- Home

- »

- Automotive & Transportation

- »

-

Electric SUV Market Size, Share And Growth Report, 2030GVR Report cover

![Electric SUV Market Size, Share & Trends Report]()

Electric SUV Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Mid-size, Full-size), By Drive Type (FWD, RWD), By Propulsion Type, By Vehicle Range, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-329-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric SUV Market Summary

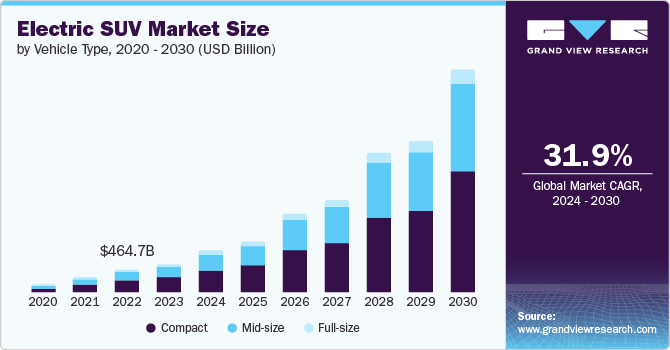

The global electric suv market size was estimated at USD 558.34 billion in 2023 and is projected to reach USD 4.33 trillion by 2030, growing at a CAGR of 31.9% from 2024 to 2030. The market growth of electric SUVs (e-SUV) is driven by various factors such as environmental concerns, government incentives, and advancements in battery technology.

Key Market Trends & Insights

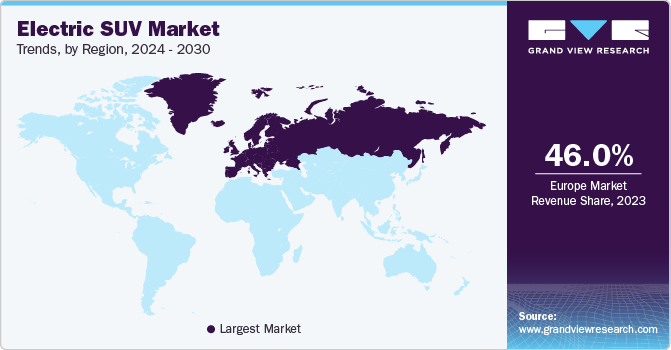

- The electric SUV market in Europe dominated in 2023 and accounted for a 46.04% share of global revenue.

- Based on vehicle type, the compact SUV segment dominated the market in 2023 and accounted for a 53.98% share of the global revenue.

- Based on propulsion type, The Battery Electric Vehicle (BEV) segment dominated the market in 2023.

- Based on vehicle range, the up to 250 mile segment dominated the market in 2023.

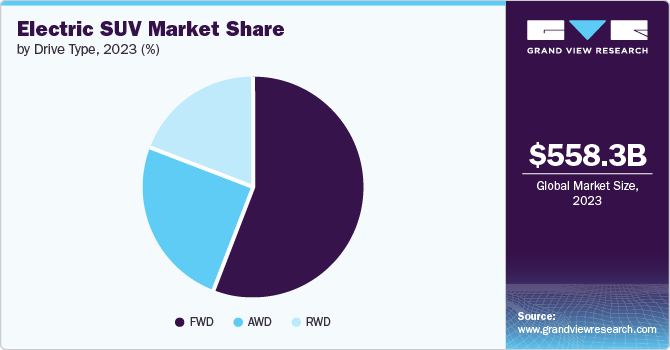

- Based on drive type, the front-wheel drive (FWD) segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 558.34 Billion

- 2030 Projected Market Size: USD 4.33 Trillion

- CAGR (2024 - 2030): 31.9%

- Europe: Largest market in 2023

- MEA: Fastest growing market

In addition, as gasoline prices fluctuate and increase, e-SUVs become a more cost-effective option in the long run. The lower operating costs of electricity compared to gasoline make e-SUVs a financially appealing choice. Thus, rising fuel prices further drive the demand for electric vehicles such as e-SUVs in the market.

Many governments around the world offer tax breaks, rebates, and other incentives for purchasing electric vehicles. This financial support significantly reduces the upfront cost of e-SUVs, making them more attractive to buyers. For instance, the U.S. government offers several incentives to encourage the purchase of electric vehicles, including electric SUVs. The Inflation Reduction Act offers a federal tax credit of up to USD 7,500 for new plug-in EVs purchased in or after 2023. This includes both plug-in hybrid electric vehicles and fully electric vehicles. Thus, increasing government initiatives and support to promote the adoption of e-SUVs are expected to contribute to the market’s growth.

Consumers are increasingly aware of the impact of fossil fuels on climate change. A shift towards reducing carbon footprints and growing environmental awareness has led consumers to adopt e-SUVs as a greener alternative to traditional gasoline vehicles. In addition, various government goals or commitments to achieve net-zero carbon emissions through the adoption of EVs are further boosting the market’s growth. For instance, in September 2023, the UK government unveiled the zero-emission vehicle (ZEV) mandate, which sets out a regulatory framework to accelerate the transition to EVs in the UK. This ambitious plan aims to make 80% of new cars sold in Great Britain zero-emission by 2030, with a goal of 100% zero-emission vehicles by 2035. Such initiatives are expected to bode well for the market’s growth.

The electric vehicle industry constantly evolves, with advanced features and technologies introduced continuously. E-SUVs are at the forefront of this innovation, offering cutting-edge features such as autonomous driving capabilities and advanced driver-assistance systems. In addition, advancements in battery technology and the rising use of lithium-ion batteries in EVs further improve the market's growth. Various benefits of lithium-ion batteries, such as high energy efficiency, high power-to-weight ratio, long life, high-temperature performance, and low self-discharge, make them ideal for EVs such as e-SUVs.

Despite the various benefits of e-SUVs, such as lower emissions, lower operating costs, and low noise operation, some challenges could hamper the market's growth. Challenges such as the high upfront cost of e-SUVs compared to gasoline-powered SUVs and range anxiety could hinder the adoption of e-SUVs. While ranges are improving, they typically fall short of what consumers might expect from a gasoline-powered SUV. This could be a concern for long road trips or situations where charging stations are scarce.

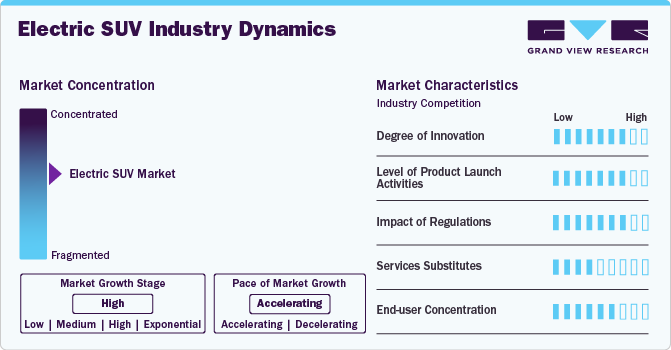

Market Concentration & Characteristics

The industry's growth stage is high, and the pace of growth is accelerating. The e-SUV industry can be characterized by a high degree of innovation, as they are at the forefront of integrating ADAS features. These systems include lane departure warning, automatic emergency braking, and adaptive cruise control, making driving safer and more comfortable.

The e-SUV industry is also characterized by a high level of new product launch activities by key companies. Companies are extending their e-SUV offerings to international markets, leveraging partnerships and distribution networks to bring customers more affordable and eco-friendly mobility solutions worldwide.

Regulative trends play a substantial role in influencing the e-SUV industry. Government regulations and tax exemptions promote the adoption of electric vehicles, thus driving the market's growth.

The e-SUV industry is expanding rapidly, driven by technological advancements, a focus on sustainable transportation, and government initiatives to reduce carbon emissions. However, alternative options to e-SUVs, such as MUVs, sedans, and hatchbacks, are gaining popularity and offering unique benefits.

The e-SUV industry has a high concentration of end users. Due to environmental concerns and government incentives, consumers increasingly demand eco-friendly transportation alternatives, which drives the market’s growth.

Vehicle Type Insights

The compact SUV segment dominated the market in 2023 and accounted for a 53.98% share of the global revenue. These e-SUVs have experienced a significant surge in popularity, driven by their appealing design and improved fuel efficiency. This trend has led to a notable increase in sales as consumers demand more practical and environmentally friendly options for their daily commutes. Hyundai IONIQ 5, Kia EV6, and Ford Mustang Mach-E are among the compact e-SUVs available. Thus, increasing demand and availability of compact e-SUVs drive the segment’s growth.

The mid-size segment is projected to witness significant growth from 2024 to 2030. Mid-size e-SUVs are becoming popular among electric car buyers as they offer versatility, practicality, and class. They are larger than their compact counterparts, providing more cargo space and passenger room, making them ideal for families or individuals who frequently travel with a lot of gear. This increased size allows for a more comfortable and practical driving experience, making them a popular choice for those who need to transport multiple passengers or large items.

Propulsion Type Insights

The Battery Electric Vehicle (BEV) segment dominated the market in 2023. These vehicles are driven by one or more electric motors, which derive energy from a large, rechargeable battery pack. BEVs are designed to rely solely on electricity for their propulsion, making them a fully electric and emissions-free mode of transportation. Thus, increasing adoption of battery-powered SUVs owing to their benefits, such as lower fuel and maintenance expenses, zero-emission driving, and a quieter driving experience, has contributed to the segment’s growth.

The Plug-In Hybrid Electric Vehicle (PHEV) segment is projected to witness significant growth from 2024 to 2030. PHEVs are designed to operate on electricity alone, using the electric motor or switching to the gasoline engine as needed, providing flexibility and efficiency. Compared to BEVs, PHEVs offer increased flexibility and extended driving range. Thus, the PHEV’s ability to operate in all-electric mode for shorter trips, lowering emissions and potentially leading to fuel savings, drives the segment’s growth.

Vehicle Range Insights

The up to 250 mile segment dominated the market in 2023. Increasing adoption of smaller or compact e-SUVs, which are more affordable due to their simpler design and smaller battery packs, drives the segment’s growth. In addition, with a range of around 250 miles, these e-SUVs are ideal for urban commutes and running errands around town. Their smaller size makes them easier to maneuver in tight spaces and navigate city traffic.

The 250-500 miles segment is projected to witness significant growth from 2024 to 2030. E-SUVs with a range of 250-500 miles offer a compelling blend of practicality and environmental benefits. Increasing demand for e-SUVs for long-distance transportation operations is boosting the segment’s growth. In addition, the vast availability of e-SUVs with 250-500-mile range is boosting the segment’s growth. For instance, the 2024 Audi Q4 e-tron’s estimated range is up to 258 miles.

Drive Type Insights

The front-wheel drive (FWD) segment dominated the market in 2023. In the automotive industry, a significant number of vehicles are designed with FWD configurations. This design approach has also been widely adopted by many e-SUV manufacturers and brands, who have placed the electric motor at the front of the vehicle to power the front wheels. Examples include Hyundai Kona Electric and Nissan Leaf.

The all-wheel drive (AWD) segment is projected to witness significant growth from 2024 to 2030. AWD technology in e-SUVs provides several benefits similar to those in ICE cars. An AWD e-SUV typically features two electric motors, one powering the front wheels and the other powering the rear wheels. The additional drive wheels enhance traction, enabling e-SUVs to handle challenging conditions like snow and rough terrain with greater confidence and capability. Many e-SUVs, such as the Tesla Model Y, have dual-motor AWD. Thus, the vast availability of e-SUVs powered by AWD drive type drives the segment’s growth.

Regional Insights

The electric SUV market in North America is expected to witness notable growth from 2024 to 2030. The United States and Canada are actively working to establish robust electric vehicle charging infrastructure across the region. The U.S. is expected to continue its steady growth in this area, driven by technological advancements, a focus on sustainable transportation, and the nation's commitment to reducing carbon emissions.

U.S. Electric SUV Market Trends

The electric SUV market in the U.S. dominated the North America market with the largest revenue share and is expected to grow at a considerable growth rate of 37.7% from 2024 to 2030. The market is rapidly expanding in the U.S. with major companies such as Tesla, Inc. The e-SUV market is further anticipated to continue its growth trajectory, with growing investment in research and development, improving charging infrastructure, and expanding model portfolios.

Canada electric SUV market is expected to grow at the highest CAGR from 2024 to 2030. The Canadian market offers a wide range of electric SUVs, including popular models like the Audi Q4 e-tron, Hyundai IONIQ 5, and Kia EV6. These e-SUVs offer various configurations to meet diverse consumer needs, from compact urban commuters to spacious family vehicles.

Asia Pacific Electric SUV Market Trends

The electric SUV market in Asia Pacific is anticipated to grow at a steady CAGR from 2024 to 2030. This growth is driven by the increasing demand for eco-friendly transportation and the presence of numerous emerging economies. In addition, stringent government regulations, environmental concerns, and the expansion of charging infrastructure further accelerate the industry's overall progress in this region.

China electric SUV market is expected to witness a steady growth rate of 29.4% from 2024 to 2030. The Chinese government has been a major driving force behind the growth of EVs, including electric SUVs. According to the government’s new technical requirements for EVs eligible for tax breaks, starting in 2024, Chinese buyers will be exempt from paying taxes on BEVs that offer a driving range of at least 200 km (approximately 124 miles) per charge. For PHEVs to qualify for this tax exemption, they must have a battery-only range of at least 43 km (approximately 27 miles). Policies such as subsidies for EV buyers, tax incentives, and stringent emissions regulations have encouraged manufacturers and consumers to shift towards electric mobility.

The electric SUV market in India is anticipated to grow at the highest CAGR from 2024 to 2030.This growth can be attributed to the increasing population, rising disposable incomes, increased demand for premium luxury cars, and a growing preference for BEVs over ICE vehicles.

Japan electric SUV market is expected to grow at a considerable CAGR from 2024 to 2030. The vast presence of major electric SUV manufacturers such as Toyota Motor Corporation, Nissan Motor Corporation, and Honda Motor Co., Ltd. is a major factor behind the country’s market growth. In addition, battery technology and vehicle design innovations further drive Japan's market.

Europe Electric SUV Market Trends

The electric SUV market in Europe dominated in 2023 and accounted for a 46.04% share of global revenue. Increasing demand for electric vehicles such as e-SUVs owing to environmental concerns and the desire for innovative, high-performance vehicles is boosting the market’s growth. According to the European Environment Agency, the number of electric vehicles in Europe is increasing annually. For instance, in 2023, electric cars accounted for 23.6% of all new car registrations.

The UK electric SUV market is expected to grow at the highest CAGR from 2024 to 2030. The UK is experiencing a rapid increase in the number of electric cars due to rising consumer demand and improved availability of electric models. Substantial subsidies and grants continue to incentivize the purchase of electric SUVs, making them more affordable and attractive to buyers.

The electric SUV market in Germany is expected to grow at a notable CAGR from 2024 to 2030. Germany encourages sustainable transportation by offering financial incentives such as tax reductions and subsidies for charging infrastructure to promote electric and hybrid vehicle ownership, aligning with its comprehensive environmental strategy. Germany's implementation of the 0.5% and 0.25% tax rules for electric and hybrid vehicles represents transformative measures aimed at advancing sustainable mobility. Thus, Germany's strong governmental support, including subsidies, tax incentives, and infrastructure investments, is accelerating the adoption of electric SUVs.

MEA Electric SUV Market Trends

The electric SUV market in MEA is anticipated to register the highest CAGR of 41.4% from 2024 to 2030. In MEA, collaboration between governments, businesses, and communities is driving efforts to promote sustainability, including the widespread adoption of EVs. Initiatives like tax incentives, toll exemptions, and prioritized parking aim to enhance affordability and convenience, thereby increasing e-SUV adoption across the region.

KSA electric SUV market is expected to witness a moderate growth rate from 2024 to 2030.KSA is actively advancing economic diversification and energy transition as part of its ambitious Vision 2030 goals. Among its initiatives, the country is promoting the adoption of EVs, supported by investments from the Public Investment Fund (PIF). In 2022, the PIF launched Ceer, Saudi Arabia’s first EV manufacturer. This joint venture with Taiwan’s Foxconn aims to design, produce, and market a variety of EVs within the country. The first EV models are anticipated to launch by 2025, with a production target set at 150,000 vehicles per year.

Key Electric SUV Company Insights

Some of the key companies operating in the market include Tesla Inc., BYD Company Ltd., Hyundai Motor Company, Volkswagen AG, Toyota Motor Corporation, Nissan Motor Corporation, Kia Corporation, and Ford Motor Company.

-

AB Volvo is a manufacturer of trucks, buses, construction equipment, and marine and industrial engines. The company also offers comprehensive financing and service solutions, catering to the diverse needs of its customers worldwide.

-

Volkswagen Group has firmly positioned itself as one of the prominent players in the electric vehicle (EV) market. With a strategic commitment to sustainable mobility, the group has introduced the ID. Series, including the ID.4 model, as part of its ambitious plan to become a leading player in the EV market. The company's substantial investments in battery technology, manufacturing infrastructure, and charging networks underscore its dedication to electrification. In addition, Volkswagen's diverse portfolio of brands, including Audi, Porsche, and Škoda, is expanding its range of electric vehicles, aiming to deliver cutting-edge technology and innovative solutions to meet the growing demand for eco-friendly transportation.

Lucid Motors, Polestar, and Fisker, Inc. are some of the emerging companies in the electric SUV market.

-

Polestar, an electric vehicle manufacturer headquartered in Gothenburg, Sweden, is a joint venture between Volvo Car Group and its parent company, Geely Holding. Polestar offers high-performance electric cars, sleek designs, and advanced technology. The company provides e-SUV models such as the Polestar 3 and Polestar 4.

-

Lucid Motors, a U.S.-based manufacturer of electric vehicles. With a mission to inspire the adoption of sustainable energy through advanced technology and luxurious design, Lucid's model, the Lucid Gravity, has set benchmarks in the EV industry for design, range, performance, convenience, utility, and efficiency. Boasting impressive battery technology and a refined aesthetic, Lucid Motors emphasizes innovation and premium quality to differentiate its products from competitors.

Key Electric SUV Companies:

The following are the leading companies in the electric SUV market. These companies collectively hold the largest market share and dictate industry trends.

- Tesla Inc.

- BYD Company Ltd.

- Hyundai Motor Company

- Toyota Motor Corporation

- Nissan Motor Corporation

- Kia Corporation

- Ford Motor Company

- Volkswagen AG

- AB Volvo

- Honda Motor Co., Ltd.

- Chevrolet

Recent Developments

-

In June 2024, Chevrolet unveiled an electric SUV, the Equinox EV, designed to appeal to mainstream buyers with its affordability, style, and impressive range. The Equinox EV starts at USD 34,995, making it one of the most affordable EVs. With a range of 319 miles, it qualifies for the full USD 7,500 Federal Electric Car Tax Credit.

-

In April 2024, Toyota Motor Corporation announced a USD 1.4 billion investment in its Princeton plant in Indiana, marking a major expansion to produce a new three-row battery-electric SUV.

-

In November 2023, Lucid Motors unveiled an innovative Lucid Gravity, a luxury electric SUV. The Gravity SUV is developed to be a high-performance vehicle with a projected driving range of over 440 miles and space for up to seven adults and their gear.

Electric SUV Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 820.46 billion

Revenue forecast in 2030

USD 4.33 trillion

Growth rate

CAGR of 31.9% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in units, revenue in USD billion/trillion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, propulsion type, vehicle range, drive type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Tesla Inc.; BYD Company Ltd.; Hyundai Motor Company; Toyota Motor Corporation; Nissan Motor Corporation; Kia Corporation; Ford Motor Company; Volkswagen AG; AB Volvo; Honda Motor Co., Ltd.; Chevrolet

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric SUV Market Report Segmentation

The report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric SUV market report based on vehicle type, propulsion type, vehicle range, drive type and region:

-

Vehicle Type Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Compact

-

Mid-size

-

Full-size

-

-

Propulsion Type Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-in Hybrid Electric Vehicle (PHEV)

-

-

Vehicle Range Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Up to 250 Miles

-

250-500 Mile

-

Above 500 Miles

-

-

Drive Type Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

FWD

-

RWD

-

AWD

-

-

Regional Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric SUV market size was estimated at USD 558.34 billion in 2023 and is expected to reach USD 820.46 billion in 2024.

b. The global electric SUV market is expected to grow at a compound annual growth rate of 31.9% from 2024 to 2030 to reach USD 4.33 trllion by 2030.

b. The compact SUV segment dominated the market in 2023 and accounted for a 53.98% share of the global revenue. These e-SUVs have experienced a significant surge in popularity, driven by their appealing design and improved fuel efficiency. This trend has led to a notable increase in sales, as consumers demand more practical and environmentally friendly options for their daily commutes. Hyundai IONIQ 5, Kia EV6, and Ford Mustang Mach-E are among the compact e-SUVs available in the market.

b. Some key players operating in the electric SUV market include Tesla Inc., BYD Company Ltd., Hyundai Motor Company, Volkswagen AG, Toyota Motor Corporation, Nissan Motor Corporation, Kia Corporation, and Ford Motor Company

b. Key factors that are driving the market growth include advanced features and technologies being introduced all the time. E-SUVs are at the forefront of this innovation, offering cutting-edge features such as autonomous driving capabilities and advanced driver-assistance systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.