- Home

- »

- Next Generation Technologies

- »

-

Edtech And Smart Classrooms Market, Industry Report, 2033GVR Report cover

![Edtech And Smart Classrooms Market Size, Share & Trends Report]()

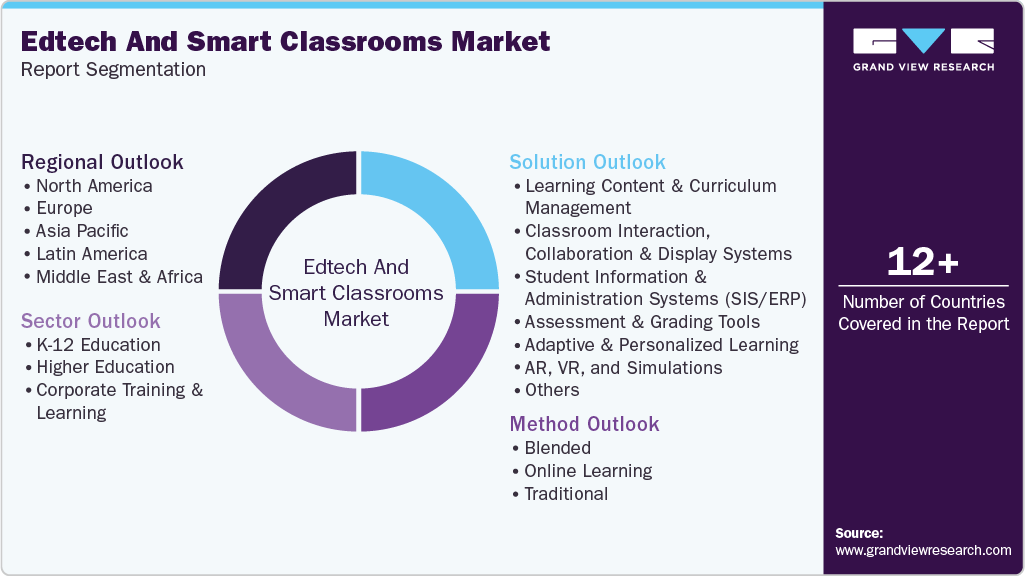

Edtech And Smart Classrooms Market (2025 - 2033) Size, Share & Trends Analysis Report By Method (Blended, Online Learning, Traditional), By Sector (K-12 Education, Higher Education), By Solution, By Region And Segment Forecasts

- Report ID: GVR-4-68040-792-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Edtech And Smart Classrooms Market Summary

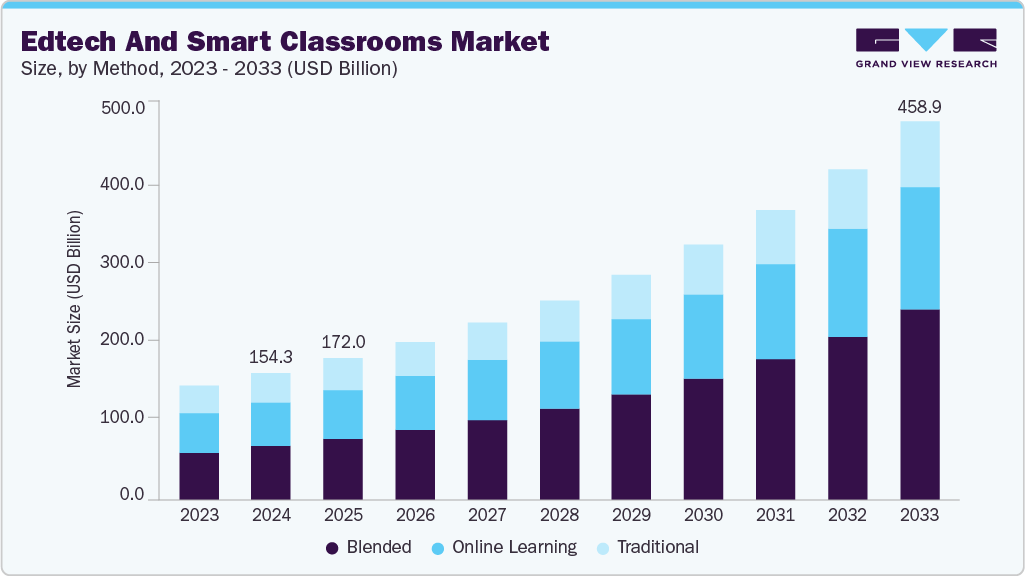

The global edtech and smart classrooms market size was estimated at USD 154.29 billion in 2024 and is projected to reach USD 458.98 billion by 2033, growing at a CAGR of 13.1% from 2025 to 2033. The market is driven by the growing demand for personalized and digital learning solutions, increased internet penetration, and widespread adoption of smart devices.

Key Market Trends & Insights

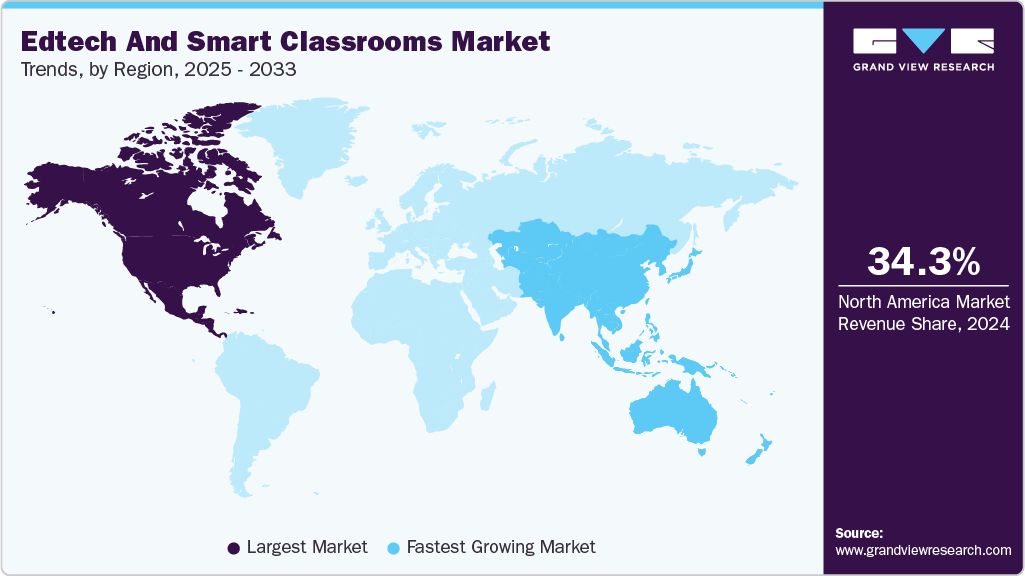

- North America dominated the global Edtech and smart classrooms market, with a revenue share of 34.3% in 2024.

- The U.S. edtech and smart classrooms market led North America and held the largest revenue share in 2024.

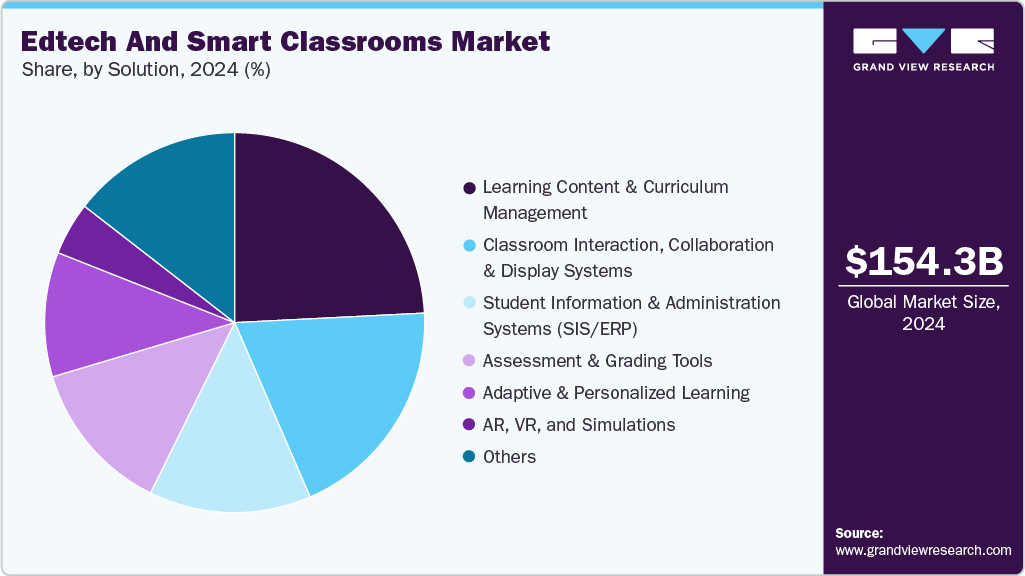

- By solution, Learning Content & Curriculum Management led the market, holding the largest revenue share of 24.2% in 2024.

- By method, blended segment held the dominant position in the market.

- By sector, higher education segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 154.29 Billion

- 2033 Projected Market Size: USD 458.98 Billion

- CAGR (2025-2033): 13.1%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Government initiatives promoting digital education, rising investments in e-learning platforms, and integrating AI, AR, and VR technologies enhance interactive learning experiences, further accelerating market growth across schools, universities, and corporate training environments. The market is primarily driven by the rising adoption of digital learning tools and the increasing emphasis on personalized education. The widespread use of smart devices and growing internet penetration have transformed conventional teaching models into interactive, technology-enabled experiences. Governments and educational institutions actively promote digital learning initiatives to enhance accessibility and inclusivity. Furthermore, the rising demand for online and blended learning solutions accelerated platform-based education. These factors, supported by growing investments in cloud-based content delivery and adaptive learning systems, are collectively propelling the market’s expansion globally.Technological innovation is a key market growth driver. The integration of artificial intelligence (AI), augmented reality (AR), virtual reality (VR), and analytics is revolutionizing the way students engage with learning content. AI-driven adaptive learning platforms enable customized content delivery, improving student performance and engagement. Meanwhile, AR and VR enhance experiential learning by simulating real-world environments, making complex subjects more understandable. Cloud computing further supports scalability and data accessibility across devices. As institutions aim to create immersive, data-driven learning ecosystems, these technologies foster significant improvements in content delivery efficiency and learning outcomes, boosting overall market growth.

Global investments and corporate participation in digital education further stimulate the market. Educational technology startups and established players are expanding their offerings through strategic partnerships, acquisitions, and product innovations. Governments are allocating substantial budgets to digital infrastructure development to improve educational quality and reach, especially in developing economies. In addition, the corporate training sector’s shift toward digital platforms is amplifying demand for interactive and flexible learning solutions. The growing recognition of continuous learning and skill development in today’s workforce underscores the long-term potential of EdTech and Smart Classrooms, ensuring sustained market growth in the coming years.

Method Insights

The blended segment dominated the market in 2024. The segment is primarily driven by the growing demand for flexible and personalized learning experiences that combine online and offline education. Institutions increasingly adopt hybrid models to enhance student engagement, improve learning outcomes, and optimize teacher efficiency through data-driven insights. The rise in digital infrastructure, affordable internet access, and widespread adoption of AI-enabled learning platforms further support this growth. In addition, government initiatives promoting digital education and the increasing need for scalable, cost-effective learning solutions are propelling the expansion of the blended method segment.

Online is expected to register a significant CAGR over the forecast period. The online learning method segment in the market is driven by growing internet penetration, widespread smartphone adoption, and increasing affordability of digital devices. Moreover, AI, cloud computing, and interactive content delivery advancements enhance engagement and learning outcomes. Moreover, the rising demand for skill development, remote education models post-pandemic, and government initiatives promoting digital education further accelerate the adoption of online learning solutions globally.

Sector Insights

The higher education segment dominated the market in 2024, propelled by several key factors. The increasing adoption of Learning Management Systems (LMS) and cloud-based education platforms facilitates flexible, scalable learning environments. Mobile learning and artificial intelligence (AI)-based personalization enhance student engagement and tailor educational experiences to individual needs. Government initiatives, such as India's PM eVidya and the EU's Digital Education Action Plan, support digital education infrastructure substantially, further accelerating adoption. In addition, the growing demand for immersive learning experiences, driven by AR, VR, and simulation advancements, is reshaping educational delivery. These factors collectively contribute to the rapid market expansion in higher education.

The corporate training & learning segment is expected to register the highest CAGR over the forecast period, driven by multiple factors. Organizations increasingly adopt digital learning platforms to upskill employees and enhance workforce adaptability amid rapid technological changes. The rise of remote and hybrid work models has fueled demand for flexible, scalable, and accessible training solutions. Technological advancements, including AI, AR, and VR, enable immersive, personalized learning experiences, while government initiatives and policies support digital education infrastructure. In addition, significant investments in EdTech companies are accelerating innovation and platform expansion, collectively strengthening the adoption and impact of corporate training and learning solutions in the global EdTech ecosystem.

Solution Insights

The learning content & curriculum management segment dominated the market with a share of over 24.2% in 2024, driven by the growing need for structured, customizable, and interactive digital learning materials. Educational institutions and corporations increasingly adopt cloud-based platforms to efficiently create, organize, and deliver dynamic content aligned with learning objectives and regulatory standards. Integrating AI and data analytics enables personalized content recommendations and performance tracking, enhancing learning efficiency. In addition, the demand for multilingual, adaptive, and competency-based curricula is expanding due to the globalized nature of education. Continuous updates in digital pedagogy, coupled with the need for seamless collaboration and real-time content management, are further fueling growth in this segment.

The AR, VR, and simulations segment is expected to register the highest CAGR over the forecast period, driven by the growing need for immersive and experiential learning environments that enhance student engagement and retention. These technologies bridge the gap between theoretical knowledge and real-world application, allowing learners to visualize complex concepts interactively. The increasing affordability of VR headsets, AR-enabled devices, and advancements in 3D modeling and AI integration are fueling adoption across schools, universities, and corporate training sectors. Moreover, the demand for remote and hybrid learning solutions has accelerated investment in simulation-based education. Government initiatives supporting digital transformation in education further strengthen this segment’s growth globally.

Regional Insights

North America dominated the Edtech and smart classrooms market with a revenue share of over 34.3% in 2024. Government initiatives and investments are promoting technology integration in education, enhancing access and quality of learning. The increasing adoption of mobile devices and broadband connectivity is facilitating the expansion of digital learning platforms. Technological advancements, including artificial intelligence, virtual reality, and gamification, create personalized and engaging learning experiences. These factors contribute to the robust growth of North America's market.

U.S. Edtech And Smart Classrooms Market Trends

The Edtech and smart classrooms market in the U.S. is expected to grow significantly in 2024. The widespread adoption of mobile devices and AI-powered personalized learning platforms enhances student engagement and learning outcomes. Government initiatives and increased investments in educational technology are further accelerating the integration of smart classroom solutions. The rise of immersive learning environments utilizing various technologies such as AR/VR and interactive displays transforms traditional classrooms into dynamic learning spaces. In addition, the growing emphasis on remote and hybrid learning models drives the demand for scalable and flexible educational tools. These factors collectively contribute to the robust market expansion in the U.S.

Europe Edtech And Smart Classrooms Market Trends

The Edtech and smart classrooms market in Europe is expected to grow significantly over the forecast period. Government initiatives, such as the European Commission's Digital Education Action Plan, actively promote digital learning infrastructure and regional policies. The increasing demand for personalized and interactive learning experiences leads to the widespread adoption of smart classroom technologies, including AI-powered tools and interactive whiteboards. In addition, the rise of hybrid and remote learning models accelerated the need for scalable and flexible educational solutions. These factors collectively contribute to the robust expansion of Europe's EdTech and smart classrooms sector.

Asia Pacific Edtech And Smart Classrooms Market Trends

The Edtech and smart classrooms market in the Asia Pacific is anticipated to be at the fastest CAGR over the forecast period. The proliferation of internet connectivity and mobile devices has facilitated access to digital learning resources. Technological advancements, including AI, AR, and VR, enhance the interactivity and personalization of learning experiences. In addition, the increasing demand for upskilling and reskilling in response to technological disruptions propels the adoption of EdTech solutions. These factors collectively contribute to the rapid market expansion in the Asia Pacific region.

Key Edtech And Smart Classrooms Company Insights

Pearson and Google LLC are key companies in the market.

-

Pearson is a key player in the EdTech and smart classrooms sector due to its extensive portfolio of educational content, assessments, and digital learning solutions. Its strong global presence across K-12, higher education, and professional learning, combined with innovative online platforms and adaptive learning technologies, enables personalized and scalable learning experiences. Continuous investment in digital transformation and partnerships with educational institutions reinforces Pearson’s dominant position in the global market.

-

Google LLC’s Google for Education leads the market by providing cloud-based tools, collaborative platforms, and digital classroom solutions that enhance teaching and learning efficiency. Its ecosystem, including Google Classroom, Workspace for Education, and Chromebooks, enables seamless integration and accessibility for educators and students worldwide. Google's strong emphasis on scalability, affordability, and innovation, coupled with widespread adoption across schools and higher education institutions, positions it as a key player in the global EdTech market.

Key Edtech And Smart Classrooms Companies:

The following are the leading companies in the edtech and smart classrooms market. These companies collectively hold the largest market share and dictate industry trends.

- Pearson

- Cisco Systems, Inc.

- Google LLC

- Microsoft

- IBM Corporation

- Apple Inc.

- Dell Inc.

- HP Development Company, L.P.

- Samsung

- SMART Technologies ULC

Recent Developments

-

In October 2025, Microsoft announced the integration of AI-powered experiences into Microsoft 365 Copilot for Education, offering tools at no additional cost to educators and students. This initiative aims to enhance teaching and learning by providing AI-driven insights and support, fostering a more efficient and personalized educational environment.

-

In March 2025, Lenovo, a technology company, partnered with Google LLC to introduce the first Chromebook Plus equipped with a Neural Processing Unit (NPU), enhancing AI capabilities for educational applications. This collaboration aims to provide educators and students with advanced tools for personalized learning experiences. The initiative also includes professional development programs to ensure effective integration of AI in classrooms.

-

In July 2025, Lenovo, a technology company, launched its first AI-powered tablet in India, the Yoga Tab Plus. The device features the proprietary Lenovo AI Now assistant, a 12.7-inch 3K PureSight Pro display, Snapdragon 8 Gen 3 chipset, and a 10,400mAh battery. The Yoga Tab Plus aims to enhance productivity and multimedia experiences, marking a significant step in integrating AI into consumer tablets for the Indian market.

Edtech And Smart Classrooms Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 172.01 billion

Revenue forecast in 2033

USD 458.98 billion

Growth rate

CAGR of 13.1% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, method, sector, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Pearson; Cisco Systems, Inc.; Google LLC; Microsoft; IBM Corporation; Apple Inc.; Dell Inc.; HP Development Company, L.P. ; Samsung; and SMART Technologies ULC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edtech And Smart Classrooms Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Edtech and smart classrooms market report based on solution, method, sector, and region:

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Learning Content & Curriculum Management

-

Classroom Interaction, Collaboration & Display Systems

-

Student Information & Administration Systems (SIS/ERP)

-

Assessment & Grading Tools

-

Adaptive & Personalized Learning

-

AR, VR, and Simulations

-

Others

-

-

Method Outlook (Revenue, USD Billion, 2021 - 2033)

-

Blended

-

Online Learning

-

Traditional

-

-

Sector Outlook (Revenue, USD Billion, 2021 - 2033)

-

K-12 Education

-

Higher Education

-

Corporate Training & Learning

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Edtech and smart classrooms market size was estimated at USD 154.29 billion in 2024 and is expected to reach USD 172.01 billion in 2025.

b. The global Edtech and smart classrooms market is expected to grow at a compound annual growth rate of 13.1% from 2025 to 2033 to reach USD 458.98 billion by 2033.

b. North America dominated the Edtech and smart classrooms market with a share of 34.3% in 2024. Government initiatives and investments are promoting the integration of technology in education, enhancing access and quality of learning. The increasing adoption of mobile devices and broadband connectivity is facilitating the expansion of digital learning platforms. Technological advancements, including the incorporation of artificial intelligence, virtual reality, and gamification, are creating personalized and engaging learning experiences. These factors contribute to the robust growth of the EdTech and smart classrooms market in North America.

b. Some key players operating in the Edtech and smart classrooms market include Pearson; Cisco Systems, Inc.; Google LLC; Microsoft; IBM Corporation; Apple Inc.; Dell Inc.; HP Development Company, L.P. ; Samsung; and SMART Technologies ULC.

b. Key factors that are driving the Edtech and smart classrooms market growth include the growing demand for personalized and digital learning solutions, increased internet penetration, and widespread adoption of smart devices. Government initiatives promoting digital education, rising investments in e-learning platforms, and integration of AI, AR, and VR technologies enhance interactive learning experiences, further accelerating market growth across schools, universities, and corporate training environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.