- Home

- »

- Automotive & Transportation

- »

-

Electric Scooters Market Size, Share, Industry Report, 2033GVR Report cover

![Electric Scooters Market Size, Share & Trends Report]()

Electric Scooters Market (2025 - 2033) Size, Share & Trends Analysis Report By Drive, By Battery, By Product (Folding, Self-balancing, Maxi, Three-wheeled), By Battery Fitting (Detachable, Fixed), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-196-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Scooters Market Summary

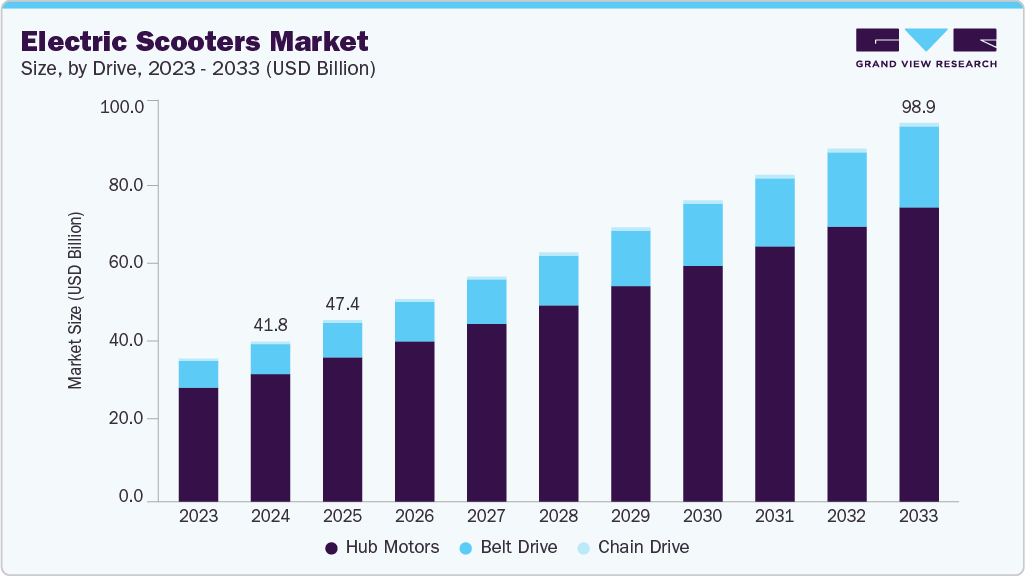

The global electric scooters market size was estimated at USD 41.78 billion in 2024, and is projected to reach USD 98.96 billion by 2033, growing at a CAGR of 9.6% from 2025 to 2033. The increasing demand for fuel-efficient vehicles, coupled with growing concerns over greenhouse gas and carbon emissions, is anticipated to drive the adoption of electric scooters (e-scooters) over the forecast period.

Key Market Trends & Insights

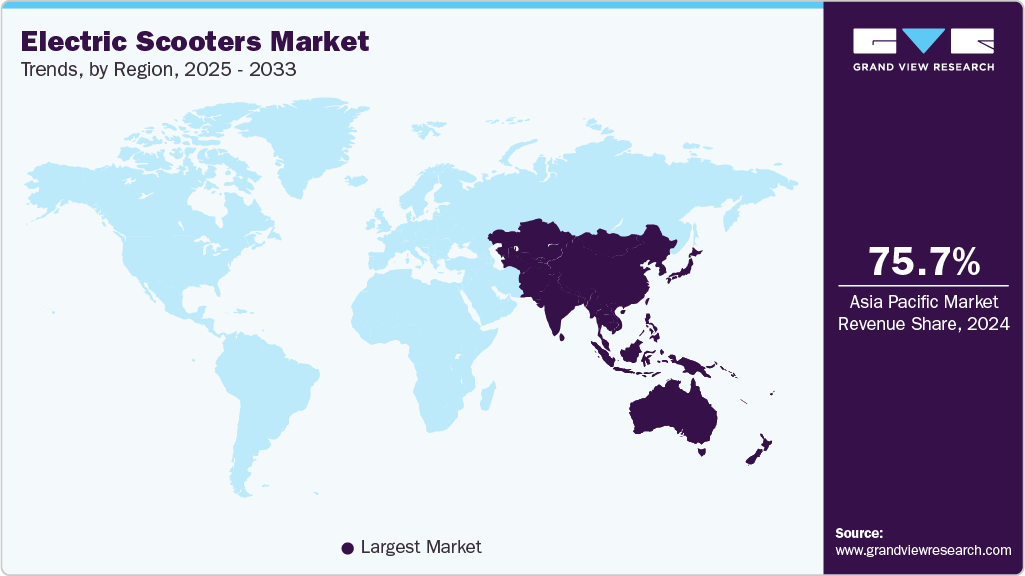

- Asia Pacific dominated the electric scooters market with the largest revenue share of 75.7% in 2024.

- The electric scooters industry in China accounted for the largest market revenue share in 2024.

- By drive, the hub motors segment led the market with the largest revenue share of 79.6% in 2024.

- By battery, the Li-ion segment accounted for the largest market revenue share in 2024.

- By product, the standard segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 41.78 Billion

- 2033 Projected Market Size: USD 98.96 Billion

- CAGR (2025-2033): 9.6%

- Asia Pacific: Largest market in 2024

Stringent emission norms by the government agencies, such as emission standards for greenhouse gas (GHG) emissions by the U.S. Environmental Protection Agency (EPA), BS-VI in India, and China VI, are driving the market for electric scooters.Besides, the electric scooters have high mechanical efficiency, offer quieter operations, and require low maintenance over the conventional counterparts; thus, electric scooters are gaining consumer traction in the market. In addition, the inclusion of electric scooter fleets in shared mobility and vehicle renting ecosystems is propelling the demand for the electric scooters industry.

The COVID-19 pandemic has led to a global economic slowdown. Lockdown implementations in various parts of the world aimed to curb the spread of the virus led to supply chain disruptions and a temporary halt in manufacturing activities. The electric scooters became particularly vulnerable due to their dependency on global sourcing for the materials and components of their batteries. In addition, the initial purchase cost of electric vehicles is more significant than their gas-powered and hybrid counterparts, which further impacts the growth of electric scooters in the emerging economies of the world. However, post-pandemic, increasing government initiatives, such as tax rebates and policy changes, have resulted in a surge in demand for electric scooters.

Increasing adoption of electric scooter sharing services in countries such as Spain, the U.S., Germany, and France has spurred the demand for battery-powered two-wheelers. Companies such as Razor, Lime, Bird, Jump, and Spin offering e-scooter sharing services are procuring these vehicles mainly from manufacturers such as Xiaomi, Gogoro, Inc., and Ninebot-Segway. The penetration of these sharing services is witnessing a growth in the adoption rate. Moreover, increasing monetary and non-monetary incentives are encouraging the adoption of battery-operated two-wheelers. Moreover, the need for sustainable urban mobility and smart transportation infrastructure is driving the transition from conventional to electric modes of transport.

The participation of vehicle manufacturers and governments in meeting the standards for zero emissions is significantly contributing to reducing the carbon emission gap by 2030. Furthermore, the issue of battery charging electric scooters is mitigated by the increasing interest in building renewable energy stations and the adoption of updated technologies, such as vehicle-to-grid technologies and smart charging.

Moreover, governments across the globe have formulated several policies to increase the penetration of electric scooters in the market. The government offers various benefits to consumers and manufacturers in the form of subsidies. For instance, in the U.S., the Corporate Average Fuel Economy (CAFÉ) standards are increasing the adoption of energy-efficient automobiles by framing regulations for enhancing the utilization of alternative fuel vehicles and the reduction of fossil fuel consumption. Similarly, the Canadian government is developing a strategy to reduce the country’s greenhouse gas emissions and increase the number of zero-emission vehicles. Besides this, the swift adoption of scooter-sharing services has triggered the demand for battery-powered two-wheelers. This, in turn, creates a highly conducive environment for the growth of the electric scooter industry.

Drive Insights

The hub motors segment led the market with the largest revenue share of 79.6% in 2024 and is expected to grow at a significant CAGR during the forecast period. The hub drives offer efficient power transmission, quieter operations, and lower repair & maintenance costs compared to their counterparts in the market. This is encouraging prominent players in the electric scooter market, such as Yadea Technology Group Co., Ltd., NIU International, and Yamaha Motor Corporation, among others, to offer a range of hub-drive electric scooters in the market.

The belt drive segment is expected to grow at the fastest CAGR during the forecast period. The segmental growth is attributed to its advantages, including low maintenance, longevity, and lighter weight. Belt drive electric scooters offer better performance, enhanced pickup, infinite gear ratios, and protect the electric scooter from overloading and slips. Thus, belt-drive scooters are expected to experience higher implementation adoption.

Battery Insights

The Li-ion batteries segment accounted for the largest market revenue share in 2024, due to their superior energy density, lighter weight, longer lifecycle, and declining cost curve. OEMs across Asia, Europe, and North America have shifted almost entirely toward Li-ion chemistries such as LFP and NMC, enabling higher range and lower maintenance compared to lead-acid batteries. Their widespread adoption in both entry-level and premium electric scooters solidifies Li-ion as the dominant battery type through the forecast period.

The “Other” battery category, primarily solid-state, sodium-ion, and next-generation chemistries, is projected to record at the fastest CAGR during the forecasted period. This growth is driven by major innovations aimed at improving safety, charging speed, and cost efficiency. Although still emerging, these technologies are gaining momentum due to strong R&D investments, pilot deployments in Asia and Europe, and the push for alternatives to conventional lithium-based chemistry. Their small base and rapid technological improvement result in the fastest growth rate.

Product Insights

The standard segment accounted for the largest market revenue share in 2024, supported by broad consumer adoption for daily commuting, shared mobility fleets, and delivery services. Their affordability, consistent performance, and suitability for urban transportation make them the highest-volume product category. The wide presence of mid-range and commuter-focused models across all regions solidifies this segment’s leadership position.

The folding electric scooter segment is expected to grow at the fastest CAGR during the forecast period, due to rising demand for portable, lightweight, and last-mile mobility solutions. Urban professionals, students, and micro-mobility users prefer compact and easy-to-carry designs, especially in congested cities. Growing integration with multimodal transport (metro, buses, and offices) and rapid adoption in Europe and Asia significantly accelerates this segment’s growth momentum.

Battery Fitting Insights

The fixed batteries segment accounted for the largest market revenue share in 2024, supported by their use in mass-produced, cost-focused electric scooters. This design offers stability, lower upfront costs, and simpler assembly for manufacturers. Fixed battery configurations dominate in markets where charging at home or at designated points remains the primary mode of energy replenishment.

The detachable (removable/swappable) batteries segment is expected to register at the fastest CAGR during the forecast period, driven by the expanding popularity of battery-swapping ecosystems and Battery-as-a-Service (BaaS) models. These batteries solve range anxiety and charging-time barriers, making them highly suitable for dense cities and delivery fleets. The rapid growth of swapping infrastructures in India, China, and Southeast Asia, along with OEM partnerships supporting standardized removable battery systems, positions this segment as the fastest-growing over the forecast period.

End-use Insights

The personal segment accounted for the largest market revenue share in 2024 and is projected to grow at a significant CAGR over the forecast period. Electric scooters are changing the landscape of personal vehicles, as the scooters are eco-friendly, affordable, lightweight, low-maintenance, and easily maneuverable; they are widely preferred over other electric counterparts. In addition, electric scooters are popular among millennials and low to middle-income groups. Many manufacturers are integrating connected vehicle technology into these scooters to provide an initiative driving experience. Moreover, the increasing focus of electric scooter manufacturers on developing private charging stations or designated spots to charge electric scooters is expected to boost the adoption of e-scooters among consumers.

The commercial segment is expected to witness at the fastest CAGR of 12.6% during the forecast period. Electric scooters are an economical and viable option for last-mile delivery in commercial applications, such as factories, universities, warehouses, and industrial sites with large land areas. E-scooters may be an option for efficient and fast transportation. As the trend of shared mobility gains traction, many vehicle rental facilities are increasing the number of e-scooters that can be used on per-mile or time-based packages for long-distance commutes, thus contributing to segmental growth.

Regional Insights

The North America electric scooters market is undergoing a structural shift in electric scooter usage, transitioning from the earlier chaotic, high-churn shared mobility deployments in downtown cores toward more organized, suburban-first commuting models. Operators are forming partnerships with corporate campuses, universities, and transit agencies, which are changing product requirements; fleets are increasingly demanding long-range, durable, and easily serviceable scooters instead of lightweight, short-trip rentals. This shift is supported by industry forecasts projecting North America’s steady multi-billion-dollar market growth ahead, driven by maturing fleet monetization and predictable replacement cycles. As a result, manufacturers must now optimize for reliability, battery-swapping support, and suburban depot charging, which are becoming more important than curbside collection models that once dominated the region.

U.S. Electric Scooters Market Trends

The electric scooters market in the U.S. is anticipated to grow at a significant CAGR during the forecast period. In the U.S., the biggest market driver is the fragmented regulatory landscape, which forces manufacturers and operators to localize hardware and firmware for different states. Some states enforce strict power and speed caps. In contrast, others allow higher-powered scooters for personal or suburban use, resulting in a differentiated product market where OTA-locked speed modes, tamper-proof throttles, and modular compliance features are key selling points. This patchwork, validated by state-by-state legal classification updates, is pushing brands to offer region-specific SKUs and compliance roadmaps rather than one-size-fits-all scooters. The U.S. market increasingly rewards players that can adapt product specifications to regulatory nuances as much as they can optimize battery range or price.

Europe Electric Scooters Market Trends

The electric scooters market in Europe was identified as a lucrative region in 2024. Europe has become the regulatory laboratory for the global micro mobility industry. Heavy municipal intervention, through licensing, fleet caps, geo-fencing, and mandatory safety telemetry, has pushed operators into a new era of professionalization. Fleets now require high-grade telematics, predictive maintenance protocols, and real-time data-sharing with transit authorities. Countries such as the UK have maintained extended rental-trial frameworks that require operators to demonstrate robust safety performance and fleet discipline to retain permits, which is shaping Europe into a region where strong municipal relationships matter more than raw fleet size. Consequently, Europe is evolving into the most compliance-first market globally, rewarding operators who invest early in data, safety, and integration with public transit APIs.

The Germany electric scooters market exhibits a distinct dual-speed market profile. On the one hand, premium commuter-focused scooters are gaining traction among affluent urban professionals who demand long range, robust build quality, and integrated analytics. On the other hand, German cities are increasingly incorporating electric scooters into urban logistics pilots, particularly for last-mile parcel delivery, where telematics, serviceability, and charging-dock integration become critical. Supported by forecasts indicating a healthy medium-term CAGR, Germany’s market shows a decisive move toward premiumization and logistics-grade performance. Brands that can integrate with logistics-routing platforms and offer German-grade reliability are positioned to lead.

The electric scooters market in the UK continues to operate under a rolling rental-trial framework rather than permanent national regulation, which has produced a market defined by caution among investors but discipline among operators. The repeated trial extensions have delayed long-term capex commitments. Yet, they have simultaneously forced operators to focus intensely on fleet safety, utilization, and data reporting to justify continued access to cities. As a result, the UK electric scooter market is consolidating around a few highly compliant operators that excel in municipal engagement, safety telemetry, and multimodal integration with buses and rail. This unique policy environment ensures that the operators with the strongest compliance records, not necessarily the largest fleets, capture long-term advantage.

Asia Pacific Electric Scooters Market Trends

Asia-Pacific dominated the global electric scooters market with the largest revenue share of 75.7% in 2024 and is expected to grow at the fastest CAGR during the forecast period. APAC is the world’s most diverse micromobility ecosystem, functioning as a multi-speed laboratory for electric scooter innovations. China and India anchor the region with their sheer scale, while Southeast Asian markets flourish through affordability-driven consumer adoption and the growth of delivery fleets. Meanwhile, premium micromobility solutions are emerging in Japan, Singapore, and Australia, where technology-driven safety features and compact vehicle formats are dominant. APAC’s dynamic policy experimentation, from battery-swapping pilots in India and China to city-specific subsidies, makes the region highly fragmented but simultaneously fast-growing. As industry outlooks confirm strong regional expansion, with China forming the largest base and India delivering the fastest growth, the APAC region demands tailored, country-specific strategies rather than a unified playbook.

The electric scooters market in China is evolving from volume-centric manufacturing to a market defined by value, safety improvements, and stronger quality differentiation. Tightening safety norms, particularly in battery and thermal standards, is prompting manufacturers to enhance design integrity, integrate more advanced BMS systems, and strengthen domestic supply chains. Consolidation trends within Chinese manufacturers emphasize compliance and quality, helping eliminate ultra-low-cost products that fail to meet evolving national standards. This quality-driven shift is enabling Chinese brands not only to dominate the domestic market but also to expand global exports with improved safety credentials and enhanced battery technology offerings.

The Japan electric scooters market remains a premium, slow-and-steady adopter of electric scooters, guided by regulatory caution and consumer demand for compact, high-quality engineering. Japanese cities, with their narrow streets and quiet residential zones, favor smaller-form, highly reliable scooters designed for low-noise operation and long battery life. Local governments and industry players are actively conducting controlled pilots for last-mile logistics in retail, hospitality, and parcel delivery, with a focus on operational efficiency and safety. Market forecasts indicate stable, moderate growth driven by affluent consumers, stringent build-quality expectations, and methodical regulatory endorsement.

The electric scooters market in India is anticipated to grow at the fastest CAGR during the forecast period, characterized by a powerful combination of consumer adoption and the electrification of commercial fleets. Government incentives, such as FAME subsidies, have historically boosted demand. However, recent subsidy adjustments in 2024 briefly moderated growth, but the market rebounded through strong localized manufacturing and rising demand from delivery fleets. India’s adoption patterns are deeply affected by affordability, widespread two-wheeler culture, and the rapid expansion of battery-swapping and BaaS models. OEMs that localize production, integrate supply chains, and remain resilient against policy fluctuations are best positioned to capture India’s large and rapidly scaling market.

Key Electric Scooters Company Insights

Some of the major players in the global electric scooters industry include AllCell Technologies LLC, BMW Motorrad International, BOXX Corp., Gogoro Inc., Green Energy Motors Corp., Greenwit Technologies Inc., Honda Motor Co. Ltd., Jiangsu Xinri E-Vehicle Co., Ltd., KTM AG, and Mahindra GenZe, among others, driven by their advancements in battery engineering, platform innovation, intelligent power management systems, lightweight chassis designs, and high-performance urban mobility solutions. These companies continue to strengthen their market position through investments in next-generation lithium-ion and solid-state battery technologies, enhanced thermal management systems, modular scooter architectures, and IoT-enabled connectivity features. Their strategic collaborations with battery suppliers, charging-network providers, and city governments further support large-scale deployments, sustainable mobility transitions, and expansion into both consumer and commercial e-scooter segments worldwide.

-

AllCell Technologies is recognized for its advanced lithium-ion battery pack engineering, especially for e-scooters requiring enhanced safety and durability. The company’s proprietary phase change material (PCM) thermal management system significantly improves battery longevity and reduces risks associated with overheating, an essential requirement for high-demand urban fleets. AllCell collaborates with leading electric scooter OEMs and fleet operators who rely on its robust thermal solutions to extend battery life cycles, optimize performance, and improve ride safety. Its expertise in custom battery design and scalable pack manufacturing positions it as a critical supplier for premium and commercial electric scooter platforms globally.

-

BMW Motorrad brings premium engineering and automotive-grade safety standards to the electric scooter market, most notably through its high-end models such as the CE series, which feature powerful drivetrains, automotive-tier electronics, and advanced urban-mobility ergonomics. BMW leverages decades of motorcycle innovation to offer e-scooters with superior ride stability, regenerative braking, and integrated digital dashboards. With strong brand equity and a global dealership network, BMW Motorrad plays a growing role in the premium e-mobility segment, targeting commuters seeking a combination of performance, safety, and luxury in electric two-wheel transportation.

Key Electric Scooters Companies:

The following are the leading companies in the electric scooters market. These companies collectively hold the largest market share and dictate industry trends.

- AllCell Technologies LLC

- BMW Motorrad International

- BOXX Corp.

- Gogoro, Inc.

- Green Energy Motors Corp.

- Greenwit Technologies Inc.

- Honda Motor Co. Ltd.

- Jiangsu Xinri E-Vehicle Co., Ltd.

- KTM AG

- Mahindra GenZe.

Recent Developments

-

In December 2023, Gogoro, a Taiwanese player, unveiled the Gogoro CrossOver GX250 domestically produced electric scooter in India. The company offers a tailor-made scooter to Indian riders. The introduction of these models marked a strategic move for Komatsu to tap into the Indian electric scooter market.

-

In September 2023, Bird, a key player in the electric micro mobility market, acquired Spin, an electric scooter and e-bike rental company, for USD 19 million. This acquisition has reduced bird competition and aided in maintaining the company’s dominance in the market.

Electric Scooters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.42 billion

Revenue forecast in 2033

USD 98.96 billion

Growth rate

CAGR of 9.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drive, battery, product, battery fitting, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AllCell Technologies LLC; BMW Motorrad International; BOXX Corp.; Gogoro, Inc.; Green Energy Motors Corp.; Greenwit Technologies Inc.; Honda Motor Co. Ltd.; Jiangsu Xinri E-Vehicle Co., Ltd.; KTM AG; Mahindra GenZe.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Scooters Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electric scooters market report based on drive, battery, product, battery fitting,end-use, and region:

-

Drive Outlook (Revenue, USD Billion, 2021 - 2033)

-

Belt Drive

-

Chain Drive

-

Hub Motors

-

-

Battery Outlook (Revenue, USD Billion, 2021 - 2033)

-

Lead Acid

-

Li-Ion

-

Other

-

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Standard

-

Folding

-

Self-Balancing

-

Maxi

-

Three-wheeled

-

-

Battery Fitting Outlook (Revenue, USD Billion, 2021 - 2033)

-

Detachable

-

Fixed

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric scooters market size was estimated at USD 41.78 billion in 2024 and is expected to reach USD 47.42 billion in 2025.

b. The global electric scooters market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2033 to reach USD 98.96 billion by 2033.

b. Asia Pacific dominated the electric scooters market with a share of 75.7% in 2024. Most electric scooter manufacturers have emerged from China, Taiwan, and Japan, acquiring the largest share all over the world.

b. Some key players operating in the electric scooters market include Mahindra GenZe; BMW Motorrad International; Vmoto Limited; Terra Motors Corporation; Gogoro Inc.; and Jiangsu Xinri Electric Vehicle Co. Ltd.

b. The increasing demand for fuel-efficient vehicles, coupled with growing concerns over greenhouse gas and carbon emissions, is anticipated to drive the growth of the electric scooters market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.