- Home

- »

- Automotive & Transportation

- »

-

Dozer Market Size, Share And Trends, Industry Report, 2033GVR Report cover

![Dozer Market Size, Share & Trends Report]()

Dozer Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Crawler Bulldozers, Mini/Compact Dozers), By Engine Capacity (Up to 250 HP, 250 - 500 HP), By Propulsion (Electric, ICE), By End Use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-681-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dozer Market Summary

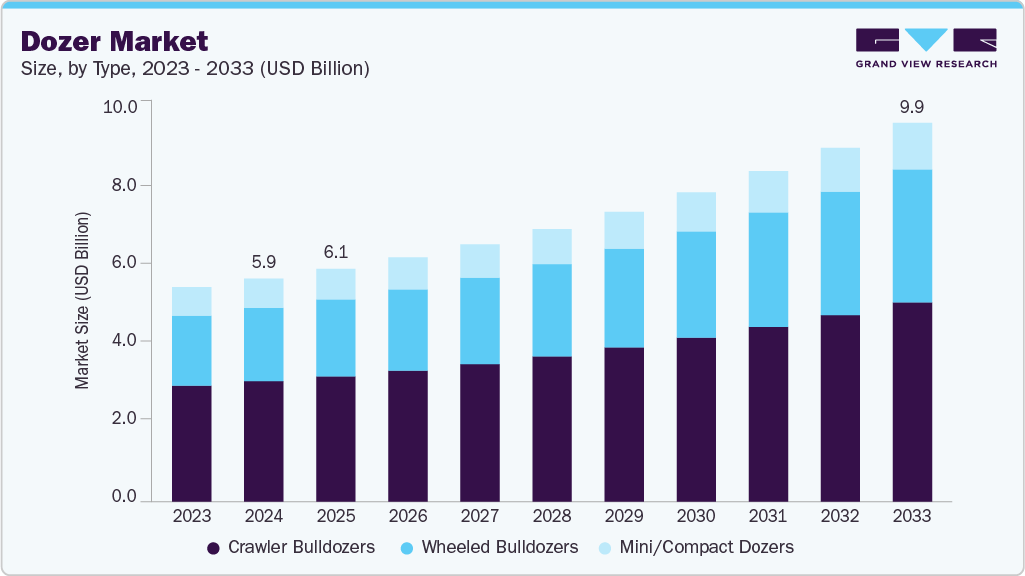

The global dozer market size was estimated at USD 5.86 billion in 2024, and is projected to reach USD 9.96 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The dozer market is gaining momentum, driven by rising infrastructure investments worldwide, particularly in transport, energy, and urban development projects.

Key Market Trends & Insights

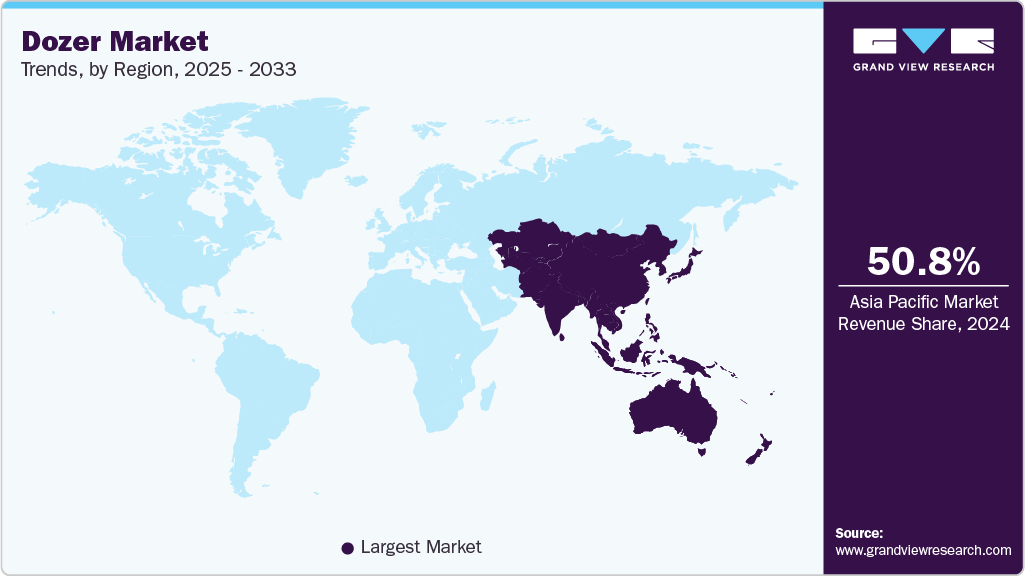

- Asia Pacific dozer market accounted for a 50.8% share of the overall market in 2024.

- By type, the crawler bulldozers (track‑type) segment accounted for the largest revenue share of 46.2% in 2024.

- By engine capacity, the up to 250 HP segment held the largest revenue share in 2024.

- By Propulsion, the internal combustion engine (ICE) segment dominated the market in 2024.

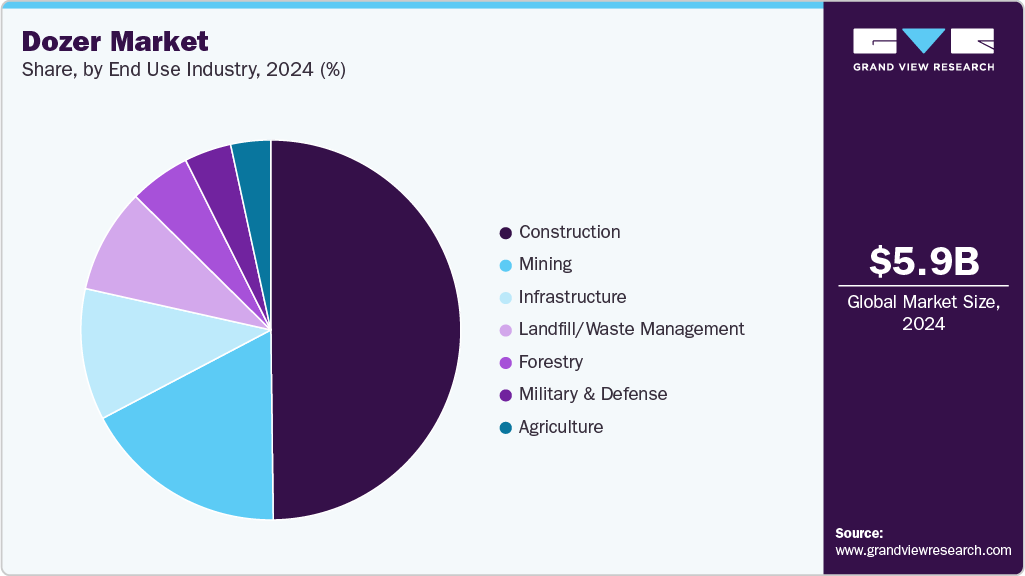

- By end use industry, the construction segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.86 Billion

- 2033 Projected Market Size: USD 9.96 Billion

- CAGR (2025-2033): 6.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The increasing demand for heavy machinery to support large-scale construction and earthmoving activities is sustaining robust market growth. Also, the expansion of the mining sector, fueled by high commodity prices and new mining developments in regions such as Australia, Africa, and Latin America, is further boosting the adoption of dozers. Technological advancements, including the integration of GPS, telematics, and autonomous systems, are enhancing operational efficiency, safety, and fleet management, accelerating market adoption.

The shift towards green construction and low-emission projects presents significant opportunities for the adoption of electric and hybrid dozers, particularly in public sector developments and eco-sensitive zones. However, high initial costs associated with advanced dozers featuring automation and telematics remain a key challenge, limiting accessibility for smaller contractors.

Rising infrastructure investments are significantly driving the growth of the dozer market as countries worldwide prioritize large-scale development projects in transportation, urbanization, and energy sectors. In India, a strong government focus on infrastructure development is attracting substantial foreign investments. According to the India Brand Equity Foundation (IBEF), Foreign Direct Investment (FDI) in construction development, including townships, housing, built-up infrastructure, and related projects, stood at approximately USD 26.76 billion, while FDI in infrastructure activity reached USD 35.24 billion between April 2000 and September 2024. This steady inflow of capital supports continued expansion in the country’s construction sector, increasing demand for heavy machinery such as dozers.

In the United States, the Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law (BIL), authorizes USD 1.2 trillion for transportation and infrastructure upgrades. With USD 550 billion allocated to new projects, this legislation is fueling extensive development of roads, bridges, and energy systems, which require heavy-duty equipment, including dozers. These massive infrastructure developments in major global economies are ensuring sustained demand for dozers and reinforcing their critical role in supporting long-term construction and industrial growth.

High commodity prices, particularly for iron ore, lithium, and rare earth elements, are encouraging mining companies to scale up operations, creating sustained demand for heavy machinery such as dozers for excavation, site preparation, and haulage support. For example, a major iron ore discovery in Australia’s Hamersley region, with estimated reserves of 55 billion metric tons valued at approximately USD 6 trillion, is set to drive significant mining activity in the coming years.

Similarly, India is accelerating the exploration and extraction of critical and strategic minerals like lithium, cobalt, and rare earth elements to support its clean energy and manufacturing sectors. Additionally, Gujarat Mineral Development Corporation (GMDC) is expanding its lignite mining capacity with three new mines in Gujarat. These mining developments across key regions such as Australia, Africa, Latin America, and India are expected to boost demand for high-performance dozers, as they remain essential equipment for large-scale mining operations.

The rising need for precise earthmoving, reduced human error, and safer operations is pushing manufacturers to integrate advanced technologies such as GPS, telematics, and autonomous control systems into their equipment. These innovations not only improve machine productivity but also enable real-time monitoring, predictive maintenance, and fuel efficiency. For instance, in September 2024, Komatsu introduced teleoperation advancements for mining dozers and blasthole drills, allowing operators to control equipment remotely in hazardous mining environments. This development significantly enhances safety, productivity, and operational flexibility. As industries continue to embrace digitalization and automation, the adoption of smart, connected dozers is expected to rise, creating new growth opportunities for the market.

The global shift toward sustainability, coupled with increasing regulatory pressure to cut carbon emissions, is encouraging equipment manufacturers and end users to explore cleaner alternatives to traditional diesel-powered machinery. For instance, in September 2024, Fortescue and Liebherr signed a USD 2.8 billion agreement to deploy 475 zero-emission mining machines, including battery-powered PR 776 dozers, supporting fossil-free, autonomous operations in large-scale mining projects.

Similarly, in September 2021, Liebherr Mining launched its Zero Emission Program aimed at delivering low-carbon and fossil fuel-free equipment by 2030 through modular electrification, alternative fuels, and sustainability-focused partnerships. These developments highlight the growing momentum behind green equipment adoption, positioning electric and hybrid dozers as future-ready solutions for sustainable construction and mining.

High initial cost of advanced dozers remains a significant barrier, particularly for smaller contractors. According to industry sources, new standard dozers typically range from USD 30,000 to USD 200,000, with mid-range models around USD 75,000 to USD 175,000, while large or high-capacity machines can reach up to USD 900,000. In contrast, advanced electric or semi-autonomous dozers, such as Caterpillar’s D7E hybrid, have been listed for around USD 600,000. This steep price premium, which can potentially double the investment compared to traditional models, limits accessibility for budget-conscious operators. Without subsidies, financing solutions, or technological cost reductions, smaller firms struggle to justify the upfront investment, which slows the widespread adoption of next-generation dozer technology in many markets.

Type Insights

The crawler bulldozers segment accounted for the largest revenue share of 46.2% in 2024, driven by increasing infrastructure development, rising demand for heavy-duty equipment in mining and construction, growing adoption of automation and telematics, and the need for higher productivity and operational efficiency. The segment benefits from crawler dozers’ superior stability, traction, and power, which make them essential for demanding earthmoving and mining applications. The shift toward smarter, safer, and more efficient machinery is further accelerating their adoption. For instance, in November 2024, Liebherr introduced the PR 776 Generation 8 crawler dozer, a 768-hp machine featuring advanced operator assistance, teleoperation readiness, and automated blade positioning to boost productivity and control.

The mini/compact dozers segment is expected to grow at the highest CAGR from 2025 to 2033. Factors such as the increasing urban infrastructure development, rising demand for compact and versatile equipment in confined construction sites, growing investments in residential and commercial real estate, and the need for cost-effective earthmoving solutions for small to medium-scale projects support the segment growth during the forecast year. The segment's growth is further supported by the versatility and lower operating costs of compact dozers, making them ideal for landscaping, roadwork, utility installation, and urban construction projects where space is limited.

Engine Capacity Insights

The up to 250 HP segment accounted for the largest revenue share in 2024, driven by increasing demand for versatile, mid-sized equipment suitable for urban construction, growing adoption in residential and commercial infrastructure projects, rising popularity among rental equipment providers, and the need for cost-effective solutions in small to medium-scale earthmoving operations. For instance, in August 2022, CASE Construction Equipment launched the Minotaur DL550, the industry’s first compact dozer loader, which combines true dozing, grading, and loading capabilities into a single 114-hp machine for versatile jobsite use. This growing preference for multi-functional, efficient equipment underscores the segment’s importance in meeting the evolving needs of modern construction and infrastructure projects.

The 250-500 HP segment is expected to grow at a significant CAGR during the forecast period. These dozers offer the ideal balance between power and fuel efficiency, making them a preferred choice for contractors working on demanding projects that require consistent performance under challenging conditions. Factors including increasing demand for high-performance machinery in large-scale infrastructure projects, rising investments in mining operations, growing need for efficient earthmoving in energy and transportation sectors, and the push for productivity improvements in heavy construction activities support the segment growth.

Propulsion Insights

The ICE segment accounted for the largest revenue share in 2024. ICE-powered dozers remain the preferred choice for large-scale earthmoving, mining, and infrastructure development projects where long operating hours and high torque are essential. Their robust performance and mature technology continue to make them a mainstay across both developed and emerging markets.

For instance, in July 2025, Trimble and Liebherr launched a factory-integrated Trimble Earthworks-ready option for Liebherr’s PR 776 Generation 8 bulldozers, enabling faster installation of grade control technology to boost productivity and operational efficiency in ICE-powered machines. The segment growth is mainly attributed to the increasing demand for high-power equipment in heavy construction and mining, widespread availability of diesel-powered machinery, lower upfront costs compared to electric alternatives, and the established reliability of ICE technology in demanding operational environments.

The electric segment is expected to register a notable CAGR from 2025 to 2033, driven by increasing emphasis on reducing carbon emissions, growing adoption of clean energy solutions in construction and mining, rising fuel costs, and stricter environmental regulations targeting diesel-powered equipment. Electric dozers are particularly gaining traction in applications where sustainability, worker safety, and emission reduction are key priorities. For instance, in June 2025, Lumina unveiled the ML6 Moonlander, a 750-hp electric autonomous dozer offering up to 10 hours of runtime, fast 75-minute recharging, and fully remote operation, specifically designed for high-risk construction and mining environments. This trend highlights the accelerating transition toward electric machinery as industries seek greener, safer, and more cost-efficient operations.

End Use Industry Insights

The construction segment accounted for the largest revenue share in 2024. This segment benefits from the steady expansion of housing, industrial parks, commercial complexes, and institutional buildings across both developed and emerging markets. The adoption of advanced dozing technology is helping contractors improve grading accuracy, reduce manual work, and enhance overall productivity on construction sites.

Factors such as the increasing demand for residential and commercial building projects, rapid urbanization, rising private sector investments in real estate development, and the growing need for efficient land preparation and site development equipment. In April 2025, Daracon Group added its first Komatsu D65EXi dozer to support large civil construction projects in Australia, highlighting the machine’s intelligent machine control (iMC) system for enhanced grading accuracy and efficiency. This trend reflects the growing preference for technologically advanced, versatile dozers that can meet the demands of modern construction projects.

The infrastructure segment is expected to register a notable CAGR from 2025 to 2033, driven by rising government investments in transportation networks, increasing demand for urban mobility improvements, expansion of public infrastructure such as highways and bridges, and the growing emphasis on regional connectivity and economic development. The surge in infrastructure spending, particularly in emerging economies, is creating sustained demand for construction machinery that can meet tight project deadlines, improve operational efficiency, and deliver reliable performance in large-scale developments.

For instance, in July 2025, the Uttar Pradesh government in India launched a USD 133 million (INR 1,111 crore) road and bridge infrastructure expansion program to improve connectivity, urban mobility, and road safety. This development underscores the role of infrastructure investment in accelerating demand for earthmoving equipment, including dozers, across highways, bridges, and urban projects.

Regional Insights

The Asia Pacific dozer market accounted for 34.2% of the global market in 2024, driven by rapid infrastructure development, expanding mining activities, fast-paced urbanization, and increasing government investments in transportation, energy, and industrial projects across key economies such as China, India, Australia, and Southeast Asia. The region’s dominance is further supported by the growing demand for advanced construction and earthmoving machinery to meet the needs of large-scale projects, including smart cities, renewable energy, and transportation networks.

Countries including India, Australia, and South Korea are increasingly focusing on infrastructure modernization and industrial growth, with rising investments in transport corridors, renewable energy, and urban redevelopment, all of which are fueling demand for construction and earthmoving equipment such as dozers. In particular, India’s rapid infrastructure expansion is creating significant growth opportunities for equipment manufacturers. According to the Confederation of Indian Industry (CII) and Kearney, India’s mining and construction equipment (MCE) sector is projected to grow at a 19.0% CAGR, reaching approximately USD 45 billion (INR 3,83,850 crore) by 2030. This surge reflects India’s emergence as the fastest-growing MCE market globally, making it a major contributor to the Asia Pacific region’s dominance in the global dozer market.

China dozer market held a substantial revenue share in 2024. China’s focus on integrating automation, digitalization, and green technologies into its construction and mining sectors is creating strong demand for advanced earthmoving equipment. The country’s strategic initiatives to boost infrastructure resilience and improve project efficiency are further accelerating the adoption of innovative machinery. For instance, in September 2022, Shantui, in collaboration with Huazhong University of Science and Technology, launched the world’s first autonomous unmanned bulldozer, marking a significant breakthrough in construction equipment automation and setting a new benchmark for smart heavy machinery in China. The Dozer market in China is experiencing rapid growth, driven by the increasing investments in smart construction technologies, the expansion of high-speed rail, renewable energy projects, and the country’s ongoing urbanization and industrial upgrading efforts.

Japan dozer market held a significant revenue share in 2024. The demand for compact and technologically advanced dozers is rising, particularly in Japan’s space-constrained urban environments and mountainous construction zones where precision, efficiency, and lower emissions are essential. Japan’s construction sector also benefits from the government’s active role in supporting infrastructure investments both domestically and internationally.

For instance, in December 2024, the Japan Overseas Infrastructure Investment Corporation (JOIN) announced an investment of approximately USD 3.15 million (JPY 500 million) in India’s brownfield annuity state road projects, reflecting Japan’s commitment to infrastructure development through global partnerships. While this investment highlights Japan’s outward infrastructure push, it also reinforces the country's domestic emphasis on high-quality, technologically sophisticated construction machinery, ensuring continued demand for advanced dozers in both home and overseas markets.

Europe Dozer Market Trends

The Europe dozer market was identified as a lucrative region in 2024. The European dozer market is witnessing significant transformation, driven by rising investments in infrastructure modernization, increasing demand for eco-friendly and low-emission construction equipment, growing urban redevelopment projects, and the region’s strong focus on sustainable construction practices. The market is also benefiting from stringent environmental regulations that are pushing contractors to adopt cleaner, more efficient machinery, including hybrid and electric dozers. Also, the revival of large-scale civil engineering projects, renewable energy installations, and transportation corridor upgrades across countries, including Germany, the UK, and France, is supporting steady equipment demand.

Germany dozer market is being shaped by increasing investments in renewable energy infrastructure, stringent environmental regulations promoting low-emission machinery, the expansion of urban redevelopment projects, and the rising adoption of automation and digital construction technologies. Germany’s strong push toward energy transition, including the development of wind farms, solar parks, and grid expansion, is driving demand for efficient earthmoving equipment. Also, the emphasis on sustainable urban planning, smart cities, and transportation upgrades is further fueling the need for advanced dozers equipped with precision control and eco-friendly technologies.

The UK dozer market is being driven by increasing investments in infrastructure renewal, a growing focus on green construction practices, the expansion of transport networks, and the country’s push for net-zero emissions in the construction sector. Major infrastructure programs such as high-speed rail projects, urban regeneration, and renewable energy developments are creating sustained demand for earthmoving equipment, including dozers. The UK’s stringent environmental regulations and commitment to decarbonizing construction are also encouraging the gradual adoption of low-emission and hybrid machinery.

North America Dozer Market Trends

The North America dozer market was identified as a lucrative region in 2024, driven by increasing investments in large-scale infrastructure projects, the expansion of commercial and residential construction, growing demand from the mining and energy sectors, and the rising adoption of advanced and efficient machinery. The region’s strong focus on upgrading aging transportation networks, expanding renewable energy infrastructure, and boosting industrial capacity is fueling steady demand for dozers across multiple applications.

Additionally, the market is witnessing growing interest in mid-sized and technologically enhanced equipment to improve jobsite productivity and cost-efficiency. For instance, in July 2024, HD Hyundai Construction Equipment North America launched its first crawler dozer, the HD100, a 115-hp machine designed for earthmoving, forestry, and material handling, expanding Hyundai’s construction equipment lineup in the region.

Similarly, in May 2022, Hyundai Doosan Infracore shipped its first DD100 dozer, a 9-metric-ton model, to North America, marking its entry into the regional dozer market and reinforcing its commitment to expanding its heavy machinery portfolio. These developments highlight how innovation, product diversification, and infrastructure growth continue to position North America as a key driver of global dozer demand.

U.S. Dozer Market Trends

The U.S. dozer market held a dominant position in 2024, driven by increasing investments in infrastructure revitalization, the rising adoption of advanced machine control technologies, a growing shift toward low-emission and hybrid machinery, and steady demand from mining, construction, and energy sectors. The U.S. market is undergoing significant transformation as contractors and fleet owners prioritize productivity, fuel efficiency, and sustainability.

The push for modernizing transportation networks, upgrading utilities, and expanding renewable energy projects is further accelerating the demand for technologically advanced earthmoving equipment. For instance, in March 2025, John Deere launched the 850 X-Tier Dozer featuring E-Drive technology and upgraded its 700, 750, and 850 P-Tier models, enhancing productivity, fuel efficiency, and operator comfort through its advanced SmartGrade systems. Such developments reflect the U.S. market’s ongoing shift toward smarter, greener, and more efficient dozer solutions, reinforcing its leadership in global equipment innovation.

Canada dozer market is driven by ongoing investments in mining, energy, and infrastructure development, particularly in remote and resource-rich regions where heavy-duty earthmoving equipment is essential. The country’s focus on expanding renewable energy projects, road networks, and natural resource extraction continues to support steady demand for advanced and durable dozers.

Key Dozer Company Insights

Some key players operating in the market include Caterpillar Inc., Komatsu Ltd., XCMG Construction Machinery Co., Deere & Company, SANY Group, and Volvo Construction Equipment AB.

-

Founded in 1925 and headquartered in Texas, U.S., Caterpillar Inc. is a prominent manufacturer of construction and mining equipment, including a wide range of dozers. The company offers an extensive portfolio of earthmoving solutions, including wheeled bulldozers, crawler bulldozers, and value-added services across sectors such as infrastructure development, mining, oil & gas, and heavy construction. Caterpillar operates a global network of manufacturing, parts distribution, and service facilities, leveraging advanced technologies such as grade control systems, telematics, and hybrid powertrains to enhance equipment efficiency, sustainability, and productivity.

-

Founded in 1921 and headquartered in Tokyo, Japan, Komatsu Ltd. is a global player in construction, mining, and utility equipment manufacturing, specializing in various types of dozers. The company’s product lineup includes wheeled bulldozers, crawler bulldozers, and intelligent machine control systems. Komatsu emphasizes innovation through autonomous equipment, teleoperation, and low-emission technologies to improve safety, productivity, and environmental performance. With a strong global presence, the company operates manufacturing and service hubs across Asia, the Americas, and Europe.

Key Dozer Companies:

The following are the leading companies in the dozer market. These companies collectively hold the largest market share and dictate industry trends.

- Komatsu Ltd.

- Caterpillar Inc.

- SANY Group (Sany Heavy Industry Co., Ltd.)

- Shantui Construction Machinery Co., Ltd.

- XCMG Construction Machinery Co., Ltd.

- Deere & Company

- Volvo Construction Equipment AB

- Liebherr Machines Bulle S.A.

- Hitachi Construction Machinery Co., Ltd.

- Guangxi LiuGong Machinery Co., Ltd.

Recent Developments

-

In April 2025, Liebherr-Canada delivered four new PR 776 dozers, including the latest Generation 8 model, to Taseko’s Gibraltar mine, highlighting fuel efficiency, lower emissions, and advanced operator assistance systems.

-

In April 2025, Leica Geosystems and Shantui launched new aftermarket machine control kits for the DH20M dozer, enabling seamless integration of 3D guidance systems to improve precision, productivity, and operational efficiency on job sites.

-

In December 2024, BEML Ltd launched India’s largest crawler dozer, the BD475-2, featuring a 950 HP engine and advanced in-house engineering to support heavy-duty mining applications and strengthen India’s self-reliance goals.

-

In April 2023, Develon unveiled the DD130 bulldozer at ConExpo, offering enhanced power, fine grading, and customizable blade options for residential and light commercial construction in the North American market.

Dozer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.86 billion

Revenue forecast in 2033

USD 9.96 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, engine capacity, propulsion, end use industry, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Caterpillar Inc.; Komatsu Ltd.; XCMG Construction Machinery Co., Ltd.; Deere & Company; SANY Group (Sany Heavy Industry Co., Ltd.); Volvo Construction Equipment AB; Liebherr Machines Bulle S.A.; Hitachi Construction Machinery Co., Ltd.; Shantui Construction Machinery Co., Ltd.; Guangxi LiuGong Machinery Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Dozer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global dozer market report based on type, engine capacity, propulsion, end use industry, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Crawler Bulldozers

-

Wheeled Bulldozers

-

Mini/Compact Dozers

-

-

Engine Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Propulsion Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Internal Combustion Engine (ICE)

-

-

End use Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Infrastructure

-

Mining

-

Landfill/Waste Management

-

Forestry

-

Agriculture

-

Military & Defense

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dozer market size was estimated at USD 5.86 billion in 2024 and is expected to reach USD 9.96 billion in 2033.

b. The global dozer market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 9.96 billion by 2033.

b. The Asia Pacific dozer market accounted for 34.2% of the global share in 2024, driven by rapid infrastructure development, expanding mining activities, fast-paced urbanization, and increasing government investments in transportation, energy, and industrial projects across key economies such as China, India, Australia, and Southeast Asia. The region’s dominance is further supported by the growing demand for advanced construction and earthmoving machinery to meet the needs of large-scale projects, including smart cities, renewable energy, and transportation networks.

b. Some key players operating in the dozer market include Caterpillar Inc.; Komatsu Ltd.; XCMG Construction Machinery Co.; Deere & Company; SANY Group; Volvo Construction Equipment AB; Liebherr Machines Bulle S.A.; Hitachi Construction Machinery Co.; Shantui Construction Machinery Co.; Guangxi LiuGong Machinery Co., Ltd.

b. Key factors that are driving the market growth include rising infrastructure investments worldwide, particularly in transport, energy, and urban development projects. The increasing demand for heavy machinery to support large-scale construction and earthmoving activities is sustaining robust market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.