- Home

- »

- Next Generation Technologies

- »

-

Electric Vehicle Testing, Inspection, And Certification Market Report 2030GVR Report cover

![Electric Vehicle Testing, Inspection, And Certification Market Size, Share & Trends Report]()

Electric Vehicle Testing, Inspection, And Certification Market (2024 - 2030) Size, Share & Trends Analysis Report By Service Type (Testing, Inspection), By Sourcing Type, By Application, By Vehicle Type, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-183-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle TIC Market Size & Trends

The global electric vehicle testing, inspection, and certification market size was estimated at USD 1.21 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 14.1% from 2024 to 2030. The electric vehicle testing, inspection, and certification (TIC) market is anticipated to experience growth propelled by advancements in electric vehicle systems and the global surge in electric vehicle sales. Moreover, the expanding development of electric and hybrid vehicles is poised to generate lucrative prospects for companies engaged in testing, certifying, and inspecting these vehicles over the forecast period.

The escalating environmental concerns and the imperative to mitigate global warming, coupled with statutory mandates and a growing consumer base for electric vehicles (EVs) worldwide, are fueling the demand for TIC services in the EV sector. TIC services offer improved customer feedback for EVs, enhancing product marketing, and consequently, manufacturers and retailers of EVs are increasingly embracing the testing, inspection, and certification approach. Governments in various countries have mandated the testing, inspection, and certification of EVs to ensure compliance with regulatory standards for these vehicles.

In addition, a growing emphasis on reducing charging time is poised to drive the development of high-power DC fast-charging stations, thereby amplifying the significance of testing and certification. Moreover, the expanding research and development activities in TIC procedures are set to enhance customer safety and security, serving as a key factor propelling revenue growth in the EV TIC market throughout the forecast period.

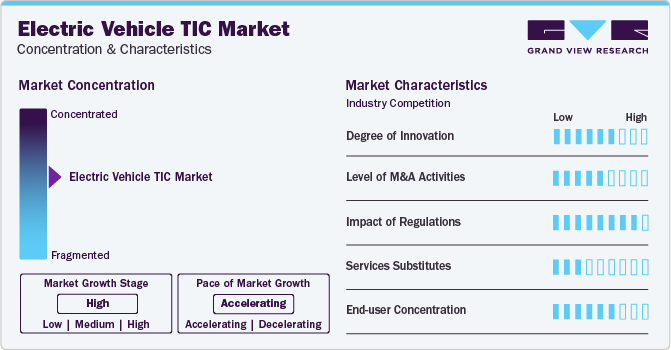

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The EV TIC market is characterized by a diverse range of offerings, encompassing testing, inspection, and certification services across various aspects of EVs, including batteries, charging infrastructure, and vehicle components. As the demand for EVs continues to increase, there is a greater need for stringent testing and certification to ensure the safety and reliability of these vehicles and increase trust among clients.

With the government's support and a focus on environmental sustainability, the market is positioned to play a key role in the transformation of the transportation sector, reducing emissions and paving the way for a more sustainable future. The electric vehicle TIC market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in January 2022, Bureau Veritas acquired PreScience Corporation, a U.S.-based construction management service provider specializing in transportation infrastructure projects. This strategic acquisition served to bolster Bureau Veritas's expansion in the transportation sector, particularly in testing and inspection, contributing to the establishment of safe and sustainable infrastructure for transportation.

TIC providers establish a profound understanding of the ever-evolving regulatory landscape that governs vehicle safety, emissions, and quality standards. This extends to evaluating the safety of high-voltage components, adherence to environmental regulations, and assurance of quality and performance in advanced EV systems. By understanding these industry-specific demands, TIC companies ensure that electric vehicles not only meet compliance but also uphold the high safety and quality standards of the EV sector.

As EVs become more prevalent, there is a growing need for specialized testing and certification services. Traditional automotive testing methods are being substituted with innovative approaches tailored to the unique characteristics of electric propulsion systems, battery technologies, and charging infrastructure. This shift is accompanied by a surge in demand for expertise in high-voltage component safety, adherence to stringent environmental regulations, and the intricate evaluation of EV systems.

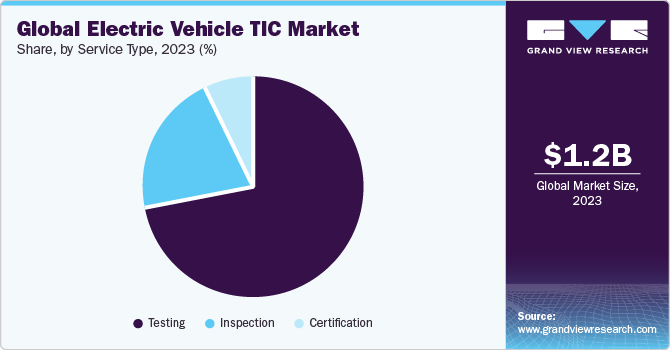

Service Type Insights

The testing segment led the market and accounted for 72.0% of the global revenue in 2023. The increasing global adoption of electric and hybrid vehicles fuels the rapid growth of the testing segment in the EV industry. The segment is evolving with the widespread adoption of artificial intelligence (AI) and machine learning (ML) for more precise and efficient testing methods. The utilization of data analysis enables the identification of patterns and irregularities, contributing to more effective testing processes. Furthermore, the industry is witnessing the creation of advanced test equipment tailored to the requirements of next-generation batteries, including solid-state batteries, which are meeting the changing needs of industry.

The certification segment is expected to register the fastest CAGR during the forecast period. The escalating complexity and interconnected nature of EVs have prompted a heightened focus on safety and cybersecurity certification. As EVs become more intricate, certification bodies are actively formulating new standards to assess these critical aspects comprehensively. Moreover, the surging demand for over-the-air (OTA) software updates to boost the performance, safety, and security of EVs is driving a shift in certification standards.

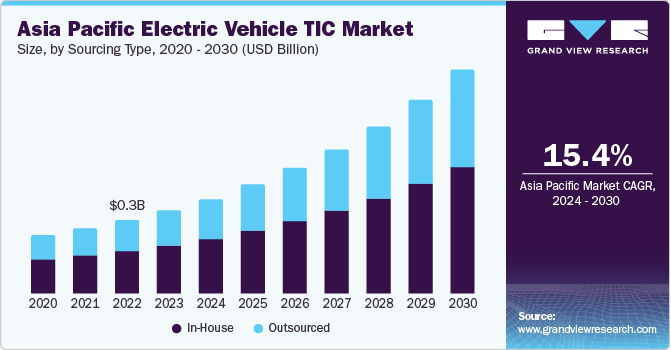

Sourcing Type Insights

The in-house segment accounted for the largest market revenue share of over 58% in 2023. In-house TIC of EVs is becoming increasingly common, mainly among major automotive manufacturers. When automotive manufacturers perform TIC in-house, they exercise full control over the entire process, starting from the formulation of test procedures to the actual execution of tests. This complete control ensures that EVs undergo thorough testing and certification, meeting the most stringent standards. By managing TIC procedures internally, automakers can enhance the precision, efficiency, and reliability of the testing processes.

The outsourced segment is projected to grow significantly over the forecast period. Outsourced TIC providers have the services and expertise necessary to test and certify EVs to the most stringent standards. This approach proves particularly advantageous for smaller automakers and companies that need more resources to invest in in-house TIC capabilities. Leading players in the industry are driving significant market growth through strategic initiatives. For instance, in June 2022, Applus+ Laboratories inaugurated a new facility dedicated to EV battery testing at its UK test center, Applus+ 3C Test. This specialized lab focuses on battery testing for UN DOT 38.3 compliance and ECE R100 homologation, showcasing the industry's commitment to advancing testing capabilities and ensuring adherence to regulatory standards.

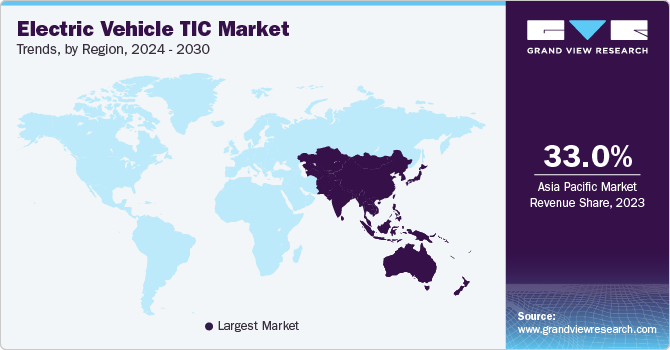

Regional Insights

Asia Pacific dominated the market and accounted for a 33.0% share in 2023. The Asia Pacific region is a powerhouse in electric vehicle production, containing some of the world's largest and most innovative electric vehicle manufacturers. This robust manufacturing ecosystem, coupled with substantial government support and incentives promoting sustainable transportation solutions, has significantly propelled the demand for TIC services to ensure compliance with rigorous safety and regulatory standards.

Europe is anticipated to witness significant growth in the electric vehicle TIC market. The European automotive industry's proactive shift toward electrification, with major automakers focusing on the development and production of EVs, has accelerated the demand for TIC services. Moreover, the region's advanced infrastructure, including a well-established charging network and supportive government incentives, fosters a conducive environment for EV adoption, prompting an increased need for testing and certification services.

Application Insights

The safety and security segment accounted for the largest market revenue share of 52.2% in 2023. EVs are equipped with a diverse range of safety features and undergo rigorous testing and safety checks before they are authorized for use on public roads. This comprehensive testing process enables the production of EVs that are safer and more efficient and ensures the safety of the infrastructure and equipment supporting these vehicles for consumers. Throughout the forecast period, the growing recommendations from regulatory bodies for TIC services are contributing significantly to market growth.

The outsourced segment is projected to grow significantly over the forecast period. A significant development in connectors is fueling the market growth of the EV TIC market. With increasing connectivity and the integration of communication features in EV connectors, TIC services are expanding to include cybersecurity assessments. This change is essential for safeguarding against potential cyber threats and mitigating the risk of data breaches in the context of the interconnected nature of modern EV systems.

Vehicle Type Insights

The BEV (battery electric vehicle) segment accounted for the largest market revenue share of over 30% in 2023. The escalating global shift towards sustainable and environmentally friendly transportation has fueled the demand for BEVs, necessitating comprehensive testing and certification services. In addition, technological advancements in battery technology and the growing complexity of electric propulsion systems necessitate specialized TIC services tailored to address the unique challenges posed by battery electric vehicles. Governments worldwide are implementing stringent regulations and standards for BEVs, driving the need for rigorous testing to meet compliance requirements.

The FCEV (fuel cell electric vehicle) segment is projected to grow significantly over the forecast period. The increasing emphasis on sustainable and zero-emission transportation solutions has elevated the significance of FCEVs in the global automotive market. Rigorous testing and certification become imperative to ensure the secure integration of hydrogen fuel cells, addressing concerns related to storage, transportation, and utilization. In addition, ongoing advancements in hydrogen fuel cell technology are further propelling the growth of the segment.

Industry Insights

The automotive segment accounted for the largest market revenue share of 53.0% in 2023. The automotive segment in the electric vehicle TIC market is emerging with an increase in sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). BEVs are gaining popularity, driven by factors like extended range, improved performance, cost reduction, and expanded charging infrastructure. PHEVs continue to be in demand, offering a blend of electric power for short trips and conventional engine range for longer journeys. Premium EV brands such as BMW AG, Tesla, and Mercedes-Benz AG are increasing their market share by providing high-quality and high-performance EV models.

The defense segment is projected to grow significantly over the forecast period. Governments worldwide are actively pursuing the integration of electric and hybrid-electric vehicles into military operations to enhance sustainability. This initiative involves the development of various military vehicles, such as armored carriers and logistics vehicles, with a focus on reducing fuel consumption, maintenance costs, and environmental impact. Collaborations between defense contractors and government agencies promote innovation in electric vehicle technologies, energy efficiency, and autonomy. Regulatory standards and certifications are being established to ensure the safety and compliance of electric defense vehicles.

Key Companies & Market Share Insights

Some of the key players operating in the market include DEKRA SE; Intertek Group plc; and Element Materials Technology

-

DEKRA SE plays a significant role in ensuring the safety, reliability, and compliance of electric vehicles and related technologies. The company's expertise covers a wide range of services, including battery testing, vehicle safety assessments, cybersecurity evaluations, and overall quality assurance for electric vehicles.

-

Intertek Group plc provides services for the testing, inspection, and certification of various products. The Assurance, Testing, Inspection, and Certification (ATIC) services offered by the company include laboratory safety, product assurance, second-party supplier auditing, quality and performance testing, sustainability analysis, process performance analysis, vendor compliance, facility plant and equipment verification, and third-party certification.

HORIBA MIRA Ltd and UTAC are some of the emerging market participants in the electric vehicle TIC market.

-

HORIBA MIRA Ltd is a global provider of engineering, research, testing, and development services with a focus on the automotive sector, including EVs. The company provides comprehensive testing and certification services for electric vehicles. This includes safety testing, performance evaluation, and compliance with regulatory standards specific to electric propulsion systems.

-

UTAC is a multinational company that provides testing, inspection, and certification services primarily in the automotive sector and specializes in automotive testing, certification, and homologation services. The company works closely with automotive manufacturers, suppliers, and regulatory authorities to ensure vehicles comply with safety and environmental standards.

Key Electric Vehicle Testing, Inspection, And Certification Companies:

- Bureau Veritas

- DEKRA SE

- Element Materials Technology

- Intertek Group plc

- iASYS Technology Solutions

- SGS Société Générale de Surveillance SA

- TÜV SÜD

- TÜV Rheinland

- The British Standards Institution

- UL LLC

Recent Developments

-

In October 2023, TÜV SÜD partnered with Segula Technologies Group, an engineering services provider. The collaboration aimed to provide an extensive array of services to automotive manufacturers, presenting a holistic solution for vehicle development, market-entry, and global market access. This comprehensive suite of services aimed to streamline processes, substantially reducing the costs and time of automotive manufacturers, mobility service providers, technology companies, and global suppliers.

-

In July 2023, TÜV SÜD opened an electric vehicle environmental laboratory in the Auburn Hills, MI, North America region to drive excellence in electric vehicles, including batteries, components, and system solutions.

-

In September 2022, Elements Material Technology acquired NTS Technical Systems, an environmental simulation testing, inspection, and certification service provider, to support its clients throughout the product lifecycle better. The acquisition was aimed at improving the company's capabilities in the crucial growth areas of connected cars, medical devices, and battery testing and strengthening the company's position in the North American region.

Electric Vehicle Testing, Inspection, And Certification Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.37 billion

Revenue forecast in 2030

USD 3.01 billion

Growth rate

CAGR of 14.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, sourcing type, application, vehicle type, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Bureau Veritas; DEKRA SE; Element Materials Technology; Intertek Group plc; iASYS Technology Solutions; SGS Société Générale de Surveillance SA; TÜV SÜD; TÜV Rheinland; The British Standards Institution; UL LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Testing, Inspection, And Certification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global electric vehicle testing, inspection, and certification market report based on service type, sourcing type, application, vehicle type, industry, and region:

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Testing

-

Battery Testing

-

Electric E-Motor Testing

-

Electromagnetic Compatibility (EMC) Testing

-

Component Testing

-

-

Inspection

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

In-House

-

Outsourced

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Safety & Security

-

Connectors

-

Communication

-

EV Charging

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

BEV

-

PHEV

-

FCEV

-

Others

-

-

Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

Automotive

-

Aerospace

-

Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle testing, inspection, and certification market size was estimated at USD 1.21 billion in 2023 and is expected to reach USD 1.37 billion in 2024.

b. The global electric vehicle testing, inspection, and certification market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 3.01 billion by 2030.

b. Asia Pacific dominated the electric vehicle TIC market with a share of 33.0% in 2023. The Asia Pacific region is a powerhouse in electric vehicle production, containing some of the world's largest and most innovative electric vehicle manufacturers.

b. Some key players operating in the electric vehicle TIC market include Bureau Veritas ; DEKRA SE; Element Materials Technology; Intertek Group plc; iASYS Technology Solutions; SGS Société Générale de Surveillance SA; TÜV SÜD; TÜV Rheinland ; The British Standards Institution; UL LLC

b. Key factors that are driving the electric vehicle testing, inspection, and certification market growth include ongoing advancements in battery technologies, and government policies and initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.