- Home

- »

- Automotive & Transportation

- »

-

Electric Golf Cart Market Size & Share, Industry Report, 2033GVR Report cover

![Electric Golf Cart Market Size, Share & Trends Report]()

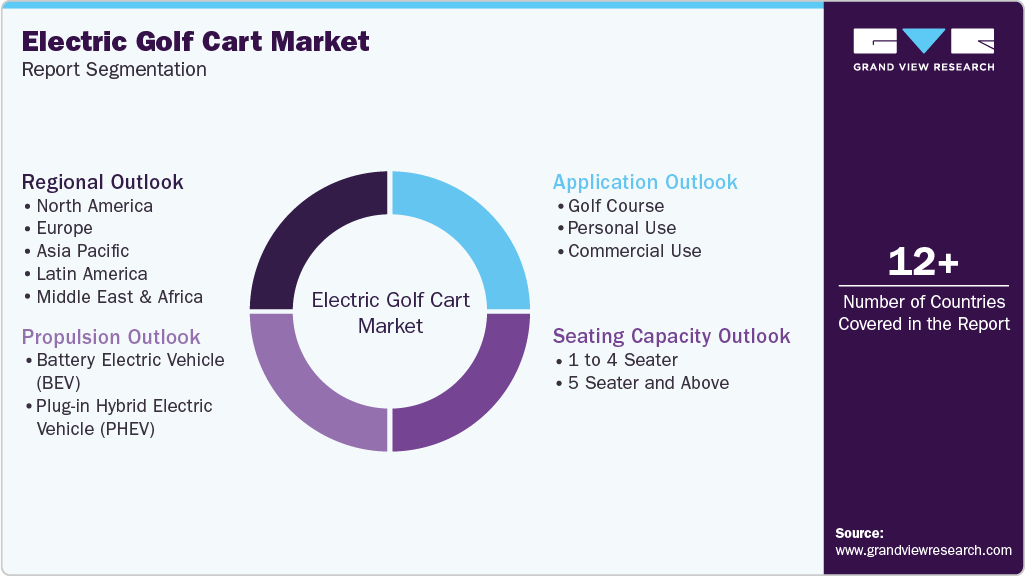

Electric Golf Cart Market (2025 - 2033) Size, Share & Trends Analysis Report By Propulsion (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle), By Seating Capacity, By Application (Golf Course, Personal Use, Commercial Use), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-642-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Golf Cart Market Summary

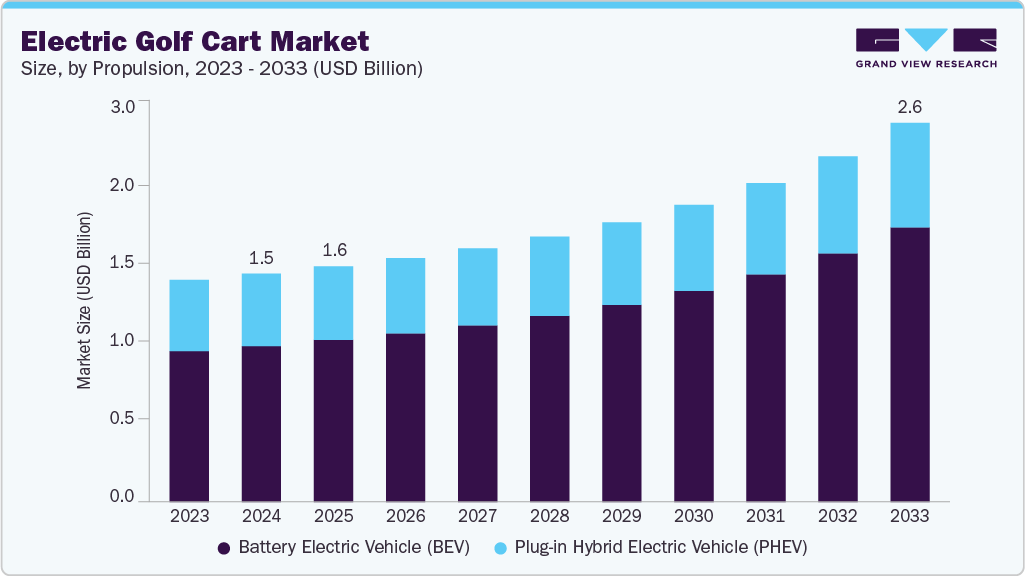

The global electric golf cart market size was estimated at USD 1.55 billion in 2024, and is projected to reach USD 2.58 billion by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The market is gaining momentum, driven by the rising adoption of electric models in resorts, gated communities, and retirement villages, where quiet and eco-friendly mobility solutions are increasingly preferred.

Key Market Trends & Insights

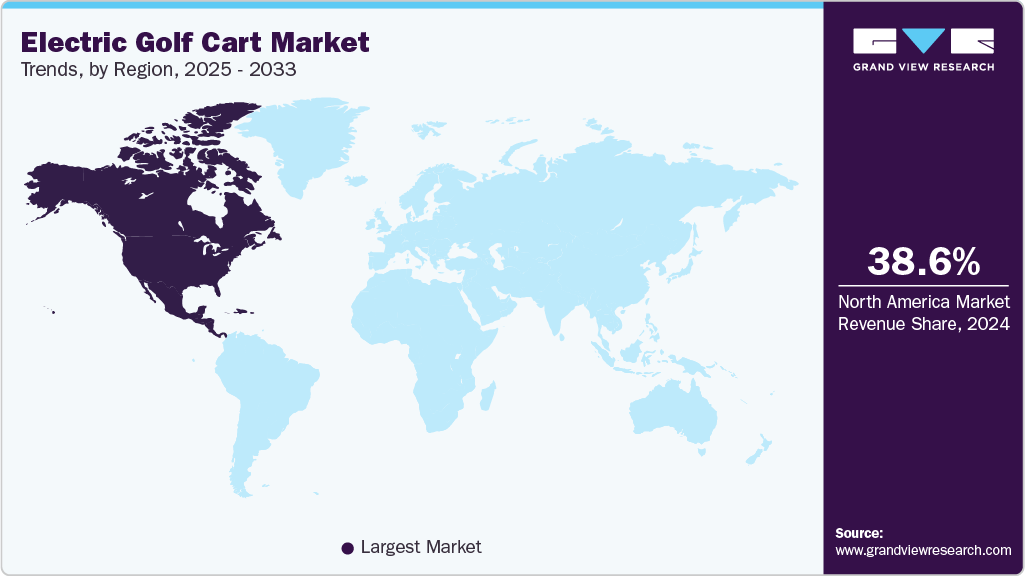

- The North America electric golf cart industry accounted for a global revenue share of 38.6% of the market in 2024.

- The U.S. electric golf cart industry held a dominant position in 2024.

- By propulsion, the battery electric vehicle (BEV) segment accounted for the largest share of 68.3% in 2024.

- By seating capacity, the 1 to 4-seater segment held the largest market share in 2024.

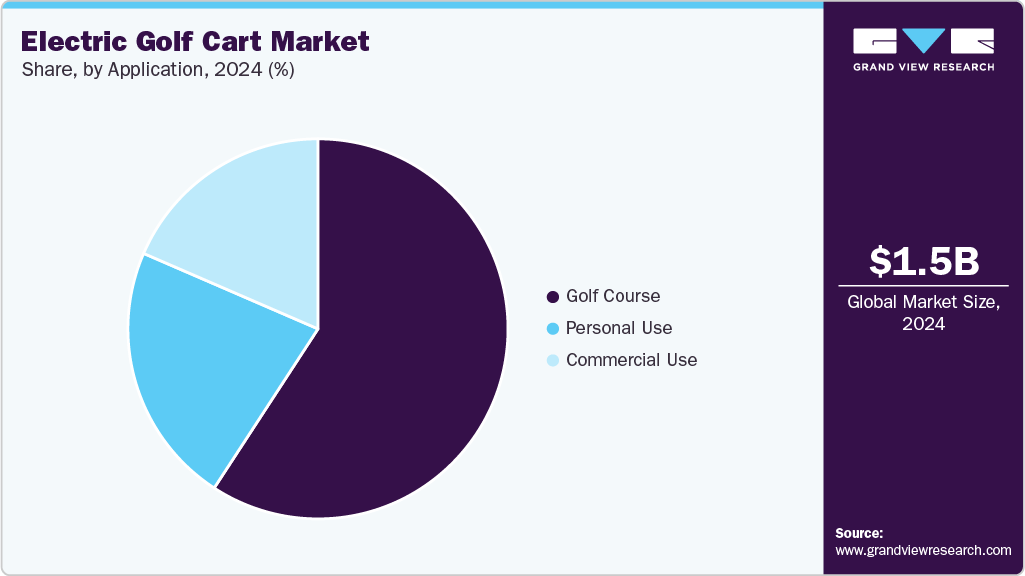

- By application, the golf course segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.55 Billion

- 2033 Projected Market Size: USD 2.58 Billion

- CAGR (2025-2033): 6.1%

- North America: Largest market in 2024

Advancements in lithium-ion battery technology are significantly enhancing vehicle range, performance, and lifecycle efficiency, making electric golf carts more viable for extended and varied applications. Also, growing pressure from environmental regulations is encouraging the shift toward zero-emission transport solutions, further accelerating market adoption across both recreational and utility-based use cases.Advancements in tourism infrastructure, electric drivetrains, and multi-purpose cart configurations present significant opportunities to support the growing popularity of golf tourism in emerging economies and the broader adoption of electric utility carts across commercial campuses, airports, and event venues. However, limited charging infrastructure, especially in less urbanized or rural areas, poses a challenge to broader adoption, restricting deployment beyond well-developed regions.

The rising adoption of electric golf carts in resorts, gated communities, and retirement villages is being driven by the need for sustainable, low-noise, and user-friendly mobility solutions tailored for short-distance transportation. These environments increasingly prioritize comfort, environmental consciousness, and operational efficiency, making electric carts a preferred choice over traditional internal combustion options. The segment is further supported by growing investments in residential leisure infrastructure and private community developments. For instance, in November 2022, Neuron Energy introduced its Adler electric golf cart range, equipped with lithium-ion batteries, GPRS tracking, and remote assistance features. Designed for diverse applications including personal travel and leisure, the product is also positioned for export to international markets such as the Middle East. Such developments reflect the expanding scope and acceptance of electric carts in non-golf recreational and residential settings.

The shift toward high-capacity, fast-charging, and thermally stable battery systems is enabling longer operational hours, reduced downtime, and improved user convenience. These innovations are especially crucial in fleet applications where reliability and endurance are key. For instance, in March 2025, Trojan Battery launched the Lithium OnePack Extended Range, a 48V 171Ah battery designed for 6-8 passenger carts, enabling travel of up to 75 miles on a single charge. Similarly, in June 2024, CTECHI unveiled a 48V LiFePO4 battery with scalable capacity and advanced battery management features. Such developments underscore the growing technological maturity reshaping the electric golf cart segment.

The expansion of electric utility cart usage across commercial campuses, airports, and event venues is creating new growth avenues for electric golf carts beyond traditional golf course applications. These vehicles offer quiet, efficient, and low-emission transport solutions ideal for short-distance, high-frequency movement of people or light cargo. The trend is being reinforced by public and private initiatives aimed at enhancing accessibility and operational efficiency. For instance, in March 2024, Saudi Arabia’s General Authority deployed smart electric golf carts at Makkah’s Grand Mosque to support elderly and disabled pilgrims, improving mobility during religious rituals.

Limited charging infrastructure in less urbanized and remote regions continues to pose a significant barrier to the widespread adoption of electric golf carts. Although these vehicles are ideal for short-range mobility, their operational viability is heavily dependent on accessible and reliable charging points. In areas lacking such infrastructure, users face range anxiety and increased logistical challenges in maintaining consistent performance. This issue becomes particularly prominent in emerging markets or rural tourism destinations, where investment in EV infrastructure is still nascent.

Propulsion Insights

The battery electric vehicle (BEV) segment accounted for the largest share of 68.3% in 2024, driven by rising environmental awareness, improved battery technologies, supportive government incentives, and growing operational cost advantages over internal combustion counterparts. BEVs are increasingly preferred for their quiet operation, zero tailpipe emissions, and lower long-term maintenance needs, particularly in environments including resorts, campuses, and leisure facilities where sustainability and comfort are key. For instance, in November 2024, Massimo Group launched the electric MVR Series featuring the MVR 2X Golf Cart and MVR Cargo Max Utility Cart. These low-speed electric vehicles offer up to 45 miles of range, modern tech features, and flexibility for both recreation and commercial use.

The plug-in hybrid electric vehicle (PHEV) segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by the demand for extended driving range, the flexibility of dual power sources, reduced range anxiety compared to BEVs, and rising interest from golf resorts and fleet operators seeking transitional low-emission solutions. PHEVs offer a balance between sustainability and practicality, making them attractive for users operating in semi-urban areas or courses with limited charging infrastructure.

Seating Capacity Insights

The 1 to 4 seater segment accounted for the largest share in 2024, driven by the rising preference for compact, energy-efficient vehicles, growing adoption in residential communities and resorts, increasing popularity of recreational golf, and demand for personalized mobility solutions. These carts offer maneuverability, lower operating costs, and are well-suited for both leisure and utility use across golf courses, gated colonies, and commercial campuses. Manufacturers are increasingly prioritizing innovation in comfort, performance, and smart functionality within this category. For instance, in May 2024, INNO Golf Carts unveiled the INNO-F2, a two-seater electric golf cart featuring advanced EV technology and premium design. Launched at the PGA Show, the INNO-F2 enhances comfort and efficiency on golf courses while offering a high-end shared riding experience for players.

The 5-seater and above segment is expected to grow at a significant CAGR during the forecast period. This growth is driven by increasing demand for multi-passenger electric golf carts across resorts, airports, and theme parks; rising use in guided tours and large-group mobility solutions; expanding applications in industrial and commercial sites; and the growing popularity of eco-friendly group transport alternatives.

Application Insights

The golf course segment accounted for the largest share in 2024, driven by increasing replacement of gasoline-powered carts with electric models, heightened emphasis on eco-friendly operations, rising golf participation rates, and greater fleet modernization initiatives by golf clubs. These trends reflect the golf industry's broader shift toward sustainability and operational efficiency. Such demand is also pushing manufacturers to scale up production and deliver enhanced electric models. For instance, in November 2022, Kandi Technologies announced the production and shipment of its 10,000th crossover electric golf cart from its Hainan facility. Featuring automotive-grade chassis and optimized control systems, the M1204 series has seen strong U.S. demand, establishing Kandi’s leadership in the growing electric golf cart category.

The commercial use segment is expected to register a notable CAGR from 2025 to 2033. Factors such as the rising deployment of electric golf carts in airports, resorts, hospitality complexes, large campuses, and event venues. Increased focus on low-emission transport solutions for short-distance mobility, growing preference for cost-effective utility vehicles, and expansion of multi-passenger shuttle applications support the segment growth.

Regional Insights

The North America electric golf cart industry accounted for a global revenue share of 38.6% of the market in 2024, driven by a strong culture of recreational golfing, widespread adoption of electric vehicles in gated communities and resorts, and supportive regulatory initiatives promoting clean mobility. The market in North America is also being driven by rising investments in golf infrastructure, expanding tourism activities, and the growing utility of electric carts in non-golf applications such as campuses and airports. The region benefits from a mature golf ecosystem, advanced EV infrastructure, and high consumer spending power.

In January 2024, the Professional Golfers' Association of America (PGA Tour) announced an approximately USD 3 billion investment agreement with Strategic Sports Group to strengthen its operations and competitiveness. According to CNBC, the deal includes equity opportunities for nearly 200 players and reflects strong investor confidence in the future growth of professional golf. This highlights the favorable environment for electric golf cart adoption across North America’s evolving golf and leisure landscape.

U.S. Electric Golf Cart Market Trends

The U.S. electric golf cart industry held a dominant position in 2024. The market in the U.S. is witnessing significant transformation, driven by increasing investments in golf course infrastructure, growing recreational usage in gated communities and resorts, and expanding applications in commercial and utility environments. A growing number of golf facilities are allocating substantial budgets toward modernizing their amenities and mobility fleets to enhance player experience and operational efficiency. For instance, in November 2024, the National Golf Foundation reported that U.S. golf facilities invested approximately USD 3.1 billion in discretionary upgrades over the past year. Nearly 60% of private clubs and about half of public courses made significant capital investments, reflecting strong financial health and a renewed focus on enhancing course operations and amenities.

Public institutions are also stepping up investments in golf infrastructure to broaden community access and prepare for major tournaments. In April 2025, the United States Golf Association (USGA) announced an approximately USD 1 million investment in public golf courses near Oakmont ahead of the U.S. Open. The funding will enhance facilities at North Park, South Park, and Schenley Park, supporting local golf communities and improving course infrastructure. Such developments support the U.S. market’s leadership and indicate sustained momentum in electric golf cart deployment across recreational and institutional settings.

The electric golf cart industry in Canada is witnessing steady growth, supported by rising recreational usage in golf courses, parks, and gated communities. Also, initiatives to promote eco-friendly mobility in tourist destinations such as British Columbia and Ontario are reinforcing demand.

Mexico electric golf cart industry is gradually expanding, particularly in hospitality hubs such as Cancún, Los Cabos, and Playa del Carmen. Although national regulations specific to golf carts are limited, regional tourism infrastructure development is creating favorable conditions for adoption.

Europe Electric Golf Cart Market Trends

The Europe electric golf cart industry was identified as a lucrative region in 2024. The European market is witnessing significant transformation, driven by rising demand for sustainable urban mobility solutions, increased adoption in hospitality and tourism sectors, and growing interest in compact electric vehicles for gated and recreational communities. In addition, expanding regulations around zero-emission zones in cities are accelerating the shift toward battery-powered transport options, including golf carts.

Manufacturers are increasingly targeting European consumers with high-end, feature-rich electric golf carts tailored for dual-purpose leisure and road use. For instance, in May 2023, Mansory, in collaboration with Garia, unveiled a street-legal electric golf cart for both the U.S. and Europe. Powered by a 10.24 kWh lithium-ion battery, it offers a range of over 80 kilometers and features a 10.1-inch touchscreen, selectable Golf and Street modes, and luxury components including forged carbon bodywork and a refrigerator.

The German electric golf cart industry is being shaped by the rising environmental awareness and supportive government policies promoting zero-emission mobility, increasing integration of low-speed electric vehicles in leisure resorts, golf clubs, and gated residential developments. Also, the country’s focus on urban clean air initiatives and noise reduction is encouraging the adoption of quiet, battery-powered transport solutions, including golf carts, in both private and semi-public environments.

The electric golf cart industry in UK is witnessing steady growth, supported by rising consumer interest in advanced, user-friendly electric trolleys and a growing focus on sustainability across golf facilities. Increasing adoption of lightweight, compact electric carts that enhance user convenience is shaping product development trends. Major companies in the country are leveraging AI and ergonomic design to improve handling and battery performance. For instance, in February 2025, Motocaddy launched the 10th generation of its best-selling electric trolley, the S1, along with the S1 DHC variant, in the UK. Redesigned with a modern chassis and AI-assisted development, the S1 features a high-performance 28V system, LCD display, one-step folding, and Click ‘n’ Connect cable-free battery integration. This reflects a strong domestic demand for technologically enhanced electric golf trolleys and reinforces the UK’s role as a key market in product innovation.

Asia Pacific Electric Golf Cart Market Trends

The Asia Pacific electric golf industry was identified as a lucrative region in 2024, driven by expanding golf infrastructure, increasing urban adoption of low-speed electric vehicles, and growing government support for electric mobility. Countries such as India, China, and Japan are witnessing a surge in recreational and commercial applications of electric golf carts in resorts, campuses, and gated communities. For instance, in December 2022, Saera Electric Auto unveiled its exclusive electric golf cart in the Indian market. Designed with a monocoque frame, AC drive system, and advanced safety features, the model aims to boost Saera’s presence in the electric mobility sector while offering a premium and comfortable ride experience. This reflects the growing regional investment in electric transport solutions and supports Asia Pacific’s emergence as a key contributor to global market expansion.

The China electric golf cart industry held a substantial market share in 2024. The market in China is experiencing rapid growth, driven by the expanding development of golf courses and resort infrastructure, favorable government policies promoting electric mobility, and the increasing use of electric carts in gated communities and industrial parks. Local manufacturers are investing in product innovation, battery efficiency, and export-focused models to strengthen their market positions.

The Japanese electric golf cart industry held a significant share in 2024. In Japan, the electric golf cart industry is influenced by the steady modernization of golf courses, the country’s aging population driving demand for accessible mobility solutions, and the strong presence of domestic OEMs with advanced engineering capabilities. These factors contribute to consistent demand for technologically enhanced, efficient, and low-maintenance electric carts tailored to local terrain and usage needs.

Manufacturers are increasingly focusing on energy efficiency and battery innovation to meet Japan’s environmental and performance expectations. In March 2025, Yamaha Motor announced the launch of two new five-seater electric golf cart models, the G30Es and G31EPs, in Japan, with plans for Taiwan expansion. Equipped with an in-house lithium iron phosphate (LFP) battery and high-efficiency AC motor, the models feature a 30% reduction in power consumption compared to previous versions.

Key Electric Golf Cart Company Insights

Some of the key players operating in the market include CLUB CAR, Textron Specialized Vehicles Inc., Yamaha Motor Co., Ltd., and Skyy Rider Electric.

-

Founded in 1958 and headquartered in Evans, Georgia, United States, Club Car specializes in the design and manufacture of zero-emission mobility vehicles, including battery electric vehicles (BEVs) and utility carts tailored for golf courses, commercial fleets, and personal transport. It offers a wide range of products under categories such as two-seater, four-seater, and multi-passenger configurations. Club Car also provides fleet management systems, connectivity tools, and lithium-ion battery technology to enhance operational efficiency and user experience across sports, commercial, and leisure sectors.

-

Founded in 1955 and headquartered in Iwata, Shizuoka, Japan, Yamaha Motor Co., Ltd. is a prominent manufacturer of electric golf carts, motorcycles, and mobility solutions. Yamaha’s electric golf carts are widely adopted in golf courses, resorts, and gated communities, especially in Japan, North America, and Southeast Asia. The company integrates advanced battery technologies such as lithium iron phosphate (LFP), smart drive systems, and energy-saving AC motors into its products. Leveraging over five decades of expertise in golf mobility, Yamaha continues to expand its footprint globally while aligning with green mobility trends and smart transportation systems.

Key Electric Golf Cart Companies:

The following are the leading companies in the electric golf cart market. These companies collectively hold the largest market share and dictate industry trends.

- CLUB CAR

- Textron Specialized Vehicles Inc.

- Yamaha Motor Co., Ltd.

- Skyy Rider Electric

- Berylline Corp

- Evolution Electric Vehicles

- HDK

- Marshell

- Star EV Corporation, USA

- Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.

Recent Developments

-

In April 2025, Motocaddy launched the ME Remote, an affordable remote-controlled electric golf cart designed for hands-free use. Positioned as an entry-level option, it combines advanced remote technology with strong handling, making it an attractive choice for golfers seeking convenience and value.

-

In February 2024, Uzbekistan announced plans to begin local production of electric golf carts through the Global OSB enterprise. Backed by approximately USD 1 million investment, the project aims to localize key components such as windshields, bumpers, and chassis covers, with operations expected to start between March and April.

-

In November 2023, Kandi Technologies Group announced the arrival of its first batch of 500 all-electric mini golf carts in the U.S. market. Designed by American professionals and manufactured in China, these compact carts feature electric telescopic functionality for added convenience and portability. Kandi aims to capture consumer interest through affordability, versatility, and distinctive design.

Electric Golf Cart Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.60 billion

Revenue Forecast in 2033

USD 2.58 billion

Growth Rate

CAGR of 6.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Propulsion, seating capacity, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

CLUB CAR; Textron Specialized Vehicles Inc.; Yamaha Motor Co., Ltd.; Skyy Rider Electric; Berylline Corp; Evolution Electric Vehicles; HDK; Marshell; Star EV Corporation, USA; Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Golf Cart Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electric golf cart market report based on propulsion, seating capacity, application, and region:

-

Propulsion Outlook (Revenue, USD Million, 2021 - 2033)

-

Battery Electric Vehicle (BEV)

-

Plug-in Hybrid Electric Vehicle (PHEV)

-

-

Seating Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

1 to 4 Seater

-

5 Seater and Above

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Golf Course

-

Personal Use

-

Commercial Use

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric golf cart market size was estimated at USD 1.55 billion in 2024 and is expected to reach USD 2.58 billion in 2033.

b. The global electric golf cart market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 2.58 billion by 2033.

b. The North America electric golf cart market accounted for 38.6% of the global share in 2024, driven by strong culture of recreational golfing, widespread adoption of electric vehicles in gated communities and resorts, and supportive regulatory initiatives promoting clean mobility. The region benefits from a mature golf ecosystem, advanced EV infrastructure, and high consumer spending power.

b. Some key players operating in the electric golf cart market include CLUB CAR, Textron Specialized Vehicles Inc., Yamaha Motor Co., Ltd., Skyy Rider Electric, Berylline Corp, Evolution Electric Vehicles, HDK, Marshell, Star EV Corporation, USA, Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.

b. Key factors that are driving the market growth include rising adoption of electric models in resorts, gated communities, and retirement villages, where quiet and eco-friendly mobility solutions are increasingly preferred. Advancements in lithium-ion battery technology are significantly enhancing vehicle range, performance, and lifecycle efficiency, making electric golf carts more viable for extended and varied applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.