- Home

- »

- Medical Devices

- »

-

Electric Breast Pumps Market Size And Share Report, 2030GVR Report cover

![Electric Breast Pumps Market Size, Share & Trends Report]()

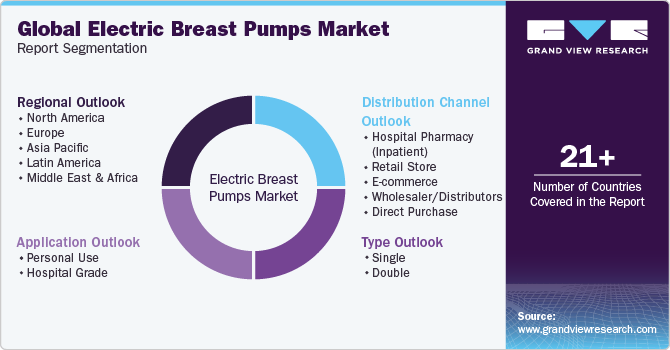

Electric Breast Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Single, Double), By Application (Personal-use, Hospital Grade), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-001-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Breast Pumps Market Size & Trends

The global electric breast pumps market size was estimated at USD 1.48 billion in 2023 and is expected to grow at a CAGR of 9.08% from 2024 to 2030. Increasing employment rates for women worldwide, improving healthcare systems in developing nations, and government initiatives to support working mothers are the major factors propelling the market growth.

According to the International Labor Organization (ILO), throughout the past 20 years, there has been notable progress in terms of employment prospects and gender equality. The ILO spearheaded the 2030 United Nations Agenda, which states that all women and girls must be empowered to achieve gender equality, productive work, economic development, and equal wage opportunity for the young and disabled population.

Electric breast pumps are a suitable choice for working mothers who intend to feed their infants while they are away from home for work. As per the World Bank Group, globally, women's labor force participation rate was around 50% in 2022, which is 30% less than men's employment rate. According to the International Labour Organization, in 2023, the global unemployment rate among women is 5.3%, slightly higher than the 5 per cent rate among men.

Motor-powered electric breast pumps deliver suction through plastic tubing to a horn that fits over the nipple. It offers much more suction, speeds up pumping considerably, and enables simultaneous pumping of both breasts. Electric breast pumps have a lot of power, are expensive, and are power-driven. When compared to alternatives like manual and battery-powered pumps, they are quicker in pumping milk. In addition, they enable double pumping, which greatly reduces pumping time. They are therefore ideal for working women who need quick pumping sessions and must freeze milk before leaving for work.

Electric pumps are typically heavy and noisy, but manufacturers continue to apply modern technologies to make lighter and quieter pumps. Electric pumps are also available for rent for moms who cannot afford to purchase a new pump and only need it for a short period. Ameda AG's Purely Yours Ultra Electric Breast Pumps and Philips AVENT's Isis iQ Duo Electric Breast Pumps are two key brands in this segment. Technological advances, such as the advent of portable instruments such as Ameda's Platinum electric breast pumps and Medela's Electric swing electric breast pumps, are projected to boost market growth in the coming years.

Furthermore, factors such as rising consumer awareness and government backing are expected to drive global demand for electric breast pumps. For example, the United Nations Children's Fund (UNICEF) and the World Health Organization (WHO) established the Baby Friendly Hospital Initiative (BFHI), which promotes evidence-based practices for breastfeeding success, to increase breastfeeding rates and enable families to attain their breastfeeding goals. As part of the Affordable Care Act, most insurance plans must now cover certain breastfeeding assistance and supplies, such as breast pumps.

Moreover, in 2021, the American Society for Biochemistry and Molecular Biology held a nursing awareness campaign. Breastfeeding may provide psychological or emotional benefits for both the mother and the child. As a result, such programs are likely to enhance product utilization. As a result, end consumers find it easier to purchase these devices, resulting in increased demand for electric breast pumps.

Governments across the globe are urging mothers to breastfeed their babies until they are six months old. Furthermore, numerous worldwide organizations are planning breastfeeding awareness campaigns. Various industry participants, including Medela LLC, Laura & Co., Newell Brands, and Ameda, as well as universities, like Washington University and Fudan University, are boosting awareness among women about breastfeeding and its benefits through campaigns and educational periodicals.

Similarly, awareness initiatives by the CDC, WHO, and the Academy of Breastfeeding Medicine (ABM) to feed babies with expressed breastmilk using electric breast pumps are expected to have a positive impact on the market growth. Thus, increased usage of electric breast pumps in the wake of rising precautionary measures is anticipated to drive market growth during the forecast period.

Furthermore, rising breastfeeding issues among women will drive demand for electric breast pumps in the near future. Breastfeeding difficulties in women include nipple pain, breast engorgement, and poor attachment. As a result of these concerns among women, nursing becomes more challenging. According to Nemours, a non-profit children's health organization, most women stop breastfeeding their newborn babies too soon, increasing the requirement for electric pumps.

In addition, engorgement is likely to be one of the primary reasons driving demand for electric breast pumps over the forecast period. Excess milk must be eliminated to avoid engorgement. Hand expression and electric breast pumps are the only two methods for evoking excess milk from the breasts in a healthy manner. As a result of insufficient bonding, mothers may experience significant nipple pain when the infant is sucking. As a result, poor attachment is another factor driving product demand.

Furthermore, social media sites such as YouTube, Facebook, and Instagram have made it possible for users to learn more about electric breast pumps and related accessories. Numerous companies provide information on these platforms. For instance, Spectra Baby USA has a page named Spectra Baby USA - Pumping for Mom Support that promotes and provides information about electric breast pumps. As a result, such factors are likely to enhance the product demand over the projected timeframe.

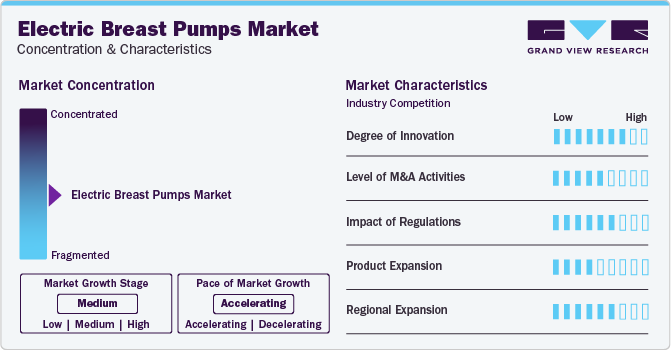

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is characterized by a high degree of innovation owing to the advancements in technologies that have been developed to improve the effectiveness and comfort of electric breast pumps. For instance, the Avent Electric Single Breast Pump incorporates natural motion technology, mimicking baby's nursing action to facilitate milk expression from the breast.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Key players in market are acquiring small- and medium-sized manufacturers of electric breast pumps to expand their product portfolios and increase their market share.

The market has been experiencing growing regulatory scrutiny. Government bodies such as the FDA and the European Medicines Agency have set up strict regulations to ensure the safety and effectiveness of medical devices, and electric breast pumps. Governments globally are actively formulating regulations to oversee the development and utilization of electric breast pumps. The implementation of such regulations has the potential to exert a substantial influence on the breastfeeding accessories market.

There are various substitutes for in the market. Some of the commonly used alternatives include manual options, battery-operated models, and wearable variants. These products may provide similar benefits to electric breast pumps.

The market is significantly affected by the concentration of end users. Depending on the preferences of the target consumers, these products may be available in speciality stores, pharmacies, online platforms, or through healthcare providers.

Type Insights

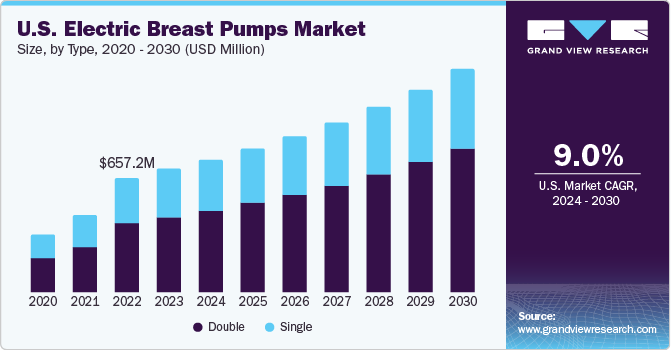

Based on type, the double electric pumps segment held the market with the largest revenue share of 61.96% in 2023 and is anticipated to witness at the fastest CAGR over the forecast period. Double electric breast pumps have several advantages over single electric breast pumps. These breast pumps extract milk from both breasts at the same time, making them more convenient for regular expression. It produces around 18% more milk than pumping from each breast separately. As a result, it is an excellent option for working mothers. Furthermore, milk derived from twice pumping has a larger fat and calorie content. These pumps can be used in a variety of positions without tiring out mothers. Some of the more modern twin electric breast pumps include a 'memory' function. Nonetheless, these types of pumps are widely available and are offered by most of the major competitors.

The single electric pumps segment is expected to grow at a moderate CAGR over the forecast period. Single electric breast pumps are both quick and efficient. Furthermore, as compared to double electric pumps, these types of pumps are very cost-effective. Milk can, however, be expressed only from a single breast at a time. These pumps are specifically developed for moms who desire to express milk on a limited basis. Aside from price, a single breast pump allows a mother to breastfeed her infant while expressing from the other breast, which is a very efficient use of time.

However, some women find it messy and a waste of precious milk when they express milk from one breast and the other breast leaks milk. As a result, such situations are anticipated to promote the adoption of double electric breast pumps in the short term, consequently limiting the market growth of single breast pumps.

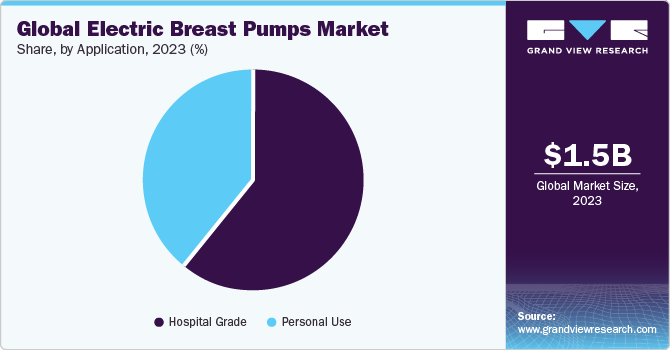

Application Insights

Based on application, the hospital grade segment held the market with the largest revenue share of 61.19% in 2023 and is projected to witness at the fastest CAGR over the forecast period. Hospital-grade electric breast pumps feature powerful motors and are commonly used in hospitals, although they can also be rented on a monthly basis for personal use. These electric breast pumps operate on a "closed system," which means that barriers are in place to prevent milk and other fluids from entering the motor. This reduces contamination and guarantees that they are safe for several users.

These electric breast pumps have various advantages, including being more powerful and effective than typical personal-use pumps. They are useful for mothers who have medical conditions that need the use of a high-powered pump or whose newborns have trouble latching and nursing. As a result of the aforementioned benefits provided by hospital-grade pumps, the segment is likely to develop significantly throughout the forecast period.

Distribution Channel Insights

Based on distribution channel, the hospital pharmacy segment held the market with the largest revenue share of 38.61% in 2023. The segment is predicted to grow as a result of increased pregnancy rates worldwide and an increase in new moms' desire for postpartum items. Furthermore, due to safety concerns, customers trust hospital pharmacies while purchasing baby and mother products. As a result, parents have a high level of trust in doctors and specialists, which encourages the growth of the hospital pharmacy business. The high growth of this industry has also been ascribed to the rise of hospitals in both developed and developing countries.

The e-commerce segment is anticipated to grow at the fastest CAGR during the forecast period. The increased availability of electric breast pumps through e-commerce is projected to contribute to market expansion. End-users can compare and select appropriate products based on their type, brand, price, and point of sale through the e-commerce channel. Amazon, Belly Bandit Walmart, Motherhood Maternity, and The Moms Co. are just a few of the top online retailers that offer products to customers.

In addition, major companies such as Koninklijke Philips N.V., Medela LLC, Newell Brands, and Ameda have started offering a broad range of postpartum products through online channels. More consumers are drawn in by sales methods such as buy one, get one free, discounts, and complimentary products. This is anticipated to promote sales of electric breast pumps through this channel, as they are usually in high demand among consumers.

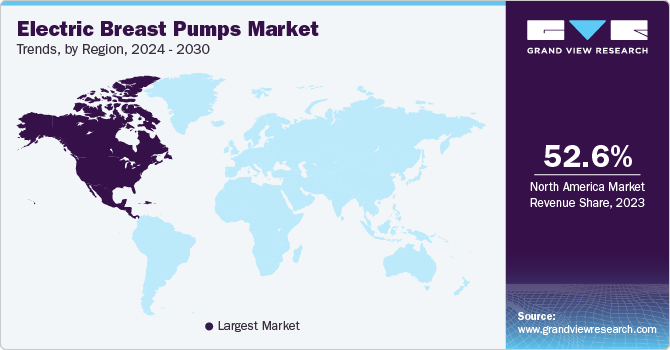

Regional Insights

North America dominated the electric breast pumps market with a revenue share of 52.55% in 2023, owing to the existence of high women employment rates, healthcare expenditure, advanced healthcare infrastructure, and patient awareness levels in this area. Furthermore, industry leaders are creating technologically advanced electric breast pumps, which will boost overall market growth throughout the forecast period.

U.S. Electric Breast Pumps Market Trends

The electric breast pumps market in U.S. held the largest share in North America in 2023. Some of the main reasons driving the market are the rising percentage of women in the workforce and the existence of significant market players in the nation. The market for electric breast pumps is anticipated to be driven by these factors. These factors are expected to drive the market growth.

Europe Electric Breast Pumps Market Trends

The electric breast pumps market in Europe is driven by factors such as the growing birth rate coupled with rising women’s employment in the region and presence of well-established healthcare infrastructure. For instance, as per a European Commission in 2022 around 3.88 million babies were born in Europe.

The UK electric breast pumps market is driven by the advancements in technology, increasing awareness about the benefits of breastfeeding, and the growing number of working mothers who require convenient and efficient pumping solutions. These factors are driving the market growth over the forecast period.

The electric breast pumps market in France is anticipated to witness at a significant CAGR over the forecast period, owing to several key factors, such as presence of several key players in the market, increasing awareness of the importance of breastfeeding and the rising number of working mothers contribute to the demand for electric breast pumps.

The Germany electric breast pumps market is driven by the factors, such as many companies are forming strategic partnerships, launching new products, and engaging in mergers and agreements. Such factors are expected to boost the market growth in Germany and intensify the competition over the forecast period.

Asia Pacific Electric Breast Pumps Market Trends

The electric breast pumps market in Asia Pacific is anticipated to witness at a significant CAGR over the forecast period. This is due to the changing lifestyles and increasing urbanization have led to a rise in the number of working mothers who require convenient and efficient breast pumping solutions are expected to present significant regional growth opportunities in the market.

The China electric breast pumps market accounted for the largest share of the Asia Pacific region in 2023. The primary drivers of market growth are the government's breastfeeding promotion programs and the increasing knowledge of the benefits of breastfeeding among Chinese moms. These factors are anticipated to drive demand for electric breast pumps in China in the next years.

The electric breast pumps market in Japan is moderately competitive, with the presence of some major companies offering wound care products. Major players in the market are adopting several strategies such as mergers & acquisitions and partnerships & collaborations to stay competitive in the market.

Latin America Electric Breast Pumps Market Trends

The electric breast pumps market in Latin America is driven due to the rising female workforce participation rates and the need for mothers to balance work and breastfeeding contribute to the adoption of electric breast pumps as convenient solutions for expressing milk, which is expected to drive market growth over the forecast period.

Middle East & Africa Electric Breast Pumps Market Trends

The electric breast pumps market in the Middle East & Africa region is expected to witness at a significant CAGR over the forecast period, due to various factors, such as the collaborations between manufacturers and healthcare professionals, as well as the expansion of distribution channels and online retail platforms, play significant roles in driving market growth in the Middle East and Africa.

Key Electric Breast Pumps Company Insights

Top players are adapting the shift towards user comfort through technological advancements, and innovative products. These innovative products are driving the market growth positively over the forecast period.

Key Electric Breast Pumps Companies:

The following are the leading companies in the electric breast pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Medela AG

- Koninklijke Philips N.V.

- Ameda AG

- Hygeia Health

- Lansinoh Laboratories, Inc.

- Spectra Baby USA

- Pigeon Corporation

- Evenflo

- Willow

- Ardo

- Motif Medical

- Elvie

Recent Developments

-

In November 2023, Pigeon launched its latest iteration, the GoMini Plus Electric Breast Pump, marking the second generation of its GoMini line. Designed with today's active mothers in mind, this pioneering advancement assures a pumping journey unlike any other, perfectly suited for the modern lifestyle

-

In March 2022, TensCare introduced the new TensCare Nouri Breast Pump line, which comprises an electric breast pump. This breast pump has novel features that make breast pumping quick and easy

-

In January 2022, Medela introduced the "Solo" electric breast pump in Canada for breastfeeding mothers and working women at an affordable price

-

In March 2021, Philips introduced the "Philips Avent Double Electric Breast Pump," which has 16 expression levels and 8 simulation levels to improve user comfort while pumping

Electric Breast Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.59 billion

Revenue forecast in 2030

USD 2.69 billion

Growth rate

CAGR of 9.08% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Medela AG; Koninklijke Philips N.V.; Ameda AG; Hygeia Health; Lansinoh Laboratories, Inc.; Spectra Baby USA; Pigeon Corporation; Evenflo; Willow; Ardo; Motif Medical; Elvie

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Breast Pumps Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric breast pumps market report based on type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single

-

Double

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Use

-

Hospital Grade

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy (Inpatient)

-

Retail Store

-

E-commerce

-

Wholesaler/Distributors

-

Direct Purchase

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric breast pumps market size was estimated at USD 1.48 billion in 2023 and is expected to reach USD 1.59 billion in 2024.

b. he global electric breast pumps market is expected to grow at a compound annual growth rate of 9.08% from 2024 to 2030 to reach USD 2.69 billion by 2030.

b. North America dominated the global electric breast pumps market with a share of 53.0% in 2023. This is attributable to various awareness campaigns leading to increasing awareness levels and a keen focus of key market players on tapping the potential offered by this region.

b. Some of the key players operating in the global electric breast pumps market include Medela AG, Koninklijke Philips N.V., Ameda AG, Hygeia Health, Lansinoh Laboratories, Inc., Spectra Baby USA, Pigeon Corporation, Evenflo, Willow, Ardo, Motif Medical, and Elvie

b. Key factors that are driving the electric breast pumps market growth include presence of favorable demographics, increasing global women employment rates, presence of government initiatives aimed at improving consumer awareness levels, improving healthcare infrastructure in emerging countries

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.