- Home

- »

- Advanced Interior Materials

- »

-

Dust Suppression System Market Size, Industry Report, 2033GVR Report cover

![Dust Suppression System Market Size, Share & Trends Report]()

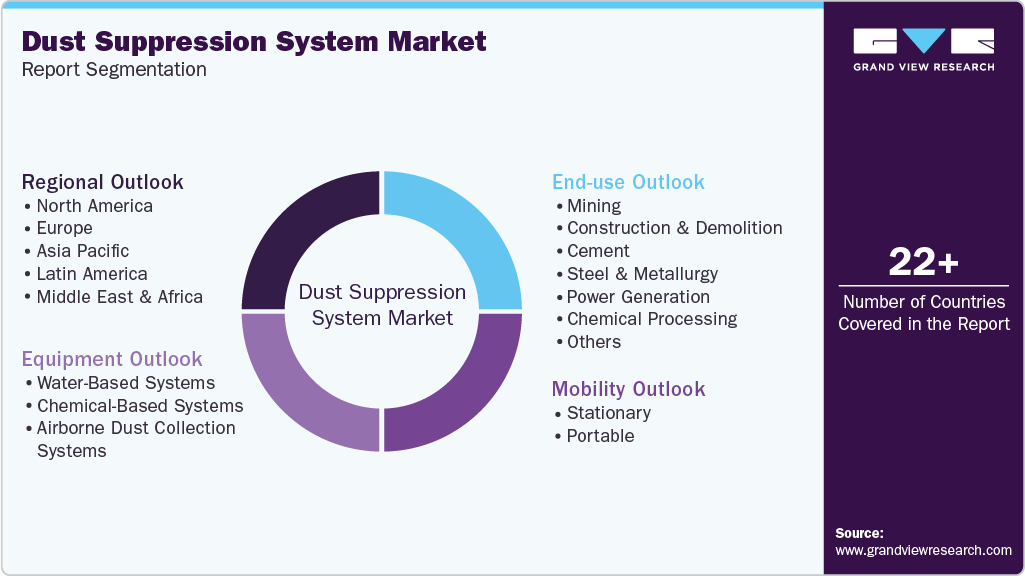

Dust Suppression System Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment (Water-Based Systems, Chemical-Based Systems), By Mobility (Stationary, Portable), By End-use (Mining, Cement, Power Generation, Chemical Processing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-821-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dust Suppression System Market Summary

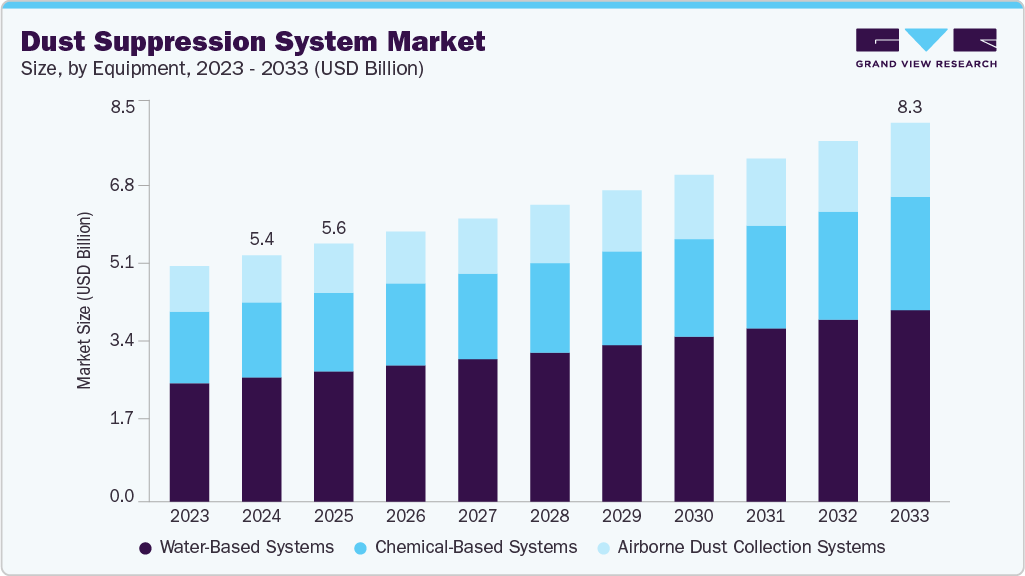

The global dust suppression system market size was estimated at USD 5,364.5 million in 2024 and is projected to reach USD 8,251.0 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033. Growing enforcement of air-quality regulations and worker safety standards is a major catalyst for dust suppression adoption worldwide.

Key Market Trends & Insights

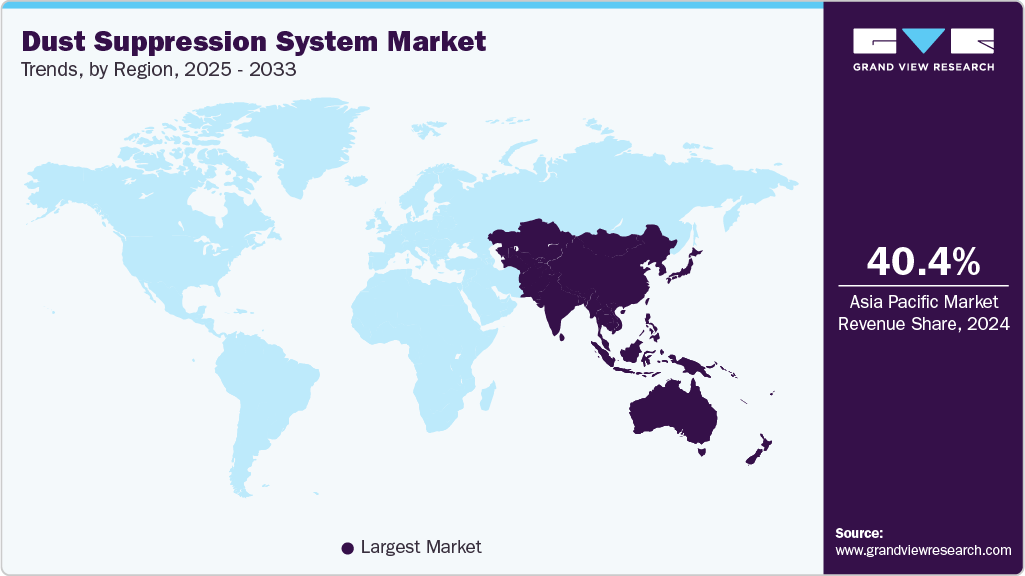

- Asia Pacific dominated the dust suppression system industry with the largest revenue share of 40.4% in 2024.

- China dominates the Asia Pacific market owing to its massive mining, construction, and cement production activities that generate substantial dust control needs.

- By equipment, the water-based systems lead the market, accounting for a 50.5% share in 2024.

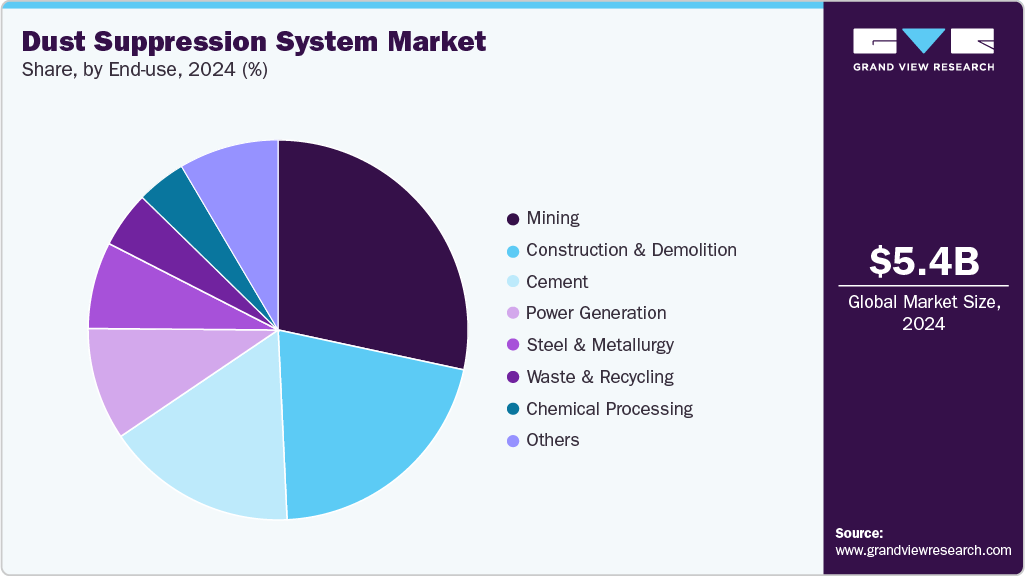

- By end-use, the mining segment remains the dominant end-use segment and accounts for 28.4% share in 2024.

- By mobility, the stationary dust suppression systems lead with a 75.8% market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,364.5 Million

- 2033 Projected Market Size: USD 8,251.0 Million

- CAGR (2025-2033): 4.9%

- Asia Pacific: Largest market in 2024

Industries such as mining, construction, cement, and power generation face stricter limits on particulate emissions, pushing investments into both wet and dry control systems. Rising awareness of occupational respiratory risks further accelerates compliance-driven spending.

Expansion of large-scale infrastructure, mining, and industrial projects, particularly in Asia-Pacific, Latin America, and Africa, is boosting dust generation points and elevating the need for reliable suppression solutions. Companies are also prioritizing sustainability, favoring water-efficient fogging systems and chemical agents that reduce water consumption. Technological advancements such as IoT-enabled control, remote monitoring, and energy-efficient collectors add additional momentum. Collectively, these trends create sustained multi-sector demand for advanced dust suppression systems.

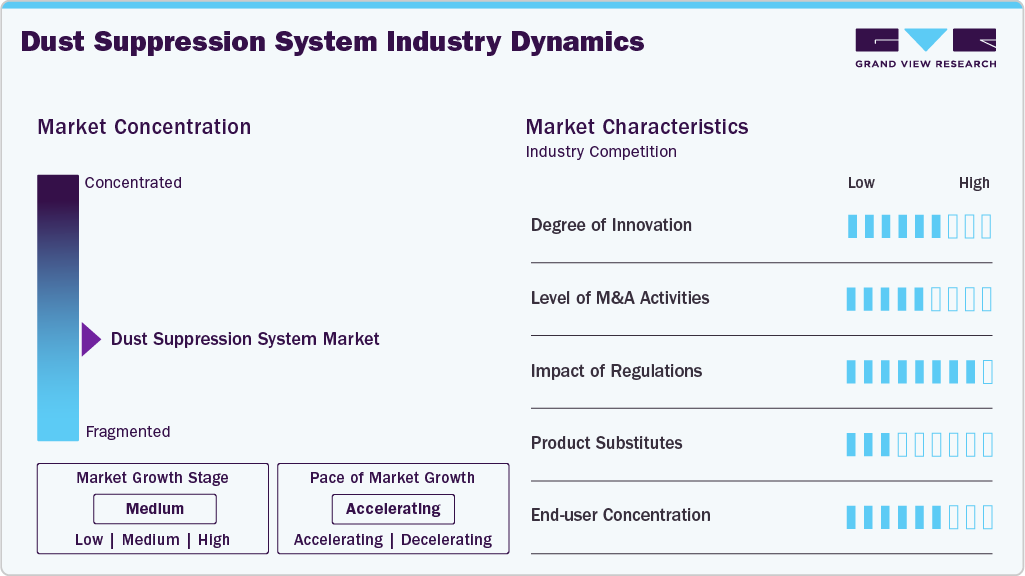

Market Concentration & Characteristics

The global dust suppression system industry remains moderately fragmented, with a mix of regional specialists and a few established multinational players. While large companies supply integrated wet and dry suppression solutions to mining, cement, and heavy industrial clients, a substantial portion of the market is served by smaller manufacturers offering localized, application-specific systems. This structure encourages strong price competition, frequent technology differentiation, and niche product development.

Innovation in the dust suppression system industry is steadily advancing, driven by the need for higher efficiency and lower water consumption. Manufacturers are integrating IoT sensors, automated flow control, and remote monitoring to improve accuracy and reduce operating costs. Chemical formulations are also evolving, offering longer-lasting surface binding and reduced environmental impact. Overall, innovation is becoming a key differentiator as end users demand smarter, more sustainable solutions.

Environmental and occupational safety regulations exert a strong influence on technology choices and investment cycles across industries. Stricter limits on particulate emissions require operators to adopt compliant suppression systems or face operational penalties. Regulatory bodies increasingly enforce continuous monitoring, pushing demand for high-performance fogging, filtration, and ESP systems. As standards tighten globally, regulation remains one of the most important drivers shaping product design and adoption.

Substitutes for dust suppression systems exist but offer limited effectiveness in most industrial environments. Natural barriers, mechanical enclosures, or operational adjustments may reduce dust temporarily but cannot replace engineered suppression at high-volume sites. PPE such as masks and respirators protect workers but do not control ambient dust or meet emission norms. As industries scale and regulations strengthen, true substitution becomes impractical, reinforcing long-term reliance on dedicated dust suppression technologies.

Drivers, Opportunities & Restraints

Rising industrial activity across mining, construction, and material processing continues to increase dust emissions, driving the need for reliable suppression systems. Governments are enforcing tighter air-quality and workplace-safety regulations, pushing operators toward compliant wet and dry control technologies. Growing awareness of respiratory health risks among workers further accelerates adoption. Additionally, demand for water-efficient and automated solutions is strengthening the market’s long-term growth outlook.

Advancements in IoT-enabled systems, automated spray controls, and smart monitoring platforms create significant opportunities for premium product differentiation. Water-scarce regions are opening strong potential for polymer-based and chemical agents that offer longer-lasting dust control with minimal consumption. Expansion of large mining and infrastructure projects in emerging markets will boost new installations. Retrofit and aftermarket services, including filter replacements and system upgrades, present recurring revenue prospects.

High initial capital costs for advanced fogging units, baghouses, and electrostatic systems can deter adoption in cost-sensitive industries. Water availability constraints in arid regions limit traditional spray-based solutions, pushing users to seek alternatives. Inconsistent enforcement of emission regulations across developing economies slows technology penetration. Maintenance complexity and the need for skilled operators also pose operational challenges, especially for smaller enterprises.

Equipment Insights

Water-based systems lead the market, accounting for a 50.5% share in 2024, because they are affordable, easy to install, and work well in many outdoor settings. Industries such as mining, construction, and bulk material handling often use sprays and misting units to quickly control dust. These systems can cover large areas without much complexity, which keeps them popular. As more companies look for low-maintenance, on-site solutions, water-based systems continue to hold the largest market share.

Airborne dust collection systems segment is expected to grow at a considerable CAGR of 5.2% from 2025 to 2033 in terms of revenue. Airborne dust collection systems are growing quickly as industries must meet stricter emission rules and need better dust control. Equipment such as baghouses, ESPs, and cyclones capture fine dust at key points in processing, so they are essential in cement, steel, and power plants. More companies are upgrading or retrofitting their systems to stay compliant, which is speeding up adoption. Because of their strong filtration and ability to meet regulations, these systems are now the fastest-growing segment in the market.

Mobility Insights

Stationary dust suppression systems lead with a 75.8% market share in 2024. They are key to large industrial facilities such as cement plants, steel mills, and power stations. These fixed units deliver consistent, high-capacity control at critical emission points. This ensures compliance with strict air-quality norms. Their long service life and process-line integration make them vital infrastructure investments. As industries focus on reliability and continuous operation, stationary systems retain the largest share.

Portable segment is expected to grow at a moderate CAGR of 4.6% from 2025 to 2033 in terms of revenue. Portable systems are growing as construction, demolition, and small mining sites demand flexible, easy-to-deploy solutions. These units allow rapid relocation and on-demand dust control, making them ideal for dynamic, short-cycle projects. Increasing adoption in urban construction zones and roadwork sites further boosts their uptake. Their lower upfront cost and versatility position portable systems as the fastest-rising mobility segment.

End-use Insights

Mining remains the dominant end-use segment and accounts for 28.4% share in 2024, because of the sheer volume of dust generated during blasting, hauling, crushing, and material transfer operations. Regulatory pressure to reduce worker exposure and community impact further drives high system adoption. Large open-pit and underground mines rely on both water-based and collection technologies for continuous compliance. The scale and intensity of mining activities ensure sustained demand for heavy-duty suppression solutions.

The cement segment is expected to grow at a significant CAGR of 5.3% from 2025 to 2033 in terms of revenue. The cement industry is witnessing strong growth in dust suppression demand as plants upgrade to meet tighter particulate emission standards. High dust generation at kilns, mills, and material handling points makes efficient suppression and filtration essential. Modernization projects and capacity expansions across emerging regions are accelerating installations. With increasing emphasis on environmental performance, cement facilities are investing in advanced airborne collection and wet control systems.

Regional Insights

Asia Pacific dust suppression system industry is a dominant market and accounted for a 40.4% of the global share, owing to large-scale mining operations, rapid construction activity, and expanding cement and metal processing industries. Governments in China, India, and Southeast Asia continue to enforce stricter air-quality standards, boosting system installations. Massive infrastructure investments create continuous dust-control needs across project sites. The region’s industrial growth and regulatory pressure firmly anchor its leading market position.

China dominates the Asia Pacific market owing to its massive mining, construction, and cement production activities that generate substantial dust control needs. The government’s strict air-quality policies and industrial emission limits drive continuous investment in advanced suppression and filtration technologies. Rapid infrastructure development across transportation, utilities, and manufacturing further increases system demand. China’s large-scale industrial base ensures sustained adoption of both wet and dry dust control solutions.

India is growing quickly as expanding infrastructure, mining, and real estate projects elevate dust management requirements across the country. Strengthening regulations from CPCB and state pollution boards are pushing industries toward more compliant, efficient suppression systems. Urban construction and road development also boost demand for portable and water-efficient technologies. Rising focus on worker safety and environmental sustainability continues to accelerate market growth in India.

North America Dust Suppression System Market Trends

North America dust suppression system industry is projected to grow steadily at a CAGR of 4.3% as industries upgrade equipment to comply with stringent OSHA and EPA emission norms. Expansion in metal recycling, construction, and quarrying supports rising demand for both wet suppression and filtration systems. Adoption of automated, high-efficiency solutions is gaining momentum due to labor and sustainability priorities. Retrofit projects in the cement and power sectors further strengthen market growth.

U.S. Dust Suppression System Market Trends

The U.S. dust suppression system industry dominated the North American market in 2024, due to its large mining, construction, and industrial processing base that continually generates high dust-control demand. Strict OSHA and EPA regulations compel facilities to invest in advanced suppression and collection technologies. Ongoing upgrades in cement, metal recycling, and power plants further strengthen adoption. The country’s focus on automation and sustainable operations keeps system spending consistently high.

Canada dust suppression system industry is growing steadily, driven by active mining operations, expanding infrastructure projects, and stricter environmental compliance requirements. The country’s strong focus on worker safety and emission control fuels the uptake of both portable and stationary dust management solutions. Investment in large-scale natural resource projects adds recurring system demand. The increasing modernization of industrial plants continues to support market growth across the region.

Europe Dust Suppression System Market Trends

Europe’s dust suppression system industry growth is propelled by stringent environmental regulations and an intense focus on decarbonization and workplace safety. Consequently, industrial facilities increasingly deploy advanced ESPs, baghouses, and low-water fog systems to comply with strict particulate thresholds. Additionally, infrastructure upgrades across Western and Eastern Europe fuel further demand. Moreover, sustainability-focused procurement practices accelerate the adoption of efficient dust control technologies.

Germany dust suppression system industry dominated the European market in 2024 due to its extensive cement, steel, and manufacturing industries that rely heavily on efficient dust control solutions. Strict EU and national emission standards drive consistent investment in advanced baghouse, ESP, and misting technologies. Continuous modernization of industrial facilities supports high demand for system replacements. Germany’s strong engineering ecosystem further accelerates the adoption of high-performance suppression systems.

The UK dust suppression system industry is growing as construction, demolition, and infrastructure renewal projects increase the need for flexible dust control solutions. Tight HSE regulations and urban environmental concerns push contractors toward portable foggers and high-efficiency filtration units. Industrial sites are also upgrading systems to meet stricter particulate standards. Government support for sustainable building practices continues to strengthen market momentum.

Middle East & Africa Dust Suppression System Market Trends

The Middle East & Africa dust suppression system industry is growing as major mining and quarrying projects expand across Africa and large construction developments advance in the GCC. Dust-intensive desert environments increase the need for efficient suppression solutions. Governments are progressively strengthening environmental compliance, particularly around urban construction. Industrial diversification and infrastructure spending continue to support long-term market expansion.

Saudi Arabia dust suppression system industry dominated the Middle East & Africa market due to its extensive construction, mining, and industrial development programs under Vision 2030. Large-scale infrastructure projects, including megacities and industrial clusters, generate high demand for reliable dust suppression systems. Strict environmental and safety regulations are driving industries to adopt advanced wet and dry control technologies. Ongoing expansion in quarrying, cement production, and logistics further strengthens the country’s leading market position.

Latin America Dust Suppression System Market Trends

Latin America dust suppression system industry is witnessing rising demand as mining, cement, and construction activities expand in countries such as Brazil and Argentina. Growing awareness of worker safety and tighter regulatory frameworks are encouraging systematic dust control investments. Large open-pit mining operations create consistent opportunities for heavy-duty suppression systems. Increasing foreign investment in infrastructure further stimulates regional market growth.

Brazil dust suppression system industry dominated the Latin American market in 2024, owing to its large mining sector, extensive construction activities, and expanding cement production. Environmental regulations and worker safety requirements are pushing industries to adopt more efficient dust suppression and filtration systems. Major mining operations in iron ore and other minerals create continuous, high-volume dust control needs. Infrastructure development and industrial modernization further bolster Brazil’s leading market position.

Key Dust Suppression System Company Insights

Some of the key players operating in the market include Donaldson Company, Inc., Camfil AB, and Ecolab Inc.

-

Donaldson Company, Inc. is a leading manufacturer of advanced filtration and dust collection technologies tailored to heavy industrial environments. The company offers high-efficiency baghouse systems, cartridge collectors, and engineered filtration media specifically designed for fine particulate control. Its solutions are widely integrated into mining, cement, metal processing, and power applications where regulatory compliance is critical. Donaldson emphasizes system reliability, long filter life, and reduced operational downtime. Its strong aftermarket service network further supports continuous performance in dust-intensive facilities.

-

Camfil AB specializes in clean air and industrial dust collection solutions with a focus on high-performance, energy-efficient systems. The company’s product line includes advanced dust collectors, filter cartridges, and engineered air filtration units used in manufacturing, cement, metals, and processing industries. Camfil is known for optimizing airflow efficiency and lowering lifecycle costs through durable filtration media. Its systems are designed to meet strict global emission standards while improving workplace air quality. The company also provides customized engineering support for complex industrial dust control challenges.

Key Dust Suppression System Companies:

The following are the leading companies in the dust suppression system market. These companies collectively hold the largest market share and dictate industry trends.

- Donaldson Company, Inc.

- Camfil AB

- Ecolab Inc.

- Cargill Incorporated

- Colliery Dust Control (Pty) Ltd

- Hexion Inc.

- Quaker Houghton Corporation

- Nederman Holding AB

- Dust Control Technologies, Inc.

- New Waste Concepts, Inc.

- Global Road Technology Ltd.

- DSH Systems Ltd.

- EmiControls GmbH

- Savic Group

- IKEUCHI EUROPE B.V.

Recent Developments

-

In October 2025, Camfil APC’s Gold Series III dust collector introduces an upgraded design that improves airflow management and filtration efficiency. Its new filter elements are engineered for stronger pulse cleaning and longer service life, helping facilities maintain consistent dust control performance. The system’s modular layout supports flexible sizing and easier expansion as industrial needs grow. It also accommodates explosion-protection features, allowing it to meet stringent safety and compliance standards in dust-sensitive environments.

-

In April 2024, Donaldson Company, Inc. launched the DFPRE 2, a compact and dependable filtration system designed for various manufacturing applications. This pre-assembled unit addresses the demand for powerful dust control systems in a smaller footprint. The DFPRE 2 features combustible dust mitigation options, an optional spark-reducing inlet, and multiple fan motor choices to handle diverse dust types and airflow needs.

Dust Suppression System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,616.1 million

Revenue forecast in 2033

USD 8,251.0 million

Growth rate

CAGR of 4.9% from 2024 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, mobility, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Donaldson Company, Inc.; Camfil AB; Ecolab Inc.; Cargill Incorporated; Colliery Dust Control (Pty) Ltd; Hexion Inc.; Quaker Houghton Corporation; Nederman Holding AB; Dust Control Technologies, Inc.; New Waste Concepts, Inc.; Global Road Technology Ltd.; DSH Systems Ltd.; EmiControls GmbH; Savic Group; IKEUCHI EUROPE B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dust Suppression System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dust suppression system market report based on equipment,mobility, end-use, and region.

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Water-Based Systems

-

Water Spray / Jet Systems

-

Fog / Mist Systems

-

-

Chemical-Based Systems

-

Foam Dust Suppression System Systems

-

Polymer / Hygroscopic Chemical Systems

-

Wetting Agent Systems

-

-

Airborne Dust Collection Systems

-

Baghouse Filters

-

Cyclone Separators

-

Electrostatic Precipitators

-

-

-

Mobility Outlook (Revenue, USD Million, 2021 - 2033)

-

Stationary

-

Portable

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Mining

-

Construction & Demolition

-

Cement

-

Steel & Metallurgy

-

Power Generation

-

Chemical Processing

-

Waste & Recycling

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dust suppression system market size was estimated at USD 5,364.5 million in 2024 and is expected to be USD 5,616.1 million in 2025.

b. The global dust suppression system market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 8,251.0 million by 2033.

b. Asia Pacific is a dominant market and accounted for the 40.4% share, owing to large-scale mining operations, rapid construction activity, and expanding cement and metal processing industries. Governments in China, India, and Southeast Asia continue to enforce stricter air-quality standards, boosting system installations.

b. Some of the key players operating in the global dust suppression system market include Donaldson Company, Inc.; Camfil AB; Ecolab Inc.; Cargill Incorporated; Colliery Dust Control (Pty) Ltd; Hexion Inc.; Quaker Houghton Corporation; Nederman Holding AB; Dust Control Technologies, Inc.; New Waste Concepts, Inc.; Global Road Technology Ltd.; DSH Systems Ltd.; EmiControls GmbH; Savic Group; IKEUCHI EUROPE B.V.

b. The global dust suppression system market is driven by stricter environmental and workplace-safety regulations that require effective control of particulate emissions. Rapid growth in mining, construction, and infrastructure projects is increasing the need for reliable on-site dust management. Additionally, rising focus on water-efficient and automated suppression technologies is accelerating adoption across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.