- Home

- »

- Homecare & Decor

- »

-

Egypt Ride Hailing Service Market Size Report, 2021-2028GVR Report cover

![Egypt Ride Hailing Service Market Size, Share & Trends Report]()

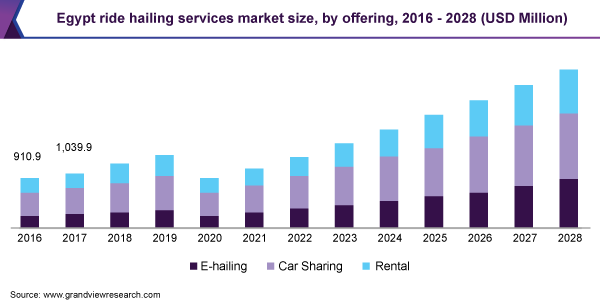

Egypt Ride Hailing Service Market Size, Share & Trends Analysis Report By Offering (E-hailing, Car Sharing, and Rental), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-448-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The Egypt ride hailing service market size was valued at USD 922.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 15.8% from 2021 to 2028. The increasing traffic congestion and the rising consumer preference for car-sharing services available at affordable rates and the desired comfort are the major factors driving the market growth. The growth is also attributed to the rising internet penetration and the use of smartphones to book rides. Ride-hailing services in Egypt have been hit hard by the COVID-19 pandemic. The service providers had the advantage of already operating several on-demand logistics services. Most companies allow their drivers to toggle between ride-hailing and on-demand delivery requests. That number now includes tens of thousands of new drivers who joined the platform to make up for lost earnings during the pandemic.

In Egypt, the growing urbanization and persistently low vehicle ownerships are likely to generate significant demand for ride hailing services in coming years. According to Urbanet, the country’s urban growth rate is over 2%. This shows that the Egyptian cities have to accommodate almost 1 million new citizens annually. Cairo alone saw half a million new inhabitants in 2017, making it the fastest-growing city in the world. This has been driving the need for commute services in these newly expanding cities.

Emerging ride-sharing companies in the country are focusing on unique strategies such as services focused on long road trips or lower overall rates and better safety. Furthermore, rising fuel prices, the growing popularity of ride-sharing services, and the increasing awareness about environmental conservation are resulting in the introduction of newer modes of transport. For instance, about 80% of the Electric Vehicles (EVs) imported in 2018 were sold outside of Cairo, which hints at the potential of electric vehicles in Egypt for ride-hailing.

An increasing number of ride-hailing service companies are opting for two-wheeler vehicles to curb the ongoing traffic emergencies in various cities across Egypt. The lower pricing of these vehicles has increased their traction in the online ride-hailing industry. For instance, Careem, which is active in 14 cities in Egypt, offers metered scooter rides starting from USD 0.38 (6 EGP). The cheapest ride costs USD 0.50 (8 EGP), which is approximately 50% lower than regular car rides.

The government of Egypt has laid down some stringent operation policies for cab servicing companies in the country. The primary rationale behind these stringent policies is to protect the interest of local taxi drivers. In May 2018, the government of Egypt approved a law governing ride hailing services. The country has two major ride-hailing apps-Uber and Careem-which faced several legal disputes due to policies designed for conventional taxis. This is expected to create significant challenges for market growth.

Offering Insights

In terms of value, the car-sharing segment dominated the Egypt ride hailing service market with a revenue share of around 47% in 2020. The segment is projected to expand at a CAGR of over 14.4% over the forecast period. Amidst the increasing traffic congestion in Egypt, consumers are opting for car-sharing or carpool services as they are convenient and offer a comfortable traveling experience at reduced prices. The number of car-sharing providers is increasingly electrifying their fleets, which is attracting environment-conscious consumers.

This segment is also driven by secured access to city centers, increased environmental awareness of the users, stricter limits on Co2 emissions, and various marketing strategies by players. In Egypt, the private sector is tasked with building charging stations for electric fleets. For instance, Revolta is the first company that is building a network of charging stations in Egypt and had over 130 charging stations in 18 cities across the country, in February 2020.

The e-hailing segment is projected to register the fastest CAGR of 18.9% from 2021 to 2028. This growth is attributed to the user-friendliness and convenience that these services offer. The rising e-commerce and smartphone penetration across the country is supporting the ever-growing demand for e-hailing services in Egypt.

Key Companies & Market Share Insights

The market for ride-hailing services in Egypt is characterized by the presence of several well-established players, such as Uber Technologies, Inc.; Avis Rent a Car System, LLC; Sixt SE; Halan Inc.; and SWVL Technologies Inc. These players account for a considerable market share and have a strong presence across the country. The ride-hailing services market also comprises small-to-midsized players, which offer a selected range of ride-hailing services and mostly serve local customers.

The companies operating in the market are focusing on strategic partnerships to offer reliable transportation services to their customers and to gain a competitive edge over other players. For instance, in May 2019, SWVL Technologies Inc. and Ford announced a strategic partnership in which Swvl operators would use Ford transit minibus as the preferred vehicle of choice. The agreement will combine the brilliance of Transit, the world’s best-selling van brand, with an app-based mass transit system that enables commuters in Egypt’s major cities to enjoy affordable, convenient, safe, and reliable transportation services. Some of the prominent players operating in the Egypt ride hailing service market are:

-

Uber Technologies, Inc.

-

Avis Rent a Car System, LLC

-

Sixt SE

-

Halan Inc.

-

Wngo Technologies Inc.

-

SWVL Technologies Inc.

-

Dubci

-

Fyonka

-

FriendyCar

-

M Car Egypt

Egypt Ride Hailing Service Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.11 billion

Revenue forecast in 2028

USD 2.99 billion

Growth rate

CAGR of 15.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Million & CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Offering

Country scope

Egypt

Key companies profiled

Uber Technologies, Inc.; Avis Rent a Car System, LLC; Sixt SE; Halan Inc.; Wngo Technologies Inc.; SWVL Technologies Inc.; Dubci; Fyonka; FriendyCar; M Car Egypt

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the Egypt ride hailing service market report based on offering:

-

Offering Outlook (Revenue, USD Million, 2016 - 2028)

-

Car Sharing

-

E-hailing

-

Rental

-

Frequently Asked Questions About This Report

b. Egypt ride hailing service market size was estimated at USD 922.0 million in 2020 and is expected to reach USD 1.11 billion in 2021.

b. Egypt ride hailing service market is expected to grow at a compound annual growth rate of 15.8% from 2021 to 2028 to reach USD 2.99 billion by 2028.

b. In terms of value, the car sharing segment dominated the Egypt ride hailing service market with a revenue share of around 47% in 2020.

b. Some key players operating in Egypt ride hailing service market include Uber Technologies, Inc.; Avis Rent a Car System, LLC; Sixt SE; Halan Inc.; SWVL Technologies Inc.; Dubci; Wngo Technologies Inc.; Fyonka; M Car Egypt; and FriendyCar.

b. Key factors that are driving the Egypt ride hailing service market growth include the increasing traffic congestion rates in Egypt coupled with consumers’ preference for car-sharing services which offered at lesser cost and at the desired comfort.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."