- Home

- »

- Advanced Interior Materials

- »

-

Electrical Discharge Machining Market Size Report, 2033GVR Report cover

![Electrical Discharge Machining Market Size, Share & Trends Report]()

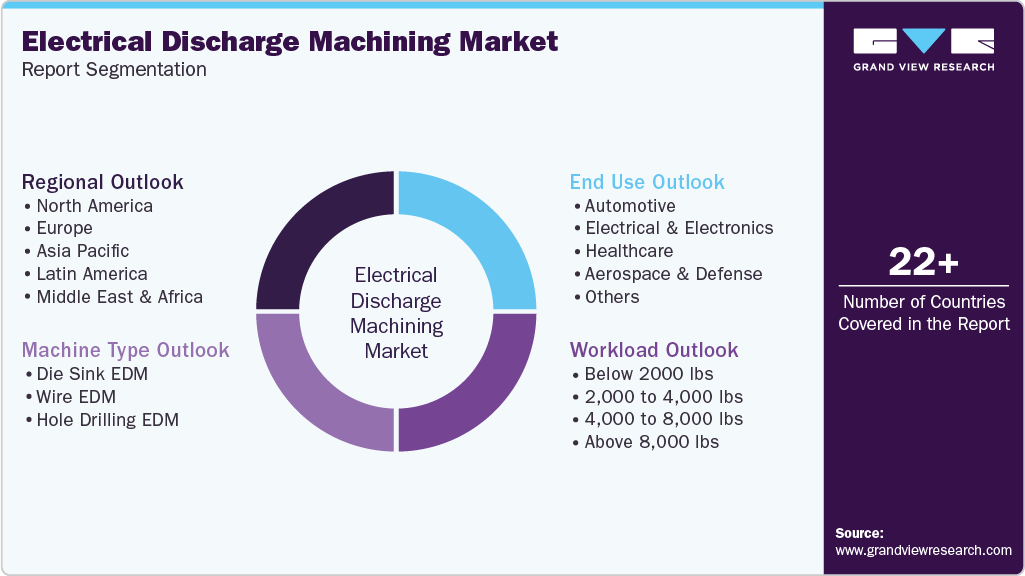

Electrical Discharge Machining Market (2025 - 2033) Size, Share & Trends Analysis Report By Workload (Below 2000 lbs, 2,000 To 4,000 lbs, 4,000 To 8,000 lbs, Above 8,000 lbs), By Machine Type (Die Sink EDM, Hole Drilling EDM), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-782-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrical Discharge Machining Market Summary

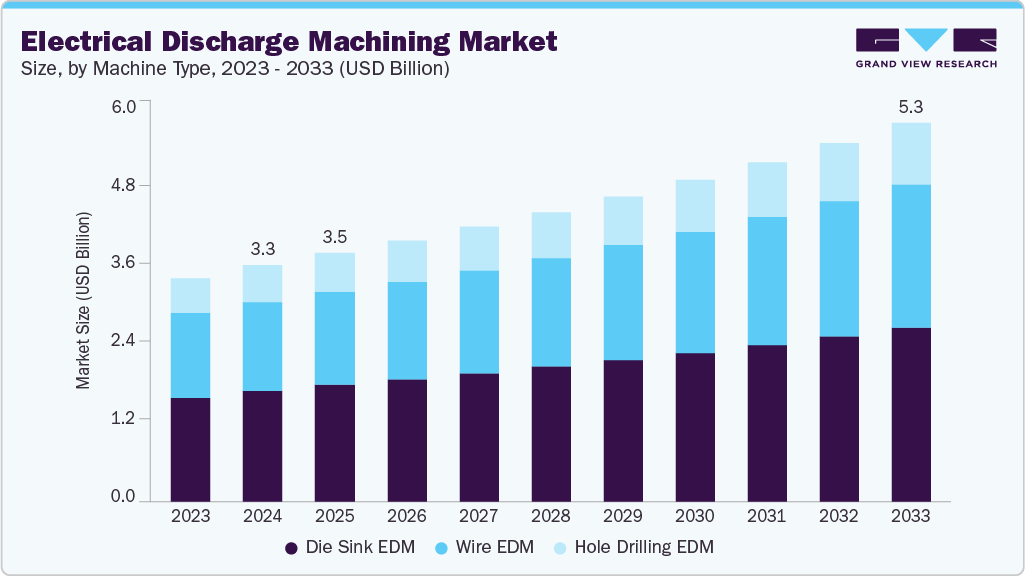

The global electrical discharge machining market size was estimated at USD 3,316.0 million in 2024 and is projected to reach USD 5,311.5 million by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The aerospace and automotive sectors are major contributors to the growth of the electric discharge machining (EDM) market, given their reliance on lightweight, high-strength alloys and complex engine or transmission components.

Key Market Trends & Insights

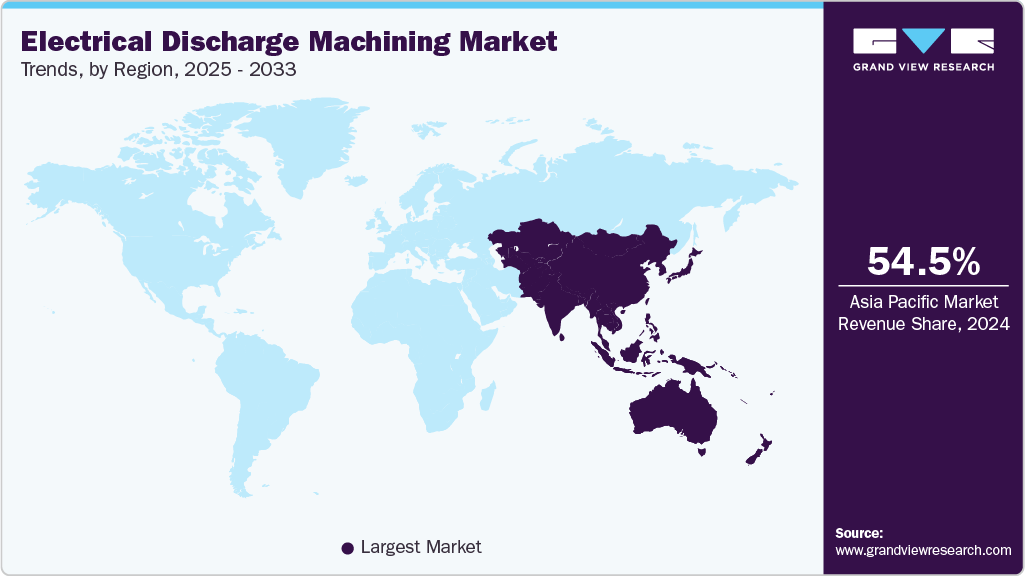

- Asia Pacific dominated the electrical discharge machining market with the largest revenue share of 54.5% in 2024.

- China electrical discharge machining market is witnessing steady growth over the forecast period.

- By workload, the below 2,000 segment is expected to grow at a CAGR of 5.9% from 2025 to 2033 in terms of revenue.

- By machine type, the hole drilling EDM segment is projected to expand at a CAGR of 5.9% from 2025 to 2033 in terms of revenue.

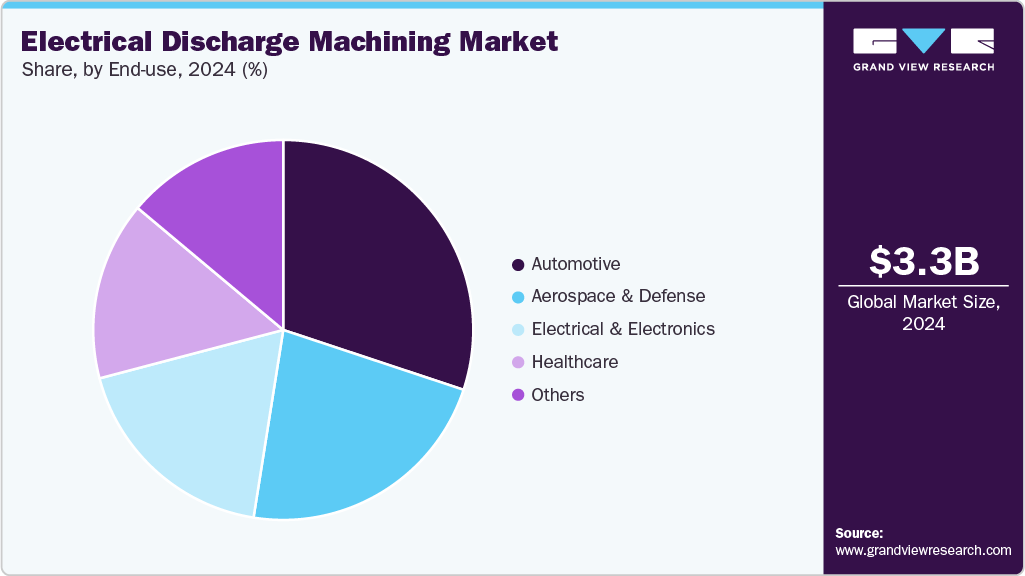

- By end use, the automotive segment dominated the global revenue share accounting for 30.1% of the market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,316.0 Million

- 2033 Projected Market Size: USD 5,311.5 Million

- CAGR (2025-2033): 5.4%

- Asia Pacific: Largest market in 2024

EDM allows for the production of turbine blades, fuel injectors, and molds with high dimensional stability. The push toward electric mobility and fuel-efficient aircraft has further increased the use of EDM to machine specialized materials such as titanium and Inconel, enhancing component reliability and performance.

Continuous advancements in EDM technology, including the development of CNC (Computer Numerical Control) EDM machines, adaptive control systems, and hybrid EDM solutions, have significantly improved process speed and efficiency. Integration with automation and robotics has reduced human error, optimized electrode usage, and improved production throughput. These innovations are attracting end users seeking cost-effective and flexible manufacturing solutions in both low- and high-volume production environments.

Market Concentration & Characteristics

The electric discharge machining market exhibits moderate concentration, with a mix of global players such as Mitsubishi Electric, Makino, and GF Machining Solutions, along with several regional manufacturers. These companies compete through product innovation, service quality, and customization capabilities. While large multinational firms dominate high-end EDM systems, smaller regional players focus on cost-effective solutions and aftersales support, maintaining a balanced competitive environment.

The market demonstrates a high degree of innovation, driven by automation, advanced control software, and hybrid EDM systems that combine additive and subtractive manufacturing. Developments in electrode materials, pulse control technology, and smart interfaces are improving machining accuracy and efficiency. Manufacturers are increasingly investing in R&D to reduce electrode wear, optimize energy consumption, and achieve superior surface finishes, ensuring continuous technological progress.

Environmental and safety regulations regarding dielectric fluids and waste management influence machine design and maintenance practices. Compliance with regional standards such as CE, ISO, and RoHS (Restriction of Hazardous Substances) ensures product reliability and eco-efficiency. End user concentration is moderate, with demand distributed across aerospace, automotive, electronics, and tool-making industries. This diversified end-user base provides market stability, minimizing dependency on any single sector.

Drivers, Opportunities & Restraints

The growing adoption of the electric discharge machining market is primarily driven by the increasing demand for precision-engineered components across industries such as aerospace, automotive, and electronics. EDM enables the machining of intricate geometries and extremely hard materials with tight tolerances that conventional machining cannot achieve. As manufacturers shift toward miniaturization and complex part designs, EDM provides unmatched accuracy and repeatability, making it indispensable in advanced manufacturing operations.

The high operational cost and slower material removal rate associated with EDM compared to conventional machining methods remain key challenges. EDM equipment requires significant capital investment, and electrode wear increases tooling expenses over time. Additionally, the process is limited to electrically conductive materials, which restricts its applicability across some manufacturing sectors. Environmental concerns over dielectric fluid disposal and maintenance further add to the operational burden, particularly in small and medium enterprises.

Emerging applications in additive manufacturing post-processing and micro-machining present substantial growth opportunities for EDM technology. The rising need for fine-featured components in medical devices, semiconductors, and precision molds is expanding the role of EDM in high-tech industries. Moreover, the integration of IoT (Internet of Things) and AI (Artificial Intelligence) for process monitoring and optimization is creating new avenues for efficiency and predictive maintenance, supporting wider industrial adoption globally.

Workload Insights

The 2,000 to 4,000 lbs segment held the dominant share in the market accounting for a share of 30.4% in 2024, due to its suitability for medium-duty industrial applications that balance precision with productivity. These machines offer optimal cutting speed and stability for complex molds, dies, and aerospace components. Their versatility across multiple materials, including hardened steel and alloys, enhances their adoption among large manufacturers.

The below 2,000 lbs segment is expected to grow at a CAGR of 5.9% from 2025 to 2033 in terms of revenue, as manufacturers increasingly adopt compact and lightweight EDM machines suitable for precision part fabrication. These systems offer lower energy consumption and operational flexibility, making them ideal for small-scale and high-accuracy applications. Growing adoption among tool rooms, prototype developers, and electronics manufacturers further drives segment expansion.

Machine Type Insights

The die sink EDM segment continues to dominate the market and accounted for a share of 46.7% in 2024due to its extensive use in mold and die manufacturing for automotive, electronics, and consumer goods applications. Its capability to produce intricate cavities and fine surface finishes in hardened materials ensures broad industrial reliance. The segment also benefits from continuous improvements in electrode technology and adaptive control systems.

The The hole drilling EDM segment is expected to grow at a CAGR of 5.9% from 2025 to 2033 in terms of revenue, as demand rises for precision drilling of small and deep holes in aerospace, medical, and energy components. Its ability to process tough materials such as titanium and carbide with high accuracy makes it ideal for turbine blades and fuel injector manufacturing. The growing use of EDM drilling for cooling holes and micro features further supports its expansion.

End-use Insights

The automotive segment dominated the electrical discharge machining market and accounted for a share of 30.1% in 2024owing to its extensive use in manufacturing molds, dies, and precision engine components. EDM enables the production of intricate designs in hardened materials required for transmission systems, fuel injectors, and electric vehicle parts. The sector’s shift toward lightweight materials and electric mobility has further increased reliance on EDM for high-precision tooling.

The aerospace & defense segment is expected to grow at a CAGR of 5.9% from 2025 to 2033 in terms of revenue, as EDM becomes essential for machining high-strength alloys used in turbine engines, landing gear, and fuel systems. Increasing aircraft production and defense modernization programs are driving demand for precision components with tight tolerances. EDM’s ability to machine complex geometries without inducing stress or distortion supports its use in mission-critical parts.

Regional Insights

The North America electrical discharge machining market is witnessing steady growth driven by the expansion of aerospace, automotive, and defense manufacturing activities. The region’s strong focus on precision engineering and advanced material machining supports consistent adoption of EDM systems. Increased reshoring of manufacturing and investments in automation further enhance market development. However, growth remains moderate due to high market maturity and slower replacement cycles for advanced machinery.

U.S. Electrical Discharge Machining Market Trends

Electrical discharge machining market in the U.S. is expanding considerably, driven by sectors such as aerospace, defense and advanced tooling. It benefits from high-technology adoption, automation trends and demand for precision machining. The growth pace is respectable though somewhat constrained by market maturity and established infrastructure.

Europe Electrical Discharge Machining Market Trends

In Europe, market growth is supported by the region’s established industrial base and continued focus on high-precision manufacturing. The strong presence of automotive and aerospace OEMs sustains demand for EDM in tooling and mold-making applications. Growing emphasis on sustainability and energy-efficient machining solutions encourages technological upgrades. Nonetheless, strict environmental standards and high operational costs slightly temper the region’s overall growth momentum.

Electrical discharge machining market in the UK is growing modestly, backed by its engineering, automotive, and precision-manufacturing base. However, growth is somewhat limited by slower overall manufacturing growth and the need for upgrades to legacy systems. Increasing adoption of computer numerical control (CNC) EDM machines and focus on high-value manufacturing projects are helping sustain market expansion.

Germany electrical discharge machining marketis witnessing steady growth, driven by the country’s strong presence in automotive and industrial engineering. The adoption of EDM systems is increasing, particularly for tooling, high-precision components, and premium manufacturing applications. There is momentum in machine upgrades and Industry 4.0 integration, supporting healthy growth. Collaboration between local manufacturers and global technology providers further drives innovation and adoption of advanced EDM solutions.

Asia Pacific Electrical Discharge Machining Market Trends

Asia Pacific led in 2024 in terms of global revenue share holding 54.5% of the market, fueled by rapid industrialization and the expansion of manufacturing sectors in countries such as China, Japan, and India. Rising investments in precision tooling, electronics, and component manufacturing are creating a robust demand base. Government initiatives promoting domestic production and technology advancement further stimulate EDM adoption. Increasing competition among local and international manufacturers continues to accelerate innovation in this region.

China electrical discharge machining marketrepresents one of the fastest-growing EDM markets, thanks to its large-scale manufacturing base, rapid expansion in automotive, electronics, and tooling industries, and strong government support for advanced manufacturing technology. Domestic manufacturers are increasingly investing in automated and hybrid EDM systems, boosting productivity and precision. Continuous infrastructure development and export-oriented manufacturing also strengthen market prospects.

Electrical discharge machining market in India is advancing rapidly from a lower base, with growth supported by rising industrialization, tooling and mold manufacturing, and increasing investment in precision machining. Growing interest from small and medium-sized enterprises (SMEs) in adopting modern EDM systems adds to the momentum. Moreover, government initiatives such as “Make in India” and the push toward technology-driven manufacturing are further accelerating the adoption of EDM systems across the country.

Middle East & Africa Electrical Discharge Machining Market Trends

The Middle East & Africa EDM market is emerging as industrial diversification and infrastructure growth gain momentum across the region. The aerospace, defense, and energy sectors are key drivers, with several countries investing in advanced machining capabilities. Growing partnerships with international machine tool suppliers are helping build regional technical capacity. Despite this progress, limited local manufacturing ecosystems and high equipment costs pose challenges to large-scale adoption.

Electrical discharge machining market in Saudi Arabiais emerging in the EDM space as part of its broader industrial diversification efforts. Growth is supported by infrastructure, defense, and aviation mandates, though the EDM market remains at an earlier stage of development compared to more mature economies. Investments in industrial zones and technology transfer initiatives are expected to accelerate adoption and strengthen the local EDM ecosystem.

Latin America Electrical Discharge Machining Market Trends

The Latin American EDM market is gradually expanding as the region strengthens its automotive, industrial tooling, and aerospace manufacturing capabilities. Growth is supported by increasing foreign investments and efforts to modernize production infrastructure. Local manufacturers are also adopting EDM technology to improve product quality and meet export standards. However, market development is constrained by limited technical expertise and uneven access to advanced machinery.

Electrical discharge machining market in Brazil is witnessing moderate growth, supported by the ongoing modernization of the automotive, industrial equipment, and tooling sectors. However, structural and macroeconomic challenges slow the pace compared to more dynamic markets. Increasing partnerships with global suppliers and localized training programs are helping to improve skill availability and machine utilization.

Key Electrical Discharge Machining Company Insights

Some of the key players operating in the market include Mitsubishi Electric Corporation and Sodick.

-

Mitsubishi Electric Corporation is a global manufacturer of electrical and electronic equipment, headquartered in Tokyo, Japan. The company offers a wide range of products including factory automation systems, elevators and escalators, air-conditioning systems, semiconductors, and electric discharge machines. The company’s EDM portfolio comprises wire-cut and die-sink EDM machines. The company focuses on R&D, advanced automation, and integration of smart technologies, positioning itself as a key player in precision engineering and industrial automation worldwide.

-

Sodick Co., Ltd. is a Japan-based company specializing in high-precision machining solutions, including Electrical Discharge Machining (EDM) and injection molding equipment. The company integrates advanced technologies such as linear motor drives, i-Groove wire rotation, and adaptive control systems in its EDM machines. The company serves industries including aerospace, automotive, medical devices, and electronics. Sodick also emphasizes global expansion, technical partnerships, and educational collaborations to strengthen its presence in emerging markets such as India and the U.S.

Key Electrical Discharge Machining Companies:

The following are the leading companies in the electrical discharge machining market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Electric Corporation

- Makino Milling Machine Co., Ltd

- Sodick

- GF Machining Solutions

- Ching Hung Machinery & Electric Industrial Co., Ltd.

- FANUC Corporation

- Seibu Electric & Machinery co., ltd

- ONA Electroerosión S.A.

- Accutex Technologies Co., Ltd

- Excetek Technologies Co., Ltd

- MC Machinery Systems, Inc

- Jiann Sheng Machinery & Electric Industrial Co., LTD.

- OSCARMAX

- Orbray Co., Ltd.

- Mirrordick

Recent Developments

-

In April 2024, Sodick Technologies India, a subsidiary of Japan's Sodick Co., Ltd., unveiled its latest wire-cut EDM machine featuring the patented i-Groove technology at the TAGMA Die Mold Exhibition in Mumbai. This machine introduces a rotating wire mechanism, enhancing cutting efficiency, reducing wire consumption, and achieving superior surface finishes and taper angles. Sodick India aims to leverage India's growing manufacturing sector and favorable policies, such as the Performance Linked Incentive (PLI) scheme, to expand its presence and support the country's industrial growth.

-

In September 2022, Sodick partnered with Pennsylvania College of Technology to enhance its machining programs by providing four VL400Q High Performance Linear Motor Drive Wire Cut EDM units. These advanced machines, now operational in the Larry A. Ward Machining Technologies Center, are integrated with touch screens, thumb drives, and Ethernet connectivity, streamlining programming and troubleshooting processes.

Electrical Discharge Machining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,483.6 million

Revenue forecast in 2033

USD 5,311.5 million

Growth rate

CAGR of 5.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Workload, machine type, end-use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Mitsubishi Electric Corporation; Makino Milling Machine Co., Ltd; Sodick; GF Machining Solutions; Ching Hung Machinery & Electric Industrial Co., Ltd.; FANUC Corporation; Seibu Electric & Machinery Co., Ltd; ONA Electroerosión S.A.; Accutex Technologies Co., Ltd; Excetek Technologies Co., Ltd; MC Machinery Systems, Inc; Jiann Sheng Machinery & Electric Industrial Co., Ltd; OSCARMAX; Orbray Co., Ltd.; Mirrordick.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrical Discharge Machining Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electrical discharge machining market report based on workload, machine type, end-use, and region.

-

Workload Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 2000 lbs

-

2,000 to 4,000 lbs

-

4,000 to 8,000 lbs

-

Above 8,000 lbs

-

-

Machine Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Die sink EDM

-

Wire EDM

-

Hole drilling EDM

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Electrical and electronics

-

Healthcare

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electrical discharge machining market size was estimated at USD 3,316.0 million in 2024 and is expected to be USD 3,483.6 million in 2025.

b. The global electrical discharge machining market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033 to reach USD 5,311.5 million by 2033.

b. The Asia Pacific market led the market in 2024 accounting for a share of 54.5% in 2024, fueled by growing industrialization and rising demand for high-precision manufacturing in industries such as automotive, aerospace, and electronics.

b. Some of the key players operating in the global electrical discharge machining market include Mitsubishi Electric Corporation, Makino Milling Machine Co., Ltd, Sodick, GF Machining Solutions, Ching Hung Machinery & Electric Industrial Co., Ltd., FANUC Corporation, Seibu Electric & Machinery Co., Ltd, ONA Electroerosión S.A., Accutex Technologies Co., Ltd, Excetek Technologies Co., Ltd, MC Machinery Systems, Inc, Jiann Sheng Machinery & Electric Industrial Co., Ltd, OSCARMAX, Orbray Co., Ltd., and Mirrordick.

b. The global Electrical Discharge Machining (EDM) market is driven by rising demand for high-precision components and complex geometries in aerospace, automotive, and electronics industries. Continuous technological advancements and adoption of automation further enhance efficiency and accuracy, supporting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.