- Home

- »

- Advanced Interior Materials

- »

-

Dry Construction Market Size, Share & Trends Report, 2030GVR Report cover

![Dry Construction Market Size, Share & Trends Report]()

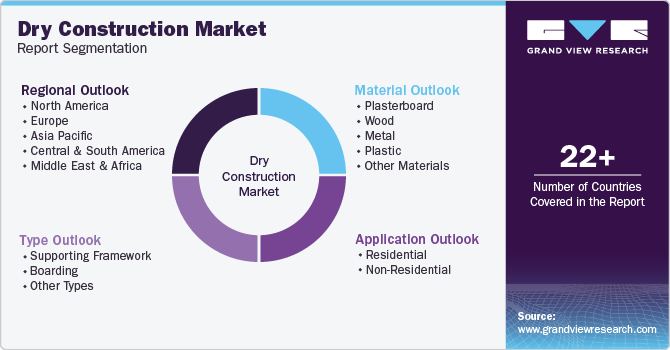

Dry Construction Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Supporting Framework, Boarding), By Material, By Application (Residential, Non-Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-433-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dry Construction Market Summary

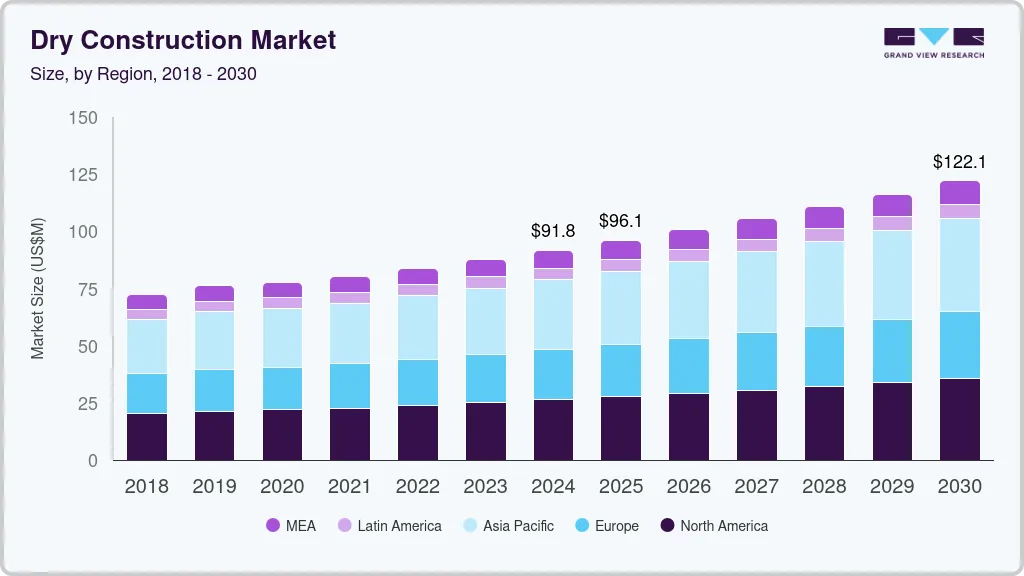

The global dry construction market size was estimated at USD 91.8 billion in 2024 and is projected to reach USD 122.1 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. The market driven by driven by Rapid urbanization and population growth, particularly in regions like Asia-Pacific.

Key Market Trends & Insights

- Asia Pacific dominated the dry construction market with the revenue share of 33.35% in 2023.

- North America emerged as the fastest growing market with a CAGR of 5.2% from 2024-2030.

- Based on type, the supporting framework segment led the market with the largest revenue share of 56.75% in 2023.

- Based on material, the plasterboard segment led the market with the largest revenue share of 28.75% in 2023.

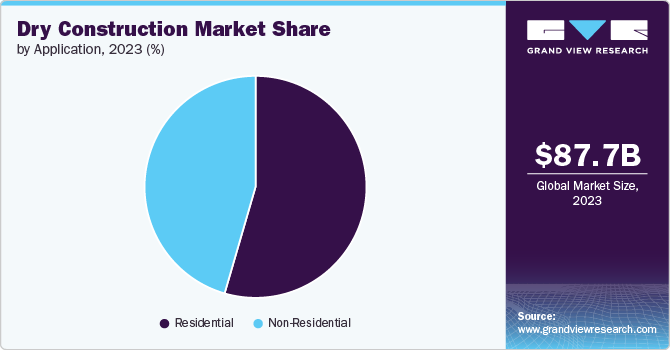

- Based on application, the residential segment led the market with the largest revenue share of 54.50% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 91.8 Billion

- 2030 Projected Market Size: USD 122.1 Billion

- CAGR (2025-2030): 4.9%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

In addition, advancements in prefabrication technology allow for faster assembly and reduced labor costs, making dry construction methods more appealing compared to traditional techniques.

Drivers, Restraints & Opportunities

The growth of the global market is significantly driven by urbanization and population growth. As cities expand and populations increase, there is a pressing need for efficient housing solutions that can be constructed quickly and cost-effectively. For instance, in rapidly urbanizing regions like Asia-Pacific, the demand for residential and commercial buildings is soaring, prompting a shift towards dry construction methods that offer faster project completion times.

A significant challenge for the market is the perception and acceptance of dry construction methods among traditional builders and clients. Many stakeholders in the industry are accustomed to conventional building techniques and may be hesitant to adopt new methods due to concerns about quality and durability. Furthermore, regulatory hurdles can impede the adoption of dry construction practices. In some regions, building codes and regulations may not fully accommodate or recognize techniques, leading to complications in project approvals and compliance.

As governments and organizations worldwide prioritize green building initiatives, dry construction methods, which typically generate less waste and utilize sustainable materials, are becoming more attractive. For instance, the use of recycled materials can significantly reduce the environmental impact of building projects. Additionally, the rise of smart building technologies presents an opportunity for integrating dry construction with advanced automation and control systems, enhancing energy efficiency and operational performance.

Type Insights

“Boarding emerged as the fastest growing type with a CAGR of 5.2%”

Based on type, the supporting framework segment led the market with the largest revenue share of 56.75% in 2023. This segment typically involves materials like gypsum board, plywood, and fiber cement board, which are designed to be lightweight, easy to install, and cost-effective. Gypsum board, in particular, is widely used for interior walls due to its fire resistance and soundproofing properties. The growing trend of open-plan living spaces in residential design has also bolstered the demand for versatile boarding solutions that can be easily modified and adapted to various layouts.

The supporting framework segment primarily encompasses structural elements that provide stability and support to buildings without the need for traditional masonry. This includes components such as steel frames, concrete panels, and lightweight metal structures. These materials are favored for their ability to be prefabricated off-site, which not only speeds up process times but also minimizes on-site labor and waste.

In other types, Insulation systems are becoming increasingly important due to rising energy efficiency standards and the need for sustainable building practices. Materials like spray foam, rigid foam boards, and mineral wool are popular for their thermal performance, which helps to reduce energy consumption in buildings. For example, the use of rigid foam boards in exterior walls can significantly enhance a building’s insulation properties, contributing to overall energy savings.

Material Insights

“Metal emerged as the fastest growing material with a CAGR of 5.4%”

Based on material, the plasterboard segment led the market with the largest revenue share of 28.75% in 2023. It consists of a gypsum core sandwiched between two sheets of heavy paper or fiberglass, making it lightweight and easy to handle. One of the primary advantages of plasterboard is its fire resistance, which is crucial for enhancing safety in residential and commercial buildings. For instance, fire-resistant plasterboards are often mandated in high-rise buildings to meet safety regulations. In addition, plasterboard is favored for its ease of installation and clean finish, which reduces labor costs and building time compared to traditional plastering methods.

Wood is another significant material in the global market, valued for its natural aesthetic, insulating properties, and sustainability. It is commonly used in framing, flooring, and as decorative elements in both residential and commercial buildings. The versatility of wood allows it to be utilized in various forms, such as engineered wood products like plywood and oriented strand board (OSB), which provide enhanced strength and stability.

Metal materials, particularly steel and aluminum, play a crucial role in the global market due to their strength, durability, and fire resistance. Steel framing systems are widely used in commercial infrastructure, providing a lightweight yet robust alternative to traditional materials. For example, steel studs are often employed in the making of interior walls, offering superior load-bearing capabilities and resistance to warping or cracking.

Application Insights

“Non-Residential emerged as the fastest growing form with a CAGR of 5.1%”

Based on application, the residential segment led the market with the largest revenue share of 54.50% in 2023. It is primarily driven by the increasing demand for housing and the growing trend of urbanization. As more people move to urban areas, the need for efficient and cost-effective construction methods becomes paramount. Dry construction techniques, such as the use of plasterboard and lightweight materials, allow for faster building times and reduced labor costs, making them attractive options for residential projects.

The non-residential application segment encompasses a wide range of structures, including commercial buildings, healthcare facilities, and educational institutions. This segment is experiencing significant growth due to the increasing investments in infrastructure and commercial real estate. Dry construction methods are favored in non-residential projects for their versatility and ability to meet specific design requirements. For example, hospitals and clinics are increasingly utilizing techniques to create flexible spaces that can be easily reconfigured as needs change. In addition, the hospitality sector is leveraging these methods to expedite the building of hotels and resorts, allowing them to capitalize on tourism trends more quickly.

Regional Insights

“North America emerged as the fastest growing market with a CAGR of 5.2% from 2024-2030”

The dry construction market in North America is characterized by a mature and well-established industry, particularly in the United States and Canada. The region is known for its advanced construction technologies and high standards of building practices. The market is driven by a robust demand for both residential and non-residential construction, with a notable emphasis on sustainability and energy efficiency.

Asia Pacific Dry Construction Market Trends

Asia Pacific dominated the dry construction market with the revenue share of 33.35% in 2023. This growth is primarily driven by rapid urbanization, industrialization, and increasing population density in countries like India and China. The demand for residential and commercial buildings is surging, leading to a significant rise in construction activities. In addition, the growing middle class in countries like India is driving demand for modern housing solutions, which often utilize dry construction methods for their efficiency and speed.

The dry construction market in China is aided by government's focus on urbanization and infrastructure development has led to a surge in infrastructure projects across the country. For example, the Chinese government has initiated several large-scale housing projects aimed at providing affordable housing to its citizens, which often utilize dry construction techniques for their efficiency. In addition, the rise of smart cities in China is promoting the use of advanced materials and technologies, further enhancing the demand for dry construction solutions.

Europe Dry Construction Market Trends

The dry construction market in Europe is characterized by stringent building regulations and a strong emphasis on eco-friendly practices. Countries like Germany and the UK are leading the way in adopting dry construction methods, particularly in residential projects. For instance, the use of lightweight partition systems and modular building techniques is becoming increasingly popular, allowing for faster project completion and reduced environmental impact.

Key Dry Construction Company Insights

The market is characterized by a competitive landscape where several key players are vying for market share through innovative products and strategic initiatives. Major companies in this sector, such as Sika AG, Ramco Industries Limited leverage their core competencies to maintain a competitive edge. For instance, Sika has focused on sustainability and energy efficiency, developing products that not only meet building codes but also contribute to green building certifications. Their commitment to innovation is evident in their extensive research and development efforts, which have led to the introduction of advanced plasterboard products that enhance thermal insulation and reduce environmental impact.

Some of the key players operating in the global market include

-

Sika AG is a Swiss multinational company that specializes in the development and production of systems and products for bonding, sealing, damping, reinforcing, and protecting in the construction and industrial sectors. Sika provides industrial flooring solutions, roofing systems, and waterproofing products, catering to both residential and commercial needs

-

Griplock Systems, LLC is a U.S.-based company that specializes in innovative dry construction solutions, particularly focusing on fastening systems designed for drywall and other materials

-

Ramco Industries offers a variety of products tailored for dry construction, including fiber cement boards, which are known for their durability and resistance to moisture and fire. These boards are widely used in both residential and commercial applications. In addition, Ramco provides lightweight wall panels and pre-fabricated building solutions, which facilitate faster construction times and lower environmental impact

Key Dry Construction Companies:

The following are the leading companies in the dry construction market. These companies collectively hold the largest market share and dictate industry trends.

- Polygon

- Griplock Systems, LLC

- Stueve Construction, LLC.

- Fullerton Building Systems.

- Ravago Hellas Building Solutions

- Hangzhou Zhongchuang Electron Co., Ltd.

- Ramco Industries Limited

- Sika AG

- YOSHINO GYPSUM CO.,LTD

- EPACK Prefab

Recent Developments

-

In July 2024, Ferrovial Construction announced collaboration with local contractors in Ireland in its bid to make a return in the country’s construction market. The company aims to take benefit from the USD 183.8 billion National Development Plan rolled out by the Ireland government for construction of new roads and rail schemes in the country

-

In November 2023, Sika AG acquired a 30% stake in Concria Oy, a company specializing in innovative concrete floors. Sika aims to leverage the expertise of Concria Oy and use its technologies in order to expand its offerings in the flooring segment of dry construction

Dry Construction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 96.1 billion

Revenue forecast in 2030

USD 122.1 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Polygon; Griplock Systems, LLC; Stueve Construction, LLC.; Fullerton Building Systems.; Ravago Hellas Building Solutions; Hangzhou Zhongchuang Electron Co., Ltd.; Ramco Industries Limited; Sika AG; YOSHINO GYPSUM CO.,LTD; EPACK Prefab

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dry Construction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dry construction market report based on type, material, application and region.

-

Type Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Supporting Framework

-

Boarding

-

Other Types

-

-

Material Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Plasterboard

-

Wood

-

Metal

-

Plastic

-

Other Materials

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dry construction market size was estimated at USD 87751.67 million in 2023 and is expected to reach USD 91,805.79 million in 2024.

b. The global dry construction market is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030 to reach USD 122,082.0 million by 2030.

b. Residential applications dominated the dry construction market and accounted for a revenue share of approximately 54.5% in 2023, driven by the increasing demand for housing and the growing trend of urbanization worldwide.

b. Some key players operating in the dry construction market include Polygon, Griplock Systems, LLC, Stueve Construction, LLC., Fullerton Building Systems., Ravago Hellas Building Solutions, Hangzhou Zhongchuang Electron Co., Ltd., Ramco Industries Limited, Sika AG, YOSHINO GYPSUM CO.,LTD, and EPACK Prefab

b. Key factors driving the dry construction market's growth include rapid urbanization and population growth, particularly in regions like Asia-Pacific. Furthermore, advancements in prefabrication technology allow for faster assembly and reduced labor costs, making dry construction methods more appealing compared to traditional techniques.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.