- Home

- »

- Distribution & Utilities

- »

-

E-house Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![E-house Market Size, Share & Trends Report]()

E-house Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Mobile, Semi-Mobile, Fixed), By Voltage (Low, Medium), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-674-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-house Market Summary

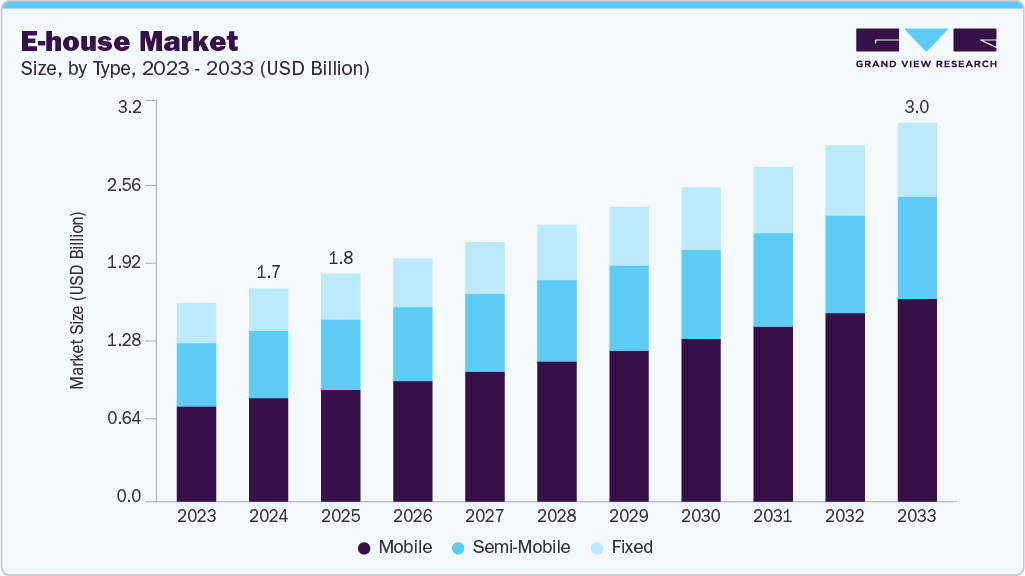

The global e-house market size was estimated at USD 1.72 billion in 2024 and is projected to reach USD 3.05 billion by 2033, growing at a CAGR of 6.56% from 2025 to 2033. E-Houses (Electrical Houses) are modular, prefabricated electrical substations integrating switchgear, transformers, and control systems into a compact, factory-built structure.

Key Market Trends & Insights

- Asia Pacific e-house market held the largest share of 29.00% of the global market in 2024.

- The e-house market in the U.S. is expected to grow significantly over the forecast period.

- By type, the mobile segment held the highest market share of 48.50% in 2024.

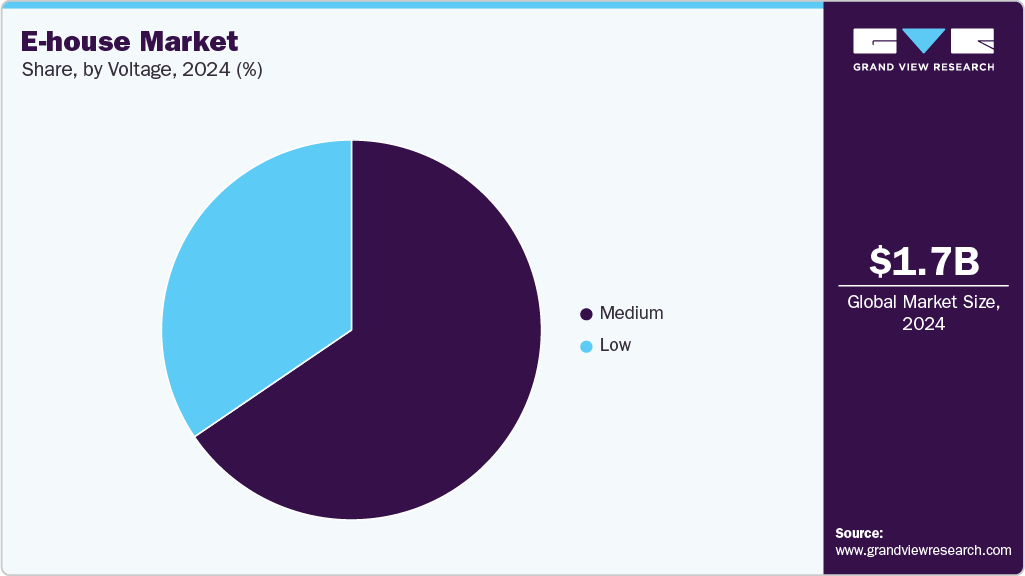

- Based on voltage, the medium segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.72 Billion

- 2033 Projected Market Size: USD 3.05 Billion

- CAGR (2025-2033): 6.56%

- Asia Pacific: Largest market in 2024

- MEA: Fastest growing market

These units enable rapid deployment, cost savings, and reduced on-site labor, making them ideal for utility, industrial, mining, and renewable energy applications. Rising demand for decentralized power systems, accelerated infrastructure development, and the shift toward renewable energy integration are key factors driving market growth. Additionally, advancements in modular construction techniques and increasing investments in grid modernization and electrification, especially in emerging economies, are expected to further support the expansion of the e-house industry throughout the forecast period.

E-Houses are primarily used in applications where rapid deployment, modularity, and space optimization are critical. While traditional substations require extensive on-site construction, e-houses offer a prefabricated alternative that integrates essential electrical components into a single, transportable unit. These solutions are ideal for industries such as oil & gas, mining, utilities, and renewable energy, where operational continuity and scalability are vital. Their plug-and-play design and reduced installation time make them especially suitable for remote or challenging environments. The increasing demand for reliable, decentralized power infrastructure in regions such as the United States, China, India, and the Middle East, alongside government initiatives supporting grid modernization and industrial automation, is a key driver accelerating the growth of the e-house market.

Drivers, Opportunities & Restraints

The global e-house market drives the rising need for rapid, modular, and cost-effective power distribution solutions across utilities, oil & gas, mining, transportation, and renewable energy. Growing investments in infrastructure development, grid modernization, and industrial automation fuel demand for prefabricated substations that minimize on-site construction time and enhance operational efficiency. E-Houses' ability to be custom-designed, factory-tested, and quickly deployed in remote or space-constrained locations is a key factor propelling market growth.

Emerging opportunities in the e-house industry include integration with renewable energy systems, expansion into offshore and hybrid microgrid projects, and advancements in digital monitoring and smart grid compatibility. The increasing adoption of modular power systems in developing regions and disaster-prone areas also presents new avenues for market expansion. However, the market faces challenges such as high initial capital costs, complex logistics for large units, and the need for project-specific customization. Additionally, competition from traditional on-site substation construction and limited standardization in certain regions can restrain widespread adoption.

Type Insights

The mobile e-house segment led the e-house market with the largest revenue share of 48.50% in 2024. The increasing demand for compact, rapidly deployable, and transportable power solutions across sectors such as oil & gas, mining, utilities, and renewables has positioned mobile E-Houses as preferred. Their ease of relocation, shorter installation time, and reduced on-site civil work make them highly suitable for remote and temporary operations where conventional substations are impractical.

Mobile e-houses enable quick power system integration with minimal disruption, offering flexibility in dynamic environments such as construction sites, emergency response areas, and off-grid renewable installations. The segment’s growth is further supported by technological advancements in modular construction, smart grid compatibility, and prefabrication techniques, which reduce production time and enhance customization. As the need for decentralized and resilient energy infrastructure grows, particularly in developing markets and areas prone to environmental disruption, the demand for mobile E-Houses is expected to surge, reinforcing their dominance in the global market.

Voltage Insights

The medium voltage segment dominated the global e-house market, with the largest revenue share of 65.50% in 2024. The widespread use of medium voltage E-Houses in industrial, utility, and infrastructure projects is a major factor driving this segment's dominance. These E-Houses typically support voltage ranges from 1 kV to 36 kV and are essential in mining operations, oil & gas fields, renewable energy plants, and grid extension projects. Their ability to balance compact design with sufficient power capacity makes them ideal for permanent and temporary installations across diverse industries.

The medium voltage segment is expected to expand significantly over the forecast period, supported by rising investments in power distribution infrastructure, smart grid upgrades, and industrial automation. Governments and utilities are increasingly deploying medium voltage E-Houses to support remote electrification and rapid infrastructure development, particularly in Asia-Pacific, the Middle East, and Africa. While high-voltage E-Houses are used in large-scale or offshore projects, they account for a smaller market share due to higher customization and cost. Meanwhile, the low-voltage segment finds applications in commercial buildings and temporary sites but lacks the capacity for most industrial-scale operations. The Medium Voltage category remains the most versatile and widely adopted voltage class in the E-House market.

Regional Insights

The Asia Pacific e-house market held a revenue share of 29.00% in 2024. Rapid industrialization, expanding power infrastructure, and rising energy demand in China, India, and Southeast Asia are key drivers for the regional market. The region’s increasing focus on smart grid development and electrification of remote areas supports strong demand for modular, transportable power substations like E-Houses. These pre-assembled electrical systems are ideal for fast deployment in energy-intensive mining, oil & gas, and manufacturing sectors.

Government initiatives to upgrade aging grid infrastructure and expand renewable energy integration further bolster the market. Countries like China and South Korea invest heavily in grid modernization and industrial automation, where E-Houses are critical components for reliable power distribution. Moreover, APAC benefits from cost-effective manufacturing hubs and strong EPC (Engineering, Procurement, and Construction) capabilities, accelerating regional deployment across both onshore and offshore projects.

North America E-House Market Trends

Widespread infrastructure upgrades and a growing emphasis on energy efficiency and grid resilience fuel the growth of the North America e-house industry. These modular substations offer scalable, plug-and-play solutions that address the region’s demand for rapid electrification in data centers, utilities, and oil & gas industries. The shift toward decentralized energy systems and microgrids makes E-Houses ideal for quick deployment and easy integration. Technological advancements in electrical protection systems and high environmental and safety standards contribute to market growth in sectors with mission-critical power needs.

Europe E-House Market Trends

The Europe e-house industry’s growth is driven by strict energy regulations, grid modernization efforts, and the expansion of renewable energy infrastructure. Driven by frameworks such as the European Green Deal and REPowerEU, E-Houses are pivotal in supporting clean energy transitions, offering compact and reliable solutions for high-voltage transmission and distribution. With the region’s focus on reducing installation time and ensuring flexibility in harsh environments, E-Houses meet the demand for compact substations that conform to high environmental standards and space-saving designs.

Latin America E-House Market Trends

The Latin America e-house industry is gaining traction as countries like Brazil, Chile, and Colombia prioritize industrial expansion and grid reliability. Growing mining operations, oil & gas activities, and renewable energy projects across remote terrains create strong demand for mobile, weather-resistant power distribution units like E-Houses. Their modular design enables rapid commissioning and reduced on-site labor costs, making them especially attractive in geographically challenging or underdeveloped regions. Government-backed energy reforms and investments in industrial automation further support market growth, as E-Houses provide a flexible alternative to conventional substation construction.

Middle East & Africa E-House Market Trends

The Middle East and Africa (MEA) e-house industry is emerging as a critical enabler of energy access, infrastructure development, and industrial modernization. High demand for scalable, relocatable power solutions in oil-rich nations like Saudi Arabia, the UAE, and Kuwait has accelerated the adoption of E-Houses in the petrochemical and utility sectors.

National development strategies such as Saudi Arabia’s Vision 2030 and Africa’s electrification roadmaps underscore the importance of rapidly deployable substations to meet growing energy needs in urban and remote locations. E-Houses are well-suited to extreme environmental conditions, offering compact solutions for energy generation, transmission, and distribution in mining, utilities, and off-grid electrification initiatives across MEA.

Key E-house Company Insights

Some of the key players operating in the e-house market include ABB Ltd., Siemens AG, Schneider Electric, Eaton Corporation, General Electric (GE), and Powell Industries, among others. These companies are actively investing in research and development to enhance modular design, improve energy efficiency, and accelerate the deployment of prefabricated power solutions across industrial and utility applications.

Key E-house Companies:

The following are the leading companies in the e-house market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Siemens AG

- Eaton Corporation

- Schneider Electric

- Powell Industries

- General Electric (GE)

- WEG

- Meidensha Corporation

- TGOOD Global Ltd.

- Unit Electrical Engineering

Recent Developments

- In February 2025, Siemens AG announced the expansion of its modular E-House production facility in Frankfurt, Germany. The upgraded plant aims to accelerate the manufacturing of prefabricated, medium- and high-voltage electrical houses tailored for rapid deployment in industrial, utility, and renewable energy projects. This strategic investment supports the growing global demand for compact, plug-and-play power solutions, especially as infrastructure developers seek faster, more flexible alternatives to traditional on-site substation construction.

E-house Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.84 billion

Revenue forecast in 2033

USD 3.05 billion

Growth rate

CAGR of 6.56% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, voltage, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

ABB Ltd.; Siemens AG; Eaton Corporation; Schneider Electric; Powell Industries; General Electric (GE); WEG; Meidensha Corporation; TGOOD Global Ltd.; Unit Electrical Engineering

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-house Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global e-house market report based on type, voltage, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Mobile

-

Semi-Mobile

-

Fixed

-

-

Voltage Outlook (Revenue, USD Million, 2021 - 2033)

-

Low

-

Medium

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global E-house market size was estimated at USD 1.72 billion in 2024 and is expected to reach USD 1.84 billion in 2025.

b. The global E-house market is expected to grow at a compound annual growth rate of 6.56% from 2025 to 2033 to reach USD 3.05 billion by 2033.

b. Based on the type segment, mobile e-house segment led the e-house market with the largest revenue share of 48.50% in 2024.

b. Some of the key players in the global E-house market include ABB Ltd.; Siemens AG; Eaton Corporation; Schneider Electric; Powell Industries; General Electric (GE); WEG; Meidensha Corporation; TGOOD Global Ltd.; Unit Electrical Engineering

b. The key factors driving the E-house market include the rising demand for lightweight, flexible, and high-efficiency solar technologies. These cells support a wide range of applications, from portable electronics to building-integrated photovoltaics, making them ideal for accelerating the global shift toward sustainable and decentralized energy solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.