- Home

- »

- Homecare & Decor

- »

-

Ecotourism Market Size, Share & Growth, Global Report, 2030GVR Report cover

![Ecotourism Market Size, Share & Trends Report]()

Ecotourism Market (2024 - 2030) Size, Share & Trends Analysis Report By Activity Type (Land, Marine), By Group (Solo, Group), By Booking Mode, By Age Group, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-967-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ecotourism Market Summary

The global ecotourism market size was valued at USD 235.54 billion in 2023 and is expected to reach USD 665.20 billion by 2030, growing at a CAGR of 16% from 2024 to 2030. The growth is mainly driven by the rising popularity of immersive travel, outdoor recreational activities, and solo traveling coupled with rapid urbanization and the availability of cheap flights.

Key Market Trends & Insights

- Europe captured the largest revenue share in 2021.

- Asia Pacific is expected to expand at the fastest CAGR of 16.0% over the forecast period.

- Based on activity type, land ecotourism segment accounted for around 70% of the revenue share in 2021.

- Based on group, the group segment captured over 80% of the revenue share in 2021.

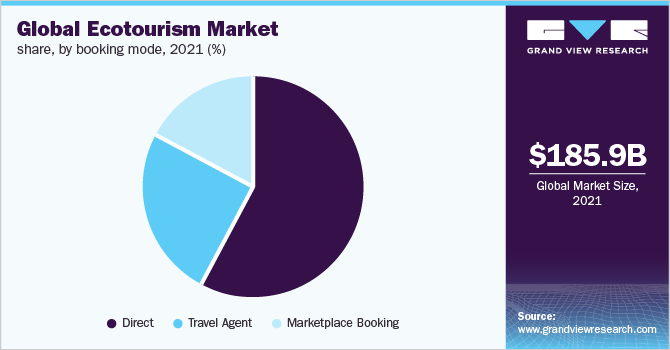

- Based on booking mode, direct booking segment held the largest revenue share of over 60% in 2021.

Market Size & Forecast

- 2023 Market Size: USD 235.54 Billion

- 2030 Projected Market Size: USD 665.20 Billion

- CAGR (2024-2030): 16%

- Europe: Largest market in 2021

- Asia Pacific: Fastest growing market

The growing awareness about the adverse impact of tourism on the environment such as water pollution, soil erosion, and habitat loss has prompted sustainable tourists and government authorities to promote ecotourism and contribute to the growth of the industry.

According to a landmark report published by World Tourism Organization (UNWTO), transport-related emissions from the tourism industry are anticipated to reach up to 5.3% of overall man-made CO2 emissions by 2030. This has necessitated the need for the tourism industry to work closely with the transport industry and government associations to support its commitment to accelerate the decarburization process and implement environmental sustainability. This is expected to drive the growth of the global market and increase consumer interest in sustainable traveling.

Ecotourism has long aided in the preservation of the environment and the protection of endangered animals. Wildlife and the communities that safeguard it were impacted by the COVID-19 pandemic in 2020 and the ensuing closure of tourist destinations. The pandemic majorly impacted ecotourism and wildlife protection. With the subsequent lockdown of the country and the collapse of ecotourism, many of the risks to biodiversity and protected areas have worsened. Poaching, animal trafficking, and logging of forests have all restarted.

According to the data published by The World Tourism Organization (UNWTO), the spread of the COVID-19 pandemic resulted in a 72% decline in international tourist arrivals in 2020. This has resulted in limited travelers traveling to ecotourism destinations causing overall disruption to the global market.

However, with governments reducing travel and tourist curbs, the business started performing well as a result of redefined travel and tourism policies that were implemented by governments and associations. In the coming years, the global market is expected to showcase prominent growth driven by rising demand for nature-based travel among elder people and a paradigm shift in consumer behavior to focus on sustainability.

The past decade has witnessed increased demand for sustainable tourism among travelers and the young generation. As consumers have understood the adverse effects of over-tourism, there has been a growing appetite for sustainable traveling. The tour operator operating in different regions have understood the impact of unbridled mass tourism and thus have started vouching for regenerative tourism as the way forward with modifying their travel packages.

According to research data published by Booking.com, over half (55%) of global travelers have become determined towards travelling sustainably and are making sustainable travel choices in 2019. The data shows how consumer perception of adverse effects of mass tourism has changed over the years and climate impact has become a major point of consideration while booking travel packages.

Government organizations such as World Tourism Organization and The United Nations Educational, Scientific and Cultural Organization (UNESCO) are promoting the leisure industry intending to attract customers and various tourist groups across the globe. Countries like the UAE have launched several initiatives and sustainability projects to protect the environment and establish themselves as global leaders among eco-friendly vacation spots.

For instance, in March 2021, the Kingdom of Saudi Arabia launched various projects to boost regional tourism and ecotourism. By 2030, the country aims to reduce its oil dependence and boost regional tourism activities to account for 10% of Saudi Arabia’s gross domestic product. Public-private partnerships will result in market development, creating profitable prospects for the local stakeholders, by enhancing transit capacities and facilitating easier access to isolated tourist locations.

Activity Type Insights

Land ecotourism accounted for around 70% of the revenue share in 2021. The growth is mainly driven by rising consumer demand for land-based sustainable tourism such as safaris, wildlife watching, and national park visits. Land-based activities are easy to do and are economical as compared to other activities. Thus, the consumer inclination towards these activities has grown exponentially showing strong consumer resilience in recent years. According to CNH tours, between 2009 to 2018, land-based tourism activities have grown by an annual rate of 16.7%, and have shown promising growth.

Marine activities are expected to grow at a notable CAGR of 14.6% from 2022 to 2030. Changing consumer preference, growing consumer sentiments for adventurous activities, and leisure and vacation activities or journeys on coastal waters are some of the major factors driving the growth of the segment.

The beauty, diversity, and cultural wealth of global coastal areas have made them a preferred destination for many domestic and international holidaymakers, making coastal and maritime tourism an important tourism sector. In Europe, the coastal and maritime tourism industry employs 3.2 million people and 51% of bed capacity in hotels across Europe is concentrated in regions with coastal borders. Thus, the segment is expected to showcase promising growth in the coming years.

Group Insights

The group segment captured over 80% of the revenue share in 2021. The growth is mainly driven by a rising inclination towards group traveling, the emergence of various traveling groups on social media sites, and a rise in the number of young eco-tourists. Additionally, often traveling young traveler’s groups have shown exceptional resilience towards group traveling in recent years. Tour operators across the globe are offering various travel packages that include various group activities to attract several group travelers. This has further elevated the growth of the global industry.

Solo traveling is expected to grow at a CAGR of 16.9% from 2020 to 2030. Solo travel has soared over the last decade with numerous travelers choosing to travel alone to gain immersive travel experience and embrace their freedom. According to a survey published by Booking.com, American women ranked first in frequent solo travels and 72% of American women are taking solo journeys. Due to the rising popularity of solo travel, tour operators and vacation firms have even started to focus exclusively on providing services for solo travelers.

Booking Mode Insights

Direct booking held the largest revenue share of over 60% in 2021. Direct tour package booking has witnessed strong growth in recent years driven by a large elderly consumer base still preferring to book their travel, flight, and hotel bookings through direct bookings. The rising number of eco-tourists are booking their travel tours and packages through direct channels to receive tailored experiences. Key companies and tour operators are offering various tailored services and discounts when booked through direct booking mode to expand their consumer reach. This has further contributed to the growth of the market.

The marketplace booking segment is anticipated to register the highest CAGR of 16.4% over the forecast period. Now the majority of tour companies have started showcasing their service portfolio online and on marketplaces and customers now can compare at the one-step store before making the purchase. The growth is majorly driven by quick travel and hotel bookings and immersive customer experiences offered by marketplace booking channels. The rise in the penetration of smartphones and the internet coupled with social media penetration has altered the way travelers book their tours and hotels.

Age Group Insights

Generation Y segment accounted for the largest revenue share of over 60.0% in 2021. The rise of social media and technology has influenced millennials’ values and their attitude toward travel and life. According to the data published by Condor Ferries ltd, US Millennials spent $200 billion on travel in 2021 and 55% of them wanted to increase the volume of their trips.

This data shows millennials’ inclination toward sustainable tourism has grown in recent years making a positive impact on the industry. Millennial travelers are placing more emphasis on unique experiences and further demand for sustainable tourism considering the overall impact on the industry. This segment is expected to showcase lucrative growth in the coming years.

The generation Z segment is expected to grow at a CAGR of 15.0% over the forecast period. Technology and social media are playing an important role in the way generation z travelers book and authentic experience is the major factor they emphasize. The hyper-connected Generation Z grew up in an era of growing awareness about technology, personal health, human behavior, and humankind’s impact on the environment.

Globalization, the 2008 financial crisis, climate change, terrorism, and technological advancements are just a few of the significant issues that have gained prominence since the dawn of the twenty-first century and have had a significant impact on Gen Zers' attitudes and beliefs, and consequently, their travel behavior.

According to the European Travel Commission, young travelers are more likely to discover new destinations, incorporate technology during their trip, and gain and contribute to the cultural benefits of the places they visit. In addition, there are more travel blogs and videos on social media, which is predicted to have a significant impact on Gen Z tourists' purchase decisions.

Regional Insights

Europe captured the largest revenue share in 2021 driven by growing environmental concern coupled with discontent around mass tourism and a rise in the demand for nature-based experiences. With an increase in demand for ecologically responsible travel and activities, several locations are introducing eco-friendlier destination packages to draw tourists while protecting their natural surroundings.

According to the CBI (Ministry of Foreign Affairs), a proportion of 15% of German travelers seek nature as a major reason to visit a destination. European governments and travelers have started paying more attention to sustainability including air and water pollution, land and water usage, climate change, plastic pollution, and the negative impact of over-tourism on host communities. Additionally, rising disposable income, rising millennials and youth inclination toward ecotourism, and growth of leisure tourism.

Asia Pacific is expected to expand at the fastest CAGR of 16.0% over the forecast period. To lessen their unfavorable economic and social effects on the locals and the environment in the locations they visit, an increasing number of travelers in Asia are reevaluating the way they travel to make their journeys more moral. Airlines, hotels, and transportation services are responding to the demand for sustainable tourism trying to minimize their carbon footprint in the travel ecosystem.

According to a survey by Global Sustainable Tourism Council (GSTC), 57.6% of the respondents mention that it’s important for them that their travel does not contribute to over-tourism. Ecological concerns and COVID-19 policies have played a major role in contributing to the sustainable tourism mindset. Thus, the regional market is expected to witness high demand for sustainable tourism in the coming years.

Key Companies & Market Share Insights

Some of the major companies operating in the ecotourism market are Adventure Alternative Ltd, Aracari, Black Kite tour PLC, G Adventures, Frosch International Travel, Gondwana Ecotours, Discover Corps, ROW Adventures, Natural Habitat Adventuresm, and Cheesemans’ Ecology Safaris. These major tour operators are making major initiatives to strengthen their market position and offer authentic and immersive experiences to the global eco-travelers.

-

In June 2022, Wetravel, Inc. partnered with Tourism Cares to launch an academy course named Introduction to Sustainable Tourism to help travel businesses become more sustainable. The newly launched course offers travel companies an introductory course and allows them to remain informed, engaged, and push for a change

-

In July 2022, Rabbie's, one of the prominent tour operators in the U.K. launched two responsible and sustainable tours in Scotland. The newly launched tours are the part of company’s ‘We Care About There’ initiative that aims at providing responsible and sustainable travel while offering a memorable and ethical travel experience

-

In May 2022, MSC Cruises, an Italian global cruise line launched sustainability-themed summer tours with nearly 1,400 tours, to feature its strong focus on sustainability. The new tour is designed to minimize the impact of tourism on the environment and support ‘nature-positive’ activities

Some prominent players in the global ecotourism market include:

-

Adventure Alternative Ltd

-

Aracari

-

Black Kite tour PLC

-

G Adventures

-

Frosch International Travel

-

Gondwana Ecotours

-

Discover Corps

-

ROW Adventures

-

Natural Habitat Adventures

-

Cheesemans’ Ecology Safaris

Ecotourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 267.57 billion

Revenue forecast in 2030

USD 665.20 billion

Growth rate

CAGR of 16% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Activity type, group, booking mode, age group, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; South Africa; Brazil

Key companies profiled

Adventure Alternative Ltd; Aracari; Black Kite tour PLC; G Adventures; Frosch International Travel; Gondwana Ecotours; Discover Corps; ROW Adventures; Natural Habitat Adventuresm; and Cheesemans’ Ecology Safaris.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ecotourism Market Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ecotourism market report based on activity type, group, booking mode, age group, and region:

-

Activity Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Land

-

Marine

-

-

Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solo

-

Groups

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct

-

Travel Agent

-

Marketplace Booking

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Generation X

-

Generation Y

-

Generation Z

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ecotourism market was estimated at USD 185.87 billion in 2021 and is expected to reach USD 208.63 billion in 2022.

b. The global ecotourism market is expected to grow at a compound annual growth rate of 15.2% from 2022 to 2030 to reach USD 665.20 billion by 2030.

b. Europe dominated the ecotourism market with a share of 37.8% in 2021. This is owing to growing environmental concern coupled with discontent around mass tourism and a rise in the demand for nature-based experiences.

b. Some key players operating in the ecotourism market include Adventure Alternative Ltd; Aracari; Black Kite tour PLC; G Adventures; Frosch International Travel; Gondwana Ecotours; Discover Corps; ROW Adventures; Natural Habitat Adventuresm; and Cheesemans’ Ecology Safaris.

b. Key factors that are driving the ecotourism market growth include the rising popularity of immersive travel, outdoor recreational activities, and solo traveling coupled with rapid urbanization and the availability of cheap flights across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.