- Home

- »

- Electronic Devices

- »

-

Electric Motor Sales Market Size And Share Report, 2030GVR Report cover

![Electric Motor Sales Market Size, Share & Trends Report]()

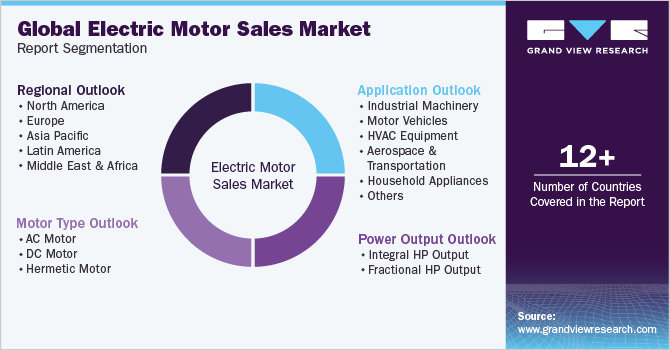

Electric Motor Sales Market Size, Share & Trends Analysis Report By Application, By Power Output (Integral HP Output, Fractional HP Output), By Motor Type (Hermetic, AC, DC), By Power Rating, By Voltage (Low, Medium, High), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-662-2

- Number of Report Pages: 94

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2021 - 2030

- Industry: Semiconductors & Electronics

Electric Motor Sales Market Size & Trends

The global electric motor sales market size was valued at USD 182.65 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2024 to 2030. An increase in awareness regarding green vehicles among customers has been a key factor driving the market. Besides this, a rising number of government incentives to encourage sales of green vehicles for safeguarding the environment from carbon emissions is expected to provide a fillip to the market. Electric motors have been observing several advancements in technology over the past few years, owing to which its demand is gaining traction. Additionally, the advent of better insulation materials has improved operational efficiency and the product's life, which has subsequently driven the market. The market is estimated to witness noteworthy growth over the forecast period owing to an increase in automobile production over the forecast period.

The product is used in fans, pumps, compressors, machine tools, domestic appliances, electric cars, HVAC applications, power tools, and automated robots. These high-efficiency motors are gaining importance, owing to various factors. These include long operating life, low maintenance, energy consumption, and a high tolerance for fluctuating voltages, thus enabling cost savings. Countries such as Brazil, the U.S., Argentina, China, and India are major markets, with a high adoption rate for energy-efficient products in both the industrial and agricultural sectors.

The demand for energy-efficient motors is driven by rising electricity prices and stringent electricity consumption standards. Additionally, stringent manufacturing and designing standards for improving their efficiency are further mandating manufacturers to develop efficient products. The market is gradually shifting towards the adoption of efficient motorized systems. However, lack of awareness about their advantages and high initial purchase cost are keeping the market from realizing its utmost potential.

Environmental benefits offered by electric motors are boosting their implementation in electric vehicles. These machines aid in augmenting a device’s efficiency, as compared to standard ones, and saving costs related to energy consumed. Moreover, rising responsiveness towards environmental changes and the greenhouse effect is anticipated to shift consumers’ focus towards electric type, which is projected to bolster the demand. The need for low power consumption and improved efficiency products is poised to fuel the demand for the product over the next few years.

Market Concentration & Characteristics

The electric motor sales market growth stage is moderate. There has been a significant amount of innovation in the electric motor sales sector in recent years. One of the main forces has been the development of technology, especially in the area of electric motor design and efficiency. The industry has witnessed a shift toward motor solutions that are more ecologically friendly and energy-efficient, with an emphasis on increasing overall cost-effectiveness and performance. Smart technology integration is spreading, providing end users with more options for monitoring and control. One such instance is IoT-enabled motors with predictive maintenance capabilities.

The industry has experienced a moderate to high level of M&A activities driven by factors such as the pursuit of technological capabilities, market expansion, and consolidation efforts among key players. The market has grown, major firms have been attempting to consolidate, and the industry has seen a moderate to high level of M&A activity due to these and other reasons. Strategic partnerships have frequently been formed as a result of M&A activity in order to expand product portfolios, open up new markets, and realize economies of scale. As businesses look to remain competitive in a market that is changing rapidly, partnerships and acquisitions are predicted to remain prominent.

The market for electric motor sales is significantly impacted by regulations, which also have an effect on market dynamics and product development. Manufacturers have had to make investments in producing motors that meet environmental restrictions and strict energy efficiency criteria. Adoption of high-efficiency electric motors is being encouraged by initiatives that support sustainable practices and reduce carbon footprints. It is now essential for market participants to adhere to international standards, such as the IE (International Efficiency) classifications.

Alternative technologies, such as piezoelectric and hydraulic systems in some specialized applications, are becoming more widely recognized even if electric motors still dominate the market. The development of these alternative technologies might put conventional electric motors at risk, particularly in sectors with special needs. On the other hand, alternatives to electric motors exhibit more niche-oriented competition rather than a broad market displacement, which is partly explained by the adaptability and extensive use of electric motors across multiple sectors.

The electric motor sales market exhibits varying degrees of end-user concentration, depending on the industry and application.Depending on the industry and application, the electric motor sales market shows different levels of end-user concentration. There may be a high end-user concentration in certain industries due to a limited number of large industrial users making up a sizable portion of the revenue. Electric motor suppliers are more sensitive to the requirements and needs of these important clients as a result of this circumstance. One of the most important ways to reduce the hazards associated with excessive end-user concentration is to customize products to satisfy unique end-user requirements and practice diversification.

Motor Type Insights

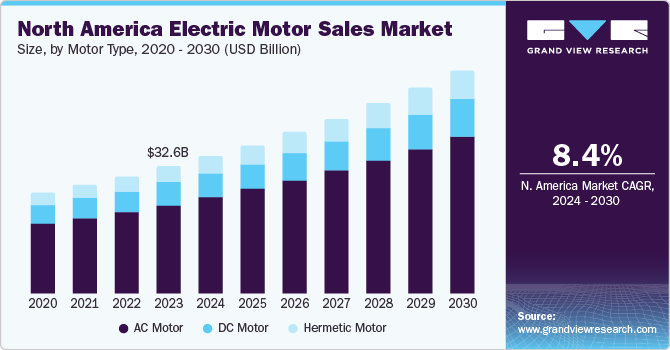

In terms of revenue, the AC motor segment dominated the electric motor market and accounted for the largest revenue share of more than 70.0% in 2023. This high share is attributable to AC motors' extensive applications ranging from irrigation pumps to modern-day robotics. Furthermore, they are smaller, cheaper, and lighter in weight and are also extensively used in HVAC equipment. The adoption of electric AC motors in the automotive industry has increased exponentially, owing to the advent of highly efficient and low-cost electronics, accompanied by improvements in permanent magnetic materials. Increasing demand for them in various industries, including chemicals, paper and pulp, cement, and wastewater treatment, is likely to further contribute to the growth of the segment. Growing sales of electric vehicles and the subsequent scope of the machine type are also expected to spur the segment's growth over the forecast period.

The burgeoning popularity of vehicle features such as motorized seats, adjustable mirrors, and sunroof systems are fueling the demand for brushless DC motors. DC types are used for variable speed control applications in industrial machinery and equipment and electronic toys. Brushless DC motors are widely used owing to their low cost of maintenance, thus, generating higher revenue in the DC segment. However, the hermetic type is estimated to witness the highest CAGR of exceeding 8.5% from 2024 to 2030, owing to ease of handling, less maintenance, and easy transportation. The segment's growth can also be attributed to increasing demand from HVAC system manufacturers backed by suitability in such applications.

Power Output Insights

In terms of revenue, the Fractional Horsepower (FHP) output segment dominated the market and accounted for the largest revenue share of more than 86.0% in 2023. This high share is attributable to its wide array of use-cases in all household appliances, ranging from vacuum cleaners to coffee machines and refrigerators. They are also used in industrial equipment as they prove to be suitable for operations in a heavy industrial environment. These motors have numerous advantages, including high starting torque and stability over electric current fluctuations.

Furthermore, the energy efficiency provided by FHP motors is higher than its counterparts, which is poised to translate into greater demand from industrial users willing to replace existing machines with more efficient ones. However, the Integral Horsepower (IHP) output segment is expected to witness the highest CAGR from 2024 to 2030. The high growth of this segment is attributable to the increasing demand for these motors for industrial applications. IHP motors provide more power to the machines and devices, which drives its demand from high-end applications in the aerospace and transportation industry.

Power Rating Insight

In terms of revenue, the 2.2 kW to 375 kW segment dominated the electric motor sales market in 2023. These electric motors find widespread use in heavy-duty industrial processes, manufacturing equipment, and large-scale machinery. This segment is anticipated to retain its dominance over the forecast period. The rising industrial automation and the adoption of advanced manufacturing technologies are driving demand for high-power electric motors in various industries such as automotive, aerospace, manufacturing, and energy. Additionally, increasing investments in infrastructure development projects, particularly in emerging economies, are driving the demand for electric motors with higher power ratings. Moreover, the growing emphasis on energy efficiency and sustainability is encouraging industries to replace traditional combustion engines with electric motors across a wide range of applications.

The 1 kW to 2.1 kW segment in the electric motor sales market is experiencing rapid growth and is anticipated to grow at the fastest CAGR from 2024 to 2030. The surge in the adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is fueling the demand for low to medium-power electric motors used in propulsion systems, power steering, and auxiliary systems. As the automotive sector transitions towards electrification to mitigate emissions and enhance fuel efficiency, the need for electric motors within this power range is projected to scale significantly. In addition, the rising demand for household appliances, consumer electronics, and HVAC systems is fueling the growth of the 1 kW to 2.1 kW segment. Electric motors in this power range are used in refrigerators, washing machines, air conditioners, fans, and other household appliances, driving market expansion. Furthermore, technological advancements in motor design, miniaturization, and energy management systems are enhancing the performance and efficiency of low to medium-power electric motors, further driving market growth.

Voltage Insight

In terms of revenue, the medium voltage (Between 690 V to 45 kV) segment dominated the electric motor sales market in 2023 owing to several key factors, including increasing industrialization, growing urbanization worldwide, and expansion of renewable energy infrastructure. These motors are essential for powering heavy-duty machinery, pumps, compressors, and HVAC systems in industrial and commercial settings. Moreover, investments in smart grid technology and grid modernization initiatives are driving the adoption of medium-voltage electric motors in utility and energy management applications. These motors are used in transformers, switchgear, and distribution systems to ensure reliable and efficient power distribution, voltage regulation, and load management, contributing to the growth of this segment.

The low voltage segment, encompassing electric motors below 690 V, is experiencing robust growth in the electric motor sales market and is anticipated to grow at the fastest CAGR from 2024 to 2030. The widespread adoption of automation and industrial robotics across manufacturing, automotive, and consumer goods sectors is driving demand for low-voltage electric motors. These motors are integral components in conveyor systems, packaging machinery, assembly lines, and robotic arms, supporting efficient production processes and enhancing productivity. Additionally, advancements in motor design, materials, and control systems are driving innovation in low-voltage electric motors, leading to improved performance and reliability, thus fueling the growth of the market.

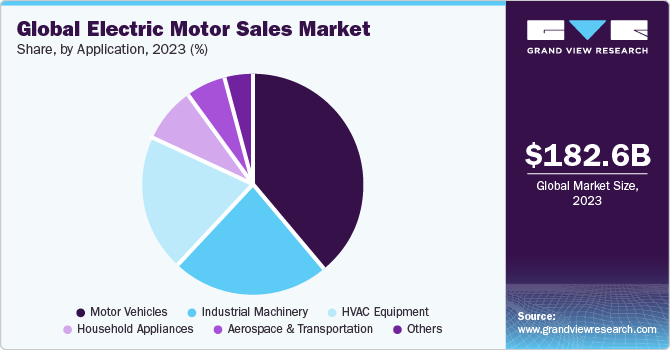

Application Insights

In terms of revenue, the motor vehicles segment dominated the electric motor sales market and accounted for the largest revenue share of 39.3% in 2023. This high share is attributable to the increased adoption of electric motors in the automotive industry. An average commercial car has more than 40 electric motors ranging from low power to high. Further, the advent of low-cost and highly efficient electronics, coupled with improvements in permanent magnetic materials, drives the market in the automotive industry. Rising fuel prices and pollution are leading to a rapid increase in the demand for electric vehicles in developed and emerging economies such as Germany, the U.S., China, and Japan. Thus, the high demand for electric motors from the electric vehicle industry drives the market significantly.

Electric motors are extensively used in heavy industrial equipment as well as agricultural types of machinery and vehicles. Countries, including Brazil, Vietnam, Sri Lanka, Argentina, and India, have a substantial population relying on agriculture. Therefore, the demand for low-cost and energy-efficient products has increased in these countries. The HVAC equipment, such as commercial and industrial air conditioners, relies heavily on electric motors. The segment is poised to experience the fastest growth at a CAGR of 10.0% from 2024 to 2030. Rising applications of electric motors in various residential and office buildings, hotels, and warehouses, are likely to encourage the growth of the segment.

Regional Insights

Asia Pacific Electric Motor Sales Market Regional Trends

Asia Pacific dominated the electric motor market and accounted for the largest revenue share of more than 50.0% in 2023. This is attributable to advancements in the agriculture sector and enormous investments in industrialization in countries, including China, India, South Korea, and Australia. Further, the increasing production and sales of electric vehicles in countries including China and Japan as well as the presence of established OEMs such as Honda Motor Co., Ltd., Hyundai Motor Company, Toyota Industries Corporation, and Nissan Motor Corporation are estimated to boost the growth prospects of the market in this region. The market is expected to witness the highest CAGR from 2024 to 2030.

The electric motor sales market in China is driven by surging electric vehicle adoption within the country. Moreover, the focus on Industry 4.0 and automation fuels the demand for specialized industrial motors in key sectors like manufacturing and robotics.

The electric motor sales market in India is propelled by an increasing focus on electric mobility and renewable energy adoption across various sectors. Government initiatives such as the Faster Adoption & Manufacturing of Hybrid & Electric Vehicles (FAME) scheme and incentives for electric vehicle manufacturers are boosting the demand for electric motors in India.

Followed by Asia Pacific, Europe and North America region held a high market share in 2023 and are witnessing rising demand for the product. These regions are the largest market for premium efficiency motors, which are used in HVAC, industrial applications, and electric cars. Growth opportunities for the market in Latin America and the Middle East and Africa are projected to rise soon, owing to increasing government funding. The rising demand for motors from the oil and gas industry, rapid development in the mining industry, and significant demand for cement across the construction industry are benefitting the market in these regions.

Europe Electric Motor Sales Market Regional Trends

The electric motor sales market in Europe is driven by several factors, including government initiatives that support incentives and regulations promoting clean transportation, which leads to the adoption of electric vehicles and motors. The focus on reducing carbon emissions and the development of charging infrastructure also contribute to the growth of the electric motor sales market in Europe. The demand for electric motors in the European market is primarily fueled by key countries such as the U.K., Germany, and France.

The electric motor sales market in the U.K. is growing due to stringent carbon emission norms pushing the focus of the U.K. government to ban the sale of new petrol and diesel cars by 2030, accelerating the adoption of electric vehicles and, thus, electric motors. Further, the expansion of offshore wind farms creates demand for specialized, high-power electric motors for turbines.

The electric motor sales market in Germany is growing at a significant CAGR because the country has a strong industrial base with a focus on advanced manufacturing that necessitates high-performance and precision electric motors.

The electric motor sales market in France is witnessing continuous demand due to increasing reliance on nuclear power plants, which are equipped with specialized motors for maintaining and upgrading the existing infrastructure. Moreover, government investments in public transportation and smart cities create opportunities for motors in urban infrastructure.

North America Electric Motor Sales Market Regional Trends

The electric motor sales market in North America is driven by collaborations between automakers, technology companies, and charging infrastructure providers. These partnerships aim to accelerate the adoption of electric vehicles and enhance the overall ecosystem, including charging infrastructure and battery technology.

The growth of the electric motor sales market in the U.S. is propelled by various factors, including tax incentives for electric vehicle purchases, investments in charging infrastructure, and consumer awareness regarding environmental issues.

Middle East & Africa Electric Motor Sales Market Regional Trends

The electric motor sales market in the Middle East and Africa is driven by the rising demand for motors from the oil and gas industry, rapid development in the mining industry, and significant demand for cement across the construction industry. Moreover, government initiatives to build smart cities present opportunities for motors in electric vehicles, renewable energy, and smart infrastructure. The demand for electric motors in the Middle East & African market is primarily fueled by key countries such as the KSA, UAE, and South Africa.

The electric motor sales market in KSA is anticipated to grow at a significant CAGR owing to the rapid shift towards downstream processing and petrochemical production that creates demand for specialized motors for complex industrial applications.

Key Companies & Market Share Insights

-

Some of the key players operating in the market include Ametek, Inc. and ABB Ltd. among others.

-

Ametek Inc. is a leading global manufacturer of electronic instruments and electromechanical devices, with a significant presence in the Electric Motor Sales market. The company specializes in the design and production of precision motion control solutions, including high-performance motors and drive systems. Ametek's commitment to innovation and advanced technologies has established it as a key player in the industry.

-

ABB Ltd. is a renowned multinational corporation known for its expertise in power and automation technologies. In the Electric Motor Sales market, ABB offers a comprehensive range of motors, drives, and control solutions. The company's commitment to sustainability and energy efficiency aligns with the growing demand for eco-friendly electric motors. ABB's global reach and extensive research and development capabilities make it a prominent choice for customers seeking reliable and advanced electric motor solutions.

-

Allied Motion Technologies, Inc. and Franklin Electric Co., Inc. are some of the emerging market participants in the target market.

-

Franklin Electric Co., Inc. is a well-established and globally recognized company specializing in the manufacturing and distribution of water and fuel pumping systems, including electric motors. The company provides a wide range of reliable and energy-efficient electric motors designed for various applications such as groundwater pumping, residential water systems, irrigation, and industrial processes.The company's dedication to quality, technological advancement, and customer satisfaction reinforces its position as a reliable provider of electric motor solutions in the ever-evolving marketplace.

- Allied Motion Technologies, Inc. is a dynamic company that specializes in the design and manufacturing of motion control products. With a focus on precision and innovation, Allied Motion Technologies provides a diverse range of motion solutions, including motors, drives, and control systems, catering to various industries such as aerospace, medical, industrial automation, and vehicle electrification.

Key Electric Motor Sales Companies:

- ABB Ltd.

- Allied Motion Technologies, Inc.

- Ametek Inc.

- Johnson Electric Holdings Limited

- Nidec Motor Corporation

- Franklin Electric Co., Inc.

- Regal Rexnord Corporation

- Schneider Electric

- Siemens

- ORIENTAL MOTOR USA CORP

Recent Developments

-

In July 2023, General Electric Vernova’ Solar & Storage Solutions partnered with Fortune Electric to develop Battery Energy Storage Solutions (BESS) in Taiwan. The purpose is to use electric motors in the storage system to keep a control on the energy flow, manage charging and discharging of batteries, and ensure smooth integration of the stored energy.

-

In May 2023, ABB Limited announced the acquisition of Siemens low voltage NEMA motor business. This acquisition will enable ABB to strengthen its position as NEMA motor manufacturer, and provide its offering in the NEMA motor sector.

-

In August 2022, Johnson Electric Holdings Limited launched a steering wheel adjuster motor. It is an electric motor that enables drivers to get access to a comfortable driving posture.

-

In August 2022, Siemens collaborated with MAHLE to develop an inductive charging system for electric vehicles that includes electric motor components. This collaboration also included the implementation of standardized efforts for ensuring interoperability between the charging infrastructure, and electric vehicles.

-

In May 2022, Allied Motion Technologies Inc. acquired ThinGap for expanding its motion capabilities, and providing integrated motion solutions. The acquisition of ThinGap’s motor resulted in the enhancement of product offerings in the market of electric motor.

Electric Motor Sales Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 197.78 billion

Revenue forecast in 2030

USD 322.08 billion

Growth Rate

CAGR of 8.5% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, power output, motor type, power rating, voltage, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, U.K., Germany, France, Japan, China, India, South Korea, Australia, Brazil, Mexico, UAE, KSA, and South Africa

Key companies profiled

ABB Ltd., Allied Motion Technologies, Inc., Ametek Inc., Johnson Electric Holdings Limited, Nidec Motor Corporation, Franklin Electric Co., Inc., Regal Rexnord Corporation, Schneider Electric, Siemens, ORIENTAL MOTOR USA CORP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Motor Sales Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global electric motor sales market report based on application, power output, motor type, power rating, voltage, and region:

-

Electric Motor Sales Motor Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

AC Motor

-

Synchronous AC Motor

-

Induction AC Motor

-

-

DC Motor

-

Brushed DC Motor

-

Brushless DC Motor

-

-

Hermetic Motor

-

-

Electric Motor Sales Power Output Outlook (Revenue, USD Billion, 2017 - 2030)

-

Integral HP Output

-

Fractional HP Output

-

-

Electric Motor Sales Power Rating Outlook (Revenue, USD Billion, 2017 - 2030)

-

Less than 1 kW

-

1 kW to 2.1 kW

-

2.2 kW to 375 kW

-

More than 375 kW

-

-

Electric Motor Sales Voltage Outlook (Revenue, USD Billion, 2017 - 2030)

-

Low Voltage (Below 690 V)

-

Medium Voltage (Between 690 V to 45 kV)

-

High Voltage (Above 45 kV)

-

-

Electric Motor Sales Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Industrial Machinery

-

Motor Vehicles

-

HVAC Equipment

-

Aerospace & Transportation

-

Household Appliances

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric motor sales market size was estimated at USD 142.7 billion in 2020 and is expected to reach USD 150.5 billion in 2021.

b. The global electric motor sales market is expected to grow at a compound annual growth rate of 6.4% from 2021 to 2028 to reach USD 232.5 billion by 2028.

b. Asia Pacific dominated the electric motor sales market with a share of 48.0% in 2019. This is attributable to increased mechanization in the agriculture sector and rapid industrialization in countries including China, India, South Korea, and Australia.

b. Some key players operating in the electric motor sales market include Ametek Inc.; Allied Motion Technologies Inc.; Baldor Electric Company Inc.; Siemens; Johnson Electric; Rockwell Automation Inc.; Franklin Electric Co. Inc.; and Asmo Co. Ltd.

b. Key factors that are driving the electric motor sales market growth include increased mechanization of farming practices and government incentives to encourage sales of green vehicles.

b. The AC motor segment led the electric motor sales market, accounting for the largest revenue share of 70.7% in 2020 and is attributable to AC motors' extensive applications ranging from irrigation pumps to modern-day robotics.

b. The hermetic type segment is projected to witness the highest CAGR of 7.0% from 2021 to 2028 and its demand is backed by its widespread application in the manufacturing of HVAC systems, thus, marking the growth of the electric motor sales market.

b. In terms of revenue, the Fractional Horsepower (FHP) output segment in the electric motor sales market accounted for the largest revenue share of 87.3% in 2020 and is attributable to its wide array of use-cases in appliances such as vacuum cleaners, coffee machines, and refrigerators.

b. In terms of revenue, the motor vehicle was the leading application segment in the electric motor sales market, accounting for a share of 40.5% in 2020 and was attributable to the increased adoption of electric motors in the automotive industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."