- Home

- »

- Automotive & Transportation

- »

-

Electric Bus Market Size, Share And Growth Report, 2030GVR Report cover

![Electric Bus Market Size, Share & Trends Report]()

Electric Bus Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle), By Battery Type, By Application (Intercity, Intracity), By End Use (Public, Private), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-974-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Bus Market Summary

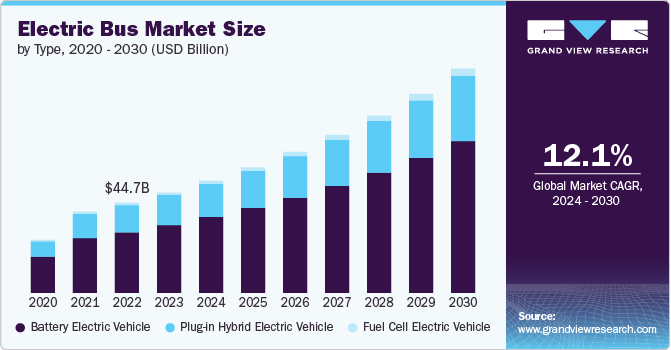

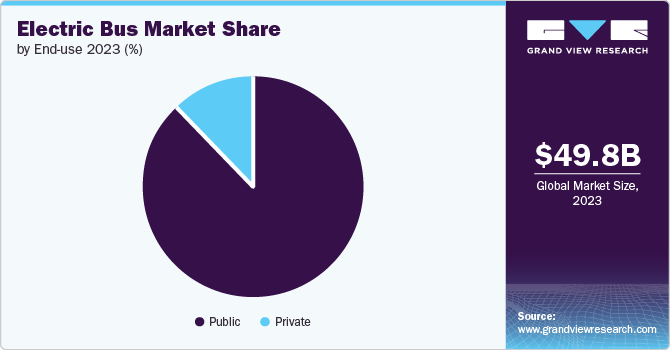

The global electric bus market size was estimated at USD 49.81 billion in 2023 and is projected to reach USD 110.44 billion by 2030, growing at a CAGR of 12.1% from 2024 to 2030. An increasing adoption of electric buses owing to rising environmental concerns and government support has contributed to the growth of the electric bus market.

Key Market Trends & Insights

- The Asia Pacific region dominated the market in 2023 and accounted for a 91.44% share of the global revenue.

- The electric bus market in China is expected to witness a steady growth rate of 11.5% from 2024 to 2030.

- By type, the battery electric vehicle segment dominated the global market and accounted for a revenue share of 67.6% in 2023.

- By battery type, the lithium iron phosphate segment dominated the market in 2023.

- By end use, the public segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 49.81 Billion

- 2030 Projected Market Size: USD 110.44 Billion

- CAGR (2024-2030): 12.1%

- Asia Pacific: Largest market in 2023

Electric buses offer a significant advantage over traditional gasoline and diesel engines by producing zero tailpipe emissions. Additionally, they are generally cleaner and more environmentally friendly. Furthermore, electric buses also provide a quieter ride, significantly reducing noise pollution. This quiet operation enhances driver awareness and passenger comfort. Thus, increasing adoption of electric buses owing to their abovementioned benefits is expected to contribute to the market’s growth from 2024 to 2030.The sales of electric buses, including all large- and medium-sized buses, are gradually increasing across the globe. According to a report published by the International Energy Agency (IEA), in 2023, China and several European countries such as Norway, Belgium, and Switzerland, achieved electric bus sales shares above 50%. Additionally, countries like Canada, the Netherlands, Chile, Finland, Portugal, Poland, and Sweden witnessed over one-fifth of their bus sales being electric. Furthermore, in 2023, nearly 50,000 electric buses were sold globally, accounting for 3% of total bus sales and increasing the global stock to around 635,000 units. Thus, the growing production and sales of electric buses across the globe are expected to contribute to the market’s growth.

In recent years, various governments have made significant announcements regarding funding for electric and zero-emission buses. Government initiatives and support to promote the adoption of electric buses are increasing across the globe. For instance, the Clean School Bus Program of the U.S. Environmental Protection Agency (EPA) offers funding to eligible applicants such as school districts, local and state government programs, non-profit organizations, federally recognized Indian tribes, and qualified contractors, to replace existing school buses with alternative fuel, clean or zero-emission buses. Furthermore, in January 2024, EPA announced the selection of 67 applicants to receive nearly USD 1 billion in funding through its Clean School Bus Program Grants Competition. Thus, increasing government investments and initiatives in the electric bus sector boosts the market’s growth.

Furthermore, several electric bus manufacturers are developing electric buses to gain a competitive edge in the global market, which, in turn, drives the market’s growth. For instance, in November 2023, Alexander Dennis, a prominent global bus manufacturer and a subsidiary of NFI Group Inc., introduced its latest generation of battery-electric buses for the U.K. and Ireland. The Enviro400EV double-decker and Enviro100EV small bus models are designed to cater to the growing demand for eco-friendly public transportation in these countries. Such initiatives are expected to bode well for the growth of the market.

Factors such as high upfront costs and complex charging infrastructure could hamper the growth of the market. The upfront cost of electric buses is significantly higher compared to conventional buses. This is primarily due to the advanced and more expensive technology used in electric buses, as well as the additional investment required for charging infrastructure. However, despite the initial higher upfront cost, the growing availability of incentives is expected to significantly limit the price gap with conventional buses.

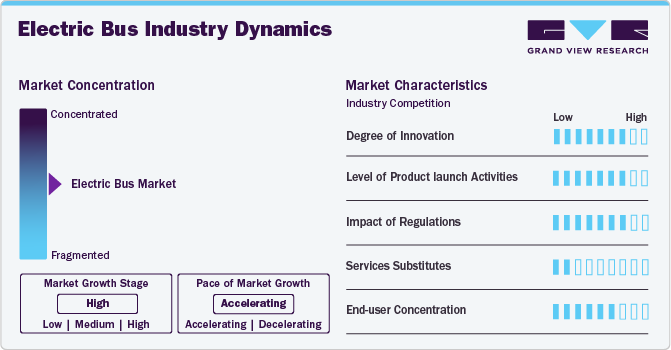

Market Concentration & Characteristics

The industry's growth stage is high, and the pace of growth is accelerating. The electric bus industry can be characterized by a high degree of innovation. The latest electric buses are equipped with cutting-edge battery technologies that have significantly improved their performance. These advancements include increased range, faster charging capabilities, and enhanced energy density.

The electric bus market is also characterized by a high level of new product launch activities by key companies. Companies are adopting this strategy to enhance their electric bus offerings in the global industry, highlighting their commitment to sustainability and innovation in the transportation sector.

Regulative trends play a substantial role in influencing the electric bus industry. Government regulations and tax exemptions promote the adoption of electric vehicles, thus driving the market’s growth.

There are no direct substitutes for the electric bus in the market. However, diesel, gas, and hybrid buses, along with their alternative fuel variants, are all alternative transportation options, but their benefits vary. Electric buses provide benefits such as low noise pollution and reduced greenhouse gas emissions compared to diesel or gas-based buses.

The electric bus market has a high concentration of end users. Schools are increasingly adopting electric buses to reduce vehicle-based air pollution and create cleaner, safer transport for kids, boosting the market’s growth.

Type Insights

The Battery Electric Vehicle (BEV) segment dominated the global market and accounted for a revenue share of 67.6% in 2023. The battery-powered bus is a more efficient alternative to zero-emission or low-emission cars. The BEVs are more effective than conventional buses. The battery-powered bus allows for faster driving as compared to buses powered by fuel or gasoline. Compared to diesel or gasoline-powered buses, BEVs are easier and less expensive to charge. Such benefits of BEVs over conventional buses are boosting the segment’s growth.

The fuel cell electric vehicle (FCEV) segment is projected to witness significant growth from 2024 to 2030. The FCEVs are powered by hydrogen and contribute to a decrease in air pollution and greenhouse gas emissions. The segment is growing because of increased government initiatives to accelerate the adoption and introduction of electric vehicles, reduce carbon emissions, and protect the environment. The Electric Vehicles (EVs) Initiative is a multi-government policy forum aimed at accelerating global EV adoption. The IEA serves as the coordinator, supporting member governments in their efforts to promote electric mobility worldwide. Such initiatives are expected to bode well for the market’s growth.

Battery Type Insights

The lithium iron phosphate segment dominated the market in 2023. Lithium-iron-phosphate batteries, which are widely used in electric school buses, exhibit superior thermal stability compared to other lithium batteries. This enhanced thermal stability ensures that the battery structure remains intact for a more extended period, even under high temperatures, thereby reducing the chances of fires spreading. Thus, the adoption of lithium-iron-phosphate batteries is growing in electric buses, as they are safer, charge faster, last longer, perform better at high temperatures, have higher power density, and are cost-effective.

The lithium nickel manganese cobalt oxide (NMC) segment is projected to witness significant growth from 2024 to 2030. A NMC battery is a type of lithium-ion battery that uses a combination of Nickel, Manganese, and Cobalt as its cathode material. NMC batteries boast a high cycling rate, combined with high power and capacity, making them ideal for electric buses due to their ability to efficiently handle repeated charge and discharge cycles. In addition, NMC batteries exhibit the lowest self-heating rate among various lithium-ion battery types. Cobalt plays a vital role in enhancing the performance and efficiency of these batteries. Thus, the rising development of electric buses that can drive longer ranges on shorter charges, with NMC batteries that last and work for a long period, propels the segment’s growth.

Application Insights

The intracity segment dominated the market in 2023. Electric buses are particularly well-suited for intracity application due to their zero-emission operation, lower operating costs, and suitability for short-to-medium distance routes. The growth of the segment can be attributed to the growing urbanization and demand for sustainable solutions to combat air pollution within the city. In addition, the increasing need for public transport and the adoption of electric buses by workplaces, schools, colleges, and tourist places further boosts the segment’s growth.

The intercity segment is projected to witness significant growth from 2024 to 2030, driven by the increasing demand for electric buses in long-distance transportation operations and the rising development and introduction of advanced electric bus models specifically designed for intercity applications. For instance, in January 2023, VE Commercial Vehicles (VECV) launched a range of vehicles featuring an intercity electric bus capable of traveling up to 500 kilometers. This bus utilizes a combination of depot charging and 30-40-minute opportunity charging during the journey to ensure seamless operation.

End Use Insights

The public segment dominated the market in 2023. The high share of the segment is attributed to the increasing transportation demand, and governments introducing several initiatives to curb GHG emissions, reduce noise & air pollution, and reduce dependency on fossil fuels. For instance, in March 2023, a Belgium-based manufacturer of buses, coaches, trailers, and trolley buses signed a contract with Netherlands-based company Qbuzz to supply 54 battery electric buses. These 15-meter e-buses are expected to be used by Qbuzz as regional public transport in Groningen and Drenthe. Such initiatives are expected to contribute to the segment’s growth.

The private segment is projected to witness significant growth from 2024 to 2030. Several countries are taking the initiative for deploying e-buses within the countries which is propelling the growth of the electric bus industry. For instance, in January 2023, GreenCell Mobility Ltd, an Indian electric mobility player, signed a contract with the transport department of the government of NCT Delhi for launching 570 electric buses in the span of the upcoming two years. Furthermore, the rising population coupled with the increasing greenhouse effect and shifting consumer preference towards public transport is further propelling the growth of the market.

Regional Insights

The electric bus market in North America is expected to witness significant growth from 2024 to 2030. In North America, the U.S. and Canadian governments are actively devising plans to establish robust charging infrastructure across the region. The U.S. is expected to continue to grow steadily in this area, driven by technological advancements, a focus on sustainable transportation, and the nation's commitment to reducing carbon emissions.

U.S. Electric Bus Market Trends

The electric bus market in the U.S. is expected to grow at a notable CAGR of 17.5% from 2024 to 2030. The growing adoption of electric school buses across the country is a major factor behind the market’s growth. This increased adoption is owing to the U.S. Environmental Protection Agency’s Clean School Bus Rebate Program, which provides funding to applicants for the replacement of existing or fuel-based school buses.

Canada Electric Bus Market is expected to grow at the fastest CAGR from 2024 to 2030. The zero-emission revolution in Canada's transportation sector is gaining momentum, with electric buses playing a pivotal role in this transformation. Thus, the increasing shift towards cleaner, greener public transportation options for reducing greenhouse gas emissions and combating climate change can be attributed to the market’s growth in the country.

Asia Pacific Electric Bus Market Trends

The Asia Pacific region dominated the market in 2023 and accounted for a 91.44% share of the global revenue. The growth can be attributed to the growing demand for eco-friendly transport and the presence of several developing economies. Furthermore, strict government mandates, environmental concerns, and growing charging infrastructure are further propelling the overall electric bus industry in this region.

The electric bus market in China is expected to witness a steady growth rate of 11.5% from 2024 to 2030. China is the global leader in the production and consumption of electric vehicles and electric buses, having pioneered the electrification of both private and mass passenger transportation. Factors such as the vast presence of electric bus manufacturers and stringent government regulations to reduce carbon emissions are driving the market’s growth in the country.

India Electric Bus Market is anticipated to grow the highest CAGR from 2024 to 2030. In August 2023, the Indian government introduced the PM eBus Sewa Scheme, allocating a budget of USD 2.4 billion to operate and deploy 10,000 electric buses across around 169 eligible cities. Such initiatives by the Indian government are expected to contribute to the market’s growth from 2024 to 2030.

The electric bus market in Japan is expected to grow at a considerable CAGR from 2024 to 2030. The market's growth can be attributed to the vast presence of automotive manufacturers and the country's commitment to reducing greenhouse gas emissions and promoting sustainable transportation solutions.

Europe Electric Bus Market Trends

The electric bus market in Europe is expected to grow at a significant CAGR of 14.3% from 2024 to 2030. The region is experiencing increased demand for electric buses owing to the government's favorable policies and the growing efforts to control vehicle emissions. Furthermore, governments in this region have started projects to make public transportation more sustainable by deploying green transportation technologies.

U.K. Electric Bus Market is expected to grow at the highest CAGR from 2024 to 2030. An increasing government initiatives and funding to roll out electric buses in the country are fueling the market’s growth. In March 2024, the UK government invested GBP 143 million (USD 180.5) to roll out almost a thousand new zero emission buses in England.

The Electric Bus market in Germany is expected to grow at a notable CAGR from 2024 to 2030. The growth can be attributed to factors such as growing technological advancements, evolving consumer preferences, and regulatory support.

MEA Electric Bus Market Trends

The electric bus market in MEA is anticipated to grow at a considerable CAGR of 13.3% from 2024 to 2030. The MEA region is experiencing rapid urbanization and population growth, which is driving demand for efficient and sustainable public transportation solutions. Electric buses offer a cleaner alternative to traditional diesel buses, addressing environmental concerns and improving air quality.

Kingdom of Saudi Arabia (KSA) electric bus market is expected to witness moderate growth rate from 2024 to 2030. The Kingdom of Saudi Arabia has expanded its use of electric vehicles to include electric buses as a sustainable alternative to traditional fossil fuel-powered vehicles, promoting a cleaner and more environmentally friendly transportation system.

Key Electric Bus Company Insights

Some of the players operating in the market include BYD Company Limited, AB Volvo, Nissan Motor Corporation, Daimler Truck AG, Hyundai Motor Company, and TATA Motors Limited.

-

AB Volvo is a manufacturer of trucks, buses, construction equipment, and marine and industrial engines. The company also offers comprehensive financing and service solutions, catering to the diverse needs of its customers worldwide.

-

TATA Motors Limited, an automobile manufacturer, provides an extensive portfolio of integrated, smart, and e-mobility solutions, including utility vehicles, cars, buses, and trucks. The company operates through five business segments: Commercial Vehicles, Passenger Vehicles, Electric Vehicles, Jaguar Land Rover, and Tata Motors Finance.

Proterra, MAN, Ashok Leyland Limited, Zhengzhou Yutong Bus Co., Ltd., and others are some of the emerging companies in the electric bus market.

-

Proterra is a prominent company in the development and production of heavy-duty, zero-emission electric transit vehicles, providing environmentally friendly and quiet transportation solutions to local communities across North America.

-

Zhengzhou Yutong Bus Co., Ltd. is a manufacturer of commercial vehicles, particularly electric buses. The company provides city buses, long-distance coaches, commuters, school buses, tourist coaches, and special mobility vehicles.

Key Electric Bus Companies:

The following are the leading companies in the electric bus market. These companies collectively hold the largest market share and dictate industry trends.

- BYD Company Limited

- AB Volvo

- Proterra

- MAN

- Nissan Motor Corporation

- Ashok Leyland Limited

- Daimler Truck AG

- Zhengzhou Yutong Bus Co., Ltd.

- TATA Motors Limited

- Hyundai Motor Company

Recent Developments

-

In March 2024, Volvo Buses, a subsidiary of AB Volvo, introduced the Volvo 8900 Electric, a cutting-edge electric low-entry bus designed for intercity, commuter, and city operations. This innovative bus is available in both two- and three-axle configurations, allowing operators to optimize their fleet for efficient, sustainable, and profitable traffic management.

-

In December 2023, Karsan is a Turkish commercial vehicle manufacturer announced the launch of its e-JEST right-hand drive minibus in Japan. The e-JEST electric minibus was first introduced in Europe in late 2018. Since then, it has expanded its global reach, being launched in the U.S. and Canada as the market’s first electric minibus.

-

In December 2021, Volvo Buses partnered with Zero Emission Bus Rapid-Deployment Accelerator (Zebra), which aims to accelerate the implementation of zero-emission buses in Latin America.

Electric Bus Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 55.58 billion

Revenue forecast in 2030

USD 110.44 billion

Growth rate

CAGR of 12.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million, Volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, battery type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

BYD Company Limited; AB Volvo; Proterra; MAN; Nissan Motor Corporation; Ashok Leyland Limited; Daimler Truck AG; Zhengzhou Yutong Bus Co. Ltd.; TATA Motors Limited; Hyundai Motor Company

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Bus Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric bus market based on type, battery type, application, end use and region:

-

Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Battery Electric Vehicle

-

Plug-in Hybrid Electric Vehicle

-

Fuel Cell Electric Vehicle

-

-

Battery Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Lithium Nickel Manganese Cobalt Oxide

-

Lithium Iron Phosphate

-

-

Application Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Intercity

-

Intracity

-

-

End Use Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Public

-

Private

-

-

Regional Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric bus market size was estimated at USD 49.81 billion in 2023 and is expected to reach USD 55.58 billion in 2024.

b. Rising demand for non-polluting, air combating, and fuel-efficient buses is driving the demand for electric buses in the market. In addition, growing environmental concerns, strict regulations, and government initiatives to achieve zero emissions targets are propelling the growth of electric buses.

b. The BEV segment dominated the market with a revenue share of 67.57% in 2023. The battery-powered bus is a great alternative to zero-emission or low-emission cars. The BEVs are quite effective when compared to conventional buses. The battery-powered bus allows faster driving as compared to buses powered by fuel or gasoline.

b. Key competitive players in the electric bus market include BYD Company Limited, AB Volvo, Proterra, Diamler AG, Zhengzhou Yutong Bus Co., Ltd. among others.

b. The global electric bus market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 110.44 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.