Elbow Replacement Market Size & Trends

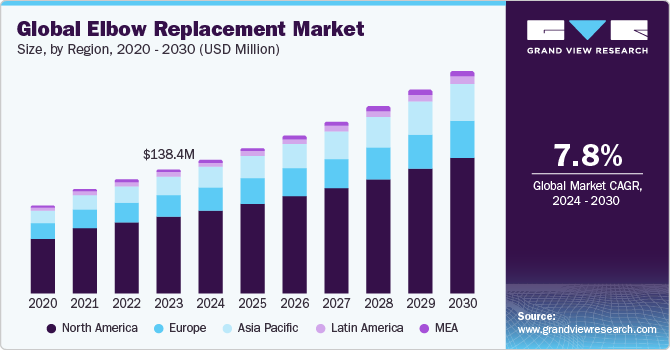

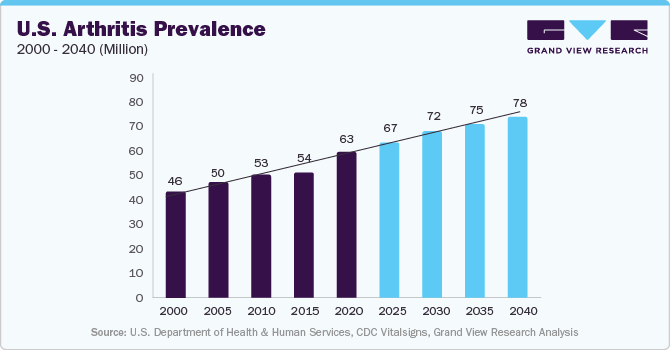

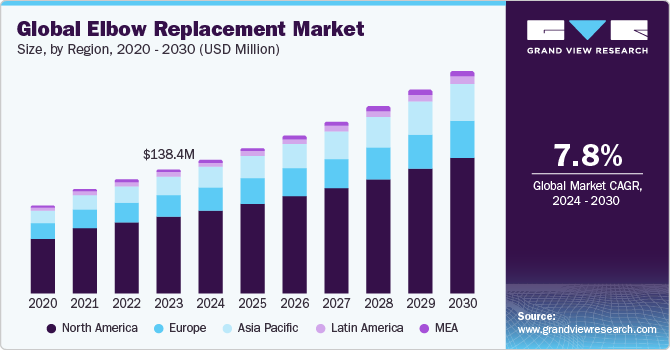

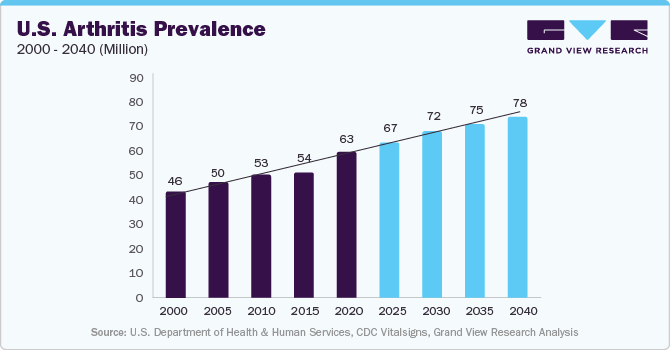

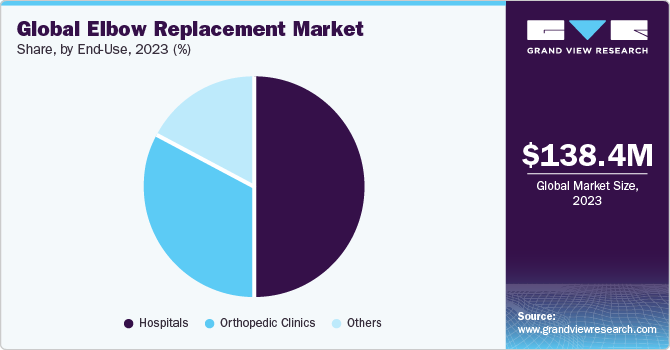

The global elbow replacement market size was valued at USD 138.4 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.74% from 2024 to 2030. The increasing prevalence of orthopedic disorders, osteoporosis, and osteoarthritis are some of the key forces driving the market growth. As per Arthritis Foundation estimates, the prevalence of arthritis in the U.S. in the population age group was estimated to be over 78 million by 2040. Furthermore, increasing participation in sporting and physical activities resulting in trauma and fractures contributes to the growing demand for elbow replacement.

The need for elbow replacements was significantly hampered by the COVID-19 pandemic outbreak. The market witnessed a substantial fall in growth as a result of the imposed lockdown and the postponement of non-emergent surgical treatments. The cost of delaying or canceling non-emergent surgical treatments during the COVID-19 pandemic was predicted to be USD 22.3 billion across the U.S. healthcare system, according to a study published in Annals of Surgery. Reputable market participants reported considerable income losses as a result of the cancellation or limitations placed on surgical treatments. For instance, Zimmer Biomet reported a fall in sales earnings of 11.8% in FY2020, whereas Stryker reported a decline in revenue earnings of 9.1% compared to last year (FY 2019).

Due to the rising need for minimally invasive procedures, surgeons are using a variety of techniques. The adoption of these surgeries is being fueled by ongoing improvements in minimally invasive techniques as well as the numerous advantages they provide, including less collateral tissue damage, shorter hospital stays, quicker recovery times, and fewer post-operative problems. As a result, one of the main factors fueling market expansion is the rising acceptance of less invasive procedures.

Procedure Type Insights

Based on the procedure, the elbow replacement market is segmented into total elbow replacement and partial elbow replacement.

The total elbow replacement segment held the largest market share in 2023. It is the most suitable fit and is widely adopted by younger as well as older patient population.

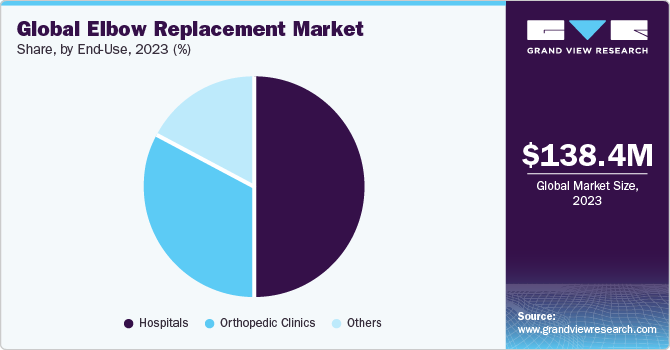

End Use Insights

On the basis of end use, the market is segmented into hospitals, orthopedic clinics, and others. Hospitals held the largest share in 2023. Hospital expansion can be attributed to the accessibility and availability of cutting-edge treatment options in hospitals, as well as the rising prevalence of sports injuries.

Further boosting the segment's growth is the availability of attractive reimbursement policies through Medicare and Medicaid.

Regional Insights

North America dominated the market in 2023. This is attributed to the presence of established healthcare infrastructure, the rising demand for high-tech healthcare services, the broad presence of key market participants, and the accessibility of extensive reimbursement coverage policies. The market expansion in North America is being driven by an increasing target patient population and an increase in orthopedic operations.

Competitive Insights

Key players operating in the market are DePuy Synthes, Stryker, Smith+Nephew, Arthrex Inc., Corin Group, Zimmer Biomet, and Wright Medical Group N.V. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In August 2022, Ossio, Inc. launched OSSIOfiber Suture Anchors, as a product portfolio expansion strategy. These anchors are used across hand/wrist surgeries.

-

A clinical trial titled "Effects of Dual Task on Physical Function in Patients with Elbow Joint Fracture (DTelbow)" sponsored by the University of Valencia began in May 2022 to evaluate the pain intensity, RPE, and neuromuscular responses in the patients suffering from elbow joint fractures, irrespective of surgical approach, and using various strategies to strengthen the upper limb.