 5.70% from 2025 to 2030

Actual data

2018 - 2024

forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug, application, route of administration, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE, Saudi Arabia, Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd, GSK plc., Supernus Pharmaceuticals, Inc., H. Lundbeck A/S, Amneal Pharmaceuticals LLC, UCB Pharma, Novartis AG, VeroScience LLC., Pfizer Inc., Boehringer Ingelheim Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dopamine Agonist Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dopamine agonist market report based on drug, application, route of administration, distribution channel, and region:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Ergot Alkaloids

-

Non-Ergot Dopamine Agonists

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Parkinson's Disease

-

Restless Legs Syndrome (RLS)

-

Hyperprolactinemia

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dopamine agonist market size was estimated at USD 1.31 billion in 2024 and is expected to reach USD 1.38 billion in 2025.

b. The global dopamine agonist market is expected to grow at a compound annual growth rate of 5.70% from 2025 to 2030 to reach USD 1.83 billion by 2030

b. Based on drug, the Non-Ergot dopamine agonists segment accounted for the largest revenue share of 63.11% in 2024. Non-ergot dopamine agonists, such as pramipexole and ropinirole, are preferred due to lower risks of fibrosis and cardiovascular complications compared to ergot-derived alternatives

b. Key players operating in the market are Teva Pharmaceutical Industries Ltd, GSK plc., Supernus Pharmaceuticals, Inc., H. Lundbeck A/S, Amneal Pharmaceuticals LLC, UCB Pharma, Novartis AG, VeroScience LLC., Pfizer Inc., and Boehringer Ingelheim Pharmaceuticals, Inc.

b. The dopamine agonist market driven by factors such as rising prevalence of neurological disorders, growing geriatric population, and advancements in drug formulations & delivery methods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.