- Home

- »

- Automotive & Transportation

- »

-

Electric Vehicle Market Size, Share & Trends Report, 2030GVR Report cover

![Electric Vehicle Market Size, Share & Trends Report]()

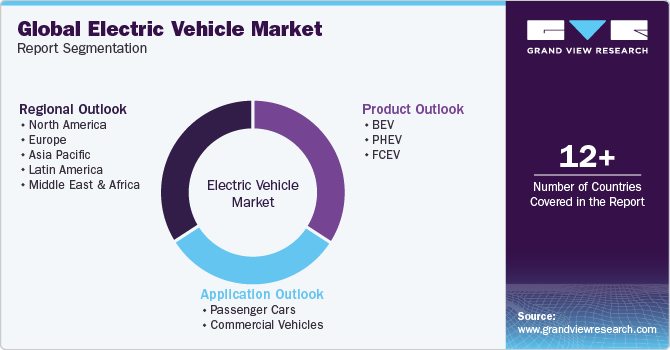

Electric Vehicle Market Size, Share & Trends Analysis Report By Product (BEV, PHEV, FCEV), By Application (Passenger Cars, Commercial Vehicles), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-259-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Electric Vehicle Market Size & Trends

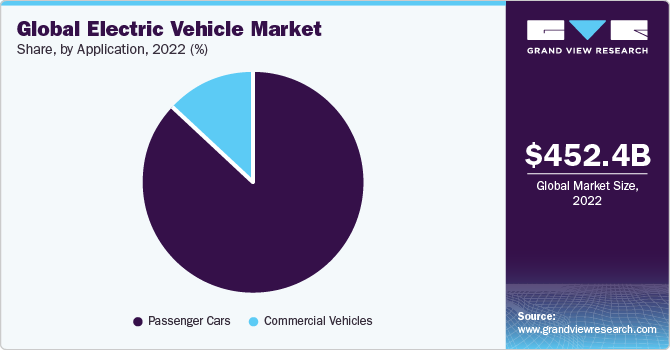

The global electric vehicle market size was estimated at USD 452.36 billion in 2022 and is expected to witness a compound annual growth rate (CAGR) of 14.5% from 2023 to 2030. The market is driven by initiatives taken by governments globally to promote the manufacturing of electric vehicles. For instance, in February 2023, the Biden-Harris Administration announced new initiatives to establish an advanced, convenient, and domestically produced electric vehicle charging network. These measures are designed to help the U.S. achieve its ambitious climate goals, including developing a national network of 500,000 EV chargers along highways and communities. By 2030, the government aims to ensure that EVs account for at least 50% of new car sales. Such actions contribute to combating the climate crisis and promote the growth of the EV charging industry and domestic EVs, aligning with the overall industrial strategy for expansion.

Stringent vehicle emission regulations have led to the increased demand for electric vehicles. For instance, the European Union has set a net-zero greenhouse gas emissions target by 2050. Electric vehicles produce lower emissions as compared to conventional vehicles. It has led governments worldwide to increase awareness and promote the adoption of EVs to reduce oil consumption, air pollution, and related emissions. Some of the most comprehensive promotions are being done in the Netherlands and Norway. Thus, the market is poised to grow rapidly during the forecast period.

Rising investments in electric vehicles are considered a major driver for the market. Companies such as Daimler AG, Ford Motor Company, and Groupe Renault are investing heavily in manufacturing EVs. In December 2018, Daimler AG announced investments worth USD 20 billion to purchase battery cells for electric vehicles. The company aimed to electrify its Mercedes Benz portfolio with 130 EVs by 2022. The same year, Ford Motor Company announced its plans to invest USD 11.0 billion to manufacture 40 EVs by 2022. Such developments are anticipated to drive industry expansion by 2030.

On the other hand, the rising need for charging infrastructure will hinder EV market growth over the estimated period. Variations in charging load and lack of standardization are major drawbacks for the market. Different countries have their standards, such as CCS (Europe, the U.S., and Korea), CHAdeMO (Japan), and GB/T (China). Some electric vehicle manufacturers, such as Tesla, Inc., focus on overcoming this obstacle by developing their own charging network. Thus, market players are strategizing about addressing these challenges and expanding their business.

The increasing adoption of electric vehicles in the commercial and government sectors is anticipated to drive the market. By March 2022, the number of battery-electric vehicles in the UK reached approximately 450,000, with around 750,000 registered vehicles with a plug. This significant increase from just 8,000 registered plug-in vehicles in 2010 showcases the country's growing demand for electric vehicles.

These numbers, provided by the Department for Transport in May 2022, can be compared to the 37.6 million cars and vans registered at that point in the UK. In a major development in January 2020, Uber announced a partnership with Nissan, wherein the auto manufacturer would supply 2,000 EVs for Uber drivers in London. The partnership was done with Uber's aim to make all its vehicles emission-free by 2025. Such developments are expected to help the market to rise over the coming years.

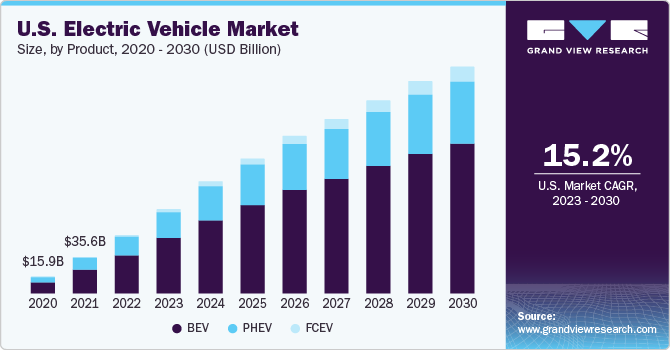

Product Insights

The product segment in the global electric vehicle market is bifurcated into battery electric vehicle (BEV), fuel cell electric vehicle (FCEV), and plug-in hybrid electric vehicle (PHEV). The BEV segment accounted for the largest revenue share of 71.7% in 2022 and is further expected to advance at a steady CAGR during the projection period. The dominant market share can be attributed to the increasing environmental awareness and benefits of BEV among consumers globally.

Meanwhile, the fuel cell electric vehicle (FCEV) segment is projected to register the highest CAGR of 22.2% during the forecast period. The FCEV segment is experiencing rapid growth in the electric vehicle (EV) market due to factors such as longer driving range, zero tailpipe emissions, improved hydrogen infrastructure, diverse applications, and ongoing research and development efforts. These factors contribute to the increasing popularity of FCEVs as a viable alternative to zero-emission transportation.

Application Insights

In terms of revenue, the passenger cars segment dominated with a market share of 86.7% in 2022. This is attributed to growing environmental concerns, advancements in EV technology, government incentives, and the availability of a range of models from different automakers. Rising awareness about environmental issues and improvements in battery capacity and charging infrastructure have made EVs more practical for everyday use. Governments globally are implementing measures to promote EV adoption, such as financial incentives and stricter emission standards. Moreover, competitive pricing for these vehicles has also boosted consumer interest and demand.

The commercial vehicle segment is poised to advance at a CAGR of 16.2% through 2030. This is owing to the increasing demand for sustainable transportation solutions, advancements in EV technology, supportive government policies and incentives, and cost competitiveness. Businesses opt for commercial EVs to reduce emissions, use improved battery capacity & charging infrastructure, benefit from financial incentives, and comply with stricter emission regulations. Additionally, the decreasing costs of EV components contribute to the overall demand growth for commercial electric vehicles in the market.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of 48.3% in 2022. This is aided by the growing demand for electric cars in China, Japan, and India. In August 2022, the Economic and Social Commission for Asia and the Pacific (ESCAP) introduced the Asia-Pacific Initiative on Electric Mobility, intending to expedite the shift towards electric mobility in public transportation. The initiative aims to reduce the transport sector's greenhouse gas emissions and offer support for implementing the Paris Agreement.

Europe is poised to advance at a CAGR of 18.1% through 2030, This is owing to the increasing environmental concerns in the region, regulatory incentives, rapid infrastructure development, technological advancements, and changing consumer preferences. The presence of well-established and renowned electric vehicle manufacturers is also fueling the regional market expansion.

North America held a substantial market revenue share in 2022. This is attributed to the increasing demand for electric vehicles in regional economies such as the U.S. Furthermore, new initiatives are being taken up by automotive manufacturers, policymakers, non-profit organizations, and charging network companies, an example being the launch of a new non-profit organization named "Veloz." This organization aims to attract investments, innovations, marketing, and drive growth of electric vehicles in North America.

In February 2023, the U.S. government announced a substantial investment in various aspects of the electric vehicle industry. It includes allocating USD 10 billion for clean transportation initiatives, USD 7.5 billion for EV charging infrastructure, and over USD 7 billion for EV-critical minerals, battery components, and materials. These major funding programs would work alongside the Inflation Reduction Act, which has provided crucial support for advanced batteries and offers expanded tax credits for EV purchases and charging infrastructure installations.

Latin America is expected to expand at the fastest CAGR of 17.6% during the forecast period in the market. While the EV market in the region is still in its early stages compared to other regions, factors such as the steadily increasing adoption of these vehicles in corporate fleets, along with government incentives, ongoing investments, and policy support, are contributing to the regional market growth.

Key Companies & Market Share Insights

Industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in April 2023, ABB E-mobility invested in Switch, a deep-tech start-up based in London. This strategic investment aims to enhance ABB E-mobility's existing portfolio of smart and connected EV charging solutions by collaborating with Switch. Together, they seek to advance a seamless EV charging ecosystem that will transform the charging experience for both operators and drivers, revolutionizing the industry.

Key Electric Vehicle Companies:

- BYD Company Ltd.

- Mercedes-Benz Group AG

- Ford Motor Company

- General Motors

- Renault Group

- Mitsubishi Motors Corporation

- Nissan Motor Co., Ltd.

- Tesla

- Toyota Motor Corporation

- Volkswagen Group

Recent Developments

-

In June 2023, EVBox, an EV charging solutions provider, introduced its fastest charging station, the EVBox Troniq High Power. With a power capacity of 400 kW, this charging station is the first such standalone charging station to undergo extensive testing and validation in the Netherlands and France in real-world conditions. The charging station represents a significant advancement in EV charging technology, offering users a reliable and efficient charging solution

-

In April 2023, Stellantis NV introduced the 2025 Ram 1500 REV, an advanced all-electric light-duty pickup truck from Ram Truck. It marks Ram's entry into the electric vehicle space and showcases its commitment to providing customers with innovative and sustainable solutions. The 2025 Ram 1500 REV is the first in a range of upcoming electrified options by the company that incorporate cutting-edge technology

-

In March 2023, Stellantis NV announced that by early 2025, the company’s Mangualde Production Center in Portugal would transition to manufacturing battery electric light commercial vehicles. This phase is anticipated to involve the production of various models, including the Peugeot e-Partner, Citroën ë-Berlingo, Fiat e-Doblò, and Opel Combo-e, in both light commercial and passenger variants. The Mangualde plant would become the first facility in Portugal to produce large-scale, fully battery electric vehicles for domestic and international markets

-

In November 2022, HRH Crown Prince launched Ceer, an electric vehicle brand from Saudi Arabia, which aims to play a pivotal role in the country's automotive manufacturing sector. The launch aligns with the strategy of the Public Investment Fund (PIF) to foster the growth of promising local sectors, contributing to the diversification of the economy, as outlined in Vision 2030. Furthermore, Ceer will actively contribute to Saudi Arabia's commitment to reducing carbon emissions, promoting sustainability, and addressing challenges posed by climate change

Electric Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 646.72 billion

Revenue forecast in 2030

USD 1,668.97 billion

Growth rate

CAGR of 14.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; United Arab Emirates (UAE); Saudi Arabia; South Africa

Key companies profiled

BYD Company Ltd.; Mercedes-Benz Group AG; Ford Motor Company; General Motors; Renault Group; Mitsubishi Motors Corporation; Nissan Motor Co., Ltd.; Tesla; Toyota Motor Corporation; Volkswagen Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global electric vehicle market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

BEV

-

PHEV

-

FCEV

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle market size was estimated at USD 452.36 billion in 2022 and is expected to reach USD 646.72 billion in 2023.

b. The global electric vehicles market is expected to grow at a compound annual growth rate of 14.5% from 2023 to 2030 to reach USD 1,668.97 billion by 2030.

b. Asia Pacific dominated the electric vehicle market with a share of over 48.3% in 2022.

b. Some key players operating in the electric vehicle market include BYD Company Ltd., Daimler AG, Ford Motor Company, General Motors Company, Groupe Renault, Mitsubishi Motors Corporation, Nissan Motor Company, Tesla, Inc., Toyota Motor Corporation, and Volkswagen Group.

b. Key factors that are driving the market growth include stringent vehicle emission regulations and the government support for both manufacturing and buying electric vehicles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."