- Home

- »

- Consumer F&B

- »

-

Egypt Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Egypt Nutraceuticals Market Size, Share & Trends Report]()

Egypt Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-676-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Egypt Nutraceuticals Market Summary

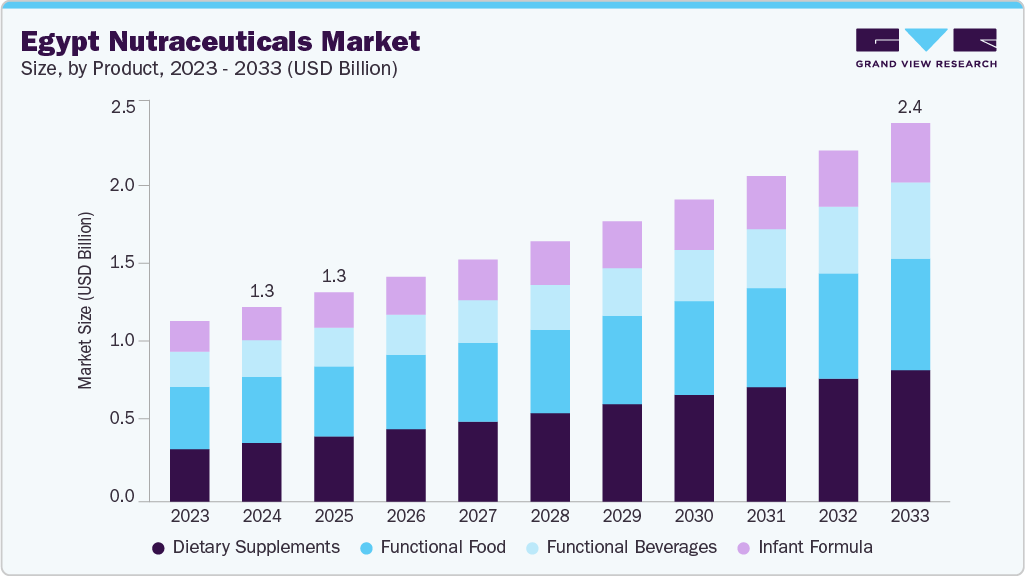

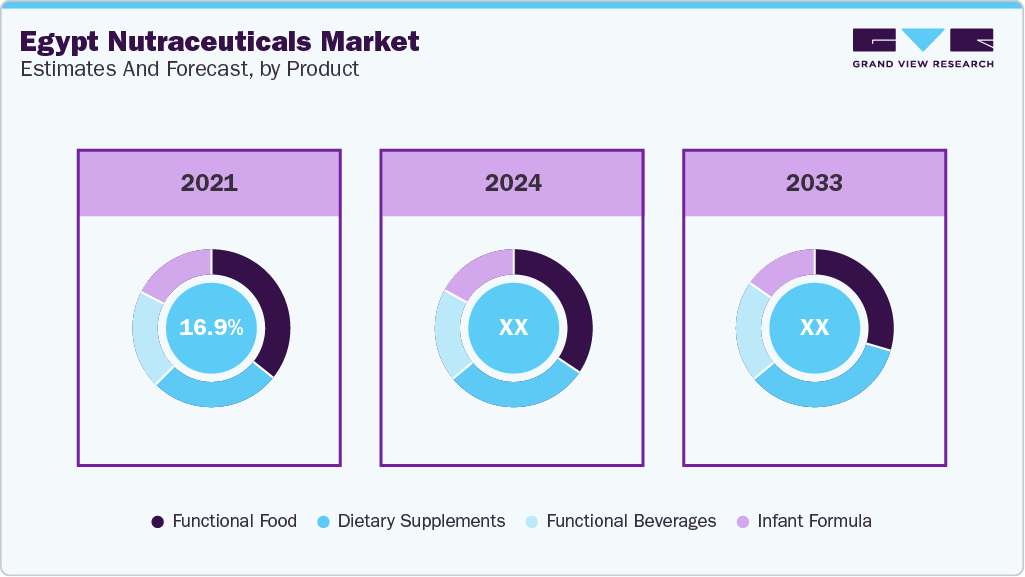

The Egypt nutraceuticals market size was estimated at USD 1.26 billion in 2024 and is projected to reach USD 2.44 billion by 2033, growing at a CAGR of 7.7% from 2025 to 2033. This growth is driven by rising consumer awareness about preventive healthcare, increased demand for immunity-boosting products, and a shift toward functional foods and dietary supplements.

Key Market Trends & Insights

- By product, the functional food segment held the highest market share of 34.0% in 2024.

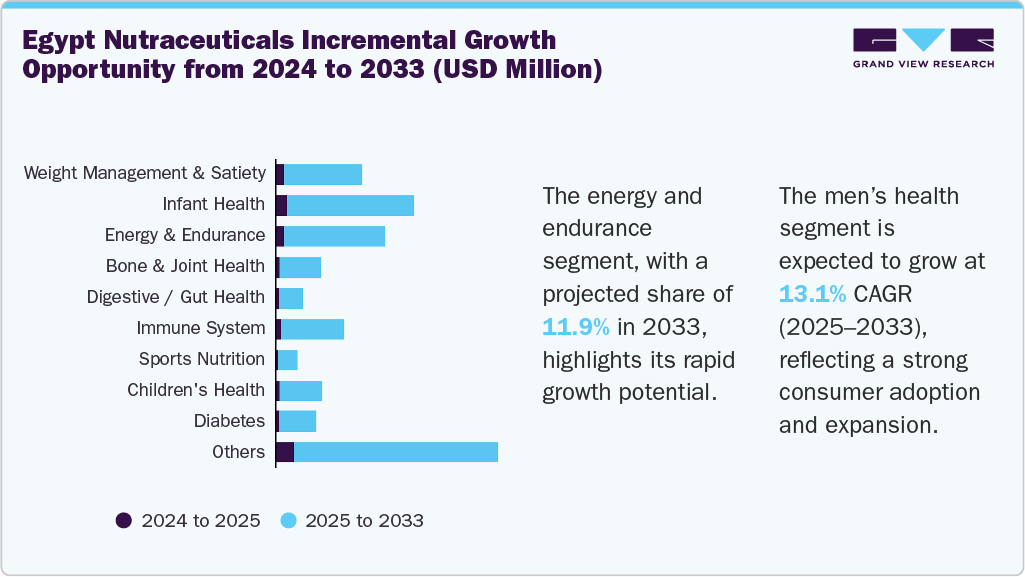

- Based on application, the weight management & satiety segment held the highest market share in 2024.

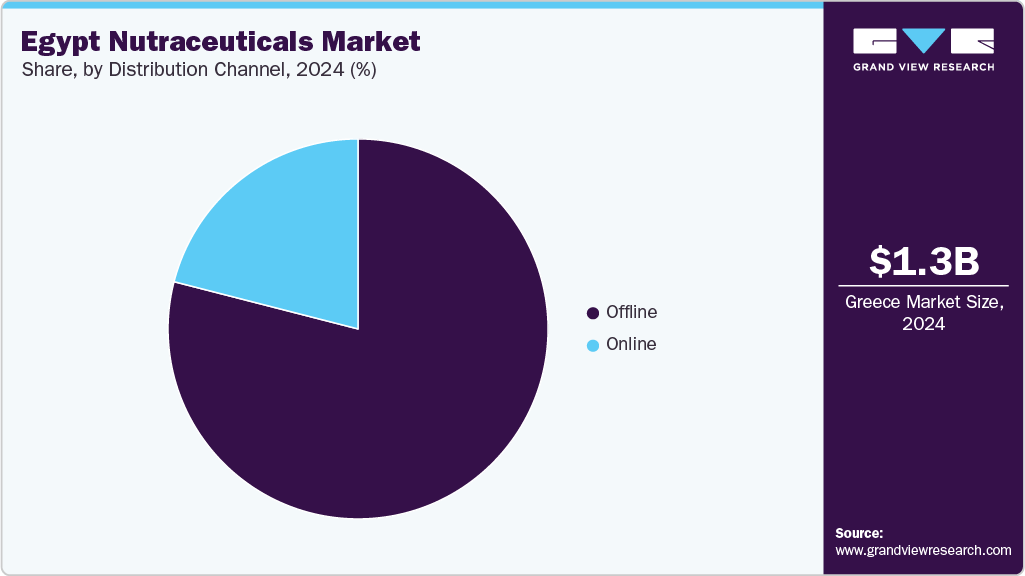

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.26 Billion

- 2033 Projected Market Size: USD 2.44 Billion

- CAGR (2025-2033): 7.7%

Functional foods and beverages fortified with probiotics and clean-label and plant-based products are gaining popularity. Innovations such as smart packaging, nanotechnology, and AI-based personalized nutrition are expected to shape the product development.In Egypt, nutraceuticals are increasingly used as supportive therapies, particularly in managing metabolic syndrome, which includes conditions such as obesity, diabetes, and cardiovascular diseases. Egypt faces a severe obesity crisis, with 44.7% of adult women and 25.9% of adult men living with obesity, well above regional averages. The country is off track in meeting nutrition related health targets, reflecting rising trends in both adult and childhood obesity. This contributes significantly to Egypt's growing burden of non-communicable diseases such as diabetes, cardiovascular disease, and obesity, which are together estimated to account for 82% of total deaths in the country, according to the World Health Organization. In response to this rising health challenge, nutraceuticals are increasingly used as supportive interventions to help manage weight, regulate metabolism, and reduce obesity-related inflammation through natural, food-based compounds.

The culture of nutraceuticals is shaped by a long-standing tradition of using natural and herbal remedies for health and wellness. Many Egyptians are culturally inclined to trust food-based and plant-derived treatments, accepting nutraceuticals such as herbal teas, fortified foods, and dietary supplements. Products such as black seed oil, fenugreek, and hibiscus have historical roots in Egyptian households, which align well with the modern concept of nutraceuticals. As a result, nutraceuticals are increasingly viewed as alternative therapies and as part of a balanced lifestyle, blending traditional beliefs with modern health practices.

Consumer Insights

In Egypt, young professionals and middle-aged adults are emerging as key consumers of nutraceuticals, motivated by an increasing emphasis on preventive healthcare, wellness, and fitness-oriented lifestyles. Millennials often prefer functional foods and sports nutrition products, such as protein powders and energy bars. At the same time, older adults (60+) are more inclined toward clinical nutrition supplements for managing chronic conditions such as obesity, diabetes, and cardiovascular diseases. In the paper titled "Awareness and Consumption Patterns of Functional Foods among Residents in Alexandria, Egypt: Insights from a Community Survey", the findings reveal that while 37.8% of respondents were aware of the health benefits associated with functional food, many remain unfamiliar with the term “functional foods” itself. Consumption patterns are significantly influenced by socio-demographic factors, including age, education, income, and marital status. Younger, well-educated individuals with higher incomes show a greater likelihood of functional food consumption. Price and product appearance emerged as the most influential factors, affecting purchasing decisions, with higher prices acting as barriers. These insights highlight the need for targeted public education initiatives and policy measures to improve awareness, accessibility, and affordability of functional foods, thereby supporting healthier dietary behavior among Egyptian consumers.

Egyptian consumers are increasingly shifting toward functional foods and beverages, particularly probiotic-rich dairy, omega-fortified staples, and energy or sports drinks that cater to active lifestyles. Online retail is becoming an essential distribution channel, supported by Egypt’s growing digital infrastructure and changing consumer preferences for convenience, clean-label products, and sustainable packaging. As regulatory support improves and innovation accelerates through smart technologies and ingredient science, consumer behavior in Egypt is becoming more nutraceutical-oriented, with demand centered on functionality, credibility, and daily health integration.

Product Insights

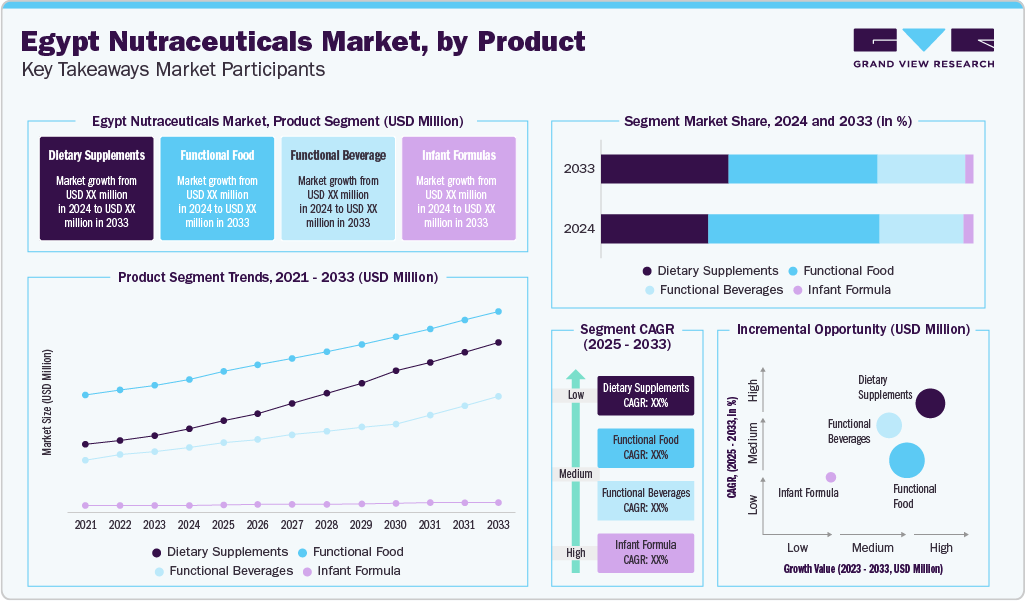

The functional food segment held the largest revenue share of 34.0% in 2024, driven by the rise in lifestyle-related diseases, greater health consciousness, and a shift toward preventive nutrition. Urban growth, a rising middle class, and aging population are fueling demand for convenient, health-boosting foods. Functional foods, which offer physiological benefits beyond basic nutrition, are gaining recognition for their role in enhancing immunity, managing metabolic conditions, and supporting overall well-being. In Egypt, this interest is reflected in consumer behavior and public health discourse, particularly as people seek natural, accessible alternatives to conventional medical interventions.

According to the paper titled “Microbial Functional Foods as a Magic Secret to Healthy Life Style,” functional foods, especially fermented and microbial-based foods, are gaining renewed interest due to their health-promoting properties, particularly in light of rising non-communicable diseases and immune-related disorders. Although the term “functional foods” remains unfamiliar to many Egyptians, traditional practices such as consuming fermented milk, yogurt, leben, and basterma are widespread and rooted in culture. These foods offer more than basic nutrition, enhance immune response, gut microbiota diversity, and protection against infections, positioning them as natural alternatives for improving public health.

The dietary supplements segment is anticipated to grow at the fastest CAGR of 9.1% over the forecast period, driven by rising health awareness, demand for preventive care, and increased access through physical and online retail channels. Postbiotics, which are increasingly formulated and marketed as dietary supplements, are recognized for their stability, safety, and potential to support areas such as digestive health, metabolic balance, and mental well-being. Postbiotics offer significant advantages to formulators, including extended shelf life, heat resistance, and regulatory clarity, compared to live probiotics. As consumer awareness around gut-brain and gut-metabolic axes increases, postbiotics are becoming a strategic choice for developing reliable, health-enhancing functional food and supplement products. According to the study titled “Consumption of dietary supplements and their determinants among adults in six Arabic countries: a cross-sectional survey”, among Egyptian respondents, the use of dietary supplements was highly prevalent, particularly for vitamin C, vitamin D, iron, and zinc.

Application Insights

The weight management & satiety segment dominated the market with a significant share of 16.6% in 2024, as more individuals adopt lifestyle changes to address growing health concerns. Sedentary routines, poor eating habits, and stress have contributed to widespread struggles with weight, prompting a shift in public mindset toward proactive wellness. As a result, there is a noticeable shift toward nutraceuticals that support metabolism, appetite control, and overall vitality. Consumers are increasingly opting for supplements and functional foods, seeking natural and effective solutions to manage weight and improve their long-term health outcomes. For instance, Otsuka Pharmaceutical and its Egyptian affiliate Arab Otsuka Nutraceuticals (AON) launched ORONAMIN C DRINK in Egypt in April 2024. Approved as a Fortify Drink by Egypt's National Food Safety Authority (NFSA), the product is a carbonated nutritional beverage rich in vitamin C, B2, and B6.

The men's health segment is anticipated to grow at the fastest CAGR over the forecast period, driven by increasing awareness of health issues such as obesity, diabetes, and cardiovascular disease. Growing interest in maintaining overall wellbeing has led many Egyptian men to adopt supplements, fitness services, and grooming products as part of their daily routines. In addition, rising urbanization and higher income levels are enabling more men to invest in health and wellness solutions, fueling demand across this segment.

Distribution Channel Insights

The offline distribution segment dominated the Egypt nutraceuticals industry in 2024. Traditional retail channels, such as pharmacies, health shops, and wellness centers, play a dominant role, serving as trusted purchase points for consumers seeking health and dietary supplements. In addition, modern trade outlets such as supermarkets and hypermarkets are increasingly becoming important retail spaces because of their wide reach and convenience.

The online segment is anticipated to record the fastest CAGR from 2025 to 2033, due to increasing internet penetration and changing consumer preferences, particularly in urban areas. Consumers are turning to e-commerce platforms for the convenience of home delivery, wider product choices, and competitive pricing. Online pharmacies and wellness-focused websites are emerging as key platforms, offering a range of supplements and functional foods. For instance, Webkul developed a mobile app for The Health Shop to cater to Egypt's mobile-first market. The app offers multilingual support, social login, and full e-commerce functionality. It addresses the Egyptian demand for one-touch accessibility and helps The Health Shop capitalize on the booming online pharmacy sector.

VitaZone eCommerce L.LC is an e-commerce platform that offers a wide range of nutraceuticals, including multi-vitamins, vitamins (such as B12 and D), omega-3, and probiotics. Noon Egypt is also one of the major regional e-commerce players, and it features an extensive category for vitamins and dietary supplements. In addition, Hercules Supplement Egypt has a strong online presence in Egypt’s market, American-imported supplements through a user-friendly e-commerce platform, providing a wide range of vitamins and proteins.

Key Egypt Nutraceuticals Company Insights

Some of the key players in the Egypt nutraceuticals industry include EVA Pharma, Amoun Pharmaceutical Co., and Danone.

-

Amoun is one of Egypt’s specializes in the full lifecycle of healthcare products development, manufacturing, marketing, distribution, and export. They serve both local and regional markets with international-standard quality.

Key Egypt Nutraceuticals Companies:

- EVA Pharma

- Amoun Pharmaceutical Co.

- Danone

- Nestlé

Recent Developments

-

In 2025, Egypt’s HOLDIPHARMA partnered with U.S.-based Dawah Pharmaceuticals Inc. to launch a joint venture focused on manufacturing and exporting pharmaceuticals and nutritional supplements., wherein Dawah Pharmaceuticals Inc. holds 60% and HOLDIPHARMA holds 40%.

Egypt Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.35 billion

Revenue forecast in 2033

USD 2.44 billion

Growth rate

CAGR of 7.7% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

EVA Pharma, Amoun Pharmaceutical Co., Danone, Nestlé Egypt S.A.E.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Egypt Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Egypt nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.