- Home

- »

- Conventional Energy

- »

-

Drilling Waste Management Market Size, Share Report, 2030GVR Report cover

![Drilling Waste Management Market Size, Share & Trends Report]()

Drilling Waste Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Offshore, Onshore), By Service (Treatment & Disposal, Solids Control, Containment & Handling), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-616-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drilling Waste Management Market Trends

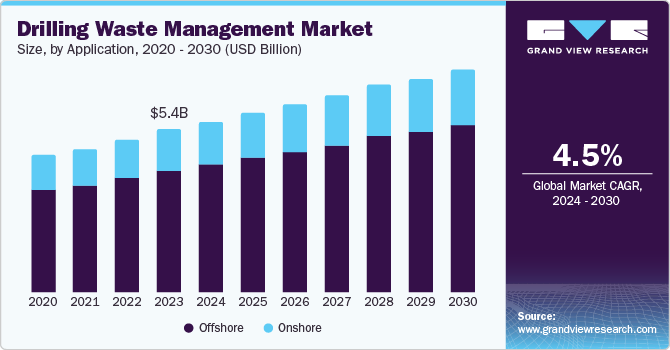

The global drilling waste management market size was valued at USD 5.43 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. This can be credited to the increasing environmental concerns and stringent regulations governments impose worldwide. Companies have increasingly recognized the need for effective drilling waste management as the oil and gas industry expands. Regulatory bodies have significantly enforced strict guidelines to minimize the environmental impact of drilling activities. This regulatory pressure ensures that companies invest in technologies and processes that reduce waste generation and enhance waste treatment and disposal methods.

The technological advancements have played a significant role in driving the drilling waste management market. Innovations in waste treatment technologies, such as thermal desorption units, advanced solid control systems, and bioremediation techniques, have been widely used in treating and recycling waste and products. These technologies improve the efficiency of waste management processes and reduce the environmental footprint of drilling operations. Companies have increasingly adopted these advanced technologies to comply with regulations and enhance their sustainability efforts

Furthermore, the growing focus on sustainable practices within the oil and gas industry has been another crucial market driver. Companies have increasingly recognized the importance of environmental stewardship and actively sought ways to minimize their ecological impact. Moreover, the increasing use of circular economy principles in the oil and gas industry has encouraged the development of efficient waste management methods focusing on recycling.

Application Insights

The offshore segment dominated the market and accounted for a share of 74.6% in 2023. Offshore drilling activities generate significant amounts of waste, including drilling fluids, cuttings, and produced water, which can have severe environmental impacts when not managed properly. This has compelled companies to increasingly adopt advanced waste management practices such as thermal desorption units and advanced solid control systems. These have significantly improved the ability to manage and reduce waste generated during offshore drilling activities. In addition, the expansion of offshore drilling activities, particularly in deepwater and ultra-deepwater regions has driven the market. The increased exploration and production activities in these regions have resulted in higher volumes of waste, necessitating effective waste management solutions.

The onshore segment is expected to register a significant CAGR during the forecast period. Waste management processes are more simplified compared to offshore installations, withbetter access to locations and overall ease of logistics. The segment was further driven by modular waste treatment technologies that facilitate on-site treatment, with no significant transportation costs. Moreover, the development of horizontal drilling and hydraulic fracturing in unconventional reservoirs introduced new waste management procedures. Companies have increasingly focused on drilling waste disposition and utilization in value models such as road bases and construction industries.

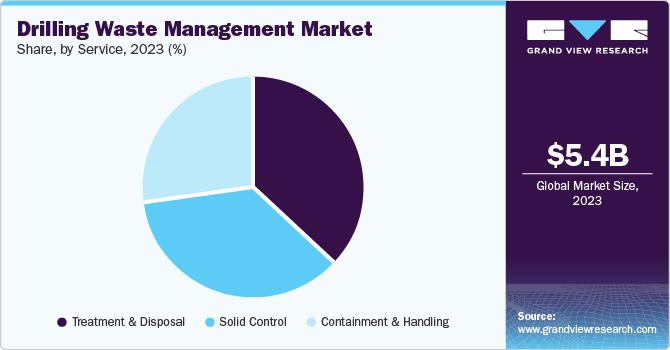

Service Insights

The treatment & disposal segment accounted for the largest market share of 36.7% in 2023 owing to the increased adoption of methods including onsite burials (pits and landfills), land-farming, land-spreading, bioremediation, thermal treatment, and slurry injection techniques. This segment is expected to maintain its dominance during the forecast period, driven by increasingly stringent regulations. These include zero-discharge standards, which require all waste to be treated and reused without being discharged into the environment, particularly the sea. Furthermore, the rising significance of sustainable solutions within the oil and gas industry has led to considerable investments in proficient techniques that reduce waste and attempt to restore the value of resources, contributing to the favorable growth of the segment’s market.

Containment and handling are expected to register the fastest CAGR of 5.2% during the forecast period. This growth can be attributed to technological developments that have influenced positive changes in containment systems such as enhanced sensors for constant monitoring, high-tech equipment for handling the containment, and efficient containment material. These improvements have made containment and handling solutions enhancing waste management performance. Moreover, the operating expense and capital cost-cutting in the oil & gas industries has augmented the growth of containment and handling systems -- capable of lowering the waste volume, transportation, and subsequent efficient and economic waste management.

Regional Insights

The North America drilling waste management market secured the dominant share of 34.3% revenue in 2023 attributed to the various drilling activities in fields including oil & natural gas, shale gas, mining, and construction sectors. In addition, stringent regulations set by the Environmental protection Agency (EPA) have driven the adoption of advanced waste management technologies. These regulations mandate the proper handling, treatment, and disposal of drilling waste to prevent environmental contamination, compelling companies to invest in advanced waste management solutions.

U.S. Drilling Waste Management Market Trends

The U.S. drilling waste management market was propelled by stringent government environmental regulations and increased investment in production and exploration activities. The market has also been boosted by a rise in well intervention activities and rapidly growing investment in the exploration and production (E&P) sector.

Asia Pacific Drilling Waste Management Market Trends

Asia Pacific drilling waste management market is expected to witness a CAGR of 5.1% over the forecast period owing to the increased construction activities and natural gas reserves in the countries including India, Japan, and China. These countries have presented vast areas of exploration in fields such as mining, oil & natural gas. Furthermore, the increasing technological advancements and innovations have further augmented the market growth.

Europe Drilling Waste Management Market Trends

The drilling waste management market in Europe held a significant market share in 2023 owing to strong commitment to stringent environmental standards and sustainable practices within the oil and gas industry. The region’s regulatory framework, guided by directives from the European Commission, prioritized waste reduction and responsible disposal. This has led to a stronger emphasis on technological advancements that promote the adoption of innovative drilling waste management solutions.

Key Drilling Waste Management Company Insights

The global drilling waste management market features key participants such as Baker Hughes, Halliburton, National Oilwell Varco, and others. These organizations have focused on several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Baker Hughes is an energy technology company that offers a wide range of products and services to the oil and gas industry. Their portfolio includes drilling systems, completion tools, artificial lift technologies, and industrial power generation equipment. The company majorly focuses on digital transformation and sustainability in the energy sector.

-

Imdex Limited is a global mining technology company that provides end-to-end solutions and real-time subsurface intelligence for the mining industry. They offer AMC (drilling fluids and equipment) and XTRACTA (drilling productivity tools). The company focuses on expanding its digital capabilities and cloud-based solutions to provide real-time data and analytics to mining companies.

Key Drilling Waste Management Companies:

The following are the leading companies in the drilling waste management market. These companies collectively hold the largest market share and dictate industry trends.

- Baker Hughes Company

- Augean

- Halliburton

- SLB

- NOV

- Scomi Group Bhd

- GN Solids Control

- Derrick Corporation

- NEWALTA

- Nuverra Environmental Solutions, Inc.

- Secure Energy

- IMDEX LIMITED

- Soli-Bond Inc.

- Ridgeline Canada, Inc.

Drilling Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.69 billion

Revenue forecast in 2030

USD 7.41 billion

Growth Rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Baker Hughes Company; Augean; Halliburton; SLB; NOV; Scomi Group BhD; GN Solids Control Derrick Corporation; NEWALTA; Nuverra Environmental Solutions, Inc.; Secure Energy.; IMDEX LIMITED;; Soli-Bond Inc.; Ridgeline Canada, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drilling Waste Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drilling waste management market report based on application, service and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid Control

-

Containment & Handling

-

Treatment & Disposal

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.