- Home

- »

- Automotive & Transportation

- »

-

Electric Kick Scooter Market Size And Share Report, 2030GVR Report cover

![Electric Kick Scooter Market Size, Share & Trends Report]()

Electric Kick Scooter Market (2025 - 2030) Size, Share & Trends Analysis Report By Battery Type ( Lead-acid Battery, Lithium-ion Battery), By Drive Type, By Product, By End-use (Personal, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-285-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Kick Scooter Market Summary

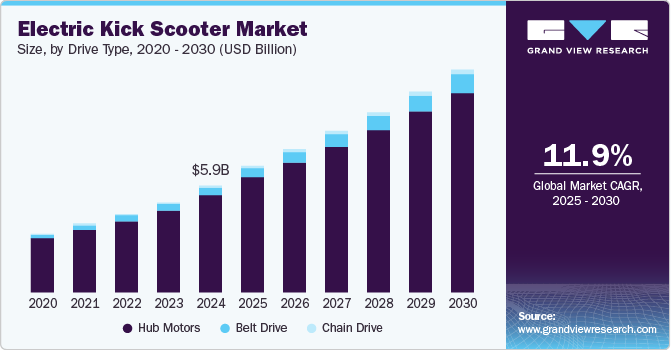

The global electric kick scooter market size was valued at USD 5.93 billion in 2024 and is projected to grow at a CAGR of 11.9% from 2025 to 2030. E-kick scooters have emerged as a cost-effective urban commute option in recent times due to their sleek design and ease of use.

Key Market Trends & Insights

- By battery type, the lithium-ion battery segment accounted for the largest share of 92.1% in 2024.

- By drive type, the hub motors segment held the largest market share in 2024.

- By product, the standard segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.93 Billion

- 2030 Projected Market Size: USD 12.27 Billion

- CAGR (2025-2030): 6.7%

Besides, increasing investment in developing bike lanes in the emerging economies of the world is driving market growth. Rising awareness about environment-friendly transportation, fluctuating fuel prices, and the increasing demand for easy short distance commuting is fueling the growth of the market. The COVID-19 pandemic has negatively impacted the overall automobile industry in 2019 and 2022. Global supply chain disruption and loss due to the shutting down of the production and assembly plants have severe impacts on the growth of the market. Post-pandemic the market is expected to benefit from the rising demand for more environment-friendly and hassle-free transportation options, due to an uptick in demand post-COVID-19, and favorable government policies.

Countries such as France, Spain, Germany, and the U.S. have recorded a significant rise in the adoption of kick scooters over the last couple of years, and this trend is expected to continue over the next few years. Additionally, electric scooter ride hailing start-ups are collaborating with top manufacturers in the market to expand their customer base offerings in the market. Besides, the benefits of e-kick scooter such as lesser parking space requirement, light in weight, ease of carry, quick charging and cost-effective transportation are expected to favor the growth and electric scooter sharing services across the world.

Growing carbon emissions have been a key concern for government authorities across the world. The government is taking various initiatives by changing policies, mandates and incentives to support electric vehicles in the market which is shifting the consumers' preference from conventional vehicles to electric two-wheelers such e-kick scooter, majorly in the developed regions of the world. Moreover, regulatory authorities are also focusing on infrastructure development that has increased the penetration of electric transportation options. Thereby the government and regulatory authorities’ initiatives are expected to create new growth opportunities for the market.

The key players in the market are focusing on developing technologically advanced, durable, low-maintenance, high-speed scooters and a wide range of electric kick scooters that meet customers’ demands globally. Consumers based in the developing nations of Latin America, the Middle East and Africa, and Asia Pacific perceive e-kick scooters as a means for short-distance transportation. However, in North America and Europe, consumers tend to consider the use of e-kick scooters more as a means of a healthy lifestyle. Therefore, global players such as NIU International, Xiaomi, Yadean Technology Group are working on developing technologically advanced design/style and high-speed electric kick scooters. For instance, in October 2022, NIU International launched the KQi3 Max with a top speed of 20 MPH, and 40.4-mile range and offers maximum comfort and stability to consumers.

Battery Type Insights

The lithium-ion battery segment accounted for the largest share of 92.1% in 2024. Performance and environmental advantages of Li-Ion batteries over lead acid batteries are expected to position Li-Ion technology as the global mainstream battery technology in the coming years. Continual improvements in battery technology have helped improve the storage capacity and reduce the overall cost of Li-Ion batteries, making them a popular choice for mobile, low-cost devices such as kick scooters.

Additionally, Li-Ion batteries with digital battery management offer faster charging time and a longer battery lifecycle as compared to lead acid batteries. Prolonged battery discharge cycles, high current density, a long usable lifespan, and reliable thermal stability work are expected to favor the segment with a significant CAGR. Furthermore, sealed lead-acid batteries involve the risk of lead contamination during manufacturing and disposal. As a result, manufacturers prefer Li-ion batteries over lead acid batteries for electric scooters.

Drive Type Insights

The hub motors segment held the largest market share in 2024. The hub drive electric kick scooter is popular owing to the compact size of hub motors which provides space to add more components such as fuel packs or battery packs. In addition, the hub drive offers simpler assembly has less weight, cuts the mechanical losses caused by the chains or belts, and requires less maintenance; thus, hub drives are widely used in electric kick scooters.

The belt drive segment is expected to register the fastest CAGR during the forecast period. This segmental growth is attributed to the increasing integration of the belt drive in the electric scooter. The benefits of rubber timing belts such as quicker operations, long shelf life, and low maintenance requirements, are encouraging prominent players in the electric scooter market to develop the belt drive system for the electric kick scooter in the market.

Product Insights

The standard segment dominated the market in 2024. The rise in shared micro-mobility services, where users can rent electric scooters on demand, is driving the growth of the segment in the market. Companies such as Lime, Bird, and others have introduced shared electric scooter fleets in cities around the world, providing an accessible and affordable mode of transportation. These services allow users to rent scooters for short trips, eliminating the need for personal ownership and lowering the entry barrier for using electric scooters.

The folding segment is projected to grow at the fastest CAGR over the forecast period. The increasing urbanization and traffic congestion fuel the growth of the segment. Folding electric kick scooters provide a convenient solution for short-distance travel within crowded cities, offering portability and flexibility that traditional vehicles cannot. Their ability to fold easily makes them particularly appealing to urban dwellers who may need to combine different modes of transportation, such as riding a scooter to a train station and then folding it up for the next part of the journey.

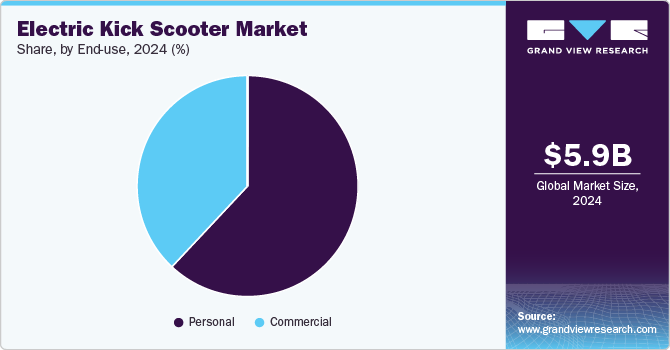

End Use Insights

The personal segment dominated the market in 2024. The high segmental share is attributed to the high adoption among kids and adults. Additionally, manufacturers shifting interest in improving the efficiency of the components such as the development of the ultra-high speed ball bearing, improving the material quality, and utilization of cut-edge technology products to increase overall performance and reliability.

The commercial segment is projected to grow at the fastest CAGR over the forecast period. The emergence of ride-sharing platforms has benefited consumers as they can avail local site seeing and short-distance commute options with the minimal cost of USD 1 per trip and 15 per minute. Besides, E-kick scooter service providers such as Bird Rides Inc. have generated a revenue share of USD 2 billion which has created a rush in manufacturers to start sharing a fleet of their own which is further expected to create opportunities for market growth.

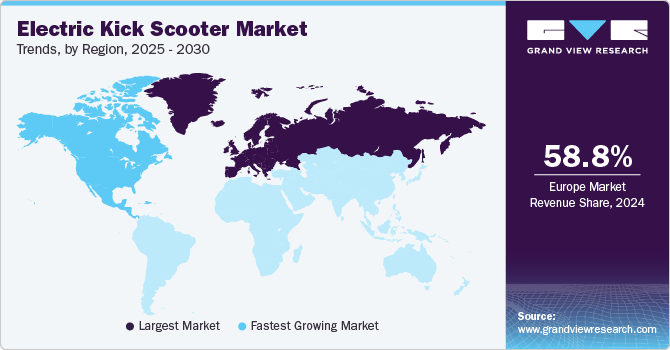

Regional Insights

North America electric kick scooter market held a significant share in 2024. There is a growing awareness of environmental issues and a shift toward more sustainable transportation options in North America. Electric kick scooters are an eco-friendly alternative to cars and public transportation, as they produce zero emissions and help reduce carbon footprint. With cities implementing green initiatives and policies to reduce pollution, many urban commuters are turning to electric scooters as a cleaner, more sustainable form of transportation.

U.S. Electric Kick Scooter Market Trends

The electric kick scooter market in the U.S. held a dominant position in 2024 as electric kick scooters offer an affordable alternative to cars, public transportation, or ride-hailing services. They have low operational and maintenance costs and help users avoid expenses such as fuel and parking, making them a cost-effective option.

Europe Electric Kick Scooter Market Trends

The electric kick scooter market in Europe was identified as a lucrative region in 2024 and accounted for 58.76% of the overall share. The growth of the electric kick scooter market in Europe can be attributed to the presence of subsidies and incentives for the purchase of electric vehicles. These financial incentives significantly reduce the upfront cost, making it easier for consumers to transition from traditional modes of transport to electric alternatives.

The U.K. electric kick scooter market is expected to grow rapidly in the coming years due to the increasing congestion and longer commute times. According to global traffic congestion rankings, London ranks first among cities, with an average traffic congestion index of 173.88. Electric kick scooters offer a practical and efficient solution to this issue, especially for short-distance trips within cities.

The electric kick scooter market in Germany held a substantial market share in 2024 owing to the changes in daily routines and commuting due to remote working and flexible job arrangements. With fewer people commuting daily to an office, there is a growing need for transportation solutions that can accommodate various travel needs, from short trips within the city to occasional longer journeys. Electric kick scooters offer a high level of convenience for such a population.

Asia Pacific Electric Kick Scooter Market Trends

The electric kick scooter market in Asia Pacificis anticipated to grow at a significant CAGR during the forecast period. Rapid urbanization in the Asia Pacific region is driving the demand for efficient and convenient transportation. Electric kick scooters are an excellent solution for short-distance travel as cities expand and become more congested. They are more compact than traditional vehicles and significantly reduce travel time.

Japan electric kick scooter market is expected to grow rapidly in the coming years due to owing to the government's mission to reduce carbon emissions and enhance urban mobility. Incentives such as subsidies and tax benefits are provided to manufacturers and consumers, making electric scooters more affordable and accessible. In addition, supportive policies, including regulatory frameworks integrating electric scooters into public transportation systems, are being implemented to encourage widespread use. These initiatives align with Japan's broader environmental goals and commitment to sustainability, resulting in increased adoption of electric kick scooters, which are a cleaner, more efficient alternative for short-distance urban travel.

The electric kick scooter market in China held a substantial market share in 2024 owing to the presence of major market players such as Ninebot and Xiaomi. Ninebot's advanced technology and Xiaomi's cost-effective, high-performance scooters drive innovation and attract a broad consumer base. Their competitive edge comes from continuous product improvements and strategic pricing. These companies also benefit from established distribution networks and strong brand recognition, fueling market growth.

Key Electric Kick Scooter Company Insights

Some of the key companies in the electric kick scooter market include Bird Rides, Inc, SEGWAY INC., Xiaomi, Niu International, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Bird Rides, Inc specializes in providing sustainable transportation solutions. The company rolls out fleets of shared electric scooters that are accessible via a user-friendly mobile application. The company operates in over 400 cities worldwide, partnering with local governments and fleet managers to integrate its lightweight electric vehicles into existing transportation systems.

-

Xiaomi provides a wide range of consumer electronics, including smartphones, smart home devices, wearables, laptops, tablets, audio equipment, and various IoT solutions. The company also offers electric scooters under the Xiaomi Electric Scooter series, which includes models, such as the Electric Scooter 4 Lite and Electric Scooter 4 Pro, known for their powerful motors, impressive battery life, and user-friendly designs aimed to enhance the commuting experience.

Key Electric Kick Scooter Companies:

The following are the leading companies in the electric kick scooter market. These companies collectively hold the largest market share and dictate industry trends.

- Jiangsu Xinri E-Vehicle Co. Ltd.

- Bird Rides, Inc

- iconBIT

- Niu International

- Razor USA LLC

- SEGWAY INC.

- SWAGTRON

- Xiaomi

- Yadea Technology Group Co., Ltd.

Recent Developments

-

In July 2024, NIU International unveiled the new KQi 100 series of electric kick scooters to be available throughout the U.S. at retailers, such as Best Buy, Kohl's, and Walmart. The KQi 100 series combines affordability, quality, and advanced technology, offering performance and features typically found in more expensive mid-tier scooters.

-

In April 2022, Bird Rides, Inc integrated its e-scooter service into Jelbi, the official mobility app operated by the BVG, the public transport company of Berlin, Germany. The partnership aimed to increase access to sustainable transportation options across Berlin by allowing Jelbi users to locate, unlock, and pay for the company’s scooters directly within the app.

Electric Kick Scooter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.99 billion

Revenue forecast in 2030

USD 12.27 billion

Growth rate

CAGR of 11.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Battery type, drive type, product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Jiangsu Xinri E-Vehicle Co. Ltd.; Bird Rides, Inc; iconBIT; Niu International; Razor USA LLC; SEGWAY INC.; SWAGTRON; Xiaomi; Yadea Technology Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Kick Scooter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric kick scooter market report based on battery type, drive type, product, end use, and region:

-

Battery Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lead-acid Battery

-

Lithium-ion Battery

-

Others

-

-

Drive Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Belt Drive

-

Chain Drive

-

Hub Motors

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Standard

-

Folding

-

Self-balancing

-

Maxi

-

Three wheeled

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric kick scooter market size was estimated at USD 5.93 billion in 2024 and is expected to reach USD 6.99 billion in 2025.

b. The global electric kick scooters market is expected to grow at a compound annual growth rate of 11.9% from 2025 to 2030 to reach USD 12.27 billion by 2030.

b. The demand for lithium-ion battery scooters accounted for over 92% of the overall revenue share in 2024. Performance and environmental advantages of Li-Ion batteries over lead acid batteries are expected to position Li-Ion technology as the global mainstream battery technology for electric kick scooters over the coming years.

b. The prominent players in the global electric kick scooter market are YADEA Technology Group Co., Ltd, NIU International, SEGWAY INC., Bird Rides, Inc., Jiangsu Xinri E-Vehicle Co. Ltd., Xiaomi among others.

b. Rising awareness about the environmentally friendly transportation, fluctuating fuel prices, and increasing demand for the easy short distance commuting is fueling the growth of the electric scooter market. Besides, increasing investment on developing bike lanes in the emerging economies of the world is driving the growth of the electric kick scooter market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.