- Home

- »

- Beauty & Personal Care

- »

-

Edible Cosmetics Market Size, Share & Growth Report, 2030GVR Report cover

![Edible Cosmetics Market Size, Share & Trends Report]()

Edible Cosmetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care) By Distribution Channel (Hypermarkets & Supermarkets, Online, Pharmacies & Drugstores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-402-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Edible Cosmetics Market Size & Trends

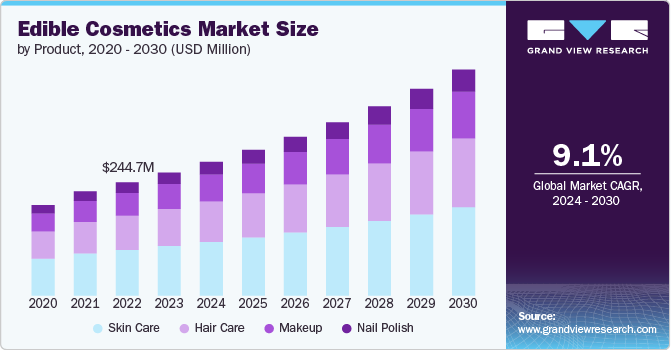

The global edible cosmetics market size was estimated at USD 265.95 million in 2023 and is expected to grow at a CAGR of 9.1% from 2024 to 2030. The beauty industry is undergoing a significant transformation with the rise of edible cosmetics. These innovative products offer benefits both externally and internally. The concept of edible cosmetics hinges on using natural, food-grade ingredients that are safe to eat, emphasizing holistic wellness and beauty. This approach attracts consumers increasingly concerned about the ingredients they apply to their bodies and overall health.

In skincare, edible cosmetics are gaining traction with products like cleansers, serums, and moisturizers that use food-grade ingredients. Brands incorporate superfoods such as berries, avocado, honey, and yogurt into their formulations. These ingredients are renowned for their antioxidant, anti-inflammatory, and hydrating properties, offering topical and internal benefits. For instance, honey-based cleansers are celebrated for their antibacterial properties, while avocado-infused moisturizers provide deep hydration and essential nutrients. This trend is not just about safety but also about harnessing the potency of natural ingredients to enhance skin health.

The clean beauty movement has significantly influenced consumer preferences, with more people seeking products free from synthetic chemicals and harsh additives. In addition, the rise in health and wellness trends has led consumers to prefer products that promote overall well-being, both inside and out. Social media and influencer marketing have also played a crucial role, with beauty influencers and celebrities advocating for natural and edible beauty products. Lastly, growing environmental concerns and the desire for sustainable living are pushing consumers towards safe products for themselves and the planet.

Edible cosmetics are gaining popularity among pregnant women due to their preference for safe, non-toxic products that minimize exposure to harmful chemicals, ensuring maternal and fetal health. This demand is driven by heightened awareness and the desire to avoid ingredients that could affect the baby. A 2022 study found that using nail polish was stopped during pregnancy by several pregnant women and using hair coloring by 7%. Moreover, pregnant women reported reducing (without totally stopping) their use of perfume. Brands like HL Edible India formulate edible lip products infused with food-grade antioxidants, which are safe for pregnant women.

Product Insights

Edible skin care cosmetics accounted for a share of 40.28% in 2023. These products appeal to consumers seeking natural and organic ingredients, providing a safer and eco-friendly alternative to traditional cosmetics. This convergence of beauty and wellness trends has driven the popularity of edible skin care products. EdenSong Essentials Skin Care provides edible skincare products crafted from organic ingredients that are safe for consumption. For instance, their Goddess Envy Moisturizer contains components that help protect delicate skin, like the area around the eyes, from UV damage. It also enhances the skin's natural capacity for regeneration, nourishment, hydration, oxygenation, and protection. The moisturizer's ingredients include emollients such as Kokum butter, orchid extract, olive squalane, emu oil, babassu oil, argan oil, and meadowfoam oil.

Demand for edible nail polish is anticipated to grow at a CAGR of about 9.7% from 2024 to 2030. The demand for edible nail polish is set to rise due to growing consumer preferences for safe and non-toxic beauty products, particularly for children. Kid Licks offers an innovative range of edible polishes from organic fruits, vegetables, and plants, ensuring ultra-gentle and kid-friendly formulations. Available in vibrant colors like Barley Grass Green, Beet Red, and Sour Carrot Orange, these polishes are easy to apply, dry quickly, and can be removed with water. Free from preservatives, Kid Licks polishes must be refrigerated, lasting up to two months.

Distribution Channel Insights

The sales of edible cosmetics through hypermarkets & supermarkets accounted for a market share of 33.84% in 2023. Hypermarkets and supermarkets are evolving into reputable destinations for beauty products, offering a wide array of skincare and cosmetics. By emphasizing visual merchandising and effective categorization, these stores enhance the beauty shopping experience. For instance, Sainsbury's and other retailers are introducing AI-powered skincare consultations that analyze customers' faces to provide tailored skincare recommendations. This trend highlights the growing emphasis on skin health and the rising popularity of products such as edible cosmetics.

Online sales of edible cosmetics are expected to grow at a CAGR of 10.8% from 2024 to 2030. The e-commerce sector of the cosmetics market is expanding rapidly due to the convenience of online shopping, which allows consumers to explore a broad range of beauty products from the comfort of their homes. Sephora, for instance, has upgraded its website to feature specialized sections for new product launches in categories like Skin Care, Makeup, Fragrance, Bath and Body, Hair, and Tools and Brushes. This structured approach appeals to customers looking for the latest innovations, including edible cosmetics, thus boosting online sales.

Regional Insights

The edible cosmetics market in North America accounted for a market share of 26.80% in 2023 in the global market. Demand for edible cosmetics in North America is rising due to increasing consumer awareness of ingredient safety and health benefits. Shampoos and cleansers with edible ingredients offer a natural, non-toxic alternative, appealing to those seeking transparency in their beauty products. In addition, the trend reflects a growing preference for multifunctional products that align with a holistic approach to wellness and self-care.

U.S. Edible Cosmetics Market Trends

The edible cosmetics market in the U.S. accounted for a market share of around 85% in 2023 the North American market. In the U.S., the demand for edible cosmetics is driven by substantial consumer spending on skincare, a priority for three-quarters of Americans. The 2023 LendingTree survey highlights that millennials and Gen Z are leading this trend, investing heavily in skincare, with edible cosmetics playing a key role. As consumers increasingly value clean, natural ingredients and products that blend health with beauty, the demand for edible cosmetics is expected to grow, reflecting a broader movement towards transparency and wellness in personal care.

Asia Pacific Edible Cosmetics Market Trends

The edible cosmetics market in Asia Pacific is anticipated to rise at a CAGR of about 9.5% from 2024 to 2030. Demand for edible cosmetics in the region is expected to rise due to growing consumer awareness of health and safety in beauty products. Increasing disposable incomes and a shift towards premium, natural ingredients are driving interest. Moreover, the region's cultural emphasis on holistic wellness supports the popularity of products that integrate skincare benefits with health-conscious formulations.

Key Edible Cosmetics Company Insights

The market is fragmented. Many brands have recognized the presence of untapped opportunities in their product offerings and have taken steps to address these gaps in the market. This may involve the development of new products or strategic acquisitions to serve consumer needs and preferences better.

Key Edible Cosmetics Companies:

The following are the leading companies in the edible cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- Natural Organic Edible Cosmetics

- EdenSong Essentials Skin Care

- Edible Beauty Australia Pty Ltd

- Skin Gourmet

- Babylogy

- HL Edible India

- Living Nature

- Kid Licks

- Skin Pot Co.

- Project MC2

Recent Developments

-

In June 2024, Skin Gourmet showcased its innovative products at the Cocoa Food Fair 2024, highlighting the versatility of cocoa in beauty and wellness. The event, part of the annual Orange Week organized by the Netherlands Embassy in Ghana, celebrated Ghana's cocoa industry with diverse contributions from local and international participants.

-

In November 2022, Edible Beauty Australia Pty Ltd was acquired by Live Verdure Ltd. The acquisition enhances the company's market presence with its diverse skincare and wellness products. This move aims to boost revenue and lower costs to strengthen the company's financial performance.

Edible Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 289.28 million

Revenue forecast in 2030

USD 488.27 million

Growth rate (Revenue)

CAGR of 9.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Argentina; Brazil; South Africa; Saudi Arabia

Key companies profiled

Natural Organic Edible Cosmetics; EdenSong Essentials Skin Care; Edible Beauty Australia Pty Ltd; Skin Gourmet; Babylogy; HL Edible India; Living Nature; Kid Licks; Skin Pot Co.; Project MC2

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edible Cosmetics Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the edible cosmetics market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Moisturizers

-

Sunscreen

-

Cleansers

-

Serums

-

Others

-

-

Hair Care

-

Shampoos

-

Conditioners

-

Hair Oils and Serums

-

Hair Masks

-

Others

-

-

Makeup

-

Face Products

-

Eye Makeup

-

Lip Makeup

-

Others

-

-

Nail Polish

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global edible cosmetics market was estimated at USD 265.95 million in 2023 and is expected to reach USD 289.28 million in 2024.

b. The global edible cosmetics market is expected to grow at a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 488.27 million by 2030.

b. Asia Pacific dominated the edible cosmetics market, with a share of around 39% in 2023. This is due to its high demand for natural and organic skincare products, driven by a large and beauty-conscious consumer base.

b. Key players in the edible cosmetics market are Natural Organic Edible Cosmetics, EdenSong Essentials Skin Care, Edible Beauty Australia Pty Ltd, Skin Gourmet, Babylogy, HL Edible India, Living Nature, Kid Licks, Skin Pot Co., Project MC2.

b. Key factors driving the edible cosmetics market's growth include the increasing consumer preference for sustainable and eco-friendly products and advancements in food-grade skincare formulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.