- Home

- »

- Automotive & Transportation

- »

-

Electric Bus Market Size, Share And Growth Report, 2030GVR Report cover

![Electric Bus Market Size, Share & Trends Report]()

Electric Bus Market Size, Share & Trends Analysis Report By Vehicle Type (Battery Electric Vehicle, Plug-in Vehicle), By Battery Type, By Application (Intercity, Intracity), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-974-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Electric Bus Market Size & Trends

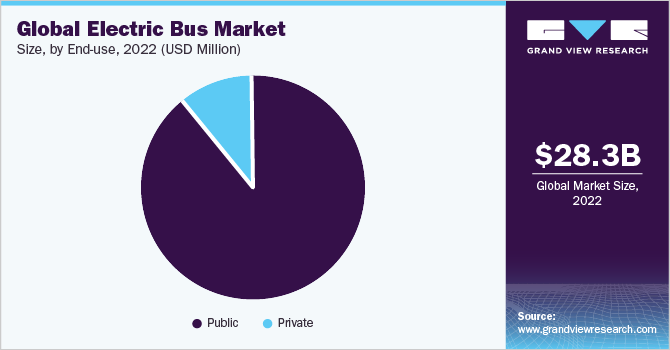

The global electric bus market size was valued at USD 28.32 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 20.4% from 2023 to 2030. Rising demand for non-polluting, air-combating, fuel-efficient buses along with initiatives from major countries seeking alternatives to transform their existing conventional bus fleets with electric buses are some of the key factors driving the growth of the global electric bus industry. In addition, growing environmental concerns, strict regulations, and government initiatives to achieve zero emissions targets are triggering the adoption of electric buses.

Several initiatives by automobile manufacturers for investing in the development of hydrogen fuel cell-powered electric bus is further driving the demand for electric buses in the global market. Moreover, rising technological advancements in terms of increasing range of mobility & deployment of fast charging infrastructure are further anticipated to provide numerous opportunities to the stakeholders over the forecast period.

Several players in the global electric bus market are largely focused on investing heavily in research and development and the incorporation of new technologies in electric buses. For instance, in May 2022, electric vehicles and technology company, Pinnacle Mobility Solutions Private Limited (EKA) entered into a partnership with an autonomous driving company based in Canada. The partnership with NuPort Robotics aims to introduce ADAS of level 2 autonomy in its electric bus range in India. EKA will be testing a variety of autonomous features developed by NuPort.

Level 2 ADAS is said to further the improvement in existing safety standards, and operational efficiency and reduce carbon footprint. By leveraging NuPort's expertise, EKA will be able to implement AI-enabled autonomous solutions in its electric bus platform. The incorporation of Artificial Intelligence is expected to improve operational efficiency, and safety, and reduce carbon emissions, advancing the overall electric bus industry growth.

Several governments in Europe are undertaking a wide range of initiatives to increase the adoption of e-buses in the region. For instance, in August 2021, the European Commission announced the Under Clean Vehicle Directive which was aimed to procure 45% of the vehicles with zero emission buses by 2025 and 65% by 2030 in European countries. Besides, the Indian Government launched the FAME II scheme in April 2019 to increase the penetration of electric vehicles such as scooters, buses, bikes, and trucks.

Moreover, emerging players in the electric bus market are majorly focusing on expanding business footprint by introducing new buses in the emerging economies of the world. For instance, in January 2022, Swedish-Kenyan electric mobility company ROAM, has introduced electric bus in Kenya.

High cost and low battery efficiency are key restraints to the growth of the electric bus market. The total cost of ownership and maintenance cost of the electric bus is higher than conventional buses which is discouraging consumers to buy gasoline-powered buses over the electric bus. In addition to this, the battery performance of electric buses is lesser than traditional buses due to low charging capacity, long charge duration, and limited range per charge. Besides this, the lower performance of electric buses in colder climates and less battery charging performance lowers the overall efficiency.

Vehicle Type Insights

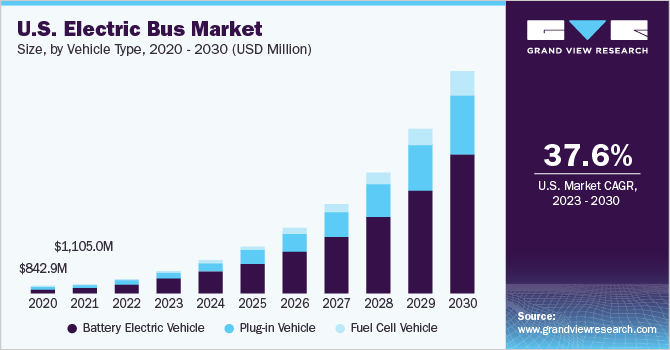

Based on vehicle type, the market is segmented into battery electric vehicles (BEV), plug-in vehicles (PHEV), and fuel cell vehicles (FCEV). The BEV segment dominated the electric bus industry with a share of more than 65% in 2022. The battery-powered bus is a more efficient alternative to zero-emission or low-emission cars. The BEVs are more effective when compared to conventional buses. The battery-powered bus allows for faster driving ascompared to buses powered by fuel or gasoline. Compared to diesel or gasoline-powered buses, BEVs are easier and less expensive to charge.

The FCEV segment is expected to witness high paced CAGR of 27.8% in the global electric bus market from 2023 to 2030. The FCEV contributes to a decrease in air pollution and greenhouse gas emissions. The segment is growing because of increased government initiatives to reduce carbon emissions and protect the environment. For instance, Germany is accelerating the adoption of fuel-cell transit buses. The German government has invested USD 642 million for the manufacturing and installation of 150 hydrogen and 1400 electric transit buses in the country. Furthermore, the growing technological advancement and adoption of advanced technologies are creating a lucrative opportunity for the growth of the segment in the electric bus industry.

Battery Type Insights

Based on battery type, the electric bus market is segmented into lithium nickel manganese cobalt oxide and lithium iron phosphate. The lithium iron phosphate battery segment dominated the market share of more than 90%in 2022. As compared to lead-acid batteries and other lithium batteries, lithium iron manganese battery offers a variety of benefits like enhanced discharge, charge efficiency, longer life term, no maintenance, optimum safety, and is lightweight. Although LiFePO4 batteries are not the most affordable in the electric bus industry, these batteries are a promising long-term investment in the changing electric bus industry owing to their extended lifespan and lack of maintenance.

The lithium nickel manganese cobalt oxide segment is anticipated to grow at a CAGR of 23.1% in the global electric bus market over the forecast period. The mineral is utilized as a cathode material in rechargeable lithium-ion batteries in batch quantities in powder form. This substance has incredibly high thermal stability. The advantageous properties of the Nickel Magnesium cobalt such as high cycle rate, capacity, and power as well as a low self-heating rate have increased its preference in the battery used for the e-buses.

Application Insights

Based on application, the market is segmented into intercity and intracity. The intercity segment dominates the overall market and held a market share of more than 90% in 2022.The growth can be contributed to the rising demand for public transport and an increasing number of people commuting to workplaces, schools, and universities throughout the world creating demand for intercity e-buses in the electric bus industry.

The intracity segment is anticipated to grow at a CAGR of 26.5% in the global electric bus industry during the forecast period. The growth of the segment is attributed to the increasing awareness among developing economies to reduce carbon emission levels and strict emission legislation pushing the adoption of e-buses. For instance, in March 2023, the UK-based bus depot, First Bus announced the launch of its three fully electric bus depots outside the capital. Furthermore, this initiative is expected to boost the launch of 5 new depots in the region by March 2024 through ZEBRA funding.

End-Use Insights

Based on end-use, the electric bus industry is segmented into public and private. The public segment held the highest market share of more than 85% of the global electric bus industry in 2022. The high share of the segment is attributed to the increasing transportation demand, and governments introducing several GHG emissions to curb air and noise pollution and reduce dependency on fossil fuels. For instance, in March 2023, a Belgium-based manufacturer of buses, coaches, trailers, and trolley buses signed a contract with Netherlands-based company Qbuzz for supplying 54 battery electric buses. These 15-meter e-buses are expected to be used by Qbuzz as regional public transport in Groningen and Drenthe.

The private segment is anticipated to grow at a CAGR of 20.4% during the forecast period. Several countries are taking the initiative for deploying e-buses within the countries which is further propelling the growth of the electric bus industry.

For instance, in January 2023, GreenCell Mobility Ltd, an Indian electric mobility player signed a contract with the transport department of the government of NCT Delhi for launching 570 electric buses in the span of the upcoming two years. Furthermore, the rising population coupled with the increasing greenhouse effect and shifting consumer preference towards public transport is further propelling the growth of the market.

Regional Insights

Asia Pacific region held the highest market share of more than 80% in the electric bus industry in 2022. The growth can be attributed to the growing demand for eco-friendly transport and the presence of countries such as China, India, and Japan. China is a major player in the electric bus industry and home to leading manufacturing companies. For instance, In March 2022, in China, more than 421,000 e-buses were in operation, which amounted to about 99% of the total fleet globally. Furthermore, strict government mandates, environmental concerns, and growing charging infrastructure are further propelling the overall electric bus industry in this region.

Europe is anticipated to grow at a CAGR of 35.3% over the forecast period owing to the favorable policies of the government and the growing efforts in controlling vehicle emissions. Furthermore, governments in this region have started projects to make public transportation more sustainable by deploying green transportation technologies.

Key Companies & Market Share Insights

The major players in the electric bus industry are BYD Company Limited; AB Volvo; Proterra Solaris Bus & Coach S.A.; Man Se; Nissan Motor Corporation; Ashok Leyland Limited; Daimler Truck AG; and Zhengzhou Yutong Bus Co., Ltd.; among others. Some key competitive factors for manufacturers include a presence in key regions, the launch of new products, and pricing. For instance, In December 2021, Volvo Buses partnered with Zero Emission Bus Rapid-Deployment Accelerator (Zebra), which aims to increase the speed of implementation of zero-emission buses in Latin America.

Furthermore, these companies adopt several strategies such as partnership, merger & acquisition, and collaboration to strengthen their industry presence and gain profits in the electric bus industry. For instance, ABB Power Grids has signed a Memorandum of Understanding (MOU) with IIT Madras and Ashok Leyland for an e-bus pilot run. The e-bus incorporates Hitachi ABB Power grid flash technology and Grid eMotionTM Flashwill be provided by Ashok Leyland while IIT Madras will provide a flash charging system. With this partnership both the parties will contribute towards the electrification in India. Some prominent players in the global market include:

-

BYD Company Limited

-

AB Volvo

-

Proterra

-

Man Se

-

Nissan Motor Corporation

-

Ashok Leyland Limited

-

Daimler Truck AG

-

Zhengzhou Yutong Bus Co., Ltd.

-

TATA Motors Limited

-

Hyundai Motor Company

Electric Bus Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 33.30 billion

Revenue forecast in 2030

USD 121.99 billion

Growth Rate

CAGR of 20.4% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative Units

Volume in Units, Revenue in USD million, CAGR from 2023-2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Vehicle type, battery type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; China; India; Japan; South Korea; Germany; U.K.; France; Spain; Netherlands; Italy; Brazil; Mexico; Chile; United Arab Emirates (UAE); Saudi Arabia; South Africa

Key Company Profiled

BYD Company Limited; AB Volvo; Proterra Solaris Bus & Coach S.A.; Man Se; Nissan Motor Corporation; Ashok Leyland Limited; Daimler Truck AG; Zhengzhou Yutong Bus Co., Ltd.; TATA Motors Limited; Hyundai Motor Company

Customization scope

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Electric Bus Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global market report based on vehicle type, battery type, application, end-use, and region:

-

Vehicle Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle

-

Plug-in Hybrid Electric Vehicle

-

Fuel Cell Electric Vehicle

-

-

Battery Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Lithium Nickel Manganese Cobalt Oxide

-

Lithium Iron Phosphate

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Intercity

-

Intracity

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global electric bus market size was estimated at USD 28.32 billion in 2022 and is expected to reach USD 33.30 billion in 2023.

b. Rising demand for non-polluting, air combating, and fuel-efficient buses is driving the demand for electric buses in the market. In addition, growing environmental concerns, strict regulations, and government initiatives to achieve zero emissions targets are propelling the growth of electric buses.

b. The BEV segment dominated the market with a revenue share of more than 60.0% in 2022. The battery-powered bus is a great alternative to zero-emission or low-emission cars. The BEVs are quite effective when compared to conventional buses. The battery-powered bus allows faster driving as compared to buses powered by fuel or gasoline.

b. Key competitive players in the electric bus market include BYD Company Limited, AB Volvo, Proterra, Diamler AG, Zhengzhou Yutong Bus Co., Ltd. among others.

b. The global electric bus market is expected to grow at a compound annual growth rate of 20.4% from 2023 to 2030 to reach USD 121.99 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."