- Home

- »

- Pharmaceuticals

- »

-

Dupixent Market Size, Share & Growth, Industry Report 2033GVR Report cover

![Dupixent Market Size, Share & Trends Report]()

Dupixent Market (2025 - 2033) Size, Share & Trends Analysis Report By Indication (Atopic Dermatitis (AD), Asthma, Chronic Rhinosinusitis With Nasal Polyps (CRSwNP), Chronic Obstructive Pulmonary Disease (COPD)), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-657-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dupixent Market Summary

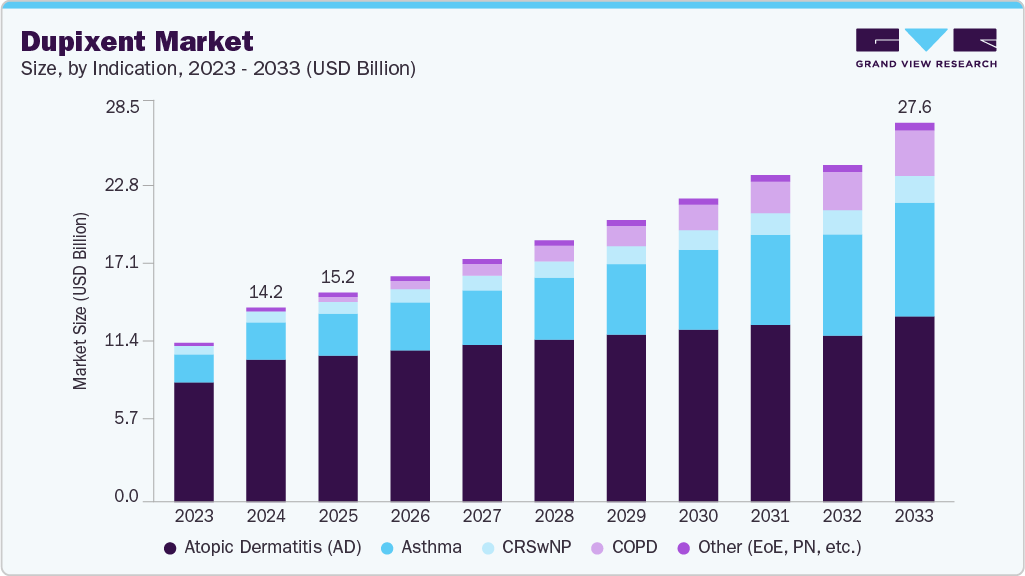

The global dupixent market size was estimated at USD 14.15 billion in 2024, and is projected to reach USD 27.58 billion by 2033, growing at a CAGR of 7.70% from 2025 to 2033. The Dupixent industry reflects a transition from traditional therapies to biologics.

Key Market Trends & Insights

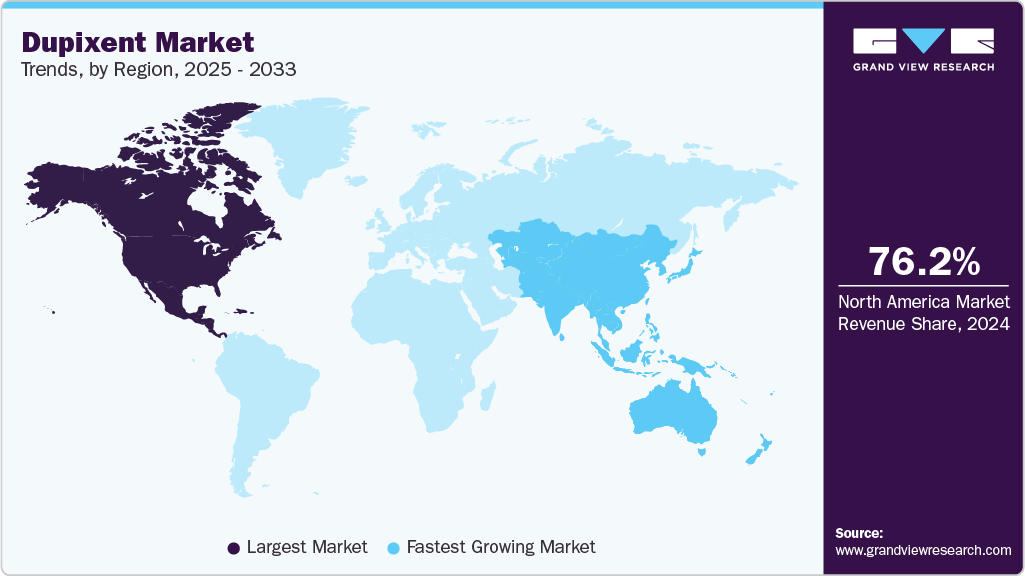

- North America led the dupixent market with the largest share of 76.15% in 2024.

- The U.S. dominates the North American Dupixent industry in 2024.

- By indication, the Atopic dermatitis (AD) segment dominated the market with the largest revenue share of 73.30% in 2024.

- By distribution channel, hospital pharmacies segment dominated the dupixent market with the largest revenue share of 53.94% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.15 Billion

- 2033 Projected Market Size: USD 27.58 Billion

- CAGR (2025-2033): 7.70%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Anchored by its innovative interleukin-4 and interleukin-13 inhibition mechanism, this growth is driven by the increasing global prevalence of Type 2 inflammatory diseases, including atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps, along with recent regulatory approvals for new indications such as bullous pemphigoid and eosinophilic esophagitis. The market growth is driven by the need for treatments addressing Type 2 inflammatory diseases. Dupixent, developed by Sanofi and Regeneron, demonstrates efficacy and safety in clinical trials, surpassing conventional options like corticosteroids for conditions including atopic dermatitis and asthma. This shift is supported by increasing global prevalence, with over 200 million atopic dermatitis patients and 300 million asthma cases reported in 2024.

Research and development efforts are a key driver of the Dupixent market’s expansion, supported by clinical trials across new therapeutic areas. Ongoing studies such as LIBERTY-CSU CUPID for chronic spontaneous urticaria and trials in allergic fungal rhinosinusitis aim to broaden the drug’s reach to new patient populations. Pediatric trials for eosinophilic esophagitis and approved use in bullous pemphigoid (January 2024) are expected to enhance patient eligibility and strengthen long-term revenue generation through 2033. These initiatives, supported by real-world evidence, are increasing Dupixent’s positioning across inflammatory and rare immunologic indications.

Sanofi and Regeneron’s global collaboration facilitates accelerated regulatory approvals and strengthens market access infrastructure. U.S. FDA approvals in June 2025 for COPD and bullous pemphigoid mark strategic milestones, expanding Dupixent’s approved indications to nine, including chronic rhinosinusitis with nasal polyps and prurigo nodularis. This has reinforced the drug’s standing in the interleukin inhibitor class, with global rollout in North America, Europe, and Asia Pacific driven by a coordinated regulatory and commercialization strategy.

Patent protection in major markets such as the U.S. and Japan until 2033 reduces biosimilar competition risk in the medium term. Additionally, manufacturing complexity and specialized facilities act as deterrents for new entrants. Market expansion opportunities remain in underpenetrated regions, particularly Latin America and the Middle East & Africa. Countries such as Brazil and Saudi Arabia present significant patient pools, supported by healthcare reforms and increasing biologics demand. Localized pricing strategies and distribution partnerships are expected to drive regional access.

Regulatory incentives such as orphan drug exclusivity in Europe, combined with a strong development pipeline, support sustained growth. However, post-2033 market dynamics, including biosimilar entry and pricing constraints in Europe and Asia Pacific, highlight the need for adaptive reimbursement strategies and patient access programs to maintain profitability.

Pipeline Analysis

Research and development for Dupixent centers on broadening its therapeutic scope, targeting new indications like chronic spontaneous urticaria and allergic fungal rhinosinusitis. Based on these positive phase 3 results, the U.S. Food and Drug Administration (FDA) approved Dupixent on April 18, 2025, as the first new targeted therapy for CSU in over a decade. This approval covers adults and adolescents aged 12 years and older whose symptoms are not adequately controlled by H1 antihistamines, potentially expanding the patient pool. Pediatric trials for eosinophilic esophagitis address unmet needs in younger populations, while studies in bullous pemphigoid, recently approved, target rare diseases. These efforts could significantly increase the market size by accessing new patient segments. Sanofi and Regeneron’s focus on real-world evidence and combination therapies strengthens Dupixent’s clinical profile, enhancing its competitive position against biosimilars. Successful outcomes from these trials may lead to label expansions, reinforcing market growth prospects through 2033. The emphasis on rare and underserved indications underscores Dupixent’s strategic approach to capturing high-value niche markets.

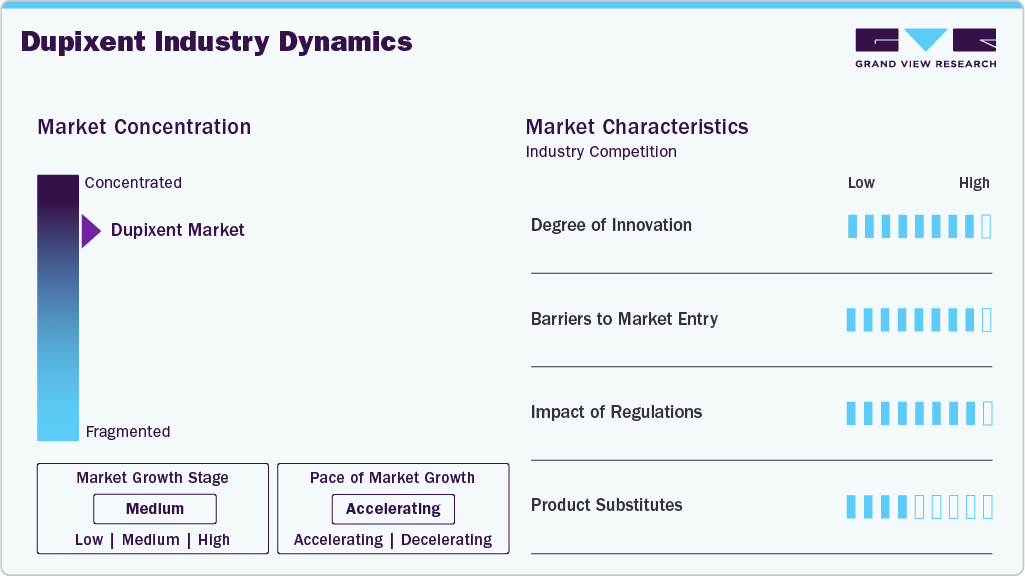

Market Concentration & Characteristics

Innovation drives the Dupixent market, with Sanofi and Regeneron advancing new indications like chronic spontaneous urticaria through trials such as LIBERTY-CSU CUPID, which received FDA approval in April 2025. Research into pediatric formulations and rare diseases, including bullous pemphigoid, expands patient eligibility. Real-world evidence studies bolster long-term efficacy claims, distinguishing Dupixent from competitors. Its dual IL-4/IL-13 inhibition mechanism remains unmatched, supporting its leadership in Type 2 inflammatory diseases. Continuous investment in clinical development ensures sustained market relevance, with new approvals enhancing its therapeutic versatility.

The Dupixent industry faces high entry barriers, including R&D costs exceeding a billion dollars for biologics development. Complex manufacturing of monoclonal antibodies requires specialized infrastructure, limiting new entrants. Regulatory hurdles, such as extensive clinical trials, delay market access. Patents until 2033 in the U.S. and Japan deter biosimilars. Established distribution networks and physician trust in Dupixent further challenge competitors, reinforcing Sanofi and Regeneron’s dominance in the interleukin inhibitors market.

Regulations significantly influence the Dupixent market. The FDA and EMA demand comprehensive clinical data, delaying but ensuring safe approvals, as seen with bullous pemphigoid in 2024. Pricing regulations in Europe require evidence of cost-effectiveness, impacting access. Orphan drug designations extend exclusivity, supporting growth. Post-marketing surveillance increases costs but ensures compliance. Regulatory alignment across regions could accelerate global approvals, enhancing market expansion.

Substitutes for Dupixent are limited due to its unique IL-4/IL-13 inhibition. Corticosteroids and topical treatments for atopic dermatitis lack systemic efficacy. Biologics like lebrikizumab target a single interleukin, showing reduced effectiveness. In asthma, inhalers are less effective for severe cases. Emerging bispecific antibodies are in early stages, posing future risks. Dupixent’s broad indications and clinical evidence minimize substitution threats, supported by ongoing trials.

Geographical expansion fuels the market growth, with North America leading due to high adoption. Asia Pacific, especially China and Japan, is growing rapidly due to rising healthcare investments. Japan’s approvals for eosinophilic esophagitis enhance penetration. Europe, led by Germany and France, shows steady growth. Latin America, and Middle East & Africa offer potential with improving infrastructure. Strategic partnerships and tailored pricing support global market dominance by 2033.

Indication Insights

The Atopic dermatitis (AD) segment dominated the market with the largest revenue share of 73.30% in 2024, driven by its high global prevalence, affecting over 200 million patients. Dupixent’s efficacy in moderate-to-severe cases, demonstrated by the LIBERTY AD trials, supports its dominance. These trials showed significant reductions in itch and skin lesions, with up to 70% of patients achieving clear or almost clear skin (IGA 0/1) after 16 weeks. The rising incidence of AD, particularly in urban populations, and increasing demand for biologics over topical corticosteroids fuel market growth. Sanofi and Regeneron’s patient access programs and global distribution networks enhance adoption, particularly in North America and Europe. Ongoing real-world evidence studies further validate Dupixent’s long-term safety and efficacy, reinforcing its position as the preferred treatment for severe AD.

Chronic obstructive pulmonary disease (COPD) is the fastest-growing indication for Dupixent, driven by its rising prevalence among aging populations, with over 250 million cases globally in 2024. The FDA’s approval in June 2024 for COPD, based on the phase 3 BOREAS and NOTUS trials, demonstrated Dupixent’s efficacy in reducing exacerbations in patients with uncontrolled disease and Type 2 inflammation. Emerging indications, such as allergic fungal rhinosinusitis (AFRS), are gaining traction, with ongoing phase 3 trials evaluating Dupixent’s potential to address nasal obstruction and inflammation. Positive results could add niche patient segments, enhancing market share. Additionally, trials for chronic spontaneous urticaria and pediatric eosinophilic esophagitis promise further diversification, positioning Dupixent for sustained growth through 2033.

Distribution Channel Insights

Hospital pharmacies dominated the Dupixent market with the largest revenue share of 53.94% in 2024, driven by their pivotal role in administering Dupixent for severe asthma and chronic obstructive pulmonary disease (COPD) in inpatient settings. Their capacity to manage complex biologics, including stringent cold-chain storage and precise dosing requirements, ensures effective delivery to patients with critical needs. Partnerships with Sanofi and Regeneron streamline access to high-cost therapies, supported by expertise in navigating reimbursement processes with payers. Hospital pharmacies’ integration with healthcare systems facilitates coordination for patients requiring intensive care.

The others segment, encompassing alternative distribution channels such as direct-to-patient programs and clinic-based dispensing, is the fastest-growing channel. Growth is driven by increasing demand for patient-centric delivery models, particularly in North America and Europe, where healthcare providers prioritize accessibility. Investments in logistics ensure the safe delivery of biologics like Dupixent. Strategic partnerships with healthcare systems and digital platforms further support this segment’s expansion, aligning with trends toward personalized care and improved patient outcomes.

Regional Insights

North America led the dupixent market with the largest share of 76.15% in 2024, driven by advanced healthcare infrastructure, high adoption of biologics, and favorable reimbursement policies. Over 26 million Americans with atopic dermatitis in 2025, and 26.8 million with asthma in 2022, fuel demand, supported by clinical evidence from trials like LIBERTY AD and QUEST. Robust marketing by Sanofi and Regeneron, coupled with patient access programs, ensures broad penetration. Canada shows steady growth, with Health Canada approvals for eosinophilic esophagitis enhancing adoption in May 2023. Mexico, though smaller, grows due to increasing healthcare investments. Challenges include pricing pressures from payers, requiring cost-effectiveness data. Opportunities lie in pediatric indications, with trials targeting younger patients.

The region’s high prevalence of Type 2 inflammatory diseases, aging population, and regulatory incentives like orphan drug exclusivity until 2031 sustain growth. Strategic partnerships with specialty pharmacies streamline distribution, while real-world evidence studies reinforce Dupixent’s efficacy. North America’s market leadership is expected to persist through 2033, though biosimilar competition post-patent expiry in 2033 could impact profitability. Investments in digital health platforms and patient education campaigns further drive adoption, positioning the region as a cornerstone of the global market for dupixent.

U.S. Dupixent Market Trends

The U.S. dominates the North American dupixent industry in 2024, driven by advanced healthcare infrastructure and high biologic adoption. The FDA approval for bullous pemphigoid in June 2024 and COPD has expanded Dupixent’s patient base, fueling demand. Clinical trials like LIBERTY AD and QUEST reinforce efficacy, while Sanofi and Regeneron’s robust marketing and patient access programs ensure strong penetration. Pricing pressures from payers pose challenges, requiring cost-effectiveness data. Opportunities lie in pediatric indications, with trials targeting younger patients. Strategic partnerships with specialty pharmacies streamline distribution, and real-world evidence studies support long-term efficacy. The U.S. market is expected to lead globally through 2033, though biosimilar competition post-patent expiry in 2033 may impact profitability.

Europe Dupixent Market Trends

Europe's dupixent industry, with key countries like the UK, Germany, and France driving growth. The region benefits from a high prevalence of atopic dermatitis (affecting 20% of children in some countries) and asthma, alongside EMA approvals for indications like CRSwNP and EoE. Germany leads due to its robust healthcare system and high adoption rates. France follows, with growth in asthma and recent approvals for bullous pemphigoid. The UK’s market is supported by NICE recommendations for atopic dermatitis and asthma, though pricing negotiations with the NHS limit margins. Spain and Italy contribute smaller shares but show potential due to rising awareness. Regulatory challenges, including stringent cost-effectiveness requirements, impact market access, but orphan drug designations provide exclusivity. Distribution through hospitals and specialty pharmacies ensures access, though regional disparities in healthcare infrastructure pose barriers. The future looks promising. The European market is expected to experience steady growth through 2033, largely due to regulatory harmonization that can enhance operational efficiency and a rising demand for innovative healthcare solutions.

The UK dupixent market holds a significant share of Europe, driven by advanced healthcare infrastructure and growing adoption of biologics. Recent approvals for conditions like bullous pemphigoid and COPD have expanded the patient pool. High prevalence of atopic dermatitis and asthma fuels demand, supported by clinical evidence from trials. Robust marketing by Sanofi and Regeneron, alongside patient access programs, ensures strong market penetration. Strategic pharmacy partnerships streamline distribution, and digital health initiatives enhance patient engagement.

The dupixent market in Germany is expected to witness growth over the forecast period. Germany is a key player in the Europe market, benefiting from a robust healthcare system and high biologic uptake. Recent approvals for new indications have broadened the patient base, with strong demand driven by prevalent atopic dermatitis and asthma cases. Clinical trial data bolsters prescriber confidence, while Sanofi and Regeneron’s marketing and access programs drive adoption. Payer pricing pressures demand cost-effectiveness evidence, but pediatric trials present growth potential. Germany’s market strength is expected to continue, though biosimilar competition post-patent expiry poses future challenges.

The France dupixent market maintains a strong position in Europe, supported by advanced healthcare and increasing biologic adoption. Recent regulatory approvals for additional indications have expanded the eligible patient population. High rates of atopic dermatitis and asthma drive demand, backed by clinical trial evidence. Partnerships with specialty pharmacies ensure efficient distribution, and real-world evidence strengthens trust in Dupixent’s efficacy. Digital health tools improve patient engagement. France’s market growth is expected to persist, with biosimilar risks emerging post-patent expiry.

Asia Pacific Dupixent Market Trends

Asia Pacific is the fastest-growing dupixent industry, propelled by rising healthcare investments and a high burden of Type 2 inflammatory diseases. Japan leads with approvals for eosinophilic esophagitis and atopic dermatitis, supported by trials like VENTURE, addressing over 10 million patients. China’s market expands rapidly due to regulatory reforms, a growing middle class. India shows potential but faces access barriers due to high costs and limited reimbursement. South Korea and Australia contribute through advanced healthcare systems. The region’s growth is driven by the increasing prevalence of atopic dermatitis, affecting 15-20% of children in urban areas, and COPD in aging populations. Regulatory approvals, such as China’s NMPA endorsement for asthma, enhance penetration. Challenges include pricing pressures and cold-chain logistics for biologics. Opportunities lie in partnerships with local distributors and tailored pricing strategies. Clinical trials for allergic fungal rhinosinusitis and pediatric indications could expand the patient pool. Sanofi and Regeneron’s focus on real-world evidence strengthens market positioning. Asia Pacific’s market is expected to grow significantly through 2033, though intellectual property enforcement in some countries remains a concern post-2033 patent expiry.

Japan’s dupixent market is expanding due to its aging population, high cancer screening rates, and integration of chemotherapies in national care guidelines. Government support for generics and well-structured hospital systems underpin market growth. Retail pharmacies dominate Dupixent distribution, with institutional support enhancing disease management.

The dupixent market in China is growing rapidly, supported by centralized procurement programs, healthcare reforms, and the rising incidence of lung and gastric cancers. The country is investing heavily in biosimilar production and oncology R&D. Online and retail pharmacies are transforming access to Dupixent-based therapies, especially in Tier 2 and Tier 3 cities.

Latin America Dupixent Market Trends

Latin America’s dupixent industry exhibits moderate growth, with Brazil as the primary contributor due to improving healthcare infrastructure and a population of over 200 million. Atopic dermatitis and asthma, affecting 10-15% of children and 7 million adults, respectively, drive demand. Brazil’s ANVISA approval for asthma in 2024 supports adoption, though high costs limit access to affluent segments. Mexico and Argentina show smaller but growing shares, with regulatory approvals for CRSwNP boosting penetration. Challenges include economic volatility, fragmented healthcare systems, and limited reimbursement frameworks, restricting broad adoption. Opportunities arise from rising awareness of biologics and government healthcare reforms. Partnerships with local distributors and specialty pharmacies are critical for overcoming logistical barriers, particularly cold-chain requirements. Clinical trials targeting regional patient populations, such as those for bullous pemphigoid, could enhance market relevance. Sanofi and Regeneron’s patient access programs aim to improve affordability, though pricing remains a hurdle. The region’s market is driven by urbanization and the increasing prevalence of chronic diseases. Long-term growth depends on regulatory alignment and investment in healthcare infrastructure to support biologics distribution.

The Brazil dupixent market is expanding due to rising atopic dermatitis prevalence, improved diagnosis, and increased access through public health systems. Strong biologics adoption and growing awareness support uptake. The market is projected to grow steadily, with Dupixent leading the monoclonal antibody segment in dermatology alongside key competitors.

Middle East & Africa Dupixent Market Trends

The growth of the Middle East & Africa dupixent industry is driven by rising awareness of atopic and eosinophilic diseases, expanding healthcare access, and increased diagnosis rates. Uptake is supported by regulatory approvals in Gulf countries and partnerships to improve biologics access. Market penetration remains limited but shows potential due to unmet needs in allergic and dermatologic care.

The Saudi Arabia dupixent market is expected to grow during the forecast period. Saudi Arabia is emerging as a key player in the Middle East, driven by increasing healthcare investments and growing biologic adoption. Recent approvals for new indications have expanded the eligible patient pool, with a high prevalence of atopic dermatitis and asthma fueling demand. Pricing pressures from payers require cost-effectiveness data, but pediatric trials offer growth opportunities. Partnerships with specialty pharmacies enhance distribution, and digital health platforms boost patient engagement. The market is poised for significant growth through 2033, though biosimilar competition post-patent expiry may pose challenges.

Key Dupixent Company Insights

Sanofi and Regeneron lead the Dupixent market through a strategic partnership that drives clinical development and global expansion. Their collaborative efforts focus on expanding indications, with recent FDA approvals for bullous pemphigoid and chronic spontaneous urticaria in 2025, supported by trials like LIBERTY-CSU CUPID. Investments in real-world evidence and pediatric formulations enhance Dupixent’s market penetration across North America, Europe, and Asia Pacific. Patient access programs and flexible pricing strategies address cost barriers in emerging markets like Latin America and the Middle East & Africa. The partnership’s robust distribution networks and regulatory expertise ensure rapid market access, positioning Dupixent as a leader in interleukin inhibitors.

Key Dupixent Companies:

The following are the leading companies in the dupixent market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi

- Regeneron

Recent Developments

-

In June 2025, The FDA approved Dupixent for bullous pemphigoid, marking its eighth U.S. indication and the first targeted therapy for this rare skin disease affecting ~27,000 adults, primarily the elderly. The approval, based on a pivotal trial demonstrating improved remission, reduced itch, and lower steroid use, expands Dupixent’s market potential.

-

In February 2025, Sanofi and Regeneron announced FDA acceptance of a supplemental Biologics License Application (sBLA) for Dupixent in bullous pemphigoid with priority review, accelerating approval timelines. This submission leveraged phase 3 data showing significant disease management improvements, reinforcing Dupixent’s regulatory momentum.

-

In April 2025, The FDA approved Dupixent for chronic spontaneous urticaria (CSU), the first new targeted therapy for this condition in over a decade. Phase 3 LIBERTY-CSU CUPID trial results showed reduced itch and urticaria activity, broadening Dupixent’s patient base.

-

In Feb 2025, Japan’s MHLW approved Dupixent for pediatric eosinophilic esophagitis, expanding its Asia-Pacific indications and addressing unmet needs in younger patients.

Dupixent Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.24 billion

Revenue forecast in 2033

USD 27.58 billion

Growth rate

CAGR of 7.70% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sanofi, Regeneron

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dupixent Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Dupixent market report based on indication, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Atopic Dermatitis (AD)

-

Asthma

-

Chronic Rhinosinusitis with Nasal Polyps (CRSwNP)

-

Chronic Obstructive Pulmonary Disease (COPD)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dupixent market size was estimated at USD 14.15 billion in 2024 and is expected to reach USD 15.23 billion in 2025.

b. The global dupixent market is projected to grow at a CAGR of 7.70% from 2025 to 2033 to reach USD 27.58 billion by 2033.

b. Based on indication, the atopic dermatitis (AD) segment dominated the market with the largest revenue share of 73.30% in 2024, driven by its high global prevalence, affecting over 200 million patients.

b. Sanofi and Regeneron lead the Dupixent market through a strategic partnership that drives clinical development and global expansion. Their collaborative efforts focus on expanding indications, with recent FDA approvals for bullous pemphigoid and chronic spontaneous urticaria in 2025, supported by trials like LIBERTY-CSU CUPID.

b. The Dupixent market is driven by expanding indications across dermatology, respiratory, and gastrointestinal conditions, strong clinical trial outcomes, regulatory approvals, and growing patient adoption. Strategic collaboration between Sanofi and Regeneron enhances global reach. Additional drivers include pediatric label expansions, real-world evidence supporting efficacy, and limited competition in targeted biologic therapies for Type 2 inflammation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.