- Home

- »

- Automotive & Transportation

- »

-

Electric Vehicle Communication Controller Market Report, 2030GVR Report cover

![Electric Vehicle Communication Controller Market Size, Share & Trends Report]()

Electric Vehicle Communication Controller Market Size, Share & Trends Analysis Report By System, By Charging, By Electric Vehicle, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-915-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Report Overview

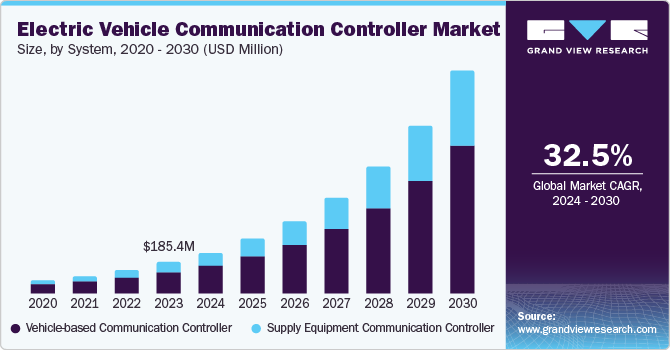

The global electric vehicle communication controller market size was valued at USD 185.4 million in 2023 and is projected to grow at a CAGR of 32.5% from 2024 to 2030. The increasing popularity and sales of electric vehicles and the rising focus on developing fast-charging solutions as part of innovations in Electric Vehicle Supply Equipment (EVSE) infrastructure are major market drivers. An electric vehicle communication controller (EVCC) allows the seamless exchange of information, such as charging data, between the Engine Control Unit (ECU) of the vehicle and the charging station. The increasing pace of global collaboration between governments, automotive manufacturers, and original equipment manufacturers to develop fast-charging stations is anticipated to encourage positive developments in the EVCC market.

There has been an increasing awareness regarding efficient vehicle charging systems due to a steady introduction of financial incentives, such as tax benefits and subsidies, offered by governments globally to encourage EV adoption. Additionally, with the increasing tightening of restrictions concerning CO2 emissions and the implementation of stringent regulatory standards in this respect, consumers are compelled to look towards EVs and hybrid EVs. According to the ‘Global EV Outlook 2023’ report published by the International Energy Agency (IEA), policies regarding EVSE have shifted significantly in recent years, with around 80% of global sales of light-duty and heavy-duty EVs being covered by such policies. There has been a sharp increase in funding related to EVSE deployment as the presence of advanced charging stations has emerged as a critical parameter for EV adoption. These charging stations require sophisticated communication systems to efficiently manage interactions between the charger and the vehicle, such as billing, authentication, and charging status updates.

The rapidly growing presence of EV fleets in major sectors such as transportation and logistics and consumer goods has boosted the demand for efficient supply equipment. For instance, in September 2024, Schneider Electric launched the Schneider Charge Pro Level 2 AC Commercial Electric Vehicle Charger. The solution has been aimed at offering convenience to EV owners at workplaces, destination venues, and commercial fleets. Such developments have become increasingly common among major providers of EVSE, such as Siemens, ABB, and Bosch, in recent years. This has led to a high demand for communication controllers to perform critical functions, including controlling charging parameters and monitoring battery status. Additionally, these components help conduct regular diagnostics and maintenance by monitoring vehicle systems and detecting abnormalities and faults, enabling proactive maintenance and reduced downtimes.

System Insights

The vehicle-based communication controller segment accounted for a dominant revenue share of 68.3% in the global market in 2023. This high share is owing to a steadily increasing emphasis on developing vehicle-based communication controllers by leading electric vehicle manufacturers. Furthermore, the rising demand for electric buses and other heavy-duty vehicles by governments worldwide to create a sustainable and improved public transportation infrastructure has created a substantial demand for these systems. EVCCs enable seamless coordination and integration between various critical vehicle systems, including powertrain, charging systems, and battery management, thus ensuring optimal and reliable EV performance for a longer period.

The supply equipment communication controller (SECC) segment, meanwhile, is expected to advance at the fastest CAGR over the forecast period. This is owing to a consistently strong demand for technologically advanced charging stations by both governments and enterprises. In this system, the communication controller is used to access card information and validate Vehicle Identification Number (VID). Rising competition among organizations to provide innovative charging communication solutions is expected to further aid segment expansion. Initiatives such as the NEVI (National Electric Vehicle Infrastructure) Program in the U.S. have necessitated the presence of both DC and AC chargers, with DC chargers requiring SECC implementation to allow DC charging. The Argonne National Laboratory, owned by the U.S. Department of Energy, has developed a customized “SpEC” (Smart-grid plugin EV Communication) module for EV charging stations to facilitate high-level communications between the EV and the charger.

Charging Insights

The wired charging (plug-in) segment accounted for the largest revenue share in the global market in 2023. A substantial rise in demand for fast-charging solutions that necessitates communication between the vehicle’s ECU and EVSE via a standard protocol is projected to enable segment expansion. Additionally, the implementation of several initiatives by automotive manufacturers and EVSE providers to install and deploy fast chargers at highway charging stations, along with different public stations, is expected to drive market growth. These systems control the entire charging process, offering optimal power delivery, authentication, and features to ensure vehicle safety, including overvoltage and overcurrent protection.

The wireless charging (inductive charging) segment is expected to advance at the fastest CAGR from 2024 to 2030. There has been a significant growth in demand for wireless charging infrastructure on account of the rising adoption of ridesharing and driverless EVs. Economies such as the U.S. and China, which have developed the required infrastructure to address the emerging demand for autonomous EVs, have increased their efforts to develop advanced wireless charging technologies. Along with proper vehicle alignment over the charging pad, seamless wireless communication between the charging station and the vehicle is vital to ensure a smooth charging process. The SECC and EVCC are nodal points for communication in the course of the EV wireless power transfer process. This communication is important to check proper alignment of power coils, the battery charge status, and detecting faults or anomalies, among other functions.

Application Insights

The passenger vehicle segment held the largest revenue share in 2023, owing to the steadily advancing passenger vehicle sales. The presence of various financial incentives and subsidies as part of government policies has encouraged consumers to purchase EVs. Moreover, a number of leading automotive manufacturers, including Ford Motor Company, General Motors, and BMW, have started providing chargers in addition to their electric cars, highlighting the need for proper communication between the car and the charger. Furthermore, automotive manufacturers have been increasingly focusing on installing EV charging stations to drive awareness regarding EVs among their employees, leading to widespread deployment of charging stations that utilize state-of-the-art communication controllers in their infrastructure.

The commercial vehicles segment is expected to witness the fastest growth in the global market from 2024 to 2030. Rising demand for commercial EVs, including trucks, buses, and vans, from end-use verticals such as logistics, e-commerce, and public transportation companies is expected to facilitate the installation of advanced charging infrastructure. These vehicles are required to carry high loads and deliver them over long distances, necessitating reliability and increased range that can be ensured by the deployment of charging stations with efficient communication controllers. Governments across several major economies are striving to replace their fuel-based bus fleets with electric buses, which acts as another major driver for segment growth.

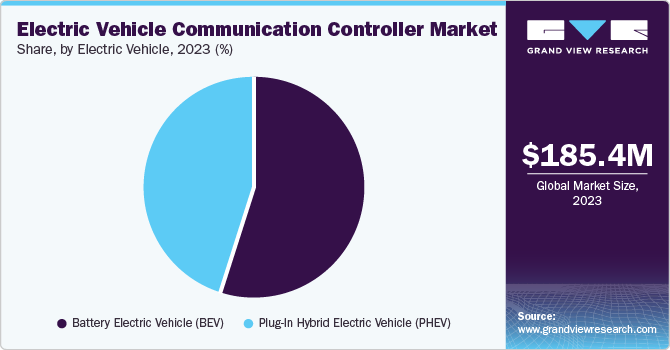

Electric Vehicle Insights

The battery electric vehicle (BEV) segment accounted for a leading revenue share in the market in 2023. Increasing pace of government efforts to promote the adoption of BEVs and constant innovations in vehicle-based communication controllers are expected to drive segment expansion in the coming years. Additionally, the use of advanced technologies, including Near-Field Communication (NFC) and Radio Frequency Identification (RFID), has led to the extensive installation of kiosk-based, self-operated, and interactive highway charging stations. This factor is anticipated to positively shape the demand for EVCCs in this segment during the forecast period.

On the other hand, the plug-in hybrid electric vehicle (PHEV) segment is projected to expand at the fastest CAGR from 2024 to 2030. An increasing need to standardize communication protocols between the grid and PHEVs, along with ongoing partnerships between the public and private sectors (PPPs) to develop communication standards for electric grids used for PHEVs, is anticipated to propel segment expansion. EVCCs efficiently manage communication protocols between external systems and the vehicle, ensuring interoperability and compatibility. Additionally, the implementation of stringent security measures by these controllers to protect data exchange and vehicle communication from cyber threats is expected to aid market appeal in this segment.

Regional Insights

Europe accounted for a leading revenue share of 42.6% in the global EVCC market in 2023. A continued focus on the development of electric vehicles and related infrastructure across regional economies, including Germany, the UK, and France, has created a promising market for EV communication controllers in this region. For instance, in July 2023, the charging company Electreon announced that its Wireless Electric Road System (ERS) had been selected by Bpifrance, a French investment bank, to undertake a project on a part of the A10 highway, located near Paris. The growing popularity of such concepts is expected to enable advancements in the communication controller market. Furthermore, the region is a hub of several initiatives focused on developing electric mobility solutions, which is expected to create significant growth avenues for the industry.

Germany Electric Vehicle Communication Controller Market Trends

The EV communication controller market in Germany is anticipated to contribute significantly to regional revenue in the coming years. The fast pace of adoption of electric vehicles in the economy, coupled with government policies to cut down on carbon emissions through the increased presence of EVs on roads, has helped in boosting the presence of this market. The German Federal Ministry of Economics and Energy (BMWi) aims to make the country a leader in the e-mobility sector. As of September 2023, close to 52,000 charging stations were accessible to the country’s citizens, while around 98,000 regular charging points and 18,577 fast charging points were accessible to EV drivers. The government’s focus on deploying one million fully operational and accessible charging points by 2030 is expected to provide significant expansion opportunities to the industry.

Asia Pacific Electric Vehicle Communication Controller Market Trends

Asia Pacific is expected to register the highest growth rate in the market over the forecast period. Increasing government support across major regional economies such as Japan, China, and India to develop and deploy charging infrastructure has compelled major global players as well as start-ups to develop innovative charging solutions. There is also a growing focus on the development of domestic and international policy regulations and frameworks to support charging infrastructure, which is expected to act as a leading driver for the regional market demand.

China is well known as a leading market for the development of electric vehicle infrastructure, owing to the presence of a strong semiconductor and electronics industry and the government’s focus on intensifying developments in this space. The public charger infrastructure network in the economy is the largest globally, with 2022 numbers stating the presence of more than one million chargers, which is more than half of the worldwide total. This highlights strong demand for EV charging solutions and the need for efficient communications between the vehicle and charger to carry out the charging process rapidly, leading to constant developments in the countrywide market.

North America Electric Vehicle Communication Controller Market Trends

North America accounted for a substantial revenue share in the global market in 2023 and is expected to remain a significant contributor over the forecast period. The presence of highly developed economies such as the U.S. and Canada, along with strong government support to drive electric mobility initiatives, is expected to establish a substantial market for EV communication controllers in the region. Substantial sales of passenger cars and commercial vehicles have increased the number of EVs on roads, driving regional demand for the integration of advanced charging capabilities at charging stations to minimize range anxiety among drivers.

U.S. Electric Vehicle Communication Controller Market Trends

The U.S. accounts for a dominant presence in the regional electric vehicle communication controller market. The presence of notable automotive companies such as GM and Tesla, along with increased sales of cars such as the Chevrolet Volt, Tesla Model S, and the Ford Fusion Energy PHEV, have encouraged OEMs and automotive companies to create cutting-edge solutions that can ensure better charging capabilities and seamless services for EV owners. In November 2023, the Michigan Department of Transportation (MDOT), in collaboration with the City of Detroit and the charging company Electreon, launched the country’s first-ever public EV charging roadway at Michigan Central. Such initiatives are expected to provide a pathway for increased deployment of such technologies, enabling growth of related markets such as EVCC.

Key Electric Vehicle Communication Controller Company Insights

Some of the key players in the EV communication controller market are ABB, LG INNOTEK, Schneider Electric, and Vector.

-

Vector Informatik GmbH specializes in developing electronics solutions for the automotive industry. The company offers hardware components such as a Bus Transceiver, GL Loggers, Smart Logger, and CCS Listener to monitor CCS-based communications between the charging station and the electric vehicle (EV). The company serves major industries such as IIoT (Industry 4.0), avionics, hybrid electric aviation, and e-mobility. Vector provides comprehensive test systems and customized ECU software to enable developers of onboard charging ECUs in charging stations, vehicles, and induction charging systems to develop products economically and quickly.

Key Electric Vehicle Communication Controller Companies:

The following are the leading companies in the electric vehicle communication controller market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- BYD Company Ltd.

- Efacec

- Sensata Technologies, Inc.

- Ficosa Internacional SA

- LG Innotek

- Mitsubishi Electric Corporation

- Bosch Limited

- Schneider Electric

- Vector Informatik GmbH

- Tesla

Recent Developments

-

In July 2024, Vector announced its partnership with AST International, a sensor specialist, bringing a solution to advance the capabilities of DC charging stations further. The collaboration has resulted in the Vector vSECC charging controller’s communication protocols becoming compatible with the AST DC Meter. This is expected to aid charging station manufacturers in shortening their development times and enabling full integration via a seamless plug-and-play solution.

-

In March 2023, Ficosa presented advanced electric mobility solutions at the first edition of the eMobility Expo & World Congress (EME VLC) held in Valencia, Spain. The company launched the Charging Communication Box, the first of its two products aimed at improving the efficiency of the EV charging process. The product is an electronic module that would allow a wireless (Wi-Fi) connection between the car and the electric charging post while providing support for the charging hose (PLC). EV owners can get an idea regarding the charger available at a particular time and plan their charging time through this solution.

Electric Vehicle Communication Controller Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 245.4 million

Revenue Forecast in 2030

USD 1,330.4 million

Growth Rate

CAGR of 32.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

System, charging, electric vehicle, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

ABB; BYD Company Ltd.; Efacec; Sensata Technologies, Inc.; Ficosa Internacional SA; LG Innotek; Mitsubishi Electric Corporation; Bosch Limited; Schneider Electric; Vector Informatik GmbH; Tesla

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Communication Controller Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric vehicle communication controller market report based on system, charging, electric vehicle, application, and region:

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Vehicle-based Communication Controller

-

Supply Equipment Communication Controller (SECC)

-

-

Charging Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired Charging

-

Wireless Charging

-

-

Electric Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-In Hybrid Electric Vehicle (PHEV)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."