- Home

- »

- Medical Devices

- »

-

Drug Device Combination Products Market Size Report, 2030GVR Report cover

![Drug Device Combination Products Market Size, Share & Trends Report]()

Drug Device Combination Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Transdermal Patches, Infusion Pumps, Inhalers, Drug Eluting Stents), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-260-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drug Device Combination Products Market Summary

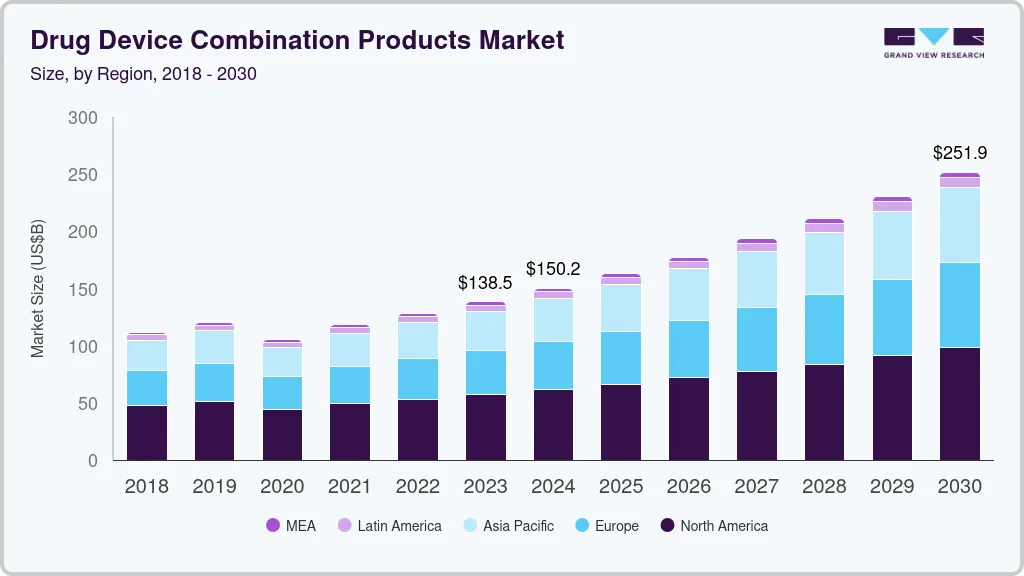

The global drug device combination products market size was estimated at USD 138.47 billion in 2023 and is projected to reach USD 251.87 billion by 2030, growing at a CAGR of 9.0% from 2024 to 2030. Technological advancements, increasing demand for minimally invasive drug delivery devices, increasing prevalence of chronic diseases such as diabetes, and the rising geriatric population are the major factors anticipated to propel market growth over the forecast period.

Key Market Trends & Insights

- North America dominated the market with the revenue share of 41.31% in 2023.

- The U.S. accounted for the revenue share of 81.7% in 2023.

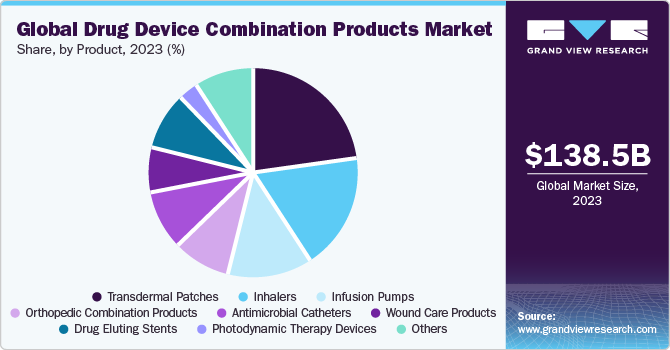

- By product, the transdermal patches segment dominated the market with the largest revenue share of 23.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 138.47 Billion

- 2030 Projected Market Size: USD 251.87 Billion

- CAGR (2024-2030): 9.0%

- North America: Largest market in 2023

According to the International Diabetes Federation (IDF), an estimated 537 million adults in the age group 20-79 were affected with diabetes in 2021, and this number is expected to grow to 783 million by 2045. The International Diabetes Federation (IDF) further stated that an estimated 90% of people with diabetes are at an elevated risk of developing type 2 diabetes.The industry is witnessing tremendous innovation and expansion because of the possibility of using combination medical products to effectively treat patients with different diseases. Technological advancements and innovations in the ability of combination medicines to release a drug over an extended period to a precise place is key factors contributing to the market's rapid expansion. For instance, the digital medicine system, ABILIFY MYCITE (aripiprazole), is a drug-device combination product developed by Otsuka Holdings Co., Ltd. in partnership with Proteus Digital Health, Inc. for the treatment of certain mental/mood disorders. It can serve as a tool to measure and identify the non-adherence of patients to drugs.

A key driver of drug device combination products is the increasing demand for minimally invasive pain-free drug delivery options. Patients are looking for more comfortable and convenient ways to receive their medications, and drug device combination products offer a promising solution. For instance, drugs are mostly administered in patients suffering from neurological disorders with the help of injections when needed, which can lead to pain and an increased risk of adverse effects. Thus, to reduce pain and other risks, the adoption of transdermal drug delivery systems, such as transdermal patches, has significantly increased in recent years. For instance, in April 2023, Teikoku Seiyaku and Kowa launched ALLYDONE Patches 55 mg and 27.5 mg for the treatment of patients with dementia due to Alzheimer’s disease. This transdermal patch suppresses the growth of dementia symptoms.

Furthermore, the rising prevalence of chronic diseases is driving the demand for drug device combination products by necessitating more effective treatment options, improving patient compliance, promoting personalized medicine approaches, leveraging technological advancements, and benefiting from regulatory incentives. For instance, in December 2022, the U.S. FDA granted 510(k) clearance to Mallya device developed by Biocorp for the treatment of diabetes. This device also has the CE mark approval in Europe as a Class llb medical device. This market clearance encourages new players to develop and commercialize new drug-device combination products and expand their businesses.

Market Concentration & Characteristics

The market growth stage is high, and pace of growth is accelerating. The market is characterized by a high degree of innovation. The integration of different technologies and the collaboration between pharmaceutical and medical device companies contribute to the continuous advancement and innovation in this industry. For instance, in February 2023, Terumo Medical Corporation partnered with Siemens Healthineers to introduce a groundbreaking program for cath lab directors in India. This initiative aimed to establish standards of care and improve efficiency in cath labs nationwide.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the players. This is due to several factors, including the desire tostrengthen product portfolios, expand market presence, and drive innovation. The convergence of pharmaceuticals and medical devices has created a fertile ground for strategic partnerships and acquisitions. For instance, in July 2022, Becton, Dickinson and Company acquired Parata Systems, an innovative provider of pharmacy automation solutions, for USD 1.525 billion.

The market is also subject to increasing regulatory scrutiny. The Food and Drug Administration (FDA) in the U.S., the European Medicines Agency (EMA) in Europe, and the Therapeutic Goods Administration (TGA) in Australia are responsible for regulating drugs, medical devices, and other healthcare products. These agencies typically operate under the authority of the government and have the power to implement and enforce regulations, conduct investigations, and impose penalties for noncompliance.

The market has been experiencing a significant level of product expansion in recent years. This expansion is driven by various factors, including technological advancements, increasing demand for personalized medicine, and the need for more effective treatment options for complex medical conditions. In August 2022, Medtronic announced the launch of its latest drug-eluting coronary stent, the Onyx Frontier DES, following the recent approval of CE Mark.

Key players in this industry are constantly seeking to expand their geographical reach to tap into new markets, increase their customer base, and enhance their competitive position. For instance, in November 2023, Terumo Medical Corporation expanded its global presence with a new subsidiary in South Africa.

Product Insights

The transdermal patches segment dominated the market with the largest revenue share of 23.1% in 2023. This high percentage can be attributed to the increasing launches and approvals of transdermal patches in developing and developed countries. For instance, in April 2023, Kowa Company, Ltd. and Teikoku Seiyaku Co., Ltd. launched the ALLYDONE Patches 27.5 mg and ALLYDONE Patches 55 mg for treating dementia due to Alzheimer’s disease in the Japan market.

The drug-eluting stents segment is expected to register at the fastest CAGR during the forecast period. This can be attributed to rising approvals and new launches of Drug-Eluting Stents. This segment includes two types of products: coronary stents and peripheral vascular stents. The major companies are expanding their product portfolios and offering these products in various sizes. For instance, in May 2022, Abbott revealed the availability of its Xience Skypoint drug-eluting stent in extended sizes of 4.5 mm and 5 mm.

Regional Insights

North America dominated the drug device combination products market with the revenue share of 41.31% in 2023, due to the established healthcare sector, developments of novel products, favorable support from regulatory bodies, and the high prevalence of chronic conditions such as cardiovascular disease. As per the CDC, every year about six in 10 American adults suffer from at least one chronic condition that requires specialized care and attention.

U.S. Drug Device Combination Products Market Trends

The drug device combination products market in U.S. accounted for the revenue share of 81.7% in 2023, due to high healthcare expenditure, increasing demand for innovative technologies, growing incidence of cancer, and surging awareness regarding early disease diagnosis. According to the American Cancer Society, in 2023, around 1,958,310 new cancer cases were diagnosed in the U.S., with around 609,820 related deaths.

Europe Drug Device Combination Products Market Trends

The drug device combination products market in Europe was identified as a lucrative region in this industry. The growth in the region can be attributed to the increasing prevalence of chronic diseases, such as diabetes, pain, & respiratory conditions, which require regular medication. According to the International Diabetes Federation, around 56.6 million adults in Europe will be living with diabetes in 2022, and the number is expected to surge over the coming decade, highlighting the growing patient population. This is expected to drive the demand for drug-device combination products to improve medication compliance and overall treatment outcomes.

The UK drug device combination products market is expected to grow at a rapid CAGR over the forecast period. The growing population, increasing demand for geriatric care, and the rising prevalence of chronic conditions, such as heart disease, arthritis, & diabetes, are expected to propel market growth. According to the British Heart Foundation, around 2.3 million people in the UK are living with Coronary Heart Disease (CHD), with around 1.5 million men and 830,000 women affected. The aforementioned statistics depict the growing demand for drug device combination products, which is expected to propel market growth over the forecast period.

The drug device combination products market in Germany held a substantial market share in 2023, owing to the rising number of respiratory failure cases and surgical procedures. As per a study published on NCBI, in 2022, around half of the hospitalized COVID-19 patients developed Acute Respiratory Distress Syndrome (ARDS). Hence, surgeons and healthcare providers use advanced techniques and products to support lung & heart function. This has increased the use of drug-device combination products across various medical specialties.

Asia Pacific Drug Device Combination Products Market Trends

The drug device combination products market in Asia Pacific is anticipated to witness at a significant CAGR during the forecast period, owing to increasing disposable income, improving healthcare infrastructure, and rapidly growing economic conditions in emerging economies such as Japan, China, & India. The large population with low per capita income in the Asia Pacific has led to a high demand for affordable treatment options. Multinational companies are looking to invest in developing economies, such as India and China, to create a strong position in the market. Hence, numerous collaborative partnerships and strategic alliances are underway between key companies in this region, which is expected to create lucrative growth opportunities.

The Japan drug device combination products market is expected to grow at a rapid CAGR over the forecast period. The growing awareness about the preventive use of medical devices to mitigate respiratory failure complications, growing advancements in healthcare infrastructure, and increasing healthcare expenditure are expected to propel market growth over the forecast period.

The drug device combination products market in China held a substantial market share in 2023, owing to the rising interest of physicians in drug-device combination products to minimize the risk of heart & lung failure and speed up recovery is prompting manufacturers to develop specialized, safe, & effective devices. According to the National Bureau of Statistics of China, in 2023, individuals aged 60 & above accounted for around 19.8% of the national population by 2022. Moreover, with several healthcare reforms in China, the market is expected to exhibit substantial growth.

Key Drug Device Combination Products Company Insights

Some of the key companies operating in the market include Abbott; Terumo Medical Corporation; Stryker; Viatris Inc.

-

Abbott is a global healthcare company specializing in developing, manufacturing, and commercializing healthcare products. The company offers products such as XIENCE Drug-eluting Stents (DES), XIENCE Skypoint Stent, XIENCE Sierra Stent in the global market

-

Terumo Medical Corporation offers products such as Infusion Pump (Full press), Infusion Pump (Smart-Midpress) Medisafe with Detachable Insulin Patch Pump for the global market

Key Drug Device Combination Products Companies:

The following are the leading companies in the drug device combination products market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Terumo Medical Corporation

- Stryker

- Viatris Inc.

- Medtronic

- Boston Scientific Corporation

- Novartis AG

- Becton, Dickinson and Company.

- Teleflex Incorporated

- W. L. Gore & Associates, Inc. Sensely, Inc.

Recent Developments

-

In October 2023, Medtronic received FDA approval for the SynchroMed III intrathecal drug delivery system, intended to manage chronic pain, cancer pain, and severe spasticity

-

In July 2023, Becton, Dickinson, and Company announced receiving FDA 510(k) Clearance for an updated version of the BD Alaris Infusion System. This clearance encompasses updated hardware features for the Point-of-Care Unit (PCU), syringe pumps, auto identification modules, Patient controlled Analgesia (PCA) pumps, large volume pumps, and respiratory monitoring

-

In February 2023, Teleflex Incorporated y announced significant milestones regarding two new catheters: the FDA 510(k) clearance of the Triumph Catheter and the inaugural clinical use of the GuideLiner Coast Catheter

Drug Device Combination Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 150.23 billion

Revenue forecast in 2030

USD 251.87 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Abbott; Terumo Medical Corporation; Stryker; Viatris Inc.; Medtronic; Boston Scientific Corporation; Novartis AG; Becton, Dickinson and Company.; Teleflex Incorporated

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drug Device Combination Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the drug device combination products market report based on product and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infusion Pumps

-

Volumetric

-

Disposables

-

Syringes

-

Ambulatory

-

Implantable

-

Insulin

-

-

Orthopedic Combination Products

-

Bone Graft Implants

-

Antibiotic Bone Cement

-

-

Photodynamic Therapy Devices

-

Transdermal Patches

-

Drug Eluting Stents

-

Coronary Stents

-

Peripheral Vascular Stents

-

-

Wound Care Products

-

Inhalers

-

Dry Powder

-

Nebulizers

-

Metered Dose

-

-

Antimicrobial Catheters

-

Urological

-

Cardiovascular

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global drug device combination products market size was estimated at USD 138.47 billion in 2023 and is expected to reach USD 150.23 billion in 2024.

b. The global drug device combination products market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 251.87 billion by 2030.

b. North America dominated the drug device combination products market with a share of 40.51% in 2023. This is attributable to extensive new product development activities conducted by prominent players across this region.

b. Some key players operating in the drug device combination products market include Abbott; Terumo Corporation; Stryker Corporation; Mylan N.V.; Medtronic; Allergan plc; Boston Scientific Corporation; Novartis AG; C.R. Bard; Teleflex Incorporated; and W. L. Gore & Associates, Inc.

b. Key factors that are driving the drug device combination products market growth include growing patient and physician preference for minimally invasive procedures and consistent-dosing treatment alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.