- Home

- »

- Power Generation & Storage

- »

-

Lithium-ion Battery Cathode Market Size, Share Report, 2030GVR Report cover

![Lithium-ion Battery Cathode Market Size, Share & Trends Report]()

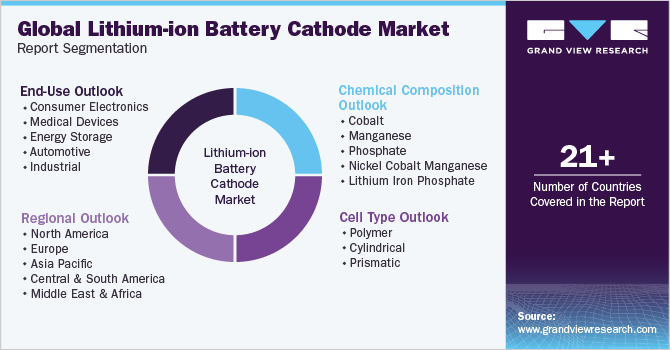

Lithium-ion Battery Cathode Market (2023 - 2030) Size, Share & Trends Analysis Report By Chemical Composition (Cobalt, Manganese, Phosphate, Nickel Cobalt Manganese, Lithium Iron Phosphate), By Cell Type, By End-use, By Region, And Segment Forecast

- Report ID: GVR-4-68040-073-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium-ion Battery Cathode Market Summary

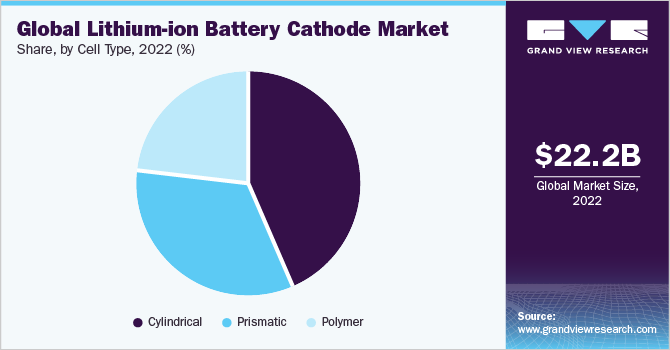

The global lithium-ion battery cathode market size was estimated at USD 22.16 billion in 2022 and is projected to reach USD 89.35 billion by 2030, growing at a CAGR of 19.9% from 2023 to 2030. The market has witnessed a substantial growth of electric vehicle supply equipment (EVSE), which also significantly affects the lithium-ion battery cathode market.

Key Market Trends & Insights

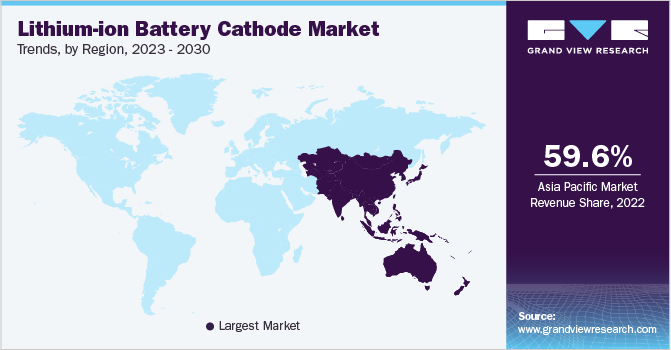

- The Asia-Pacific region accounted for 59.63% of the global lithium-ion battery cathode market share in 2022.

- Based on chemical composition, cobalt will account for the largest market share in 2022, reaching a level of 32.25%, and is expected to be Increasing market growth over the forecast period.

- Based on Cell type,Cylindrical segment accounted for largest share of 43.51% in 2022

- Based on end-use, consumer electronics is the largest market segment with a market share of 39.58% in 2022

Market Size & Forecast

- 2022 Market Size: USD 22.16 Billion

- 2030 Projected Market Size: USD 89.35 Billion

- CAGR (2023-2030): 19.9%

- Asia Pacific: Largest market in 2022

Public policies are further encouraging the development of multiple charging stations through direct investments and the formation of public-private partnerships, specifically in urban areas. The demand for renewable energy sources is increasing owing to the depletion of fossil fuels and rising environmental pollution caused by non-renewable sources of energy. Renewable sources such as tidal, wind, & solar energy need to be converted and stored for further applications. Sources such as wind and solar produce variable power that needs to be converted into a storable form. Energy storage systems (ESS) aid in storing the energy produced from renewable sources for further use.The cost of lithium-ion batteries is estimated to decrease over the next seven years owing to the increasing number of manufacturing facilities of companies such as BYD, Tesla, Samsung, BAK Battery, Shandong Wina Battery, and Zhejiang Tianneng. The low weight of lithium, along with its excellent energy-to-weight performance, is predicted to fuel demand lithium-ion battery cathode over the forecast period.

Major technological advancements in lithium-ion batteries, including the electrolytes, changes in the anode material of the silicon drastically increasing the voltage capacity, and the Li-S & Li-air technologies exhibiting high-energy-density, are projected to boost the demand for the lithium-ion battery cathode chemical composition in the near future.

Favorable government policies for domestic infrastructure developments through the National Infrastructural Plan of the U.S. are anticipated to support the growth of the lithium-ion battery cathode market in the country over forecast period.

GDP growth of the country and increase in its industrial output are expected to lead to flourishing medical, electronics, industrial controls, furniture, and appliances sectors in the U.S. The abovementioned trend is projected to promote the usage of lithium-ion batteries in the country in the coming years.

Some states of the U.S., including California, Colorado, Connecticut, Indiana, Massachusetts, Washington, Virginia and Kentuckyhave started considering the deployment of energy storage systems in their utilities as a part of their integrated resource plans.

Chemical Composition Insights

Based on chemical composition, the lithium-ion battery cathode market has been segmented into cobalt, manganese, phosphate, nickel cobalt manganese, lithium iron phosphate, and others. In terms of revenue, due to high energy density and high safety, lithium cobalt oxide batteries are in great demand for mobile phones, tablets, laptops, and cameras, so cobalt will account for the largest market share in 2022, reaching a level of 32.25%, and is expected to be Increasing market growth over the forecast period. Growing demand for lithium manganese oxide in various applications including power tools, others, energy storage, and electric drivetrain due to high power, long life, and safety is expected to drive its demand over the forecast period. However, factors such as high discharge rate and low capacity and energy density may hamper the segment growth during the forecast period.

Cell Type Insights

Based on Cell type, the lithium-ion battery cathode market has been segmented into polymer, cylindrical and prismatic. Cylindrical segment accounted for largest share of 43.51% in 2022 and expected to maintain its dominance in coming years owing to the applications in electric vehicles and energy storage systems.

Polymer emerged as second largest segment in 2022 due to its application in mobile devices, electric vehicles and toys. Cylindrical segment in expected to grow at a stagnant growth over forecast period.

End-Use Insights

Based on end-use, the lithium-ion battery cathode market has been segmented into consumer electronics, automotive, energy storage systems, industrial, and medical equipment. Consumer electronics is the largest market segment with a market share of 39.58% in 2022 owing to the widespread use of Ni-MH and Li-ion as portable batteries. Electric and hybrid electric vehicles are expected to be the major consumers of lithium-ion batteries in the coming years. Rising awareness among the general public about the benefits of battery-powered vehicles and rising fossil fuel prices, especially in Asia Pacific, Europe, and North America, are expected to aid the growth of the lithium-ion battery cathode market for automotive applications. forecast period.

Regional Insights

The Asia-Pacific region accounted for 59.63% of the global lithium-ion battery cathode market share in 2022. The booming electric vehicle market in Asia-Pacific countries, including India and China, is one of the key factors positively impacting the demand for lithium-ion batteries. Lithium-ion batteries in the area. The rise of the Asia-Pacific region as a global manufacturing hub has led to the increasing adoption of tools powered by lithium-ion batteries. Furthermore, the region has the largest population in the world. This has led to high sales of consumer electronics such as mobile phones and laptops that operate on lithium-ion batteries in Asia Pacific.

North America held the second largest share in the lithium-ion battery cathode market due to increasing demand for lithium-ion batteries for smartphones due to increased shelf life and improved efficiency. Rising demand for electric vehicles owing to increasing consumer awareness to reduce global carbon emissions is expected to drive market growth.

In addition, due to EPA regulations on lead pollution and resulting environmental hazards, as well as regulations on storage, disposal and recycling of lead-acid batteries, the demand for lead-acid batteries has decreased leading to an increase in demand for lithium-ion batteries in automobiles.

Key Companies & Market Share Insights

The global lithium-ion battery cathode market is a competitive market owing to the research and development activities to develop lithium-ion battery for various applications. For Instance: In January 2023, Allox Advance Materials Pvt Ltd announced to development of multi-GW lithium cathode manufacturing facility in Telangana, India with capacity of 3GWH/PA. Some prominent players in the global lithium-ion battery cathode market include:

-

BASF SE

-

LG Chem

-

NEI Corporation

-

Nichia Chemical

-

POSCO Chemicals

-

Samsung SDI

-

Sumitomo Chemicals

-

Targray Technology international, Inc.

-

Umicore SA

Lithium-ion Battery Cathode Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 25.11 billion

Revenue forecast in 2030

USD 89.35 billion

Growth Rate

CAGR of 19.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Chemical composition, cell type, end-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, Spain, Italy, France, Russia, China, Japan, India, South Korea, Australia, Saudi Arabia, UAE, South Africa, Egypt, Brazil, Colombia, Paraguay

Key companies profiled

Nichia Chemical, BASF SE, Sumitomo Chemicals, LG Chem, Samsung SDI, Targray Technology international, Inc., NEI Corporation, POSCO Chemicals, Umicore SA, Hitachi

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium-ion Battery Cathode Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030 For the purpose of this study, Grand View Research has segmented the global lithium-ion battery cathode market report on the basis of chemical composition, cell type and end-use:

-

Chemical Composition Outlook (Revenue, USD Million, 2018 - 2030)

-

Cobalt

-

Manganese

-

Phosphate

-

Nickel Cobalt Manganese

-

Lithium Iron Phosphate

-

-

Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer

-

Cylindrical

-

Prismatic

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Medical Devices

-

Energy Storage

-

Automotive

-

Industrial

-

Frequently Asked Questions About This Report

b. The global lithium-ion battery cathode market size was estimated at USD 22.16 billion in 2022 and is expected to reach 25.11 billion in 2023.

b. The global lithium-ion battery cathode market is expected to grow at a compound annual growth rate of 19.9% from 2023 to 2030 to reach USD 89.35 billion by 2030.

b. Cobalt accounted for the largest share of 32.25% in the market in 2022 owing to the high demand for lithium cobalt oxide batteries in consumer electronics.

b. Some key players operating in the lithium-ion battery cathode include Nichia Chemical, NEI CORPORATION, BASF SE, Sumitomo Chemical Co., Ltd., LG Chem, Samsung SDI, Umicore SA, among others.

b. Rising adoption of electric vehicles and growing consumption of rechargeable batteries are expected to drive lithium-ion battery cathode market over forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.