- Home

- »

- Consumer F&B

- »

-

Durian Fruit Market Size And Share, Industry Report, 2030GVR Report cover

![Durian Fruit Market Size, Share & Trends Report]()

Durian Fruit Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Frozen Pulp & Paste, Whole Fruit), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-511-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Durian Fruit Market Summary

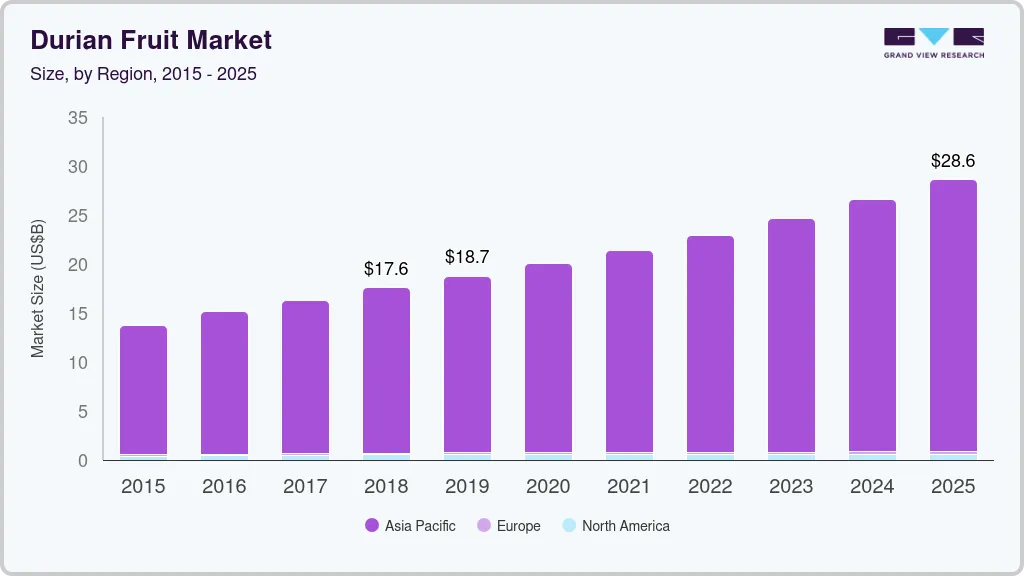

The global durian fruit market size was estimated at USD 1.74 billion in 2023 and is projected to reach USD 2.44 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The increasing popularity of durian as a delicacy in international markets is boosting demand.

Key Market Trends & Insights

- The Asia Pacific durian fruit market held the largest revenue share of 36.9% in the global durian fruit market in 2023.

- By product, the frozen pulp & paste segment accounted for 70.0% of the market revenue in 2023.

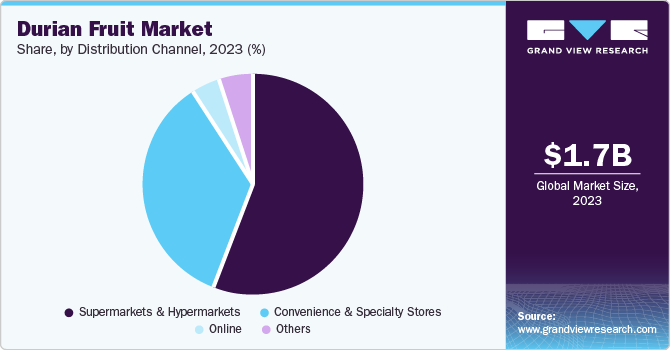

- By distribution channel, the supermarkets & hypermarkets segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.74 Billion

- 2030 Projected Market Size: USD 2.44 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

In addition, the rising awareness of durian’s nutritional benefits, such as its high vitamin and mineral content, is attracting health-conscious consumers. The expansion of e-commerce platforms has also made it easier for consumers to access durian, further fueling market growth. Moreover, advancements in agricultural practices and post-harvest technologies are improving the quality and shelf-life of durian, making it more appealing to a broader audience.

The "king of fruits" has solidified its popularity beyond Southeast Asia, with countries such as the U.S., UK, and Australia embracing durian in diverse culinary applications. Recent high-profile collaborations, such as durian-flavored products launched by international food chains, including Dunkin' Donuts and Baskin-Robbins, highlight the fruit's versatility and growing acceptance. The market is anticipated to be driven by further cross-cultural integration, with innovative products appearing in mainstream supermarkets and specialty stores across Europe and North America.

In addition, the rise of global travel and gastronomic tourism is expected to sustain interest, particularly in Thailand and Malaysia, where durian-themed attractions and festivals draw international visitors. Governments in these regions also support the industry through policies aimed at boosting production and agro-tourism, ensuring that durian continues to gain prominence on the world stage.

Product Insights

The frozen pulp & paste segment accounted for 70.0% of the market revenue in 2023. This dominance can be attributed to the convenience and versatility of frozen durian products. Frozen pulp and paste are widely used in various culinary applications, including desserts, beverages, and bakery products, making them highly popular among consumers and food service providers. The extended shelf life of frozen durian products also contributes to their demand, allowing for year-round availability and reducing the risk of spoilage. In addition, the ease of transportation and storage of frozen durian products makes them a preferred choice for international trade, further boosting their market share.

The whole fruit segment is expected to grow at a CAGR of 4.5% from 2024 to 2030. The increasing consumer preference for fresh and natural products drives this growth. Whole durians are often perceived as more authentic and flavorful than processed forms, attracting durian enthusiasts and health-conscious consumers. The rising popularity of durian in Western markets, where consumers are becoming more adventurous with exotic fruits, also contributes to the growth of the whole fruit segment. Furthermore, advancements in packaging and transportation technologies are improving the shelf life and quality of whole durians, making them more accessible to a global audience.

Distribution Channel Insights

The supermarkets & hypermarkets segment dominated the market in 2023. This dominance can be attributed to the widespread availability and accessibility of durian in these large retail formats. These retail giants also benefit from extensive distribution networks and significant purchasing power, allowing them to offer competitive prices and promotions that attract a broad customer base. In addition, the convenience of one-stop shopping and the ability to physically inspect the quality of durian before purchase contributes to the popularity of supermarkets and hypermarkets as the preferred distribution channel for durian fruit.

The online segment is expected to grow the fastest over the forecast period from 2024 to 2030. This rapid growth is driven by the increasing penetration of e-commerce and the rising consumer preference for online shopping. Online platforms offer the convenience of home delivery, a wide range of product options, and the ability to compare prices and read reviews, making them an attractive choice for durian buyers. Furthermore, advancements in cold chain logistics and packaging technologies are enhancing durian quality and shelf life during transit, addressing concerns about freshness and spoilage. The COVID-19 pandemic has also accelerated the shift towards online shopping, with many consumers continuing to prefer this mode of purchase even post-pandemic.

Regional Insights

North America durian fruit market accounted for 20.3% of the global market revenue in 2023. This dominance is driven by the increasing popularity of exotic fruits among health-conscious consumers and the growing Asian population in the region, which traditionally prefers durian. The rising awareness of durian’s nutritional benefits, such as its high vitamin and mineral content, further boosts its demand.

U.S. Durian Fruit Market Trends

The U.S. durian fruit market dominated the North American region in 2023. The country’s leadership in this market can be attributed to its large and diverse consumer base, which is increasingly open to trying new and exotic foods. A significant Asian-American population also contributes to the high demand for durian. Moreover, the U.S. market benefits from well-established distribution channels, including major supermarket chains and online retailers, which make durian readily available to consumers. The trend of incorporating durian into various culinary applications, such as desserts and beverages, is also gaining traction, further driving market growth.

Asia Pacific Durian Fruit Market Trends

The Asia Pacific durian fruit market held the largest revenue share of 36.9% in the global durian fruit market in 2023 primarily due to the fruit’s native status and cultural significance in Thailand, Malaysia, and Indonesia. The region’s market is characterized by high consumption levels and a strong export demand, particularly from China. The popularity of premium durian varieties, such as Musang King, is also a significant growth driver. In addition, the expansion of durian plantations and advancements in agricultural practices enhance the supply chain, ensuring a steady availability of high-quality durian. The rise of durian-themed tourism in countries such as Malaysia and Thailand further boosts market growth.

China durian fruit market is a major player in the global market, accounting for a substantial portion of the demand. The country’s appetite for durian has been growing rapidly, driven by its middle-class population's increasing disposable income and changing dietary preferences. Durian is highly popular in China as a fresh fruit and an ingredient in various processed foods, such as pastries, ice creams, and beverages. The Chinese market is also characterized by a strong preference for premium durian varieties, which command higher prices. The government’s efforts to streamline import procedures and improve cold chain logistics further facilitate the growth of the durian market in China.

Europe Durian Fruit Market Trends

The European durian fruit market is expected to grow at a CAGR of 5.3% from 2024 to 2030, driven by the increasing interest in exotic and tropical fruits among European consumers. The rising awareness of durian’s health benefits and its unique flavor profile is attracting a niche but growing market segment. Countries such as the UK, Germany, and France are seeing a surge in demand for durian in fresh and processed forms. In addition, fusion cuisine, which incorporates exotic ingredients such as durian, is gaining popularity in the region.

The durian fruit market in the UK is expected to grow steadily, driven by the increasing multicultural population and the rising popularity of Asian cuisine. A significant number of Asian supermarkets and specialty stores that stock durian products are contributing to this trend. In addition, the influence of food bloggers and social media is helping to introduce durian to a broader audience.

Latin America Durian Fruit Market Trends

The Latin American durian fruit market is expected to grow the fastest over the forecast period. This rapid growth is driven by the increasing awareness of durian’s nutritional benefits and its unique flavor among consumers in the region. Countries including Brazil and Mexico are seeing a rise in demand for exotic fruits, including durian, as part of a broader trend toward healthy eating and culinary experimentation. The expansion of specialty grocery stores and the availability of durian through online platforms are making it more accessible to consumers. The region’s favorable climate conditions for tropical fruit cultivation are encouraging local production, which is expected to support the market.

Key Durian Fruit Company Insights

The global durian fruit market is driven by several key companies, including Charoen Pokphand Group, Sunshine International Co., Ltd., Chainoi Food Company Limited, and Thai Agri Foods Public Company Limited, among others.

-

Charoen Pokphand Group is an agribusiness conglomerate that is heavily involved in the durian market, particularly in Thailand. They are known for their extensive distribution network and high-quality durian products. The company plans to significantly increase its durian sales in China, leveraging its strong presence in supermarkets and convenience stores.

-

Sunshine International is known for its frozen durian products. The company supplies a wide range of frozen fruits, including durian, to markets in Australia and Canada under the brand “Fruit King.”

Key Durian Fruit Companies

The following are the leading companies in the durian fruit market. These companies collectively hold the largest market share and dictate industry trends.

- Charoen Pokphand Group

- Sunshine International Co., Ltd.

- Chainoi Food Company Limited

- Thai Agri Foods Public Company Limited

- Interfresh Co., Ltd.

- TRL (South East Asia) Sdn Bhd

- Top Fruits Sdn Bhd

- Hernan Corporation

- Grand World International Co., Ltd.

- Royal Fruits

Recent Developments

-

In July 2024, Malaysia's tourism sector has unveiled the "Durian Tourism Packages 2024/2025," featuring a collection of 62 specialized durian-focused packages offered by 27 local tour operators from 12 different Malaysian states. These packages provide a combination of durian tasting opportunities and exciting activities, highlighting the wide range of flavors found in this famous fruit.

-

In August 2024, Malaysia commenced fresh durian exports to China, a significant expansion from previously limited frozen durian products and whole durians. A meticulously coordinated logistics infrastructure, including rail, road, and other transportation modes, ensures efficient distribution of fresh durians throughout China within 24 hours. This rapid delivery network enables swift access to key markets such as Beijing and Shanghai.

Durian Fruit Market Scope

Report Attribute

Details

Market size value in 2024

USD 1.83 billion

Revenue forecast in 2030

USD 2.44 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Charoen Pokphand Group, Sunshine International Co., Ltd., Chainoi Food Company Limited, Thai Agri Foods Public Company Limited, Interfresh Co., Ltd., TRL (South East Asia) Sdn Bhd, Top Fruits Sdn Bhd, Hernan Corporation, Grand World International Co., Ltd., Royal Fruits

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Durian Fruit Market Report Segmentation

This report forecasts revenue & volume growth of the Durian Fruit market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global durian fruit market report based on product, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen Pulp & Paste

-

Whole Fruit

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience & Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.