- Home

- »

- Power Generation & Storage

- »

-

Electric Bus Battery Pack Market Size, Industry Report, 2030GVR Report cover

![Electric Bus Battery Pack Market Size, Share & Trends Report]()

Electric Bus Battery Pack Market (2025 - 2030) Size, Share & Trends Analysis Report By Propulsion (BEC, PHEV), By Battery Chemistry (LFP, NCA, NCM, MNC, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-498-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Bus Battery Pack Market Trends

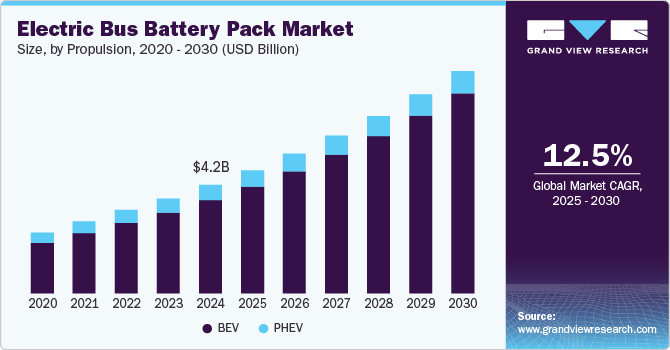

The global electric bus battery pack market size was estimated at USD 4,292.2 million in 2024 and is expected to expand at a CAGR of 12.5% from 2025 to 2030. A growing global push for sustainable transportation and reduced emissions in urban areas. Cities worldwide are implementing strict environmental regulations and setting ambitious zero-emission goals, prompting transit authorities to transition their fleets from diesel to electric buses.

Government incentives and subsidies play a crucial role in market growth. Many countries offer substantial financial support to offset the higher initial costs of electric buses and their battery packs. China's New Energy Vehicle (NEV) subsidies have significantly boosted adoption, while the European Union's Clean Vehicles Directive mandates minimum procurement targets for clean buses. In the U.S., the Federal Transit Administration's Low or No Emission Vehicle Program provides funding for state and local governments to purchase electric buses and related infrastructure, thus boosting the market’s growth.

Rapid urbanization has led to a surge in public transportation demand, which necessitates efficient, eco-friendly alternatives to traditional buses. Cities worldwide are adopting electric buses to combat air pollution and reduce operational costs. For instance, Shenzhen, China, became the first city to fully electrify its bus fleet, deploying over 16,000 electric buses. This shift drives the demand for high-performance, long-lasting battery packs, as urban transit authorities prioritize vehicles with higher energy density and extended range.

Technological advancements and declining battery costs are also significantly benefiting the electric bus battery pack industry. The cost of lithium-ion batteries has decreased dramatically over the past decade, making electric buses more commercially viable. Improvements in battery chemistry and energy density have also addressed range anxiety concerns, with modern electric buses capable of operating for entire days on a single charge. For instance, BYD's latest battery packs offer ranges exceeding 300 kilometers, while manufacturers such as CATL and LG Energy Solution continue to develop advanced battery technologies with faster charging capabilities and longer lifespans. Additionally, innovations in battery thermal management systems have enhanced performance and safety, particularly in extreme weather conditions, making electric buses more reliable for year-round operation.

Propulsion Insights

Based on the voltage rating, the electric bus battery pack industry is segmented into BEV and PHEV. BEV segment registered largest revenue market share of over 85.0% in 2024 and is expected to grow at the fastest CAGR of 13.4% during the forecast period. BEV battery packs are designed to power fully electric buses, relying solely on electricity stored in large battery systems without the support of an internal combustion engine. These battery packs typically have high voltage ratings to ensure sufficient energy density and range for commercial operations. BEVs are known for their zero tailpipe emissions, making them a popular choice for urban public transportation and cities aiming to reduce air pollution and achieve sustainability goals.

PHEV battery packs are used in buses that combine an internal combustion engine with an electric motor and a rechargeable battery. These battery packs generally have lower voltage ratings (up to 400V) compared to BEVs, as they are supplemented by the engine for extended range and higher power requirements. PHEVs offer flexibility for transit agencies by reducing reliance on charging infrastructure while still contributing to lower emissions. Therefore, the demand for PHEV battery packs is driven by their versatility, as they offer both electric and traditional fuel modes. This dual capability makes PHEVs particularly appealing for regions where charging infrastructure is underdeveloped.

Battery Chemistry Insights

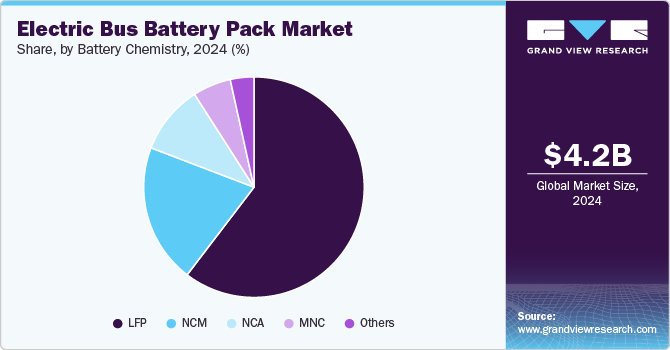

Based on battery chemistry, the market is segmented into LFP, NCA, NCM, MNC, and others. The LFP (Lithium Iron Phosphate) segment accounted for the highest revenue market share of over 60.0% in 2024. LFP batteries are widely used in electric buses due to their exceptional thermal stability, long cycle life, and high safety profile. These batteries exhibit excellent performance in high-temperature conditions and are known for their robust structural integrity, making them suitable for heavy-duty applications like electric buses.

The NCM (Nickel Cobalt Manganese) segment is expected to grow at a faster CAGR of 16.4% during the forecast period. NCM batteries balance high energy density and thermal stability, making them one of the most used chemistries in electric buses. They offer good performance in terms of range and power, along with moderate safety characteristics.

Moreover, NCA (Nickel Cobalt Aluminum Oxide) batteries are recognized for their high energy density and long lifespan, making them suitable for long-range electric buses. They offer excellent power output, making them a preferred choice for electric buses that operate on routes with varying terrain and require consistent energy delivery.

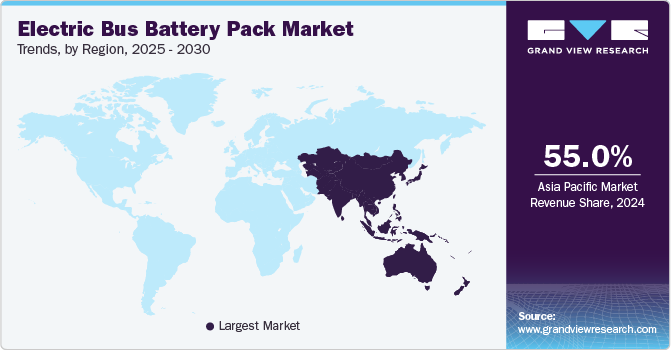

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 55.0% in 2024. The region benefits from robust government support and ambitious clean transportation initiatives. China has implemented aggressive policies to promote electric bus adoption, including substantial subsidies and mandates for cities to electrify their public transport fleets. For example, Shenzhen became the first city globally to achieve 100% electrification of its public bus fleet with over 16,000 electric buses. Other countries such as India have launched similar initiatives, with its FAME II (Faster Adoption and Manufacturing of Electric Vehicles) scheme allocating significant funding for electric bus procurement.

China Electric Bus Battery Pack Market Trends

China's dominance in the global electric bus battery pack market stems from several key factors. The country has implemented aggressive policies to promote electric vehicle adoption, particularly in public transportation, through initiatives such as the "New Energy Vehicle" (NEV) program. Additionally, the country's strategic control over critical battery raw materials and well-established battery manufacturing infrastructure gives it a significant competitive advantage. Companies such as CATL, BYD, and Gotion High-tech Co., Ltd. have invested heavily in research and development, leading to improvements in battery technology and manufacturing processes.

North America Electric Bus Battery Pack Market Trends

The North America’s growth in the electric bus battery pack market is driven by several key factors. The region's aggressive push toward sustainable transportation, coupled with substantial government support through initiatives such as the Infrastructure Investment and Jobs Act (IIJA) and the Clean School Bus Program, has created a robust framework for electric bus adoption. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) awarded nearly USD 1.0 billion in rebates to help school districts purchase over 2,700 clean school buses across 280 school districts.

Europe Electric Bus Battery Pack Market Trends

The region's stringent environmental regulations and ambitious climate goals form the foundation of the growth of the market in the region. The European Union's commitment to reduce greenhouse gas emissions by at least 55% by 2030 has led many cities to transition their public transport fleets to zero-emission vehicles. For instance, major European cities such as Paris aim to convert its entire bus fleet to electric by 2025, while Amsterdam plans to have emission-free urban transport by 2025. These initiatives have created a strong demand for electric bus battery packs, attracting investments from both domestic and international manufacturers, thus benefiting the market in the region.

Key Electric Bus Battery Pack Company Insights

The market is characterized by intense competition. Key players such as BYD, CATL, LG Energy Solution, and Samsung SDI dominate the market with advanced battery technologies, high energy densities, and robust supply chain networks. The competitive environment is further intensified by the entry of new players, partnerships, and collaborations aimed at enhancing battery efficiency, reducing costs, and increasing energy storage capacities. Regional players are leveraging government incentives and local production capabilities to gain market share, while established companies focus on R&D, vertical integration, and scaling production to maintain their competitive edge.

-

In September 2024, CATL, a major Chinese battery manufacturer, launched its new TECTRANS LFP battery range at the IAA Transportation 2024 event in Germany. This innovative battery system is designed specifically for commercial vehicles, including heavy-duty trucks and electric buses, with a focus on enhanced performance and sustainability. The TECTRANS - Bus Edition features an impressive energy density of 175 Wh/kg, which CATL claims is the highest for lithium iron phosphate (LFP) chemistry in bus applications. This model is engineered for long-distance passenger transport, enhancing vehicle layout flexibility and energy efficiency

-

In October 2023, Scania unveiled its new battery-electric bus platform at Busworld, showcasing a commitment to sustainable transport solutions. This platform introduces low-entry 4×2 buses equipped with batteries that can store up to 520 kWh of energy, allowing for a range of over 500 km under optimal conditions.

Key Electric Bus Battery Pack Companies:

The following are the leading companies in the electric bus battery pack market. These companies collectively hold the largest market share and dictate industry trends.

- CATL

- WattEV

- Hitachi

- LG Energy Solution

- SK Innovation

- XALT Energy

- Tesla

- Proterra

- BYD

- Samsung SDI

Electric Bus Battery Pack Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,880.9 million

Revenue forecast in 2030

USD 8,807.2 million

Growth rate

CAGR of 12.5% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Propulsion, battery chemistry, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia, UAE; South Africa

Key companies profiled

CATL; WattEV; Hitachi; LG Energy Solution; SK Innovation; XALT Energy; Tesla; Proterra; BYD; Samsung SDI

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

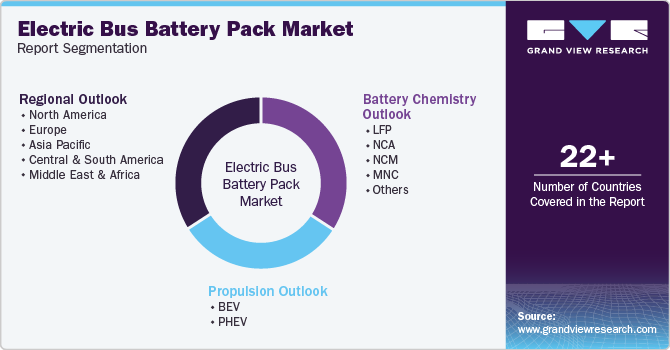

Global Electric Bus Battery Pack Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric bus battery pack market report on the basis of propulsion, battery chemistry, and region:

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

BEV

-

PHEV

-

-

Battery Chemistry Outlook (Revenue, USD Million, 2018 - 2030)

-

LFP

-

NCA

-

NCM

-

MNC

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric bus battery pack market size was estimated at USD 4,292.2 million in 2024 and is expected to reach USD 4,880.9 million in 2025.

b. The global electric bus battery pack market is expected to witness a compound annual growth rate of 12.5% from 2025 to 2030 to reach USD 8,807.2 millionby 2030.

b. BEV segment registered largest revenue market share of over 85.0% in 2024 due to BEV battery packs are designed to power fully electric buses, relying solely on electricity stored in large battery systems without the support of an internal combustion engine.

b. Some key players operating in the wind power market include BYD, CATL, LG Energy Solution, and Samsung SDI, among others.

b. Government incentives and subsidies play a crucial role in market growth. Many countries offer substantial financial support to offset the higher initial costs of electric buses and their battery packs. This drives the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.