- Home

- »

- Consumer F&B

- »

-

Honey Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Honey Market Size, Share & Trends Report]()

Honey Market (2023 - 2030) Size, Share & Trends Analysis Report By Processing (Organic, Conventional), By Distribution Channel (Hypermarkets & Supermarkets, Online, Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-280-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Honey Market Summary

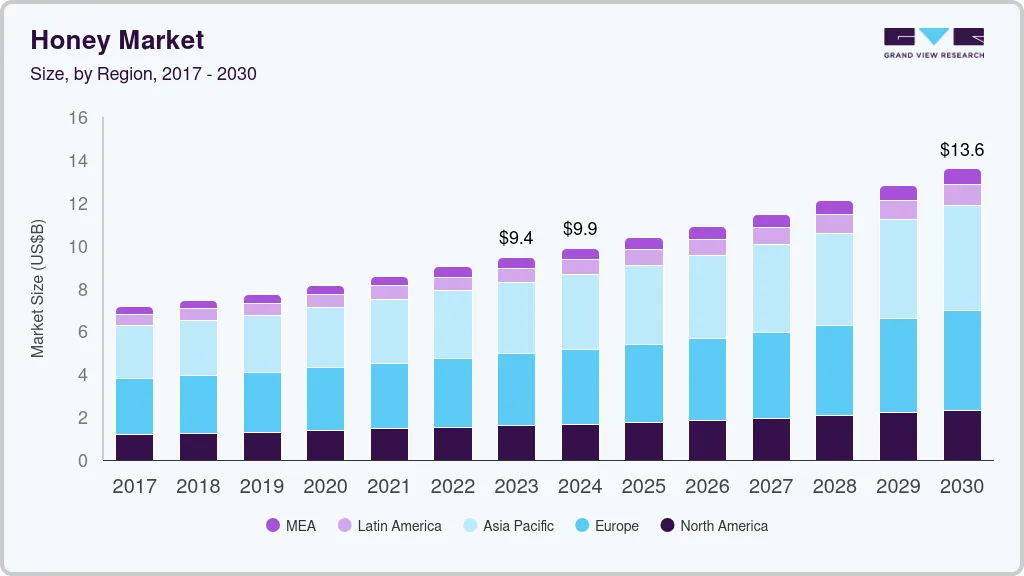

The global honey market size was valued at USD 9.01 billion in 2022 and is projected to reach USD 13.57 billion by 2030, growing at a CAGR of 5.3% from 2023 to 2030. Honey is an excellent source of numerous nutritional ingredients including vitamins, minerals, calcium, and antioxidants. High demand for nutritious food products is a prominent factor driving the market, as people are increasingly becoming more aware of the benefits of living a healthy lifestyle.

Key Market Trends & Insights

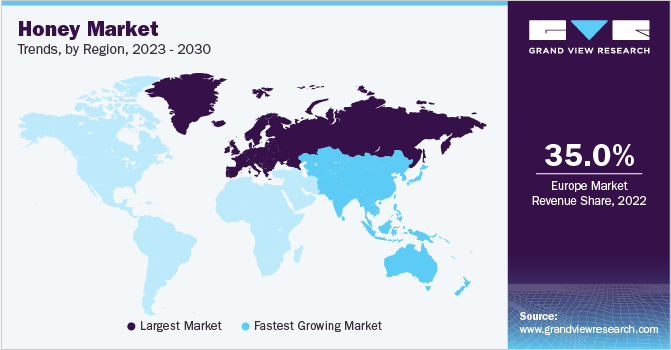

- Europe held the largest revenue share of over 35.0% in 2022

- By processing, The conventional segment held the largest revenue share of over 80.0% in 2022 and is expected to maintain its lead over the forecast period

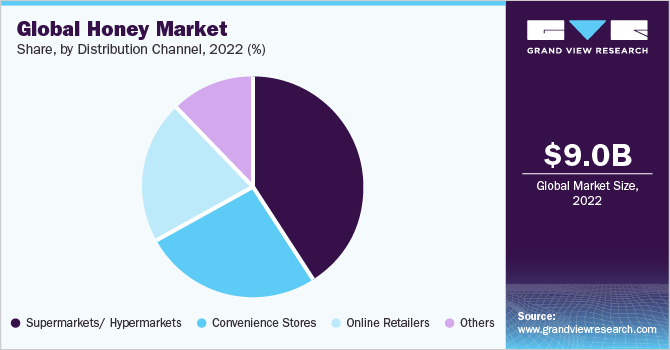

- By distribution channel, The hypermarkets and supermarkets segment captured the largest revenue share of over 40.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 9.01 Billion

- 2030 Projected Market Size: USD 13.57 Billion

- CAGR (2023-2030): 5.3%

- Europe: Largest market in 2022

The growing health concerns in the wake of the COVID-19 pandemic could be a game-changer for the honey sector. Due to its antibacterial, antiviral, and anti-fungal properties, the product is receiving appreciation and wider acceptance as an effective medicine to treat acute cough and throat infections observed in corona-infected patients.

Honey can be used in beverages, processed foods, jams, and jellies and is increasingly used as an ingredient in health and beauty products. The easy availability of a wide range of these products, coupled with the product’s ability to impart a desirable taste in food and beverage products, is aiding the market demand. Moreover, honey contains a number of medical characteristics, including the ability to boost metabolic activity, control blood pressure, lower the risk of diabetes, and even treat burn wounds. Thus, it is widely used in many applications apart from food and beverages, such as cosmetics and pharmaceuticals, which is also estimated to augment market growth.

Product manufacturers are coming up with innovative launches to engage an increasing number of consumers. For instance, in July 2021, Dabur launched honey-infused syrups, a new line of syrups and spreads segment. The product has no added sugar and is a healthier version of the classic strawberry syrups and sugary chocolates available in the market. The rising health consciousness among consumers has motivated them to include natural sweeteners in their diets and reduce white sugar usage. The antioxidant and antibacterial properties of natural sweeteners have made them an ideal sweetener choice for consumers. Furthermore, the longer shelf-life of the product and high affordability are other prominent factors that positively impact market growth.

Processing Insights

The conventional segment held the largest revenue share of over 80.0% in 2022 and is expected to maintain its lead over the forecast period, owing to its lower prices and wider availability in comparison to organic honey. Further, nowadays, new flavors with exotic add-ons are being introduced in conventional products as per the changing consumer demands, which is likely to drive the conventional segment. The organic segment is projected to register the fastest CAGR of 5.9% from 2023 to 2030 due to the growing trend of eating healthy among millennials and adults.

Furthermore, substituting plant-based sweeteners for natural honey sweeteners will promote market growth in the years to come. Moreover, the growing population and increasing number of people moving towards honey sweeteners provide a significant growth opportunity for the key players operating in the market. Many key players including Blenditup, Just Like Honey, and Vegan Honey Company are launching vegan honey.

Distribution Channel Insights

The hypermarkets and supermarkets segment captured the largest revenue share of over 40.0% in 2022. The increasing penetration of independent retail giants such as Walmart and Costco is boosting product visibility and attracting a larger consumer base. Consumers prefer to physically verify these products before buying, which is driving sales through this channel. The online distribution channel is projected to register the highest CAGR of 6.6% from 2023 to 2030. Consumers are switching from offline to online channels owing to the change in their purchasing patterns and a considerable shift in lifestyles.

Online platforms offer high levels of convenience, increased product visibility, and at-home delivery features, which is promoting segment growth. A majority of consumers rely on virtual stores to help them navigate through the multitude of products available and at times, return and exchange options available to them if not satisfied with the delivered products. Numerous market players prefer to sell varieties of honey, royal jelly, and wax through these stores as they offer more accountability with respect to overall customer service.

Regional Insights

Europe held the largest revenue share of over 35.0% in 2022 and is expected to maintain its lead over the forecast period. A rapidly improving economy due to rising disposable income, urbanization, and changing lifestyles is projected to drive product demand in the respective region, thereby augmenting the overall market growth in the years to come. Asia Pacific is expected to register the highest CAGR from 2023 to 2030. Consumers’ increasing inclination towards healthy and tasty eating habits is boosting market growth.

Moreover, the presence of well-established players in the region and the constantly growing millennial population, along with its willingness to spend more on healthier sweeteners, are driving the market in the Asia Pacific. The market is mainly dominated by players like Jedwards International, Inc.; Koru Natural; and Pacific Resources International. Furthermore, the chief factors that are expected to favor the regional market growth include an increase in the production volume of honey and a rise in its consumption among people.

Key Companies & Market Share Insights

The market is characterized by the presence of a few well-established players and several medium players. Industry players are taking up key strategic initiatives such as product launches to gain a competitive edge in the market.

-

In September 2021, Amul launched a new product, developed by Gujarat Cooperative Milk Marketing Federation Ltd. (GCMMF) along with the National Bee Board. With this step, the government is promoting bee-keeping among small farmers.

-

In July 2021, Dabur announced its entry into the syrups and spreads segment by launching ‘Dabur Honey Tasties.’ This new product is launched in two flavors - Strawberry and Chocolate. In May 2021, Conscious Food, a pioneer of organic food products in India, launched a new raw unprocessed Himalayan multiflora honey, a completely unfiltered and unpasteurized product that retains the immense natural benefits of honey as it travels 'from bee to the bottle’.

-

In March 2023, Bagrrys India, a prominent brand in the Indian breakfast cereals and health food market, unveiled a new product called Bagrry's Organic Wild Honey. The brand is well-known for its range of products, including oats, mueslis, cornflakes, muesli bars, nut butter, bran, and more.

-

In December 2022, U.S.-based MeliBio is partnering with organic food producer Narayan Foods to bring its plant-based bee-free honey product to Europe under the Better Foodie Brand.

Some of the key players operating in the global honey market include:

-

Beeyond the Hive

-

Barkman Honey LLC

-

Dabur India Ltd.

-

Capilano Honey Ltd.

-

New Zealand Honey Co.

-

Streamland Biological Technology Ltd.

-

Oha Honey LP

-

Billy Bee Honey Products

-

Little Bee Impex

-

Dutch Gold Honey, Inc.

Honey Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.45 billion

Revenue forecast in 2030

USD 13.57 billion

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Processing, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America. Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Beeyond the Hive; Barkman Honey LLC; Dabur India Ltd.; Capilano Honey Ltd.; New Zealand Honey Co.; Streamland Biological Technology Ltd.; Oha Honey LP; Billy Bee Honey Products; Little Bee Impex; Dutch Gold Honey, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

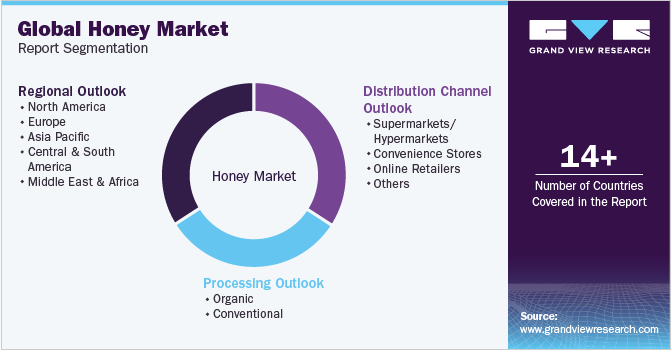

Global Honey Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global honey market report on the basis of processing, distribution channel, and region.

-

Processing Outlook (Revenue, USD Million, 2017 - 2030)

-

Organic

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets/ Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global honey market size was estimated at USD 9.01 billion in 2022 and is expected to reach USD 9.45 billion in 2023.

b. The global honey market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 13.57 billion by 2030.

b. Conventional honey dominated the honey market with a share of more than 80.0% in 2022. This is attributed to lower prices of conventional honey in comparison to organic types and the wide availability of products across the distribution channels.

b. Some key players operating in the honey market include Beeyond the Hive, Barkman Honey LLC, Dabur India Ltd., Capilano Honey Ltd., New Zealand Honey Co., Streamland Biological Technology Ltd., Oha Honey LP, Billy Bee Honey Products, Little Bee Impex, and Dutch Gold Honey Inc.

b. Key factors that are driving the honey market growth include shifting consumer preferences towards a healthy, nutritious, and natural alternative for sugar and increasing consumers' traction towards healthy spreads.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.